Coiled Tubing Market By Service (Well Intervention and Production, Drilling, Others), By Operation (Circulation , Pumping , Logging , Perforation), By Application (Onshore, Offshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 35682

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

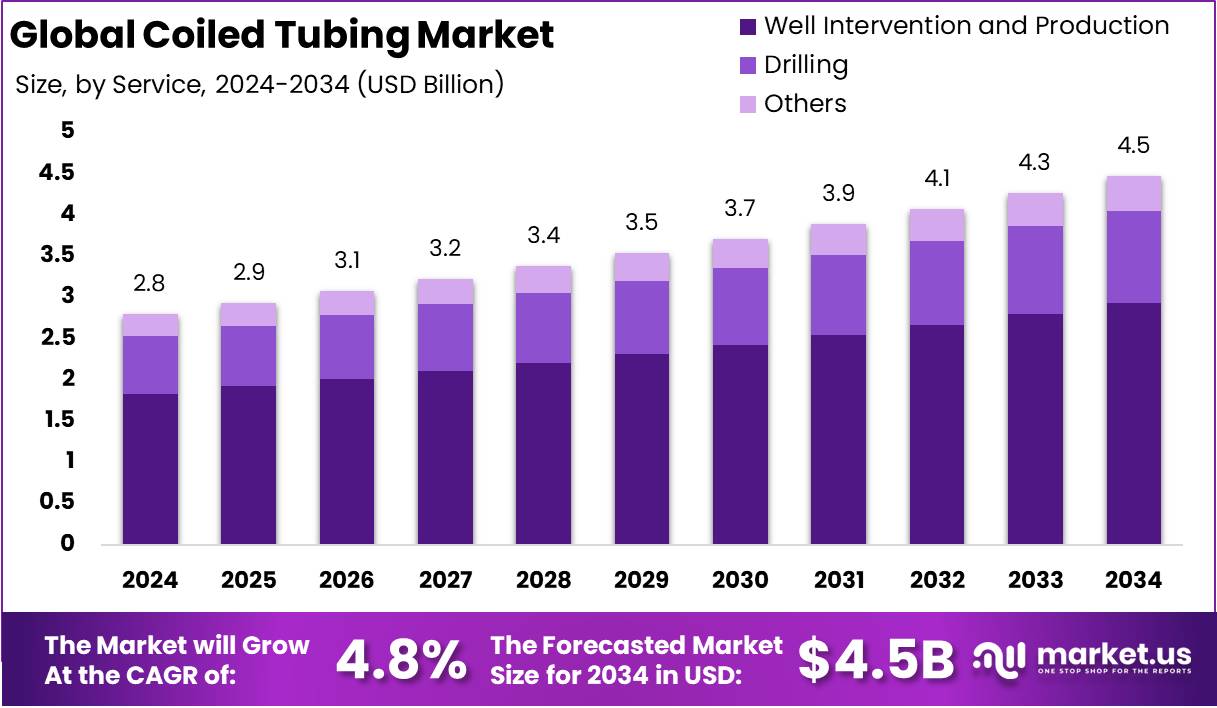

The Global Coiled Tubing Market size is expected to be worth around USD 4.5 Billion by 2034 from USD 2.8 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Coiled tubing refers to a continuous length of small-diameter steel pipe wound on a spool, which is deployed into oil and gas wells without the need to remove the well’s existing tubing. It is widely used for a range of interventions, including well cleaning, acidizing, hydraulic fracturing, and logging operations.

Unlike conventional pipe systems, coiled tubing enables operators to carry out maintenance and stimulation activities while the well remains under pressure, thus enhancing efficiency and minimizing operational downtime. Its flexibility and ability to access challenging well geometries make it a highly valuable tool across both onshore and offshore oilfields.

The coiled tubing market encompasses the global production, deployment, and servicing of coiled tubing equipment and services across oil and gas exploration, production, and maintenance operations. This market includes tools, accessories, and related services that support well intervention, drilling, and completion activities.

