Clinical Trial Biorepository & Archiving Solution Market By Product Type (Clinical products (Stem cells, Organs, Human tissue, and Other clinical products), and Preclinical products), By Services (Biorepository services (Warehousing and storage, Transportation, Sample processing, and Other services), and Archiving solution services (Database indexing & management, and Scanning and destruction)), By Phase (Preclinical, Phase IV, Phase III, Phase II, and Phase I), By End-user (Pharmaceutical companies, Contract research organizations, Biotechnology companies, and Academic and research institutions), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160413

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

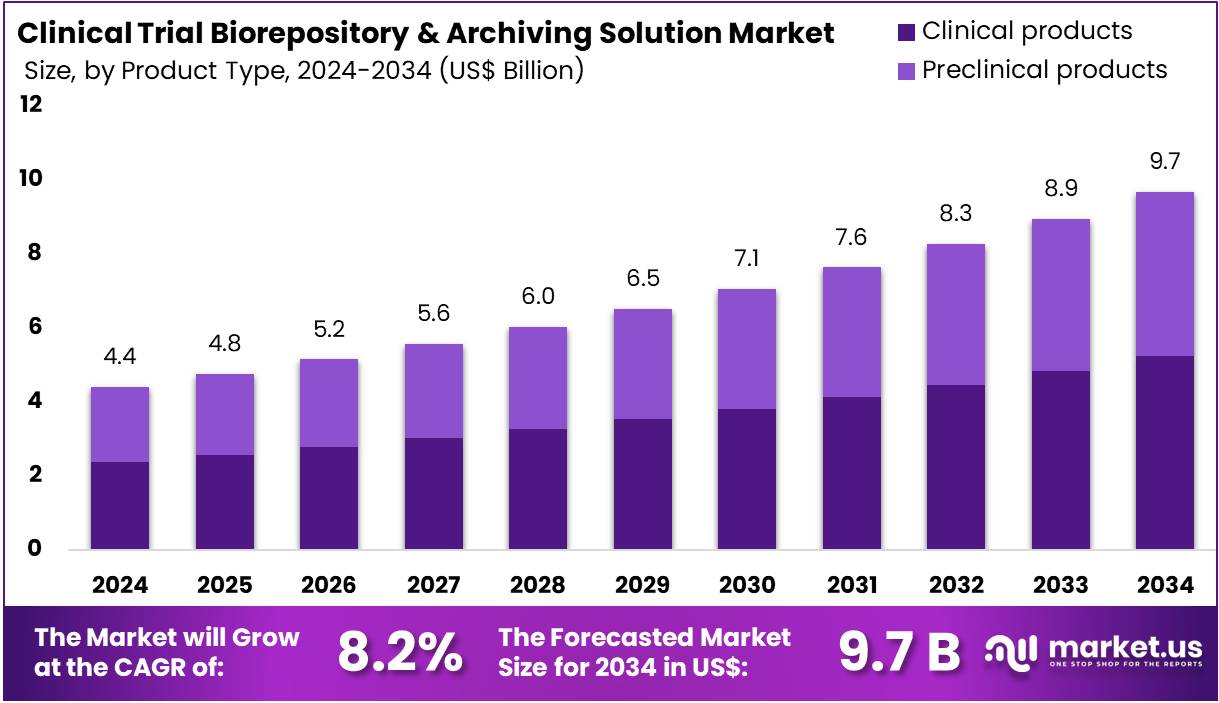

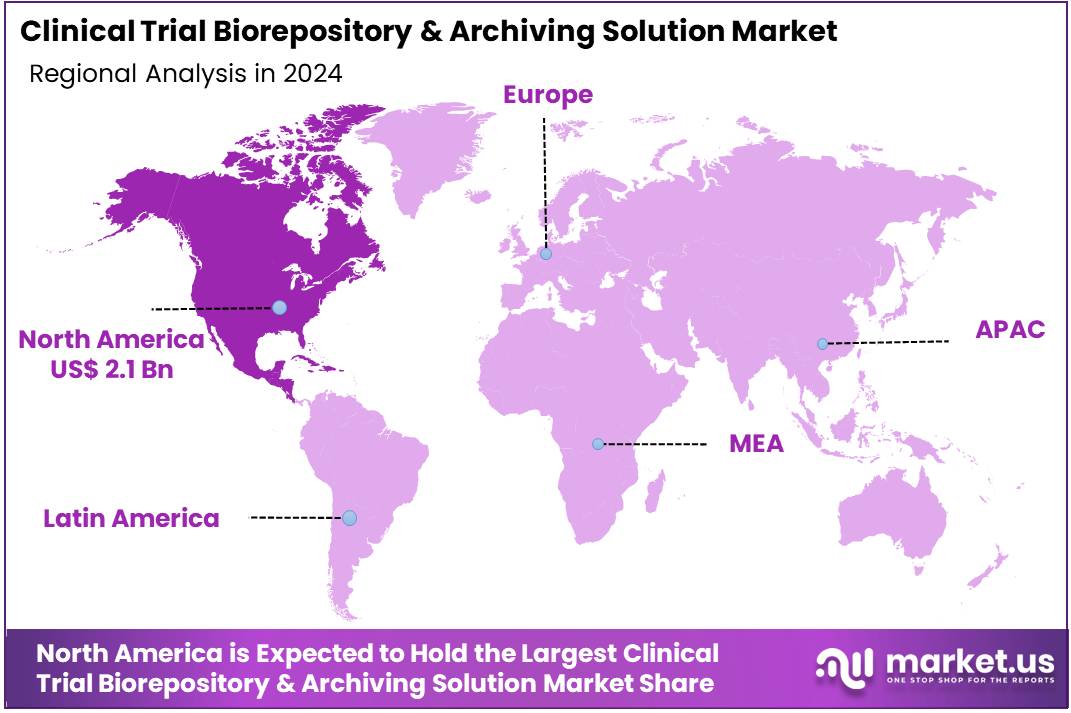

The Clinical Trial Biorepository & Archiving Solution Market size is expected to be worth around US$ 9.7 billion by 2034 from US$ 4.4 billion in 2024, growing at a CAGR of 8.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 48.2% share and holds US$ 2.1 Billion market value for the year.

Rising demand for reliable biospecimen management is propelling the clinical trial biorepository and archiving solution market, as researchers require secure storage to advance therapeutic discoveries. This trend is particularly evident in oncology, where sponsors utilize these solutions to preserve tumor samples for longitudinal genomic profiling and biomarker validation. The expansion of precision medicine initiatives further fuels this demand, with archiving systems increasingly used to track plasma derivatives in immunotherapy efficacy studies.

Additionally, contract research organizations (CROs) are adopting biorepository platforms for neurology trials, ensuring the safe storage of cerebrospinal fluid specimens that support critical endpoint analyses. As ClinicalTrials.gov reported 554,798 registered studies as of December 2024, the escalating volume of materials requiring robust preservation protocols underscores the foundational role of clinical trial biorepository solutions in maintaining data integrity across research applications.

