Global Coconut Products Market Size, Share, And Industry Analysis Report By Product (Coconut Oil, Coconut Water, Coconut Milk and Cream), By Form (Liquid, Solid, Powder), By Application (Food and Beverage, Cosmetics), By Distribution Channel (Supermarkets and Hypermarkets, Convenience and Grocery Stores, Online Retail Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170026

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

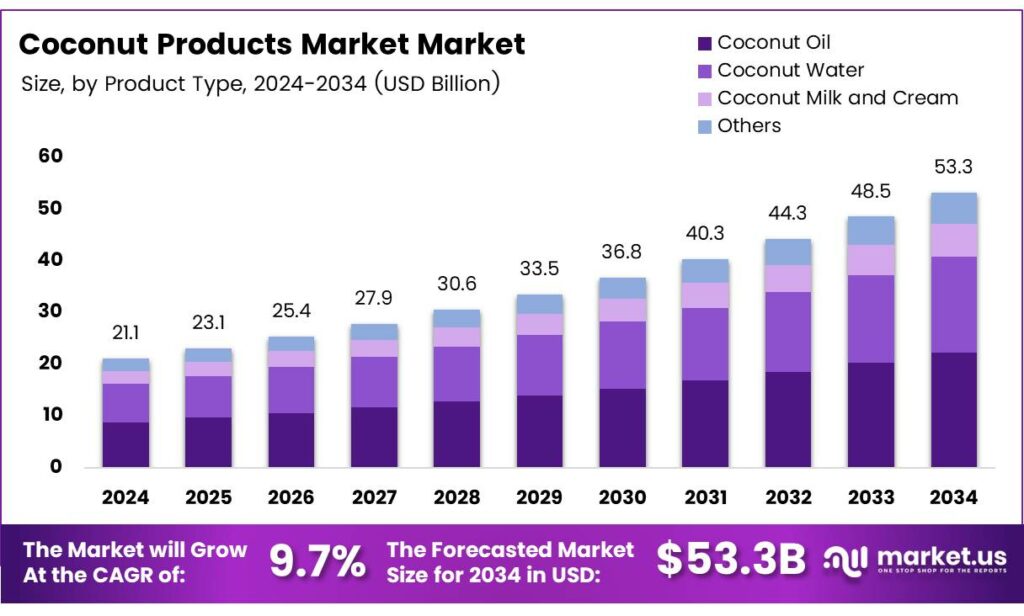

The Global Coconut Products Market size is expected to be worth around USD 53.3 billion by 2034, from USD 21.1 billion in 2024, growing at a CAGR of 9.7% during the forecast period from 2025 to 2034.

The Coconut Products Market includes food and beverage, cosmetic, and nutraceutical applications derived from coconut oil, coconut milk, copra, palm sugar, VCO, and coconut-based proteins. It supports global demand for plant-based nutrition, natural sweeteners, functional oils, and clean-label ingredients used across consumer and industrial value chains. The Coconut Products Market continues expanding as consumers shift toward natural, plant-based, and functional ingredients.

Increasing global acceptance of coconut milk, coconut water, VCO, and coconut sugar accelerates its penetration. Moreover, rising wellness spending supports coconut-derived proteins and healthy fats, improving long-term category stability and boosting manufacturing capacity across producing economies.

- Copra is recognised by the Indian Directorate of Coconut Development as the richest oil-bearing seed, containing 65–68% fat, 15–20% carbohydrates, 9% protein, and 4.1% crude fibre. India processes two main types: edible copra, consumed as a dry fruit, and milling copra, which is used for oil extraction and downstream value-added coconut products.

APCC specifies strict quality parameters for Virgin Coconut Oil, requiring moisture below 0.1%, volatile matter under 0.2%, FFA below 0.2%, peroxide value under 3 meq/kg, and density between 0.915–0.920. Meanwhile, the International Coconut Community highlights rising demand for coconut palm jaggery, with 15% sugar recovery supporting a fast-growing alternative sweetener industry valued at USD 1.3 billion, driven by preference for low-glycemic, nutrient-rich substitutes.

