Global Commercial Helicopter Market Size, Share Report By Type (Light Helicopters (1-3 tons), Medium Helicopters (3-8 tons), and Heavy Helicopters (>8 tons)), By Number of Engine (Single-Engine and Multi-Engine), By Rotor System Type (Single Main Rotor, Tandem Rotor, Co-Axial Rotor, and Tilt-Rotor), By Application (Offshore Oil & Gas Transport, Emergency Medical Services (EMS), Law Enforcement & Surveillance, Tourism & VIP Transport, Cargo & Logistics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153876

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

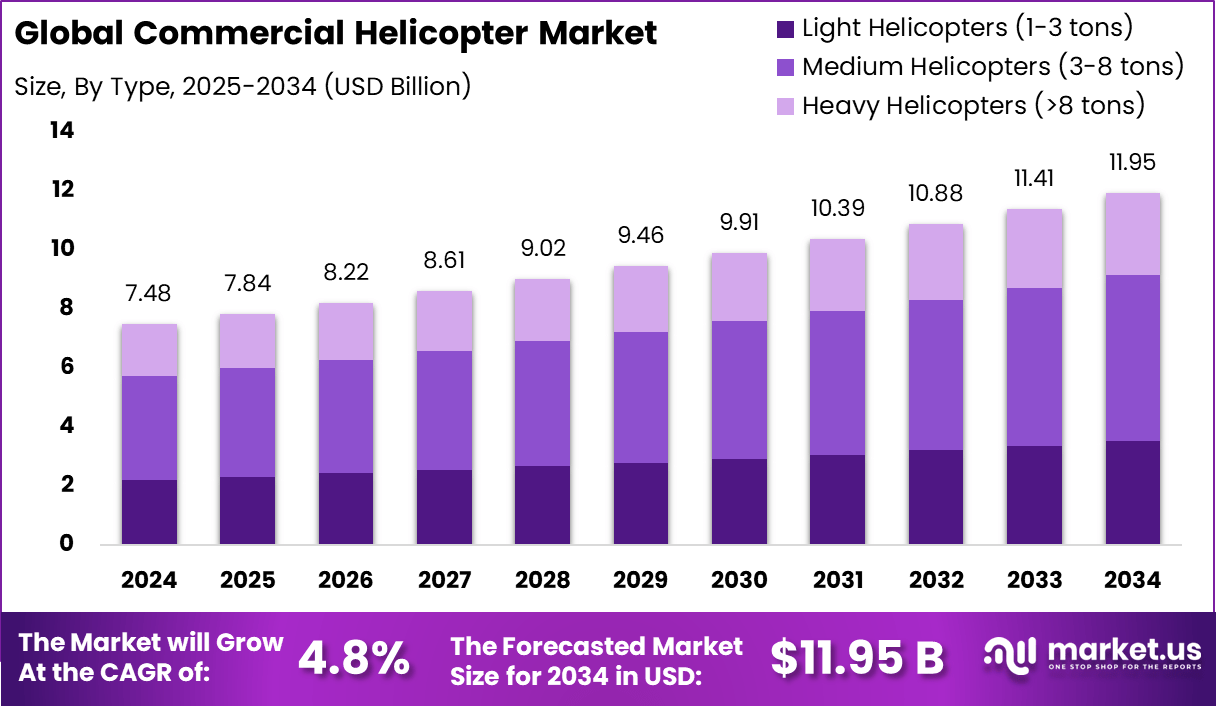

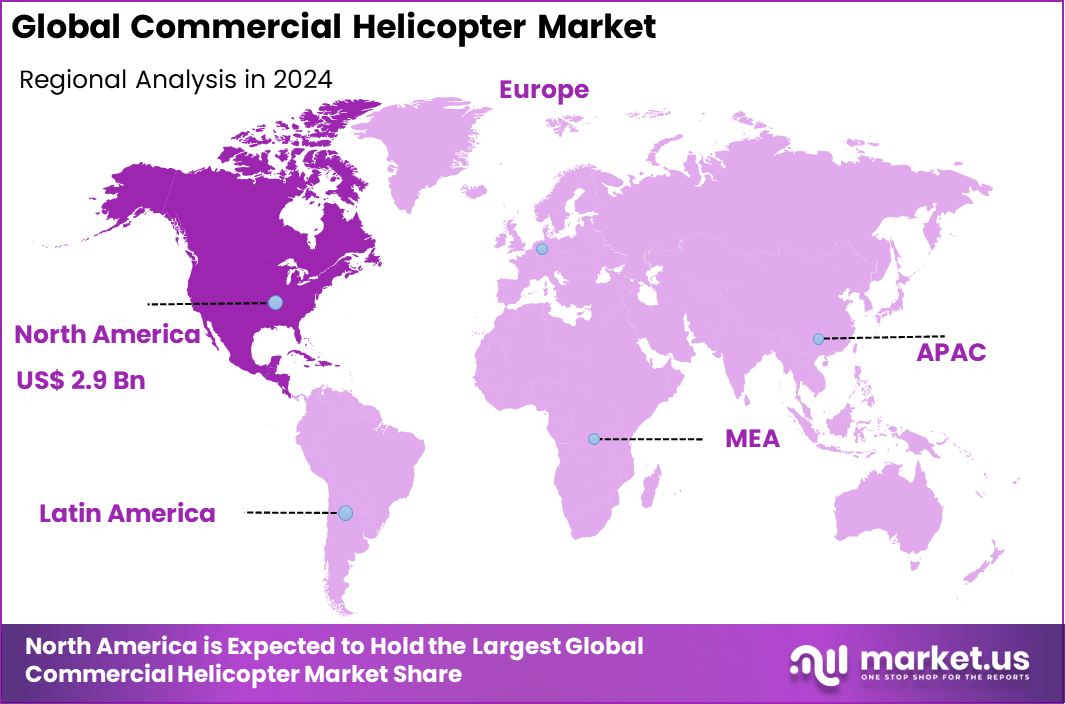

The Global Commercial Helicopter Market size is expected to be worth around USD 11.9 billion by 2034, from USD 7.48 billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40% share, holding USD 2.9 billion in revenue.

The commercial helicopter market stands as a dynamic sector within aviation, acting as a cornerstone for industries such as emergency medical services, oil and gas exploration, law enforcement, public safety, and urban transportation. With their unique ability to access remote or constrained environments, helicopters provide invaluable support for critical tasks like patient evacuation, cargo delivery, firefighting, and sightseeing.

Growth is powered by increasing demand in emergency medical services and offshore support operations. Expanding public safety needs and increased urbanization are contributing to a steady rise in deployments. Investments in industries such as offshore wind support and aerial firefighting are also serving as key levers for greater adoption.

In March 2025, Global Medical Response (GMR) agreed to acquire up to 15 H140 helicopters from Airbus, starting with an initial order of 10 units. This move supports the growing demand for air medical services and is expected to boost commercial helicopter industry growth by enhancing rapid emergency response capabilities.

