Global Commercial Drone Market By Type (Fixed-Wing Drones, Multirotor Drones, Hybrid Drones), Industry Vertical (Agriculture, Construction, Energy and Utilities, Transportation and Logistics, Public Safety and Law Enforcement, Mining and Quarrying, Media and Entertainment), By Application (Mapping and Surveying, Aerial Photography and Videography, Inspections, Delivery and Logistics, Monitoring and Surveillance, Precision Agriculture), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 106902

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

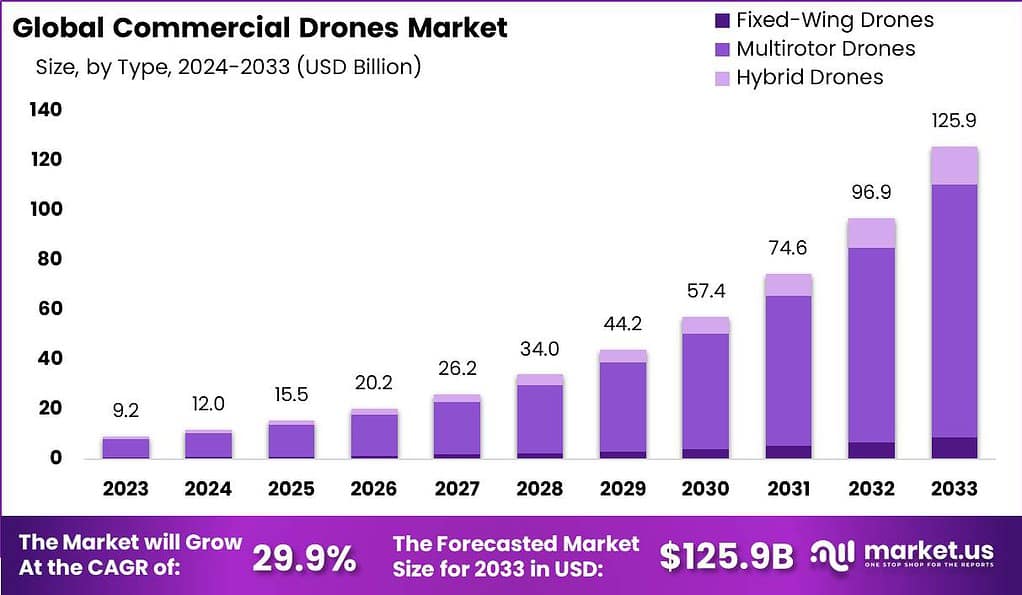

The global commercial drone market is anticipated to surge to USD 125.9 billion by 2033. It is estimated to record a steady CAGR of 29.9% in the review period 2024 to 2033. It is likely to total USD 9.2 billion in 2023.

Drones, often referred to as unmanned aerial vehicles (UAVs), are aircraft that are operated remotely by individuals on the ground or autonomously guided by onboard computer systems. Various sectors are making significant investments in commercial drone technology and are actively exploring its wide range of applications. This growing interest is anticipated to have a positive impact on the business landscape.

The Commercial drones are unmanned aerial aircrafts designed specifically for commercial applications like risk mitigation, resource planning, excavation & research & excavation planning & excavation planning urban planning engineering farming management tourism aerial imaging LiDAR applications cargo management weather monitoring traffic control green mapping among others. Commercial drones can serve many sectors including agriculture & environment media entertainment energy government among others as business solutions.

Note: Actual Numbers Might Vary In The Final Report

The market expansion can be attributed to an expanding enterprise usage of drones across various industry verticals. Drone manufacturers continue testing, inventing, and upgrading solutions tailored to various markets while the incorporation of modern technologies into commercial drones provides new growth opportunities in this rapidly-evolved sector. Furthermore, business use cases for drones have vastly increased over the years.

