Global Cloud VPN Services Market Size, Share and Growth Report By Connectivity Type (Site-to-Site VPN, Remote Access VPN), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare, Retail & E-commerce, Government & Public Sector, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2026-2035

- Published date: Dec. 2025

- Report ID: 171457

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Quick Market Facts

- Role of Generative AI

- U.S. Market Size

- Connectivity Type Analysis

- Deployment Model Segment Analysis

- Organization Size Analysis

- End-User Industry Analysis

- Increasing Adoption Technologies

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

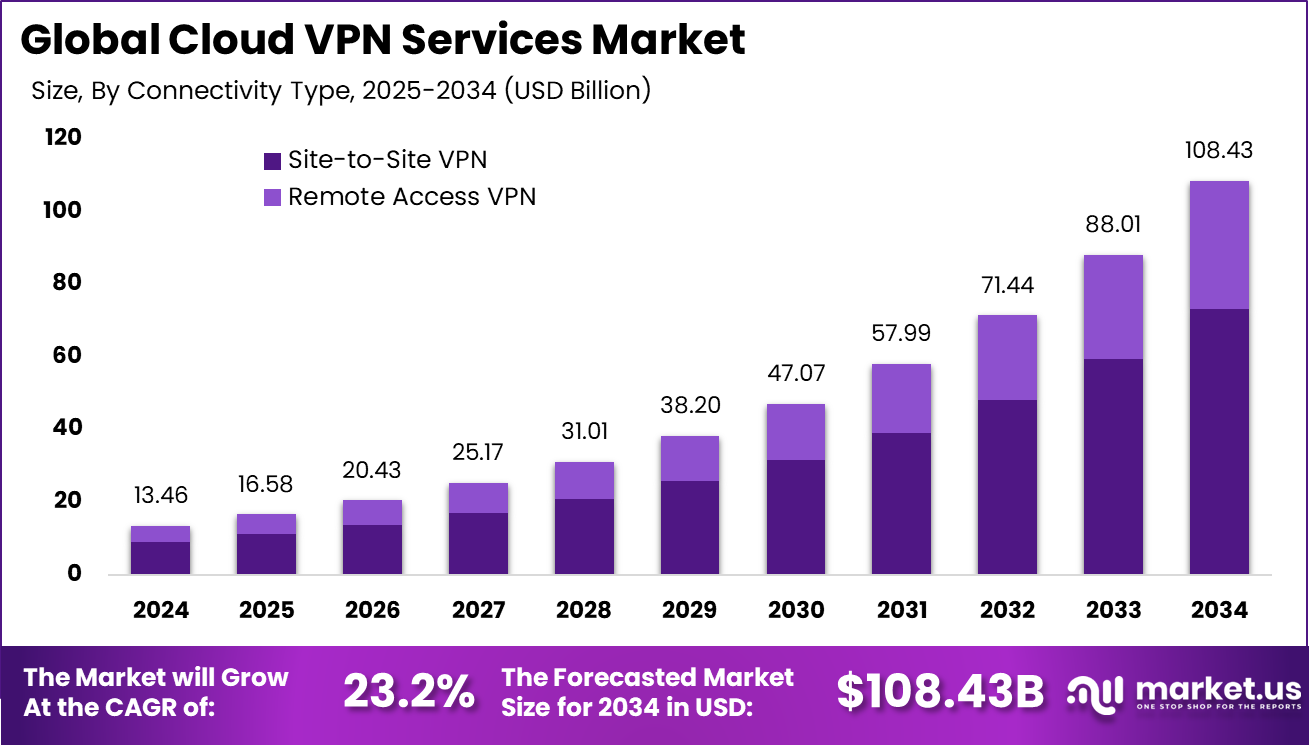

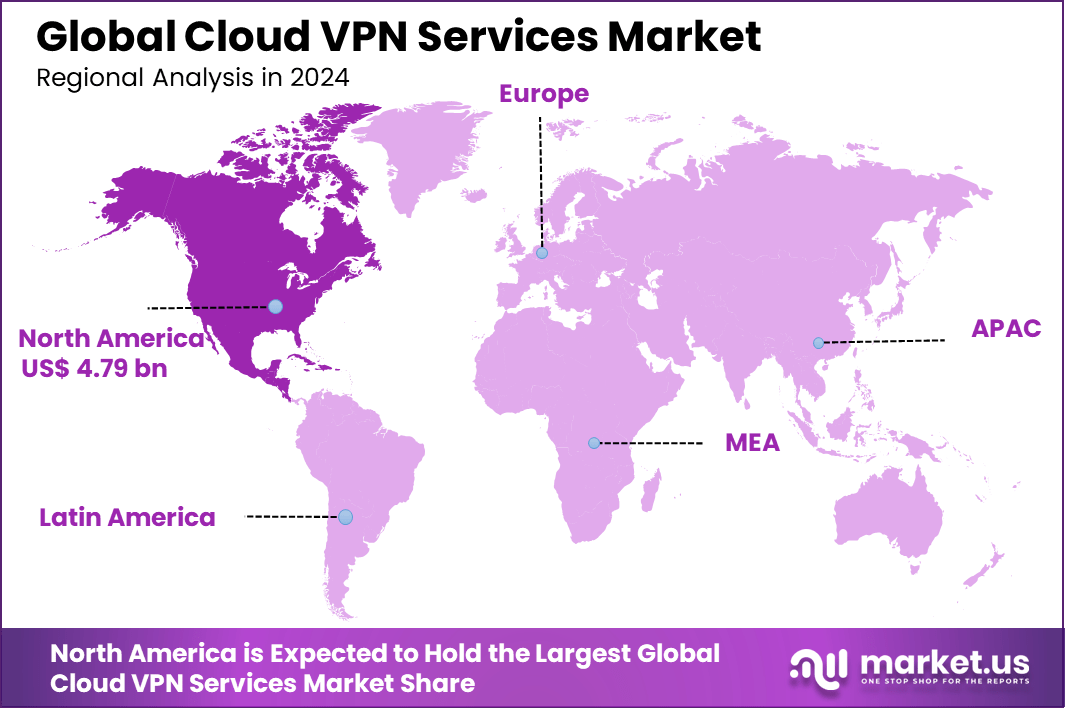

The Global Cloud VPN Services Market size is expected to be worth around USD 108.43 billion by 2034, from USD 13.46 billion in 2024, growing at a CAGR of 23.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 35.6% share, holding USD 4.79 billion in revenue.

The Cloud VPN Services Market is defined by the delivery of virtual private network (VPN) services through cloud-based infrastructure to secure data transmission and remote access for users and networks. These services create encrypted connections over public and private networks, facilitating secure access to corporate and cloud resources regardless of location. Growth of the market has been driven by rising needs for secure connectivity and the shift toward cloud and hybrid work models.

