Global Collaborative Combat Aircraft Market Size, Share, Industry Analysis Report By Aircraft Type (Manned Collaborative Combat Aircraft, Unmanned Collaborative Combat Aircraft (UCAVs)), By Platform Type (Fixed-Wing, Rotary-Wing), By Application (Air-to-Air Combat, Air-to-Ground Combat, Reconnaissance & Surveillance), By End User (Defense Forces, Government Agencies, Private Defense Contractors) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct. 2025

- Report ID: 161503

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

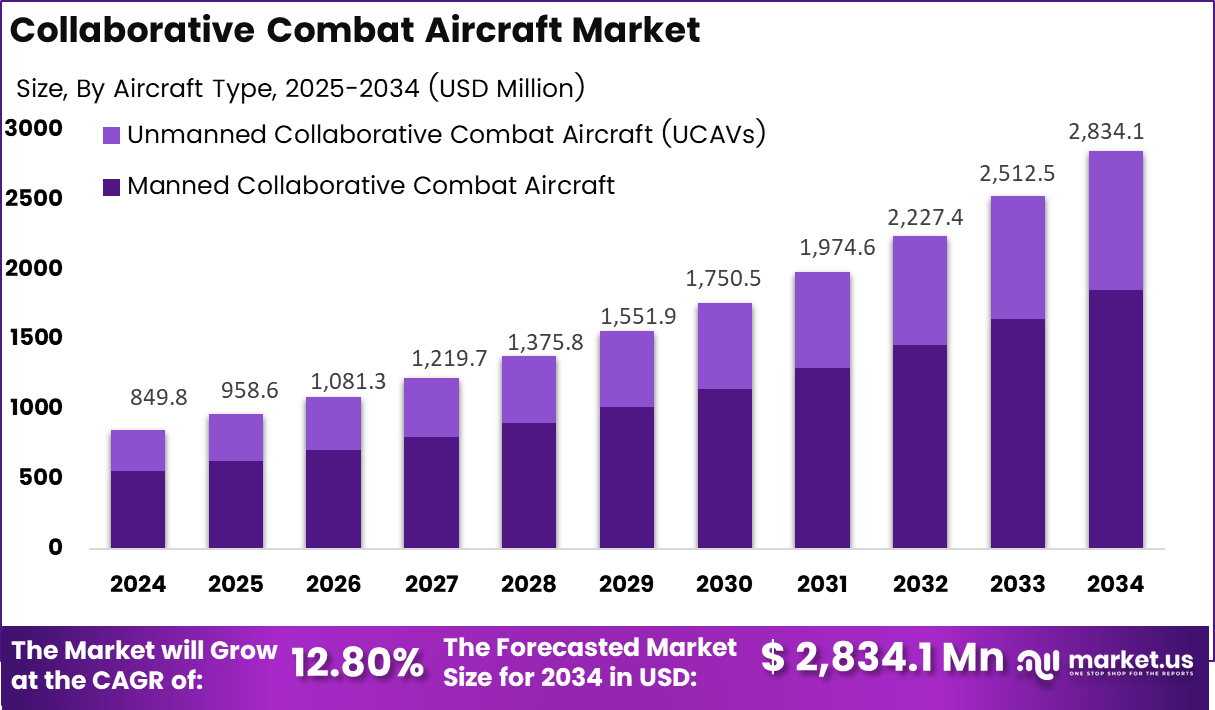

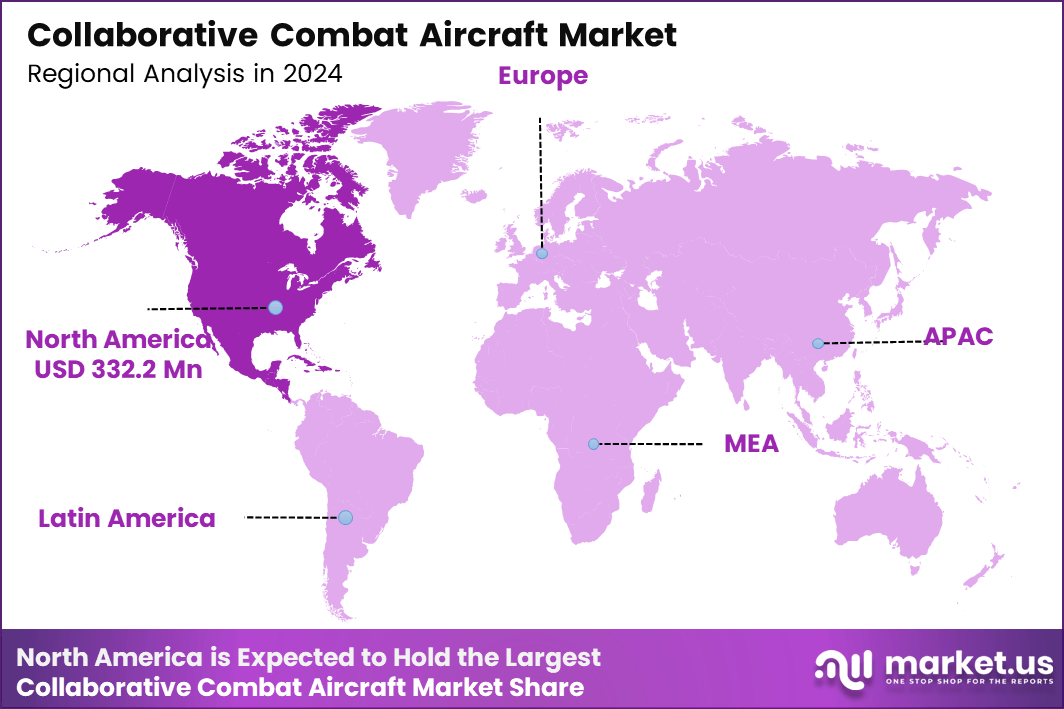

The Global Collaborative Combat Aircraft Market is projected to experience strong growth, reaching approximately USD 2,834.1 million by 2034 from USD 849.8 million in 2024, expanding at a CAGR of 12.8% during 2025–2034. North America accounted for USD 332.2 million in 2024, emerging as the leading regional market due to robust investments by the U.S. Department of Defense and continued development of programs such as the U.S. Air Force’s Collaborative Combat Aircraft initiative.

The Collaborative Combat Aircraft market includes autonomous and semi-autonomous aircraft that operate with or alongside manned fighter jets and other combat platforms. These aircraft are designed to perform missions such as reconnaissance, surveillance, electronic warfare, and strike support. They act as supporting partners to crewed aircraft, reducing human risk while expanding operational reach and flexibility.

The market is driven by rising global defense budgets and the increasing need for flexible air-combat solutions. The demand for systems that can enhance mission success while minimizing pilot risk is growing steadily. Countries are adopting network-based and autonomous aircraft operations to respond to complex threat environments. The ability of CCAs to perform critical missions at lower operational costs compared with advanced fighter jets has encouraged governments to invest in this technology.

Key Takeaways

- By aircraft type, Manned Collaborative Combat Aircraft led with 65.5% share in 2024, as the defense sector continues to integrate AI-assisted systems while maintaining pilot command for critical operations.

