Global Commercial Aircraft Turbine Blades and Vanes Market By Material (Steel & Nickel Alloys , Titanium Alloys) By Engine Type (Fixed-Wing , Rotary-Wing), By Blade Type (Equiaxed, Directionally Solidified), , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: May 2023

- Report ID: 60940

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

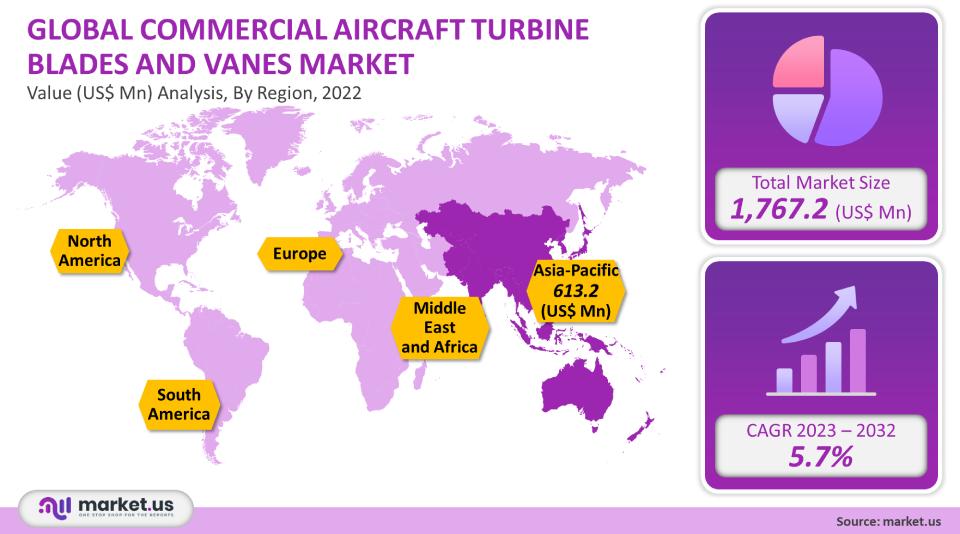

The global commercial aircraft turbine blades and vanes market is valued at USD 1.76 billion in 2022. It is estimated to reach USD 3.07 billion at a CAGR of 5.71% between 2023 and 2032. The market development can be attributed to the growing demand for commercial aircraft across the globe.

Moreover, the increasing number of air passengers is also driving the need for advanced and new commercial aircraft, which in turn is fueling the development of this industry.

In aircraft turbine engines, blades and vanes extract energy from the high-pressure and high-temperature gas produced in the combustion chamber. This market report gives a detailed analysis of the commercial aircraft turbine blades and vanes market size, share, growth, key trends, and other factors.

The blades and vanes are manufactured and designed to endure high temperatures and pressure for extended durations. Turbine blades use numerous cooling methods to work in different climatic conditions, including internal air channels, boundary layer cooling, and thermal barrier coatings. Though, blade fatigue is a primary source of disappointment in turbines.

Fatigue is initiated by the stress induced by resonance and vibration within the operating range of machines. A commercial aircraft turbine blade and vane are gas turbine engine components that create thrust to control the aircraft. The blades and vanes drive air into the engine’s burning chamber, mixed with ignited fuel. The resultant hot gases expand, directing the turbines which control the compressor blades.

The rising demand for fuel-efficient engines and the increasing number of manufactured aircraft are some factors that are estimated to drive the market’s development. However, the present backlog in aircraft supplies and issues related to blade fatigue and material costs might obstruct the market growth.

Global Commercial Aircraft Turbine Blades and Vanes Market Scope:

Material Analysis

The global market has been divided into titanium alloys, steel and nickel alloys, and other materials. In 2022, steel and nickel alloys dominated and are anticipated to rise at the most significant CAGR during 2023-2032. Aircraft turbine blades and vanes are manufactured utilizing steel and nickel alloys with high strength and melting points. Thus, the segment is estimated to raise the most significant CAGR from 2023 to 2032.

Engine Type Analysis

The commercial aircraft turbine blades and vanes market by engine type comprises rotary-wing and fixed-wing. In 2022, the fixed-wing segment is market dominant and is anticipated to rise at the highest CAGR during the forecast period. The fixed-wing segment is further divided into turboprop, turbojet, and turbofan. Growing aircraft being demanded and manufacturing for new aircraft from countries including India and China is anticipated to drive the segment development.

Blade Type Analysis

Based on blade type, it accounted for a more significant share of the global commercial aircraft turbine blades and vanes market in 2022. Blades are utilized in all commercial aircraft engines and account for an essential portion of an engine’s weight. Blade type is separated into single-crystal blades, equiaxed blades, and directionally solidified blades.

The directionally solidified blade dominated the industry in 2022. It is expected to project the most prominent CAGR during 2023-2032. Directionally hardened blades offer several benefits, including high tolerance against strain and enhanced flexibility. Hence, this segment is anticipated to rise at the highest CAGR during 2023-2032.

