Global Comic Convention Insurance Market Size, Share and Analysis Report By Coverage Type (General Liability Insurance, Event Cancellation & Abandonment Insurance, Exhibitor & Vendor Insurance, Property & Equipment Insurance, Others), By Policy Duration (Single-Event Coverage, Annual/Multi-Event Coverage), By Purchaser (Convention Organizers, Exhibitors & Vendors, Artists & Creators, Venue Owners), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171756

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Adoption and Usage Rates

- AI-Led Growth Outlook

- Increasing Adoption of Technologies

- U.S. Market Size

- Coverage Type Analysis

- Policy Duration Analysis

- Purchaser Analysis

- Value Chain Overview

- Emerging Trends

- Growth Factors

- Driver

- Restraint

- Opportunity

- Challenge

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

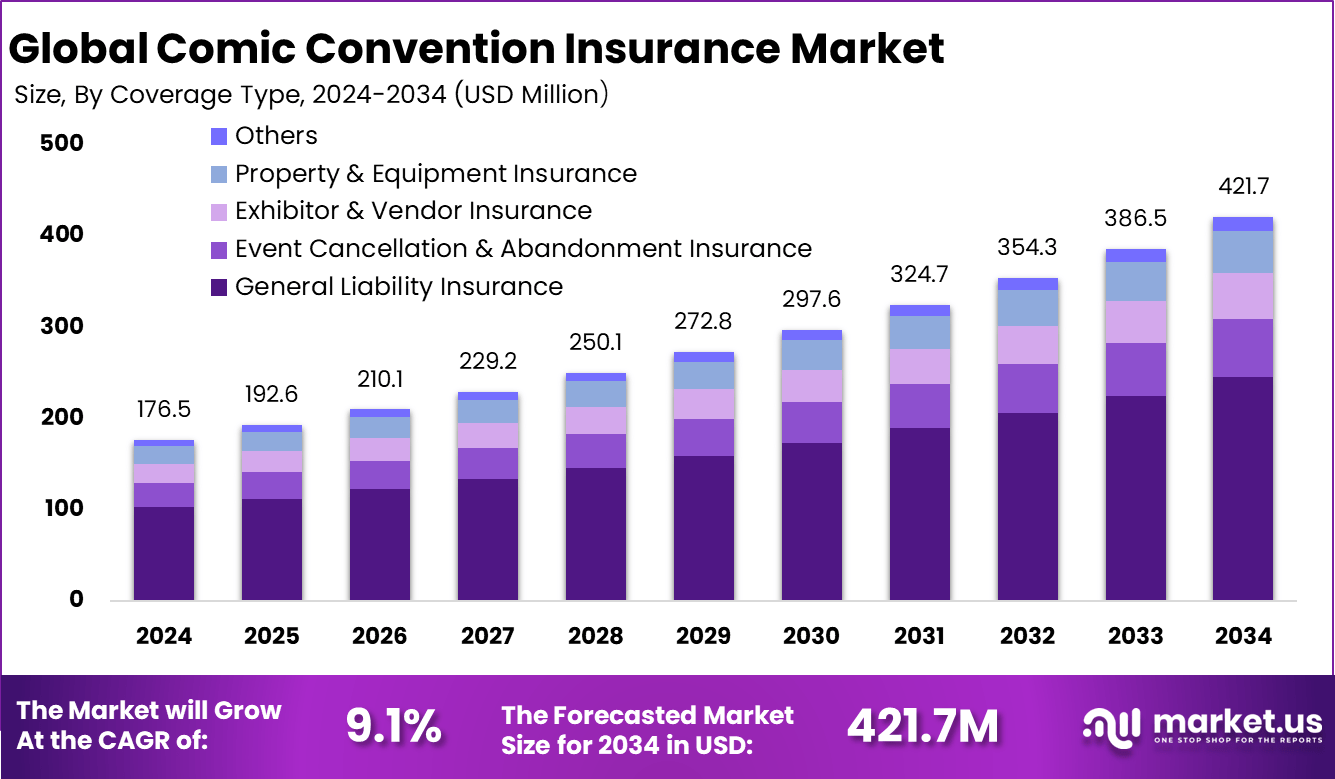

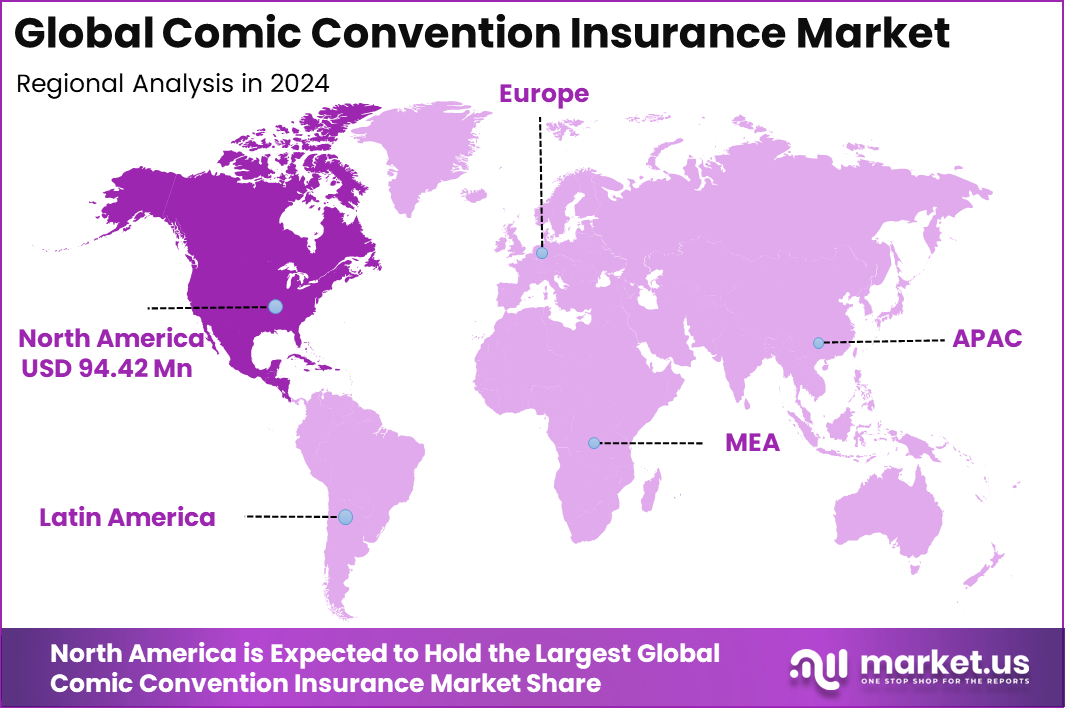

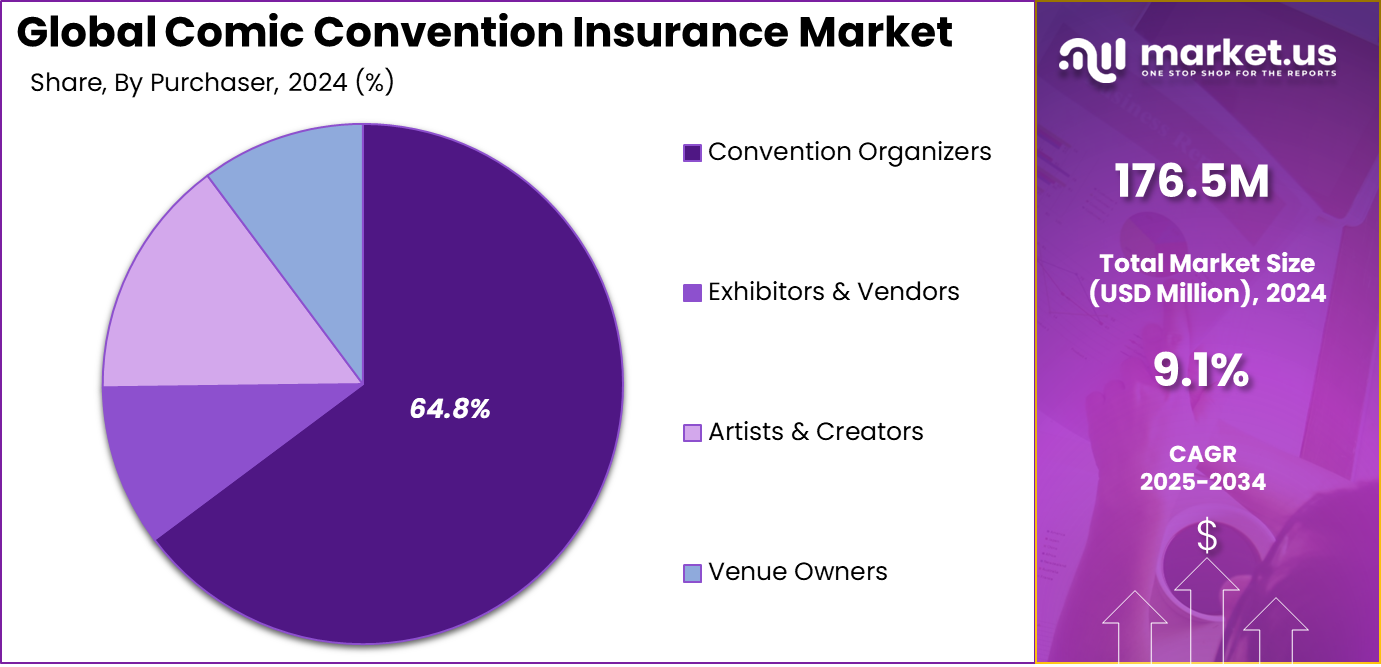

The Global Comic Convention Insurance Market size is expected to be worth around USD 421.7 million by 2034, from USD 176.5 million in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 53.3% share, holding USD 94.42 million in revenue.

