Global Cognitive Computing Market Size, Share Report By Technology (Machine learning, Natural Language Processing (NLP), Human computer interaction (Computer vision, Machine vision, Robotics), Deep learning, and Others), By Component (Platform, and Service (Professional services (Consulting, Integration and deployment, Support and maintenance), Managed services)), By Deployment Model (On-premise, and Cloud), By Organization Size (Small and Medium Enterprises (SME), and Large Enterprises), By Industry (Healthcare, BFSI, Retail and e-commerce, Government and defense, IT and telecom, Energy and power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153882

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Cognitive Computing Market Size

- Key Features and Trends

- By Technology Analysis

- Component Analysis

- Deployment Model Analysis

- By Organization Size Analysis

- By Industry Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

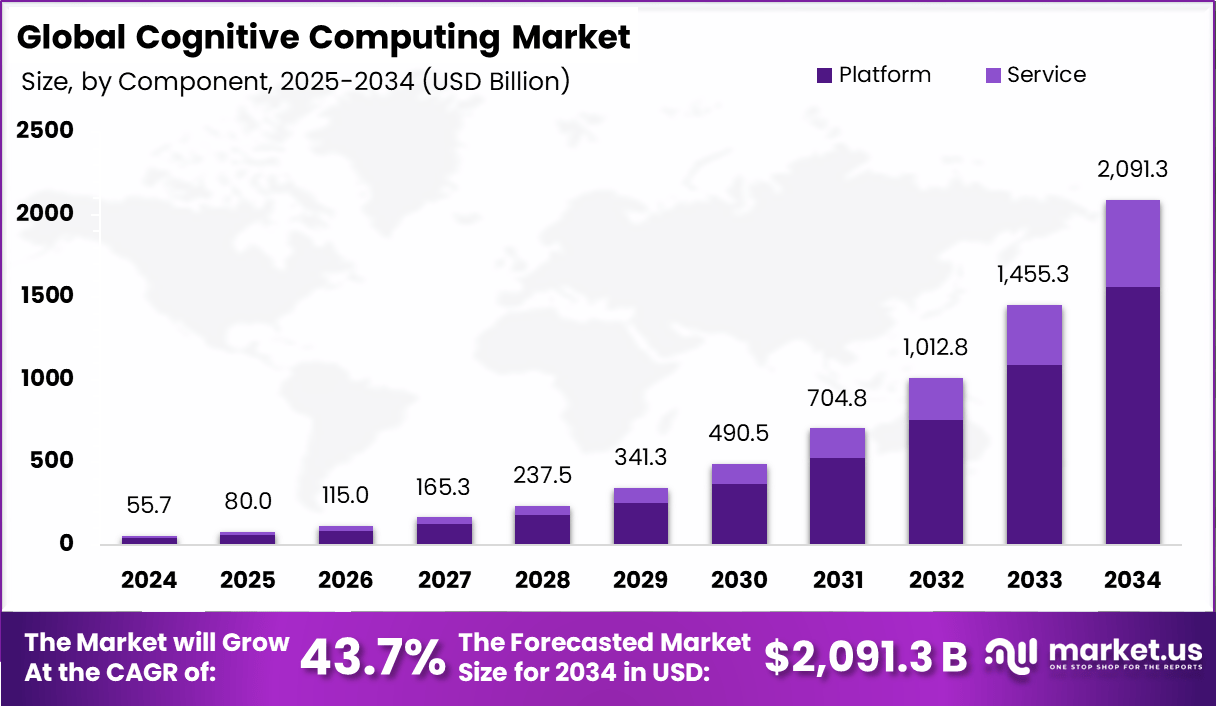

The global Cognitive Computing market size accounted for USD 55.70 billion in 2024 and is predicted to increase from USD 80.0 billion in 2025 to approximately USD 2,091.33 billion by 2034, expanding at a CAGR of 43.70% from 2025 to 2034.

