Global Cold Storage Market Report By Type (Refrigerated Warehouse, Refrigerated Transport By Temperature Type (Frozen, Chilled), By Application (Food & Beverages, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 39475

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

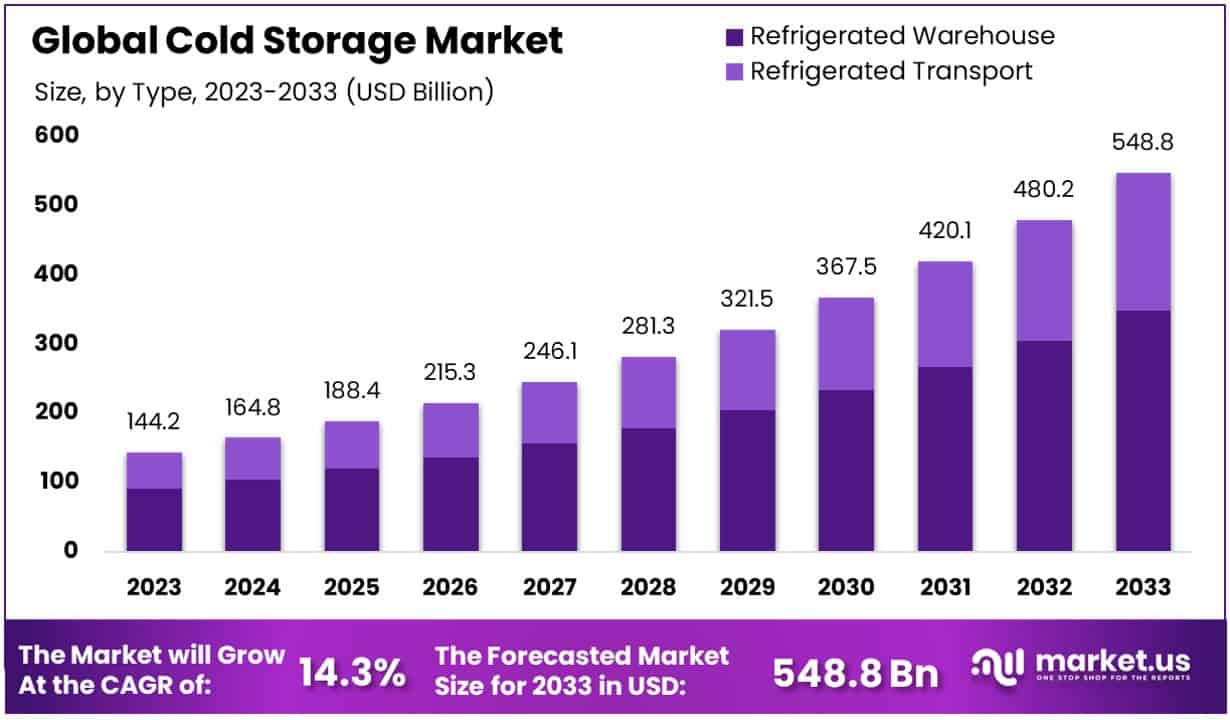

The Global Cold Storage Market size is expected to be worth around USD 548.8 Billion by 2033, from USD 144.2 Billion in 2023, growing at a CAGR of 14.3% during the forecast period from 2024 to 2033. North America dominated a 35.1% market share in 2023 and held USD 50.61 Billion in revenue from the Cold Storage Market.

Cold storage refers to the preservation of perishable goods in an environment maintained at low temperatures. This method extends the shelf life of products such as food, pharmaceuticals, and chemicals by slowing down the decomposition process caused by microbial growth.

The cold storage market involves the infrastructure and services necessary for the cooling and freezing of perishable products. It encompasses various facilities such as refrigerated warehouses, distribution centers, and transportation means that are essential for maintaining the cold chain during the storage and transit of goods.

The growth of the cold storage market is primarily driven by the increasing demand for perishable foods globally and the expansion of retail chains requiring efficient storage solutions. Technological advancements in refrigeration technologies are also enhancing the efficiency and capacity of cold storage facilities.

Demand in the cold storage market is spurred by the rising consumption of fresh and frozen foods, particularly in urban areas. The pharmaceutical sector’s need for precise temperature-controlled environments for vaccine and medicine preservation further accelerates this demand.