It forms an integral part of the oilfield services sector and is characterized by its sensitivity to oil prices, E&P activity levels, and technological advancements. The market serves key upstream activities where high operational uptime, cost-efficiency, and pressure control are critical. As energy companies aim to optimize output from aging wells and complex reservoirs, coiled tubing solutions continue to see increased integration into standard well service operations.

The growth of the coiled tubing market can be attributed to the rising global demand for oil and gas, coupled with a strong push toward enhanced oil recovery (EOR) techniques. As mature fields constitute a significant portion of global production, the need for efficient well intervention and maintenance solutions has intensified.

Demand for coiled tubing is driven primarily by its ability to reduce non-productive time (NPT) in well servicing operations and improve reservoir output in both conventional and unconventional plays. Increasing shale gas developments and tight oil exploration, particularly in North America, have further elevated the demand for coiled tubing units equipped for horizontal well interventions.

Significant opportunity lies in the expansion of coiled tubing applications beyond traditional intervention services into coiled tubing drilling (CTD) and managed pressure drilling (MPD) domains. Emerging markets in Latin America, the Middle East, and Asia-Pacific, where vast untapped hydrocarbon reserves exist, present a favorable landscape for coiled tubing service providers.

According to Stock Titan, Azure Holdings has entered into a strategic Joint Venture Agreement with Coil Tubing Technology Inc. (CTT), under which CTT will contribute $14.0 million worth of proprietary coiled tubing tools to an AZRH-owned subsidiary. The JV includes exclusive distribution rights and will follow a 50/50 profit-sharing structure.

CTT, known for its advanced solutions in thru-tubing fishing, workover, pipeline clean-out, and lateral drillout operations, is expected to bolster market competitiveness. The tools, free of liens and obligations, signify a robust step toward increasing technological capabilities and operational efficiency in the coiled tubing segment.

According to Halliburton , a groundbreaking coiled tubing intervention system was recently unveiled at its New Iberia, Louisiana Training Facility. This advanced system includes a V135HP coiled tubing injector, a 36,000-foot capacity reel for 2-3/8-inch tubing, and a 750-ton tension lift frame twice the size of typical frames.

The tubing string is engineered from alloy steel with a 120,000-pound yield strength, making it the strongest and longest ever deployed. Such technological innovation signals robust market growth, underpinned by rising operational scale, deeper well access, and increased preference for high-strength, large-volume coiled tubing solutions.

Key Takeaways

- The global Coiled Tubing Market is projected to reach approximately USD 4.5 billion by 2034, growing from USD 2.8 billion in 2024 at a CAGR of 4.8% during the forecast period from 2025 to 2034.

- In 2024, Well Intervention and Production emerged as the leading service segment, accounting for over 65.4% of the total market share.

- The Logging operation segment dominated the market in 2024, capturing over 31.6% of the global revenue share.