The demand for cloud VPN solutions has been propelled by the increasing prevalence of remote and hybrid work arrangements, which require secure access to enterprise systems from varied locations. Cybersecurity concerns, including the protection of sensitive data and prevention of breaches, have reinforced the importance of encrypted network connections.

Moreover, accelerated migration to cloud computing and digital transformation initiatives has necessitated robust security frameworks that integrate seamlessly with cloud environments. For instance, in October 2025, Juniper Networks, Inc., enhanced Security Director Cloud with VPN profile grouping for site-to-site and hub-and-spoke IPsec deployments across SRX firewalls. This simplifies scaling Cloud VPNs for service providers, cutting repetitive config work in multi-site setups.

Enterprise adoption of cloud VPN services is largely influenced by the imperative to support distributed workforces and protect corporate infrastructure. Industries with stringent regulatory requirements such as finance, healthcare, and government have shown particular demand due to compliance and data privacy obligations. Growth in internet usage and cloud application reliance has reinforced the need for secure network tunnels to protect data in transit.

Key Takeaway

- Site-to-site VPN dominated connectivity with a 67.4% share, as enterprises prioritize secure links between offices, data centers, and cloud environments.

- Public cloud deployment led with 71.6%, reflecting preference for scalable, centrally managed VPN services that reduce infrastructure overhead.

- Large enterprises accounted for 58.9%, driven by complex network architectures and higher security and compliance requirements.