A key feature of the present market is the increasing adoption of innovative technologies. Hybrid-electric and electric propulsion systems, lightweight materials, advanced avionics, and predictive maintenance software are at the forefront. Modern helicopters are now integrated with health monitoring systems and AI-powered diagnostics to ensure reliability while reducing operational costs.

For instance, In July 2024, RTX Corporation entered into a strategic partnership with Airbus to co-develop a hybrid-electric propulsion system for the H145-based PioneerLab demonstrator. This collaboration reflects the industry’s urgent push toward cleaner aviation technologies. The initiative is expected to deliver a 30% improvement in fuel efficiency while significantly lowering CO2 emissions.

Scope and Forecast

Report Features Description Market Value (2024) USD 7.48 Bn Forecast Revenue (2034) USD 11.95 Bn CAGR(2025-2034) 4.8% Leading Segment Single Main Rotor: 72% Largest Market North America [40% Market Share] Largest Country U.S. [2.8 Bn Market Revenue, CAGR: 3.2%] Key Takeaways

- The global commercial helicopter market was valued at USD 7.48 billion in 2024 and is expected to grow at a CAGR of 4.8% from 2025 to 2034, driven by increasing demand across sectors such as offshore transportation, emergency medical services, and VIP travel.

- Medium helicopters (3–8 tons) held the largest share by type at 47%, due to their versatility and suitability for both industrial and civil missions.

- Single-engine helicopters dominated the market by number of engines with a 56% share, owing to their cost-effectiveness and preference for short-range and light-duty applications.