The comic convention insurance market covers insurance products designed to protect organizers, exhibitors, vendors, and venues involved in comic and pop culture events. These events include comic conventions, fan expos, cosplay gatherings, and entertainment shows. Insurance policies address risks related to public attendance, property damage, and event operations. The market supports the safe and compliant execution of large-scale fan events.

Comic conventions attract large crowds, high-value merchandise, and celebrity appearances. This increases exposure to financial and operational risks. Event organizers rely on specialized insurance coverage to manage these risks. As fan conventions grow in scale and frequency, demand for tailored insurance solutions continues to rise.

Rising attendance at comic conventions is increasing demand for event insurance, as large crowds, interactive displays, and vendor setups raise the risk of accidents. Many venues now require at least USD 2 million in general liability coverage, making insurance a basic requirement for hosting events. Past incidents such as slips in crowded aisles or unstable booth installations continue to push organizers to prioritize risk protection as event scale and complexity grow.

Demand is also driven by vendor requirements, as exhibitors must provide proof of coverage to secure booth space at major conventions. In large cities, about 40-45% of similar events carry insurance, while smaller locations remain much lower at 2-5% due to limited awareness. Vendors increasingly rely on fast online insurance options to meet tight deadlines, as lack of coverage can mean exclusion from high demand events.

According to Market.us, The global liability insurance market was valued at USD 270.5 billion in 2023 and is projected to reach approximately USD 493.6 billion by 2033, expanding at a CAGR of 6.20% during the forecast period from 2024 to 2033. In 2023, North America dominated the market with more than 42.3% share, generating around USD 144.4 billion in revenue.

For instance, in November 2025, Chubb Ltd rolled out an AI-powered embedded insurance engine through its Chubb Studio platform. This tool tailors quick liability and cancellation coverage for event organizers, including comic cons, right at ticket sales. Partners can now offer fans seamless protection against booth mishaps or weather woes, boosting uptake at crowded U.S. gatherings like New York Comic Con.

Key Takeaway

- General liability insurance led coverage types with a 58.3% share, as organizers prioritize protection against attendee injuries, property damage, and third-party claims.

- Single-event policies dominated with 71.4%, reflecting the short-duration nature of comic conventions and the preference for event-specific risk coverage.

- Convention organizers accounted for 64.8% of policy purchases, driven by their responsibility for venue safety, vendor coordination, and crowd management.

- North America held a 53.5% share, supported by a high concentration of large-scale conventions and established event insurance practices.

