Global Coatings Raw Materials Market By Type (Resins, Pigments and Fillers, Solvents, Additives), By Application (Solvent-based, Water-based, Powder Coatings, Radiation Curable Coatings), By End-use (Building And Construction, Oil And Gas, Aerospace, Marine, Industrial, Power Generation, Mining, Automotive, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151440

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

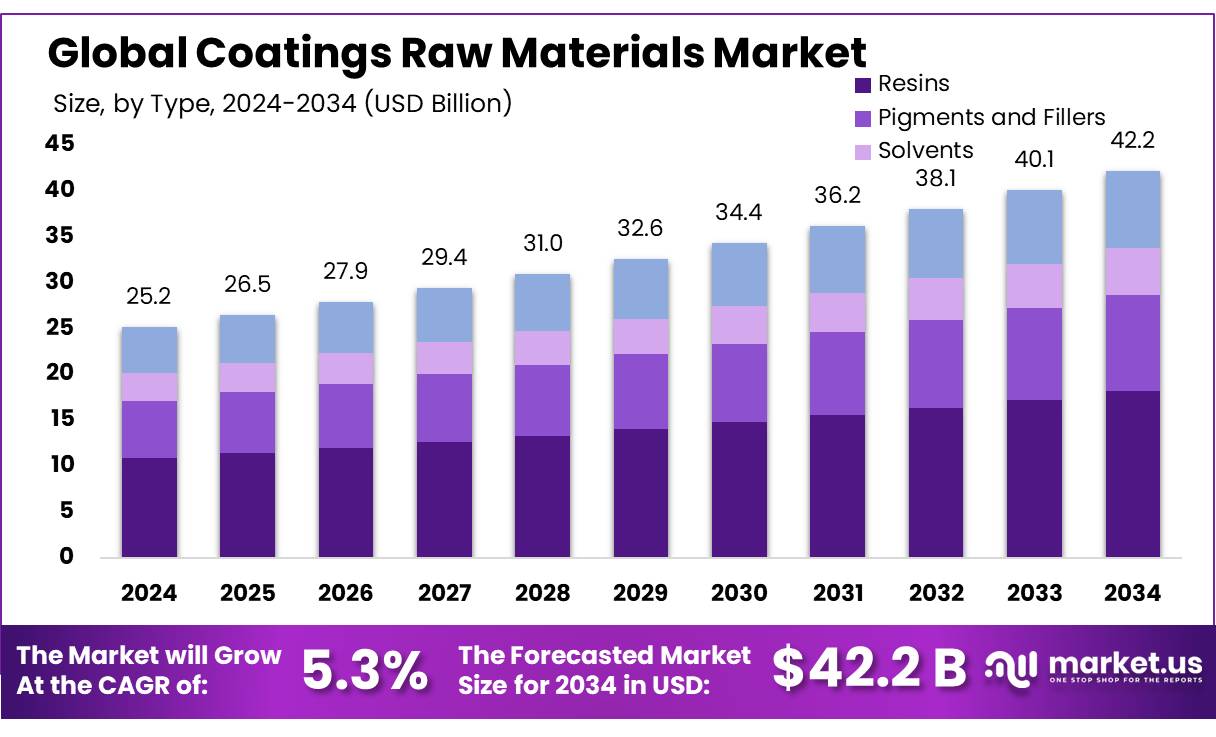

The Global Coatings Raw Materials Market size is expected to be worth around USD 42.2 Billion by 2034, from USD 25.2 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

Coatings raw materials concentrates—comprising resins, binders, pigments, solvents, and additives—serve as essential inputs for decorative, industrial, and protective coatings. These concentrates provide performance enhancements such as corrosion resistance, UV protection, and aesthetic color.

Primary concentrate categories include synthetic polymer binders, pigment dispersions, and functional additives engineered for viscosity control, adhesion, or biocidal properties. Formulated in concentrated form, they are diluted later by manufacturers to develop final paint and coating products. Foundational inputs—such as resins, pigments, solvents, and additives—are recorded at an estimated value of $63.5 billion globally, supporting a consumption volume of 34.3 million metric tons.