Cognitive computing refers to systems that emulate human cognitive functions by integrating artificial intelligence, natural language processing, machine learning and reasoning to interpret and act upon vast volumes of unstructured data, such as text, speech, images and sensor signals. These platforms support tasks including dialog generation, vision recognition and predictive analytics. The use of these systems has expanded across industries seeking to enhance insight‑driven decision making.

The growth of cognitive computing can be attributed to rapidly increasing volumes of enterprise data and the demand for sophisticated analytics to yield actionable insight. Rising investment in AI and machine learning and the shift toward cloud‑based deployment models also drive adoption. Additionally, the need to automate complex tasks and enhance decision accuracy in sectors such as healthcare, finance and retail underlies strong uptake

For instance, In March 2023, Tata Consultancy Services (TCS) introduced the TCS Cognitive Plant Operations Adviser, a 5G-powered solution tailored for Microsoft Azure Private Mobile Edge Computing. This AI-driven tool supports industries like manufacturing, oil and gas, consumer goods, and pharmaceuticals in enhancing productivity.

The industry is expanding rapidly, fueled by increasing data volumes, the rise of AI-driven solutions, and the growing need for real-time insights. As machine learning and NLP continue to advance, the cognitive computing industry is expected to further evolve, becoming an integral part of business strategies and technological innovation globally.

Scope and Forecast

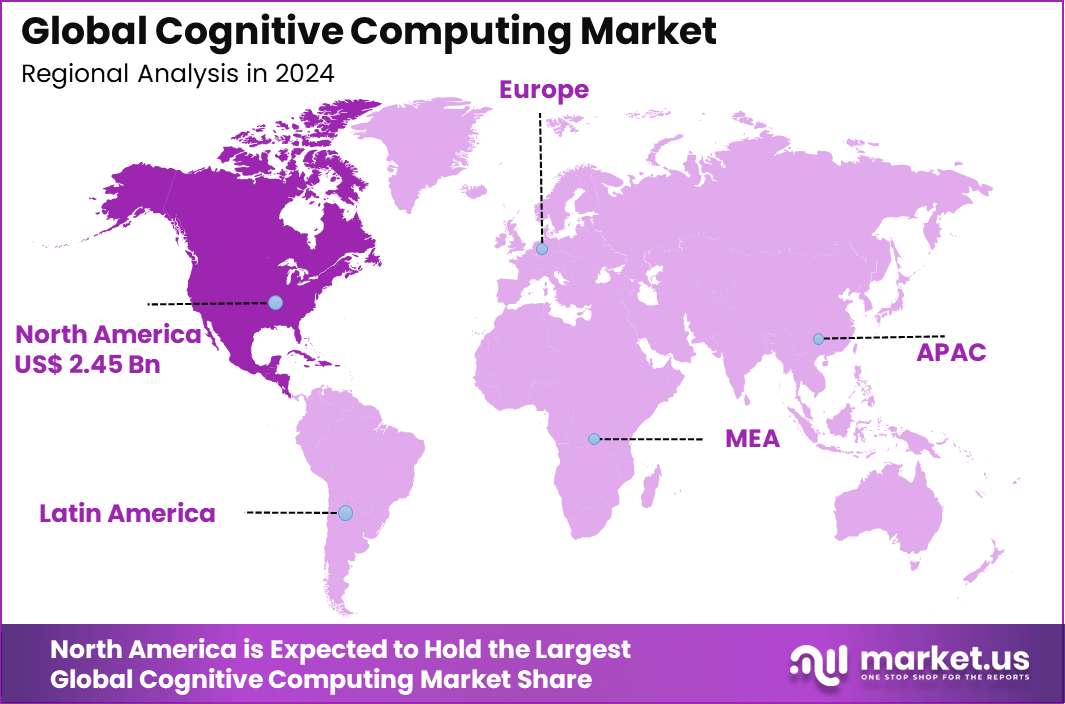

Report Features Description Market Value (2024) USD 55.7 Bn Forecast Revenue (2034) USD 2,091.3 Bn CAGR(2025-2034) 43.7% Leading Segment Platform – 74.7% Largest Market North America [38.4% Market Share] Largest Country U.S. [17.80 Bn Market Revenue, CAGR: 42.8%] Key Takeaways

- In 2024, the Natural Language Processing (NLP) segment held a dominant market position, capturing more than a 30.6% share of the Global Cognitive Computing Market.