Unmanned Aerial Vehicles (UAV) have become one of the main drivers behind market expansion. A UAV is an aircraft without an attendant pilot on board that can either be remotely controlled or autonomously flown using preprogrammed flight plans; providing 24/7 security as well as inspecting utility guidelines with high precision at cost-effectiveness.

In May 2023, A2Z Drone Delivery, Inc introduced its latest cutting-edge delivery drone, the RDSX Pelican. This innovative drone employs a hybrid VTOL airframe without traditional control surfaces, seamlessly blending the reliability and flight stability of a multirotor platform with the extended range characteristic of a fixed-wing aircraft. The Pelican is meticulously crafted to adhere to the FAA Part 107 regulations regarding take-off weight, capping it at 55 pounds. With the capacity to transport payloads weighing up to 5 kilograms, it is capable of roundtrip journeys spanning 25 miles.

Key Takeaways

- Market Size and Growth: The global commercial drone market is projected to reach USD 125.9 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 29.9%. In 2023, the market is expected to total USD 9.2 billion.

- Definition of Commercial Drones: Commercial drones, also known as unmanned aerial vehicles (UAVs), are aircraft operated remotely or autonomously. They find applications across various industry sectors.

- Industry Verticals: Commercial drones are utilized in several industry verticals, including Agriculture, Construction, Energy and Utilities, Transportation and Logistics, Public Safety and Law Enforcement, Mining and Quarrying, and Media and Entertainment.

- Applications: Drones serve multiple applications, such as Mapping and Surveying, Aerial Photography and Videography, Inspections, Delivery and Logistics, Monitoring and Surveillance, and Precision Agriculture.

- Type Analysis: Multirotor drones dominate the market, capturing over 81% of the Commercial Drones Market in 2023. Fixed-wing drones and Hybrid drones also play significant roles in specific applications.

- Market Share by Industry Vertical: In 2023, the Media and Entertainment sector holds the largest market share at 24%, followed by Agriculture and Construction. Each sector benefits from unique drone applications.

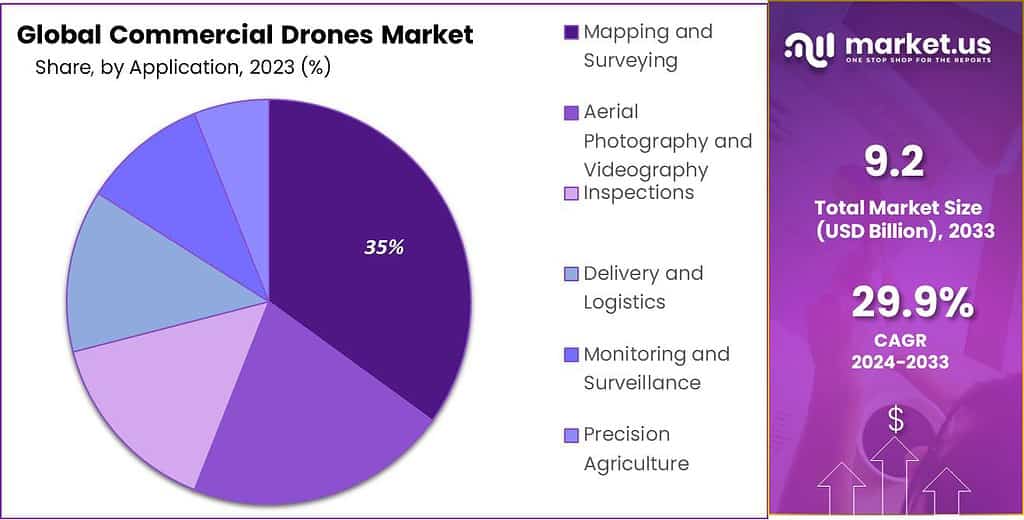

- Application Analysis: Mapping and Surveying represent the largest application segment, accounting for over 35% of the market. Aerial Photography and Videography, Inspections, and Delivery and Logistics are also significant segments.

- Driving Factors: Technological advancements, increasing demand for aerial services, regulatory support, and the expanding range of applications are driving the market’s growth.

