Global Cold Mix Asphalt Additives Market By Type(Emulsion-based Cold Mix Asphalt Additive, Solvent-based Cold Mix Asphalt Additive), By Product Formulation(Traditional Cold Mix Asphalt, Polymer-Modified Cold Mix Asphalt), By Application(Cold Patch Stockpile Mix, Cold Mix Paving, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: May 2024

- Report ID: 17210

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

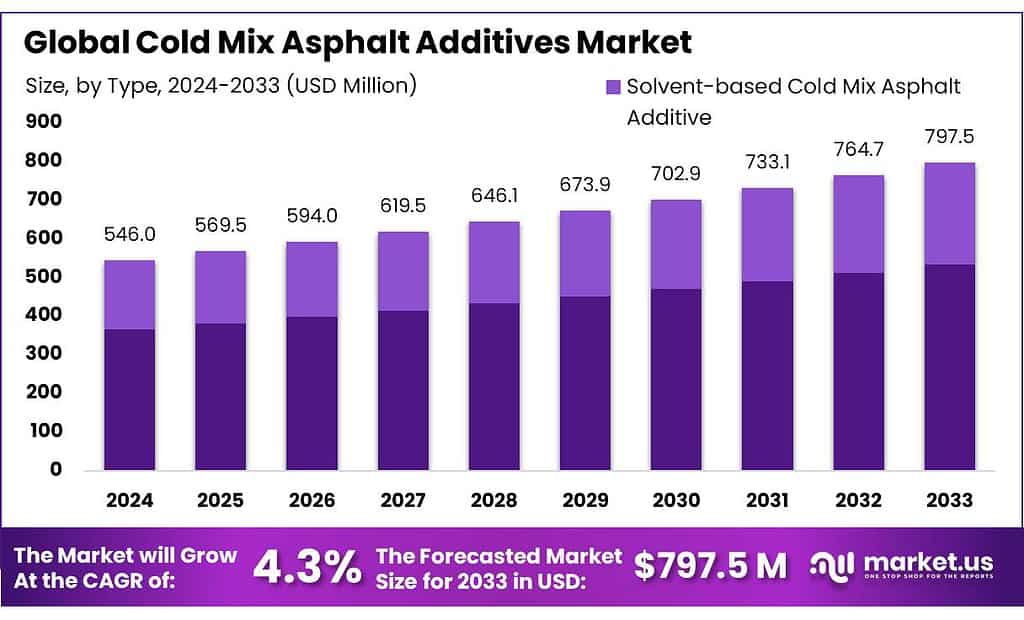

The global Cold Mix Asphalt Additives Market size is expected to be worth around USD 797.5 Million by 2033, from USD 546 Million in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

The Cold Mix Asphalt Additives Market refers to the segment of the construction and road maintenance industry that focuses on the production and distribution of additives used in cold mix asphalt formulations. These additives are essential for enhancing the performance of asphalt used in road construction and repair at lower temperatures, where traditional hot mix asphalt would not be feasible.

Cold mix asphalt is typically used for patching roads, filling potholes, and minor repair works, especially in colder climates or during colder months when hot mix asphalt cannot be used effectively. The additives included in the cold mix asphalt help improve the asphalt’s workability, adhesion, and resistance to water, thereby extending the life of the road surface.

The market for cold-mixed asphalt additives is driven by several factors, including increasing road construction activities, maintenance of aging infrastructure, and the need for cost-effective solutions that reduce the energy consumption associated with heating asphalt. Environmental concerns and regulations also play a crucial role in promoting the use of cold-mix asphalt, as it produces fewer emissions compared to hot-mix asphalt.

Key players in the market may include manufacturers of chemical additives, asphalt producers, and companies specializing in road construction materials. The market is segmented based on the type of additives used, such as emulsifiers, polymers, anti-strip & adhesion promoters, and others.

Key Takeaways

- Market Growth Projection: Cold Mix Asphalt Additives market is expected to reach USD 797.5 million by 2033, with a CAGR of 4.3% from 2023.

- Type Segmentation: Emulsion-based additives held a 67.4% market share in 2023.