- By rotor system type, single main rotor helicopters accounted for 72% of the market, driven by their simpler design, lower maintenance requirements, and operational efficiency.

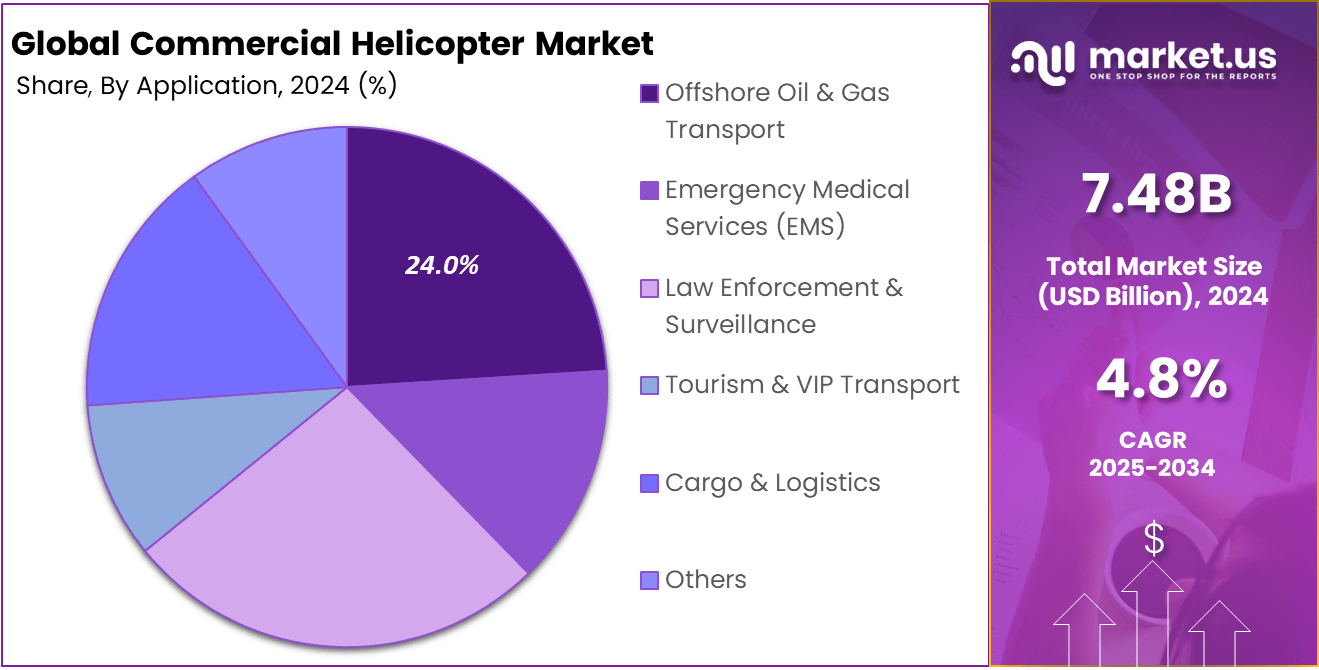

- In terms of application, offshore oil and gas transport was the leading segment with a 24% share, supported by ongoing investments in offshore energy infrastructure and the need for reliable crew transportation.

