Global Comic Book Market By format (Digital (E-Books, Audiobook), Print), By Distribution Channel (Physical stores, Online stores), By End User (Children, Adults), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 117712

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

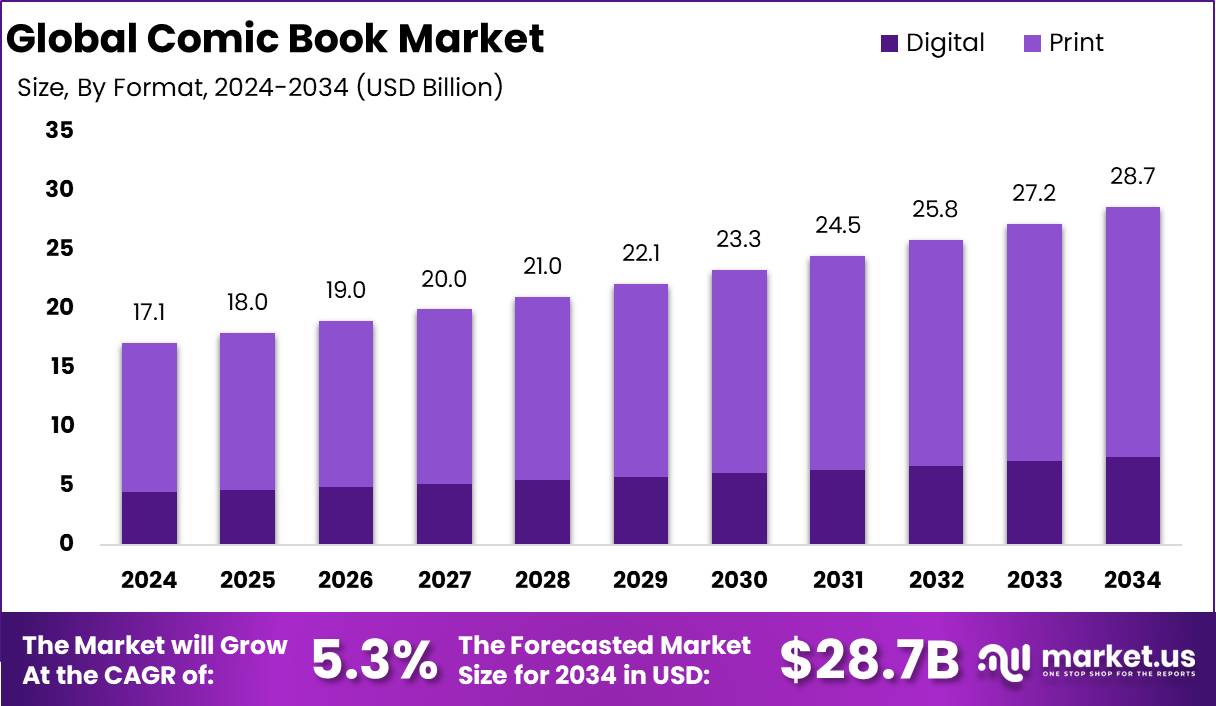

The Global Comic Book Market size is expected to be worth around USD 28.7 Billion by 2034, from USD 17.1 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

Comic books have long captivated readers with their unique combination of storytelling and visual art. They are a form of sequential art that uses a combination of images and text to tell a narrative. Comic books encompass a wide range of genres, including superheroes, fantasy, science fiction, and more. They have gained a devoted following among readers of all ages and have become a significant part of popular culture.

The comic book market refers to the industry and marketplace surrounding the creation, distribution, and sale of comic books. It is a dynamic and diverse market that includes publishers, artists, writers, collectors, and fans. Comic books are typically published by established companies, such as Marvel Comics and DC Comics, as well as independent publishers.

The comic book market has evolved over the years, embracing digital platforms and online distribution alongside traditional print formats. Comic book conventions, such as Comic-Con, provide a space for fans to gather, discover new titles, and meet their favorite creators. Additionally, comic book adaptations in movies and television have contributed to the growth and popularity of the market.

Marvel products account for approximately 37% of the total revenue generated from comics and graphic novels sold through specialist comic book stores. Following closely behind, DC holds the second position with a market share of 26%.