Growing emphasis on regulatory compliance and data interoperability is unlocking substantial opportunities within the market. Developers are innovating automated retrieval systems that facilitate access to archived samples, such as serum for cardiology trials, streamlining post-trial audits. Academic consortia are also exploring the integration of blockchain technology for vaccine development repositories, ensuring tamper-proof records for viral isolates.

Furthermore, biopharmaceutical leaders are increasingly repurposing historical tissue banks for drug repositioning efforts, particularly in rare disease studies. These advancements highlight the potential of biorepository and archiving solutions to foster collaborative, compliant ecosystems, enabling innovative trial designs and supporting more efficient research across various therapeutic areas.

Recent trends in the market focus on infrastructure expansions and specialized cryopreservation solutions designed to handle escalating sample volumes. Biorepository providers are enhancing temperature-controlled vaults for specialized applications, such as cryopreserving bone marrow for hematology and transplant research. In June 2023, Azenta opened a 40,000-square-foot facility in Billerica, MA, increasing its capacity to meet growing demands for secure, long-term sample preservation.

Similarly, in October 2024, Cryoport unveiled IntegriCell cryopreservation services at its Houston facility, which standardizes leukapheresis storage for cell therapy trials. Alongside these infrastructure developments, AI-optimized inventory tracking systems are emerging, particularly for endocrinology biospecimens, reducing retrieval times in multi-site studies. These initiatives reflect a market shift toward scalable, specialized solutions that address the increasingly complex archiving needs of clinical trials.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.4 billion, with a CAGR of 8.2%, and is expected to reach US$ 9.7 billion by the year 2034.