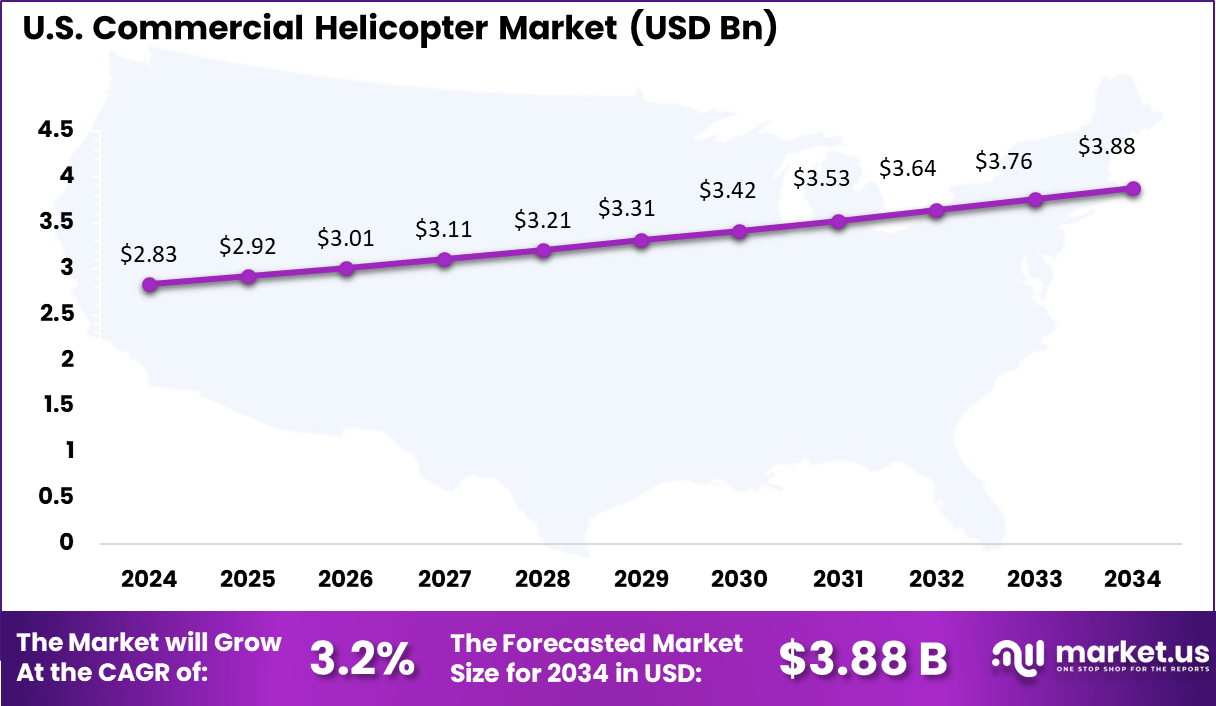

- Regionally, North America led the global market with a 40% share, with the United States alone contributing USD 2.8 billion, and growing at a CAGR of 3.2%.

U.S. Commercial Helicopter Market

The U.S. commercial helicopter market is a mature yet steadily expanding sector, projected to grow from USD 2.83 billion in 2024 to USD 3.88 billion by 2034, at a CAGR of 3.2%. Growth is driven by sustained demand in emergency medical services (EMS), law enforcement, offshore transport, tourism, and aerial firefighting.

The U.S. performs over 400,000 air medical patient transports annually, with helicopters playing a vital role in rural and time-sensitive emergencies. The rise in wildfire incidents, particularly in Western states like California, has also boosted demand for firefighting rotorcraft. In urban areas, helicopter commuting and tourism are on the rise.

Companies such as Blade Air Mobility offer luxury helicopter shuttle services between Manhattan and area airports, generating over USD 45 million in short-distance revenue in 2022. However, safety concerns following accidents, such as the Hudson River crash, have prompted legislative efforts like the Improving Helicopter Safety Act, aimed at limiting non-essential flights in urban areas.

Meanwhile, technological advancements are reshaping the market. Autonomous test flights by Honeywell and Near Earth Autonomy, along with the FAA’s push toward eVTOL certification by 2025, highlight future potential. U.S. OEMs like Bell, Sikorsky, and Robinson continue to innovate with fuel-efficient, next-gen rotorcraft, reinforcing the country’s leadership in this space.

In 2024, North America held a dominant market position, capturing more than a 40% share and generating approximately USD 2.9 billion in revenue within the global commercial helicopter market. This leadership is supported by a well-established ecosystem for emergency medical services, law enforcement, and offshore energy operations.

The region also benefits from a high density of certified operators and maintenance providers, which ensures consistent service availability across urban and remote regions. Strong demand from both public and private sectors continues to reinforce procurement cycles, especially for light and medium helicopters suited for EMS, surveillance, and passenger transport.

The presence of advanced aerospace infrastructure in the United States further accelerates North America’s market strength. Continuous investments in R&D for hybrid and electric helicopters by regional players contribute to the adoption of low-emission aviation solutions. Additionally, regulatory clarity and supportive FAA guidelines on powered-lift aircraft are encouraging innovation in next-generation rotorcraft.

By Type Analysis

The type segment of the global commercial helicopter market is broadly classified into light (1–3 tons), medium (3–8 tons), and heavy (>8 tons) helicopters. Among these, medium helicopters dominate the market with a 47% share in 2024, owing to their versatility, cost-efficiency, and optimal payload-to-range balance.

