Global Cold Chain Packaging Market Size, Share, Growth Analysis By Service Type (Refrigerated Transportation, Refrigerated Warehousing), By Temperature Range (Chilled [8°C to 0°C], Frozen [0°C to -25°C], Deep Frozen [Below -25°C]), By Product Type (EPS Containers, PUR Containers, Pallet Shippers, Vacuum Insulated Panels, Others), By End-use Industry (Pharmaceuticals, Food, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170061

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

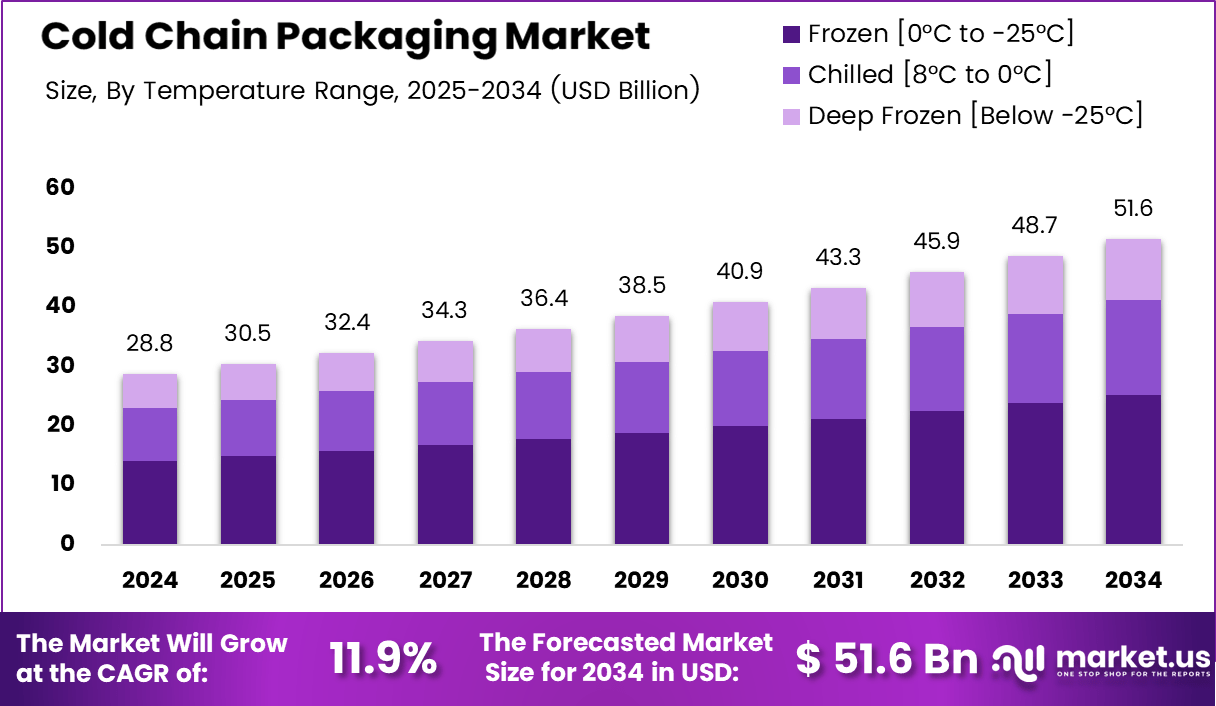

The Global Cold Chain Packaging Market size is expected to be worth around USD 51.6 billion by 2034, from USD 28.8 billion in 2024, growing at a CAGR of 11.9% during the forecast period from 2025 to 2034.

The Cold Chain Packaging market refers to specialized packaging systems designed to maintain controlled temperatures for sensitive goods during storage and transportation. It supports industries such as pharmaceuticals, fresh food, biologics, and specialty chemicals, ensuring product stability across increasingly complex supply networks.

Analysts observe steady market expansion as temperature-controlled logistics strengthen globally due to rising biologics shipments and fresher food delivery demand. Meanwhile, companies adopt advanced insulated solutions to meet stricter handling requirements, enabling wider use of cold chain packaging across healthcare, retail, and food distribution ecosdeliystems.

Furthermore, expansion accelerates as regulatory agencies tighten thermal compliance expectations across borders. Government efforts to reduce spoilage, enhance traceability, and improve cross-border food safety create additional momentum. These regulatory measures encourage businesses to adopt robust cold packaging formats that ensure safe last-mile delivery and regulatory adherence.

