Global Concrete Release Agents Market By Base Type (Mineral Oil, Vegetable Oil, and Others), By Category (Solvent-based and Water-based), By Formwork Type (Wooden, Metal, and Plastics), By Application Method (Brushing, Spraying, and Others), By Application (Precast Concrete, Ready-Mix Concrete, and Site-Mix Concrete), By End-use (Residential, Commercial, Infrastructure, and Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175028

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

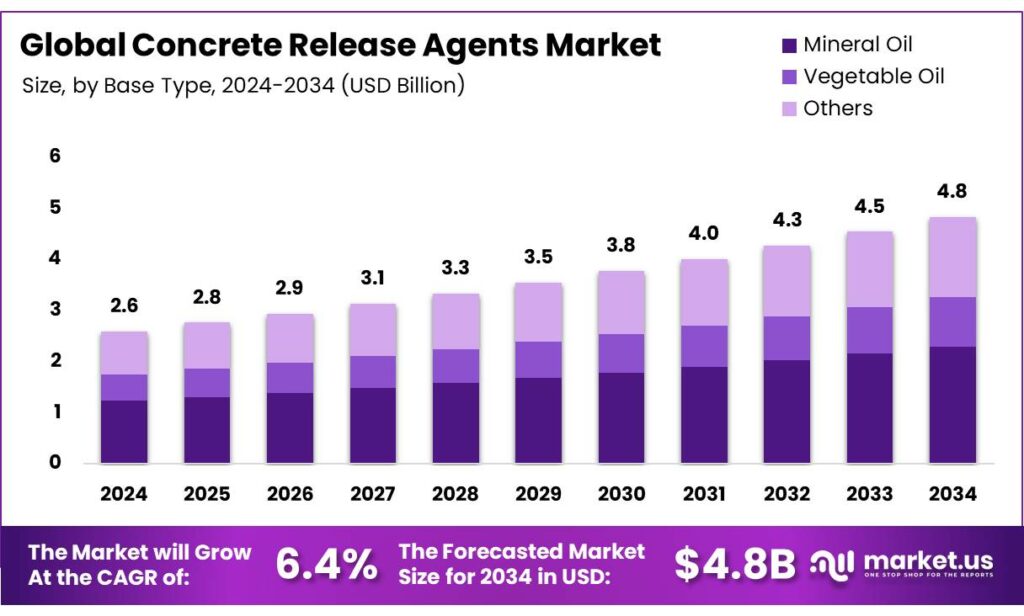

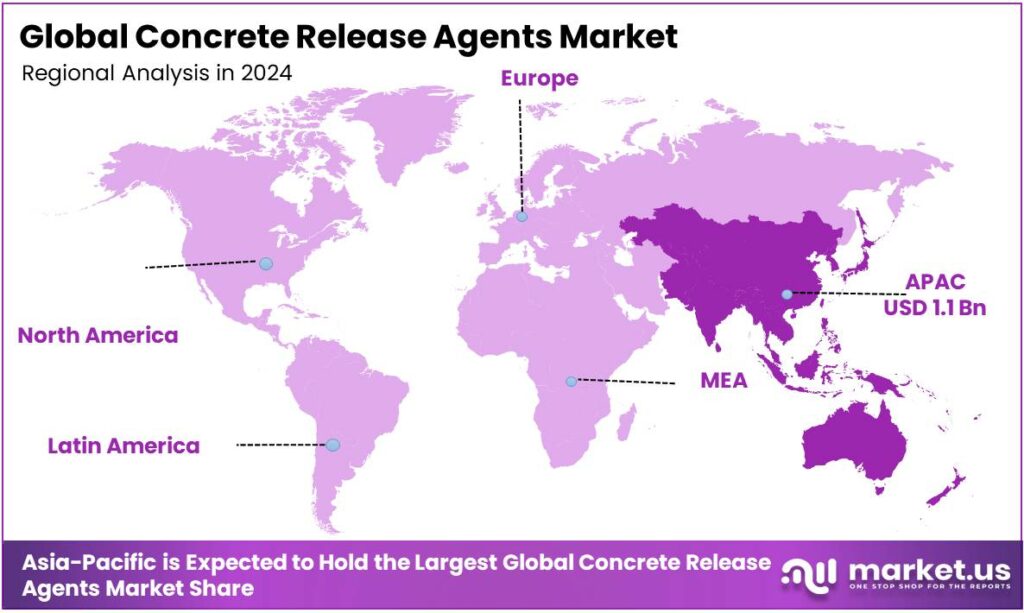

Global Concrete Release Agents Market size is expected to be worth around USD 4.8 Billion by 2034, from USD 2.6 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 46.2% share, holding USD 44.5 Billion in revenue.

Concrete release agents are liquids or powders applied to forms (molds) or stamps that prevent freshly poured concrete from sticking, allowing for clean separation, easier removal, extended form life, and smoother, defect-free finishes, often by creating a barrier or chemically reacting with the concrete. Its market is characterized by a diverse range of products designed to enhance the efficiency and quality of concrete molding and casting processes.

- According to the National Bureau of Statistics of China, from January to August 2025, the national investment in fixed assets, excluding rural households, amounted to 32,611.1 billion yuan, up by 0.5% from 2024. China’s construction sector is one of the largest in the world, contributing to the widespread use of these agents to improve mold efficiency and surface quality in concrete products.

