Global Condom Market By Material Type (Latex Condoms and Non-latex Condoms), By Product (Male Condoms and Female Condoms) By Distribution Channel (Mass Merchandizers, Drug Stores, and E-commerce) Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Aug 2024

- Report ID: 19318

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

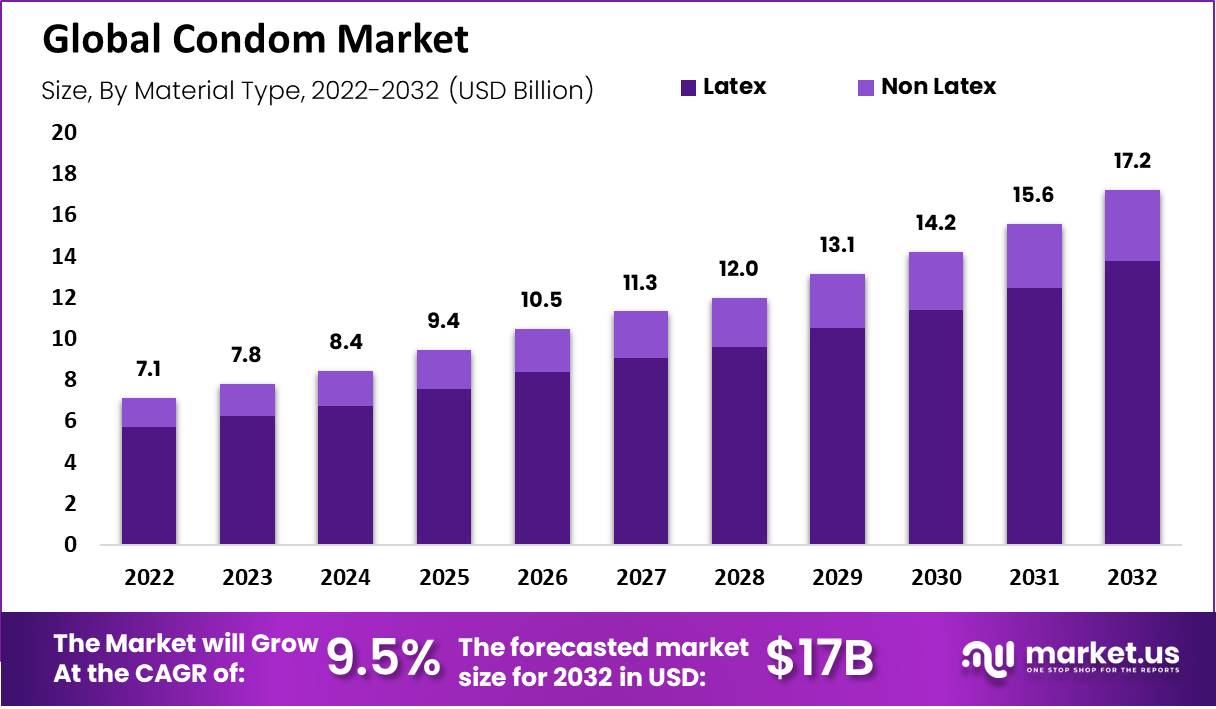

The Global Condom Market size is expected to be worth around USD 17.2 Billion by 2032, from USD 7.1 Billion in 2022, growing at a CAGR of 9.5% during the forecast period from 2023 to 2032.

A condom is a form of barrier contraception that is typically made from latex, polyurethane, or lambskin. It is designed to be worn on the penis during sexual intercourse to prevent pregnancy and reduce the risk of sexually transmitted infections (STIs) by blocking the exchange of bodily fluids. Condoms are available in various sizes, textures, and flavors, and are widely used for both contraceptive purposes and to promote safer sexual practices. They are considered an effective method for preventing the spread of HIV and other STIs when used correctly and consistently.

The global condom market is experiencing robust growth, primarily driven by heightened awareness of sexual health and significant initiatives from both government bodies and public health organizations. Male condoms dominated the market due to their widespread availability, ease of use, and cost-effectiveness compared to female condoms. The segment benefits from broad acceptance across multiple distribution channels, including pharmacies and online retailers, with the latter gaining popularity post-COVID-19 due to increased consumer comfort with e-commerce.