Medium helicopters such as the Airbus H145, Leonardo AW139, and Bell 412 are widely used in emergency medical services (EMS), offshore oil and gas transport, search and rescue (SAR), and VIP transport. For example, the AW139, capable of carrying 15 passengers and operating in challenging conditions, is a preferred choice for offshore operations in regions like the North Sea and the Gulf of Mexico.

Light helicopters are gaining popularity in tourism, urban mobility, and training sectors due to their lower acquisition and operational costs. Models like the Robinson R44, Bell 505, and Airbus H125 are extensively used in air charter services, sightseeing tours, and pilot training schools worldwide.

Meanwhile, heavy helicopters, such as the Sikorsky S-92 and Mi-26, are primarily used in specialized applications including heavy-lift cargo, firefighting, and large-scale evacuation missions. However, their high costs limit their widespread commercial use. Overall, each category serves distinct market needs, contributing to a diverse and evolving global helicopter ecosystem.

By Number of Engine Analysis

The number of engine segments in the global commercial helicopter market is categorized into single-engine and multi-engine helicopters. In 2024, single-engine helicopters command the majority share at 56%, primarily due to their lower acquisition and operating costs, simpler maintenance requirements, and suitability for a broad range of commercial applications.

Popular single-engine models such as the Airbus H125, Bell 206 JetRanger, and Robinson R66 are widely used in aerial tourism, agricultural operations, law enforcement, news gathering, and pilot training. For example, the H125 is a favorite among tourism operators in locations like Hawaii and the Grand Canyon due to its maneuverability and cost-effectiveness.

Multi-engine helicopters, although more expensive to acquire and maintain, offer greater power, redundancy, and safety, making them indispensable in high-risk operations. They are predominantly used in offshore oil and gas transport, emergency medical services (EMS), and search and rescue missions. Multi-engine platforms include the Leonardo AW139, Airbus H155, and Sikorsky S-76.

These helicopters provide superior performance in harsh environments and over water, meeting strict safety regulations. While single-engine helicopters dominate in volume due to cost-efficiency and operational flexibility, multi-engine variants play a critical role in mission-critical and premium service segments, ensuring a balanced market demand across both types.

By Rotor System Type Analysis

The rotor system type segment in the global commercial helicopter market is a critical classification, influencing aircraft design, maneuverability, and mission adaptability. In 2024, single main rotor systems dominate the market with a 72% share, owing to their simpler design, cost-efficiency, and widespread use in light to medium helicopters.

This configuration, seen in widely used models such as the Bell 407 and Airbus H125, is ideal for general-purpose roles like aerial tourism, news broadcasting, and emergency medical services. Operators favor these helicopters for their ease of maintenance and versatility in both urban and remote environments.

Tandem rotor systems, characterized by two large rotors placed at either end of the helicopter, provide superior lift capacity and are primarily used in heavy-lift missions. Though less common in the commercial sector, models like the Boeing CH-47 Chinook are occasionally used for specialized civilian logistics and firefighting due to their high payload capacity.

Co-axial rotor systems, such as those found in the Russian Kamov Ka-32, eliminate the need for a tail rotor, enhancing maneuverability and compactness ideal for firefighting and confined-area operations. Meanwhile, tilt-rotor systems like the Bell V-280 Valor (though still largely military) represent emerging technology with high-speed potential, and are increasingly attracting attention for future urban air mobility and VIP transport applications.

By Application Analysis

The application segment of the global commercial helicopters market is highly diversified, with significant adoption across critical, high-value missions. In 2024, Offshore Oil & Gas Transport leads with a 24% market share, driven by the need to transport personnel and equipment to and from remote oil rigs.

Helicopters like the Leonardo AW139 and Airbus H175 are widely used by companies such as Bristow Group and PHI Inc., offering reliable performance in harsh maritime conditions. Emergency Medical Services (EMS) is another major application area, where speed and maneuverability are crucial for saving lives. Helicopters such as the Airbus H135 and Bell 429 are widely deployed for air ambulance services.

According to the Association of Air Medical Services, there are over 1,000 EMS helicopters operating in the U.S. alone, performing thousands of lifesaving missions annually. Law Enforcement & Surveillance relies on helicopters for border patrol, traffic monitoring, and public safety. Agencies often utilize light helicopters like the MD 500 and Airbus H125 for their agility and low operating costs.