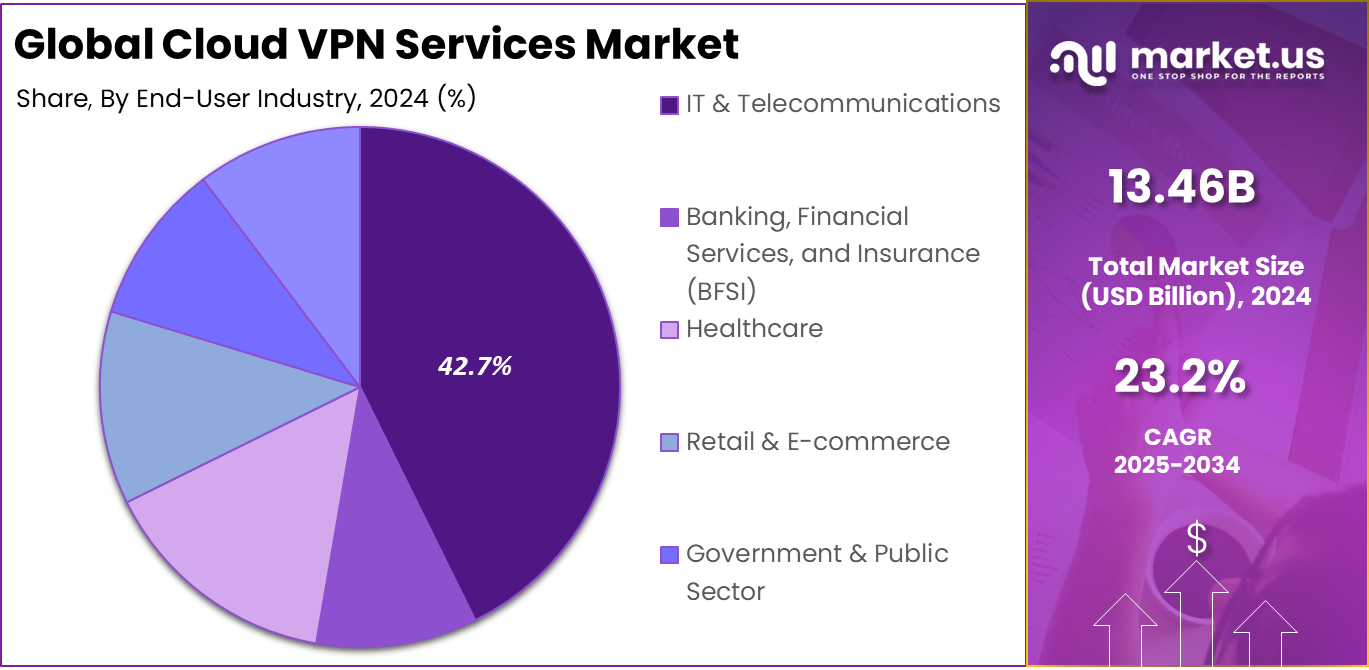

- IT and telecommunications captured 42.7%, supported by continuous network operations and strong demand for secure remote access.

- North America held a 35.6% share, backed by advanced cloud adoption and strong cybersecurity spending.