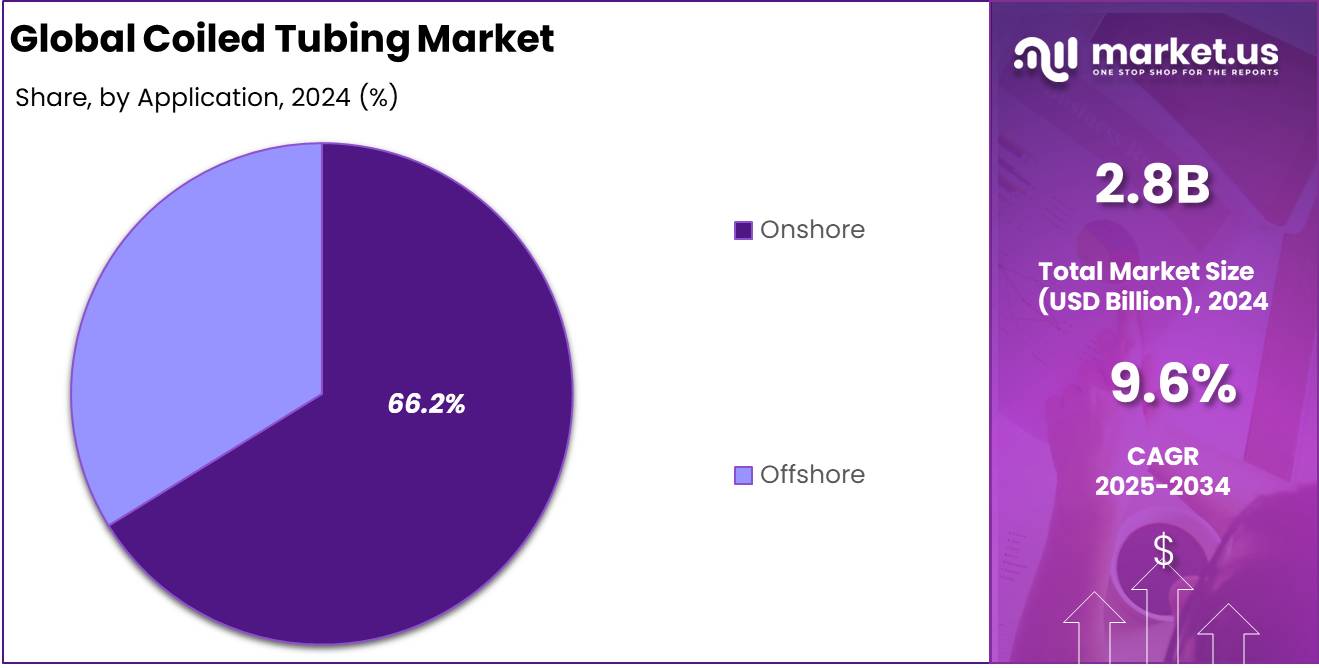

- The Onshore segment held a major share of 66.2% in 2024, signifying strong adoption of coiled tubing technologies in land-based oil and gas operations.