Key Market Segments:

By Material

- Steel & Nickel Alloys

- Titanium Alloys

- Other Materials

By Engine Type

- Fixed-Wing

- Rotary-Wing

By Blade Type

- Equiaxed

- Directionally Solidified

- Single-Crystal

Market Dynamics:

Drivers:

- The growing demand from developing industries will lead to forecasts for development in the commercial aircraft turbine blades and vanes market. Factors such as stringent rules about carbon dioxide and noise emissions, high fuel prices, and improved rivalry from LCCs will force producers to progress toward a lightweight modern aero-engine design it saves fuel. This rise in the growth of new aircraft will expand commercial gas turbine engine demand, which contains turbine blades and vanes.

- Growing fuel expenditures are the main concern for airline operatives. According to IATA, fuel prices accounted for around 30.1% of the airline’s working cost. Therefore, engine producers are emerging with advanced and new technologies.

- GE9X, CFM’s, and LEAP engines are the following generation fuel-efficient engines that guide to decrease the weight and the overall effectiveness of the aircraft. Such inventions are probable to drive the industry during 2023-2032.

Restraints:

- The increasing number of aircraft manufactured and the rising demand for fuel-efficient engines are estimated to drive market development. However, the present backlog in aircraft supplies and issues related to blade fatigue and material costs might obstruct the commercial aircraft turbine blades and vanes market’s growth.

- The material cost required for commercial Aircraft turbine blands is high. The minor material issue can create a considerable coat gap. Technical issues related to turbine blades are another factor that may hamper the growth of the target product.

Opportunities:

- Technical advancement of light-weighted and fuel-efficient engines and growing demand for air travel are some elements that are expected to create growth opportunities for emerging key players. The global air travel market is projected to rise at a CAGR of 6.6% from 2023 to 2032, reaching an entire value of $8,24,000 million by 2032.

- This progression is driven by the growing number of travelers traveling by air, increasing disposable revenues in evolving markets, the aviation infrastructure, and emerging new airports. In addition, airlines are capitalizing on new aircraft to see the increasing demand for air travel, growing the number of commercial aircraft globally.

- Aircraft manufacturers constantly develop new technologies that progress fuel reduction emissions and proficiency. These progressions drive the need for more advanced and fresher turbine blades and vanes to capitalize on, providing chances for suppliers in this growing the commercial aircraft turbine blades and vanes market segment.

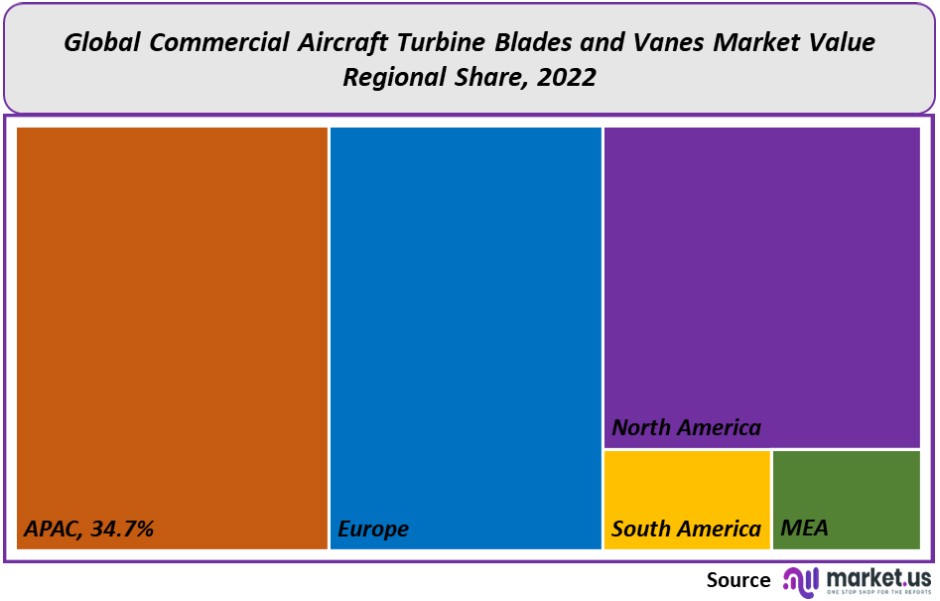

Regional Analysis

Based on the region, the market has been classified as North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. The Asia Pacific dominated the global commercial aircraft turbine blades and vanes market in revenue, with a share of 34.7% in 2022. The region is expected to witness significant growth over the forecast period owing to a growing demand for new aircraft from numerous countries, such as China and India. Furthermore, growing disposable income and improved passenger traffic are expected to drive regional progression.

Europe accounted for nearly 21% of the overall revenue share in 2022 because of high demand from countries including Germany and the UK. However, sluggish economic conditions are estimated to hamper Europe’s commercial aerospace industry, which may result in lower turbine blade and vane sales over the coming eight years.