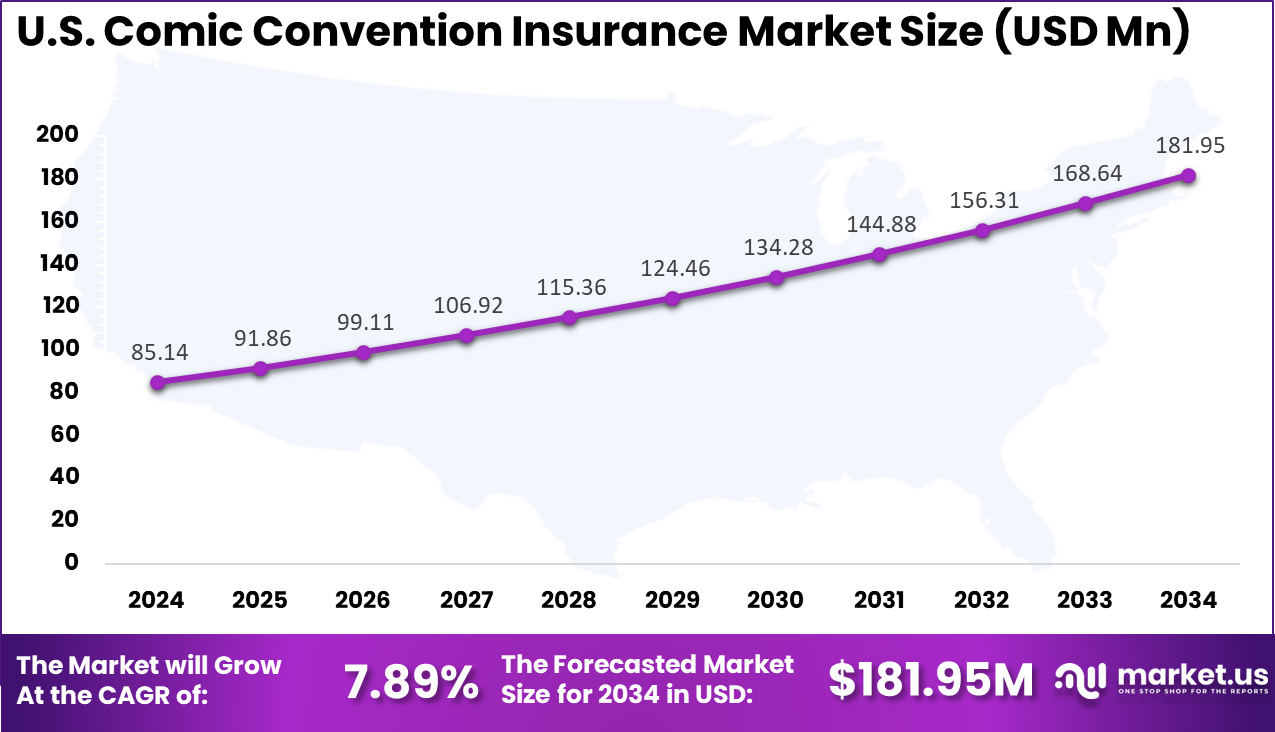

- The U.S. market reached USD 85.14 million and is expanding at a 7.89% CAGR, driven by rising event attendance, stricter liability requirements, and growing awareness of event risk management.

Adoption and Usage Rates

- General liability insurance adoption among professional exhibitors is close to 100% at major North American conventions, as venues commonly require proof of coverage for booth participation at events such as San Diego Comic-Con and New York Comic Con.

- Adoption levels are lower at smaller and regional conventions, where only 40% to 45% of mid-sized events in emerging markets currently include formal insurance coverage.

- Ticket insurance usage on the attendee side is increasing as digital ticketing platforms such as Eventbrite and Ticketmaster integrate insurance options directly at checkout.

- Industry feedback indicates that 81% of financial executives now view embedded insurance as a required feature for digital transactions by 2025, supporting wider acceptance across event ecosystems.

AI-Led Growth Outlook

AI-led innovations are accelerating growth in the comic convention insurance market by enhancing risk prediction, automating claims, and enabling personalized policies for event organizers and exhibitors. Predictive analytics and generative AI tools analyze attendance data, weather patterns, and historical claims to offer dynamic pricing and proactive risk mitigation.

Insurtech platforms integrate AI for instant underwriting, reducing processing times and appealing to time-constrained convention stakeholders. Asia Pacific leads this AI adoption with a 10.2% regional CAGR, driven by rapid event growth and digital infrastructure. Forward-looking providers leveraging AI gain competitive edges through fraud detection and customized coverage for hybrid events.

Increasing Adoption of Technologies

Digital platforms are increasingly used to manage event insurance processes. Online policy purchasing and digital documentation simplify coverage management. This improves access for small and mid-sized event organizers. Technology adoption improves efficiency. Data analytics tools are also being used by insurers to assess event risk. Crowd size, location, and event duration are analyzed. This supports more accurate policy pricing. Technology improves underwriting precision.