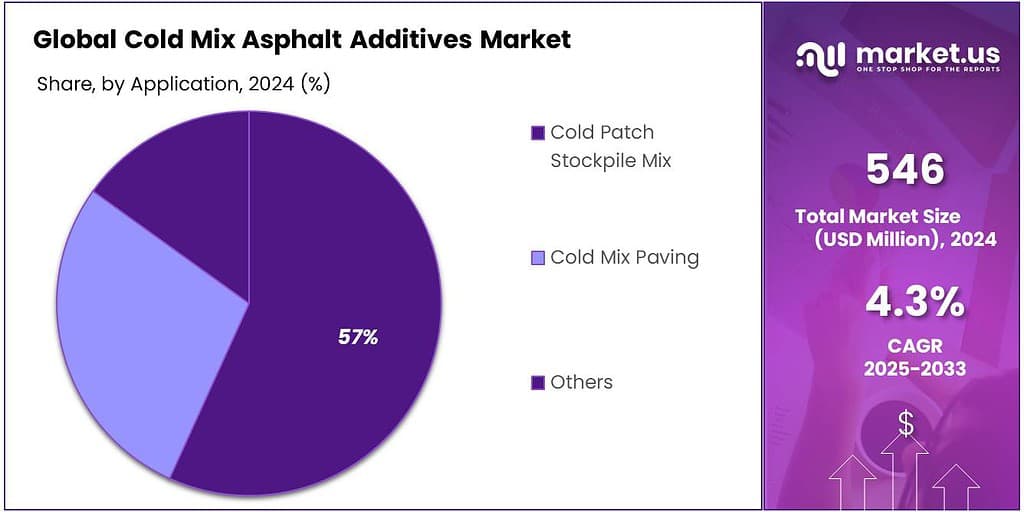

- Application Segmentation: Cold Patch Stockpile Mix led with 56.5% market share.

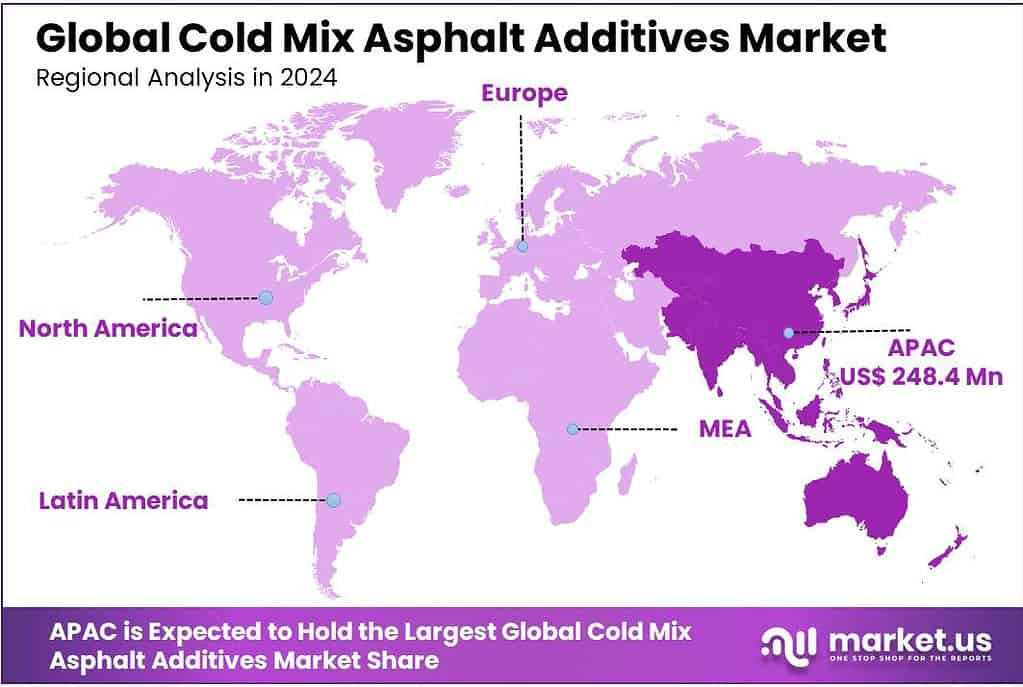

- Regional Analysis: Asia Pacific dominated with a 45.6% market share in 2023, driven by rapid urbanization and evolving preferences.