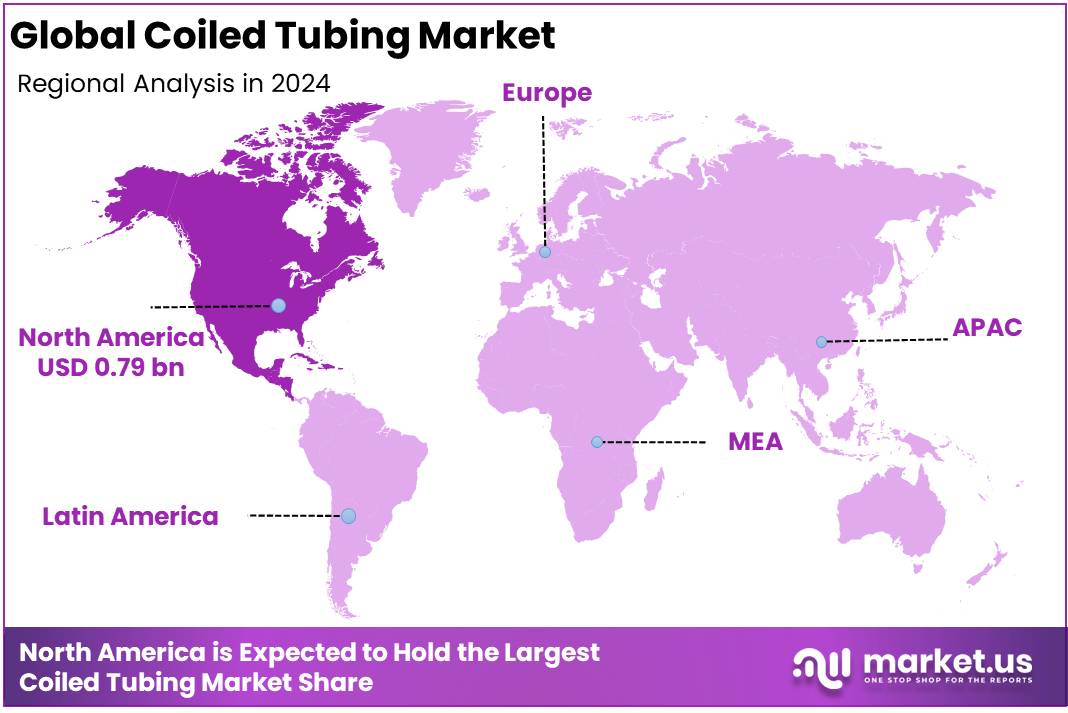

- North America led the global market with a significant 28.4% share in 2024, valued at USD 0.79 billion, indicating robust demand and advanced infrastructure in the region

By Service Analysis

Well Intervention and Production dominated the Coiled Tubing Market by Service, securing over 65.4% share.

In 2024, Well Intervention and Production held a dominant market position in the Coiled Tubing Market by Service, capturing more than 65.4% share. This strong market presence can be attributed to the rising global demand for well maintenance, stimulation, and cleaning operations, especially in mature oilfields across North America, the Middle East, and parts of Asia Pacific.

The growing need to restore production rates from aging wells has significantly propelled the use of coiled tubing in well intervention procedures. Moreover, the service’s ability to reduce non-productive time (NPT) while ensuring continuous production flow has made it a preferred option among oilfield service providers.

The shift toward energy optimization and increased efficiency in hydrocarbon recovery processes has further amplified the demand for coiled tubing in production enhancement activities. Technological advancements in real-time downhole monitoring and precision-controlled coiled tubing tools have enhanced operational performance, supporting its dominance in this segment.

Additionally, the relatively lower cost and quicker deployment of coiled tubing, compared to conventional techniques, continue to support its widespread adoption in well intervention services across onshore and offshore fields.

In 2024, Well Intervention and Production dominated the Coiled Tubing Market by Service due to rising demand for cost-effective solutions in mature oilfields. Coiled tubing is widely used for well maintenance, stimulation, and cleanouts, offering operational efficiency and minimal downtime. Its ability to operate without rigs supports rapid deployment in high-activity zones.

Continued advancements in downhole tools and real-time monitoring systems have further boosted adoption. Growing focus on enhancing output from aging wells and reducing production costs, along with digital integration and regulatory support for enhanced recovery, has reinforced segment growth across onshore and offshore sites.

The Drilling segment saw notable market share in 2024, supported by the rise of underbalanced and horizontal drilling in unconventional fields. Coiled tubing enables efficient, low-damage drilling in tight reservoirs and is ideal for shale and marginal wells due to its flexibility and continuous circulation.

Increased exploration in challenging environments, especially in the U.S. and Middle East, and the push for cost-effective drilling methods have driven demand. Its suitability for enhanced oil recovery and compact operations strengthens its appeal, though adoption depends on well complexity and equipment capabilities.

The Others segment, including logging, perforation, and hydraulic fracturing, also captured a considerable share. These services benefit from coiled tubing’s speed, flexibility, and efficiency, especially in remote and multi-well pad operations.

By Operation Analysis

Logging dominated the Coiled Tubing Market by Operation, securing over 31.6% share.

In 2024, Logging held a dominant market position in the By Operation segment of the Coiled Tubing Market, capturing more than 31.6% of the global share. This strong market presence can be attributed to the growing demand for real-time data acquisition and reservoir evaluation, especially in mature oilfields and complex well environments. Logging operations are essential for gathering subsurface information, including formation pressure, temperature, and rock properties.

The increased focus on production optimization and enhanced oil recovery (EOR) programs has further boosted the adoption of coiled tubing logging services, as operators seek precise reservoir insights while minimizing operational downtime.

Moreover, technological advancements in coiled tubing-deployed logging tools have enhanced the efficiency, depth capability, and accuracy of downhole data collection. The shift toward digital oilfields and intelligent well systems has also supported market expansion in this segment. North America, driven by shale reserves in the U.S., remains a key contributor to the growth of logging operations. Additionally, the resurgence of drilling and completion activities in offshore environments has expanded the application of logging via coiled tubing across various well types and geographies.