- Restraining Factors: Privacy and security concerns, operational challenges, air traffic management, and the high initial investment are potential obstacles to market growth.

- Growth Opportunities: The market presents growth opportunities through expansion into emerging markets, advancements in AI and machine learning integration, partnerships and collaborations, and increased public and private sector investment.

- Challenges: Regulatory hurdles, safety and security risks, public perception issues, and technical limitations are challenges that need to be addressed for sustained market growth.

- Key Market Trends: Beyond Visual Line of Sight (BVLOS) operations, increased use of drones for delivery services, integration with 5G technology, and sustainability initiatives are notable trends.

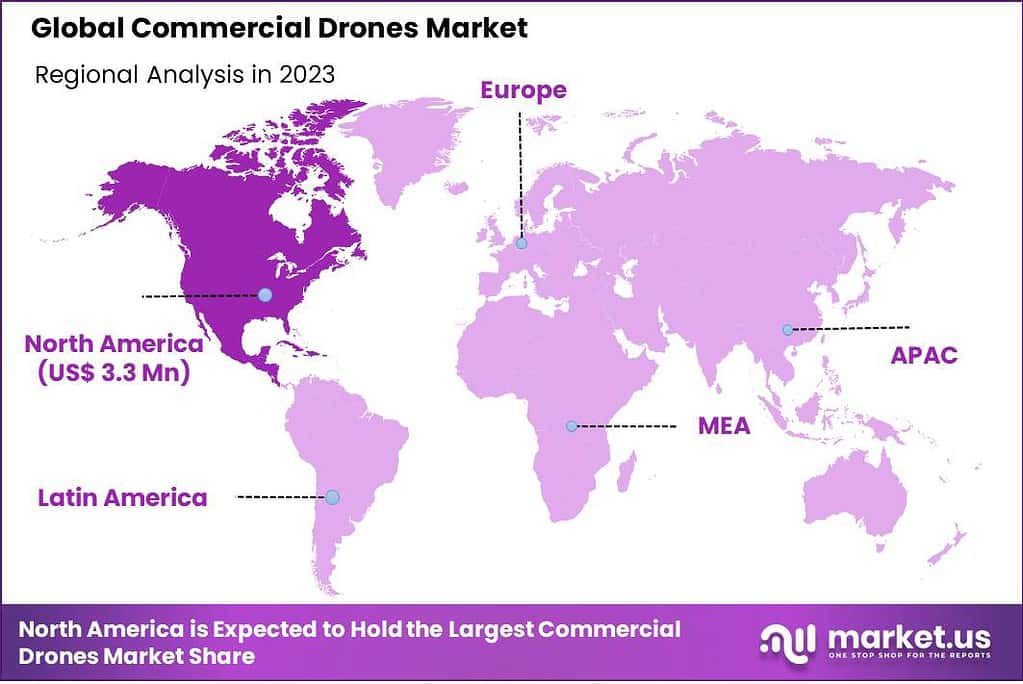

- Regional Analysis: Asia-Pacific (APAC) leads the market, capturing over 36% of the market share in 2023. North America and Europe also play significant roles in the commercial drone market.

- Key Players: DJI Technology Co. Ltd, Parrot SA, AeroVironment Inc, PrecisionHawk, Yuneec International, and others are key players in the commercial drone market.

Type Analysis

In 2023, the Multirotor Drones segment held a dominant market position, capturing more than an 81% share of the Commercial Drones Market. These drones are favored for their vertical takeoff and landing capabilities, maneuverability, and stability, which are essential for applications in surveillance, aerial photography, and inspection tasks. Their design allows for precise hovering and agile movement, making them ideal for industries that require detailed and focused imagery. Furthermore, advancements in battery technology and payload capacity have expanded their utility in commercial sectors.