These agents are crucial in industries such as precast concrete and infrastructure development, where the demand for smooth surface finishes, mold protection, and corrosion prevention is paramount. Conventionally, solvent-based agents have been favored for their superior performance, particularly in preventing adhesion and offering better protection against wear and tear on metal formwork.

- According to the US Geological Survey, in 2024, global cement production was around 4 billion metric tons, and the clinker capacity reached 3.8 billion metric tons. As the cement production is scaling up in response to the booming construction and infrastructure industry, it creates a consistent demand for concrete release agents.

However, environmental concerns have driven a shift toward more sustainable, water-based, and biodegradable alternatives. Despite the growing adoption of eco-friendly agents, solvent-based products remain dominant due to their cost-effectiveness and reliability, particularly in large-scale industrial applications. Moreover, the market is observing the integration of nanotechnology, further improving the durability and surface quality of concrete products, particularly in infrastructure projects.

Key Takeaways

- The global concrete release agents market was valued at USD 2.6 billion in 2024.

- The global concrete release agents market is projected to grow at a CAGR of 6.4% and is estimated to reach USD 4.8 billion by 2034.

- Based on the base type, mineral oil dominated the market, with a market share of around 47.5%.

- Based on category, the market is dominated by solvent-based, comprising 52.8% share of the total market.

- Based on the formwork type, metal held a major share in the market, 51.4% of the market share.

- Based on the application method, spraying dominated the market, with a substantial market share of around 60.1%.