Circulation operations play a critical role in maintaining wellbore cleanliness, managing formation pressure, and clearing debris or obstructions within the well. This method supports uninterrupted production by enabling continuous fluid flow, making it highly valuable for both drilling and maintenance activities in unconventional oil and gas fields. Its application helps reduce downtime and increase overall well efficiency, which is essential in high-activity production zones.

Growth in this operation is supported by rising investments in brownfield developments and the increasing need for routine wellbore cleanouts. The integration of intelligent diagnostics and real-time monitoring tools has enhanced the precision and reliability of circulation services. Regions with aging oil assets, including parts of the Middle East and Latin America, are increasingly adopting these services to extend the operational life of existing wells and maintain productivity.

Pumping operations through coiled tubing are widely used for acidizing, cementing, and fracturing services, especially in low-permeability formations. These operations are crucial for stimulating wells and achieving zonal isolation, which directly contributes to improved hydrocarbon recovery. The flexibility and cost-efficiency of conducting multiple pumping interventions without the need for rig mobilization have strengthened their appeal across both onshore and offshore fields.

Advancements in high-pressure pumping tools and their deployment in challenging environments such as high-temperature, high-pressure wells have significantly enhanced operational performance. The role of these services in supporting hydraulic fracturing, particularly in shale basins, further underscores their strategic importance. Operators are increasingly relying on these solutions to execute targeted treatments while maintaining operational safety and efficiency.

Perforation operations enable the creation of flow paths between the reservoir and wellbore, serving as a foundational step in production initiation. Coiled tubing-conveyed perforating is particularly advantageous in deviated and horizontal wells, allowing for precise access to target zones. The growing complexity of well designs and the rise in multi-zone completions are key factors driving the demand for this operation.

Innovations such as selective perforating systems and pressure-activated tools are enhancing the safety and effectiveness of perforation processes. The ability to perform controlled and efficient perforation in difficult formations makes it a valuable solution across developing and mature oilfields alike. The continued expansion of energy exploration in regions like Asia-Pacific and Africa further supports the steady adoption of coiled tubing perforation technologies.

By Application Analysis

Onshore dominated the Coiled Tubing Market by Application, securing over 66.2% share.

In 2024, Onshore held a dominant market position in the By Application segment of the Coiled Tubing Market, capturing more than a 66.2% share. This substantial share can be attributed to the widespread use of coiled tubing in onshore oil and gas operations, particularly for well intervention, acidizing, and nitrogen pumping applications.

Onshore sites are typically more accessible and cost-effective than offshore installations, allowing for more frequent deployment of coiled tubing services. The increased focus on enhancing production from existing onshore wells particularly in regions such as North America, the Middle East, and parts of Asia Pacific has been a key driver fueling this segment’s growth.

Moreover, the onshore segment benefits from relatively lower operational risks and reduced logistical complexities, which further encourages the use of coiled tubing in routine maintenance and stimulation processes. Technological advancements in horizontal drilling and hydraulic fracturing have also significantly increased the demand for coiled tubing in unconventional oil and gas basins.

In countries like the United States, shale formations have witnessed growing adoption of coiled tubing for cost-effective and rapid well interventions. These factors collectively reinforce the strong market position of the onshore segment and are expected to sustain its dominance over the forecast period.

In 2024, Offshore accounted for a notable share in the By Application segment of the Coiled Tubing Market. While smaller compared to the onshore segment, offshore coiled tubing operations are steadily growing, driven by the rise in deepwater and ultra-deepwater exploration and production activities. Offshore drilling requires specialized coiled tubing units due to harsh environmental conditions and deeper well depths, increasing the complexity and value of services.

