Global Cloud Billing Market By Component (Platform, Services), By Billing Type (Subscription, Usage Based, One-Time, Others), By Service Model (IaaS, PaaS, SaaS), By Deployment Type (Private Cloud, Public Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small & Medium), By Industry Vertical (BFSI, IT & Telecommunication, Retail, Healthcare, Media and Entertainment, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 114737

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

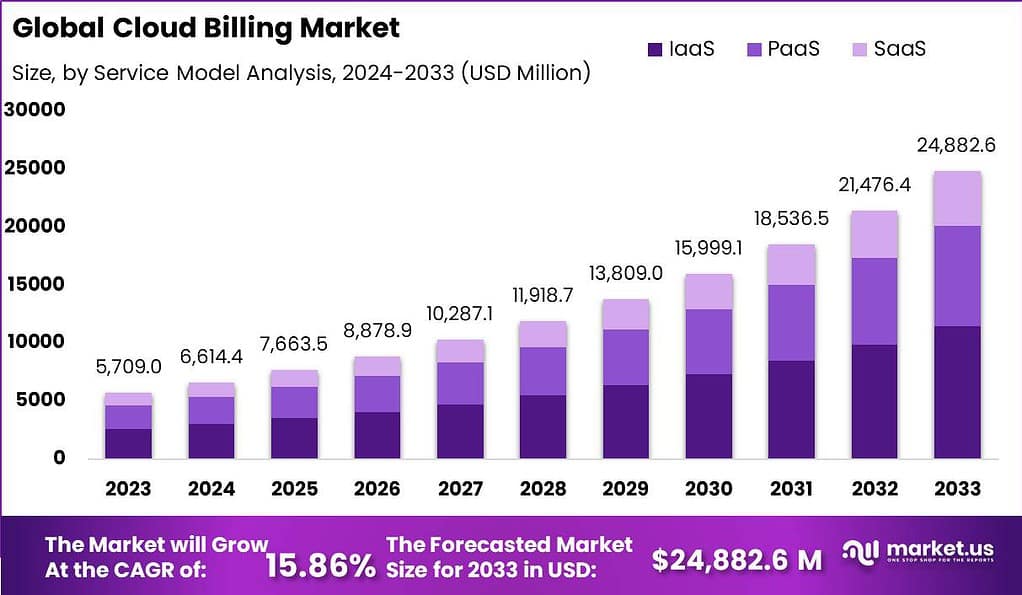

The Global Cloud Billing Market size is expected to be worth around USD 24,882.6 Million by 2033, from USD 5,709.0 Million in 2023, growing at a CAGR of 15.86% during the forecast period from 2024 to 2033.

Cloud billing refers to the process of generating and managing invoices for cloud-based services and resources. As organizations increasingly adopt cloud computing, they require efficient and accurate systems to track and bill for the usage of cloud resources such as virtual machines, storage, and network bandwidth.

The cloud billing market, encompassing solutions and services that enable enterprises to generate bills from the resource usage data provided by cloud services, is witnessing significant growth. This expansion can be attributed to the increasing adoption of cloud services across various industries, driven by the need for cost-efficient billing solutions, enhanced scalability, and the flexibility to manage complex billing processes.

Cloud billing solutions integrate seamlessly with cloud platforms, offering features such as subscription management, usage-based billing, and real-time billing analytics. These capabilities facilitate improved financial management and customer relationship management for businesses. The market is further propelled by the rising trend of digital transformation, as companies seek to leverage cloud technologies to innovate their billing systems and enhance operational efficiencies.

The integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) into cloud billing solutions is also contributing to the market’s growth, enabling automated and error-free billing processes. As industries continue to migrate towards cloud-based infrastructures, the demand for cloud billing services is expected to rise, underscoring the market’s potential for substantial growth in the coming years.

According to analyst perspective, Zuora, a prominent player in the cloud billing space, secured an investment of $60 million through convertible notes in 2022, underscoring investor confidence in its subscription management services. Similarly, Aria Systems, known for its enterprise billing solutions, successfully raised $44 million in a Series E funding round in 2023, further exemplifying the strong investment appetite within the sector.

Subscription-centric companies have also garnered substantial attention, with Recurly securing $180 million in Series E funding in 2022, and Chargify being acquired by InvoiceCloud for $30 million, highlighting the growing importance of subscription models in the cloud billing domain.