Looking ahead to 2023, projections indicate that more than 70% of comic book publishers will offer subscription-based services for digital comics. This shift towards subscription models reflects the industry’s response to changing consumer preferences and the increasing demand for convenient access to digital content.

Additionally, it is projected that over 65% of comic book enthusiasts will rely on digital platforms and apps for their reading and purchasing needs by 2023. This trend highlights the growing popularity of digital consumption among comic book readers, who seek the convenience and flexibility offered by digital formats.

According to Gitnux, the Comic Book Market is characterized by an increasingly diverse and digitally engaged readership. The average age of comic book readers globally is 34, with a slightly higher average of 37 years in the United States. Women now comprise nearly 40% of readers globally, with this figure rising to 46% in France, indicating a trend towards greater gender diversity.

Furthermore, digital sales have grown to represent 20% of the market, underscoring the shift towards online platforms. Additionally, over 30% of readers engage with the community through social media, and around 40% collect comics as a hobby, highlighting both the social and collector dimensions of the market. This diverse engagement is supported by an industry that employs over 100,000 people worldwide, illustrating its significant economic impact.

Key Takeaways

- The global comic book market is projected to grow from USD 17.1 billion in 2024 to approximately USD 28.7 billion by 2034, indicating a robust CAGR of 5.3% over the forecast period.

- In 2024, print comics maintained dominance, capturing over 74% of the market share. This preference is driven by the tangible experience and collectibility factor associated with print editions.

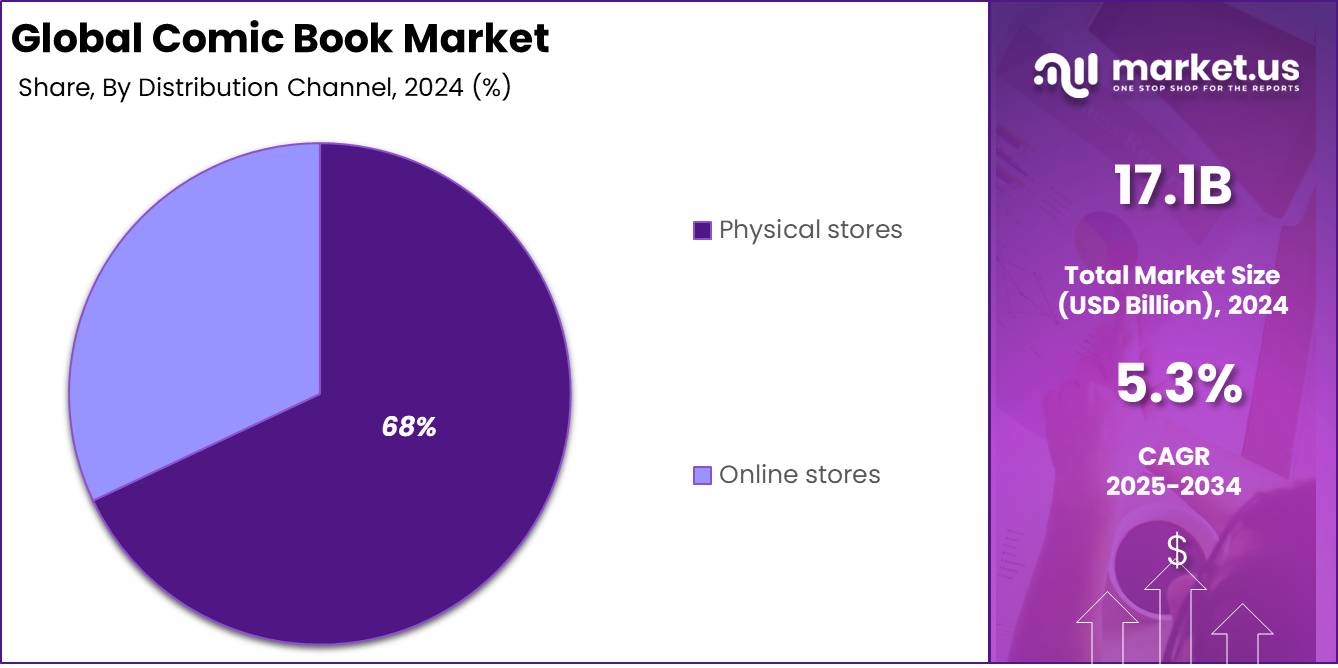

- Physical stores held a dominant market position in 2024, accounting for over 68% of the market share. These stores offer a unique shopping experience and serve as cultural hubs for comic book enthusiasts.