The coatings industry is integral to the global chemicals market, representing approximately 5% of its $4.5 trillion value. Key raw materials include resins, pigments, solvents, and additives, each playing a crucial role in the performance and application of coatings. Resins, particularly acrylics, polyurethanes, and alkyds, serve as binders that provide adhesion and durability. Pigments, such as titanium dioxide, offer color and opacity, while fillers like calcium carbonate and talc enhance texture and coverage. Solvents, both organic and water-based, facilitate application, and additives modify properties like rheology, drying time, and UV stability.

Major geopolitical and policy developments have driven both raw material and concentrates markets. In the United States, the Department of Energy allocated a record USD 6 billion in March 2024 towards industrial decarbonization—including support for chemical and materials processing—to reduce approximately 14 million metric tons of CO2 annually. Similarly, the European Union’s Critical Raw Materials Act (March 2023) aims to bolster domestic extraction, processing, and recycling, mandating that by 2030 at least 10% of EU consumption of strategic materials be extracted, 40% processed, and 25% recycled.

Key Takeaways

- Coatings Raw Materials Market size is expected to be worth around USD 42.2 Billion by 2034, from USD 25.2 Billion in 2024, growing at a CAGR of 5.3%.

- Resins held a dominant market position, capturing more than a 43.30% share in the global coatings raw materials market.

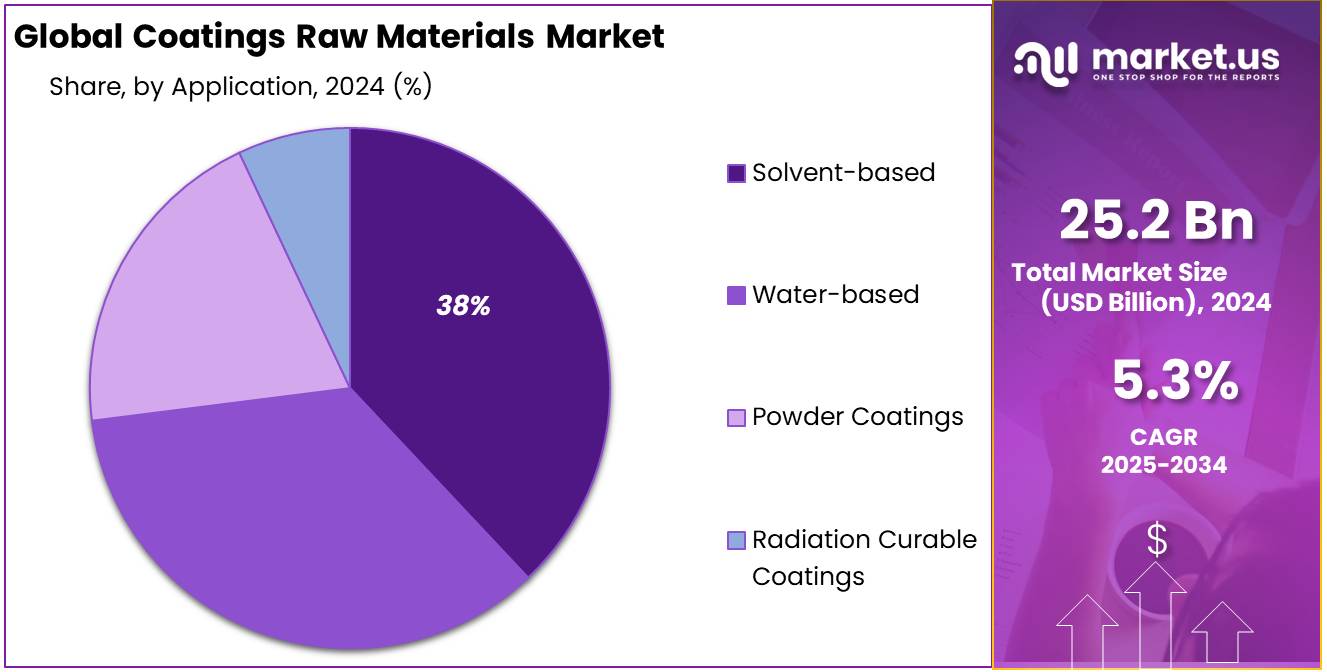

- Solvent-based held a dominant market position, capturing more than a 38.40% share in the coatings raw materials market.