Meanwhile, Tourism & VIP Transport and Cargo & Logistics segments are growing due to the rising demand for luxury travel experiences and last-mile aerial logistics. For instance, companies like Blade offer premium urban air mobility (UAM) services in cities like New York and Mumbai. As urban congestion grows, helicopters are becoming vital assets across diverse operational landscapes.

Key Features and Trends

Feature / Trend Details Hybrid/Electric Propulsion Rapid R&D in fuel-efficient, low-emission technologies to meet sustainability demands. Advanced Avionics & Automation Incorporation of smart cockpit tech, autopilot, and predictive maintenance systems. Lightweight Composite Materials Enhancing payload/range and reducing costs/noise. Modular & Multipurpose Designs Helicopters designed for easy mission conversion (EMS, SAR, VIP, cargo). Data Analytics & IoT Monitoring Use of real-time monitoring, remote diagnostics, AI-driven maintenance for fleet uptime. Subscription & On-demand Models Rise of helicopter leasing and on-demand air mobility services. Safety System Innovation Investments in safety features, crash survivability, and regulatory compliance. UAV/Autonomous Flight Integration Increasing overlap with UAVs and autonomous flight capabilities. Driving Factor

Urban tourism, luxury travel, and VIP charters

Urban tourism, luxury travel, and VIP charters are emerging as major driving forces in the global commercial helicopter market, particularly in regions with dense urban centers, scenic landscapes, or high-net-worth populations. These services cater to time-sensitive travelers, celebrities, corporate executives, and tourists seeking premium, time-saving transport options.

According to Airbus Helicopters, VIP and corporate helicopter demand accounted for around 20% of civil deliveries globally in recent years. With rising disposable incomes, urban congestion, and evolving tourism preferences, this segment continues to fuel commercial helicopter market growth worldwide.

Helicopter charters offer point-to-point travel, avoiding ground congestion and airport delays, especially relevant in megacities like New York, São Paulo, Mumbai, Dubai, and London. In New York, companies like BLADE provide luxury helicopter services between Manhattan and JFK/LaGuardia airports, reducing travel time from over an hour to under 10 minutes.

The company reported over 200,000 passenger flights in 2023, a testament to growing demand. Tourist-centric helicopter services are thriving in scenic regions such as the Grand Canyon, the Swiss Alps, the French Riviera, and the Great Barrier Reef, offering aerial sightseeing experiences. In India, companies like Pawan Hans and Thumby Aviation operate heli-tourism services across pilgrimage routes (e.g., Kedarnath, Vaishno Devi) and luxury destinations (e.g., Coorg, Goa).

Restraining Factor

High acquisition and operational costs

One of the most significant restraints in the global commercial helicopter market is the high cost associated with acquiring and operating helicopters. The initial purchase price of a new commercial helicopter ranges from USD 1 million for light models to over USD 30 million for heavy-lift or VIP-configured models.

For example, the Airbus H225 Super Puma, widely used in offshore transport, can cost upwards of USD 27 million, excluding customization. These high acquisition costs act as a major barrier, especially for small operators and startups in developing regions. Operational costs are also substantial.

The hourly operating cost of a helicopter can range from USD 1,000 to over USD 5,000, depending on the model and mission profile. This includes fuel, maintenance, crew salaries, insurance, and regulatory compliance. According to a report by Honeywell, maintenance expenses alone account for nearly 35% of the total operational cost over a helicopter’s lifecycle.

Additionally, helicopters require frequent inspections and part replacements under strict aviation safety standards, further inflating ongoing expenses. Such high capital and operational burdens limit market penetration in cost-sensitive segments like EMS in rural areas or tourism in emerging economies. Consequently, many operators are shifting toward leasing models or used helicopters, though even these come with complex cost structures and regulatory scrutiny.

Growth Opportunity

Strategic partnerships and assembly expansion

Strategic partnerships and local assembly expansion present a significant opportunity in the global commercial helicopter market, enabling OEMs and regional players to reduce costs, accelerate delivery timelines, and strengthen market presence. By collaborating with local governments or private entities, global helicopter manufacturers can bypass high import tariffs, create jobs, and cater to region-specific demand more effectively.