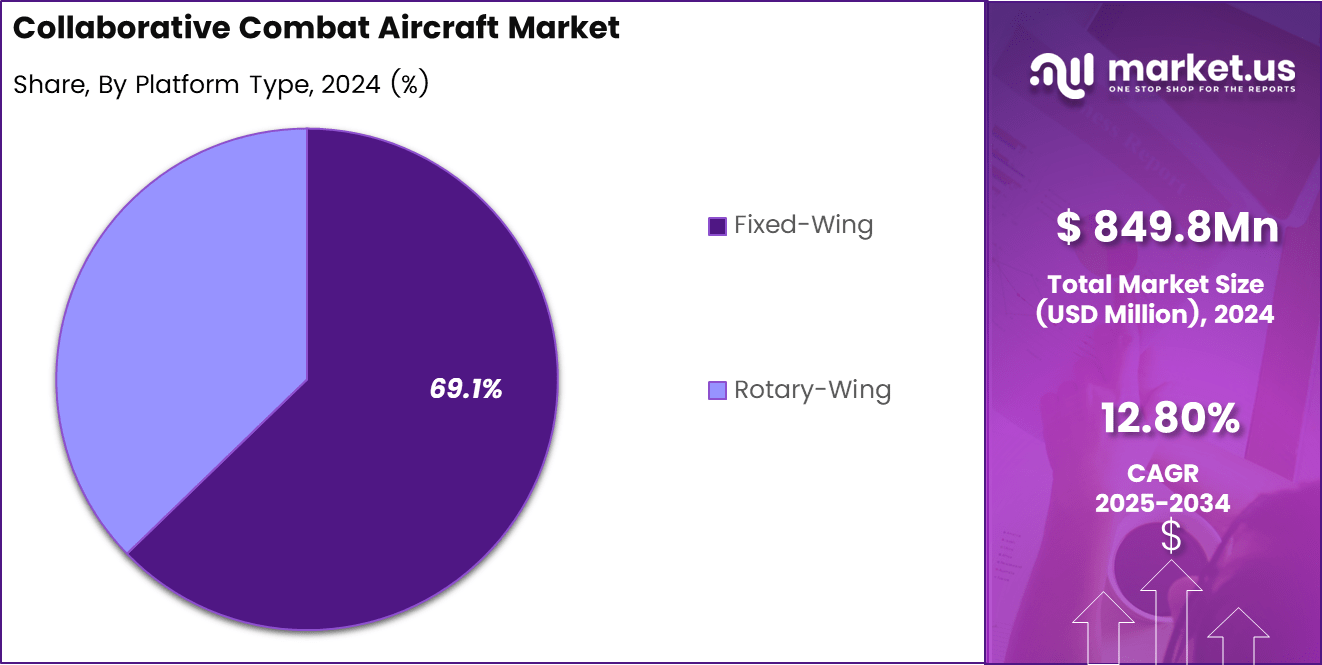

- By platform type, Fixed-Wing aircraft accounted for 69.1% share due to their endurance, high payload capacity, and suitability for air superiority missions.

- By application, Air-to-Air Combat held 39.5% share, driven by increased emphasis on aerial dominance and multi-domain operations.

- By end-user, Defense Forces dominated with 66.3% share, reflecting rising global investments in modernization and autonomous combat capabilities.

- The global market is forecasted to reach USD 2,834.1 million by 2034, with significant growth opportunities across AI integration, autonomous teaming, and international defense collaborations.

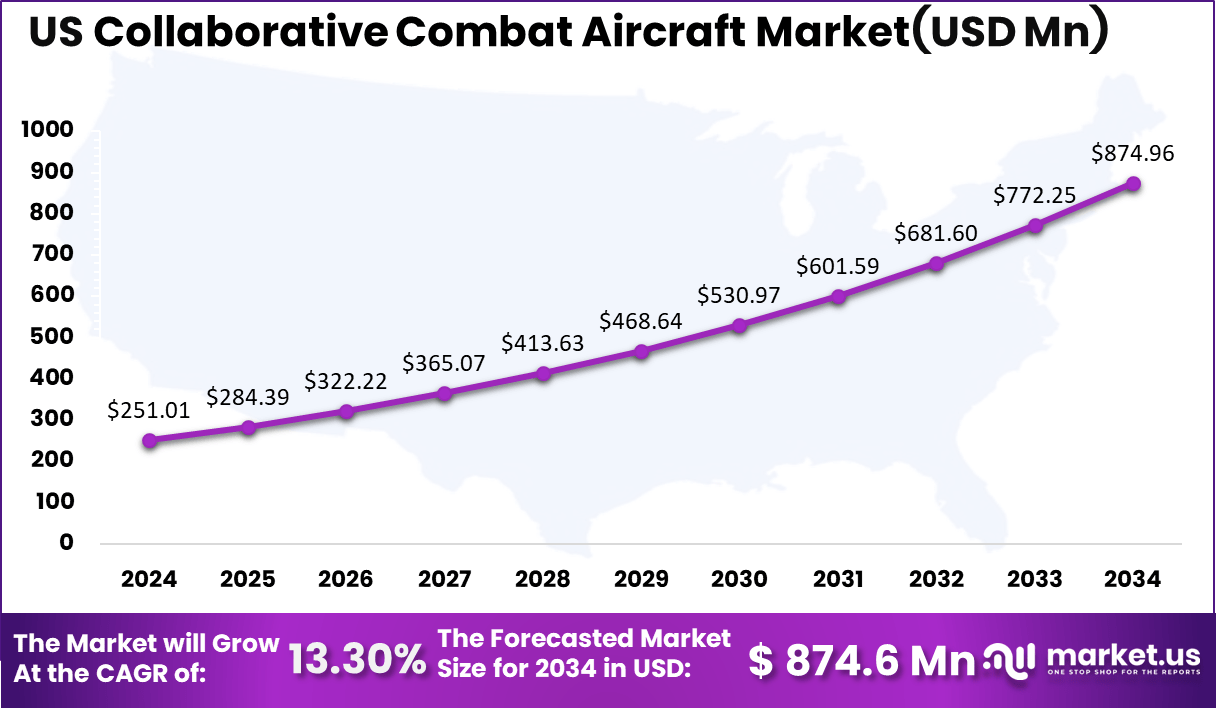

- The U.S. collaborative combat aircraft market is projected to reach USD 874. 9million by 2034, growing at a CAGR of 13.3% from USD 251.0 million in 2024, reflecting strong government and defense sector investments.