Additionally, opportunities grow with direct-to-consumer delivery models gaining traction across groceries, meal kits, and wellness products. Enhanced e-commerce penetration encourages producers to deploy lightweight, recyclable, and resilient packaging for faster and safer doorstep deliveries. This shift reinforces long-term adoption of eco-friendly cold boxes and insulated liners.

Moreover, sustainability preferences rise as companies adopt recyclable and compostable insulation alternatives. Paper-based liners, biodegradable cooling media, and reusable packaging assets increasingly complement traditional solutions. These trends reshape material innovation, creating competitive differentiation for suppliers delivering cleaner, greener systems.

In the supply chain context, growth is supported by food safety standards, stricter pharmaceutical stability guidelines, and rising biologics volumes. Cold chain packaging becomes essential for temperature assurance, quality retention, and risk reduction throughout multi-stage handling cycles. This creates ongoing investment potential in monitoring, insulation, and thermal-validation technologies.

Toward the data, analysts highlight increasing digital shopping behavior as a key driver. According to various industry surveys, 60% of consumers increased their use of direct-to-consumer channels during the pandemic, expanding demand for reliable cold packaging that prevents spoilage in home-delivery environments.

Additionally, according to the US Food and Drug Administration, dairy products must remain below 45°F to maintain freshness, reinforcing the importance of high-performance insulation for food shipping. Sustainable materials also gain relevance; CelluLiner provides up to 48 hours of temperature protection and is 100% curbside recyclable, according to manufacturer information.

Key Takeaways

- The Global Cold Chain Packaging Market reached USD 28.8 billion in 2024 and is projected to hit USD 51.6 billion by 2034.

- The market expands at a strong 11.9% CAGR, driven by rising biologics, frozen food logistics, and stricter compliance requirements.

- Refrigerated Transportation leads the service type segment with a dominant 64.7% share in 2024.

- Frozen (0°C to -25°C) remains the top temperature range segment, accounting for 48.9% of the global market.

- EPS Containers dominate the product type category with a 38.5% share due to cost efficiency and insulation reliability.

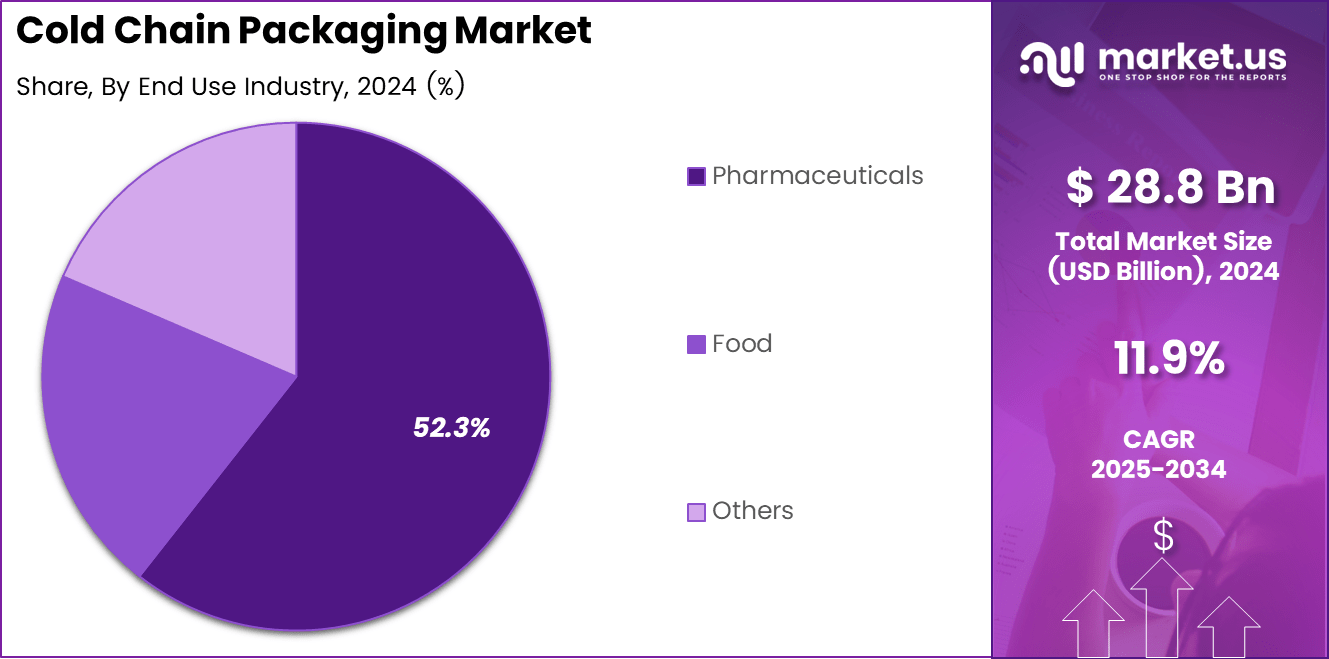

- Pharmaceuticals represent the leading end-use industry with a 52.3% market share in 2024.

