Global Cold Chain Tracking and Monitoring Market Size, Share, Trends Analysis Report By Component (Hardware and Software), By Solution (Storage and Transportation), By End-User (Food & Beverages, Pharmaceuticals, Chemical, Other End-Users), By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct. 2024

- Report ID: 12052

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

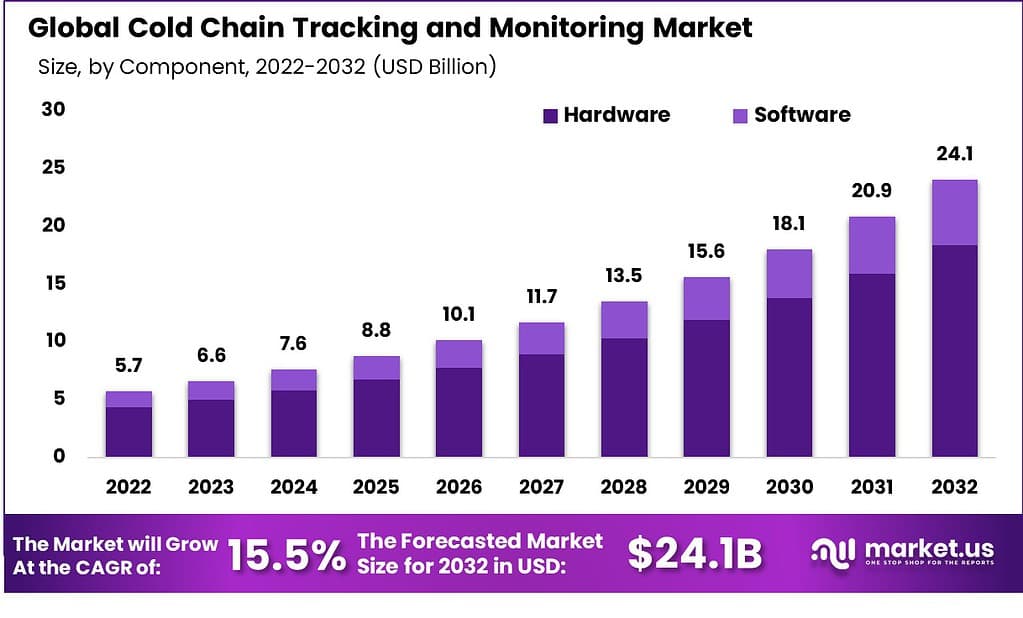

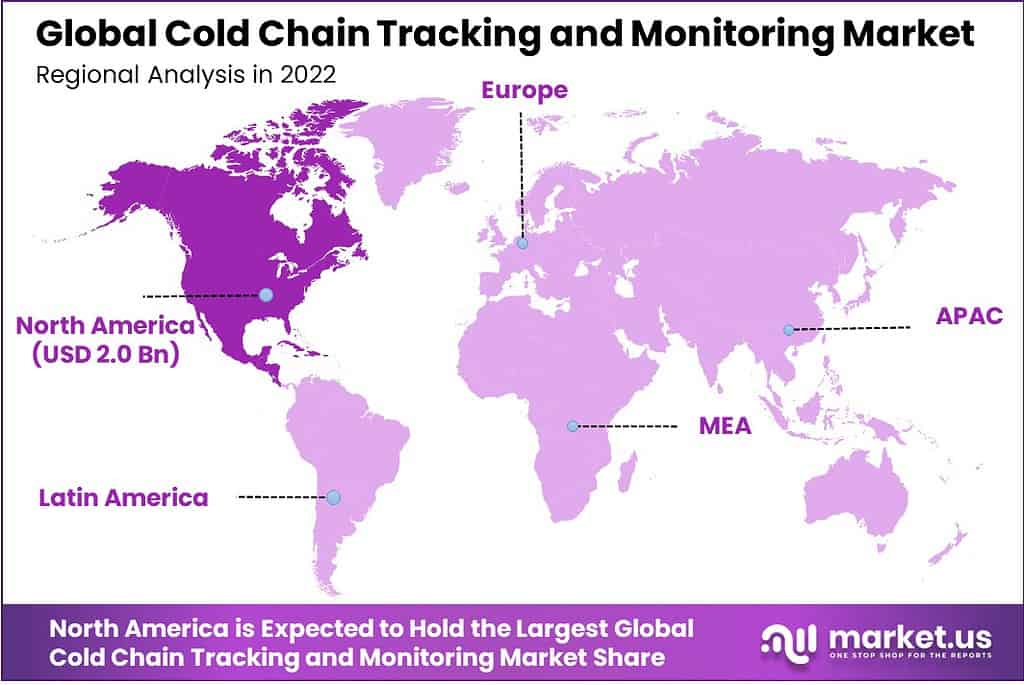

The Global Cold Chain Tracking and Monitoring Market size is expected to be worth around USD 24.1 Billion By 2033, from USD 6.6 Billion in 2023, growing at a CAGR of 15.5% during the forecast period from 2023 to 2032. In 2022, North America held a dominant market position, capturing more than a 35.2% share, holding USD 2.0 Billion revenue.

Cold chain tracking and monitoring is a critical aspect of managing temperature-sensitive products throughout their storage and transportation phases. This system ensures that items such as pharmaceuticals, perishable food, and other sensitive products are kept within specific temperature ranges to maintain their quality and safety.

Advanced technologies like the Internet of Things (IoT), Radio Frequency Identification (RFID), and real-time data analytics play a pivotal role in this process, enabling precise tracking and visibility throughout the supply chain. The cold chain tracking and monitoring market is experiencing significant growth due to the increasing demand for perishable goods across global markets.

This market encompasses a range of solutions, including hardware like sensors and RFID devices, and software that provides real-time data and analytics to manage the conditions of goods while in transit or storage. Companies operating in pharmaceuticals, food and beverage, and other industries rely heavily on these technologies to meet stringent regulatory standards and manage the logistics of temperature-sensitive products effectively.