- Building & Construction held a dominant market position, capturing more than a 28.30% share in the coatings raw materials market.

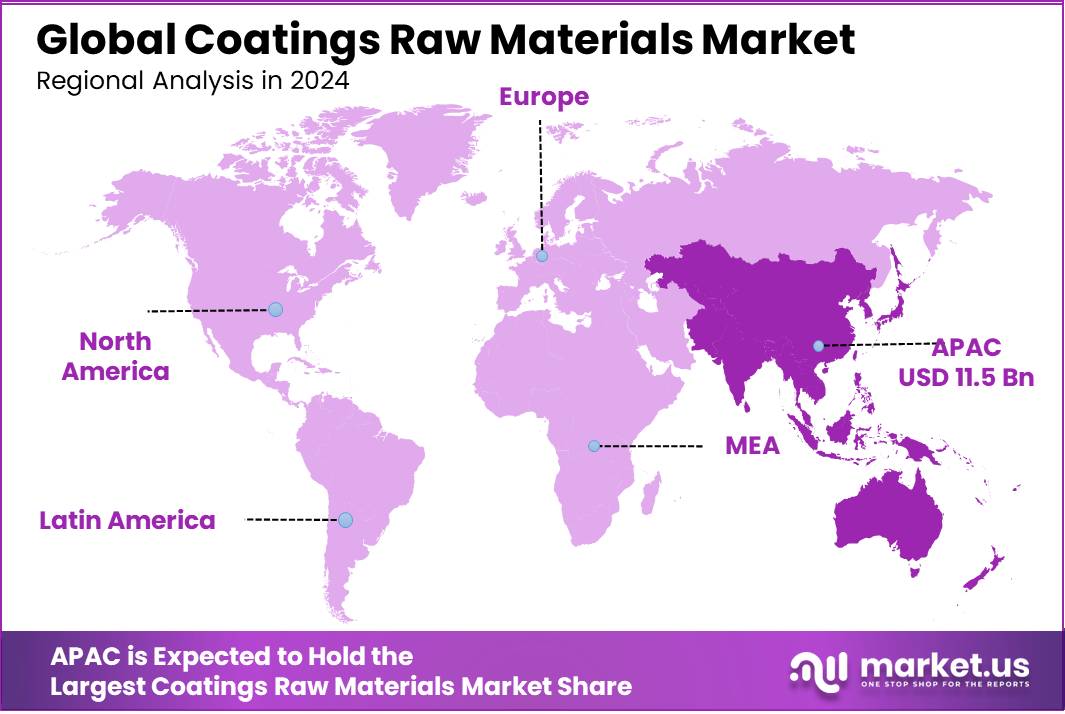

- Asia-Pacific (APAC) region held a dominant position in the global coatings raw materials market, accounting for more than 45.70% of the total share, with a market value of approximately USD 11.5 billion.

By Type

Resins dominate with 43.30% share in 2024 due to their versatile application in protective and decorative coatings.

In 2024, Resins held a dominant market position, capturing more than a 43.30% share in the global coatings raw materials market. This strong share is mainly due to their vital role as binding agents that form the film and provide adhesion, durability, and chemical resistance in coatings. Resin types such as acrylic, epoxy, alkyd, polyurethane, and polyester continue to be the backbone of both industrial and architectural coatings.

The demand for water-based resins also increased in 2024, driven by regulatory push for low-VOC and environmentally safe alternatives across North America and Europe. Across various sectors including construction, automotive, and industrial equipment, resin-based formulations accounted for a major portion of coating consumption. This preference is expected to remain strong in 2025 as manufacturers focus on innovation in bio-based and hybrid resins to meet performance and sustainability goals.