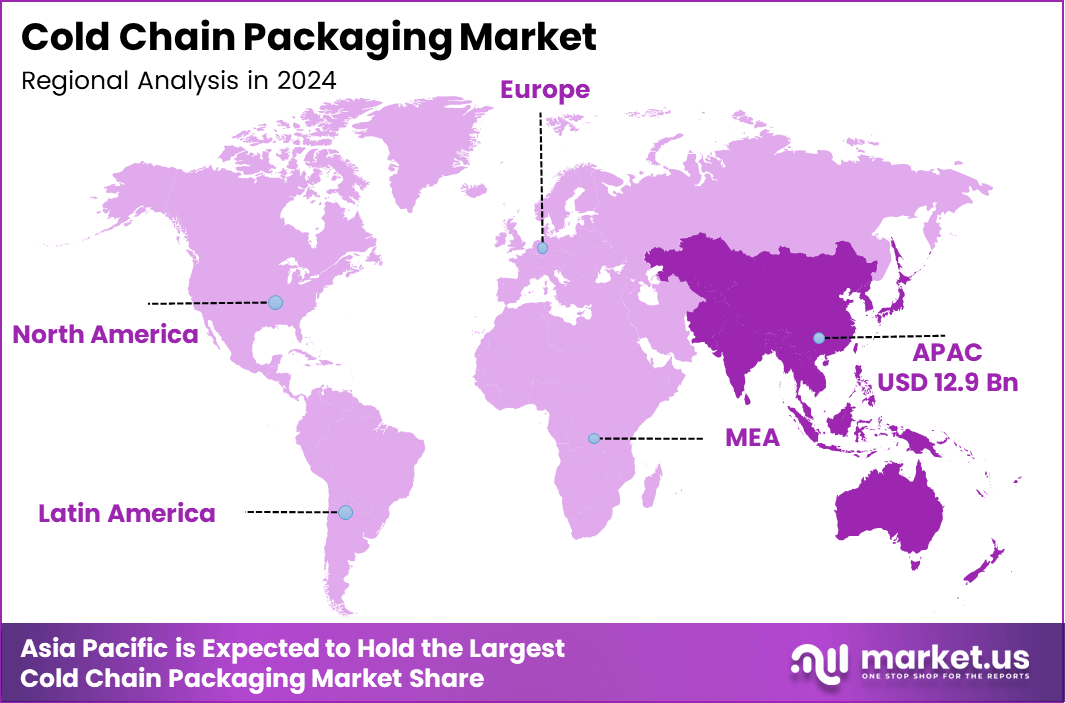

- Asia Pacific is the largest regional market, holding a 44.8% share valued at USD 12.9 billion in 2024.

By Service Type Analysis

Refrigerated Transportation dominates with 64.7% due to its critical role in long-distance temperature-controlled logistics.

In 2024, Refrigerated Transportation held a dominant market position in the By Service Type Analysis segment of the Cold Chain Packaging Market, with a 64.7% share. This segment expands as pharmaceuticals, biologics, and fresh foods require precise temperature integrity. Growing e-commerce food delivery further strengthens the demand for temperature-assured distribution fleets globally.

Refrigerated Warehousing continues supporting long- and short-term storage needs across pharmaceuticals, food products, and chemical applications. This segment advances as manufacturers increase buffer stocks and comply with stringent stability requirements. Improved warehouse monitoring systems and sustainable building designs enhance operational reliability across multi-temperature zones, ensuring products remain stable throughout extended storage timelines.

By Temperature Range Analysis

Frozen dominates with 48.9% due to its essential application for meat, seafood, and vaccine-grade biologics.

In 2024, Frozen [0°C to -25°C] held a dominant market position in the By Temperature Range Analysis segment of the Cold Chain Packaging Market, with a 48.9% share. This range supports frozen foods, specialty chemicals, and clinical shipments. Rising frozen food consumption and strict bio-storage standards continue driving stable packaging adoption.