By Type

In 2023, Emulsion-based Cold Mix Asphalt Additive held a dominant market position, capturing more than a 67.4% share. This segment benefits from its environmental friendliness and energy efficiency, as emulsion-based additives allow for asphalt to be mixed and applied at lower temperatures, reducing energy use and emissions.

Moreover, these additives enhance the adhesion and durability of asphalt, making them ideal for repair and maintenance projects in variable climatic conditions. The widespread adoption of emulsion-based additives is also driven by their cost-effectiveness and ability to improve the workability of asphalt, catering to the growing demand for sustainable and efficient road repair solutions.

On the other hand, Solvent-based Cold Mix Asphalt Additive forms a smaller segment of the market. Although less prevalent, these additives are valued for their quick-drying properties and robust performance in extremely cold environments.

They facilitate the rapid setting of asphalt, which is crucial for time-sensitive projects and emergency repairs during unfavorable weather conditions. However, environmental concerns and stricter regulations regarding VOC emissions are gradually limiting the growth of this segment. As a result, the market is seeing a gradual shift towards more environmentally friendly alternatives, like emulsion-based products.

By Product Formulation

In 2023, Traditional Cold Mix Asphalt held a dominant market position, capturing more than a 55.6% share. This segment is favored for its cost-effectiveness and ease of use, making it a popular choice for minor repairs and maintenance works like filling potholes or patching roads.

Traditional cold mix asphalt is versatile and can be applied in various weather conditions, which significantly contributes to its widespread adoption, particularly in regions with fluctuating temperatures and limited budgets for road maintenance.

Meanwhile, Polymer-Modified Cold Mix Asphalt is gaining traction, offering enhanced performance characteristics compared to traditional mixes. This type of asphalt incorporates polymers that improve elasticity, durability, and resistance to water damage, making it suitable for more demanding applications.

Although it represents a smaller portion of the market, the demand for polymer-modified cold mix asphalt is growing as transportation authorities and contractors seek longer-lasting road repair solutions that can withstand harsher conditions and heavier traffic. The segment’s growth is supported by increasing awareness of the long-term cost savings and reduced environmental impact provided by these advanced materials.

By Application

In 2023, Cold Patch Stockpile Mix held a dominant market position, capturing more than a 56.5% share. This segment is highly preferred for its convenience and readiness for use, making it ideal for quick road repairs and maintenance.

Cold patch stockpile mix is extensively used for fixing potholes, minor cracks, and other surface irregularities, particularly in emergencies or during colder months when other types of mixes are less effective. Its ability to be stored and used as needed without significant preparation or special equipment supports its widespread adoption among municipal and local road agencies.

Cold Mix Paving, another important segment, is utilized for larger-scale paving projects that require durable and long-lasting asphalt at lower temperatures. This application is particularly valuable in areas where environmental concerns or weather conditions make hot mix asphalt less viable.

Cold mix paving is gaining attention for its reduced environmental impact and the ability to pave in cooler conditions without compromising on the quality of the road surface.

Key Market Segments

By Type

- Emulsion-based Cold Mix Asphalt Additive

- Solvent-based Cold Mix Asphalt Additive

By Product Formulation

- Traditional Cold Mix Asphalt

- Polymer-Modified Cold Mix Asphalt

By Application

- Cold Patch Stockpile Mix

- Cold Mix Paving

- Others

Drivers

Increasing Demand for Road Maintenance and Repair

One of the primary drivers propelling the growth of the Cold Mix Asphalt Additives Market is the increasing demand for road maintenance and repair. As global infrastructure continues to age, the need for efficient and cost-effective solutions for road maintenance becomes crucial. Cold mix asphalt, enhanced with various additives, provides a viable solution due to its ability to be applied in diverse weather conditions and its lower energy requirements compared to traditional hot mix asphalt.