One key reason for adoption is financial protection against unexpected incidents. Events face risks such as attendee injuries and equipment damage. Insurance reduces financial exposure. This provides operational confidence. Another reason is protection against event cancellation or disruption. Factors such as weather or venue issues can impact events. Insurance helps recover costs. Organizers benefit from reduced uncertainty.

U.S. Market Size

The United States reached USD 85.14 Million with a CAGR of 7.89%, reflecting steady market growth. Expansion is driven by increasing event frequency and attendee participation. Organizers continue to prioritize risk protection. Insurance remains essential for sustainable event operations.

For instance, In October 2025, Chubb Ltd highlighted its event liability solutions at RISKWORLD 2025, offering tailored insurance coverage for large comic conventions in the U.S. The packages address crowd related risks and venue requirements, with quick bind options providing up to USD 2 million in coverage to protect organizers against accidents, booth damage, and event disruptions.

North America holds 53.5%, supported by a strong culture of large-scale comic conventions. The region hosts numerous fan-driven events with high attendance. Insurance adoption is well established across event organizers. Risk awareness supports consistent demand.

For instance, In April 2025, Marsh & McLennan Companies received the 2025 U.S. Insurance Award for Insurance Placement Technology Innovation. Its platform improves event risk transfer by speeding up policy placement and optimizing liability and property coverage, helping comic convention organizers manage complex multi vendor exposures more efficiently.

Coverage Type Analysis

In 2024, The General Liability Insurance segment held a dominant market position, capturing a 58.3% share of the Global Comic Convention Insurance Market. It protects against common slips, trips, or injuries in busy halls filled with fans, booths, and cosplay crowds. Organizers choose it to meet venue demands and handle third-party claims smoothly. This keeps events running without legal headaches from unexpected accidents. Real cases show it covers medical costs fast, building trust with partners.

Beyond basics, this coverage extends to property damage from spills or booth mishaps during peak hours. Conventions see heavy foot traffic, so reliable protection matters. It often includes legal defense, which saves time and stress for teams. Many events require certificates proving this in place before doors open. Organizers value its broad shield for high-stakes gatherings like these.

For Instance, in October 2025, Chubb Ltd expanded its general liability options for large gatherings. The firm rolled out new packages aimed at events with high crowd risks, including comic conventions where slips or booth accidents often happen. This move helps organizers meet venue rules fast while covering third-party claims smoothly.

Policy Duration Analysis

In 2024, the Single-Event Coverage segment held a dominant market position, capturing a 71.4% share of the Global Comic Convention Insurance Market. They target risks like sudden rain, canceling outdoor panels, or tech glitches halting demos. Organizers grab these online for instant quotes, fitting tight schedules. No need for year-long commitments when events pop up seasonally. This setup cuts costs while ticking safety boxes for all involved.

These policies shine in flexibility, activating just for the event dates listed. Weather threats or vendor no-shows get handled without extras. Venues push for them to limit exposure. Organizers report easy claims processes that resolve post-event issues quickly. For pop culture shows, this duration matches the fast-paced nature perfectly.

For instance, in November 2025, AXA SA launched tailored contingency insurance for short-term events. Their policies cover single-day or weekend cons against cancellation from weather or no-shows, offering quick activation for pop-up gatherings. Organizers appreciate the low-cost setup for seasonal shows.

Purchaser Analysis

In 2024, the Convention Organizers segment held a dominant market position, capturing a 64.8% share of the Global Comic Convention Insurance Market. They cover attendee slips, vendor disputes, or stage mishaps under one umbrella. Venues demand that they be named as additional insureds. This central buying simplifies logistics for multi-booth setups. Teams focus on smooth operations, knowing risks stay contained.

Exhibitors lean on these main plans, but organizers bear the bulk. Policies wrap broad liability to prevent shutdowns from claims. Contracts with halls enforce this buyer role upfront. It fosters partnerships where everyone shares protection layers. Organizers track real incidents to refine future coverage needs.

For Instance, in October 2025, Marsh & McLennan Companies Inc. announced a brand shift to focus on event brokers. They aim to streamline policies for organizers handling multi-vendor cons, covering liability across venues and crowds. This supports lead buyers in big setups.

Value Chain Overview

The value chain begins with insurers and reinsurers developing underwriting models based on event data, feeding into brokers and agents who customize policies for organizers, exhibitors, and vendors. Digital platforms facilitate direct sales and instant certificates, streamlining distribution while end-users integrate coverage into event planning. Claims handling closes the loop, with AI automating assessments for rapid payouts.