Several factors drive the demand for cold chain tracking and monitoring. Key among these is the globalization of food supply chains and stringent regulatory standards that necessitate meticulous temperature management to ensure safety and compliance. The growth of e-commerce in food and pharmaceutical sectors also amplifies the need for effective cold chain solutions. Moreover, the rising consumer awareness about the health implications of improperly handled perishable products is increasing demand for advanced monitoring solutions.

Technological innovation is central to the development of the cold chain tracking and monitoring market. IoT and RFID technologies have revolutionized how temperature-sensitive products are monitored by providing real-time data that enhances decision-making and operational efficiency. Furthermore, advancements in AI and machine learning are being leveraged to predict and mitigate risks before they can impact the supply chain, thereby improving overall supply chain resilience

Market demand for cold chain tracking and monitoring is primarily fueled by the healthcare and food & beverage industries. These sectors require precise temperature conditions to prevent product spoilage and ensure efficacy, particularly with vaccines and biopharmaceuticals. Opportunities are emerging from technological advancements such as the integration of AI and blockchain, which enhance traceability and predictive analytics, potentially opening up new avenues for market growth.

Key Takeaways

- The Global Cold Chain Tracking and Monitoring Market is set to witness remarkable growth, with its value projected to reach USD 24.1 billion by 2033, up from USD 6.6 billion in 2023. This indicates a Compound Annual Growth Rate (CAGR) of 15.5% throughout the forecast period from 2023 to 2032.

- In 2022, North America led the market with over 35.2% of the total share, bringing in approximately USD 2.0 billion in revenue. This dominance is largely driven by the region’s advanced cold chain infrastructure and the increasing demand for perishable goods.

- Within the market segments, the Hardware category took the spotlight in 2022, capturing a significant 76.4% market share. This high percentage reflects the essential role of physical tracking devices in maintaining product integrity throughout the cold chain.