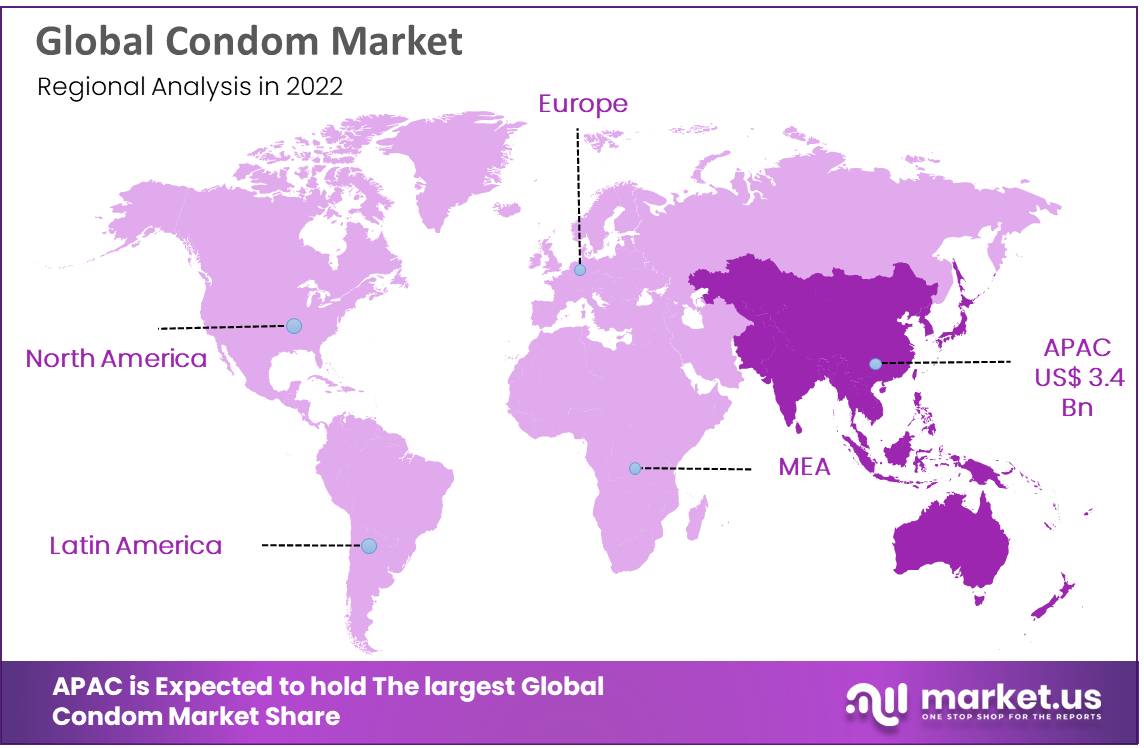

The Asia-Pacific region is emerging as a key region in the condom market, accounting for over half of the global market share. This region’s prominence is bolstered by extensive manufacturing capacities in countries like China and India, enabling it to meet substantial international demand. Government regulations and health initiatives play a critical role in shaping market dynamics. For instance, the French government has been providing free condoms to individuals under 25 since December 2022 to reduce sexually transmitted infections (STIs). Similarly, various African nations, supported by organizations like the United Nations Population Fund (UNFPA), distribute free condoms to combat the spread of HIV/AIDS.

Market expansion is also supported by rising populations and increasing educational efforts on reproductive health in densely populated regions like Asia. Noteworthy is the growing consumer preference for natural and eco-friendly condoms, such as those made from latex and lambskin, which are favored for their effectiveness in preventing STDs and pregnancies. The synthetic condom segment is expanding as well, catering to individuals with latex allergies and those seeking alternatives like polyisoprene or polyurethane.

Innovations are continually reshaping the condom market. For example, in 2019, an Argentinian company introduced a novel condom designed to open with four hands, highlighting the importance of consent. This innovation reflects a broader trend towards promoting safe sex practices and mutual agreement in sexual activities.

Overall, the global condom market is bolstered by a combination of government initiatives, consumer behavior shifts towards safer sexual practices, and continuous product innovation, making it a dynamic sector with significant growth prospects.

Key Takeaways

- The condom market is projected to grow at a CAGR of 9.5% from 2022 to 2032.

- Correctly used, male condoms can prevent pregnancy and STDs by 98%.

- The non-latex condoms segment is expected to grow at a CAGR of 9.93%.

- The male condom market experienced a 12.69% CAGR during the forecast period.