By Application

Solvent-based coatings lead with 38.40% share in 2024 owing to their strong performance in heavy-duty applications.

In 2024, Solvent-based held a dominant market position, capturing more than a 38.40% share in the coatings raw materials market by application. This leadership can be attributed to their ability to deliver high-performance results in environments requiring resistance to abrasion, chemicals, and extreme temperatures. These coatings are widely used in industrial sectors such as automotive, marine, metal fabrication, and heavy machinery, where durability and quick drying are essential.

Despite increasing regulatory pressures around VOC emissions, many manufacturers continued to rely on solvent-based systems in 2024 due to their consistent performance and compatibility with harsh operating conditions. Looking ahead to 2025, while water-based and powder alternatives are gaining traction, solvent-based coatings are still expected to hold steady demand, particularly in developing regions where cost and infrastructure limitations influence formulation choices.

By End-use

Building & Construction leads with 28.30% share in 2024 driven by rising demand for protective and decorative coatings in infrastructure projects.

In 2024, Building & Construction held a dominant market position, capturing more than a 28.30% share in the coatings raw materials market by end-use. This dominance was mainly supported by steady growth in residential and commercial infrastructure developments across emerging economies and the renovation boom in developed regions. Coatings used in this sector serve both aesthetic and protective functions—offering resistance to moisture, UV radiation, and surface wear.

The demand for raw materials like acrylic and epoxy resins, along with pigments and additives, remained strong in 2024 as builders prioritized long-lasting finishes and environmental compliance. Additionally, energy-efficient building standards boosted the use of heat-reflective and insulating coatings. Looking into 2025, the construction sector is expected to maintain its influence, especially with increasing public investments in affordable housing, urban renewal, and smart city initiatives worldwide.

Key Market Segments

By Type

- Resins

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Fluoropolyner

- Vinyl

- Others

- Pigments and Fillers

- Fillers and Extenders

- Titanium Dioxide (TiO2)

- Color Pigments

- Others

- Solvents

- Oxygenated Solvents

- Hydrocarbon Solvents

- Additives

- Rheology Modifiers

- Biocides

- Surfactants

- Defoamers

- Others

By Application

- Solvent-based

- Water-based

- Powder Coatings

- Radiation Curable Coatings

By End-use

- Building & Construction

- Oil & Gas

- Aerospace

- Marine

- Industrial

- Power Generation

- Mining

- Automotive

- Others

Drivers

Increasing Demand from the Food Industry

One major driving factor for the Coatings Raw Materials Market is the increasing demand for food-grade coatings and packaging materials. As the global food industry continues to grow, particularly in regions such as North America and Europe, there is a heightened focus on sustainable, safe, and high-performance coatings for packaging. These coatings not only protect the food from external factors but also contribute to maintaining freshness and extending shelf life. The growing demand for ready-to-eat meals and convenience foods, coupled with an increasing preference for eco-friendly packaging solutions, has significantly impacted the coatings market.

In 2024, the global food packaging market was valued at USD 356 billion and is projected to grow at a CAGR of 5.5% through 2027. A significant portion of this market is driven by the need for functional coatings in food packaging. Coatings are vital for protecting food from contamination and environmental exposure, enhancing product safety. In the United States, for example, food packaging accounts for approximately 18% of the total packaging market share, with a steady shift toward biodegradable and food-safe coating solutions.

The U.S. Department of Agriculture (USDA) has also supported this demand through initiatives like the Food Quality Protection Act (FQPA), which encourages the development of safer, more efficient food-contact materials. Moreover, the Food and Drug Administration (FDA) ensures that food packaging materials, including coatings, meet stringent safety standards. Government regulations worldwide have forced manufacturers to prioritize the use of non-toxic and environmentally sustainable materials, pushing innovations in raw material coatings.