On the other hand, Fixed-Wing Drones constitute a smaller yet significant portion of the market. These drones are known for their extended flight times and ability to cover vast distances, making them suitable for agricultural monitoring, large-scale surveying, and long-duration missions. Their efficient aerodynamic design allows for greater speed and altitude, appealing to sectors needing broad, continuous coverage.

Lastly, Hybrid Drones, which combine the features of fixed-wing and multirotor models, are emerging as a versatile solution. They offer the endurance and speed of fixed-wing drones while maintaining the vertical takeoff and landing capabilities of multirotors. Although currently a niche, this segment is expected to grow as technology evolves and more applications emerge that require the combined advantages of both designs. The integration of sophisticated sensors and AI is further anticipated to propel the market growth, offering innovative solutions across various commercial applications. Each segment’s evolution reflects a dynamic market, responsive to technological advancements and diversifying industry needs.

Industry Vertical Outlook

In 2023, the Media and Entertainment segment held a dominant market position within the Commercial Drones Market, capturing more than a 24% share. This sector has embraced drone technology for its ability to provide innovative angles and aerial shots, enhancing film and event production quality. Drones offer cost-effective solutions for capturing high-resolution images and videos, revolutionizing the way audiences experience visual content.

The Agriculture sector also significantly benefits from commercial drones, which assist in monitoring crop health, irrigation, and pest control. These drones utilize advanced imaging technologies to provide farmers with actionable insights, leading to increased crop yields and more efficient farm management. As precision agriculture gains traction, the demand for drones in this segment is expected to grow steadily.

In Construction, drones are transforming site surveying and inspection processes. They offer a safer and more efficient means to access hard-to-reach areas, providing real-time data for project management and structural assessments. This sector’s focus on reducing operational risks and enhancing productivity is likely to boost the adoption of drones.

The Energy and Utilities industry is deploying drones for infrastructure inspection, particularly in remote and hazardous areas. They play a critical role in maintaining and monitoring power lines, wind turbines, and solar panels, ensuring uninterrupted service and safety compliance.

Transportation and Logistics are exploring drones for package delivery and inventory management, aiming to reduce delivery times and operational costs. Though in its nascent stages, this segment shows potential for significant growth as regulatory landscapes evolve and technology advances.

Public Safety and Law Enforcement agencies are increasingly relying on drones for surveillance, search and rescue operations, and crowd monitoring. The ability of drones to provide a comprehensive aerial view enhances situational awareness and response times, making them invaluable assets in emergency and security situations.

Lastly, Mining and Quarrying are adopting drones for site mapping, volumetric calculations, and safety inspections. These drones help in optimizing operations, enhancing worker safety, and minimizing environmental impact.

Each of these industry verticals demonstrates a unique set of requirements and benefits from the adoption of commercial drones. As technology continues to advance, the integration of drones is expected to deepen, driving further market growth and innovation across all sectors.

Application Analysis

In 2023, the Mapping and Surveying segment held a dominant market position within the Commercial Drones Market, capturing more than a 35% share. This segment benefits significantly from drones’ ability to collect geospatial data quickly and accurately. Industries such as construction, real estate, and environmental management rely on this data for detailed site analysis, planning, and asset management. The precision and efficiency of drones, coupled with advanced imaging technologies, have made them indispensable for topographic mapping and land surveys.

Aerial Photography and Videography is another prominent application. Drones provide unique perspectives and high-quality imagery for various purposes, including film production, real estate marketing, and tourism promotion. Their ability to capture stunning visuals from the sky has revolutionized the way content is created and consumed.

In Inspections, drones are becoming increasingly valuable, especially in sectors like infrastructure, energy, and utilities. They offer a safer and more cost-effective means to inspect hard-to-reach structures such as bridges, towers, and pipelines, reducing the need for human intervention in potentially hazardous environments.

The Delivery and Logistics sector is exploring drones to revolutionize the way goods are transported, particularly in last-mile deliveries. Although still in the early stages of adoption, drones promise to enhance delivery speed, reduce costs, and increase accessibility, especially in remote areas.