- In 2024, Platform held a dominant market position, capturing more than a 74.7% share.

- In 2024, the On-premise segment held a dominant market position, capturing more than a 58.9% share of the market.

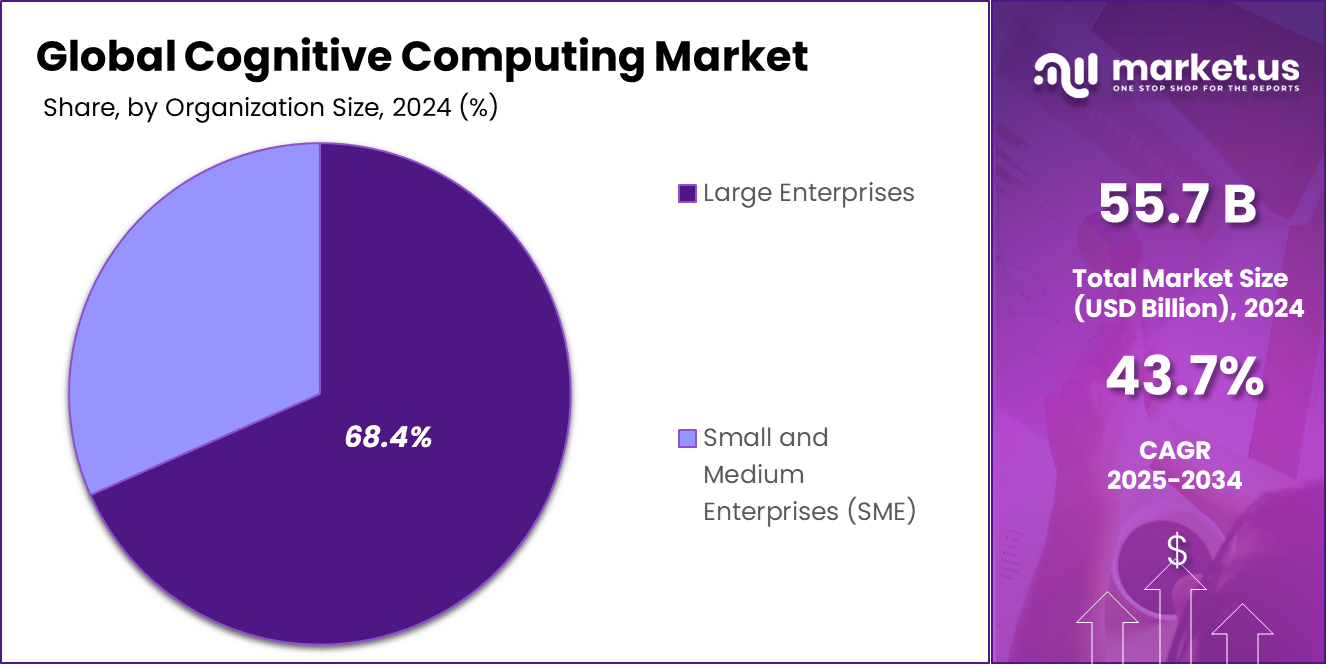

- In 2024, the Large enterprises segment held a dominant market position, capturing more than a 68.4% share.

- In 2024, Healthcare held a dominant market position, capturing more than a 32.5% share.