Restraints

Rising Raw Material Costs

A significant restraining factor for the Coatings Raw Materials Market is the increasing cost of raw materials, particularly in the food packaging sector. As the demand for high-quality, eco-friendly coatings rises, manufacturers are facing the challenge of higher production costs. Key materials used in food-grade coatings, such as resins, pigments, and polymers, have seen price hikes due to supply chain disruptions, inflation, and raw material shortages. These rising costs are significantly impacting the profit margins of companies operating in the food packaging industry.

In 2023, the cost of raw materials for food packaging saw a sharp increase, with resins, which are a major component of coatings, increasing by 12% in price. The Food and Agriculture Organization (FAO) notes that raw material inflation is a persistent issue, especially as the cost of oil-based products and petrochemicals used in packaging and coatings continues to rise. This price surge has put pressure on manufacturers to balance quality and cost while maintaining sustainability, a key trend in the food industry.

Government initiatives such as the European Union’s Green Deal, aimed at reducing carbon footprints and increasing sustainability, are pushing food packaging manufacturers to use more environmentally friendly materials. However, the development of these alternative, sustainable materials, such as biodegradable or plant-based coatings, often involves higher initial costs. While these eco-friendly options are beneficial in the long term, their high production costs are a major hurdle for smaller and medium-sized food packaging companies.

Opportunity

Growth Opportunities in Sustainable Food Packaging

A significant growth opportunity in the Coatings Raw Materials Market lies in the increasing demand for sustainable food packaging solutions. As global awareness of environmental issues rises, consumers and industries are shifting towards eco-friendly alternatives to traditional plastic packaging. This shift is driven by the need to reduce plastic waste and the environmental impact associated with conventional packaging materials.

The Food and Agriculture Organization (FAO) highlights that food packaging plays a crucial role in reducing food waste and ensuring food safety. Innovations in packaging materials, such as biodegradable films and coatings, are being explored to replace petroleum-based plastics. These alternatives aim to provide similar protective qualities while being more environmentally friendly. For instance, the development of bio-based coatings derived from renewable resources is gaining traction in the industry.

Government initiatives are also supporting this transition. For example, the European Union’s Green Deal and various national policies encourage the adoption of sustainable practices in food packaging. These policies provide incentives for companies to invest in research and development of eco-friendly materials, fostering innovation in the sector.

Trends

Shift Toward Bio-Based and Biodegradable Coatings

A significant trend shaping the Coatings Raw Materials Market is the increasing adoption of bio-based and biodegradable coatings, particularly in food packaging. This shift is driven by growing consumer demand for sustainable products and stringent environmental regulations. Governments worldwide are implementing policies to reduce plastic waste, prompting industries to seek eco-friendly alternatives.

For instance, the European Union’s Single-Use Plastics Directive, effective since 2021, bans certain plastic products and encourages the use of biodegradable materials in packaging . Similarly, the U.S. Food and Drug Administration (FDA) has been evaluating the safety of bio-based coatings for food contact applications, paving the way for their broader use in the industry.

Innovations in material science have led to the development of coatings derived from renewable resources such as plant-based oils, proteins, and polysaccharides. These coatings not only offer biodegradability but also provide functional benefits like moisture and oxygen barrier properties, essential for preserving food quality. For example, research has demonstrated that coatings made from chitosan, a biopolymer derived from crustacean shells, can effectively extend the shelf life of perishable foods.

Regional Analysis

Asia-Pacific dominates with 45.70% share, valued at USD 11.5 billion, due to expanding industrial and construction activity.

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global coatings raw materials market, accounting for more than 45.70% of the total share, with a market value of approximately USD 11.5 billion. This strong regional performance is primarily attributed to rapid urbanization, large-scale infrastructure projects, and a growing manufacturing base across countries such as China, India, Japan, and South Korea. China remains the largest contributor within the region, driven by its expansive real estate sector, continued investment in industrial production, and large-scale shipbuilding and automotive output.