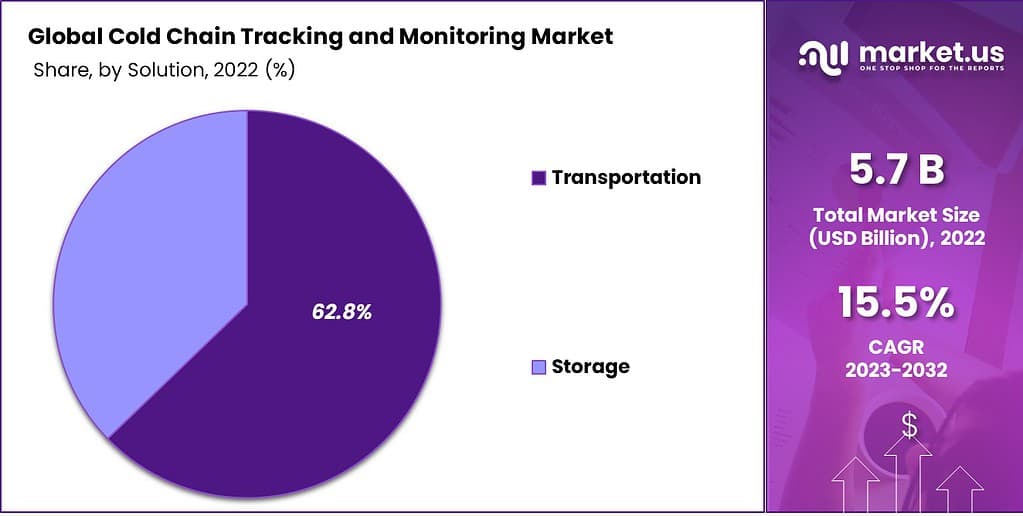

- The Transportation sector also played a critical role in the market, holding a 62.8% share in 2022. Reliable transportation tracking is essential for ensuring the quality and safety of perishable goods, boosting demand for advanced monitoring solutions.

- Lastly, the Food & Beverages segment stood out, accounting for 76.8% of the market share in 2022. With the high perishability of these products, effective cold chain monitoring is essential to maintain safety and compliance standards, fueling growth in this segment.

Component Analysis

In 2022, the Hardware segment held a dominant market position in the Cold Chain Tracking and Monitoring Market, capturing more than a 76.4% share. This segment’s leadership is primarily attributed to its crucial role in the physical monitoring and control of temperature-sensitive products across various industries, including pharmaceuticals, food and beverages, and chemicals.

Hardware components such as sensors, RFID devices, and data loggers are integral to establishing a reliable cold chain. These devices continuously monitor environmental parameters like temperature and humidity, ensuring that products remain within safe limits throughout their journey. This constant monitoring is essential for compliance with stringent regulatory standards that govern the transportation and storage of perishable goods.

Moreover, the ongoing advancements in hardware technology have significantly enhanced the efficiency and accuracy of these monitoring tools. Modern sensors are not only more precise but also have features like longer battery life and robust data storage capabilities, which are critical for long transportation routes and extended storage periods. The integration of IoT technology has further enabled real-time tracking and alerts, which help in proactive management of the cold chain.

The robustness and reliability of hardware solutions, combined with their ability to integrate with advanced technologies, explain why this segment continues to lead the market. As industries increasingly emphasize transparency and compliance in supply chain operations, the demand for sophisticated hardware solutions in cold chain tracking and monitoring is expected to remain strong.

Solution Analysis

In 2022, the Transportation segment held a dominant market position in the Cold Chain Tracking and Monitoring Market, capturing more than a 62.8% share. This segment’s lead is primarily driven by the critical importance of ensuring the integrity of perishable goods, such as pharmaceuticals and food products, during their transit across increasingly global supply chains.