- The children’s segment dominated the market in 2024, capturing over 60% of the market share. Comic books are increasingly recognized as valuable tools for literacy and education among children.

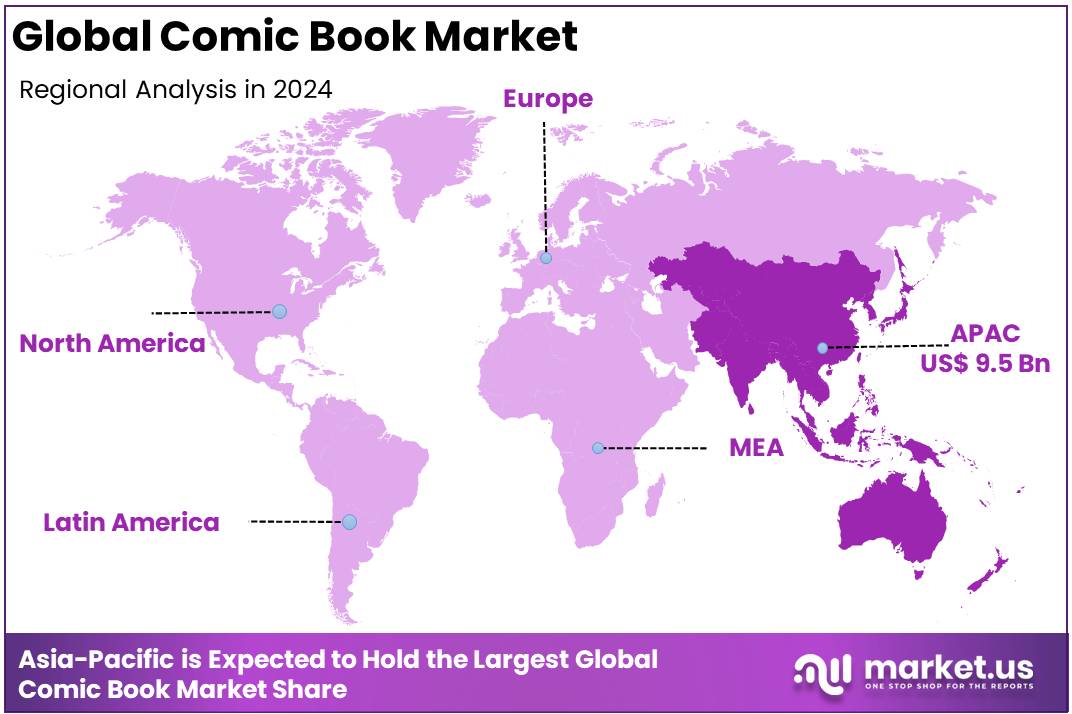

- The Asia-Pacific region dominated the global comic book market in 2024, holding over 56.0% share, with demand valued at USD 9.5 billion in 2023 and expected significant growth in the coming years.

- 2024 witnesses a significant growth in the adoption of print-on-demand (POD) and self-publishing platforms among independent comic book creators, with a projected increase of 20% compared to 2023.

- The integration of web3 technologies within the comic book industry is set to rise by 25% year-over-year in 2024.

- In the United States of America, baby boomers constitute 25% of comic book readers. This demographic’s engagement reflects the broad appeal of comic books, transcending age barriers and highlighting the medium’s capacity to resonate with a wide spectrum of readers through diverse storytelling and artistic styles.

- As of 2022, the comic book publishing landscape in the United States was dominated by three major publishers: Marvel Comics, capturing 38.8% of the market share; DC Comics, with 24.3%; and Image Comics, holding 11.9%. These publishers’ leading positions illustrate their significant influence on the industry’s trends and the tastes of the reading public.

- Comichron and Diamond Comics together command 90% of the comic book sale market in the United States, signifying a concentrated distribution network. This consolidation points to the critical role these distributors play in the availability and accessibility of comic books across the nation.