Significant opportunities in the cold storage market arise from the growing e-commerce sector, especially in food delivery services. Innovations in energy-efficient storage solutions and the integration of IoT technologies for real-time monitoring and management present additional avenues for market expansion.

The cold storage market is strategically positioned to meet the growing global demands for perishable goods preservation, particularly in developing regions where supply chain advancements are pivotal.

Presently, the total capacity of cold storage facilities stands at 374.25 lakh metric tons (MT), according to data from pib.gov.in, which notably surpasses the estimated necessity of 350 lakh MT outlined by NABARD Consultancy Service (NABCONS). This indicates a robust infrastructure that not only meets current needs but also accommodates potential market growth.

Investment incentives further bolster the market’s expansion potential. Government initiatives offering financial support, with grants of 35% in general areas and an enhanced 50% in specific regions like the North East States, up to a maximum of ₹10 crore per project, are pivotal. These incentives are designed to foster infrastructure development in the storage and transport sectors, crucial for enhancing logistic efficiencies in perishable goods management.

Moreover, the integration of advanced technologies such as IoT for real-time monitoring and AI for predictive maintenance in cold storage systems is set to revolutionize the market. These innovations promise to improve operational efficiencies and reduce wastage, driving further investment into the sector.

Additionally, the expansion of e-commerce in the food and pharmaceutical sectors creates new avenues for growth, demanding more sophisticated and expansive cold storage solutions to ensure product integrity during transit.

Altogether, the cold storage market presents a compelling investment landscape, ripe with opportunities for technological integration and capacity expansion, backed by supportive government policies and a growing necessity for advanced perishable goods management.

Key Takeaways

- The Global Cold Storage Market size is expected to be worth around USD 548.8 Billion by 2033, from USD 144.2 Billion in 2023, growing at a CAGR of 14.3% during the forecast period from 2024 to 2033.

- In 2023, Refrigerated Warehouses held a dominant market position in the by-type segment of the Cold Storage Market, with a 63.5% share.

- In 2023, Frozen held a dominant market position in the By Temperature segment of the Cold Storage Market, with a 74.6% share.

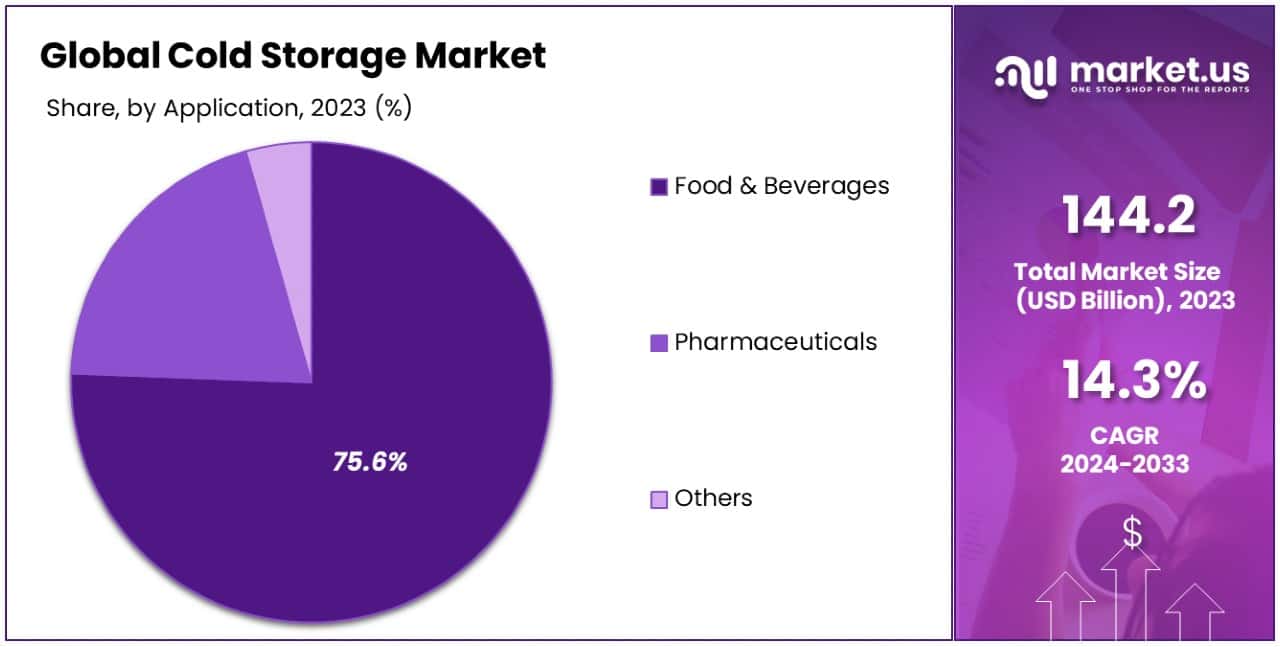

- In 2023, Food & Beverages held a dominant market position in the By Application segment of the Cold Storage Market, with a 75.6% share.