- The product type segment is divided into clinical products, preclinical products, with clinical products taking the lead in 2023 with a market share of 54.1%.

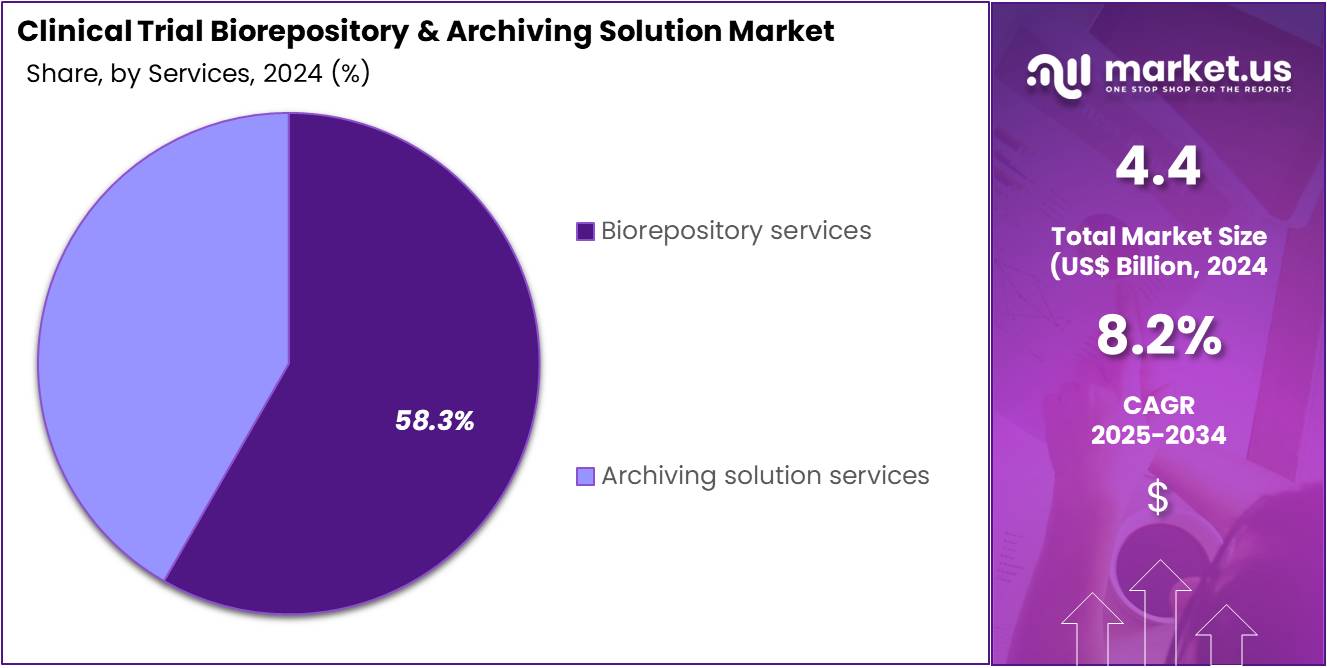

- Considering services, the market is divided into biorepository services, archiving solution services. Among these, biorepository services held a significant share of 58.3%.

- Furthermore, concerning the phase segment, the market is segregated into preclinical, phase I, phase II, phase III, and phase IV. The preclinical sector stands out as the dominant player, holding the largest revenue share of 32.2% in the market.

- The end-user segment is segregated into pharmaceutical companies, contract research organizations, biotechnology companies, and academic and research institutions, with the pharmaceutical companies segment leading the market, holding a revenue share of 42.7%.

- North America led the market by securing a market share of 48.2% in 2023.

Product Type Analysis

Clinical products hold 54.1% of the market share and are expected to continue leading the growth of the Clinical Trial Biorepository & Archiving Solution market. The increasing number of clinical trials, particularly in therapeutic areas such as oncology, immunology, and neurology, is driving the demand for clinical products. The need for storing and preserving clinical trial samples, such as blood, tissue, and biological fluids, is likely to increase as the focus on personalized medicine and targeted therapies expands.

Clinical products are essential for understanding patient responses to treatments and are integral to the regulatory approval process. The growing complexity of clinical trials, which require the handling of vast amounts of biological data and samples, is anticipated to boost the demand for sophisticated biorepository and archiving solutions. Furthermore, advances in biotechnologies and improvements in drug development pipelines are expected to propel the use of clinical products in clinical trials, contributing to the growth of the market.