- North America dominated the global market with a valuation of USD 332.2 million in 2024, supported by extensive R&D programs under the U.S. Department of Defense and active involvement of major defense contractors.

US Market Size

The US Collaborative Combat Aircraft Market is projected to expand significantly, reaching USD 874.6 million by 2034, up from USD 251.0 million in 2024, growing at a CAGR of 13.3% during 2025-2034. This strong growth reflects increased defense spending on next-generation air combat technologies and the integration of artificial intelligence in mission coordination.

The rising adoption of manned-unmanned teaming (MUM-T) concepts and autonomous flight systems is expected to further drive market expansion. Investments in advanced communication links, data fusion systems, and AI-enabled decision support platforms are enhancing operational efficiency and situational awareness.

The US Department of Defense’s focus on multi-domain operations and collaborative combat systems, particularly through initiatives like the Air Force’s CCA program, is anticipated to propel consistent market demand through 2034

North America dominated the collaborative combat aircraft market in 2024, valued at USD 332.2 million, driven by major U.S. defense initiatives and strong R&D investments in AI-based air systems. Programs like the U.S. Air Force’s Collaborative Combat Aircraft Market initiative and partnerships with Boeing and Lockheed Martin strengthened regional leadership.

Europe is progressing through projects such as the Future Combat Air System (FCAS) and the UK’s Tempest program, emphasizing manned-unmanned integration. Asia-Pacific is projected to grow rapidly due to rising defense budgets in China, India, and Japan, while MEA and Latin America advance through modernization and cross-border defense collaborations.

By Aircraft Type

In 2024, Manned collaborative combat aircraft account for 65.5% of the market, showing their strong role in advanced air missions. These aircraft combine human decision-making with automated capabilities, providing flexibility and precision in contested environments. Pilots benefit from real-time coordination with autonomous or semi-autonomous systems that enhance situational awareness and target engagement.

The demand for manned models continues to rise as defense agencies prefer trusted human oversight in critical operations. Integration with AI-enabled drones further boosts mission efficiency and reduces pilot workload. This balance between autonomy and human control supports safer and more effective combat strategies.

By Platform Type

In 2024, Fixed-wing platforms dominate the collaborative combat aircraft market with 69.1% share. Their design offers endurance, high-speed performance, and the ability to carry larger payloads. These features make them suitable for long-range missions, including surveillance, reconnaissance, and air superiority roles.

Growing military investments in next-generation fixed-wing systems show increasing focus on networked combat operations. These aircraft form the backbone of coordinated defense strategies, where multiple assets communicate seamlessly to execute complex aerial missions with precision.

By Application

In 2024, Air-to-air combat applications represent 39.5% of market demand, driven by rising need for superiority and defensive capabilities in contested skies. Collaborative aircraft working with unmanned wingmen can track, intercept, and neutralize threats at high speed while sharing targeting data in real time.

This segment reflects renewed emphasis on deterrence and situational dominance. Modern air combat systems now rely on advanced sensors, AI coordination, and integrated command networks to maintain rapid response and tactical advantage in critical air battles.

By End User

In 2024, Defense forces hold 66.3% of the market as they lead adoption of collaborative combat technologies. Their focus on enhancing operational coordination and air dominance continues to drive procurement and testing of both manned and unmanned collaborative assets.

Governments across major regions are exploring integrated combat systems that enable coordinated missions across air platforms. The ability of defense forces to integrate these aircraft into existing fleets improves mission resilience, situational control, and long-term strategic readiness.

Role of Generative AI

- Generative AI is enhancing autonomous mission planning by simulating thousands of combat scenarios for optimized strategy formulation.

- It supports predictive maintenance by analyzing vast sensor datasets to forecast aircraft performance and reduce downtime.

- AI-driven flight simulations and virtual training environments are being developed to train pilots and autonomous systems in complex combat maneuvers.

- Generative AI assists in adaptive threat recognition, enabling aircraft to respond dynamically to enemy tactics and changing battlefield conditions.