A notable example is Airbus Helicopters’ partnership with the Tata Group in India. In January 2024, they announced the establishment of India’s first private helicopter assembly line in Karnataka to produce the H125 light utility helicopter, primarily for civil and tourism applications. The facility is expected to be operational by 2026, positioning India as a strategic hub for Airbus’s South Asian operations.

Similarly, Bell Textron and Leonardo Helicopters have entered into various joint ventures and localization agreements across the Middle East and Asia-Pacific, aiming to enhance after-sales service capabilities and increase fleet deployment in high-growth regions. These partnerships also facilitate technology transfer, training, and the development of regional maintenance, repair, and overhaul (MRO) hubs, which reduce long-term operational costs.

Key Market Segments

Type

- Light Helicopters (1-3 tons)

- Medium Helicopters (3-8 tons)

- Heavy Helicopters (>8 tons)

Number of Engines

- Single-Engine

- Multi-Engine

Rotor System Type

- Single Main Rotor

- Tandem Rotor

- Co-Axial Rotor

- Tilt-Rotor

Application

- Offshore Oil & Gas Transport

- Emergency Medical Services (EMS)

- Law Enforcement & Surveillance

- Tourism & VIP Transport

- Cargo & Logistics

- Others

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

Key Player Analysis

In the global commercial helicopters market, key players dominate with a strong presence across multiple segments. Airbus Helicopters leads the market with an estimated 27–30% share in 2024, owing to its broad portfolio and global customer base. Bell Textron follows with around 22–24%, driven by demand in North America and Asia.

Leonardo Helicopters holds approximately 15–17%, supported by strong EMS and defense-related contracts. Russian Helicopters and MD Helicopters also contribute significantly, especially in emerging markets. These players focus on strategic partnerships, assembly expansion, and innovation, especially in hybrid and sustainable rotorcraft, to maintain competitive advantages in a consolidating market landscape.

Top Key Players in the Commercial Helicopter Market

- Leonardo S.p.A.

- Bell Textron

- Airbus SE

- Aviation Industry Corporation of China

- Hindustan Aeronautics Limited

- Kaman Corporation

- Lockheed Martin Corporation

- MD Helicopters Inc.

- Robinson Helicopter Company

- Rostec

- Textron Inc.

- Other Key Players

Recent Developments

- June 2025: Airbus unveiled its HTeaming modular crewed–uncrewed teaming system ahead of the Paris Air Show, successfully tested in May with an H135 and Flexrotor UAS. The system is expected to be available to operators from

- May 2025: Malaysia ordered up to 28 Leonardo AW149 helicopters under a long-term lease-to-own deal worth ~USD 3.5 billion. Deliveries are slated for 2026–27 to support CSAR, EMS, maritime surveillance, and policing.

- March 2025: Bell partnered with Omni Helicopters for a six-month operational evaluation of the Bell 525 in Guyana’s offshore environment, preparing the model for oil & gas missions pending certification.

- March 2025: At VERTICON 2025 in Dallas, Airbus secured 118 orders and commitments, including 63 firm orders – notably over 74 for its new H140 light twin-engine helicopter targeting EMS operators like Air Methods, Stat Medevac, and ADAC.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Light Helicopters (1-3 tons), Medium Helicopters (3-8 tons), and Heavy Helicopters (>8 tons)), By Number of Engine (Single-Engine and Multi-Engine), By Rotor System Type (Single Main Rotor, Tandem Rotor, Co-Axial Rotor, and Tilt-Rotor), By Application (Offshore Oil & Gas Transport, Emergency Medical Services (EMS), Law Enforcement & Surveillance, Tourism & VIP Transport, Cargo & Logistics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Leonardo S.p.A., Bell Textron, Airbus SE, Aviation Industry Corporation of China, Hindustan Aeronautics Limited, Kaman Corporation, Lockheed Martin Corporation, MD Helicopters Inc., Robinson Helicopter Company, Rostec, Textron Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Helicopter MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Commercial Helicopter MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Leonardo S.p.A.

- Bell Textron

- Airbus SE

- Aviation Industry Corporation of China

- Hindustan Aeronautics Limited

- Kaman Corporation

- Lockheed Martin Corporation

- MD Helicopters Inc.

- Robinson Helicopter Company

- Rostec

- Textron Inc.

- Other Key Players