Monitoring and Surveillance applications are growing, with public safety, security, and wildlife conservation sectors utilizing drones for continuous observation. They provide a non-intrusive method to monitor sensitive areas, track wildlife, and ensure public safety in crowded or disaster-stricken regions.

Precision Agriculture is another key application area where drones are making an impact. They assist in monitoring crop health, irrigation, and field conditions with high precision. By providing data-driven insights, drones help farmers optimize treatments, conserve resources, and ultimately improve yields and profitability.

Note: Actual Numbers Might Vary In The Final Report

Driving Factors

- Technological Advancements: Continuous improvements in drone technology, including longer flight times, better cameras, and enhanced data processing capabilities, are significantly driving the market. These advancements make drones more efficient and versatile for a variety of commercial applications.

- Increasing Demand for Aerial Services: There’s a growing demand for aerial photography, videography, and surveillance across multiple industries such as media, agriculture, and real estate. This demand is propelling the commercial drones market as businesses seek more innovative and cost-effective ways to capture and utilize aerial data.

- Regulatory Support: As governments around the world begin to recognize the potential of commercial drones, many are implementing regulations that encourage safe and responsible use. This regulatory clarity is helping businesses to adopt drone technology more broadly and with greater confidence.

- Diverse Application Areas: The expanding range of applications, from delivery and logistics to disaster management and conservation efforts, is driving the market forward. As more sectors realize the potential benefits of drones, the market continues to grow.

Restraining Factors

- Privacy and Security Concerns: Potential misuse of drones for unauthorized surveillance and data collection raises privacy and security concerns, hindering market growth. Public apprehension and stringent regulations regarding privacy can limit the adoption of commercial drones.

- Operational Challenges: Issues such as limited battery life, vulnerability to weather conditions, and the need for skilled operators can restrain market growth. These operational challenges make it difficult for drones to be widely adopted in some commercial settings.

- Air Traffic Management: As the airspace becomes increasingly crowded with drones, there’s a growing need for robust air traffic management systems to prevent collisions and ensure safety. The lack of such systems can act as a restraint in the commercial drones market.

- High Initial Investment: The initial cost of high-quality commercial drones and the technology to support them can be prohibitive for small and medium-sized enterprises, restraining market growth among these potential users.

Growth Opportunities

- Expansion into Emerging Markets: Developing countries are beginning to explore the use of commercial drones for various applications. This presents a significant growth opportunity as these markets have less saturated airspace and a high potential for innovative drone applications.

- Advancements in AI and Machine Learning: Integrating drones with AI and machine learning can open up new possibilities for autonomous operations, predictive maintenance, and improved data analysis, presenting substantial growth opportunities within the market.

- Partnerships and Collaborations: Opportunities for growth exist in forming partnerships between drone manufacturers and businesses across different industries. These collaborations can lead to the development of industry-specific drone solutions and expanded market reach.

- Increased Public and Private Sector Investment: As the potential of commercial drones becomes more widely recognized, increased investment from both public and private sectors can fuel research, development, and deployment of advanced drone technologies.

Challenges

- Regulatory Hurdles: Navigating the complex and often varying regulatory landscape can be a significant challenge for companies in the commercial drones market. Compliance with diverse regulations across different regions can impede growth and innovation.

- Safety and Security Risks: Concerns about drones colliding with other aircraft, falling from the sky, or being used for malicious purposes pose challenges to market growth. Ensuring the safety and security of drone operations is a critical issue that needs ongoing attention.

- Public Perception: Negative public perception and privacy concerns can lead to resistance against commercial drone operations. Overcoming this challenge requires robust education and transparency about the benefits and regulations of drone technology.

- Technical Limitations: Despite advancements, drones still face technical limitations, such as limited endurance, payload capacity, and reliability in adverse weather conditions. Overcoming these limitations is a significant challenge for the wider adoption of commercial drones.