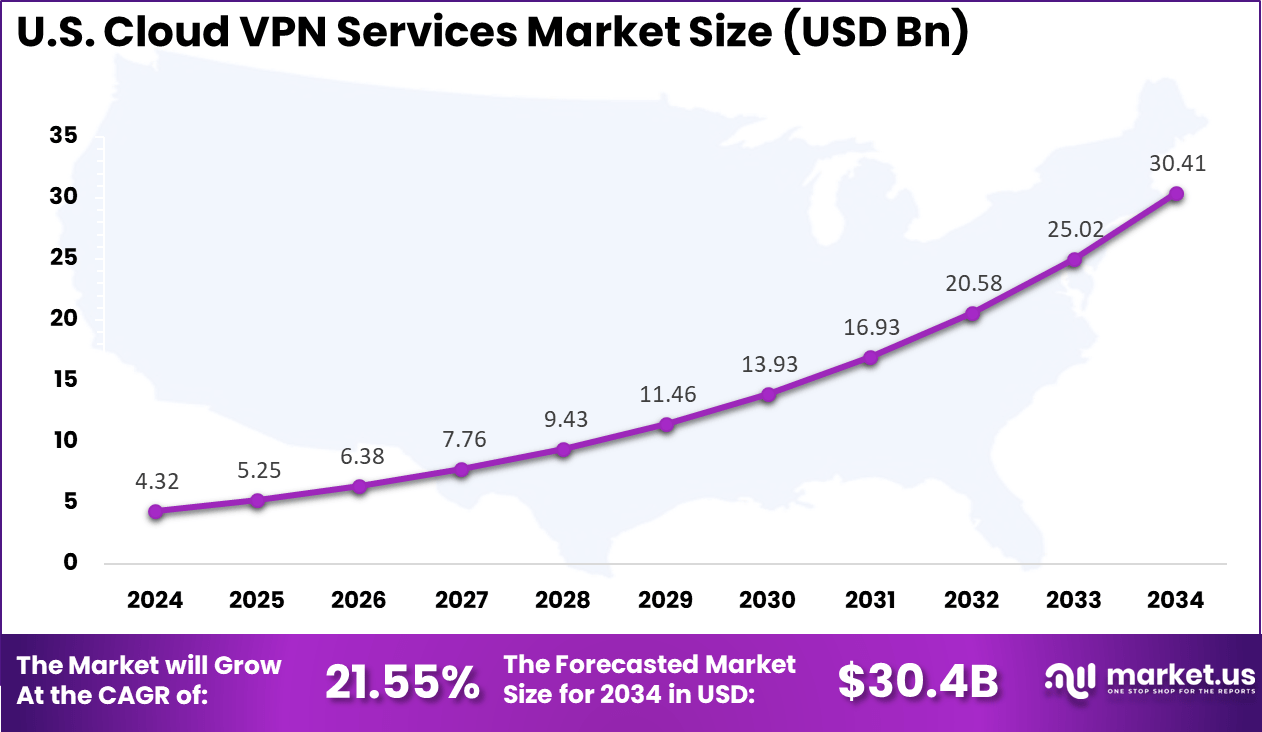

- The U.S. market reached USD 4.32 billion in 2024 and is expanding at a 21.55% CAGR, driven by cloud migration, remote work adoption, and rising security needs.

Quick Market Facts

Key Performance and Usage Metrics

- High availability VPN services now deliver 99.99% uptime, offering stronger reliability compared to classic gateways that typically operate at 99.9% service availability.

- VPN usage is highest on smartphones at 64% and laptops or PCs at 62%, reflecting demand for secure access across both mobile and desktop environments.

- Among mobile VPN users, 52% rely on iOS devices, while 37% use Android, indicating stronger adoption within premium mobile ecosystems.

- The leading barrier to VPN adoption remains lack of perceived need at 59%, followed by concerns around cost at 22% and technical setup complexity at 21%.

Enterprise vs. Personal Trends

- Enterprise usage is widespread, with 93% of organizations using VPNs to protect remote access and distributed workforces.

- Security concerns remain high, as 92% of organizations worry about ransomware exposure through VPN connections.

- A strategic shift is underway, with 65% of enterprises planning to move toward zero trust network access models by late 2025.

- In the personal user segment, nearly 50% depend solely on free VPN services despite known limitations.

- Performance dissatisfaction is common, with 60% of free VPN users reporting issues such as slow speeds and intrusive advertising.

- IT and telecommunications account for the largest industry share at 28.7%, reflecting high reliance on secure connectivity.

- Healthcare shows the fastest adoption momentum, with a 24.5% growth rate driven by expanded telehealth usage and remote clinical access.

Role of Generative AI

Generative AI plays a key part in strengthening cloud VPN security by predicting and blocking threats faster than traditional methods. Organizations note a 56% improvement in their security setup when using these AI tools, as they analyze past incidents to spot risks early and respond in real time.

This shift helps VPNs adapt to new attack patterns without constant human input, keeping networks safer during high-traffic periods. Providers build models that learn from data flows, cutting detection times and reducing false alarms effectively.

Beyond defense, generative AI fine-tunes VPN performance by managing traffic and resources on the fly. It forecasts demand peaks and reroutes connections to avoid slowdowns, ensuring smooth operation even under heavy loads. Tests show these systems achieve high accuracy in threat assessment, making VPNs more reliable for daily use. This approach lets teams focus on core tasks while AI handles the background adjustments seamlessly.

U.S. Market Size

The market for Cloud VPN Services within the U.S. is growing tremendously and is currently valued at USD 4.32 billion, the market has a projected CAGR of 21.55%. The market is growing due to rising remote work demands that require secure access to corporate networks from anywhere.

Businesses face increasing cyber threats, pushing the adoption of encrypted tunnels for data protection. Cloud migration accelerates as firms link on-premises systems to public infrastructures seamlessly. Strict regulations like zero-trust mandates further drive uptake among enterprises handling sensitive information.

For instance, in September 2025, Fortinet, Inc. advanced its Secure SD-WAN and FortiClient VPN offerings with crypto-agile protections amid global brute-force waves targeting SSL VPNs. Holding strong North American enterprise adoption, Fortinet’s integrated security fabric maintains high margins and rapid threat mitigation, exemplifying U.S. leadership in resilient cloud VPN deployments.