The need for transportation solutions in cold chain logistics stems from the complexities of shipping sensitive products across varied climatic zones. Transporting these goods involves not only maintaining specific temperature ranges but also ensuring that the conditions are constantly monitored and controlled. Hardware and software solutions designed for transportation are equipped with GPS tracking, real-time temperature monitoring, and advanced data analytics to provide insights into shipment status and environmental conditions.

Furthermore, the growth of international trade in perishable goods has amplified the demand for robust transportation solutions. As companies expand their reach into new markets, the logistical challenges of maintaining product integrity during longer transit times have become more prominent. The transportation segment addresses these challenges by offering technologies that ensure compliance with international safety standards, which is crucial for market access and consumer safety.

The combination of regulatory compliance needs, the expansion of global markets, and the technological advancements in monitoring systems explains why the Transportation segment continues to capture a significant share of the Cold Chain Tracking and Monitoring Market. These factors underscore the segment’s essential role in the global supply chain, ensuring that it remains at the forefront of market demand.

End-User Analysis

In 2022, the Food & Beverages segment held a dominant market position in the Cold Chain Tracking and Monitoring Market, capturing more than a 76.8% share. This segment’s leadership is largely due to the escalating global demand for fresh and quality food products that require strict temperature controls during shipping and storage to ensure safety and extend shelf life.

The surge in consumer preference for fresh fruits, vegetables, dairy products, and other perishable foods has significantly contributed to the expansion of the cold chain infrastructure. These products need to be stored and transported in temperature-specific conditions to prevent spoilage and meet food safety standards, which are becoming increasingly stringent globally. As a result, the Food & Beverages industry heavily invests in cold chain solutions to preserve the quality of these sensitive products, from the point of origin to consumption.

Additionally, the rise in international trade of food products has necessitated robust cold chain solutions to manage the logistics of long-distance transportation across varied climatic conditions. This includes advanced tracking and monitoring systems that ensure real-time visibility and control, crucial for maintaining the cold chain without interruptions.

Technological advancements, such as IoT-enabled tracking systems, have further propelled the Food & Beverages segment by providing detailed insights into the supply chain, enhancing operational efficiencies, and reducing wastage. This ongoing evolution in technology, coupled with growing market demands and regulatory pressures, solidifies the Food & Beverages sector’s lead in the Cold Chain Tracking and Monitoring Market.

Key Market Segments

Component

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Others

- Software

- On-Premise

- Cloud-Based

Solution

- Storage

- Transportation

End-User

- Food & Beverages

- Pharmaceuticals

- Chemical

- Other End-Users

Driver

Growing Demand for Perishable Goods

The cold chain tracking and monitoring market is primarily driven by the escalating global demand for perishable goods such as food and pharmaceuticals, which require stringent temperature management to maintain quality and safety. The rapid expansion of the food sector, including fresh produce and frozen products, coupled with the growth of the pharmaceutical industry, which relies heavily on the safe transport of temperature-sensitive drugs and vaccines, significantly propels market growth.

The incorporation of advanced technologies like IoT and RFID in cold chain systems enhances monitoring precision and efficiency, further boosting the market. These systems ensure critical real-time data is available to stakeholders, optimizing the supply chain and reducing waste due to spoilage.

Restraint

High Implementation Costs

One of the significant restraints facing the cold chain tracking and monitoring market is the high cost associated with setting up and maintaining these systems. Initial expenses include the purchase and installation of specialized monitoring equipment and technology such as sensors and networking infrastructure.

Moreover, the operational costs of running these systems – especially over long distances and through various climatic conditions – add financial burdens on businesses. These costs can be prohibitive, particularly for small and medium-sized enterprises (SMEs), and may slow down the adoption rate of advanced cold chain monitoring solutions.

Opportunity

Technological Advancements and Emerging Markets

The market presents substantial opportunities through technological advancements and expansion into emerging markets. Innovations in sensor technology, data analytics, and the integration of blockchain for enhanced transparency and traceability in the cold chain are creating new avenues for market growth.