Cold mix asphalt additives improve the performance characteristics of the asphalt, such as enhanced adhesion, reduced susceptibility to water damage, and increased durability. This makes it particularly suitable for repairing potholes, cracks, and other surface defects that can develop due to weather extremes and regular wear and tear.

The ability to use cold mix asphalt in colder temperatures, where hot mix applications would be impractical, offers significant operational flexibility to road authorities and contractors. This flexibility is vital in regions experiencing colder climates, extending the road repair season and allowing for emergency repairs during winter months.

Moreover, the environmental benefits associated with cold mix asphalt, such as reduced energy consumption and lower emissions during production and application, align with the increasing global emphasis on sustainability. Governments and regulatory bodies are actively promoting environmentally friendly construction practices, which in turn fuels the demand for cold mix asphalt additives. These additives often enable the asphalt to cure at ambient temperatures, thereby saving energy that would otherwise be used for heating and reducing the carbon footprint associated with road construction and maintenance projects.

The economic advantages are also significant. Using cold-mix asphalt can lead to cost savings in terms of both materials and operational procedures. Since cold-mixed asphalt can be stockpiled and used on an as-needed basis, it reduces waste and the costs associated with reheating materials. Additionally, the quick application and setting times associated with enhanced cold mix formulations reduce labor costs and road closure times, minimizing the economic impact on local communities and road users.

Restraints

Limitations in Performance and Durability Under Certain Conditions

A significant restraint in the Cold Mix Asphalt Additives Market is the limitations in performance and durability under certain conditions, which can impede its wider adoption for more extensive or heavy-duty road applications. While cold mix asphalt offers considerable advantages for minor repairs and maintenance, particularly in cooler climates, its performance compared to hot mix asphalt can be suboptimal in scenarios demanding high durability and long-term resilience.

Cold mix asphalt, even with additives, generally has lower load-bearing capacity than hot mix asphalt. This characteristic makes it less suitable for roads with high traffic volumes or heavy vehicle usage. The binders used in cold mix asphalt do not always achieve the same level of cohesion and compaction as those in hot mix asphalt, potentially leading to quicker deterioration and shorter lifespans of the road surfaces. This is a critical factor for road engineers and city planners who must ensure that roads can withstand the demands of traffic over many years without requiring frequent repairs.

Additionally, environmental conditions play a crucial role in the effectiveness of cold mix applications. In regions with very hot climates, cold mixed asphalt can become too soft and may rut or deform under the stress of regular traffic, particularly during peak summer temperatures. Conversely, in extremely cold regions, while advantageous for its cold application, cold mix asphalt might not perform well under the freeze-thaw cycles, leading to surface cracking and moisture infiltration, which can compromise the pavement’s integrity.

The performance of cold mix asphalt is also dependent on the quality and proportion of the additives used. Achieving the right mix can be complex, and inconsistencies in additive quality or improper mixing can lead to poor performance outcomes. This dependency on precise formulations can introduce variability in the quality of road repair work, potentially leading to increased maintenance costs and reduced user satisfaction.

Moreover, the perception of cold-mixed asphalt as a less durable option can also be a market restraint. Decision-makers might opt for more traditional solutions perceived as more reliable or having a proven track record, especially for critical infrastructure projects. Overcoming this perception requires continuous product innovation and effective demonstration of improved performance through long-term studies and real-world application evidence.

Opportunity

Expansion into Emerging Markets and Rural Road Development

A major opportunity for the Cold Mix Asphalt Additives Market lies in its expansion into emerging markets and rural road development projects. These regions often face unique challenges such as limited access to sophisticated construction equipment, fluctuating weather conditions, and the need for cost-effective solutions due to budget constraints. Cold mix asphalt, with its additives, presents an ideal solution to these challenges, offering a method for building and maintaining roads that requires fewer resources in terms of both equipment and operational costs.

In many developing countries, rapid urbanization and industrial growth drive the need for robust infrastructure development, including transportation networks. However, the high cost of traditional hot mix asphalt, along with the need for specialized equipment to heat and apply it, can be prohibitive.