- North America dominated a 35.1% market share in 2023 and held USD 50.61 Billion in revenue from the Cold Storage Market.

By Type Analysis

In 2023, Refrigerated Warehouse held a dominant market position in the “By Type” segment of the Cold Storage Market, with a 63.5% share. This segment’s prominence is attributed to the escalating demand for efficient, large-scale storage solutions capable of maintaining the integrity and quality of perishable goods across diverse industries, including food, pharmaceuticals, and chemicals.

The significant share of refrigerated warehouses underscores their critical role in supply chain security, offering controlled environments essential for prolonging the shelf life of sensitive products.

Refrigerated Transport, although smaller in market share, plays a vital role in connecting production sites with warehouses and end consumers. It ensures a continuous cold chain during the transit of perishable goods, making it indispensable for global trade, especially in sectors where time and temperature are crucial factors.

The integration of advanced technologies such as real-time GPS tracking and temperature monitoring systems in refrigerated transport is enhancing its efficiency and reliability, thereby supporting the growth of this segment.

Together, these segments are pivotal in the comprehensive management of perishable products, ensuring that they reach consumers in optimal condition, thereby reducing waste and increasing the efficiency of resource use across industries.

The continued growth and technological enhancement in both segments are expected to drive further innovation and investment in the cold storage market.

By Temperature Analysis

In 2023, the “Frozen” category held a dominant market position in the “By Temperature” segment of the Cold Storage Market, with a 74.6% share. This substantial market share highlights the critical role of frozen storage solutions in extending the shelf life of a wide range of products, from frozen foods to bio-pharmaceuticals, by maintaining temperatures that significantly slow down biological and chemical processes.

The dominance of the frozen segment is further driven by the rising consumer demand for convenience foods and the increasing requirement for long-term storage capabilities in the pharmaceutical sector, where vaccines and other critical medical supplies need stringent temperature management to remain effective.

The “Chilled” segment, though smaller, is equally vital, catering primarily to fresh produce, dairy products, and some pharmaceuticals that require temperatures above freezing but still within a controlled range. This segment ensures the quality and freshness of perishables during storage and smart transportation, playing a crucial role in maintaining the supply chain of fresh goods.

Together, these temperature-based segments of the cold storage market address diverse needs across multiple industries, ensuring product safety and quality from farm or factory to table. The ongoing technological advancements and increasing investments in both segments are set to enhance their efficiency and reliability, further bolstering the market’s growth.

By Application Analysis

In 2023, the “Food & Beverages” category held a dominant market position in the “By Application” segment of the Cold Storage Market, with a 75.6% share. This segment’s commanding lead is primarily due to the essential need for preserving the quality and extending the shelf life of a vast array of consumable products, ranging from perishable foods to beverages.

The significant share underscores the industry’s reliance on cold storage solutions to meet consumer expectations for freshness, safety, and variety, particularly at a time when global food distribution requires robust logistical support.

Other important sub-segments within this category include Fruits & Vegetables, Dairy Products, Fish, Meat, and Seafood, each requiring specific temperature and humidity conditions to maintain product integrity. The growth in these sub-segments is propelled by increasing global consumption patterns and the rising demand for a diverse diet that includes high-quality perishable products from around the world.

Moreover, the “Pharmaceuticals” segment, which includes critical sub-segments like Vaccines and Blood Banking, although smaller, represents a rapidly growing sector that depends heavily on precise cold storage solutions to ensure the efficacy and safety of life-saving medical products.

Overall, each sub-segment within the “By Application” category highlights the expanding scope and sophistication of cold storage technologies, catering to a broad spectrum of industries with varying preservation needs.