- Asia Pacific is expected to have double-digit growth at a 10.38% CAGR.

- Europe’s market will grow at a CAGR of 7.14%.

- Drug stores are the leading distribution channel, with e-commerce experiencing the fastest growth.

- Market growth is limited by issues like allergies, tears, and limited awareness in low-income countries.

- Opportunities lie in promoting sexual education programs and increasing awareness of contraceptives to combat STDs.

- The COVID-19 pandemic initially affected demand, but increased product availability is expected to boost market growth.

- Latex condoms are the dominant material type in the market, with both latex and non-latex condoms expected to grow due to new product launches.

Material Type Analysis

The latex condom segment holds the largest revenue share in the condom market. The study analyzed key segments, including latex and non-latex. Over the forecast period, the condom market is expected to grow due to new product launches and increased demand from the aging baby boomers. Latex condoms are effective between 82% and 98%, making them popular among consumers. Most condom brands use latex, a type of natural rubber, due to its durability and flexibility. Latex condoms offer effective contraception and protection from STDs.

Non-latex condoms, however, are expected to experience the fastest growth, with a 9.93% Compound Annual Growth Rate (CAGR) during the forecast period. These condoms offer advantages such as being thin, odorless, and non-allergic. The development of non-latex condoms was driven by increased allergy cases associated with latex condoms. Despite these benefits, non-latex condoms can be costlier and are less effective at preventing viral infections like STDs or HIV.