Cold mix asphalt can be used at ambient temperatures, eliminating the need for expensive heating equipment and making it accessible for smaller communities or regions with limited infrastructure. This accessibility supports quicker and more affordable road construction and maintenance, facilitating better connectivity and economic development in underserved areas.

Moreover, cold mix asphalt’s ability to be stockpiled and used as needed without significant degradation in quality makes it particularly suitable for remote and rural areas. These regions may not have the same immediate access to asphalt plants, and the logistics of transporting hot mix asphalt over long distances can be both challenging and costly.

By using cold mix asphalt, road repairs, and construction can be conducted as necessary, with materials that have been prepared and stored nearby, thus greatly reducing transportation costs and project timelines.

The environmental aspect of cold-mixed asphalt also presents a significant opportunity. As global awareness of environmental issues increases, and as regulations around emissions and energy use tighten, the demand for greener construction materials is on the rise.

Cold mix asphalt’s lower energy requirements during production and application, along with reduced emissions, make it an attractive option for governments and organizations looking to minimize environmental impact. This is especially pertinent in emerging markets, where sustainable development is increasingly prioritized to ensure long-term environmental and economic health.

Additionally, advancements in additive technologies offer the potential to further enhance the properties of cold mix asphalt, making it more comparable in performance to hot mix asphalt. Innovations in polymer-modified asphalts and other additive types could improve the durability and load-bearing capacity of cold mix asphalt, expanding its applicability to a broader range of projects and conditions.

As these technologies evolve, they create new opportunities for the cold mix asphalt additives market to penetrate more traditional segments that have relied on hot mix solutions.

Trends

Increasing Adoption of Eco-Friendly and Sustainable Practices

A prominent trend in the Cold Mix Asphalt Additives Market is the increasing adoption of eco-friendly and sustainable practices within the road construction and maintenance industries. This trend is driven by a growing global awareness of environmental issues and the need for more sustainable infrastructure solutions. As a result, there is a significant shift toward using cold mix asphalt additives that contribute to lower carbon footprints, reduced energy consumption, and minimal environmental impact.

Cold mix asphalt itself offers considerable environmental benefits over traditional hot mix asphalt because it does not require high temperatures for mixing and laying. This results in significantly lower energy usage and reduced emissions of greenhouse gases and other pollutants during production and application. As environmental regulations become stricter and public demand for greener construction practices grows, the use of cold mix asphalt is becoming increasingly attractive to both public and private sector stakeholders.

Additives used in cold mix asphalt further enhance these environmental benefits. For example, bio-based and recycled materials are being integrated into additive formulations to reduce reliance on virgin petroleum products and decrease the overall environmental impact of asphalt production. These innovative additives not only help in making the asphalt mix more sustainable but also improve its performance characteristics such as water resistance and durability, thereby extending the lifespan of asphalt surfaces.

Moreover, the development and application of cold mix asphalt additives are being supported by advancements in material science and chemical engineering. Researchers and companies are exploring new combinations of materials that can provide the necessary performance while being environmentally benign. This includes experimenting with natural rubber, recycled plastic, and other sustainable materials as components of the asphalt mix.

The trend towards sustainability is also opening up new markets for cold mix asphalt additives. Municipalities and local governments, in particular, are looking for road repair solutions that align with their sustainability goals and budgets. Cold mix asphalt’s ability to be applied quickly and at lower temperatures makes it ideal for urban areas where minimizing disruption and environmental impact is crucial.

Additionally, there is a growing emphasis on lifecycle assessments within the industry, with more companies and projects considering the long-term environmental and economic impacts of their materials choices. This holistic approach to sustainability is further encouraging the adoption of cold mix asphalt additives, as they can contribute to more durable road surfaces that require fewer repairs and replacements over time, thus reducing the overall environmental impact associated with frequent roadworks.

Regional Analysis

In 2023, the Asia Pacific region emerged as a formidable force in the global market for cold mix asphalt additives, commanding an impressive 45.6% share of the total market. This remarkable standing is primarily driven by the region’s swift urbanization, burgeoning disposable incomes, and evolving consumer preferences. Notably, the Asia Pacific region has witnessed significant traction in its construction and infrastructure sectors, where cold-mixed asphalt additives are indispensable for enhancing pavement durability and performance.