The segment benefits from advancements in subsea technology and the use of specialized equipment for remote offshore operations. The growing number of mature offshore wells needing intervention and the focus on maximizing production from existing assets are boosting market demand. Despite higher capital and operational costs, offshore projects offer long-term production benefits, particularly in regions like the North Sea, Gulf of Mexico, and offshore Brazil. The segment is expected to experience steady growth, especially as offshore investments recover in the post-pandemic period.

Key Market Segments

By Service

- Well Intervention and Production

- Well Completion

- Well Cleaning

- Others

- Drilling

- Others

By Operation

- Circulation

- Pumping

- Logging

- Perforation

By Application

- Onshore

- Offshore

Driver

Increasing Well Intervention Activities in Aging Oilfields

The primary driver accelerating the growth of the global coiled tubing market in 2024 is the increasing demand for well intervention operations, particularly in aging and mature oilfields. As conventional oil reserves decline and production efficiency diminishes in aging wells, operators are focusing on cost-effective and minimally invasive technologies to enhance hydrocarbon recovery.

Coiled tubing provides a continuous length of steel pipe that can be deployed into a well under pressure, enabling swift interventions without halting production. This advantage makes it indispensable in rejuvenating mature reservoirs through applications such as well cleanouts, acidizing, and fracturing. The increasing preference for non-intrusive and economically viable solutions is propelling coiled tubing adoption worldwide.

Additionally, the growing energy demand across industrialized and emerging economies has intensified upstream activities, particularly in North America, the Middle East, and Asia-Pacific regions. These regions are witnessing heightened activities in brownfield projects, which require frequent maintenance and stimulation procedures. Coiled tubing operations offer speed, operational flexibility, and reduced costs compared to traditional methods, aligning well with operators’ financial and technical objectives. Thus, the increasing emphasis on prolonging asset life and improving recovery rates from existing wells serves as a strong foundational driver for market growth.

Restraint

Volatility in Crude Oil Prices and Capex Uncertainty

One of the foremost restraints affecting the coiled tubing market in 2024 is the continued volatility in global crude oil prices, which contributes to uncertainty in capital expenditure (capex) planning by upstream operators. The fluctuation in oil prices creates a cyclical pattern of investment in exploration and production (E&P) activities.

When oil prices fall below the profitability threshold, operators tend to scale back on interventions, well completions, and drilling operations all of which are primary applications of coiled tubing services. This unpredictable investment behavior directly impacts service providers and reduces the overall utilization rates of coiled tubing equipment.

Moreover, oil price instability impairs long-term project planning and delays procurement and deployment of coiled tubing units, especially in cost-sensitive markets. Companies operating in volatile regions often postpone maintenance or shut down wells to minimize operational costs, leading to a temporary decline in demand for coiled tubing interventions.

In 2023, crude oil prices experienced fluctuations within a range of $70–$90 per barrel, which disrupted budget allocation for secondary recovery operations. This restraint is particularly critical in regions with high extraction costs such as offshore deepwater or unconventional fields, where consistent investments are vital. As a result, the unpredictable nature of crude oil pricing continues to exert downward pressure on coiled tubing market expansion.

Opportunity

Expansion of Unconventional Oil and Gas Exploration Activities

A key opportunity fostering growth in the coiled tubing market is the rapid expansion of unconventional oil and gas exploration, particularly in shale gas and tight oil formations. These formations require advanced stimulation and well-completion techniques, for which coiled tubing is increasingly employed.

The growth of hydraulic fracturing and horizontal drilling has fueled the need for coiled tubing in plug milling, well cleaning, nitrogen lifting, and other post-fracturing operations. This presents a significant opportunity for coiled tubing service providers, especially in regions such as North America, which continues to dominate shale production on a global scale.

Furthermore, the increasing focus on energy security and diversification is encouraging governments and private operators to tap into previously uneconomical reserves. As drilling operations move into deeper and more complex geologies, coiled tubing’s ability to access difficult-to-reach zones becomes critical. The integration of real-time monitoring and fiber-optic-enabled smart coiled tubing is also unlocking new capabilities in complex well environments.