Chilled [8°C to 0°C] remains vital for dairy, fresh produce, and ready-to-eat meals requiring moderate cooling. Expansion of healthy-food retail formats and meal-kit subscription services increases chilled-product shipments. This segment benefits from better insulated shippers, strong regulatory focus on freshness, and consumer expectations for intact nutritional quality.

Deep Frozen [Below -25°C] addresses ultra-low temperature needs for advanced biologics, cell therapies, and genetic materials. With specialized packaging, this category ensures molecular stability across global clinical trials. The rise in precision medicine and increased investment in biotechnology strengthen the adoption of deep frozen packaging for long-haul and multi-stage research logistics.

By Product Type Analysis

EPS Containers dominate with 38.5% due to their strong insulation efficiency and low material cost.

In 2024, EPS Containers held a dominant market position in the By Product Type Analysis segment of the Cold Chain Packaging Market, with a 38.5% share. These containers offer lightweight thermal stability, making them widely used for pharmaceuticals, food shipments, and temperature-sensitive retail deliveries across regional and international networks.

PUR Containers provide higher insulation performance for demanding pharmaceutical payloads. Their adoption increases as complex biologics and specialty vaccines require longer temperature retention times. Enhanced durability and precise temperature shielding make PUR solutions suitable for high-value clinical and biopharma shipments across extended transit durations.

Pallet Shippers serve bulk transport needs for large-scale food, chemical, and healthcare logistics. Their robust handling efficiency supports long-haul exports, reducing product loss while ensuring stable chamber conditions. Growing global freight flows reinforce pallet shipper usage across supply chains.

Vacuum Insulated Panels deliver superior insulation for mission-critical shipments. Advanced thermal resistance enables their use in ultra-sensitive biologics and high-risk research materials. Their premium structure supports precise climatic control during complex multi-leg transport.

Others include hybrid liners, gel-based solutions, and recyclable shippers. This category expands as sustainability initiatives push companies toward greener, lighter, and reusable designs to meet corporate responsibility goals.

By End-use Industry Analysis

Pharmaceuticals dominate with 52.3% due to strict stability requirements across biologics, vaccines, and clinical trial materials.

In 2024, Pharmaceuticals held a dominant market position in the By End-use Industry Analysis segment of the Cold Chain Packaging Market, with a 52.3% share. Complex drug molecules, regulatory compliance, and global R&D pipelines continue strengthening demand for reliable, certified temperature-controlled packaging systems across distribution channels.

Food applications utilize cold chain packaging to protect freshness across dairy, meat, seafood, ready-made foods, and fresh produce. Expanding retail networks and rising global consumption of packaged frozen and chilled foods sustain growth. Consumer expectations for safety and quality further encourage wider adoption of efficient insulated packaging.

Others include chemicals, specialty materials, and agricultural biotechnology requiring stable temperature conditions. Increased industrial diversification and the movement of sensitive goods across borders support segment expansion. Growing temperature-control awareness strengthens the adoption of reliable packaging for non-food, non-pharma categories.

Key Market Segments

By Service Type

- Refrigerated Transportation

- Refrigerated Warehousing

By Temperature Range

- Chilled [8°C to 0°C]

- Frozen [0°C to -25°C]

- Deep Frozen [Below -25°C]

By Product Type

- EPS Containers

- PUR Containers

- Pallet Shippers

- Vacuum Insulated Panels

- Others

By End-use Industry

- Pharmaceuticals

- Food

- Others

Drivers

Expansion of Temperature-Sensitive Pharmaceutical and Biologics Pipelines Drives Market Growth

The Cold Chain Packaging market grows steadily as more pharmaceutical and biologic products require strict temperature control during transport. Rising innovation in vaccines, biosimilars, and specialty therapies increases the need for reliable, insulated packaging that prevents spoilage and maintains safety from manufacturing to patient delivery.

Additionally, demand accelerates as global consumers increasingly rely on fresh and frozen food logistics. Growing consumption of ready-to-eat meals, seafood, meat, and dairy strengthens cold distribution networks. As households seek higher-quality food deliveries, insulated packaging becomes essential for freshness and compliance with safety standards.

Moreover, regulatory agencies tighten rules on thermal compliance in cross-border trade. Many countries now mandate stricter validation for packaging performance to reduce spoilage and enforce product stability. This pressure encourages manufacturers and logistics providers to adopt better, compliant cold packaging systems.