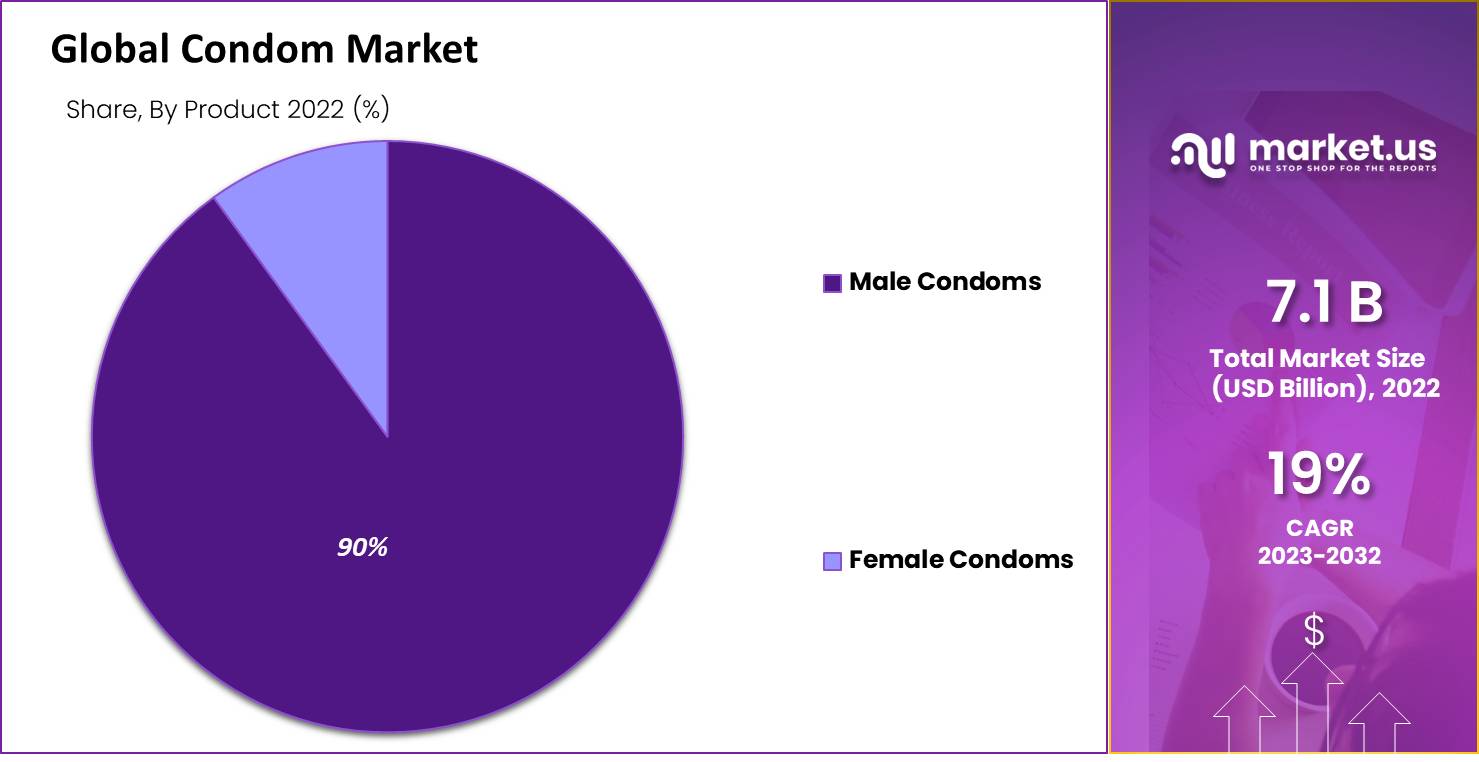

Product Analysis

There are two types of condoms on the market male and female. The male condom market has grown due to manufacturers’ emphasis on male condoms rather than female condoms. They also have a wider portfolio. Because of the rising prevalence of HIV/AIDS, many countries in Africa are still underdeveloped. This means that there is a great unmet demand for men’s condoms. Due to their popularity among couples, male condoms are in high demand and hold a high revenue share.

The forecast period will see the fastest growth at a 12.69% CAGR. The acceptance of female condoms is increasing for their ability to reduce the risk of STIs and unplanned pregnancies. FDA granted a genderless rebranding to a female condom in January 2019 and gave it a generic name, “single-use inner condom.” It was classified under the counter. The World Health Organization has set strict requirements for female condoms. Only a few companies have passed this prequalification process, which leaves a lot of potentials for companies to enter the condom market. Due to high unmet demands, top players like Veru, Inc, are targeting this segment.

Distribution Channel Analysis

This growth can be attributed largely to the ease of access and availability of drug stores. The trend towards e-commerce is changing due to closed markets and restrictions on physical movement during pandemics. The forecast period will see e-commerce experience a 9.11% compound annual rate (CAGR), the fastest growth. The segment growth is expected to be driven by the availability of discrete delivery services and the freedom to choose from e-commerce platforms.

Recent digitalization has led to increased internet access in underdeveloped and developing countries. This has created opportunities for significant growth in e-commerce platforms. Reckitt Benckiser and Church & Dwight are focusing on online marketing strategies to promote the condom brand. This reflects the potential and importance of e-commerce.

Key Market Segments

By Material Type

- Latex

- Non-Latex

By Product

- Male Condoms

- Female Condoms

By Distribution Channel

- Mass Merchandizers

- Drug Stores

- E-commerce

Drivers

Increased Awareness Regarding Condom Use

The global condom market is experiencing significant growth due to several key factors. Firstly, enhanced sex education programs are crucial in raising awareness about the importance of using condoms. This has been instrumental in addressing the rising incidences of sexually transmitted diseases (STDs) worldwide. Additionally, the market is benefiting from the proliferation of online distribution channels which facilitate easier access to these products. Another contributing factor is the increasing adoption of contraceptives to prevent unintended pregnancies, underscoring the growing health consciousness among individuals globally.

Manufacturers Aim to Diversify Product Offerings

Leading companies in the condom industry are innovating by introducing a variety of new products that not only enhance safety but also increase user satisfaction through various features and designs. These efforts are part of a broader strategy to expand product portfolios and tap into new market segments. Government initiatives play a pivotal role in this context, as they often involve campaigns that effectively serve as free advertising for condom manufacturers. Moreover, governments in several countries subsidize condoms and distribute them at low costs to promote public health awareness, thereby expanding the user base and bolstering market growth.

Restraints

Impacting Growth in the Sexual Wellness

Market growth within the sexual wellness sector faces notable challenges, primarily due to issues such as allergies and product durability. Allergic reactions associated with materials used in male genital products and lubricants are significant constraints. Additionally, the integrity of products, including the propensity for male and female condoms to split or tear, poses a critical limitation to consumer confidence and product efficacy.

Furthermore, market expansion is hampered by a lack of awareness in low-income regions. Data indicates that awareness and accessibility of sexual wellness products are substantially lower in rural areas compared to urban centers. This disparity is exacerbated in countries with limited healthcare education and outreach programs, leading to reduced market penetration.

Statistical insights from health organizations highlight that approximately 15% of individuals report allergic reactions to latex condoms, a common material in the industry. Meanwhile, product failure rates, including tearing, are estimated at about 2% under typical usage conditions. These issues not only affect user satisfaction but also impact public health outcomes.

