Cloud Based Drug Discovery Platform Market By Product Type (Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS)), By Application (Pharmaceutical Vendors, CROs, Biotech Vendors, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158085

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

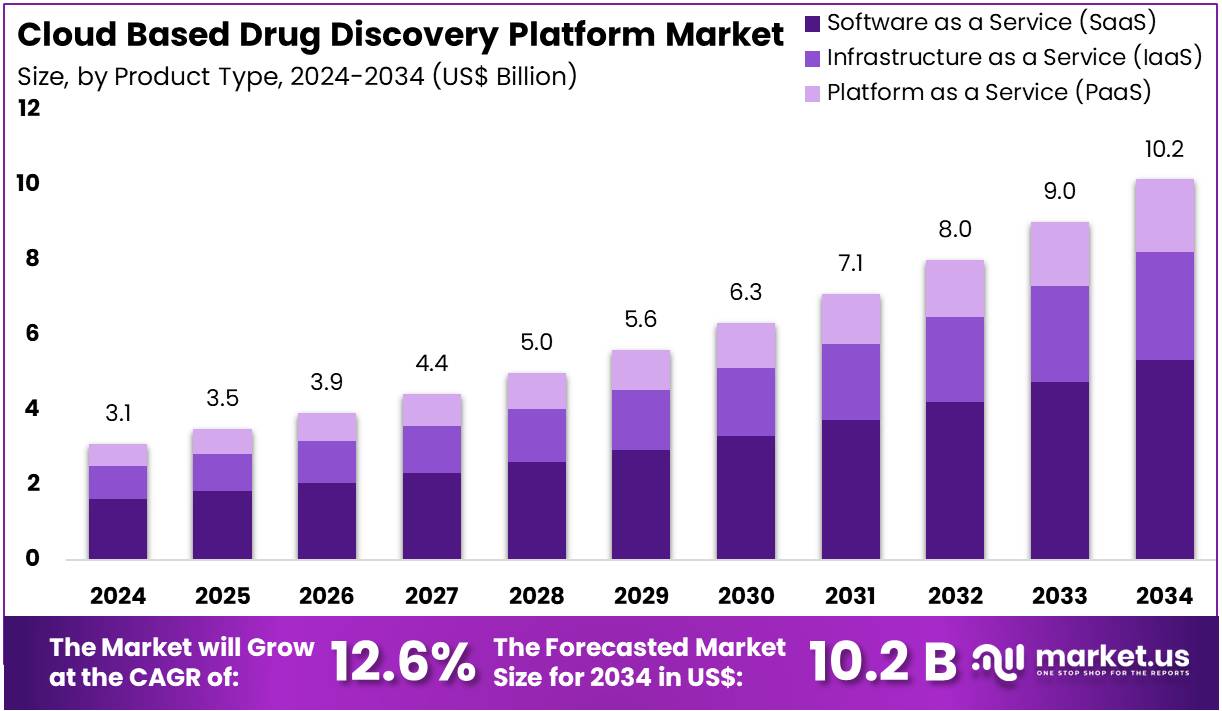

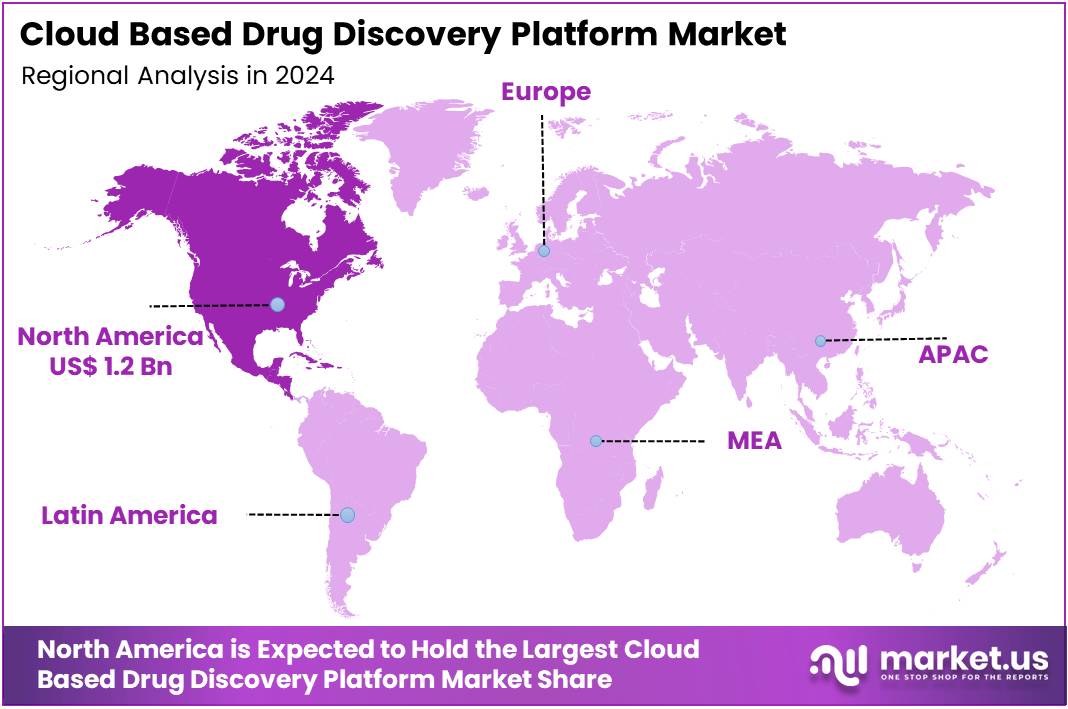

The Cloud Based Drug Discovery Platform Market size is expected to be worth around US$ 10.2 billion by 2034 from US$ 3.1 billion in 2024, growing at a CAGR of 12.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40.3% share and holds US$ 1.2 Billion market value for the year.

Rising complexity of drug R&D and a growing need for more efficient research processes are primary drivers of the cloud-based drug discovery platform market. Traditional drug development is a lengthy and expensive endeavor, often taking over a decade and costing billions of dollars.

Cloud platforms address this by providing scalable computing power, enabling researchers to process massive datasets from genomics, proteomics, and chemical libraries more quickly and affordably. According to the FDA’s Center for Drug Evaluation and Research, the average number of novel drug approvals between 2018 and 2024 was 50 per year, a rate that the industry is continuously striving to accelerate.

Growing adoption of artificial intelligence and a shift towards collaborative R&D are key trends shaping the market. Companies are leveraging AI algorithms on cloud platforms to predict molecular properties, screen vast compound libraries, and design new molecules in a fraction of the time it would take with traditional methods.

For example, in December 2024, BenevolentAI announced a major strategic overhaul to refine its business model and return to its original mission of AI-driven drug discovery. This strategic shift highlights the dynamic nature of the market as companies seek to optimize their operations and pipelines to compete in the highly competitive space of AI-driven drug discovery.

Increasing investment in digital infrastructure and a greater focus on early-stage discovery are creating significant opportunities for market expansion. The pharmaceutical industry is directing a growing portion of its R&D spending toward early-stage discovery and preclinical research, where cloud-based tools can have the greatest impact.

The average cost to develop a new medicine, including the cost of failures, is estimated to be over US$2 billion, according to industry sources. Cloud platforms help mitigate this risk by identifying promising drug candidates and de-risking pipelines earlier in the process. The shift to a more data-centric approach is empowering researchers to identify novel targets and accelerate the journey from lab bench to clinical trial.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.1 billion, with a CAGR of 12.6%, and is expected to reach US$ 10.2 billion by the year 2034.

- The product type segment is divided into software as a service (SaaS), infrastructure as a service (IaaS), and platform as a service (PaaS), with software as a service (SaaS) taking the lead in 2023 with a market share of 52.6%.