Key Market Trends

- Beyond Visual Line of Sight (BVLOS) Operations: The development and approval of BVLOS operations are becoming a significant trend, allowing drones to operate beyond the pilot’s direct view. This opens up new possibilities for long-range missions and is a game-changer for industries like logistics and inspections.

- Increased Use of Drones for Delivery Services: Companies like Amazon and UPS are experimenting with drone delivery services. This trend is set to grow as technology and regulations evolve, potentially revolutionizing the logistics and delivery industry.

- Integration with 5G Technology: The integration of 5G technology with drones is a key trend, offering faster data transmission, improved connectivity, and enhanced operations. This can lead to more efficient and reliable drone services, particularly in areas like real-time data collection and autonomous flight.

- Sustainability Initiatives: There’s a growing trend of using drones for environmental monitoring and conservation efforts. As businesses and governments become more focused on sustainability, the use of drones for tasks like wildlife tracking, forest monitoring, and pollution assessment is likely to increase.

Key Market Segments

Type

- Fixed-Wing Drones

- Multirotor Drones

- Hybrid Drones

Industry Vertical

- Agriculture

- Construction

- Energy and Utilities

- Transportation and Logistics

- Public Safety and Law Enforcement

- Mining and Quarrying

- Media and Entertainment

Application

- Mapping and Surveying

- Aerial Photography and Videography

- Inspections

- Delivery and Logistics

- Monitoring and Surveillance

- Precision Agriculture

Regional Analysis

In 2023, Asia-Pacific (APAC) region occupied the largest market share within the Commercial Drones Market, capturing more than 36% of the market. The demand for Commercial Drones in North America was valued at US$ 3.3 Million in 2023 and is anticipated to grow significantly in the forecast period.

This is largely attributed to rapid industrialization, increasing technological adoption, and substantial investments in sectors such as agriculture, construction, and delivery services. Countries like China and Japan are at the forefront, driving innovation with supportive government policies and a thriving tech ecosystem. The region’s vast and varied landscape also presents numerous opportunities for applications in monitoring, surveying, and disaster management.

North America, particularly the United States, is another significant player in the commercial drones market. The region’s strong emphasis on research and development, coupled with a robust regulatory framework, has fostered a conducive environment for drone technology advancements. North America is a hub for drone innovation, with a focus on enhancing commercial applications in media, inspection, and surveillance.

Europe’s market is characterized by its strict regulatory standards, which have shaped a more controlled growth environment for commercial drones. However, these regulations also ensure safer skies and more reliable operations, which in turn fosters public trust and industry growth. European countries are increasingly leveraging drones in creative and commercial ventures, particularly in agriculture and infrastructure.

Latin America is emerging as a promising market for commercial drones, with countries like Brazil and Mexico leading the way. The region is exploring the use of drones for agricultural development, environmental monitoring, and public safety. As regulatory frameworks continue to evolve and technology becomes more accessible, Latin America is expected to experience substantial growth in this market.

The Middle East and Africa (MEA) region is witnessing a growing interest in commercial drones, particularly for infrastructure development, oil and gas inspections, and agricultural modernization. The diverse landscape and vast natural resources in this region present unique opportunities for the deployment of drones. Moreover, initiatives by governments to diversify economies and invest in technology are further propelling the market in MEA.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Thailand

- Singapore

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The commercial drone market is extremely competitive and consists of several key players that contribute to the development, manufacturing, and distribution of commercial drone systems and solutions. These companies offer a vast variety of drone platforms as well as software and services for various sectors and application.

Top Key Players

- DJI Technology Co. Ltd

- Parrot SA

- AeroVironment Inc

- PrecisionHawk

- Yuneec International

- 3D Robotics (3DR)

- Autel Robotics

- Insitu Inc. (a subsidiary of Boeing)

- FLIR Systems Inc.

- AgEagle Aerial Systems Inc.

- Draganfly Inc.