The expansion of e-commerce grocery platforms further boosts demand. As last-mile cold delivery increases, companies require lightweight, durable, and affordable temperature-controlled packaging to support fast deliveries. As a result, cold chain packaging becomes a core enabler of the modern online food retail landscape.

Restraints

High Operational and Maintenance Costs for Insulated Packaging Systems Restrain Market Growth

The Cold Chain Packaging market faces limitations as insulated packaging systems demand higher operational and maintenance spending. Coolants, liners, and advanced boxes require frequent replenishment and quality checks, raising total logistics costs for businesses handling temperature-sensitive shipments.

In many emerging and remote regions, limited cold chain infrastructure slows adoption. Insufficient refrigerated transport, unstable power supply, and inadequate storage facilities restrict the reach of temperature-controlled packaging. These gaps create higher spoilage risks and discourage investment in premium cold packaging.

Supply chain disruptions also challenge market stability. Fluctuating availability of refrigerants, insulation materials, and specialized components impacts manufacturers’ ability to meet rising demand. Delays and shortages increase costs and reduce shipment efficiency for logistics providers.

Growth Factors

Adoption of Reusable and Recyclable Passive Thermal Packaging Solutions Creates Market Opportunities

The market experiences a strong opportunity as companies adopt reusable and recyclable passive thermal packaging to reduce waste and long-term cost. These solutions offer longer temperature stability and support sustainability targets, creating new value for food and pharmaceutical logistics.

Integration of IoT-enabled condition monitoring also reshapes market potential. Smart packaging units that track temperature, humidity, and tampering in real time help businesses improve quality assurance and regulatory compliance, opening opportunities for advanced technology providers.

Additionally, rising investment in biologics and cell and gene therapy distribution generates high-growth prospects. These products require ultra-precise temperature control, encouraging demand for premium cold chain packaging designed for sensitive medical shipments.

Emerging Trends

Surge in Lightweight Thermal Packaging Using Advanced Insulation Materials Influences Market Trends

Lightweight thermal packaging gains momentum as industries seek lower shipping costs and reduced carbon footprints. Advanced insulation materials improve temperature retention while keeping packages easy to handle, supporting efficient logistics operations.

Phase-change materials are increasingly gaining traction for multi-temperature applications. Their ability to maintain stable ranges enhances reliability for pharmaceuticals and frozen foods, making them a preferred choice for long-distance shipments.

Eco-friendly coolant technologies also trend upward as businesses prioritize sustainability. Reduced-toxicity coolants and biodegradable gel packs help companies meet environmental goals while maintaining product safety.

Automation-ready cold packaging designs further shape market evolution. These standardized, sensor-compatible formats support automated warehousing, faster order fulfillment, and integration with modern logistics systems.

Regional Analysis

Asia Pacific Dominates the Cold Chain Packaging Market with a Market Share of 44.8%, Valued at USD 12.9 Billion

Asia Pacific holds the leading position due to rapid pharmaceutical manufacturing expansion, high vaccine distribution activity, and strong growth in perishable food exports. The region’s diverse climate conditions and rising regulatory focus on product safety strengthen investments in advanced insulated shippers and temperature-controlled solutions. The presence of large e-commerce grocery networks further accelerates cold-packaging adoption across emerging economies.

North America Cold Chain Packaging Market Trends

North America demonstrates steady growth supported by mature cold chain logistics, stringent FDA guidelines, and rising biologics shipments across the US and Canada. Increasing adoption of sustainable materials and improved thermal technologies enhances product integrity throughout long-distance transportation. The region’s strong retail and food-service sectors reinforce consistent demand for reliable cold packaging systems.

Europe Cold Chain Packaging Market Trends

Europe benefits from harmonized regulatory standards, a strong emphasis on reducing temperature excursions, and growing biologics production across major countries. Expanding cross-border food trade and stringent GDP compliance drive the use of high-performance insulated containers. Sustainability commitments also encourage wider adoption of recyclable and reusable cold chain packaging formats.

Middle East and Africa Cold Chain Packaging Market Trends

The Middle East and Africa region is experiencing gradual expansion driven by rising pharmaceutical imports, vaccine distribution programs, and increasing modern retail penetration. Infrastructure development initiatives improve cold storage capacity and enhance temperature-controlled transport networks. Growth in fresh produce exports also contributes to the region’s need for advanced packaging solutions.