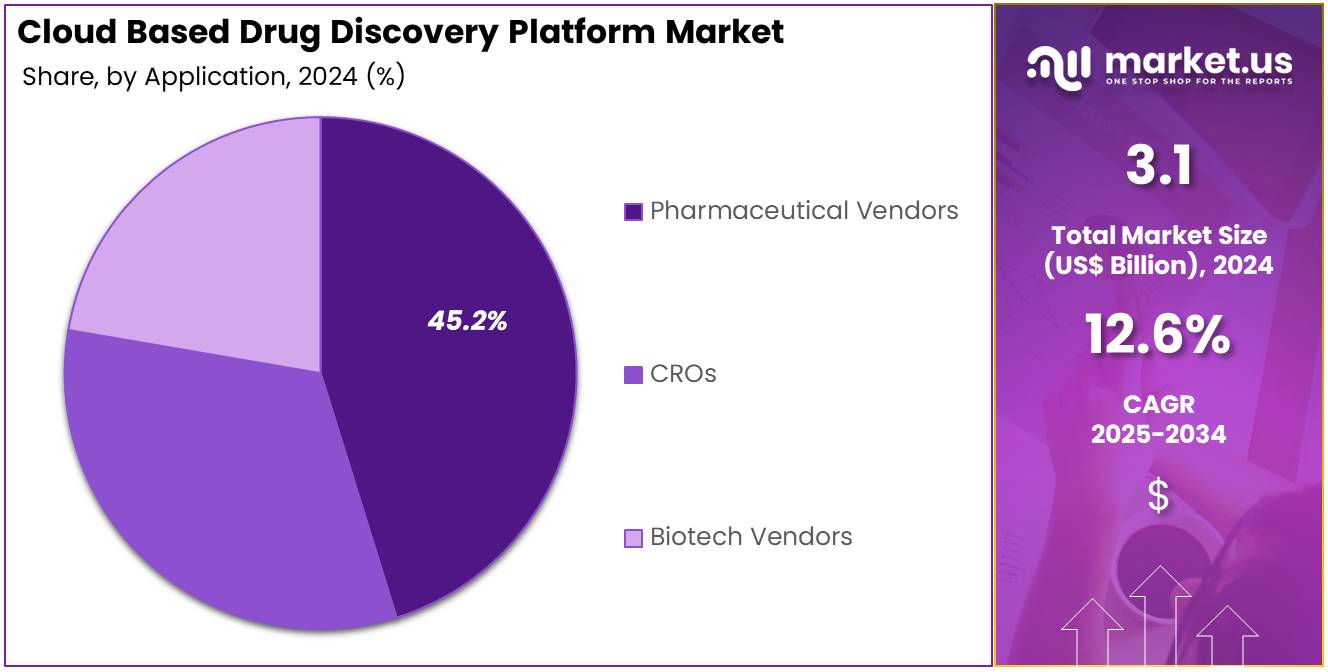

- Considering application, the market is divided into pharmaceutical vendors, CROs, biotech vendors, and others. Among these, pharmaceutical vendors held a significant share of 45.2%.

- North America led the market by securing a market share of 40.3% in 2023.

Product Type Analysis

Software as a Service (SaaS) holds the largest share of 52.6% in the cloud-based drug discovery platform market. The growth of this segment is expected to continue as pharmaceutical companies and research institutions increasingly adopt SaaS platforms to streamline drug discovery processes. SaaS platforms offer several advantages, including cost-effectiveness, scalability, and ease of access, making them an attractive solution for organizations looking to enhance their research capabilities without heavy upfront investment in infrastructure.

The ability to access advanced drug discovery tools via the cloud is anticipated to accelerate the development of new drugs and therapies. As the demand for cloud-based solutions in the pharmaceutical industry increases, SaaS offerings will continue to evolve with cutting-edge features, making this segment a key driver in the market’s growth.

Application Analysis

Pharmaceutical vendors account for 45.2% of the application segment in the cloud-based drug discovery platform market. This sector’s growth is expected to continue as pharmaceutical companies increasingly embrace digital transformation in their research and development processes. The adoption of cloud-based platforms allows pharmaceutical vendors to access vast amounts of data, analyze it efficiently, and collaborate with other research teams globally, accelerating the pace of drug discovery.

Furthermore, cloud platforms offer the flexibility and scalability required to handle the complex computational needs of modern drug development. As regulatory requirements become more stringent, pharmaceutical vendors will continue to leverage cloud-based drug discovery platforms to meet compliance standards and improve the efficiency of their drug development pipelines. These factors are expected to fuel significant growth in the pharmaceutical vendor segment of the market.

Key Market Segments

By Product Type

- Software as a Service (SaaS)

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

By Application

- Pharmaceutical Vendors

- Biotech Vendors

- CROs & Others

Drivers

The exponential growth of biological data is driving the market

The market for cloud-based drug discovery platforms is being driven by the sheer volume and complexity of biological data that modern research generates. High-throughput technologies, such as next-generation sequencing, proteomics, and metabolomics, are producing petabytes of data that traditional, on-premise computational systems are simply unable to handle. This explosion of data includes massive datasets of human genomes, protein structures, and patient clinical records, which all hold clues for identifying new drug targets and biomarkers.