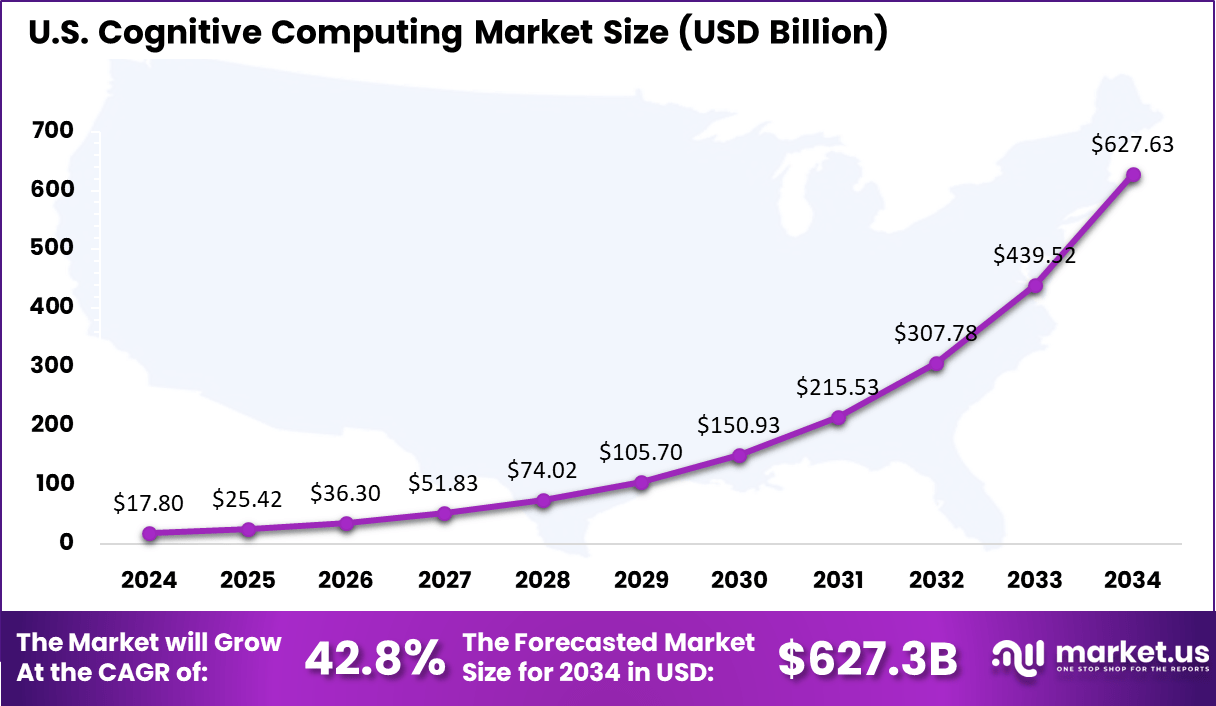

- The U.S. Cognitive Computing Market was valued at USD 17.80 Billion in 2024, with a robust CAGR of 42.8%.

- In 2024, North America held a dominant market position in the global Cognitive Computing Market, capturing more than a 38.4% share.

U.S. Cognitive Computing Market Size

The US Cognitive Computing Market was valued at USD 17.80 Billion in 2024, with a robust CAGR of 42.8%. The U.S. cognitive computing market is experiencing rapid growth, fueled by the adoption of artificial intelligence (AI) and machine learning technologies across various sectors.

Organizations in industries such as healthcare, finance, retail, and manufacturing are leveraging cognitive computing to enhance decision-making, automate processes, and improve customer experiences. One of the main drivers of market expansion is the increasing use of cloud-based solutions, which offer scalability and cost-efficiency.

Moreover, advancements in natural language processing (NLP) and data analytics are making cognitive computing more effective in real-time data processing and insights generation. The market also benefits from robust investments in AI research and development, enabling more sophisticated cognitive systems.