Key Takeaways

- By 2033, the cloud billing market is expected to surpass USD 24,882.6 Million, marking a remarkable increase from USD 5,709 Million in 2023. These projections underscore the immense potential and attractiveness of cloud billing solutions for businesses worldwide.

- In 2023, the Platform segment held a dominant market position in the cloud billing market, capturing more than a 72.3% share.

- In 2023, the Usage-based segment held a dominant market position in the cloud billing market, capturing more than a 36% share.

- In 2023, the SaaS (Software as a Service) segment held a dominant market position in the cloud billing market, capturing more than a 46% share.

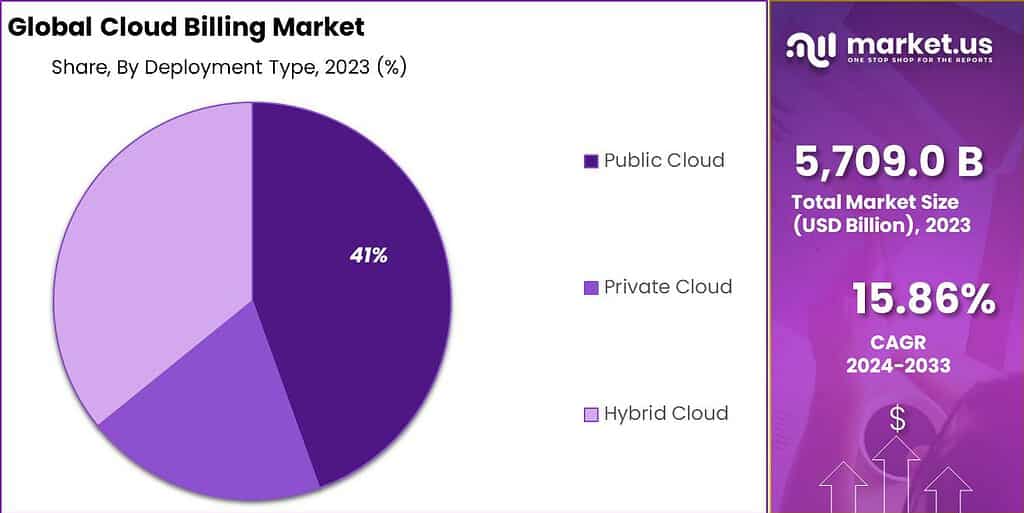

- In 2023, the Public Cloud segment held a dominant market position in the cloud billing market, capturing more than a 41% share.

- In 2023, the Large Organizations segment held a dominant market position in the cloud billing market, capturing more than a 63% share.

- In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the cloud billing market, capturing more than a 27% share.

Component Analysis

In 2023, the Platform segment held a dominant market position in the cloud billing market, capturing more than a 72.3% share. This significant market share can be attributed to the increasing adoption of cloud-based solutions across various industries, including telecommunications, IT, and e-commerce.

Platforms in cloud billing provide essential infrastructure for the automated management of billing processes, subscription management, and revenue management. The scalability and flexibility offered by cloud billing platforms enable businesses to efficiently manage their billing operations, accommodating a range of billing models such as subscription-based, usage-based, and a combination thereof.

The leading position of the Platform segment is further reinforced by the growing demand for cost-effective and efficient billing solutions. Cloud billing platforms offer a reduction in operational costs by minimizing the need for extensive on-premise hardware and software.

Moreover, these platforms enhance operational efficiency by automating routine billing tasks, reducing errors, and ensuring compliance with various financial regulations. The ability to integrate with other cloud services and legacy systems also contributes to the preference for cloud billing platforms, facilitating seamless operations and improved customer satisfaction.

Technological advancements and innovations in cloud billing platforms, such as the incorporation of artificial intelligence (AI) and machine learning (ML) for predictive analytics and automation, have also played a crucial role in their market dominance. These technologies help in analyzing billing patterns, predicting revenue leakage, and offering personalized billing solutions to customers.

Furthermore, the emphasis on improving the customer experience through transparent billing processes and flexible payment options has led to increased investments in cloud billing platforms by companies aiming to enhance their competitive edge.