Key Market Segments

By Type

- Refrigerated Warehouse

- Refrigerated Transport

By Temperature Type

- Frozen

- Chilled

By Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

Drivers

Key Drivers of Cold Storage Growth

The Cold Storage Market is experiencing significant expansion, driven primarily by the surge in global food consumption and increased consumer preference for perishable goods. As urban populations grow and dietary habits evolve, the demand for fresh, high-quality food that requires refrigerated storage and transport is also rising.

Additionally, the pharmaceutical industry contributes to this growth trend, with an urgent need for cold chain solutions to store and transport temperature-sensitive medicines and vaccines, especially in light of global health challenges.

Technological advancements are further catalyzing the market, as innovations in refrigeration techniques and IoT integration enhance the efficiency and effectiveness of cold storage operations. This confluence of factors makes cold storage facilities indispensable in maintaining the integrity and longevity of critical products, thereby fueling ongoing growth in the sector.

Restraint

Challenges Limiting Cold Storage Expansion

One of the primary restraints in the Cold Storage Market is the high cost associated with setting up and maintaining these facilities. The initial investment for the advanced refrigeration systems, insulation materials, and property is substantial.

Additionally, the ongoing expenses for energy consumption and system maintenance can be significant, deterring smaller players from entering the market. Regulatory challenges also pose hurdles, as cold storage operations must comply with stringent health, safety, and environmental regulations, which can vary significantly by region and add to the complexity and cost of projects.

These financial and regulatory barriers can slow down the expansion of cold storage capabilities, especially in regions with less developed infrastructure or where energy costs are particularly high.

Opportunities

Expanding Opportunities in Cold Storage

The Cold Storage Market is ripe with opportunities, particularly driven by the burgeoning e-commerce sector and the global push towards more sustainable practices. As online grocery sales continue to climb, the demand for cold storage solutions is escalating, providing ample opportunities for market expansion.

Additionally, the shift towards sustainability is prompting innovations in energy-efficient refrigeration technologies, which not only reduce operational costs but also attract environmentally conscious customers. Emerging markets also offer new frontiers for growth, where urbanization and rising incomes are increasing the demand for perishable goods.

By leveraging technological advancements and expanding into new geographic areas, cold storage providers can tap into these growing demands, securing a robust foothold in a dynamically evolving marketplace.

Challenges

Key Challenges Facing Cold Storage

The Cold Storage Market faces significant challenges, notably the stringent regulatory environment and the rising costs of energy. These facilities must adhere to rigorous health and safety standards, which can vary greatly between countries and regions, complicating global operations.

Energy consumption remains a critical issue, as cold storage systems require continuous power to maintain necessary low temperatures, making them susceptible to fluctuations in energy prices and availability. Furthermore, the need for specialized technology and skilled personnel to manage advanced refrigeration systems adds to the operational complexities and costs.

These challenges require ongoing investment in technology and training, which can strain the resources of companies, especially smaller players. The industry must navigate these issues carefully to maintain profitability and compliance while meeting the growing global demand for cold storage solutions.

Growth Factors

Driving Growth in Cold Storage

The Cold Storage Market is primarily driven by the increasing global demand for fresh and frozen foods and the need for efficient pharmaceutical logistics. As global populations grow and urbanize, there is a heightened demand for a variety of perishable products, from dairy and produce to seafood, requiring robust cold-chain solutions.

Simultaneously, the pharmaceutical industry’s expansion, fueled by the rising need for vaccines and biopharmaceuticals, necessitates precise temperature-controlled environments, further propelling the growth of cold storage facilities.

Technological advancements, such as IoT-enabled warehousing and energy-efficient refrigeration systems, also play a critical role in enhancing the efficiency and capacity of these facilities. This convergence of increased consumer demand and technological innovation is setting a strong foundation for sustained growth in the cold storage sector.

Emerging Trends

Emerging Trends in Cold Storage

The Cold Storage Market is witnessing several emerging trends that are reshaping its landscape. A notable trend is the integration of advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT), which enhance operational efficiency and real-time monitoring capabilities.

These technologies allow for smarter energy management and predictive maintenance, reducing costs and improving service reliability. Another significant trend is the increasing adoption of automated systems within cold storage facilities, which minimizes human error and maximizes space utilization through high-density storage solutions.

Additionally, there is a growing focus on sustainable practices, with more companies investing in green energy sources and eco-friendly refrigerants to reduce the environmental impact of their operations. These trends are not only driving efficiency and sustainability but are also creating competitive advantages for companies in the rapidly evolving cold storage market.