In 2024, North America held a dominant market position in the global Cognitive Computing Market, capturing more than a 34.4% share. The region holds a dominant share in the global market, driven by rapid advancements in AI, machine learning, and natural language processing technologies.

Key drivers include the increasing demand for automation, real-time data processing, and enhanced decision-making across industries like healthcare, finance, and manufacturing. Cloud adoption, the growing use of AI-powered solutions, and the integration of cognitive systems into enterprise workflows are key trends in the market.

Additionally, North America’s strong technological infrastructure and significant investments in AI research and development further bolster the market’s growth, positioning the region as a leader in the cognitive computing space.

Key Features and Trends

Feature/Trend Details Advanced Natural Language Processing Enhanced language understanding for chatbots, virtual assistants, and automated workflows. Real-time Data Processing Instant analytics and response for decision-making in dynamic environments (e.g., finance). Integration with IoT Cognitive systems paired with IoT for smart automation and predictive insights. Context Awareness & Reasoning Ability to interpret context, intent, and dynamically adapt outputs. Cloud-based Deployments Flexible, scalable, and cost-efficient implementations across enterprises. Multimodal AI Systems handle text, voice, and image data for richer cognitive capabilities. Predictive & Prescriptive Analytics From merely descriptive analysis to proactively suggesting actions or automating tasks. Autonomous & Self-learning Systems Continuous learning to improve performance without human intervention. By Technology Analysis

In 2024, the Natural Language Processing (NLP) segment held a dominant market position, capturing more than a 30.6% share of the Global Cognitive Computing Market, due to its crucial role in enabling machines to understand, interpret, and generate human language. This technology has transformed the way businesses interact with customers and manage vast amounts of unstructured data.

NLP is pivotal in applications such as chatbots, sentiment analysis, and language translation, allowing businesses to provide more personalized and efficient customer experiences. It is increasingly integrated into various sectors including healthcare, finance, retail, and customer service.

The growing need for automated text and speech processing, along with the rise of AI-powered conversational agents and virtual assistants like Siri and Alexa, has made NLP a key technology. NLP’s ability to process vast amounts of unstructured data from diverse sources, such as social media, documents, and voice interactions, further contributes to its dominance in the cognitive computing landscape.

Component Analysis

In 2024, the Platform segment held a dominant market position, capturing more than a 74.7% share of the Global Cognitive Computing Market, due to the increasing demand for cloud-based cognitive platforms. These platforms enable businesses to deploy and manage cognitive computing systems without extensive on-premise infrastructure, offering scalability, flexibility, and cost-efficiency.

The growing preference for cloud platforms stems from their ability to provide real-time data processing, advanced analytics, and seamless integration with existing IT systems. This makes cognitive platforms ideal for industries like healthcare, finance, and retail, where real-time decision-making and data-driven insights are critical. Additionally, the rise of machine learning and AI tools within these platforms makes them indispensable for automation and optimization tasks, further cementing their dominant position in the market.

Deployment Model Analysis

In 2024, the On-premise segment held a dominant market position, capturing more than a 58.9% share of the Global Cognitive Computing Market, primarily due to its high level of security and cost efficiency. Organizations often prefer on-premise deployment as it allows for full control over their data, crucial for industries dealing with sensitive information, such as healthcare, finance, and government sectors.

This model ensures that companies can manage their infrastructure, security measures, and compliance with regulations internally. Additionally, on-premise solutions provide better customization to meet specific business needs, offering more flexibility compared to cloud-based alternatives.

Moreover, for businesses with established IT infrastructure, on-premise solutions are more cost-effective in the long term, especially when avoiding ongoing cloud service fees. As data privacy concerns continue to rise globally, the preference for on-premise deployment remains strong, positioning it as the leading choice in the market.

By Organization Size Analysis

In 2024, the Large enterprises segment held a dominant market position, capturing more than a 68.4% share of the Global Cognitive Computing Market, due to the significant investment capabilities of large organizations, which allow them to adopt cutting-edge technologies like AI, machine learning, and natural language processing.

