Global Coated Glass Market By Coating Type (Hard, Soft), By Application (Architecture, Automotive, Optical, Other applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 62720

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

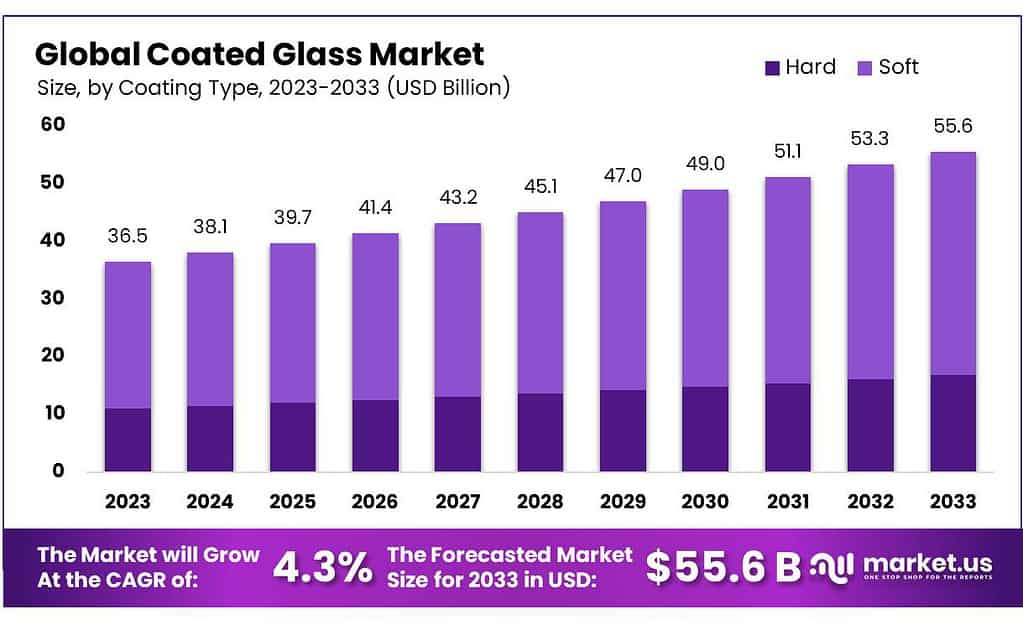

The Coated Glass Market size is expected to be worth around USD 55.6 billion by 2033, from USD 36.5 Bn in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

Market growth is predicted to be boosted by the increasing use of green buildings, the need for energy efficiency improvements, and increased awareness. Coated glass is used for commercial and residential buildings to keep the interior rooms cool and let in maximum light.

Coated glass reduces the need for air conditioning by reflecting infrared energy. The product can also be used in colder areas to maintain room temperature. The market will benefit from the U.S. construction industry’s growth.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth: The Coated Glass Market is projected to expand from USD 36.5 billion in 2023 to approximately USD 55.6 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 4.3%.

- Driving Factors: Increased emphasis on energy efficiency, especially in green buildings, along with growing awareness, boosts market growth. The construction industry’s expansion, utilizing coated glass for energy-saving benefits, also contributes significantly.

- Coating Types: Soft coatings dominated the market in 2023, capturing over 69.8% share due to their versatility and extensive application across various industries.