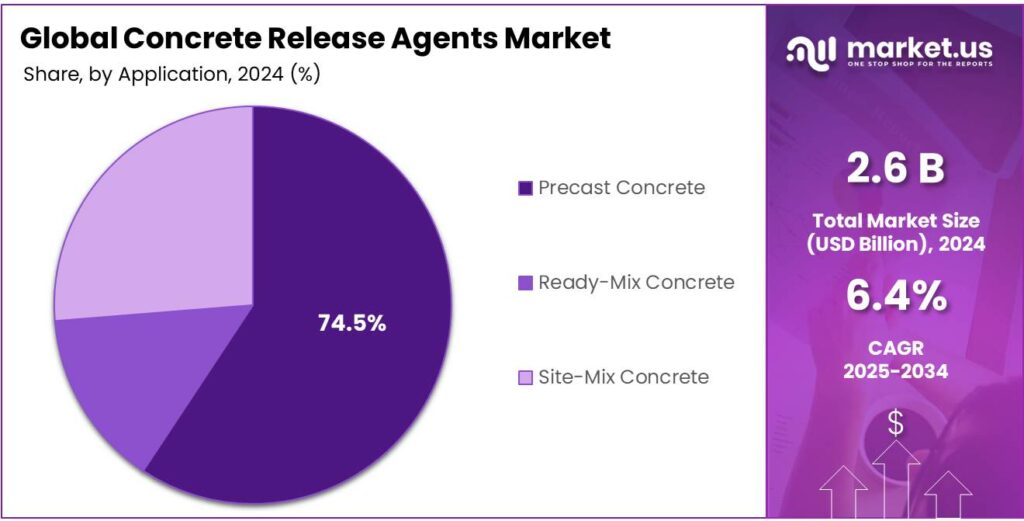

- Among the applications of the concrete release agents, precast concrete led the market, with a substantial 74.5% market share.

- Among the end-uses of concrete release agents, the infrastructure sector held a major share in the market, 36.9% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the concrete release agents market, accounting for around 41.3% of the total global consumption.

Base Type Analysis

Mineral Oil is a Prominent Segment in the Concrete Release Agents Market.

The concrete release agents market is segmented based on base type as mineral oil, vegetable oil, and others. The mineral oil dominated the concrete release agents market, comprising around 47.5% of the market share, primarily due to its cost-effectiveness and proven performance in demanding applications. Mineral oils provide excellent release properties, ensuring smooth concrete surfaces and preventing sticking, which is crucial in high-volume precast concrete production.

Additionally, their effectiveness in preventing corrosion, particularly in steel formwork used in ceilings and walls, makes them a preferred choice for many precast plants. Similarly, mineral-oil-based agents are readily available and offer a longer shelf life, making them convenient for large-scale operations. While vegetable oil or ester-based agents are more sustainable and environmentally friendly, their higher cost and sometimes less reliable performance under high technical demands limit their widespread adoption.

Category Analysis

Solvent-based Concrete Release Agents are Most Widely Utilized.

On the basis of the category of concrete release agents, the market is segmented into solvent-based and water-based. The solvent-based concrete release agents dominated the market, comprising around 52.8% of the market share. Solvent-based agents offer faster evaporation rates, which prevent the formation of excess moisture on the mold surface, ensuring a smoother, more consistent finish for the concrete. In addition, they provide better protection against corrosion and formwork wear, particularly in challenging environments such as high-temperature conditions.

Similarly, these agents are more versatile and effective for a variety of concrete types, making them the go-to option in large-scale industrial settings. While water-based release agents are more environmentally friendly, their slower evaporation and tendency to leave moisture behind can affect concrete surface quality, making them less reliable for certain high-performance applications.

Formwork Type Analysis

Metal Dominated the Concrete Release Agents Market.

Based on the formwork type, the market is divided into wooden, metal, and plastic. The metal dominated the concrete release agents market, with a market share of 51.4%, due to the specific properties of metal formwork, which often requires superior protection against corrosion and wear. Metals, such as steel, are more susceptible to the chemical reactions caused by concrete, leading to surface deterioration over time.

Concrete release agents help prevent adhesion, making the removal of concrete from metal molds easier and protecting the formwork from corrosion. In contrast, wood and plastic are less prone to corrosion, and their porous surfaces allow concrete to naturally release without the same need for intensive protection. Additionally, the durability and longevity of metal molds in harsh conditions make them more reliant on high-performance release agents to extend their service life.

Application Method Analysis

Spraying Method for Concrete Release Agents is a Major Fragment in the Market.

The concrete release agents market is segmented based on application method as brushing, spraying, and others. The spraying method dominated the market, comprising around 60.1% of the market share, as it ensures a uniform, consistent coating across large surface areas, which is essential for optimal performance. In contrast to brushing, which can result in uneven distribution and leave excess product in certain areas, spraying allows for quick and efficient application, especially on complex or intricate molds.