Billing Type Analysis

In 2023, the Usage-based segment held a dominant market position in the cloud billing market, capturing more than a 36% share. This prominence is largely due to the increasing preference for pay-as-you-go models by both businesses and consumers, which align closely with the usage-based billing approach.

This model offers flexibility and cost-efficiency, allowing customers to pay only for the services or resources they consume. Such a billing strategy is particularly appealing in industries with fluctuating service usage, including telecommunications, media, and utilities, where it enables businesses to align their expenses directly with revenue generation.

The surge in demand for usage-based billing can also be attributed to the growing adoption of cloud services and the Internet of Things (IoT) devices. As businesses increasingly rely on cloud computing for their operations, the need for a billing solution that can accurately track and bill for dynamically consumed resources has become critical.

Usage-based billing platforms cater to this requirement by offering granular visibility into service consumption, enabling businesses to track usage patterns, optimize costs, and prevent revenue leakage. Moreover, the integration of advanced analytics and real-time monitoring tools within these platforms allows for the implementation of dynamic pricing models, further driving the segment’s growth.

Furthermore, the shift towards digital transformation across industries has propelled the need for transparent and customizable billing solutions. Usage-based billing provides customers with detailed insights into their service consumption, fostering transparency and trust. This level of detail helps businesses improve their customer relationships and retention rates by offering more personalized and flexible billing options.

Service Model Analysis

In 2023, the SaaS (Software as a Service) segment held a dominant market position in the cloud billing market, capturing more than a 46% share. This leadership position is attributed to the widespread adoption of SaaS solutions across various business operations, from customer relationship management (CRM) to enterprise resource planning (ERP) systems.

SaaS offerings provide businesses with cost-effective, scalable, and easily accessible software solutions that do not require extensive hardware or high upfront costs. The inherent flexibility and scalability of SaaS align perfectly with the dynamic needs of modern businesses, enabling them to leverage advanced software applications hosted in the cloud without significant investment in IT infrastructure.

The dominance of the SaaS segment is further propelled by the increasing preference for subscription-based services, which offer predictable recurring revenue for providers and lower total cost of ownership for consumers. As businesses continue to embrace digital transformation, the demand for cloud-based applications that can be updated and managed remotely has surged. SaaS billing platforms facilitate this by offering streamlined, automated billing processes, subscription management, and financial reporting, which are essential for managing the recurring revenue model that is typical of SaaS offerings.

Additionally, the global shift towards remote work and the need for digital collaboration tools have significantly contributed to the growth of the SaaS segment. Organizations require flexible, cloud-based solutions that can be accessed from anywhere, at any time, to ensure business continuity and employee productivity.

SaaS applications meet these requirements, offering easy integration with existing systems and enabling businesses to rapidly adapt to changing market conditions. The ability to offer tailored solutions and pricing models based on usage or subscription levels further enhances the attractiveness of SaaS solutions, driving their adoption across a wide range of industries.

Deployment Type Analysis

In 2023, the Public Cloud segment held a dominant market position in the cloud billing market, capturing more than a 41% share. This dominance is primarily due to the scalability, cost-effectiveness, and ease of deployment that public cloud services offer.

Public clouds provide businesses with the ability to access computing resources over the internet, managed by third-party providers. This model eliminates the need for substantial upfront capital investment in infrastructure, making it an attractive option for businesses of all sizes, especially startups and SMEs (Small and Medium-sized Enterprises) that are looking for ways to optimize operational costs.

The leading position of the Public Cloud segment is further bolstered by its inherent flexibility and global reach. Companies can easily scale their resource usage up or down based on demand, without worrying about the physical limitations of their own data centers. This flexibility is particularly beneficial in today’s dynamic business environment, where consumer demands and market trends can shift rapidly.

Moreover, public cloud platforms often offer a vast ecosystem of services and tools, including advanced analytics, artificial intelligence, and machine learning capabilities, enabling businesses to innovate and enhance their offerings more quickly than would be possible with on-premises solutions.

Additionally, the shift towards digital transformation and the increasing reliance on cloud-native applications have significantly contributed to the growth of the Public Cloud segment. Businesses are leveraging public cloud services to deploy and manage applications and services more efficiently, facilitating remote work, collaboration, and customer engagement in a secure and scalable manner. The public cloud’s ability to provide robust disaster recovery and business continuity plans with minimal investment further enhances its attractiveness to businesses prioritizing operational resilience.