- The largest demographic of comic book purchasers comprises readers aged 12 to 29 years, who represent 57% of the market. This statistic highlights the genre’s popularity among younger audiences and underscores the importance of catering to this age group’s preferences and interests to sustain market growth

Format Analysis

In 2024, the print segment of the comic book market maintained a dominant position, capturing more than a 74% share. This leadership can be largely attributed to the tangible nature of print comics, which offers a distinct reading experience that digital formats cannot replicate.

Collectors and enthusiasts often prefer print for the physical quality of the books, which can be collected, displayed, and even increase in value over time. The tactile sensation of turning pages and the visual appeal of comic book art are heightened in print form, contributing to its continued popularity.

Furthermore, special editions, variants, and independent releases often find a dedicated audience in the print market. The experience of purchasing at comic book stores and conventions also adds a communal aspect to the hobby, fostering a strong, engaged community of readers and collectors. Despite the growing digital trends across various media, the print comic book market benefits from a deeply rooted culture and the desire for physical collectibles, sustaining its leading position in the industry.

The digital segment, encompassing e-books and audiobooks, while smaller, is rapidly expanding due to its convenience and accessibility. Digital comics offer the advantage of instant access to a vast library of titles without the need for physical storage, appealing to new generations of readers and those with limited access to comic book shops. Subscription models and digital platforms are making it easier for fans to explore a wider range of content, including indie and international titles, contributing to the segment’s growth.

Distribution Channel Analysis

In 2024, the physical stores segment held a dominant market position within the comic book industry, capturing more than a 68% share. This dominance is primarily attributed to the unique shopping experience that physical stores offer, which goes beyond the mere purchase of comic books.

These stores serve as cultural hubs for fans, offering a place to meet, discuss, and immerse themselves in the comic book community. The tactile experience of browsing through shelves, the visual delight of seeing art up close, and the personal recommendations from knowledgeable staff all contribute to the continued popularity of physical stores.

Moreover, many consumers value the condition and collectibility of comic books, aspects that are best assessed in person. Physical stores also host events, signings, and launches, creating a sense of event around comic book purchasing that online stores struggle to replicate. The social interactions and community building facilitated by these stores play a crucial role in nurturing the comic book culture, reinforcing the physical store’s position in the market.

End User Analysis

In 2024, the Children segment held a dominant market position in the Comic Book Market, capturing more than a 60% share. This substantial market share can be attributed to several factors, notably the increasing recognition of comic books as valuable tools for literacy and education.

Educators and parents have increasingly embraced comic books as mediums that promote reading habits, enhance vocabulary, and develop language skills among children. The visual nature of comic books, combined with compelling storytelling, has proven to be an effective method in engaging young readers, fostering a love for reading from an early age.

The growth of the Children segment is further supported by the diversification of content, catering to a wide array of interests and age groups. Publishers have significantly invested in genres beyond traditional superheroes, incorporating themes of adventure, fantasy, science, history, and culture. This broadening of scope has not only expanded the market’s reach but has also made comic books more inclusive, appealing to children with varied tastes and interests.

Moreover, the advent of digital platforms has made comic books more accessible to children, overcoming geographical and physical barriers. The digital format also caters to the growing screen preference among younger audiences, contributing to the segment’s expansive growth.

Key Market Segments

By Format

- Digital

- E-Books

- Audiobook

By Distribution Channel

- Physical stores

- Online stores

By End User

- Children

- Adults

Driver

Increased Global Digital Accessibility

The global comic book market is experiencing significant growth, primarily driven by increased digital accessibility and the rising popularity of digital platforms. As internet penetration deepens globally, more consumers have access to digital comic books through smartphones, tablets, and computers. This shift is not only expanding the reach of traditional comic book publishers but also enabling independent creators to distribute their work more broadly.

In 2024, the trend of digital consumption continues to be a pivotal driver, as it allows for immediate access to a vast array of titles, including those in niche genres that previously faced distribution challenges. Digital platforms also offer enhanced reading experiences with features like animated panels and integrated sound effects, making comic books more appealing to the tech-savvy generation.

Furthermore, the digital model supports a subscription-based revenue structure, which ensures a steady income stream for publishers and creators, fostering sustained growth in the comic book industry.