Additionally, this method reduces the risk of over-application, which can affect the quality of the concrete finish. Similarly, spraying minimizes labor time and effort, making it ideal for high-volume operations such as precast plants. Furthermore, it ensures better coverage of hard-to-reach areas of the mold, leading to improved mold release and a smoother surface for the concrete product.

Application Analysis

Concrete Release Agents on Precast Concrete Dominated the Market.

On the basis of application, the market is segmented into precast concrete, ready-mix concrete, and site-mix concrete. The concrete release agents on the precast concrete dominated the market, comprising around 74.5% of the market share, as they help ensure smooth and efficient mold release in a controlled, high-volume production environment. Precast concrete involves the casting of concrete in molds that must be removed once the concrete has set, making release agents essential to prevent sticking and surface defects.

The demand for consistent surface quality in precast components, such as beams, panels, and slabs, drives the widespread use of these agents. In contrast, ready-mix and site-mix concrete are often poured directly into forms or structures on-site, where the focus is on finishing and curing rather than mold release. Similarly, the forms used for ready-mix or site-mix are often reused more casually, and mold release agents are less critical compared to the precision required in the production of precast concrete.

End-Use Analysis

Concrete Release Agents Were Mostly Utilized for Infrastructure Development.

Based on the end-use of concrete release agents, the market is divided into residential, commercial, infrastructure, and industrial. The infrastructure development dominated the market, with a market share of 36.9%. Concrete release agents are predominantly used in infrastructure development due to the scale and complexity of the projects involved. Infrastructure projects such as bridges, tunnels, highways, and dams require large, robust molds that are often exposed to harsh environmental conditions, making the need for effective release agents essential.

In contrast, residential, commercial, and industrial development often involves smaller-scale projects with simpler forms, where mold release agents are not as critical. These developments may use more straightforward formwork that does not require the same level of protection or surface quality provided by release agents.

Key Market Segments

By Base Type

- Mineral Oil

- Vegetable Oil

- Others

By Category

- Solvent-based

- Water-based

By Formwork Type

- Wooden

- Metal

- Plastics

By Application Method

- Brushing

- Spraying

- Others

By Application

- Precast Concrete

- Dry Cast

- Wet Cast

- Ready-Mix Concrete

- Site-Mix Concrete

By End-Use

- Residential

- Commercial

- Infrastructure

- Industrial

Drivers

The Booming Infrastructure and Construction Industry Drives the Demand for Concrete Release Agents.

The increasing pace of infrastructure development and construction activities globally has significantly contributed to the rising demand for concrete release agents. These agents play a crucial role in preventing concrete from sticking to molds and forms, thereby ensuring smoother and more efficient production. The rapid expansion of urbanization, along with large-scale projects such as bridges, highways, and residential complexes, has necessitated the use of such agents to enhance the quality of finished surfaces.

- By 2050, the global population is projected to reach 9.7 billion, with approximately 6.4 billion people living in urban areas, equivalent to an increase of about 200,000 new urban residents every day. To accommodate this growth, the construction industry will need to deliver an average of 13,000 new buildings per day through 2050, representing roughly 3,600 additional buildings per day above the current construction rate.

- A 2022 analysis by the World Bank on the US economy found that every US$1 invested in infrastructure led to US$1.50 in resulting economic activity, with a bigger effect during a recession.

In addition, the growing emphasis on reducing construction time has led to a heightened demand for efficient release agents that minimize labor costs and maximize productivity. For instance, the construction of high-rise buildings and expansive road networks demands superior mold release performance to maintain structural integrity and aesthetic appeal.

Restraints

Operational Challenges Might Delay the Growth of the Concrete Release Agents Market.