Organization Size Analysis

In 2023, the Large Organizations segment held a dominant market position in the cloud billing market, capturing more than a 63% share. This significant market share can be attributed to the complex billing requirements and large-scale operational needs of these organizations.

Large enterprises often engage in multiple, diverse business activities, requiring sophisticated billing systems capable of managing intricate and voluminous transactions. The scalability and flexibility offered by cloud billing solutions are particularly beneficial to these organizations, enabling them to streamline billing processes, manage subscriptions, and handle usage-based billing efficiently across various departments and services.

Moreover, large organizations are increasingly focusing on digital transformation to enhance their operational efficiency and customer engagement. As part of this transformation, there is a growing reliance on cloud-based services, necessitating advanced cloud billing solutions that can seamlessly integrate with other cloud services and legacy systems.

The ability of cloud billing platforms to provide real-time billing analytics, automate billing processes, and support various pricing models aligns with the strategic objectives of large enterprises to improve transparency, reduce operational costs, and enhance customer satisfaction.

Additionally, the stringent compliance and security requirements of large organizations further drive the adoption of cloud billing solutions within this segment. Cloud billing providers typically offer robust security measures, compliance with international standards, and detailed audit trails, which are critical for large enterprises operating in regulated industries such as finance, healthcare, and telecommunications. The assurance of data security and compliance with regulatory requirements not only mitigates risk but also enhances the trust of customers and stakeholders in the organization’s billing practices.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the cloud billing market, capturing more than a 27% share. This substantial market share can be attributed to the increasing adoption of cloud billing solutions within the BFSI sector, driven by several factors. Firstly, BFSI organizations operate in a highly competitive landscape, characterized by evolving customer demands, stringent regulatory requirements, and the need for rapid innovation.

Cloud billing platforms offer these organizations the agility and scalability required to respond quickly to market changes, launch new products and services, and improve customer experiences. Furthermore, the BFSI sector faces complex billing processes and compliance challenges, particularly regarding data privacy and security.

Cloud billing solutions provide robust security features, such as encryption, access controls, and compliance certifications, ensuring that sensitive financial information is protected and regulatory requirements are met. This level of security and compliance assurance is crucial for BFSI organizations to maintain customer trust and adhere to regulatory standards, such as GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard).

Additionally, the BFSI sector has been an early adopter of cloud technologies due to the potential cost savings and operational efficiencies they offer. Cloud billing platforms enable BFSI organizations to reduce their infrastructure costs, improve billing accuracy, and streamline revenue management processes. By leveraging cloud billing solutions, these organizations can optimize their billing operations, automate routine tasks, and allocate resources more efficiently, leading to improved profitability and competitive advantage.

Key Market Segments

By Component

- Platform

- Services

By Billing Type

- Subscription

- Usage Based

- One-Time

- Others

By Service Model

- IaaS

- PaaS

- SaaS

By Deployment Type

- Private Cloud

- Public Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small & Medium

By Industry Vertical

- BFSI

- IT & Telecommunication

- Retail

- Healthcare

- Media and Entertainment

- Others

Driver

Increasing Adoption of Subscription-Based Business Models

The growing adoption of subscription-based business models drives the demand for cloud billing solutions. Companies across various industries are transitioning from traditional one-time purchases to subscription-based services, leading to a need for efficient billing processes. Cloud billing platforms offer flexible subscription management, automated billing, and revenue recognition functionalities, enabling businesses to monetize their offerings effectively and maintain customer loyalty through recurring revenue streams.Restraint

Data Security Concerns

One of the primary restraints in the cloud billing market is data security concerns. As organizations migrate their billing processes to the cloud, they face apprehensions regarding the security and privacy of sensitive billing information. Data breaches and cybersecurity threats pose significant risks to businesses, potentially resulting in financial losses, reputational damage, and regulatory non-compliance. Addressing these security concerns through robust encryption protocols, access controls, and compliance certifications is crucial to instilling confidence in cloud billing solutions and overcoming adoption barriers.Opportunity

Integration with Advanced Technologies

An opportunity for the cloud billing market lies in the integration with advanced technologies such as artificial intelligence (AI), machine learning (ML), and blockchain. By leveraging AI and ML algorithms, cloud billing platforms can automate billing processes, predict customer behavior, and optimize pricing strategies.