Transitioning to product diversification, coconut derivatives now address high-growth niches such as low-glycemic sweeteners and premium edible oils. Coconut palm sugar gains rapid traction as global consumers reject high-fructose alternatives. Meanwhile, VCO’s purity and oxidative stability enable strong adoption in food, baby care, and wellness categories, reinforcing premium positioning.

Key Takeaways

- The Global Coconut Products Market is projected to reach USD 53.3 billion by 2034, rising from USD 21.1 billion in 2024 at a 9.7% CAGR.

- Coconut Oil led the market under By Product in 2024, holding a dominant 41.9% share.

- Liquid Form dominated the By Form segment with a 47.3% market share in 2024.

- Food and Beverage remained the largest application area with a 56.2% share in 2024.

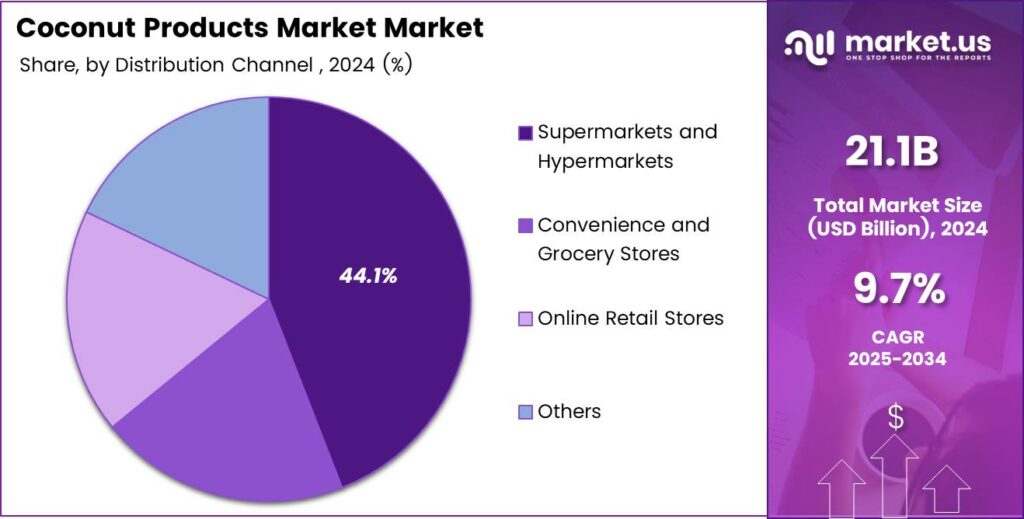

- Supermarkets and Hypermarkets accounted for the highest distribution share at 44.1% in 2024.