The implementation of the REACH regulation has prompted manufacturers to replace conventional solvent-based concrete release agents with more eco-friendly alternatives, marking a significant shift towards sustainability. While this transition is beneficial for the environment and the longevity of materials, it introduces operational challenges. Solvent-based agents, which are known for their efficiency, protect polyurethane materials and maintain mould stability over time.

However, water-based and silicone-based alternatives, while non-toxic, tend to leave excess moisture in molds, leading to surface defects such as droplets that hinder proper concrete curing. This water retention, which cannot evaporate efficiently, can cause delays in the setting of concrete products and affect their quality.

Furthermore, the absence of solvents weakens the maintenance properties of the release agents, thus reducing their effectiveness in protecting formwork and ensuring durability. Although the shift to eco-friendly solutions is driven by regulatory pressures, these practical challenges may dampen the widespread adoption of these alternatives in the industry.

Opportunity

Sustainable Concrete Release Agents Create Opportunities in the Market.

The growing demand for sustainable solutions in the construction sector has created significant opportunities for eco-friendly concrete release agents. These products, designed to be biodegradable and free from harmful solvents, align with the industry’s increasing focus on environmental responsibility. Sustainable concrete release agents, such as those made from vegetable oils, water, or silicones, effectively prevent issues, such as concrete discoloration and mold corrosion, which can affect the quality and durability of the final product.

In addition, some of these agents are observed to minimize surface residues, ensuring smoother finishes that are critical for subsequent applications, such as painting and coating. For instance, FUCHS Lubricants Germany had developed SOK ECO 107, SOK ECO 911, and SOK HU ECO for requirements of this kind, further gaining the EU Ecolabel certification.

Furthermore, with environmental regulations becoming more stringent, products that meet eco-certifications, such as the EU Ecolabel, are gaining traction as trusted solutions for construction projects. The transition to these environmentally friendly agents helps companies reduce their carbon footprint and enhances their standing among environmentally conscious clients and regulatory bodies, driving increased adoption in the market.

Trends

Adoption of Nanotechnology Concrete Release Agents.

The adoption of nanotechnology in concrete release agents is emerging as a powerful trend, significantly enhancing the durability and performance of cement-based materials. According to the studies, the application of nanoSiO2-/nanoTiO2-engineered release agents (nSRa/nTRa) on formwork surfaces improves the surface quality and the long-term durability of concrete. Studies have demonstrated that these nanoparticle-infused agents reduce surface porosity by up to 19.4%, depending on the formulation, resulting in a more compact and resilient surface.

Moreover, when mortar samples were cast using these modified molds, they exhibited improved resistance to sulfate attack, chloride migration, and freeze-thaw cycles. Specifically, after 120 days of sulfate exposure, compressive strength losses in the nSRa/nTRa-coated samples were reduced by up to 1.57%, and chloride migration coefficients dropped by as much as 26.6%. These enhancements, along with a 12% increase in dynamic modulus elasticity after freeze-thaw testing, underscore the substantial benefits of integrating nanotechnology into concrete release agents.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Concrete Release Agents Market by Disrupting the Essential Supply Chains in the Market.

Geopolitical tensions, especially in Eastern Europe and parts of Asia, have significantly affected the concrete release agents market by disrupting global supply chains and increasing raw material costs. Trade restrictions and tariffs, such as the 10% baseline tariff imposed by the Trump administration in 2025, have led to higher costs for essential materials, such as steel, aluminum, and copper, which are critical for construction.

Consequently, there is a 9.7% rise in input costs for U.S. construction firms, creating financial pressure across the industry. Although cement production itself faces less strain, the overall construction sector is deeply impacted, which in turn affects the demand for concrete release agents. Additionally, the Russia-Ukraine conflict has disrupted supplies of key materials, including steel and timber, further driving up prices and slowing production.

Furthermore, global shipping flows have been compromised by disputes in regions such as the South China Sea and the Suez Canal, causing delays and escalating shipping costs. These supply chain disruptions lead to project delays and higher overall expenses, indirectly impacting the availability and affordability of concrete release agents, as manufacturers face higher costs for shipping, raw materials, and production. The cumulative effect of these geopolitical challenges significantly reshapes market dynamics in the construction industry.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Concrete Release Agents Market.