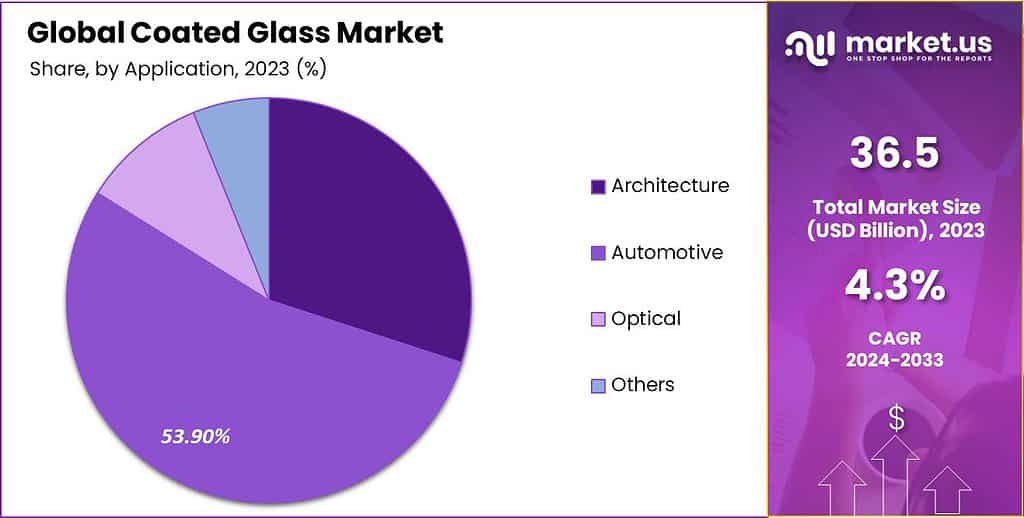

- Applications: The architecture segment led in 2023, claiming 53.9% of the market share. Coated glass is favored for its energy efficiency, aesthetics, and structural reinforcement in architectural designs.

- Market Challenges: High manufacturing costs, especially in float glass production, pose a significant challenge. These costs involve raw materials, energy consumption, labor, and overheads.

- Opportunities: The rise in solar capacity globally, escalating demands in sectors like solar panels and construction, particularly in Europe with its focus on green construction, presents significant growth opportunities.

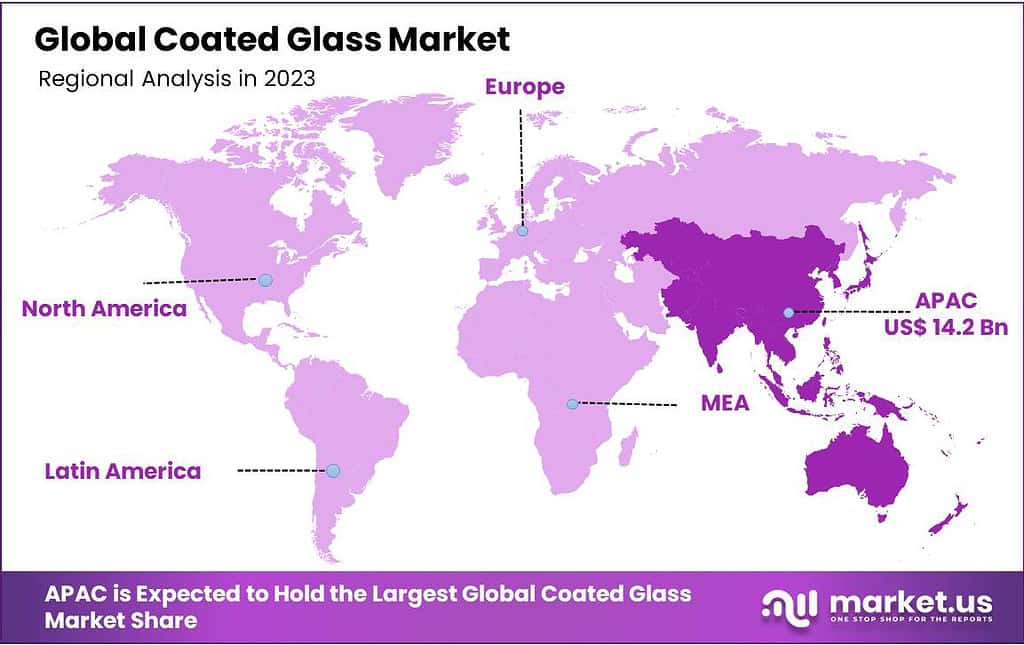

- Regional Analysis: Asia Pacific held the largest revenue share in 2023 at over 38.9%, with countries like China, South Korea, and Japan playing pivotal roles. Europe is expected to grow at a CAGR of 10.3% between 2022 and 2032.

- Key Players: Leading participants in the market include Guardian Industries, Euroglass, AGC Inc., China Glass Holding, Ltd., among others.