Regional Analysis

The Cold Storage Market is witnessing diverse growth trajectories across various regions, reflecting localized demand dynamics and infrastructural developments. North America leads the global landscape with a 35.1% market share, representing a value of USD 50.61 billion. This dominance is fueled by advanced logistics networks and the substantial consumption of frozen and refrigerated goods.

In Europe, stringent food safety regulations drive the need for compliant cold storage solutions, supporting a sophisticated supply chain that spans across the continent. Asia Pacific is experiencing rapid growth due to urbanization and rising income levels, which increase demand for perishable goods and drive investments in cold chain infrastructure.

Meanwhile, the Middle East & Africa region is gradually expanding its cold storage capacities to support its growing food import needs and efforts to reduce food waste. Latin America, though smaller in market share, is seeing growth influenced by improvements in agricultural export capabilities and the modernization of retail food sectors.

Each region’s development is shaped by unique consumer behaviors, regulatory environments, and technological integrations, making the cold storage market a dynamic component of the global supply chain.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Cold Storage Market, three key players—Americold Logistics, Lineage Logistics Holdings, and Nichirei Corporation—stand out for their strategic positioning and expansive operational footprints in 2023.

Americold Logistics has cemented its status as a powerhouse through strategic acquisitions and robust investments in technology. As a leading provider in North America, Americold has expanded its global reach by enhancing its infrastructure with state-of-the-art automated systems.

This focus not only improves operational efficiency but also caters to the increasing demand for rapid and reliable perishable goods distribution, making Americold a critical player in both regional and international markets.

Lineage Logistics Holdings, recognized for its innovative approach to cold storage, utilizes AI and machine learning to optimize warehousing and transportation. Lineage’s commitment to sustainability—evidenced by its efforts to reduce carbon emissions across its facilities—aligns with the global push towards environmentally friendly practices.

The company’s aggressive expansion strategy, marked by both acquisitions and greenfield projects, has positioned it as a pivotal entity capable of shaping industry standards and practices worldwide.

Nichirei Corporation, based in Japan, leverages its geographical advantage to dominate the Asia-Pacific market. The company’s focus on integrating advanced refrigeration technologies has enhanced its service offerings, particularly in catering to the nuanced needs of the pharmaceutical sector.

Nichirei’s strategic partnerships and dedication to quality control underscore its role in advancing cold chain logistics within and beyond the region.

Together, these companies not only drive technological and operational advancements in the Cold Storage Market but also shape competitive dynamics by setting benchmarks in efficiency, sustainability, and global supply chain integration. Their respective strengths and strategic initiatives are essential for understanding the market’s trajectory and the evolving demands of cold storage services.

Top Key Players in the Market

- Americold Logistics

- Lineage Logistics Holdings

- Nichirei Corporation

- Burris Logistics

- Agro Merchants Group

- Kloosterboer

- United States Cold Storage

- Tippmann Group

- VersaCold Logistics Services

- Henningsen Cold Storage Co

- Coldman

- Congebec Inc.

- Conestoga Cold Storage

Recent Developments

- In October 2024, Kloosterboer: Received a $50 million investment to innovate its automation technology, enhancing efficiency across its European facilities.

- In July 2023, Agro Merchants Group: Launched a new organic-certified cold storage facility in California, boasting an initial capacity of 150,000 pallets.

- In March 2023, Burris Logistics: Acquired a smaller competitor to expand its regional footprint in the Northeast, adding 200,000 square feet of cold storage space.

Report Scope

Report Features Description Market Value (2023) USD 144.2 Billion Forecast Revenue (2033) USD 548.8 Billion CAGR (2024-2033) 14.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered ((Food & Beverages,(Fruits & Vegetables, Fruit Pulp & Concentrates, Dairy Products, Fish, Meat, and Seafood, Processed Food, Bakery & Confectionary, Others)), Pharmaceuticals,((Vaccines, Blood Banking, Others))) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Americold Logistics, Lineage Logistics Holdings, Nichirei Corporation, Burris Logistics, Agro Merchants Group, Kloosterboer, United States Cold Storage, Tippmann Group, VersaCold Logistics Services, Henningsen Cold Storage Co, Coldman, Congebec Inc., Conestoga Cold Storage Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-