To address these challenges, industry stakeholders are increasingly investing in education campaigns and product innovations. For instance, the development of hypoallergenic materials and robust product designs is prioritized to enhance safety and user experience. Moreover, targeted initiatives in rural and low-income areas are crucial for improving product accessibility and awareness, thereby fostering market growth.

Opportunity

Enhancing STD Awareness and Prevention

In response to the escalating HIV statistics, with an estimated 39.0 million individuals affected globally as of 2019, governments worldwide are intensifying their efforts to combat sexually transmitted diseases (STDs) through comprehensive sexual education programs. Such initiatives are aimed at both increasing awareness and promoting preventive measures among the younger population.

One significant approach includes the integration of relationship and sex education into school curriculums at an early age. This educational strategy is designed to equip students with the knowledge and skills necessary to make informed decisions regarding their sexual health.

Various regional campaigns and initiatives also exemplify these efforts. For example, Asia’s “100% Condom Program” has been pivotal in promoting safe sexual practices. Similarly, in the UK, the “Project against STIs” by Public Health England and the annual “Sexual and Reproductive Health Awareness Week” both serve to heighten awareness and encourage public discourse about STDs. Additionally, “World Contraceptive Day” plays a crucial role in advocating for responsible contraceptive use worldwide.

These government-led initiatives, often supported by non-governmental organizations (NGOs), are crucial in fostering a proactive approach to sexual health. By focusing on educational and awareness campaigns, there is a potential to significantly reduce the prevalence of STDs and consequently drive demand for contraceptives. This combined effort is anticipated to not only enhance public health but also stimulate growth in the related markets.

Trends

Innovations in Condom Technology Enhance Comfort and Safety

In a significant advancement within the personal protective equipment market, leading companies have launched innovative products designed to enhance user experience and safety. Among the notable introductions is Durex’s new line of Air condoms. These ultra-thin condoms are engineered to maximize intimacy and sensitivity while maintaining a high level of protection. The Air series aims to provide a more natural and instinctive user experience by reducing friction, enhancing lubrication, and preventing stickiness, thereby ensuring ultimate comfort.

In addition to Durex’s efforts, the condom market has seen inventive developments from other companies. The Origami condom, initially funded by the Bill and Melinda Gates Foundation in 2009, is a noteworthy innovation. Made from silicone, this condom features a unique reciprocating motion design that facilitates smoother movement and minimizes discomfort. The silicone’s lubricated texture enhances this effect further.

Other innovative products in the market include Hydrogel and The Galactic Cap, which offer unique approaches to condom design, focusing on user comfort and effectiveness. Additionally, the female condom, FC2, remains a critical component of the market, providing an alternative protective option that empowers women in sexual health management.

These product innovations reflect a broader industry trend towards enhancing user experience while maintaining rigorous safety standards. As condom manufacturers continue to innovate, they contribute significantly to public health efforts by improving the acceptability and usability of condoms, crucial in global sexual health and reproduction initiatives.

Regional Analysis

In 2024, Asia Pacific held a dominant market position, capturing more than a 47.8% share and holds US$ 3.4 Billion market value for the year. This region is expected to experience the fastest growth rates during the forecast period. This can be attributed to a rise in demand in countries such as China and India, Australia, and Japan. According to the National Health and Family Planning Commission of China (U.S., U.K., and Japan), the country ranks among the top four countries when it comes to condom production and usage. China has a huge market with potential double-digit growth at a 10.38% CAGR.

Local startups are trying hard to capture market share. A chinese condom made with waterborne polyurethane was launched in Gansu Province in June 2017. According to the company, this Condom had the thinnest protective sheath. It was meant to increase market share for Japanese manufacturers Sagami & Okamoto. Europe’s market will grow at a compound annual rate of 7.14%.

North America was second with the largest market shareholding region. This is due to increasing demand from sex workers and lesbians (MSM). Countries with the highest market shares include France, Germany, and the U.K. To prevent HIV transmission, these countries have launched government initiatives to encourage contraceptive use among their youth population.

As part of its efforts to combat HIV and AIDS, the France Ministry of Health announced in November 2018 that they would reimburse the cost of the prescription of condoms by doctors. North America has seen an increase in condom demand, despite a gradual vaccination drive. COVID restrictions have been relaxed. It is possible to increase condom use, especially among women who use them less than men. Sexual awareness can also help. The need to adopt condoms is further heightened by the rise in the number of sexually transmitted diseases (STDs).