Latin America Cold Chain Packaging Market Trends

Latin America showcases emerging demand supported by agricultural exports, rising consumption of frozen foods, and improving logistics networks. Investments in cold warehouses and temperature-monitoring technologies strengthen supply chain reliability. Government health campaigns and pharmaceutical expansion further accelerate the need for insulated and compliant packaging options.

U.S. Cold Chain Packaging Market Trends

The U.S. market grows steadily due to advanced biopharma operations, nationwide vaccine distribution channels, and strict regulatory frameworks. Increasing preference for eco-friendly thermal packaging and digital monitoring tools improves operational efficiency. A strong cold logistics ecosystem fosters continuous adoption of high-performance packaging formats across food, healthcare, and e-commerce sectors.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Cold Chain Packaging Company Insights

The global Cold Chain Packaging Market in 2024 reflects steady advancement as manufacturers strengthen insulated solutions, phase-change materials, and reusable packaging systems to support stringent temperature-controlled logistics. The market shows active innovation among established players, with each focusing on sustainability, validated thermal performance, and global distribution capabilities.

Sancell is expected to emphasize lightweight insulated shippers and recyclable packaging formats as demand rises for eco-friendly cold transport in pharmaceuticals and fresh food logistics. Its focus on cost-efficient thermal solutions positions the company well in regions expanding temperature-sensitive supply chains.

Sonoco ThermoSafe continues strengthening its thermal packaging portfolio through engineered containers and reusable systems tailored for biologics, clinical-trial logistics, and high-value perishable shipments. Its emphasis on temperature integrity across long-haul routes reinforces its position among global cold chain solution providers.

Polar Tech Industries Inc. remains an important contributor through insulated containers, refrigerants, and molded-foam solutions designed for frozen and chilled distribution. Its product breadth supports small and mid-scale distributors seeking consistent temperature retention for food, pharmaceuticals, and specialty goods.

Cold Chain Technologies advances high-performance shippers and phase-change-material-based systems suited for biologics and advanced therapies where regulatory expectations are rising. The company’s strategy of improving reusability and thermal qualification supports customers targeting lower waste and stronger compliance.

Peli BioThermal enhances the adoption of robust reusable containers engineered for extreme-temperature resilience, increasingly selected for cell-and-gene therapy transport. Orora Group expands protective packaging solutions through integrated materials and logistics networks. CREOPACK develops insulated shippers suited for regional food and pharma movement.

Sofrigam focuses on energy-efficient packaging validated for global clinical-trial logistics. Intelsius supports precision-engineered systems for diagnostic and healthcare shipments. Nordic Cold Chain Solutions offers refrigerant technologies and insulated mailers supporting fast-growing e-commerce cold delivery.

Top Key Players in the Market

- Sancell

- Sonoco ThermoSafe

- Polar Tech Industries Inc.

- Cold Chain Technologies

- Peli BioThermal

- Orora Group

- CREOPACK

- Sofrigam

- Intelsius

- Nordic Cold Chain Solutions

Recent Developments

- In Jun 2025, Great Point Partners acquired a majority stake in Eutecma, a provider of sustainable temperature controlled pharmaceutical packaging solutions. The partnership supports the global expansion of Eutecma’s modular, reusable, and cold chain packaging technologies for life sciences applications.

- In Oct 2025, Peli BioThermal announced an acquisition aimed at expanding its cold chain logistics solutions and advancing cryogenic transport for cell and gene therapies. The acquisition strengthens Peli BioThermal’s capabilities in ultra low temperature shipping and supports the growing demand for next generation biologics logistics.

Report Scope

Report Features Description Market Value (2024) USD 28.8 Billion Forecast Revenue (2034) USD 51.6 billion CAGR (2025-2034) 11.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Refrigerated Transportation, Refrigerated Warehousing), By Temperature Range (Chilled [8°C to 0°C], Frozen [0°C to -25°C], Deep Frozen [Below -25°C]), By Product Type (EPS Containers, PUR Containers, Pallet Shippers, Vacuum Insulated Panels, Others), By End-use Industry (Pharmaceuticals, Food, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sancell, Sonoco ThermoSafe, Polar Tech Industries Inc., Cold Chain Technologies, Peli BioThermal, Orora Group, CREOPACK, Sofrigam, Intelsius, Nordic Cold Chain Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cold Chain Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Cold Chain Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sancell

- Sonoco ThermoSafe

- Polar Tech Industries Inc.

- Cold Chain Technologies

- Peli BioThermal

- Orora Group

- CREOPACK

- Sofrigam

- Intelsius

- Nordic Cold Chain Solutions