- It plays a critical role in data fusion, synthesizing multi-source intelligence to provide real-time situational awareness and coordinated swarm operations.

Top 5 Use Cases

- Manned-Unmanned Teaming (MUM-T): Collaborative aircraft are being deployed to operate alongside piloted fighters, enhancing strike range, reconnaissance, and survivability through coordinated mission execution.

- Autonomous Air-to-Air Combat: AI-driven UCAVs are used for real-time target identification, interception, and engagement, enabling faster response times and reduced pilot workload.

- Electronic Warfare and Jamming: Collaborative aircraft systems are applied for disrupting enemy radar and communication systems, supporting stealth missions, and offensive electronic attack operations.

- Intelligence, Surveillance, and Reconnaissance (ISR): Unmanned collaborative aircraft are integrated into ISR missions to provide persistent situational awareness and data relay over contested airspace.

- Precision Strike and Tactical Support: Coordinated drone swarms are used to support precision-guided weapon delivery, enhancing mission accuracy and reducing exposure risk for manned assets.

Emerging Trends

- Increasing integration of AI-powered autonomy in aircraft decision-making processes is transforming combat operations into data-driven and adaptive mission strategies.

- The rise of modular aircraft design allows faster integration of advanced payloads, sensors, and AI processors for multi-role capabilities.

- Adoption of swarm intelligence enables large groups of UCAVs to perform synchronized missions under minimal human supervision.

- Nations are expanding collaborative combat aircraft programs, such as the U.S. Next Generation Air Dominance (NGAD) and Europe’s FCAS initiative, focusing on future-ready air combat networks.

- Growing collaboration between defense manufacturers and AI technology firms is accelerating the deployment of next-generation air combat ecosystems with predictive maintenance and adaptive learning capabilities.

Key Market Segment

By Aircraft Type

- Manned Collaborative Combat Aircraft

- Unmanned Collaborative Combat Aircraft (UCAVs)

By Platform Type

- Fixed-Wing

- Rotary-Wing

By Application

- Air-to-Air Combat

- Air-to-Ground Combat

- Reconnaissance & Surveillance

By End User

- Defense Forces

- Government Agencies

- Private Defense Contractors

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Geopolitical Tensions & Defense Budgets

In recent years, international friction and regional conflicts have pushed many nations to boost defense expenditure. This has created a favorable environment for procuring advanced systems such as collaborative combat aircraft. For instance, the U.S. has prioritized its Collaborative Combat Aircraft Market program to maintain aerial dominance amid peer competition.

Governments are less hesitant to invest in next-generation platforms that leverage AI, autonomy, and cooperative engagement models. As more nations adopt multi-domain warfare postures, they see collaborative air systems as force multipliers rather than optional upgrades. This steady influx of capital underpins market growth.

Restraint

High Costs and Regulatory Hurdles

One of the main restraints facing the collaborative combat aircraft market is the high cost of development, integration, and procurement. Sophisticated technologies such as AI, sensor fusion, and secure communication networks demand significant investment, making it challenging for smaller or less wealthy nations to participate fully.

Additionally, complex regulatory requirements and export controls slow market expansion by creating hurdles for cross-border technology sharing and collaboration. Cybersecurity and interoperability issues also add layers of complexity, raising concerns about system reliability and secure operation in contested environments. These challenges limit the rapid deployment and adoption of CCAs despite their benefits, putting pressure on defense budgets and program timelines.

Opportunity

Next-Gen Autonomy and Multi-Domain Integration

The CCA market offers substantial opportunities through the adoption of next-generation autonomy and AI innovations. Enhancing autonomous decision-making capabilities and integrating multi-domain operations – across air, land, sea, and cyber – opens new pathways for tactical advantages. Rising investments in AI-driven combat strategies, sensor technologies, and secure communication systems foster innovation and expand the market’s reach.

Furthermore, collaborations between defense contractors and governments provide opportunities for technology sharing and joint projects. Emerging economies provide fertile growth grounds as they modernize air forces and seek scalable, interoperable platforms. The broadening roles for CCAs in surveillance, reconnaissance, and precision strikes continually expand market applications and growth potential globally.

Challenge

Data Security and Technology Integration

A key challenge in the growth of the collaborative combat aircraft market is ensuring robust data security and seamless integration with legacy systems. CCAs rely on constant data exchange and networked operations, making them vulnerable to cyberattacks and data breaches. Maintaining secure, reliable communication links and protecting sensitive information are critical for mission success and operational safety.