- Delair

- Other Key Players

Recent Developments

Acquisitions

- DJI acquires Terra Drone (July 2023): The Chinese drone industry leader, DJI, completed the acquisition of Terra Drone, a prominent Japanese company specializing in industrial drone software and data analytics. This strategic move enhances DJI’s position in the enterprise market.

- Skydio acquires Cobalt Robotics (May 2023): Skydio, a notable U.S. firm recognized for its autonomous drone systems, acquired Cobalt Robotics, an innovator in self-charging drone stations. This acquisition broadens Skydio’s offerings in autonomous security and inspection applications.

- Ehang acquires AirGo Robotics (March 2023): Ehang, a Chinese pioneer in passenger drone development, successfully acquired AirGo Robotics, a German company specializing in aerial logistics. This acquisition strengthens Ehang’s global presence and extends its aspirations in urban air mobility.

Company News

- In May 2023, Tinamu, the Swiss drone automation technology supplier, and Parrot, a leading European drone manufacturer, jointly announced a collaboration. This partnership aims to integrate the Parrot ANAFI Ai drone into Tinamu’s indoor-monitoring systems.

- In January 2023, Draganfly Inc. revealed a strategic partnership with Remote Sensing Instruments (“RSI”), a well-established Geospatial Technology company in India specializing in Remote Sensing and Geographic Information System (“GIS”).

Report Scope

Report Features Description Market Value (2023) USD 9.2 Bn Forecast Revenue (2033) USD 125.9 Bn CAGR (2023-2032) 29.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Fixed-Wing Drones, Multirotor Drones, Hybrid Drones), Industry Vertical (Agriculture, Construction, Energy and Utilities, Transportation and Logistics, Public Safety and Law Enforcement, Mining and Quarrying, Media and Entertainment), By Application (Mapping and Surveying, Aerial Photography and Videography, Inspections, Delivery and Logistics, Monitoring and Surveillance, Precision Agriculture) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape DJI Technology Co. Ltd, Parrot SA, AeroVironment Inc, PrecisionHawk, Yuneec International, 3D Robotics (3DR), Autel Robotics, Insitu Inc. (a subsidiary of Boeing), FLIR Systems Inc., AgEagle Aerial Systems Inc., Draganfly Inc., Delair, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Commercial Drones Market?The Commercial Drones Market refers to the industry involved in the development, manufacturing, and utilization of unmanned aerial vehicles (drones) for various commercial applications.

How big is commercial drone market?The global commercial drone market is anticipated to surge to USD 125.9 billion by 2033. It is estimated to record a steady CAGR of 29.9% in the review period 2024 to 2033. It is likely to total USD 9.2 billion in 2023.

What are the Key Drivers of the Commercial Drones Market?The market is primarily driven by factors such as technological advancements, increased industrialization, growing investments, and expanding applications in sectors like agriculture, construction, and surveillance.

What is the future of commercial drones?The future of commercial drones is promising, with anticipated growth driven by advancements in technology, expanding applications across industries, and increasing acceptance of drone technology. Key areas of growth include urban air mobility, enhanced autonomy, and integration into diverse sectors.

Is the drone industry profitable?The drone industry has the potential to be profitable, with numerous opportunities for companies involved in drone development, manufacturing, services, and applications. Profitability depends on factors such as market demand, regulatory environment, and the ability of businesses to innovate and provide valuable solutions.

Which Regions Dominate the Commercial Drones Market?The dominant regions include the Asia-Pacific (APAC) with a focus on China and Japan, North America, Europe, Latin America, and the Middle East and Africa (MEA).

-

-

- DJI Technology Co. Ltd

- Parrot SA

- AeroVironment Inc

- PrecisionHawk

- Yuneec International

- 3D Robotics (3DR)

- Autel Robotics

- Insitu Inc. (a subsidiary of Boeing)

- FLIR Systems Inc.

- AgEagle Aerial Systems Inc.

- Draganfly Inc.

- Delair

- Other Key Players