Coating Glass Analysis

In 2023, Soft coatings emerged as the frontrunner in the Coated Glass market, capturing a commanding share of over 69.8%. These coatings hold a significant edge due to their versatile nature, finding extensive applications across diverse industries.

Soft coatings offer a flexible and adaptable solution, making them highly sought-after in architectural designs, automotive glazing, and electronic displays. Their ability to cater to different needs within these sectors has positioned Soft coatings as a preferred choice, influencing their dominance within the market.

In colder areas, to retain heat inside the rooms, a sputtered coating can be applied to the outside of the room to reflect the heat. This type of glass can be used in any climate and is commonly found in double-glazed units. The air gap between the units allows for better heat insulation than single-pane windows.

Hard-coated glass does not require special handling or equipment. This product can be shipped using the same equipment for non-value-added float glass. This segment has seen significant growth due to its durability. This glass is heat-strengthened, laminated, and tempered, used for glazing purposes without worrying about losing its coating.

Application Analysis

In 2023, the Architecture segment claimed the largest market share within the Coated Glass market, surpassing others with a dominant 53.9% share. This prominent position underscores the substantial utilization of coated glass in architectural applications.

Architects and designers favor coated glass for its multifaceted advantages, including energy efficiency, aesthetic enhancements, and structural reinforcement. The versatility of coated glass allows its integration into various architectural designs, contributing significantly to modern construction projects across commercial and residential spaces.

Numerous governments across the globe are establishing new building codes to reduce the energy consumption of buildings. Low-E glass is an important technology because it reduces the emission of UV and IR. This allows for cooling of the building’s temperature and other architectures. This is a huge opportunity for market players.

From 2022 to 2032, the volume of the automotive segment is expected to grow at 4.2%. Automobile windshields are made of coated products, including Low-e glass. These products are used in automobile windshields to reduce AC usage, increase fuel efficiency, and lower carbon emissions. The government should also support the growth of coated glasses in the automotive industry.

Actual Numbers Might Vary in the Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Coating Type

- Hard

- Soft

By Application

- Architecture

- Automotive

- Optical

- Other applications

Drivers

The Coated Glass market is being significantly propelled by several key drivers. One notable factor is the surge in global solar capacity, emphasizing the increasing reliance on solar panels to generate electricity. Coated glass, particularly in solar panels with advanced nanocoatings, is witnessing substantial adoption.

The incorporation of nanomaterials renders these panels water-repellent, self-cleaning, and anti-reflective, ideal for areas experiencing frequent precipitation. As the solar industry expands due to technological advancements, environmental concerns, and decreasing solar system costs, the demand for coated glass within solar panel constructions is expected to surge. Coated glass acts as a protective barrier, influencing the efficiency and performance of solar photovoltaic systems, thereby becoming integral in enhancing their output.

Additionally, the growth of the Building and Construction industry stands as a significant driver for the Coated Glass market. Coated glass finds extensive usage in buildings for facades, windows, and partitions, offering energy-saving benefits by reducing heating and air conditioning expenses.

The global focus on enhancing building energy efficiency, with buildings accounting for a substantial share of global energy consumption, intensifies the demand for coated glass. With the increasing implementation of energy-efficient building regulations globally, especially evident in China’s stringent standards since 2003, the market for coated glass, particularly low-e glasses, continues to witness substantial growth prospects.

Overall, the Coated Glass market is witnessing a notable upward trajectory, primarily driven by the expanding solar capacity and the building and construction industry’s emphasis on energy efficiency, augmented by stringent global regulations and technological advancements. These factors collectively contribute to the rapid expansion and promising future outlook of the coated glass market.

Restraints

The Coated Glass market faces a significant restraint due to the high manufacturing costs associated with its production. The primary production method for coated glass involves the use of float glass, where over 90% of the world’s flat glass is manufactured through the float glass method.

However, establishing and operating float glass facilities require substantial initial investments, making them cost-intensive endeavors. For these facilities to be profitable, they need to operate at over 70% capacity utilization, adding pressure to maintain high production levels.