Moreover, the complexity of integrating CCAs with existing manned and unmanned systems poses logistical and technical difficulties. Legacy systems may not support newer, modular, or AI-driven platforms, requiring costly upgrades and interoperability solutions. Overcoming these barriers demands continued R&D investments, strong cybersecurity frameworks, and close cooperation among defense stakeholders to implement reliable, effective CCA operations.

Key Players Analysis

The Collaborative Combat Aircraft Market is led by major defense and aerospace innovators such as Lockheed Martin Skunk Works, Boeing, Northrop Grumman, and General Atomics Aeronautical Systems, Inc. These companies are pioneering autonomous combat systems that integrate manned-unmanned teaming (MUM-T), AI-driven mission planning, and real-time threat analysis.

Emerging defense technology firms including Anduril Industries, Kratos Defense & Security Solutions, and Shield AI contribute through advanced autonomy frameworks, edge computing, and AI-enabled flight control systems. Their unmanned aerial vehicles (UAVs) are designed to perform reconnaissance, electronic warfare, and strike coordination alongside piloted aircraft.

Global aerospace and defense manufacturers such as Raytheon Technologies, Airbus Defence and Space, Leonardo S.p.A., Dassault Aviation, Saab AB, BAE Systems, Embraer, Elbit Systems, Israel Aerospace Industries (IAI), Kawasaki Heavy Industries, Mitsubishi Heavy Industries, AeroVironment, and General Aviation Systems, along with other key players, are investing in AI-driven flight autonomy, sensor fusion, and mission coordination technologies.

Top Key Players

- General Atomics Aeronautical Systems, Inc.

- Anduril Industries

- Lockheed Martin Skunk Works

- Boeing

- Northrop Grumman

- Kratos Defense & Security Solutions

- Shield AI

- Raytheon Technologies

- General Aviation Systems

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries

- Leonardo S.p.A.

- Airbus Defence and Space

- Dassault Aviation

- Saab AB

- BAE Systems

- Embraer

- AeroVironment

- Elbit Systems

- Israel Aerospace Industries (IAI)

- Others

Recent Developments

- October 2025, General Atomics Aeronautical Systems, Inc. (GA-ASI) secured a U.S. Navy contract to develop conceptual designs for a modular, carrier-capable Collaborative Combat Aircraft. This effort follows their August first flight of the YFQ-42A, the Air Force’s first production-representative unmanned fighter under the CCA program. GA-ASI emphasizes rapid reconfiguration and upgrades for evolving missions, aiming for fast integration into carrier air wings.

- September 2025, Lockheed Martin Skunk Works unveiled the Vectis, a stealthy, survivable Group 5 CCA designed to work alongside manned fighters like the F-22 and F-35. The drone is planned to fly within two years, bringing high-end autonomous capabilities for precision strike, electronic warfare, and ISR missions.

Report Scope

Report Features Description Market Value (2024) USD 849.8 Mn Forecast Revenue (2034) USD 2,834.1 Mn CAGR(2025-2034) 12.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Aircraft Type (Manned Collaborative Combat Aircraft, Unmanned Collaborative Combat Aircraft (UCAVs)), By Platform Type (Fixed-Wing, Rotary-Wing), By Application (Air-to-Air Combat, Air-to-Ground Combat, Reconnaissance & Surveillance), By End User (Defense Forces, Government Agencies, Private Defense Contractors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape General Atomics Aeronautical Systems, Inc., Anduril Industries, Lockheed Martin Skunk Works, Boeing, Northrop Grumman, Kratos Defense & Security Solutions, Shield AI, Raytheon Technologies, General Aviation Systems, Kawasaki Heavy Industries, Mitsubishi Heavy Industries, Leonardo S.p.A., Airbus Defence and Space, Dassault Aviation, Saab AB, BAE Systems, Embraer, AeroVironment, Elbit Systems, Israel Aerospace Industries (IAI), Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Collaborative Combat Aircraft MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Collaborative Combat Aircraft MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- General Atomics Aeronautical Systems, Inc.

- Anduril Industries

- Lockheed Martin Skunk Works

- Boeing

- Northrop Grumman

- Kratos Defense & Security Solutions

- Shield AI

- Raytheon Technologies

- General Aviation Systems

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries

- Leonardo S.p.A.

- Airbus Defence and Space

- Dassault Aviation

- Saab AB

- BAE Systems

- Embraer

- AeroVironment

- Elbit Systems

- Israel Aerospace Industries (IAI)