Upstream suppliers provide risk analytics and tech infrastructure, enabling midstream providers to offer competitive premiums. Downstream, venues and municipalities enforce compliance, driving demand across segments like property insurance for collectibles. This interconnected chain supports scalability, with embedded insurance via ticketing apps enhancing accessibility for attendees.

Emerging Trends

In the comic convention insurance market, a notable trend is the expansion of tailored coverage options that align with event-specific risks and attendee profiles. Comic conventions often feature a mix of exhibitors, artists, vendors, cosplayers, and large crowds, each presenting unique liability exposures.

Insurers are structuring policies that specifically address scenarios such as vendor booth accidents, cosplay prop mishaps, and staged performance risks. This trend reflects a movement away from generic event insurance toward more bespoke protection that better matches the operational realities of fan-centric gatherings. Another emerging trend is the integration of digital tools and analytics to support risk assessment and underwriting.

Organisers and insurers are employing data-driven methods to evaluate attendee volumes, crowd flow patterns, historical claims, and site characteristics. These analytics help tailor premiums, refine coverage parameters, and identify risk mitigation measures before and during events. This trend enhances transparency and supports more informed decision making for stakeholders involved in planning and executing comic conventions.

Growth Factors

A primary growth factor in the comic convention insurance market is the rapid increase in scale and frequency of fan culture events. Comic conventions and related pop culture gatherings have expanded globally, attracting larger audiences and generating higher operational complexity.

This expansion drives demand for insurance solutions that can address elevated liabilities associated with high density crowds, elaborate displays, and multimedia experiences that are typical of modern fan conventions.

Another significant factor supporting growth is the increasing professionalism of event management practices within the comic convention ecosystem. Organisers are placing higher emphasis on formal risk management, compliance with venue regulations, and safeguarding against financial loss.

Insurance becomes a strategic tool to protect revenue streams from unforeseen cancellations, property damage, or third-party claims, making it a more integral component of event planning rather than a peripheral afterthought.

Driver

A principal driver of the comic convention insurance market is the recognition of heightened liabilities in interactive and experiential event formats. Comic conventions often include activities such as celebrity panels, cosplay contests, workshops, and live demonstrations that increase the potential for accidents or property loss.

Insurance solutions tailored to these immersive experiences help organisers manage exposure and reassure stakeholders that potential losses are appropriately mitigated. Another driver is the increasing requirement for proof of insurance by venues and partners.

Many convention centres, hotels, and municipal authorities mandate specific coverage levels as a condition of hosting events. This requirement obligates organisers to secure appropriate insurance policies, which in turn expands the market for providers that specialise in comic convention risks.

Restraint

A notable restraint in this market is the perception of high costs associated with comprehensive event coverage. Smaller or emerging comic conventions may find the premiums for specialised insurance to be a significant portion of their operational budget. This cost concern can lead some organisers to under-insure or seek minimal coverage, which may expose them to financial risk if unexpected incidents occur.

Another restraint relates to ambiguities in policy terms and coverage definitions. Event organisers may struggle to interpret the scope of protection afforded by certain policies, especially when unconventional activities such as live performances or interaction driven exhibits are involved. This complexity can lead to hesitancy in policy selection and require expert guidance to ensure adequate protection is obtained.

For instance, in January 2025, Travelers raised its catastrophe reinsurance retention to $4 billion for 2025. This reflects higher costs from prior claims in property and casualty lines. Event organizers face elevated premiums for similar risks, like accidents. Smaller groups struggle with budgets tied to ticket sales. Custom plans add further expense burdens.

Opportunity

A distinct opportunity in the comic convention insurance market lies in education and advisory services for organisers. Providers that offer consultative support, risk planning guidance, and pre-event risk assessments can help organisers understand their exposure and craft appropriate coverage. This educational approach strengthens client relationships and positions insurers as strategic partners rather than transactional vendors.

Another opportunity exists in expanding coverage into ancillary areas such as cancellation protection, intellectual property legal support, and attendee travel disruption. As conventions become more elaborate, organisers and participants increasingly seek safeguards that go beyond traditional liability coverage. Offering bundled or modular products that address these adjacent needs can differentiate providers and broaden market appeal.

Challenge

One of the main challenges for the comic convention insurance market is forecasting and pricing risk in highly variable event environments. Each convention may differ in scale, activities, location, and attendee behaviour, making standardized underwriting difficult. Insurers must balance risk exposure with competitive pricing, which demands nuanced analysis and flexible product design.