Services Analysis

Biorepository services dominate the services segment with 58.3% share and are projected to experience substantial growth due to the increasing number of clinical trials and the growing importance of sample storage. As clinical trials become more complex, the demand for high-quality, secure, and accessible biorepositories is expected to rise. These services are integral in maintaining and storing biological samples such as blood, plasma, tissue, and other biospecimens for future research and trials. The rise in genomic and molecular research is expected to further fuel demand for biorepository services, as researchers require long-term storage and precise cataloging of samples for analyses.

Additionally, the growing trend of personalized medicine, which relies on patient-specific data, is anticipated to lead to increased reliance on biorepositories for storing large volumes of genetic material and other biomarkers. Biorepositories are also becoming key to advancing precision medicine by supporting the development of biomarkers, and as regulatory agencies increasingly require biobanks, the market for biorepository services is expected to grow significantly.

Phase Analysis

Preclinical trials hold the largest share in the market 31.2%, and are expected to continue driving growth due to their critical role in drug development. Preclinical studies, which involve testing new compounds on animal models, are essential for assessing the safety and efficacy of potential drug candidates before moving to human trials.

The growth of this segment is expected to be driven by the increasing investment in pharmaceutical R&D and the expanding number of early-stage drug development projects. With the rise in research activities aimed at discovering treatments for complex diseases such as cancer, neurological disorders, and autoimmune diseases, the demand for biorepository and archiving solutions to store preclinical samples is likely to increase.

Furthermore, advancements in biotechnologies and the growing focus on personalized medicine, which require extensive preclinical data, are anticipated to further boost the demand for preclinical phase solutions. The need for secure, long-term storage and efficient management of biological samples and data from these studies is expected to foster the continued growth of this phase in the market.

End-User Analysis

Pharmaceutical companies lead the end-user segment with 42.7% of the market share and are expected to continue expanding due to increased investments in research and development (R&D) aimed at driving innovation in drug discovery and development. As pharmaceutical companies continue to develop new treatments and therapies, particularly in areas like oncology, cardiovascular, and autoimmune diseases, the need for effective biorepository and archiving solutions becomes critical.

Pharmaceutical companies require the storage of clinical trial samples and related data to comply with regulatory requirements and ensure the integrity of clinical trial results. The increasing collaboration between pharmaceutical companies and contract research organizations (CROs) to streamline clinical trials is likely to enhance the demand for biorepository services.

Moreover, the growing trend of personalized medicine, which necessitates extensive patient data storage, is projected to further expand the market for pharmaceutical companies. The expansion of global pharmaceutical operations, particularly in emerging markets, is expected to contribute to increased demand for biorepository and archiving solutions tailored to clinical trial needs.

Key Market Segments

By Product Type

- Clinical products

- Stem cells

- Organs

- Human tissue

- Other clinical products

- Preclinical products

By Services

- Biorepository services

- Warehousing and storage

- Transportation

- Sample processing

- Other services

- Archiving solution services

- Database indexing & management

- Scanning and destruction

By Phase

- Preclinical

- Phase IV

- Phase III

- Phase II

- Phase I

By End-user

- Pharmaceutical companies

- Contract research organizations

- Biotechnology companies

- Academic and research institutions

Drivers

Rising Volume of Clinical Trials is Driving the Market

The increasing global volume of registered clinical trials serves as a primary driver for the Clinical Trial Biorepository and Archiving Solution market, as each trial generates a significant number of biological specimens and associated data that require specialized storage and management. The complexity of modern clinical research, particularly in areas like personalized medicine and biomarker discovery, necessitates the secure, long-term preservation of diverse biospecimens—from tissue samples and blood components to nucleic acids and cell lines.

Robust biorepository services and archiving solutions are essential to ensure sample integrity and traceability for future analysis, regulatory compliance, and post-trial research. The sheer scale of global clinical research activity translates directly into heightened demand for specialized infrastructure, including ultra-low temperature freezers, automated storage systems, and advanced Biorepository Information Management Systems (BIMS). This driver is strongly substantiated by official registry data on trial registration.