Cloud platforms provide the scalable computing power and flexible storage necessary to process and analyze this information efficiently. For instance, the National Institutes of Health (NIH)’s All of Us Research Program has already made whole genome sequences from more than 414,000 participants available to researchers, and it continues to grow. This vast dataset, along with others of its kind, necessitates a cloud-based infrastructure, as it allows researchers to access, share, and analyze the data without the need for expensive hardware investments, thereby accelerating the pace of scientific discovery.

Restraints

Cybersecurity and data privacy concerns are restraining the market

A significant restraint on the cloud-based drug discovery platform market is the ever-present threat of cybersecurity risks and intellectual property theft. The data managed on these platforms is exceptionally valuable, including proprietary drug compound information, clinical trial data, and highly sensitive patient genomic information.

A data breach could result in catastrophic financial losses, expose a company’s research and development secrets to competitors, and lead to severe regulatory penalties. This makes pharmaceutical companies, which are often targets of cyberattacks, cautious about migrating their most valuable assets to the cloud.

According to a 2023 report on pharmaceutical industry cybersecurity, the average total cost of a data breach in the pharmaceutical industry was US$ 4.82 million, which was among the highest of any sector. This constant threat forces companies to invest heavily in security, and for some, the perceived risk of storing mission-critical data on a third-party cloud service remains a significant hurdle to full-scale adoption.

Opportunities

The growing number of strategic collaborations is creating growth opportunities

A key growth opportunity for the cloud-based drug discovery market lies in the increasing number of strategic collaborations between major pharmaceutical companies, biotech startups, and academic institutions. The complexity and cost of modern drug development have made it nearly impossible for a single entity to possess all the necessary expertise and resources.

Cloud platforms facilitate these partnerships by providing a secure, shared digital workspace where collaborators can access and analyze data in real time, regardless of their physical location. This model accelerates the discovery process by enabling the seamless exchange of information and expertise.

For example, a major pharmaceutical company like AstraZeneca has engaged in multiple collaborations, including with companies that offer AI-powered platforms on the cloud, to accelerate its drug discovery efforts. This trend of co-development and open innovation, which is made possible by cloud platforms, is creating a strong demand for these services and driving the market forward.

Impact of Macroeconomic / Geopolitical Factors

The cloud-based drug discovery platform market is driven by the need for more efficient and cost-effective R&D processes, but its growth is susceptible to macroeconomic and geopolitical factors. High inflation and rising interest rates can make it more expensive for pharmaceutical companies, particularly smaller biotech firms, to secure funding for research and development.

Geopolitically, the market is exposed to risks related to data security and data sovereignty, as countries increasingly implement regulations on where data can be stored and processed. This can complicate international collaborations and increase compliance costs for platforms operating across multiple jurisdictions.

The current US trade policy adds another layer of complexity. Tariffs on key electronic components from countries like China, such as a 50% tariff on certain semiconductors, or the 25% duty on medical consumables like syringes, raise the underlying costs of the IT infrastructure that underpins these cloud-based platforms. These tariffs can compel companies to absorb the costs or pass them on to end-users, potentially hindering the adoption of this technology.

Latest Trends

The accelerated integration of AI and machine learning is a recent trend

A defining trend in the cloud-based drug discovery platform market in 2024 is the accelerated integration of artificial intelligence (AI) and machine learning. These technologies are being used to analyze vast, complex datasets to identify new drug targets, predict molecular interactions, and optimize lead compounds with a speed and accuracy that is not possible with traditional methods.

AI can sift through billions of potential molecules to find promising candidates in a fraction of the time, thereby reducing the duration and cost of the early stages of drug development. This trend is demonstrated by the surge in related patent filings.

The US Patent and Trademark Office (USPTO) and other international bodies have seen a significant increase in patents for AI-driven drug discovery technologies, as companies work to secure their intellectual property. The number of patents in this area is a strong indicator of a concerted industry-wide effort to leverage AI on cloud platforms to transform the entire drug discovery pipeline.

Regional Analysis

North America is leading the Cloud Based Drug Discovery Platform Market

North America holds a dominant 40.3% share of the global cloud-based drug discovery platform market, a position driven by the region’s strong pharmaceutical and biotechnology sectors. These industries are increasingly adopting digital technologies to expedite research and development (R&D) processes.