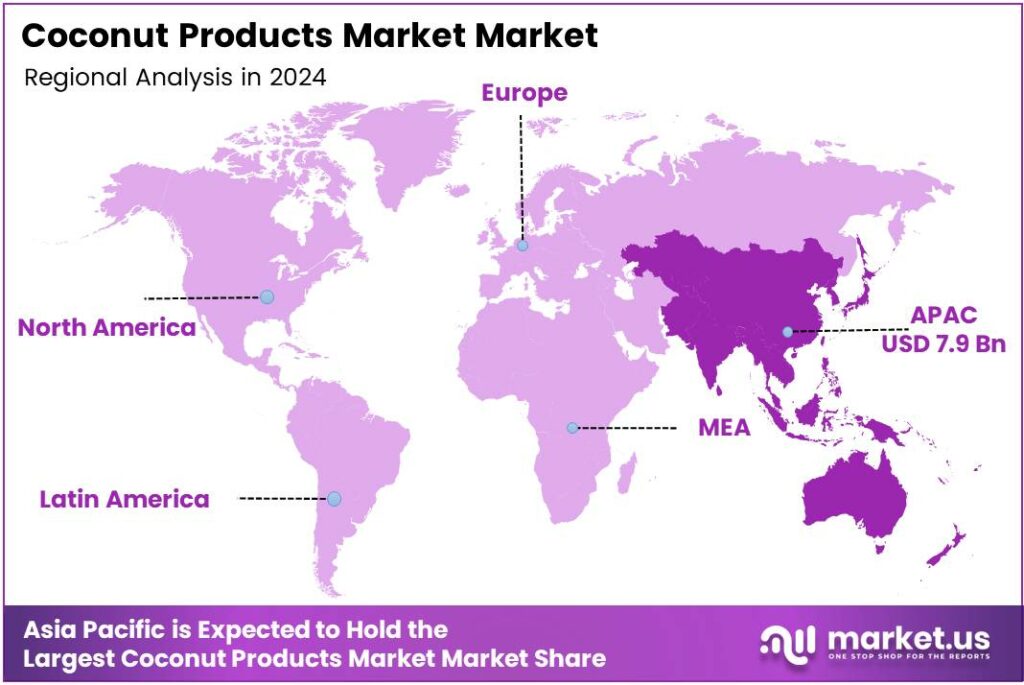

- Asia Pacific emerged as the leading region with a 37.8% market share valued at USD 7.9 billion in 2024.

By Product Analysis

Coconut Oil dominates with 41.9% due to its strong use across the food, cosmetic, and wellness industries.

In 2024, Coconut Oil held a dominant market position in the By Product segment of the Coconut Products Market, with a 41.9% share. This strong lead reflects its high global acceptance, natural wellness appeal, and wide industrial usage. Demand expands steadily as consumers shift toward cleaner and plant-based oils.

Coconut Water held a significant position in the By-Product segment of the Coconut Products Market. Its popularity increased due to hydration needs and natural electrolytes. Growing preference for low-calorie drinks strengthened adoption. Brands expanded flavoured offerings, improving accessibility and supporting broader consumer acceptance across regions.

Coconut Milk and Cream captured rising interest within the By-Product segment. Their adoption accelerated as plant-based diets expanded. Food manufacturers increasingly use these ingredients in dairy alternatives, confectionery, and ready-to-cook meals. Their creamy texture and natural flavour positioned them well for evolving culinary applications across global markets.

By Form Analysis

Liquid Form dominates with 47.3% owing to its versatility in beverages, cosmetics, and cooking applications.

In 2024, Liquid held a dominant market position in the By Form segment of the Coconut Products Market, with a 47.3% share. Its wide adaptability in drinks, oils, and skincare boosted demand. Producers expanded liquid-based coconut lines, strengthening the segment’s relevance in retail and industrial channels.

Solid Form maintained steady traction in the By Form segment. Products like copra, desiccated coconut, and blocks supported bakery, confectionery, and traditional cooking needs. Their stable shelf life and dependable texture improved adoption. Growing packaged food demand further supported consistent usage across domestic and export markets.

Powder Form continued gaining interest across the By Form segment. Coconut milk powder and flour served as convenient options for manufacturers. Their extended storage stability and ease of transportation increased their value. Demand grew within plant-based formulations, bakery mixes, and nutritional products, strengthening long-term growth prospects.

By Application Analysis

Food and Beverage dominate with 56.2% due to their extensive use in drinks, cooking ingredients, and packaged foods.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Coconut Products Market, with a 56.2% share. Demand surged as coconut water, milk, oil, and derivatives gained widespread culinary and nutritional acceptance. Health-driven consumers increasingly preferred coconut ingredients in their daily diets.

Cosmetics achieved strong relevance in the By Application segment. Coconut oil, milk, and extracts supported moisturising, cleansing, and hair-care formulations. Brands enhanced natural product portfolios, boosting adoption. As clean-label beauty trends accelerated, coconut-based cosmetics secured stronger demand across offline and online retail channels.

Others in the By Application segment included household, pharmaceutical, and artisanal uses. These applications expanded as coconut derivatives found roles in soaps, balms, herbal preparations, and speciality craft items. Although smaller in comparison, these categories benefited from consumer preferences for natural and multifunctional ingredients.

By Distribution Channel Analysis

Supermarkets and Hypermarkets dominate with 44.1% as they offer broad assortments and strong visibility for coconut products.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Coconut Products Market, with a 44.1% share. Their extensive shelf space, product variety, and attractive promotions improved accessibility. Urban consumers especially relied on these stores for consistent coconut product availability.