The burgeoning middle-class populace and ongoing urban expansion serve as primary catalysts for the market’s expansion. Key nations like China, Taiwan, and Japan have emerged as pivotal centers for both the production and consumption of cold-mixed asphalt additives, catering to domestic and international demands alike.

Countries such as Japan, China, and South Korea have experienced a surge in demand for cold-mix asphalt additives, crucial for optimizing various construction projects. With a vast population, notably in China and India, the Asia Pacific region presents an extensive consumer base for cold mix asphalt additives and associated products.

A growing inclination toward innovative construction practices and the adoption of advanced technologies have fueled the demand for cold-mix asphalt additives. The Asia Pacific region has positioned itself as a leading manufacturer of these additives, characterized by substantial investments in production facilities and advancements in manufacturing techniques.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Cold Mix Asphalt Additives Market features a diverse array of key players, each contributing to the industry with unique product offerings and strategic initiatives. Prominent companies in this market include ArrMaz, Dow Chemical Company, BASF SE, Arkema Group, and Honeywell International Inc.

These companies are recognized for their extensive research and development efforts, which focus on improving the efficacy and environmental compatibility of asphalt additives.

Market Key Players

- Medtronic

- Sigvaris

- Medi

- BSN Medical

- Juzo

- 3M

- Bauerfeind AG

- Thuasne Corporate

- Pretty Legs Hosiery

- Salzmann-Group

- Paul Hartmann

- Cizeta Medicali

- Belsana Medical

- Gloria Med

- Zhende Medical Group

- Maizi

- TOKO

- Okamoto Corporation

- Zhejiang Sameri

- MD

Recent Developments

Medtronic is primarily known for its operations in the healthcare sector, focusing on medical devices and technologies rather than construction materials or asphalt additives.

Sigvaris is primarily known for its expertise in the production of medical compression garments and orthopedic products, rather than in construction or road maintenance materials.

Report Scope

Report Features Description Market Value (2023) US$ 546 Mn Forecast Revenue (2033) US$ 797.5 Mn CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Emulsion-based Cold Mix Asphalt Additive, Solvent-based Cold Mix Asphalt Additive), By Product Formulation(Traditional Cold Mix Asphalt, Polymer-Modified Cold Mix Asphalt), By Application(Cold Patch Stockpile Mix, Cold Mix Paving, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Medtronic, Sigvaris, Medi, BSN Medical, Juzo, 3M, Bauerfeind AG, Thuasne Corporate, Pretty Legs Hosiery, Salzmann-Group, Paul Hartmann, Cizeta Medicali, Belsana Medical, Gloria Med, Zhende Medical Group, Maizi, TOKO, Okamoto Corporation, Zhejiang Sameri, MD Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Cold Mix Asphalt Additives Market?Cold Mix Asphalt Additives Market size is expected to be worth around USD 797.5 Million by 2033, from USD 546 Million in 2023

What CAGR is projected for the Cold Mix Asphalt Additives Market?The Cold Mix Asphalt Additives Market is expected to grow at 4.3% CAGR (2024-2033).Name the major industry players in the Cold Mix Asphalt Additives Market?Medtronic(Covidien), Sigvaris, Medi, BSN Medical, Juzo, 3M, Bauerfeind AG, Thuasne Corporate, Pretty Legs Hosiery, Salzmann-Group, Paul Hartmann, Cizeta Medicali, Belsana Medical, Gloria Med, Zhende Medical Group, Maizi, TOKO, Okamoto Corporation, Zhejiang Sameri, MD,

Cold Mix Asphalt Additives MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Cold Mix Asphalt Additives MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- Sigvaris

- Medi

- BSN Medical

- Juzo

- 3M

- Bauerfeind AG

- Thuasne Corporate

- Pretty Legs Hosiery

- Salzmann-Group

- Paul Hartmann

- Cizeta Medicali

- Belsana Medical

- Gloria Med

- Zhende Medical Group

- Maizi

- TOKO

- Okamoto Corporation

- Zhejiang Sameri

- MD