The cost structure of float glass production involves various elements such as raw materials, energy consumption, labor wages, overheads, transportation, and depreciation. Notably, the expenses incurred in raw materials and energy consumption contribute significantly to the overall production costs.

Melting and refining processes during float glass manufacturing account for the highest costs, consuming approximately 60-70% of the total energy utilized in the glass production process. These energy-intensive processes primarily rely on fossil fuels or electricity to power the furnaces.

While ongoing research and development endeavors aim to reduce energy consumption in glass manufacturing, energy expenses continue to constitute a substantial portion of the overall production costs. Mitigating these high manufacturing costs poses a challenge, impacting the Coated Glass market’s growth trajectory despite the burgeoning demand driven by the construction industry and solar sector.

Opportunities

The Coated Glass market is poised for significant opportunities driven by new capacity expansions and escalating demands in various sectors. The rise in solar capacity globally, coupled with the increasing adoption of floating solar farms, stands as a promising avenue for amplified demand in solar panels, subsequently driving the need for coated glass.

Europe has particularly witnessed substantial growth in floating solar farms, with large-scale installations like the Queen Elizabeth II reservoir’s project, encompassing nearly 23,000 solar panels, contributing to the surge in coated glass demand. Moreover, infrastructure developments like the expansion of Philadelphia International Airport’s Terminal F have further propelled the need for coated glass, as seen in the fabrication of approximately 3,800 square feet of coated glass by architectural glass fabricators like J.E. Berkowitz.

European nations’ construction sectors, led by the UK, are projected to experience robust expansion. According to projections, Britain may become Europe’s dominant construction market by 2030 after outstripping Germany owing to government-backed megaprojects designed to stimulate this industry.

Initiatives like the expansion of Heathrow Airport, emphasizing vast glass expanses and eco-friendly spaces, signal a favorable landscape for the coated glass market in Europe. The increasing focus on environmental concerns within building activities is expected to drive further demand for coated glass, positioning it as a crucial component in construction projects, thereby boosting the global coated glass market in the forthcoming years.

Challenges

Navigating the Coated Glass market can present unique obstacles, despite its attractive growth prospects. One notable difficulty faced by manufacturers lies within technological restrictions and complexity involved with advanced coatings; particularly those tailored for specific functionalities like self-cleaning, antireflective and energy efficiency properties require considerable research, development and implementation efforts from manufacturers to be fully implemented successfully.

Manufacturers face considerable technical hurdles as they attempt to produce coatings that meet rigorous quality standards while meeting various application needs – an impressive technical feat in itself!

Coated Glass Market Faces Obstacles Related to Regulatory Compliance and Environmental Standards The market faces additional barriers related to regulatory compliance and environmental standards, specifically evolving regulatory requirements across different regions requiring constant adaptation and compliance; additionally, stringent environmental regulations designed to reduce carbon footprints while encouraging sustainable manufacturing present coated glass producers with challenges when it comes to maintaining eco-friendly processes while remaining cost-effective.

Fluctuations in raw material prices and energy resources pose ongoing difficulties to industry operations costs, particularly energy-intensive processes for glass manufacturing combined with fluctuating raw material costs affecting overall expenses and profitability.

Retaining cost competitiveness while mitigating fluctuating resource costs remains an enormous challenge to market players. Though the Coated Glass market offers significant potential across sectors like solar and construction, its sustainable expansion faces formidable hurdles due to technological complexity, stringent regulations, fluctuating raw material costs, and production cost management issues.

Geopolitical and Recession Impact Analysis

Geopolitical Impact on the Coated Glass Market

When countries have disagreements or trade problems, they might put taxes or restrictions on the materials used to make coated glass. This can make it tough to get these materials, become more expensive, and disrupt how they’re made and shipped.

Sometimes, the rules about how these materials should be used can change because of big political shifts. This might mean companies have to change how they make coated glass and follow new rules, which can be a bit tricky.

If the places that need these materials have issues like fights or problems, it can be challenging for companies to grow there. Also, if there are arguments about where to get these materials, it can create problems for making the glass and being good for the environment.