Convenience and Grocery Stores continued playing a vital role in the By Distribution Channel segment. Their neighbourhood presence supported frequent purchases of daily-use coconut items. These outlets catered to quick-buy behaviour, especially in rural and semi-urban markets, strengthening routine consumption patterns.

Online Retail Stores expanded rapidly across the distribution Channel segment. E-commerce platforms improved the reach for premium and speciality coconut products. Subscription models, direct-to-consumer brands, and doorstep delivery supported adoption. Digital shopping convenience drove strong visibility for coconut-based offerings nationwide.

Key Market Segments

By Product

- Coconut Oil

- Coconut Water

- Coconut Milk and Cream

- Others

By Form

- Liquid

- Solid

- Powder

By Application

- Food and Beverage

- Cosmetics

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience and Grocery Stores

- Online Retail Stores

- Others

Emerging Trends

Rising Shift Toward Clean-Label and Plant-Based Nutrition Shapes Market Trends

A major trend shaping the coconut products market is the strong shift toward clean-label, minimally processed, and plant-based foods. Consumers increasingly prefer products with simple ingredients and natural origins, making coconut-based items a natural fit.

- Coconut water continues to trend as a hydration drink due to its natural electrolytes. Its popularity is growing in fitness and lifestyle segments, strengthening demand across markets. According to the Food and Agriculture Organisation (FAO), global coconut production reached 63.6 million tonnes, supported strongly by countries such as the Philippines, Indonesia, and India.

Coconut-based dairy alternatives are also trending as more people look for lactose-free or vegan products. This trend is supported by expanding retail shelves and faster online delivery channels. Sustainability is another key trend. Brands promoting eco-friendly farming, fair-trade sourcing, and zero-waste processing are gaining stronger customer trust.

Drivers

Rising Preference for Natural and Healthy Coconut-Based Products Drives Market Growth

Growing consumer interest in natural, chemical-free, and plant-based products is a major driver for coconut products. People increasingly choose coconut oil, coconut water, and coconut milk because they see them as healthier and more nutritious than synthetic alternatives.

- The food and beverage industry is using coconut ingredients in snacks, dairy alternatives, desserts, and functional drinks. This wider use gives producers a steady market and encourages product innovation. The U.S. Department of Agriculture (USDA) notes that coconut water contains about 600 mg of potassium per cup, which makes it appealing to people who want natural replenishment.

Health awareness also plays a strong role. Consumers link coconut products to better digestion, hydration, and overall wellness. This trend is expanding in both developed and emerging markets. Government support for coconut farming in countries like India, Indonesia, and the Philippines further strengthens supply chains and boosts farmer income, helping the market grow.

Restraints

Fluctuating Raw Material Availability Limits Market Expansion

One of the biggest restraints is unstable coconut supply caused by climate issues, ageing plantations, and low replanting rates. These factors often lead to unpredictable yields and high production costs. Price volatility is also a major challenge. When coconut prices rise sharply, manufacturers struggle to maintain consistent pricing, reducing market competitiveness.

- Small farmers in major coconut-growing regions often lack access to modern tools, irrigation, and financial support. This limits productivity and creates gaps in product quality. The Asian and Pacific Coconut Community (APCC), virgin coconut oil typically contains less than 0.2% free fatty acids, giving it a longer shelf life and making it suitable for edible uses, baby care, and skincare.

Another restraint is the availability of cheaper substitutes such as vegetable oils and synthetic cosmetic ingredients, which reduce demand during periods of high coconut prices.

Growth Factors

Growing Demand for Value-Added Coconut Derivatives Creates New Opportunities

The market has strong opportunities as companies shift from basic coconut products to high-value derivatives like virgin coconut oil, coconut flour, coconut sugar, and coconut-based cosmetics. These products earn better margins and attract health-focused consumers.

Rising global interest in plant-based and lactose-free diets creates further openings for coconut milk, cream, and yogurt alternatives. Food companies continue to expand their coconut-based product lines to meet this demand. Opportunities are also growing in premium personal-care products where coconut extracts are used for skin and hair nourishment.