Blockchain technology offers immutable and transparent transaction records, enhancing trust and security in billing transactions. Integrating these advanced technologies into cloud billing solutions presents an opportunity for providers to offer innovative functionalities, differentiate themselves in the market, and cater to evolving customer demands.

Challenge

Interoperability and Integration Complexity

A significant challenge facing the cloud billing market is the complexity of interoperability and integration with existing systems and applications. Businesses often operate in multi-cloud or hybrid environments, requiring seamless integration between cloud billing platforms and other business systems such as CRM, ERP, and accounting software.

Ensuring compatibility, data consistency, and synchronization across these disparate systems pose challenges for organizations and service providers alike. Overcoming this challenge requires standardized protocols, robust API frameworks, and collaboration between vendors to simplify integration processes and enhance interoperability.

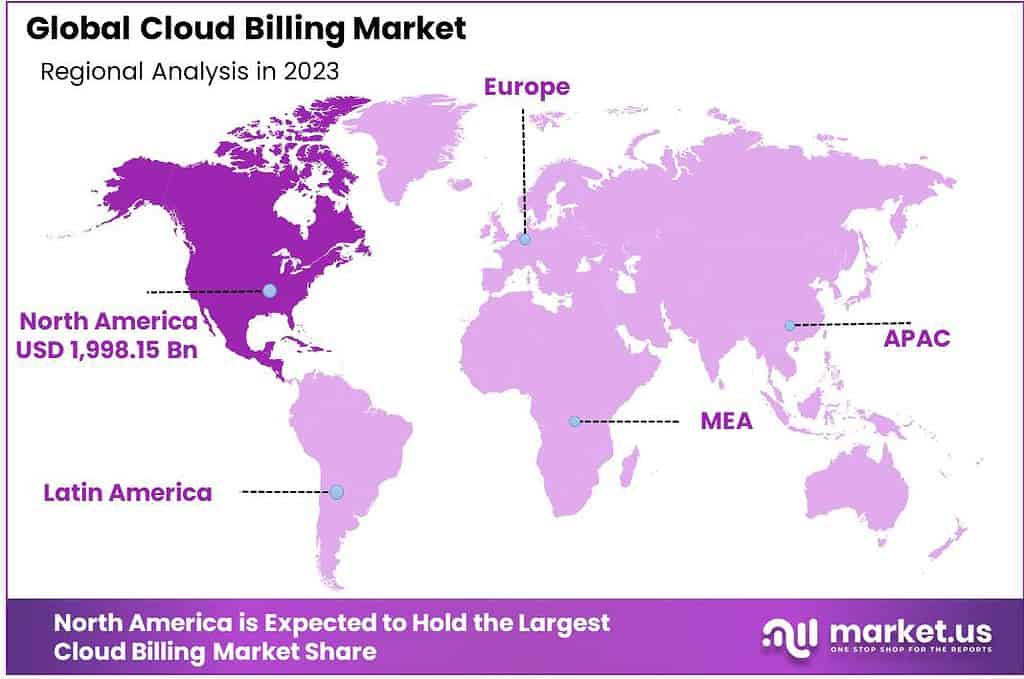

Regional Analysis

In 2023, North America held a dominant market position in the cloud billing sector, capturing more than a 35% share. The demand for Cloud Billing in North America was valued at US$ 1,998.15 billion in 2023 and is anticipated to grow significantly in the forecast period. This can be attributed to the region’s early adoption of cloud technologies, coupled with the presence of several key market players. The robust digital infrastructure, coupled with a high level of technological awareness among businesses and consumers, propelled the growth of cloud billing solutions in the region.

Furthermore, the increasing demand for flexible billing models and the need for efficient revenue management solutions drove the adoption of cloud billing services across various industries in North America. Moving on to Europe, the region emerged as a prominent market for cloud billing solutions, accounting for a substantial market share in 2023. With the rapid digitization of businesses and the increasing adoption of cloud-based services, there has been a growing emphasis on streamlining billing processes and enhancing revenue management capabilities.