According to recent projections, unconventional hydrocarbon production is expected to grow by over 6% annually through 2028, creating a robust pipeline of demand for advanced well intervention services. Hence, the proliferation of unconventional resource development presents a highly scalable and long-term growth opportunity for the coiled tubing market.

Trends

Integration of Digital Technologies and Automation in Coiled Tubing Operations

A prominent trend shaping the coiled tubing market in 2024 is the increasing integration of digital technologies and automation into field operations. Advancements in downhole monitoring tools, real-time data acquisition, and remote-control capabilities are transforming how coiled tubing services are delivered.

Digitalization enhances operational precision, reduces risks, and enables predictive maintenance, which significantly improves efficiency and safety in both onshore and offshore environments. Automated coiled tubing units are becoming more prevalent, allowing for consistent deployment in challenging well conditions with minimal human intervention.

This shift toward smart coiled tubing systems is being driven by the broader digital transformation occurring within the oil and gas sector. Operators are increasingly investing in intelligent platforms that provide real-time analytics on wellbore conditions, fluid dynamics, and tool performance. This enables data-driven decisions, minimizes downtime, and extends the life of field assets.

The application of artificial intelligence and machine learning in coiled tubing operations is also gaining traction, facilitating optimized job design and post-operation evaluation. With rising emphasis on reducing operational costs and environmental risks, the adoption of digital coiled tubing solutions is expected to increase significantly, cementing this trend as a vital contributor to the market’s forward momentum.

Regional Analysis

North America Coiled Tubing Market with Largest Market Share of 28.4%

The Coiled Tubing Market in North America is poised for significant growth, commanding a dominant market share of 28.4% in 2024. The market in this region is valued at USD 0.79 billion, which reflects the region’s leadership in the global landscape. This growth can be attributed to the increasing demand for coiled tubing services in the oil and gas industry, driven by advancements in extraction technologies and the ongoing trend toward unconventional oil and gas production.

North America, particularly the United States, continues to be a key player, with a high level of investment in shale gas production and deepwater drilling operations. The extensive infrastructure and established oil and gas industry provide a solid foundation for the expansion of coiled tubing services, contributing to the region’s dominant position in the market.

In Europe, the Coiled Tubing Market is witnessing steady growth, supported by an expanding oil and gas exploration sector. Europe accounted for a significant portion of the market in 2024. The region’s growth is mainly driven by the ongoing exploration activities in the North Sea and other mature fields, where coiled tubing services are essential for enhanced oil recovery and maintenance operations. Additionally, the increasing focus on reducing environmental impact and improving the efficiency of production processes is driving demand for coiled tubing technologies.

The Coiled Tubing Market in the Asia Pacific region is experiencing rapid growth, driven by the increasing demand for oil and gas extraction services in emerging economies such as China and India. The growing need for energy resources in these countries, coupled with the expansion of the oil and gas exploration activities, is fueling the demand for coiled tubing services.

Furthermore, the adoption of advanced technologies and the region’s shift toward more efficient and sustainable oil production methods are expected to drive market growth. The Asia Pacific market is projected to become one of the fastest-growing segments over the next few years.

The Middle East and Africa region maintains a significant share of the global Coiled Tubing Market due to the region’s vast oil reserves, particularly in countries like Saudi Arabia, UAE, and Iraq. These nations continue to invest heavily in coiled tubing operations to enhance oil recovery and optimize production processes. Given the large-scale oil extraction activities, the demand for coiled tubing services remains high, positioning the Middle East & Africa as a crucial market for coiled tubing solutions.

In Latin America, the Coiled Tubing Market is growing steadily, with countries such as Brazil and Mexico playing a key role in the market dynamics. The growing focus on enhanced oil recovery techniques and the increasing exploration of offshore reserves are driving the demand for coiled tubing services. As exploration activities intensify in these regions, the market is expected to expand in the coming years, although at a slower pace compared to other regions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global Coiled Tubing Market in 2024 is characterized by a highly competitive landscape, with several key players contributing significantly to the market’s growth and innovation. Tenaris, Schlumberger Limited, Baker Hughes Company, and Halliburton Company are among the dominant players, benefiting from their extensive service portfolios and global reach.