Additionally, emerging markets with increasing participation in global trade provide fresh prospects for the deployment of cold chain solutions. As these regions develop their food and pharmaceutical sectors, the demand for effective cold chain monitoring systems is expected to rise, offering significant market opportunities.

Challenge

Standardization and Regulatory Compliance

A major challenge in the cold chain tracking and monitoring market is the need for standardization and compliance with diverse regulatory frameworks across different regions. Companies must navigate a complex landscape of standards pertaining to the transportation and storage of temperature-sensitive products, which can vary widely by country and region.

Ensuring compliance while maintaining efficiency and cost-effectiveness requires continuous updates and adaptations in technology and practices. This challenge is compounded by the rapid pace of technological changes and the need for ongoing training and system upgrades to meet regulatory requirements.

Growth Factors

The cold chain tracking and monitoring market is primarily driven by the increasing global demand for perishable goods such as food products and pharmaceuticals. The need to maintain the quality and safety of these temperature-sensitive products during storage and transportation is critical, leading to significant growth in the market.

The adoption of advanced technologies like IoT and RFID, which enhance the efficiency and accuracy of cold chain logistics, further fuels this growth. The rigorous regulatory environment, particularly in the pharmaceutical sector, necessitates robust cold chain solutions to ensure compliance and maintain product integrity, pushing the market forward.

Emerging Trends

Emerging trends within the cold chain tracking and monitoring market include the integration of cutting-edge technologies such as AI and blockchain. These technologies are revolutionizing the market by providing enhanced traceability, security, and efficiency.

The use of AI helps in predicting potential disruptions and optimizing the cold chain processes, while blockchain technology ensures transparency and trust in the monitoring processes. Moreover, the expansion of IoT applications within the cold chain is leading to more sophisticated monitoring solutions that offer real-time data and analytics, enabling quicker decision-making and problem-solving.

Business Benefits

Implementing cold chain tracking and monitoring systems provides substantial business benefits including improved compliance with global standards, enhanced operational efficiency, and reduced waste due to spoilage. These systems significantly reduce financial risks by protecting the quality of sensitive goods throughout the supply chain.

Real-time monitoring capabilities allow businesses to respond promptly to any issues that might affect the product environment, thus maintaining the quality and extending the shelf life of products. Additionally, these systems help in bolstering consumer trust by ensuring the delivery of high-quality products.

Regional Analysis

In 2022, North America held a dominant market position in the Cold Chain Tracking and Monitoring Market, capturing more than a 35.2% share with a revenue of USD 2.0 billion. This leadership is primarily attributed to the region’s advanced technological infrastructure and stringent regulatory standards, which drive the adoption of sophisticated cold chain solutions.

North America’s leadership in the market is further bolstered by its well-established pharmaceutical and food safety sectors, which require rigorous cold chain management to ensure product integrity and compliance with health regulations. The presence of major pharmaceutical companies and a large consumer market for perishable foods necessitate robust cold chain monitoring systems to manage the logistics of sensitive products effectively.

Additionally, the region is home to some of the leading companies in the cold chain monitoring technology sector, such as ORBCOMM and Sensitech, which contribute to the development and implementation of innovative solutions. These companies are at the forefront of integrating IoT and AI technologies into their offerings, enhancing the efficiency and reliability of cold chain operations across the continent.

Moreover, the increasing investments in research and development activities related to cold chain technologies in North America are expected to sustain its market dominance. The focus on improving the sustainability and efficiency of cold chains is likely to drive further growth, catering to the growing demands of sectors like healthcare, which saw a significant uptick in cold chain requirements due to the COVID-19 pandemic’s impact on vaccine distribution.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

As of 2022, the Market is highly competitive, with major players competing to capture market share. Some notable names in this field are Sensitech Inc., Emerson Electric Company, Digi International Inc., and Thales Group – these are just some of the current names dominating it. These companies have established themselves as industry leaders through an expansive product offering, strategic partnerships, and global presence.