In 2024, North America held a dominant market position in the Global Cloud VPN Services Market, capturing more than a 35.6% share, holding USD 4.79 billion in revenue. This dominance is due to early cloud adoption by businesses seeking secure remote access amid rising cyber risks.

Strict data protection laws push enterprises to deploy encrypted connections for compliance. Widespread remote work trends demand reliable links between offices and cloud setups. Advanced IT infrastructure supports quick scaling, while telecom growth fuels high-traffic VPN needs across sectors.

For instance, In December 2025, Google Cloud VPN introduced predefined monitoring dashboards in the Cloud console to provide project wide system health and tunnel performance insights. The update simplifies diagnostics and improves operational efficiency, reinforcing Google Cloud’s strength in North American cloud VPN deployments.

Connectivity Type Analysis

Site-to-site VPN accounts for 67.4%, showing its strong role in connecting multiple business locations securely. This connectivity type allows organizations to link branch offices, data centers, and cloud environments through encrypted tunnels. It supports continuous and secure data exchange between fixed locations. Many enterprises rely on this model for stable network communication.

The dominance of site-to-site VPN is driven by growing multi-location operations. Enterprises prefer this approach to maintain centralized control over network traffic. It also reduces exposure to external threats across distributed environments. These benefits support long-term adoption.

For Instance, in June 2025, Cisco Systems, Inc. launched a simplified site-to-site VPN wizard in its Security Cloud Control platform. This tool makes setup faster for businesses linking multiple offices securely over the internet. Teams now configure encrypted tunnels with fewer steps, cutting deployment time and errors in hybrid networks.

Deployment Model Segment Analysis

In 2024, Public cloud deployment holds 71.6%, reflecting strong preference for cloud-based VPN services. Organizations use public cloud VPNs to secure access to applications and data hosted on shared cloud platforms. This model offers flexibility and quick deployment. It also supports remote access across geographies.

Growth in public cloud VPN usage is driven by rapid cloud migration. Enterprises benefit from lower infrastructure costs and scalable security services. Public cloud VPNs allow faster expansion without heavy setup. These advantages continue to support demand.

For instance, in October 2025, Palo Alto Networks, Inc., enhanced BGP and OSPF features in Strata Cloud Manager for public cloud VPN. Advanced routing options like authentication and aggregation improve traffic handling across public infrastructures. Organizations manage global connections more efficiently without on-site hardware.

Organization Size Analysis

In 2024, Large enterprises represent 58.9%, highlighting their higher reliance on cloud VPN services. These organizations manage large workforces and complex IT environments. Secure connectivity is critical for daily operations. VPN services help protect sensitive enterprise data.

Adoption among large enterprises is driven by advanced security policies and compliance needs. Cloud VPNs provide centralized control and monitoring. They also support secure access for remote and hybrid work models. This strengthens enterprise-level adoption.

For Instance, in July 2025, Google LLC expanded zero-trust security in Google Cloud VPN at Cloud Next. Large enterprises use IAM tools for verified access in multi-site setups, securing data across vast networks. This fits complex operations with remote teams needing constant protection.

End-User Industry Analysis

In 2024, The IT and telecommunications sector holds 42.7%, making it the largest end-user industry. These organizations handle high volumes of data and network traffic. Secure connectivity is essential for service delivery and infrastructure management. VPN services help protect internal and external communications.

Demand in this sector is driven by network complexity and service reliability needs. Cloud VPNs support secure management of distributed systems. They also enable controlled access to critical network resources. Reliability remains a key requirement.

For Instance, in September 2025, Juniper Networks, Inc. updated cloud VPN routing for telecom infrastructures. Enhanced protocols handle 5G device surges, providing encryption for data centers and user access. Sector leaders deploy faster with reduced downtime in evolving networks.

Increasing Adoption Technologies

Technologies supporting cloud VPN adoption include advanced encryption standards, multi-factor authentication, and integration with secure access service edge (SASE) frameworks, which unify network and security services. Cloud-native orchestration and management tools allow for scalable deployment across public, private, and hybrid cloud environments.

Increasing use of remote access protocols and mobile device management solutions further enables enterprise connectivity and user flexibility. Together, these innovations enhance performance, security, and ease of management for cloud VPN services. Organizations prioritize cloud VPN solutions to ensure secure remote access for employees and partners while maintaining operational efficiency.