Key Regions and Countries covered in the report:

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- The UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

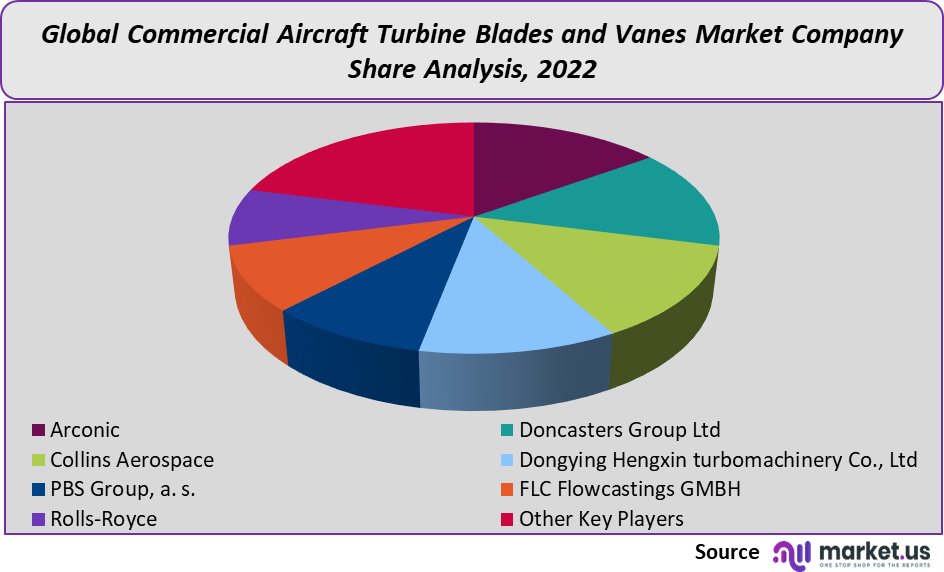

The global commercial aircraft turbine blades and vanes market is exceptionally competitive as maximum vendors compete on component reliability, quality, cost basis, and market shares. The merchants must offer users high-quality and cost-effective commercial aircraft turbine blades and vanes to survive in this modest market. Key companies included in this industry are Arconic, Doncasters, and others companies.

Commercial Aircraft Turbine Blades and Vanes Market Key Players:

- Arconic

- Doncasters Group Ltd

- Collins Aerospace

- Dongying Hengxin Turbomachinery Co., Ltd

- PBS Group, a. s.

- FLC Flowcastings GMBH

- Rolls-Royce

- Precision Castparts Corp

- Safran

- Turbine Casting SAS

- Inc.

- GE Aviation

- Chromalloy

- Turbocam International

- The Robert E. Morris Company

These are the key market players in this industry.

For the Commercial Aircraft Turbine Blades and Vanes Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

USD 1,767.21 million

Growth Rate

5.71%

Forecast Value in 2032

USD 3079.28 million

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What will be the market size for Commercial Aircraft Turbine Blades and Vanes Market in 2032?In 2032, the Commercial Aircraft Turbine Blades and Vanes Market will reach USD 3.07 billion.

What CAGR is projected for the Commercial Aircraft Turbine Blades and Vanes market?The Commercial Aircraft Turbine Blades and Vanes market is expected to grow at 5.71% CAGR (2023-2032).

Name the major industry players in the Commercial Aircraft Turbine Blades and Vanes market.Arconic, Doncasters Group Ltd, Collins Aerospace, Dongying Hengxin Turbomachinery Co., Ltd, PBS Group, a. s., FLC Flowcastings GMBH, and Other Key Players are the main vendors in Commercial Aircraft Turbine Blades and Vanes.

List the segments encompassed in this report on the Commercial Aircraft Turbine Blades and Vanes market?Market.US has segmented the Commercial Aircraft Turbine Blades and Vanes market by geographic (North America, Europe, APAC, South America, and MEA). By Materials, market has been segmented into Steel & Nickel Alloys, Titanium Alloys, and Other Materials. Engine Type, the market has been further divided into, Fixed-Wing and Rotary-Wing.

What are the main business areas for the Commercial Aircraft Turbine Blades and Vanes market?APAC and Europe are the largest market share in Commercial Aircraft Turbine Blades and Vanes Market operates.

Commercial Aircraft Turbine Blades and Vanes MarketPublished date: May 2023add_shopping_cartBuy Now get_appDownload Sample

Commercial Aircraft Turbine Blades and Vanes MarketPublished date: May 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Arconic

- Doncasters Group Ltd

- Collins Aerospace

- Dongying Hengxin Turbomachinery Co., Ltd

- PBS Group, a. s.

- FLC Flowcastings GMBH

- Rolls-Royce

- Precision Castparts Corp

- Safran

- Turbine Casting SAS

- Inc.

- GE Aviation

- Chromalloy

- Turbocam International

- The Robert E. Morris Company