The integration of artificial intelligence (AI) and machine learning (ML) into these platforms enables researchers to analyze vast datasets and identify potential drug candidates with unparalleled speed and precision. Significant investments in biomedical research further support this growth.

For example, the National Institutes of Health (NIH) allocated US$36.94 billion in extramural research funding in fiscal year 2024, supporting over 407,000 jobs and generating US$94.58 billion in economic activity. Pharmaceutical giants are also making substantial R&D investments; Johnson & Johnson allocated approximately US$15.1 billion to R&D in 2023, about 17.7% of its total revenue. The ability of cloud-based platforms to enable global collaboration while minimizing costly on-site infrastructure has cemented their importance in modern drug discovery.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is projected to be the fastest-growing market for cloud-based drug discovery platforms during the forecast period. This growth is largely attributed to the modernization of healthcare infrastructure and significant government and private sector investments in life sciences. Countries such as China and India are leading this development, with strong government initiatives supporting research and innovation.

In 2024, China’s total R&D expenditure surpassed 3.6 trillion yuan, an 8.3% increase from the previous year, signaling the country’s growing commitment to advancing scientific and technological progress. In India, government programs like the Biotechnology Ignition Grant (BIG) and the Startup India Seed Fund Scheme (SISFS) are fueling innovation and supporting early-stage biotech startups.

The region’s rising number of contract research organizations (CROs) and a large, skilled scientific workforce further contribute to the growing adoption of cloud-based platforms. Additionally, the expanding patient population and the increasing prevalence of chronic diseases in the region are expected to drive demand for more efficient drug discovery solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the drug discovery platform market are primarily focused on leveraging artificial intelligence and machine learning to analyze vast datasets and accelerate the identification of new drug candidates. They are also actively engaged in strategic collaborations and partnerships with pharmaceutical companies and research institutions to expand their portfolios and offer a more comprehensive suite of services.

Furthermore, companies are broadening their market reach by providing scalable and secure cloud-based solutions that can be easily adopted by a wide range of organizations, from small biotech firms to large corporations. This combination of advanced technology and strategic business development is crucial for maintaining a competitive edge.

Schrödinger, a key player in this market, has a business model centered on its proprietary physics-based computational platform, which enables accelerated drug discovery and materials design. The company’s strategy involves a two-pronged approach: it licenses its advanced software solutions to a broad customer base while also using the platform internally to develop its own proprietary drug pipeline.

Schrödinger leverages its technology to form deep collaborations with major pharmaceutical companies, sharing both the risks and rewards of drug development. This hybrid model of software sales and internal drug development allows Schrödinger to generate multiple revenue streams and validate its platform’s effectiveness.

Top Key Players in the Cloud Based Drug Discovery Platform Market

- Zymeworks

- WuXi AppTec

- Thermo Fisher Scientific

- NVIDIA

- Insilico Medicine

- EXAS

- Emerging Therapeutics

- CytoReason

- ChemAxon

- Biognosys

Recent Developments

- In August 2025: Epicore Biosystems announced a new partnership with REUS Cares to deploy its sweat-sensing technology for agricultural workers in Latin America. Epicore’s Connected Hydration Armband monitors sweat, electrolytes, and fluid loss, providing real-time, personalized rehydration guidance to help mitigate heat stress.

- In February 2025: Atomwise announced the appointment of Steve Worland, Ph.D. as its new Chief Executive Officer. This move is aimed at leveraging his extensive pharmaceutical and R&D experience to drive the company’s next phase of growth. This development is significant as it shows that even established players are bringing in new leadership to navigate the evolving market and capitalize on the growing demand for AI-driven drug discovery platforms.

Report Scope

Report Features Description Market Value (2024) US$ 3.1 billion Forecast Revenue (2034) US$ 10.2 billion CAGR (2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS)), By Application (Pharmaceutical Vendors, CROs, Biotech Vendors, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zymeworks, WuXi AppTec, Thermo Fisher Scientific, NVIDIA, Insilico Medicine, EXAS, Emerging Therapeutics, CytoReason, ChemAxon, Biognosys. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud Based Drug Discovery Platform MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Cloud Based Drug Discovery Platform MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

-

- Zymeworks

- WuXi AppTec

- Thermo Fisher Scientific

- NVIDIA

- Insilico Medicine

- EXAS

- Emerging Therapeutics

- CytoReason

- ChemAxon

- Biognosys

-