These companies have maintained a strong market position through technological advancements in coiled tubing services, as well as their ability to provide efficient and cost-effective solutions to the oil and gas industry. Their focus on expanding product offerings, including advanced coiled tubing systems and digital solutions for enhanced operational efficiency, positions them as leaders in the sector.

Weatherford International PLC and Calfrac Well Services Ltd. also play a vital role in the market, with a focus on improving well integrity and offering a range of coiled tubing applications. Altus Intervention, NexTier Oilfield Solutions, and Superior Energy Services contribute significantly through their specialized services, particularly in well intervention and pressure control, ensuring operational reliability and safety.

Trican Well Services and Oceaneering International, Inc. have differentiated themselves with unique service offerings in specialized environments, including offshore and deepwater operations. Smaller but competitive players such as Legend Energy Services and National Energy Services Reunited have carved niches in regional markets, leveraging their agility and customer-focused approaches. Together, these companies shape the future of the coiled tubing industry by driving technological advancements and expanding service capabilities to meet the evolving needs of the oil and gas sector.

Top Key Players in the Market

- Tenaris

- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Weatherford International PLC

- Calfrac Well Services Ltd.

- Altus Intervention

- NexTier Oilfield Solutions

- Superior Energy Services

- Trican Well Services

- Oceaneering International, Inc.

- Legend Energy Services

- National Energy Services Reunited

Recent Developments

- In March 2025, Baker Hughes (NASDAQ: BKR), a leading energy technology firm, revealed the signing of a long-term agreement with Dubai Petroleum Establishment (DPE), on behalf of Dubai Supply Authority (DUSUP). This collaboration focuses on providing coiled-tubing drilling services for the Margham Gas storage initiative, aiming to enhance the reliability of Dubai’s energy supply by ensuring smooth transitions between natural gas and solar energy.

- In May 2025, Halliburton (NYSE: HAL) introduced its advanced coiled tubing intervention system at the company’s New Iberia, Louisiana, facility. This state-of-the-art system features the company’s V135HP coiled tubing injector, a 36,000-foot coiled tubing reel, and an impressive 750-ton tension lift frame, all designed to handle some of the most demanding operational needs. The tubing string is constructed using high-strength alloy steel, marking it as the most powerful system Halliburton has ever deployed.

- In 2023, Archer Limited announced the acquisition of Baker Hughes Limited’s coil tubing and pumping division in the United Kingdom. This transaction includes the transfer of several complete CT&P packages, along with specialized equipment tailored for the UK market. The deal also involves a team of 51 professionals, who will join Archer under the Transfer of Undertakings (Protection of Employment) regulations.

- In November 2024, Azure Holdings Group Corp (OTC PINK: AZRH) and Coil Tubing Technology Inc. (CTT) entered into a joint venture, with Azure investing $14 million in coil tubing technology tools. This collaboration also grants Azure exclusive distribution rights to a broader set of technologies, with both companies agreeing to share profits equally through a newly formed subsidiary.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Billion Forecast Revenue (2034) USD 4.5 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Well Intervention and Production , Drilling. Other), By Operation (Circulation , Pumping , Logging , Perforation), By Application (Onshore , Offshore) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Schlumberger Limited, Baker Hughes Company, Halliburton Company, Weatherford International PLC, Calfrac Well Services Ltd., Altus Intervention, NexTier Oilfield Solutions, Superior Energy Services, Trican Well Services, Oceaneering International, Inc., Legend Energy Services, National Energy Services Reunited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tenaris

- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Weatherford International PLC

- Calfrac Well Services Ltd.

- Altus Intervention

- NexTier Oilfield Solutions

- Superior Energy Services

- Trican Well Services

- Oceaneering International, Inc.

- Legend Energy Services

- National Energy Services Reunited