Another challenge is ensuring effective communication of policy coverage to clients with varied experience levels. Comic convention organisers range from seasoned professionals to passionate volunteers running their first event. Clear articulation of what is covered, how claims processes work, and how exclusions might apply is essential to prevent misunderstandings and build confidence in insurance solutions.

Key Market Segments

By Coverage Type

- General Liability Insurance

- Event Cancellation & Abandonment Insurance

- Exhibitor & Vendor Insurance

- Property & Equipment Insurance

- Others

By Policy Duration

- Single-Event Coverage

- Annual/Multi-Event Coverage

By Purchaser

- Convention Organizers

- Exhibitors & Vendors

- Artists & Creators

- Venue Owners

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

AXA, Allianz, Chubb, Zurich Insurance Group, and Travelers play a leading role in the comic convention insurance market by offering comprehensive coverage for large scale fan events. Their policies typically cover public liability, property damage, cancellation risks, and exhibitor protection. These insurers focus on risk assessment, financial stability, and global underwriting expertise.

Aon, Marsh McLennan, Tokio Marine, Hiscox, Liberty Mutual, CNA Financial, and Nationwide strengthen the market through brokerage services and tailored insurance programs. Their offerings help organizers manage crowd related risks, vendor liabilities, and event disruptions. These providers emphasize customized coverage, regulatory compliance, and efficient claims handling.

Markel, Beazley, HCC Insurance Holdings, and other players expand the landscape with niche and flexible insurance solutions for mid sized and regional comic conventions. Their products address short term event needs and emerging risk scenarios. These companies focus on underwriting agility and cost effective coverage. Increasing number of pop culture events worldwide continues to drive steady growth in the comic convention insurance market.

Top Key Players in the Market

- AXA SA

- Allianz SE

- Chubb, Ltd.

- Zurich Insurance Group, Ltd.

- Aon plc

- Marsh & McLennan Companies, Inc.

- Tokio Marine Holdings, Inc.

- Hiscox, Ltd.

- Travelers Companies, Inc.

- Liberty Mutual Insurance Company

- CNA Financial Corporation

- Nationwide Mutual Insurance Company

- Markel Corporation

- Beazley plc

- HCC Insurance Holdings, Inc.

- Others

Recent Developments

- In November 2025, Chubb launched an AI-powered embedded insurance engine through its Chubb Studio platform, enabling event organizers to get personalized coverage recommendations instantly at digital points of sale. This innovation helps comic convention promoters secure tailored protection for cancellations, liability, and property risks with real-time data insights.

- In August 2024, Marsh McLennan introduced a $50 million port blockage facility, but quickly adapted the model for entertainment events following major disruptions. This move provides comic convention organizers with robust contingency coverage against venue closures or supply chain issues. Marsh’s proactive risk engineering keeps North American events resilient amid rising uncertainties.

Report Scope

Report Features Description Market Value (2024) USD 176.5 Mn Forecast Revenue (2034) USD 421.7 Mn CAGR(2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (General Liability Insurance, Event Cancellation & Abandonment Insurance, Exhibitor & Vendor Insurance, Property & Equipment Insurance, Others), By Policy Duration (Single-Event Coverage, Annual/Multi-Event Coverage), By Purchaser (Convention Organizers, Exhibitors & Vendors, Artists & Creators, Venue Owners) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AXA SA, Allianz SE, Chubb, Ltd., Zurich Insurance Group, Ltd., Aon plc, Marsh & McLennan Companies, Inc., Tokio Marine Holdings, Inc., Hiscox, Ltd., Travelers Companies, Inc., Liberty Mutual Insurance Company, CNA Financial Corporation, Nationwide Mutual Insurance Company, Markel Corporation, Beazley plc, HCC Insurance Holdings, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Comic Convention Insurance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Comic Convention Insurance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AXA SA

- Allianz SE

- Chubb, Ltd.

- Zurich Insurance Group, Ltd.

- Aon plc

- Marsh & McLennan Companies, Inc.

- Tokio Marine Holdings, Inc.

- Hiscox, Ltd.

- Travelers Companies, Inc.

- Liberty Mutual Insurance Company

- CNA Financial Corporation

- Nationwide Mutual Insurance Company

- Markel Corporation

- Beazley plc

- HCC Insurance Holdings, Inc.

- Others