Data protection is a compelling reason, as encrypted tunnels reduce the risk of interception during transmission over public networks. Adoption is also motivated by regulatory compliance requirements that mandate secure handling of sensitive information. In addition, cloud-based deployment simplifies maintenance and reduces dependency on on-premise hardware.

Emerging Trends

Emerging trends in the Cloud VPN Services Market reflect ongoing innovation in encryption, authentication, and security protocols that enhance connectivity and data protection. Advanced encryption standards and sophisticated authentication mechanisms are being implemented to address evolving cybersecurity threats and strengthen secure access.

These trends also include tighter integration with cloud-native platforms and secure access frameworks to support seamless connectivity across distributed environments. Such developments indicate a shift toward more resilient and adaptive VPN solutions tailored for modern infrastructure. Another emerging trend involves the incorporation of artificial intelligence and analytics to optimize performance and detect anomalies in real time.

AI-enabled features are increasingly influencing service offerings, providing automated threat identification and response capabilities. Additionally, managed and scalable VPN services are gaining traction, particularly among small and medium enterprises that seek simplified security operations. These shifts demonstrate the market’s orientation toward more intelligent, efficient, and user-centric VPN services.

Growth Factors

The primary growth factor for the cloud VPN market is the widespread adoption of remote work and hybrid work models that require secure remote access to enterprise networks. As more organizations support distributed workforces, the demand for encrypted connectivity solutions rises, reinforcing the relevance of cloud-based VPN solutions. This structural change in work patterns has significantly expanded the need for scalable and secure access technologies.

Another key driver is the increasing concern over data privacy and cybersecurity threats that compel organizations to strengthen network defenses. The rise in cyberattacks and data breaches has underscored the importance of secure communication channels, stimulating investments in cloud VPN services. Growth in cloud computing adoption also contributes to market expansion, as businesses migrating applications and workloads to the cloud seek cohesive security frameworks that include virtual private networks.

Key Market Segments

By Connectivity Type

- Site-to-Site VPN

- Remote Access VPN

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail & E-commerce

- Government & Public Sector

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Multi-Cloud Adoption Surge

Enterprises are increasingly adopting multi cloud strategies to improve performance, cost control, and resilience, which is driving demand for secure and flexible network connectivity. Cloud VPN solutions enable encrypted connections across different cloud environments, allowing organizations to scale quickly and manage workloads without complex reconfiguration or latency issues.

The adoption of SD WAN and virtualized security tools further supports this shift by improving bandwidth efficiency and reducing reliance on hardware heavy networks. Multi cloud VPNs provide greater control over traffic flow, lower vendor lock in, and stronger network agility, helping enterprises adapt infrastructure to changing application needs.

For instance, In July 2025, Google introduced Cloud WAN to replace traditional MPLS with managed site to site connectivity on its global infrastructure. Features such as Cross Site Interconnect and Premium Tier routing support secure, low latency multi cloud architectures, highlighting the industry move toward agile and software driven WAN models.

Restraint

High Setup Costs

High implementation costs remain a key challenge for cloud VPN adoption, especially for smaller organizations. Deploying secure connections across multiple cloud environments requires spending on licenses, skilled personnel, and training, while growing user bases and complex traffic patterns increase operational expenses. Frequent scaling needs can further strain limited IT budgets and delay adoption decisions.

Ongoing maintenance, security updates, and compliance management add to long term costs, creating pressure as cloud environments evolve. In March 2025, Check Point enhanced its CloudGuard site to site VPN for Azure Virtual WAN, enabling direct on premises connectivity without separate VPN gateways. This approach simplifies routing, reduces manual effort, and helps enterprises lower operating costs in complex cloud networks.

Opportunities

Regulatory Compliance Push

Rising global data protection regulations are creating strong opportunities for cloud VPN providers, as enterprises need secure and compliant cross border connectivity. Cloud VPNs enable encrypted data transfer across multi cloud environments while supporting compliance with frameworks such as GDPR and CCPA. This makes them essential for organizations handling sensitive data and operating across jurisdictions.

Growing IoT adoption is further accelerating demand, as connected devices require secure and policy driven access to cloud platforms. Providers that offer built in compliance controls and seamless IoT integration are well positioned to expand in regulated sectors such as finance, healthcare, and manufacturing.