In 2024, the Asia Pacific dominated the global concrete release agents market, holding about 41.3% of the total global consumption, driven by rapid urbanization, large-scale construction projects, and a strong focus on infrastructure development. Countries such as China, India, and Japan are seeing significant growth in both residential and commercial construction, creating high demand for reliable concrete release agents.

- According to the India Brand Equity Foundation, the Foreign Direct Investment (FDI) in construction developments, townships, housing, built-up infrastructure, and construction development projects, and construction, infrastructure, activity sectors stood at US$ 27.21 billion and US$ 36.85 billion, respectively, between April 2000 and June 2025. India’s expanding infrastructure projects, such as highways and smart cities, are fueling demand for sustainable and high-performance release agents.

Furthermore, the growing emphasis of the region on environmental sustainability has accelerated the adoption of eco-friendly release agents, further boosting market share. With substantial investment in construction and infrastructure, the Asia Pacific region continues to lead global consumption and innovation in concrete release technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the concrete release agents market are focusing on several strategic activities to enhance market share and expand their reach. The companies focus on the development of eco-friendly and sustainable products, driven by increasing environmental awareness and stricter regulations. Furthermore, manufacturers are investing in research and development to create bio-based, non-toxic agents that can meet performance and sustainability standards.

Additionally, companies are expanding their geographical presence by entering emerging markets in Asia and Africa, where construction activities are booming. Similarly, strategic partnerships and collaborations with construction firms are being prioritized to offer tailored solutions that meet specific regional needs.

The Major Players in The Industry

- Sika AG

- FUCHS Group

- BASF SE

- Henkel AG & Co. KGaA

- Fosroc, Inc.

- MAPEI S.p.A.

- Evonik Industries AG

- MC-Bauchemie

- PERI India Pvt. Ltd

- R. Meadows, Inc.

- Chryso S.A.S.

- Schepens N.V.

- Innospec

- Smooth-On, Inc.

- Other Key Players

Key Development

- In February 2025, Saint-Gobain completed the acquisition of FOSROC, a leading global construction chemicals player with a strong geographic footprint in India, the Middle East, and Asia-Pacific in particular. The acquisition was announced in June 2024.

- In July 2025, MC-Bauchemie entered a strategic joint venture with SwissChem Construction Chemicals, an established Egyptian supplier of high-quality construction solutions, to strengthen its market presence and operational capabilities in Egypt and the wider region.

Report Scope

Report Features Description Market Value (2024) US$2.6 Bn Forecast Revenue (2034) US$4.8 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Base Type (Mineral Oil, Vegetable Oil, and Others), By Category (Solvent-based and Water-based), By Formwork Type (Wooden, Metal, and Plastics), By Application Method (Brushing, Spraying, and Others), By Application (Precast Concrete, Ready-Mix Concrete, and Site-Mix Concrete), By End-use (Residential, Commercial, Infrastructure, and Industrial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Sika AG, FUCHS Group, BASF SE, Henkel AG & Co. KGaA, Fosroc, Inc., MAPEI S.p.A., Evonik Industries AG, MC-Bauchemie, PERI India Pvt. Ltd., W. R. Meadows, Inc., Chryso S.A.S., Schepens N.V., Innospec, Smooth-On, Inc., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Concrete Release Agents MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Concrete Release Agents MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Sika AG

- FUCHS Group

- BASF SE

- Henkel AG & Co. KGaA

- Fosroc, Inc.

- MAPEI S.p.A.

- Evonik Industries AG

- MC-Bauchemie

- PERI India Pvt. Ltd

- R. Meadows, Inc.

- Chryso S.A.S.

- Schepens N.V.

- Innospec

- Smooth-On, Inc.

- Other Key Players