These enterprises have complex data needs and rely heavily on cognitive computing systems to handle massive volumes of data, streamline operations, improve decision-making, and gain competitive advantages. Furthermore, large businesses are better positioned to implement enterprise-wide cognitive computing systems due to their robust infrastructure, large IT teams, and access to advanced technologies.

Additionally, large enterprises often require highly specialized, scalable, and customized cognitive solutions to meet diverse needs across departments such as finance, HR, and customer service, contributing to their dominant market position. As the market continues to grow, these organizations are expected to continue driving the demand for more advanced and integrated cognitive computing systems.

By Industry Analysis

In 2024, the Healthcare segment held a dominant market position, capturing more than a 68.4% share of the Global Cognitive Computing Market, due to its ability to significantly enhance patient care, streamline operations, and improve decision-making through data-driven insights.

Cognitive computing enables healthcare providers to analyze vast amounts of patient data, medical records, and real-time information to assist in diagnosis, personalized treatment, and predictive analytics. The ability to process and interpret medical imaging, genomic data, and unstructured data (like patient records) is a critical factor driving the demand for cognitive computing in this sector.

Moreover, cognitive computing supports advancements in drug discovery, remote patient monitoring, and clinical decision support systems (CDSS). The increasing need for AI-powered tools that can automate administrative tasks, improve diagnostic accuracy, and assist in clinical research further strengthens the position of healthcare as the dominant industry segment.

Key Market Segments

By Technology

- Machine learning

- Natural Language Processing (NLP)

- Human computer interaction

- Computer vision

- Machine vision

- Robotics

- Deep learning

- Others

By Component

- Platform

- Service

- Professional services

- Consulting

- Integration and deployment

- Support and maintenance

- Managed services

- Professional services

By Deployment Model

- On-premise

- Cloud

By Organization Size

- Small and Medium Enterprises (SME’s )

- Large Enterprises

By Industry

- Healthcare

- BFSI

- Retail and e-commerce

- Government and defense

- IT and telecom

- Energy and power

- Others

Drivers

Advancements in Artificial Intelligence and Machine Learning

Quantum computing represents a revolutionary shift in how we process information. Unlike classical computers that rely on binary bits (0s and 1s) to represent data, quantum computers use quantum bits or “qubits,” which can exist in multiple states simultaneously due to quantum superposition. This ability allows quantum computers to solve certain problems at an exponentially faster rate than classical computers.

In the context of the Cognitive Computing (TRNG) market, advancements in quantum computing play a crucial role. Quantum computers are capable of performing complex calculations and simulations that classical computers struggle with, especially in encryption and cryptography.

This has raised significant concerns about the security of existing cryptographic methods, particularly those based on pseudo-random number generators (PRNGs) and classical encryption algorithms, as quantum computers could potentially break these systems by leveraging their computational power to solve mathematical problems that are practically infeasible for classical computers.

Restraint

Data Privacy and Security Concerns

Data privacy and security are critical challenges when implementing cognitive computing systems. As these systems process vast amounts of sensitive and confidential data, concerns about data breaches, misuse, and unauthorized access become more pronounced. Regulatory compliance, especially with frameworks like GDPR in Europe and similar laws in other regions, adds another layer of complexity for businesses.

The need to protect patient records in healthcare, financial transactions in banking, and proprietary business data further emphasizes the importance of robust cybersecurity measures. These concerns create hesitation among enterprises when adopting cognitive computing technologies.

Opportunities

Healthcare Advancements through Cognitive Computing

Cognitive computing in healthcare presents significant opportunities, especially with AI-driven technologies revolutionizing patient care, diagnostics, and treatment plans. The use of machine learning algorithms for personalized medicine and predictive analytics enables early disease detection and better treatment outcomes.