Recession Impact on the Coated Glass Market

When the economy isn’t doing well, people might spend less on things like coated glass, even though it’s important. They might choose other options to save money, which can lower the demand for these glass types.

Because everyone’s careful with money, they’ll pay closer attention to how much these glasses cost. Companies might need to rethink their prices to keep up with the competition and keep selling.

When times are tough, it can mess up how these glasses are made and sent out. If the companies making them or sending them to stores have money problems, it could slow down making and getting these glasses. Also, people might care more about the environment when money’s tight. They might prefer glasses that are better for the planet and make less waste.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 38.9% in 2023. South Korea, China, and Japan are all important markets in the Asia Pacific. Developing economies like India and Thailand, as well as Southeast Asian countries like Indonesia and Thailand, have enormous potential. Rising economic growth, disposable income, and increased investment in EVs, solar installations, and housing construction in these countries are all contributing to market growth.

Automobile production is expected to rise significantly in the Asia Pacific region. Even though coated glass products in the automotive industry have not increased. Automakers, particularly luxury vehicles, are beginning to incorporate these products into their vehicles. Cost advantages in Asian countries, such as China, can help boost vehicle production.

Between 2022 and 2032, the coated glass market in Europe is expected to grow at a 10.3 % compound annual growth rate (CAGR). A particular focus on green construction in Europe is expected to boost the market’s growth. Heating and cooling, insulation, and lighting are three key focus areas in Europe’s green construction sector. Low-E solar control glass is used in high-efficiency buildings. The heat is reflected through the windows, and cool air is provided for ventilation in the summer.

Actual Numbers Might Vary in the Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Guardian Industries, for instance, expects to see its highest growth in value-added product sales shortly. Euroglass., AGC Inc., and China Glass Holding, Ltd. were among the most appealing participants on the market in 2023.

Energy efficiency has been the driving force behind innovation in coated glass manufacturing in the last five years. This innovation has been driven by the evolution of building codes and energy conservation programs.

Further, building owners have a legitimate aspiration for environmentally friendly and energy-saving products. This will drive the demand for energy-saving products such as Low-E coated glasses. Here are some of the major players in the global market for coated glass:

Маrkеt Кеу Рlауеrѕ

- China Glass Holding, Ltd.

- AGC Inc.

- Euroglass

- Guardian Industries

- Central Glass Co. Ltd.

- Fuyao Glass Industry Group Co. Ltd.

- Other Key Players

Recent Developments

Guardian Industries, for instance, expects to see its highest growth in value-added product sales shortly. Euroglass., AGC Inc., and China Glass Holding, Ltd. were among the most appealing participants on the market in 2023.

Report Scope

Report Features Description Market Value (2023) US$ 36.5 Bn Forecast Revenue (2033) US$ 55.6 Bn CAGR (2023-2032) 4.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Coating Type(Hard, Soft), By Application(Architecture, Automotive, Optical, Other applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape China Glass Holding, Ltd., AGC Inc., Euroglass, Guardian Industries, Central Glass Co. Ltd., Fuyao Glass Industry Group Co. Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is coated glass?Coated glass is regular glass that has been treated with special coatings to enhance its properties. These coatings can offer benefits like energy efficiency, improved durability, or aesthetic enhancements.

Where is coated glass used?It's used in various industries such as construction, automotive, electronics, and solar power. In buildings, it can enhance insulation and reduce energy consumption, while in automotive applications, it improves visibility and safety.

What types of coatings are applied to glass?Coatings include low-emissivity (low-E) coatings that reduce heat transfer, reflective coatings for solar control, anti-reflective coatings for enhanced visibility, and hydrophobic coatings to repel water and dirt.

-

-

- China Glass Holding, Ltd.

- AGC Inc.

- Euroglass

- Guardian Industries

- Central Glass Co. Ltd.

- Fuyao Glass Industry Group Co. Ltd.

- CEVITAL GROUP

- Central Glass

- Wattanachai Safety Glass

- PMK-Diamond Glass

- Other Key Players