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global condom market is characterized by intense competition, with major brands like Durex and Trojan dominating the landscape. However, local companies are striving to carve out market share by launching innovative products, enhancing packaging, and executing targeted promotions to cater to regional consumer preferences.

In strategic moves to bolster their market positions, leading players are increasingly turning to mergers and acquisitions. For example, in November 2020, Karex Berhad, a major player in the condom industry, acquired a 30% stake in the U.S.-based condom company GP, effectively gaining full ownership. Such acquisitions are pivotal in consolidating market presence and enhancing competitive leverage.

LifeStyles Healthcare, a significant private entity in the sector, boasts a comprehensive product portfolio backed by a robust workforce. Cupid Limited, another prominent company, exports both male and female condoms to approximately 66 countries. Their international strategy is focused on expanding their product line and enhancing global market presence. Notably, in August 2020, Cupid Limited received U.S. FDA approval to market male condoms in the United States, a crucial step in its expansion strategy.

The condom market remains highly fragmented with numerous local and regional players. Companies are vigorously competing with global giants, particularly those with established brand identities and extensive distribution networks. To maintain competitive edges, companies are adopting various growth strategies such as partnerships and new product introductions.

Overall, the condom market’s dynamic nature is driven by both global leaders and agile local players, each employing distinct strategies to capture consumer interest and increase market share.

Market Key Players

- Durex

- Okamoto

- Trojan

- Reckitt Benckiser Group Plc

- Church & Dwight Co. Inc.

- Okamoto Industries Inc.

- Cupid Limited Karex

- Ansell

- Sagami

- Gulin Latex

- NOX

- Mayer Laboratories Inc.

- Lifestyles Healthcare Pte Ltd.

- HLL Lifecare

- Fujilatex Co. Ltd

- Okamoto Industries Inc.

- Other Key Players

Recent Development

- In June 2024: Trojan introduced the Magnum Raw collection, a new addition to its Magnum line. This series features the thinnest Magnum condoms to date, designed to enhance comfort without compromising on size or safety. This launch highlights Trojan’s commitment to expanding its product offerings to cater to varying customer preferences.

- In April 2024: Trojan announced the Ultra Fit collection. This innovative line includes uniquely shaped condoms tailored to enhance individual fit and feel, improving the overall sexual experience. Each product in this collection is designed to cater to different preferences for condom fit, significantly affecting comfort and satisfaction during use.

- In January 2024: Mayer Laboratories received accreditation for its new manufacturing facility dedicated to producing non-latex condoms. This development is part of its commitment to serve consumers with latex allergies and expand its market share in the non-latex segment of the condom market.

- In October 2023: Durex launched a new range of sexual wellness toys, including the “Vibe & Tease” vibrator, “Slide & Ride” sleeve, and “Deep & Deeper” anal plug set. These products aim to enhance sexual pleasure for various preferences and experiences and are available online and in major retail stores like Superdrug and Boots.

- In August 2023: Mayer Laboratories announced a partnership with a leading e-commerce platform to increase product accessibility. This strategic move aims to improve the distribution and availability of Mayer Laboratories’ condom range, targeting the growing online consumer base.

Report Scope

Report Features Description Market Value (2022) USD 7.11 Bn Forecast Revenue (2033) USD 17.9 Bn CAGR (2024-2033) 9.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type- Latex Condoms and Non-latex Condoms; By Product- Male Condoms and Female Condoms; By Distribution Channel- Mass Merchandizers, Drug Stores, and E-commerce Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Durex, Okamoto, Trojan, Reckitt Benckiser Group Plc, Church & Dwight Co., Inc., Okamoto Industries, Inc., Cupid Limited Karex, Ansell, Sagami, Gulin Latex, NOX, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Durex

- Okamoto

- Trojan

- Reckitt Benckiser Group Plc

- Church & Dwight Co. Inc.

- Okamoto Industries Inc.

- Cupid Limited Karex

- Ansell

- Sagami

- Gulin Latex

- NOX

- Mayer Laboratories Inc.

- Lifestyles Healthcare Pte Ltd.

- HLL Lifecare

- Fujilatex Co. Ltd

- Okamoto Industries Inc.

- Other Key Players