Restraint

Competition from Other Entertainment Media

One of the primary restraints facing the Comic Book Market is the intense competition from various forms of entertainment media, including video games, streaming services, and social media. These platforms offer immersive and interactive experiences that can more effectively capture and retain the attention of both children and adults.

The rise of digital content consumption has made these alternatives more accessible, often at lower costs or through subscription models that provide vast libraries of content. This competition is particularly challenging in capturing the interest of younger audiences, who may find dynamic and interactive digital experiences more engaging than traditional comic book reading. As a result, comic book publishers are compelled to innovate both in content and delivery methods to maintain relevance and attract readership in a crowded entertainment landscape.

Opportunity

Expansion of Comic Book Genres and Diverse Storytelling

2024 presents a substantial opportunity for the comic book market through the expansion of genres and incorporation of diverse storytelling. As audiences become more global and varied, there is a growing demand for stories that reflect a wider range of experiences, including those of different cultures, ethnicities, and gender identities. This diversification not only broadens the market base but also enriches the comic book medium itself.

Publishers and creators who tap into this trend by offering more inclusive content are likely to see increased engagement from new demographics. For instance, the rise of graphic novels dealing with real-world issues such as mental health, social justice, and personal identity attracts readers who seek more than traditional superhero narratives. This shift not only opens up new revenue streams but also elevates the cultural relevance of comic books, positioning them as a significant form of contemporary literature.

Challenge

Balancing Print and Digital Formats

A key challenge for the Comic Book Market is balancing the coexistence of print and digital formats. While digital comics offer convenience and accessibility, there remains a strong contingent of readers who prefer the tangible experience of reading physical comic books. The sentimental value and collectibility associated with print editions are aspects that digital formats cannot fully replicate.

Publishers must navigate this duality by allocating resources effectively to cater to both segments without compromising the quality and availability of content. This balancing act requires strategic investments in digital platforms while maintaining a robust print publication lineup, a task that becomes increasingly complex as consumer preferences continue to evolve.

Emerging Trends

- Augmented Reality (AR) in Comics: Incorporating AR to create interactive experiences, bringing characters and stories to life beyond the page.

- Eco-Friendly Publishing: Adoption of sustainable practices in printing and packaging, responding to growing environmental concerns among consumers.

- Rise of Indie and Self-Publishing: Technological advancements and digital platforms enabling independent creators to publish and distribute their work, diversifying the market.

- Webtoons and Mobile Platforms: The popularity of webtoons and mobile-optimized comics, appealing to consumers seeking content on-the-go.

Growth Factors

- Licensing and Merchandising: Expanding revenue streams through the licensing of comic book characters for movies, merchandise, and video games.

- Global Market Penetration: Digital distribution enabling publishers to reach international markets with ease, contributing to global market growth.

- Collaborations and Crossovers: Partnerships between publishers or with other media to create crossover series, generating buzz and attracting diverse fan bases.

- Educational Initiatives: Leveraging comic books as educational tools in schools to promote literacy and engagement among students.

Regional Analysis

In 2024, the Asia-Pacific region held a dominant position in the global comic book market, capturing more than a 56.0% share. The demand for Comic Book in Asia-Pacific was valued at USD 9.5 billion in 2023 and is anticipated to grow significantly in the forecast period.

This significant market share can be attributed to several key factors that underscore the region’s leading position in the industry. Firstly, the vibrant cultural affinity towards comics and graphic novels, deeply ingrained in countries such as Japan, South Korea, and China, has fostered an expansive consumer base. Japan, in particular, is renowned for its manga culture, which has not only captivated a domestic audience but also gained immense popularity worldwide.

The proliferation of digital platforms and online distribution channels in the Asia-Pacific region has further facilitated the accessibility and consumption of comic books, contributing to the market’s growth. Additionally, the integration of comic book characters and narratives into multimedia franchises, including movies, video games, and merchandise, has amplified their appeal and market penetration across the Asia-Pacific region.

The influence of the Asia-Pacific market on the global comic book industry extends beyond its substantial market share. Innovations in comic book formats and storytelling, often originating from this region, have set new trends that resonate on a global scale. The adaptation of comic books into various languages and the localization of content have played pivotal roles in expanding their reach, attracting diverse audiences across the globe.