The region also benefits from lower raw material production costs and high domestic consumption, making it a key global supplier of essential inputs such as resins, solvents, and pigments. In 2024, the growth of water-based and environment-friendly coatings has accelerated in countries like Japan and South Korea, supported by regulatory policies aimed at reducing VOC emissions.

Moreover, foreign investments in APAC’s coatings sector have strengthened the supply chain for raw materials, improving both availability and innovation. By 2025, APAC is expected to retain its leading position, supported by rising consumer demand, expanding automotive manufacturing, and sustained growth in the construction sector, especially in Southeast Asia and South Asia. The region continues to be a global hub for both production and consumption of coatings raw materials.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is a leading global supplier of raw materials for coatings, offering a wide portfolio including resins, pigments, dispersions, and additives. In 2024, the company strengthened its position through innovations in water-based and bio-based solutions, aligning with regulatory trends on sustainability. Its coatings division serves construction, automotive, and industrial markets across Europe, Asia, and the Americas. BASF also focused on reducing carbon intensity across its production sites to support eco-efficient product development.

Celanese Corporation plays a vital role in the coatings raw materials market with its advanced portfolio of emulsions, vinyl acetate-based polymers, and performance additives. In 2024, the company expanded its production capacity in Asia-Pacific, targeting rising demand from construction and industrial segments. Celanese continues to develop high-performance formulations that offer durability, water resistance, and VOC compliance. The company’s integration of sustainable chemistry practices further supports its coatings materials used in architectural and specialty coatings applications.

Allnex is recognized globally for its strong capabilities in industrial resins and additives for coatings applications. In 2024, the company maintained leadership in UV-curable, powder coating, and waterborne resins, supplying to over 100 countries. Its product innovations address sustainability needs by reducing solvent content and improving coating efficiency. With manufacturing sites across Europe, China, and the U.S., Allnex continues to focus on customized solutions for automotive, protective, and architectural coatings sectors, while enhancing its eco-profile and circularity efforts.

Top Key Players in the Market

- BASF SE

- Celanese Corporation

- Allnex

- Dow

- Eastman Chemical

- Evonik Industries AG

- Huntsman Corporation

- Lanxess AG

- Momentive Performance Materials, Inc.

- W.R. Grace, et al.

- Cathay Industries

- Heubach Group

- Arkema Inc.

- Covestro

- DIC Corporation

- Cabot Corporation

- Matsuo Sangyo Co., Ltd.

- Altana AG

- Nouryon

- Other Key Players

Recent Developments

In 2024, BASF SE’s Coatings division achieved approximately €4.3 billion in global sales, reflecting its strong footprint in raw materials for automotive, industrial, and decorative coatings.

In 2024, Celanese Corporation reported total net sales of $10.3 billion, supported significantly by its coatings-related acetyl intermediates and emulsion products.

Report Scope

Report Features Description Market Value (2024) USD 25.2 Bn Forecast Revenue (2034) USD 42.2 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Resins, Pigments and Fillers, Solvents, Additives), By Application (Solvent-based, Water-based, Powder Coatings, Radiation Curable Coatings), By End-use (Building And Construction, Oil And Gas, Aerospace, Marine, Industrial, Power Generation, Mining, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Celanese Corporation, Allnex, Dow, Eastman Chemical, Evonik Industries AG, Huntsman Corporation, Lanxess AG, Momentive Performance Materials, Inc., W.R. Grace, et al., Cathay Industries, Heubach Group, Arkema Inc., Covestro, DIC Corporation, Cabot Corporation, Matsuo Sangyo Co., Ltd., Altana AG, Nouryon, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Coatings Raw Materials MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Coatings Raw Materials MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Celanese Corporation

- Allnex

- Dow

- Eastman Chemical

- Evonik Industries AG

- Huntsman Corporation

- Lanxess AG

- Momentive Performance Materials, Inc.

- W.R. Grace, et al.

- Cathay Industries

- Heubach Group

- Arkema Inc.

- Covestro

- DIC Corporation

- Cabot Corporation

- Matsuo Sangyo Co., Ltd.

- Altana AG

- Nouryon

- Other Key Players