Additionally, cognitive computing systems are improving clinical decision-making by analyzing vast data sets, including medical images and electronic health records. The demand for AI-powered tools for drug discovery, patient monitoring, and automating administrative tasks will continue to grow, allowing healthcare providers to improve efficiency and reduce operational costs.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Cognitive Computing Market, major players such as Amazon Web Services, IBM, Oracle, and SAP are driving innovation through cloud-based platforms and AI services. Their capabilities in natural language processing, machine learning, and big data analytics are enabling businesses to build intelligent applications.

Several key contributors include Cloudera, Denodo Technologies, Informatica, TIBCO Software, and Talend. These firms are focusing on data integration, virtualization, and advanced analytics. Their offerings help enterprises extract insights from structured and unstructured data with ease. By providing robust data pipelines and real-time intelligence, they are addressing the growing need for faster, more accurate decision-making.

Emerging players such as Atlan, Dremio, Stardog Union, and K2View are gaining traction with innovative platforms built for modern data stacks. Meanwhile, established tech firms like Hitachi Vantara, Hewlett Packard Enterprise, and NetApp are enhancing their cognitive capabilities through strategic investments. Companies such as Qlik, Software AG, and MapR Technologies are advancing in data discovery and integration tools.

Top Key Players in the Market

- Amazon Web Services, Inc.

- Atlan Pte. Ltd

- Cloudera Inc.

- world, Inc.

- Denodo Technologies

- Dremio

- Hewlett Packard Enterprise

- Hitachi Vantara

- IBM

- Informatica Inc.

- K2View

- MapR Technologies

- NetApp

- Oracle

- Qlik

- SAP

- Software AG

- Stardog Union

- Talend

- TIBCO Software Inc.

- Others

Recent Developments

- In Feb 2025, SupportLogic, the world’s first AI-native support experience (SX) platform, announced the launch of SupportLogic Cognitive AI Cloud, an AI platform designed specifically to power enterprise-class AI agents that automate and transform customer support operations.

- In Sept. 2024, Stampli, the only finance operations platform centered on Accounts Payable (AP), unveiled Cognitive AI and its first application in Purchase Order (PO) matching at SuiteWorld 2024. Stampli’s Cognitive AI represents a breakthrough in applying AI to financial processes.

- In Feb, 2024, Mphasis, an Information Technology (IT) solutions provider specialising in cloud and cognitive services, announced the launch of DeepInsights Doc AI, an intelligent document processing solution, powered by generative AI. Mphasis helps enterprises extract context-specific data from any document format and integrate it with IT systems for actionable insights.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Machine learning, Natural Language Processing (NLP), Human computer interaction (Computer vision, Machine vision, Robotics), Deep learning, and Others), By Component (Platform, and Service (Professional services (Consulting, Integration and deployment, Support and maintenance), Managed services), By Deployment Model (On-premise, and Cloud), By Organization Size (Small and Medium Enterprises (SME), and Large Enterprises), By Industry Healthcare, BFSI, Retail and e-commerce, Government and defense, IT and telecom, Energy and power, Others), Region Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services, Inc., Atlan Pte. Ltd., Cloudera Inc., data.world, Inc., Denodo Technologies, Dremio, Hewlett Packard Enterprise, Hitachi Vantara, IBM, Informatica Inc., K2View, MapR Technologies, NetApp, Oracle, Qlik, SAP, Software AG, Stardog Union, Talend, TIBCO Software Inc., and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cognitive Computing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Cognitive Computing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services, Inc.

- Atlan Pte. Ltd

- Cloudera Inc.

- world, Inc.

- Denodo Technologies

- Dremio

- Hewlett Packard Enterprise

- Hitachi Vantara

- IBM

- Informatica Inc.

- K2View

- MapR Technologies

- NetApp

- Oracle

- Qlik

- SAP

- Software AG

- Stardog Union

- Talend

- TIBCO Software Inc.

- Others