This niche continues to expand across online and retail markets. Investment in sustainable farming and processing technologies can significantly boost supply consistency, offering long-term potential for companies that modernise their operations.

Regional Analysis

Asia Pacific Leads the Coconut Products Market with a 37.8% Share, Valued at USD 7.9 Billion

Asia Pacific dominated the global Coconut Products Market in 2024, accounting for a 37.8% share and reaching a value of USD 7.9 billion. The region benefits from strong coconut cultivation bases across Southeast Asia, rising health-conscious consumption, and expanding food, cosmetics, and wellness industries. Growing export capabilities and government programs supporting coconut value-addition further strengthen growth prospects.

North America continues witnessing the rapid adoption of coconut-based beverages, oils, and plant-based alternatives. Rising consumer interest in clean-label and natural ingredients supports steady expansion. The region benefits from strong retail penetration, increased demand for dairy substitutes, and a growing focus on functional nutrition across the U.S. and Canada.

Europe shows consistent growth driven by rising vegan lifestyles, premium food preferences, and increasing use of coconut derivatives in the bakery, confectionery, and personal care sectors. Regulatory promotion of healthy ingredients and sustainability-focused consumer behaviour also contribute to higher market acceptance across major European economies.

Latin America’s market expansion is influenced by lifestyle shifts toward healthier diets and growing demand for plant-based and natural products. Coconut-based snacks, oils, and beverages are gaining popularity, supported by improved distribution networks and rising consumer awareness about the nutritional benefits of coconut derivatives.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Coconut Products Market saw strong momentum as brands expanded sourcing networks, strengthened supply chains, and tapped into surging consumer demand for natural hydration, plant-based nutrition, and clean-label ingredients.

Vita Coco continued shaping market direction through its broad coconut water portfolio and strong distribution reach. The company benefited from rising adoption of low-sugar beverages, helping reinforce its leadership in the packaged coconut beverage category.

PepsiCo advanced its coconut-focused strategy by leveraging its global retail presence and diversified beverage ecosystem. Its ability to integrate coconut water into mainstream wellness trends supported higher market penetration, especially in urban and health-driven consumer clusters.

Coca-Cola (Zico) maintained a focused position in premium coconut beverages. Despite selective product rationalisation in past years, Zico preserved brand visibility across key retail channels, driving steady interest among consumers looking for natural hydration options.

Eco Biscuits strengthened its market relevance by aligning coconut-based bakery and snack offerings with clean-label and allergen-friendly demand patterns. Its emphasis on coconut-derived ingredients supported broader adoption across niche consumer groups seeking healthier indulgence options.

Top Key Players in the Market

- Vita Coco

- Pepsico

- Coca-Cola (Zico)

- Eco Biscuits

- Dutch Plantin

- Koh Coconut

- PECU

- UFC Coconut Water

Recent Developments

- In 2025, PepsiCo highlighted sustainable farming models in Petrolina, Brazil, where coconuts are intercropped with cacao to enhance soil health and biodiversity; this aligns with broader crop portfolio strategies for tropical commodities like coconut water and derivatives.

- In 2025, Coca-Cola discontinued Zico coconut water in the U.S. 2020 to streamline its portfolio, but the brand has seen an independent revival under its founder. Amid Coca-Cola’s leadership transition in December, outgoing CEO James Quincey reflected on portfolio rationalisation, which underscores the brand’s shift to independent operation.

Report Scope

Report Features Description Market Value (2024) USD 21.1 billion Forecast Revenue (2034) USD 53.3 billion CAGR (2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Coconut Oil, Coconut Water, Coconut Milk and Cream, Others), By Form (Liquid, Solid, Powder), By Application (Food and Beverage, Cosmetics, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience and Grocery Stores, Online Retail Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Vita Coco, Pepsico, Coca-Cola (Zico), Eco Biscuits, Dutch Plantin, Koh Coconut, PECU, UFC Coconut Water Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Coconut Products MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Coconut Products MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vita Coco

- Pepsico

- Coca-Cola (Zico)

- Eco Biscuits

- Dutch Plantin

- Koh Coconut

- PECU

- UFC Coconut Water