Temperature monitoring solutions, data loggers, and software platforms designed to meet specific industry needs ensure safe transportation and storage of temperature-sensitive goods. Market dynamics such as rising demand for perishable goods, as well as real-time monitoring, are expected to drive further expansion within this Market – creating opportunities for both established and emerging players.

Top Key Players in the Cold Chain Tracking and Monitoring Market

- Sensitech Inc.

- Emerson Electric Co.

- Digi International Inc.

- Control

- Carrier

- ELPRO-BUCHS AG

- Berlinger & Co. AG

- Geotab Inc.

- Monnit Corporation

- Zest Labs Inc.

- Infratab Inc.

- Hanwell Solutions

- Americold Logistics LLC.

- Thales Group

- Omega Engineering Inc.

- Other Key Players

Recent Developments

- Sensitech Inc. launched a new feature on its SensiWatch® platform in November 2023, specifically designed for last-mile monitoring of outbound shipments. This solution integrates IoT sensors and real-time alerts, providing visibility and quality control from distribution centers to endpoints like stores and restaurants.

- ORBCOMM formed a strategic partnership with a leading cloud service provider in September 2024 to boost its data analytics and machine learning capabilities. This collaboration aims to optimize route planning and enable predictive maintenance, enhancing its cold chain monitoring solutions.

- Controlant released a blockchain-based traceability solution for cold chain monitoring in May 2024. This technology provides immutable records of temperature data, ensuring better compliance and transparency in cold chain processes.

Report Scope

Report Features Description Market Value (2023) USD 6.6 Bn Forecast Revenue (2032) USD 24.1 Bn CAGR (2023-2032) 15.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component – Hardware and Software; By Solution – Storage and Transportation; By End-User – Food & Beverages, Pharmaceuticals, Chemical, and Other End-Users Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Sensitech Inc., Emerson Electric Co., Digi International Inc., Controlant, Carrier, ELPRO-BUCHS AG, Berlinger & Co. AG, Geotab Inc., Monnit Corporation, Zest Labs Inc., Infratab Inc., Hanwell Solutions, americold logistics llc., Thales Group, Omega Engineering Inc., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is cold chain tracking and monitoring?Cold chain tracking and monitoring refers to the practice of tracking temperature, humidity, and other environmental conditions for perishable goods as they travel along their supply chains. It ensures they remain within their required temperature range in order to preserve freshness and quality while remaining fresh for customers.

What is the projected market size and growth rate of the Cold Chain Tracking And Monitoring Market?The Global Cold Chain Tracking and Monitoring Market size was estimated at USD 5.7 billion in 2022 and expected to reach around USD 24.1 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 15.5% during the forecast period 2023 to 2032.

What are the key driving factors for the growth of the Cold Chain Tracking And Monitoring Market?Key drivers for growth of the Cold Chain Tracking and Monitoring market include:

- An increase in temperature-sensitive products like food, pharmaceuticals and vaccines.

- Increased understanding of food safety and quality; regulatory mandates on these issues

- Technological developments in cold chain tracking and monitoring solutions.

What are the top players operating in the Cold Chain Tracking And Monitoring Market?The top players operating in the cold chain tracking and monitoring market include: Sensitech Inc., Emerson Electric Co., Digi International Inc., Controlant, Carrier, ELPRO-BUCHS AG, Berlinger & Co. AG, Geotab Inc., Monnit Corporation, Zest Labs Inc., Infratab Inc., Hanwell Solutions, americold logistics llc., Thales Group, Omega Engineering Inc., and Other Key Players.

Cold Chain Tracking and Monitoring MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample

Cold Chain Tracking and Monitoring MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Sensitech Inc.

- Emerson Electric Co.

- Digi International Inc.

- Control

- Carrier

- ELPRO-BUCHS AG

- Berlinger & Co. AG

- Geotab Inc.

- Monnit Corporation

- Zest Labs Inc.

- Infratab Inc.

- Hanwell Solutions

- Americold Logistics LLC.

- Thales Group

- Omega Engineering Inc.

- Other Key Players