In December 2025, Microsoft Azure upgraded its VPN Gateway with higher throughput and expanded ExpressRoute limits to support large scale hybrid networking. Enhanced Route Server capabilities improved hub and spoke connectivity, enabling secure and compliant multi cloud interoperability for regulated workloads.

Challenges

Zero-Trust Shift

The shift toward zero trust security models is challenging the relevance of traditional VPN architectures. Zero trust frameworks continuously verify users and devices, reducing reliance on broad network tunnels and lowering exposure to credential based attacks. As enterprises adopt application level access controls, VPN providers are being pushed to adapt their offerings to security stacks that prioritize granular identity verification.

Multi cloud environments add further pressure by introducing latency, interoperability, and patch management challenges that legacy VPNs were not designed to address. Ensuring consistent performance across platforms requires frequent updates and real time visibility, increasing operational complexity. In December 2025, credential spraying attacks on VPN gateways highlighted these risks, accelerating enterprise moves toward ZTNA models that favor app specific access over traditional VPN tunnels.

Key Players Analysis

Cisco, Microsoft, Google, Amazon Web Services, Palo Alto Networks, and Check Point lead the cloud VPN services market with secure, scalable connectivity solutions for remote users and distributed enterprises. Their platforms support encrypted tunnels, identity based access, and seamless integration with cloud workloads. These companies focus on performance, reliability, and strong security controls. Rising remote work and cloud adoption continue to reinforce their leadership.

Fortinet, Citrix, Juniper Networks, Huawei, Oracle, and IBM strengthen the market with enterprise grade VPN services integrated into broader networking and cloud security portfolios. Their solutions support hybrid cloud environments, branch connectivity, and centralized policy management. These providers emphasize high availability, traffic optimization, and compliance readiness.

Zscaler, Perimeter 81, OpenVPN, and other players expand the landscape with cloud native and zero trust oriented VPN alternatives. Their offerings focus on simplified deployment, user centric access, and reduced reliance on traditional perimeter models. These companies serve organizations seeking flexible and cost efficient secure connectivity.

Top Key Players in the Market

- Cisco Systems, Inc.

- Microsoft Corporation

- Google LLC (Google Cloud VPN)

- Amazon Web Services, Inc. (AWS VPN)

- Palo Alto Networks, Inc.

- Check Point Software Technologies, Ltd.

- Fortinet, Inc.

- Citrix Systems, Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Oracle Corporation (Oracle Cloud Infrastructure VPN)

- IBM Corporation

- Zscaler, Inc.

- Perimeter 81, Ltd.

- OpenVPN, Inc.

- Others

Recent Developments

- In April 2025, Fortinet, Inc. earned the 2025 Google Cloud Technology Partner of the Year award for its FortiGate VM next-generation firewall, which strengthens Cloud VPN deployments with scalable, integrated security across hybrid clouds. This recognition highlights Fortinet’s role in helping enterprises secure multi-cloud connections seamlessly.

- In November 2025, Amazon Web Services, Inc. launched VPN Concentrator for Site-to-Site VPN, enabling up to 100 low-bandwidth remote sites to connect efficiently via a single Transit Gateway attachment. The feature cuts costs and simplifies management for distributed enterprises scaling VPN access.

Report Scope

Report Features Description Market Value (2024) USD 13.4 Bn Forecast Revenue (2034) USD 108.4 Bn CAGR(2025-2034) 23.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Connectivity Type (Site-to-Site VPN, Remote Access VPN), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare, Retail & E-commerce, Government & Public Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., Microsoft Corporation, Google LLC (Google Cloud VPN), Amazon Web Services, Inc. (AWS VPN), Palo Alto Networks, Inc., Check Point Software Technologies, Ltd., Fortinet, Inc., Citrix Systems, Inc., Juniper Networks, Inc., Huawei Technologies Co., Ltd., Oracle Corporation (Oracle Cloud Infrastructure VPN), IBM Corporation, Zscaler, Inc., Perimeter 81, Ltd., OpenVPN, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cisco Systems, Inc.

- Microsoft Corporation

- Google LLC (Google Cloud VPN)

- Amazon Web Services, Inc. (AWS VPN)

- Palo Alto Networks, Inc.

- Check Point Software Technologies, Ltd.

- Fortinet, Inc.

- Citrix Systems, Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Oracle Corporation (Oracle Cloud Infrastructure VPN)

- IBM Corporation

- Zscaler, Inc.

- Perimeter 81, Ltd.

- OpenVPN, Inc.

- Others