Furthermore, the region’s commitment to nurturing comic book artists and creators has led to a rich and diverse portfolio of works that cater to a wide range of tastes and interests. The market’s robust infrastructure for comic book publication and distribution, supported by significant investments in digital technologies, positions the Asia-Pacific region as a critical hub for the future growth and evolution of the global comic book market.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global comic book market, Marvel Comics remains a formidable presence, primarily due to its extensive portfolio of iconic characters and its successful integration with other media forms, notably film and digital platforms.

This synergy has not only broadened its audience but also deepened its market penetration globally. DC Comics Inc. follows closely, leveraging its rich history and classic superheroes to maintain a loyal fan base while expanding into new digital formats and collaborative ventures with other media.

Image Comics distinguishes itself through its creator-owned model, which has consistently attracted a diverse array of talent, yielding unique and innovative storytelling that resonates with a niche, yet growing, segment of the market. Similarly, IDW Publishing and Dark Horse Comics have carved out significant niches by focusing on licensed properties and graphic novels, respectively, appealing to specific demographics.

On the international front, Japanese publishers like Shogakukan, Hakusensha, and Shueisha Inc. dominate with their manga offerings, which continue to capture the imaginations of readers worldwide, demonstrating the enduring appeal and cultural crossover of manga. Tokyopop and Panini, bridging eastern and western comic traditions, play crucial roles in the globalization of the comic book industry, facilitating the accessibility of diverse comic styles and stories.

Collectively, these key players are instrumental in shaping the dynamics of the global comic book market, each contributing to the industry’s complexity and appeal through their distinctive strategies and product offerings.

Top Market Leaders

- Marvel Comics

- DC Comics Inc.

- Image Comics

- IDW Publishing

- Dark Horse Comics

- Shogakukan

- Hakusensha

- Shueisha Inc.

- Tokyopop

- Panini

- Other key players.

Recent Developments

- In 2023, Valiant Entertainment teamed up with Alien Books to bolster its publication capabilities across the Valiant Universe. With over 25 years of experience, Alien Books, led by Matias Timarchi, has become a prominent figure in the comic book industry both in the United States and internationally. This partnership is expected to inject new vitality into Valiant’s publications, setting the stage for a dynamic 2024 publishing schedule.

- In 2023, Kartoon Studios, trading as TOON on the NYSE American and owning “Stan Lee Universe, LLC,” revealed its plans to launch STAN LEE COMICS. This line will feature digital and print comics based on unreleased works by Stan Lee, in collaboration with Legible Inc., a leader in online book streaming and multimedia publishing. This initiative will make approximately 12 original comic series accessible globally through Legible’s extensive network.

- In 2024, Dstlry secured $5 million in seed funding to expand its innovative digital comics publishing and collectibles business. This investment raises the total funding to $7.4 million since the company’s start in 2022, paving the way for a new era in comics and digital collectibles.

- In 2025, the Random House Publishing Group announced its acquisition of BOOM! Studios, which will be incorporated into its Random House Worlds portfolio. The acquisition, announced by Scott Shannon, President of Random House Worlds, and Ross Richie, Chairman and Founder of BOOM! Studios, is set to finalize in the summer of 2024.

- In 2025, Alliance Entertainment, known as AENT, won the bid to acquire most of the assets of Diamond Comic Distributors, Inc., which is currently under a court-supervised bankruptcy process. This acquisition includes Diamond Comic Distributors, Alliance Game Distributors, Diamond Select Toys & Collectibles, and the Collectible Grading Authority. These entities are recognized leaders in the fields of comics, tabletop games, pop culture merchandise, and collectible grading.

Report Scope

Report Features Description Market Value (2024) USD 17.1 Bn Forecast Revenue (2034) USD 28.7 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By format (Digital (E-Books, Audiobook), Print), By Distribution Channel (Physical stores, Online stores), By End User (Children, Adults) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Marvel Comics, DC Comics, Inc., Image Comics, IDW Publishing, Dark Horse Comics, Shogakukan, Hakusensha, Shueisha Inc., Tokyopop, Panini, Other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Marvel Comics

- DC Comics Inc.

- Image Comics

- IDW Publishing

- Dark Horse Comics

- Shogakukan

- Hakusensha

- Shueisha Inc.

- Tokyopop

- Panini

- Other key players.