European organizations across sectors such as BFSI, healthcare, and retail are increasingly leveraging cloud billing platforms to automate billing operations, improve billing accuracy, and enhance customer experience. Moreover, stringent data privacy regulations, such as GDPR, have spurred the demand for secure cloud billing solutions in the region

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The cloud billing market is highly competitive and comprises several key players that offer a wide range of cloud billing solutions and services. These market players play a crucial role in driving innovation, expanding market reach, and meeting the diverse needs of organizations seeking efficient cloud billing systems.

One of the prominent players in the cloud billing market is Amazon Web Services (AWS). AWS provides a comprehensive suite of cloud services and offers integrated billing capabilities to its customers. With its vast customer base and global presence, AWS has established itself as a leading cloud service provider, including robust billing features and functionalities.

Another major player in the market is Microsoft Corporation. Microsoft Azure, the cloud computing platform offered by Microsoft, includes advanced billing capabilities that enable organizations to effectively manage their cloud expenses. Microsoft’s strong brand recognition, extensive customer base, and continuous investment in cloud technology contribute to its significant presence in the cloud billing market.

Top Market Leaders

- Zuora

- Amazon Web Services, Inc.,

- ConnectWise, LLC.

- Aria Systems, Inc.

- SAP SE

- Salesforce

- Cerillion

- BillingPlatform

- Recurly, Inc.

- Chargify LLC.

- Comarch

- Other key players

Recent Developments

1. Zuora:

- January 2023: Launched Zuora Central Platform 2.0, featuring enhanced scalability, security, and integrations with other cloud platforms.

- May 2023: Partnered with Google Cloud to offer a combined solution for subscription management and cloud infrastructure.

- October 2023: Acquired Zepto Systems, a cloud-native monetization platform, expanding its offering for B2B commerce.

2. Amazon Web Services (AWS):

- February 2023: Expanded AWS Billing capabilities with new features for cost allocation, reporting, and invoice customization.

- July 2023: Launched AWS Marketplace Metering Service, simplifying usage-based billing for third-party software vendors.

- November 2023: Partnered with Accenture to develop industry-specific solutions for cloud billing, including potential applications in life insurance.

Report Scope

Report Features Description Market Value (2023) US$ 5,709.0 Mn Forecast Revenue (2033) US$ 24, 882.6 Mn CAGR (2024-2033) 15.86% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Platform, Services), By Billing Type (Subscription, Usage Based, One-Time, Others), By Service Model (IaaS, PaaS, SaaS), By Deployment Type (Private Cloud, Public Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small & Medium), By Industry Vertical (BFSI, IT & Telecommunication, Retail, Healthcare, Media and Entertainment, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Zuora, Amazon Web Services Inc. , ConnectWise LLC., Aria Systems Inc., SAP SE, Salesforce, Cerillion, BillingPlatform, Recurly Inc., Chargify LLC., Comarch, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Cloud Billing?Cloud Billing refers to the process of generating and managing invoices for cloud-based services and resources. It involves the automated calculation of usage charges, subscription fees, and other billing-related activities in a cloud computing environment.

How big is Cloud Billing Industry?The Global Cloud Billing Market size is expected to be worth around USD 24,882.6 Billion by 2033, from USD 5,709.0 Billion in 2023, growing at a CAGR of 15.86% during the forecast period from 2024 to 2033.

What Drives the Growth of the Cloud Billing Market?The Cloud Billing Market is propelled by factors such as the increasing adoption of cloud services across industries, the demand for flexible and scalable billing solutions, the rise of subscription-based business models, and the need for accurate and transparent billing processes to optimize costs and improve financial management.

Who Are Some Leading Players in the Cloud Billing Market?Zuora, Amazon Web Services Inc. , ConnectWise LLC., Aria Systems Inc., SAP SE, Salesforce, Cerillion, BillingPlatform, Recurly Inc., Chargify LLC., Comarch, Other key players are the major companies operating in the Cloud Billing Market.

Which region held the largest cloud billing market share?In 2023, North America held a dominant market position in the cloud billing sector, capturing more than a 35% share.

Which billing type analysis segment accounted for the largest cloud billing market share?In 2023, the Usage-based segment held a dominant market position in the cloud billing market, capturing more than a 36% share.

-

-

- Zuora

- Amazon Web Services, Inc.,

- ConnectWise, LLC.

- Aria Systems, Inc.

- SAP SE

- Salesforce

- Cerillion

- BillingPlatform

- Recurly, Inc.

- Chargify LLC.

- Comarch

- Other key players