For instance, according to ClinicalTrials.gov, the number of registered studies grew from 399,470 at the beginning of 2022 to 437,493 by the end of 2022, and further increased to 477,203 by the end of 2023. This growth signifies a continuous and substantial need for biorepository and archiving solutions to handle the proliferating volume of biospecimens and their corresponding metadata generated by this research surge.

Restraints

High Operational Costs of Sample Management is Restraining the Market

The substantial and ongoing operational costs associated with maintaining high-quality biorepositories and archiving solutions act as a significant restraint on market growth, particularly for smaller research institutions or biotech companies. Biorepositories require continuous investment in specialized infrastructure, including ultra-low temperature storage equipment like −80∘C freezers and liquid nitrogen tanks, which have high energy demands and require continuous monitoring.

Furthermore, managing the repository demands highly skilled personnel for sample processing, quality control, data management, and compliance with stringent regulatory guidelines. These expenses encompass not only the initial capital outlay but also the recurring operational expenditure necessary for long-term sustainability. For instance, data from one institutional biorepository indicates that the annual storage fee for investigator-initiated studies can be approximately US$17.00 per box (81 slots) in a −80∘C freezer and around US$31.00 per box in a liquid nitrogen freezer, as of their approved rates.

Moreover, specialized services like the processing of plasma or serum from whole blood can cost about US$22.50 per sample (up to 3 aliquots). Such cumulative costs for processing, retrieval, and long-term storage can become prohibitive, prompting some organizations to limit the scope of their biobanking efforts or forgo in-house solutions in favor of outsourcing, which itself represents a major expense, thereby acting as a market-wide constraint.

Opportunities

Expansion of Cell and Gene Therapies is Creating Growth Opportunities

The rapid expansion and regulatory approval of highly complex and sensitive Cell and Gene Therapy (CGT) products presents a significant growth opportunity for specialized clinical trial biorepository and archiving solutions. CGTs, such as CAR T-cell therapies and gene-editing products, rely heavily on autologous or allogeneic living cells and viral vectors, which require ultra-stringent, cryopreserved conditions, often in liquid nitrogen, and meticulous chain of custody (COC) and chain of condition (COCn) documentation.

The specialized logistics, ultra-low temperature storage, and precise tracking required for these therapies exceed the capabilities of standard biorepositories. This creates a critical need for advanced, high-precision biorepository services that can maintain the viability and integrity of these high-value, temperature-sensitive products.

The growth in this domain is directly evidenced by the increasing number of regulatory approvals. For example, the US Food and Drug Administration (FDA) approved several key CGT products in the 2022-2024 period, including ZYNTEGLO (approved August 2022) and SKYSONA® (approved September 2022), followed by approvals like ELEVIDYS and ROCTAVIAN™ in June 2023, and CASGEVY™ and LYFGENIA™ in early 2024.

The approval of these complex therapies necessitates highly specialized and compliant biorepository and archiving solutions to support ongoing clinical trials, post-marketing surveillance, and long-term archiving of critical patient samples, opening a lucrative and technically demanding niche within the market.

Impact of Macroeconomic / Geopolitical Factors

Rising interest rates and supply chain inflation strain budgets in the clinical trial sample management sector, delaying upgrades to automated storage systems. US-China tensions and Southeast Asia unrest disrupt cryogenic equipment supplies, extending trial site setup times and raising audit risks. Still, firms build local vendor networks and scalable platforms to boost data security and flexibility.

Growing precision medicine trials drive investments in robust archiving solutions. The US 10% universal tariff on imports, effective April 5, 2025, raises costs for biorepository consumables, squeezing margins and pausing global partnerships. Proactive companies leverage domestic expansion incentives, creating biotech jobs. These efforts streamline AI-driven archiving processes, strengthening resilience. Such adaptations ensure sustained growth and market leadership.

Latest Trends

Increased Adoption of Digital Technologies for Sample Management and Archiving is the Recent Trend

A prominent and recent trend in the clinical trial biorepository and archiving solution market is the accelerated adoption of digital and automated technologies, particularly for enhancing data integrity, sample traceability, and inventory management. This trend involves implementing advanced Laboratory Information Management Systems (LIMS), Biorepository Information Management Systems (BIMS), and integrating automation for sample handling and storage. These digital tools provide real-time tracking of every biospecimen, including its processing history, storage location, and temperature log, ensuring compliance with global regulatory standards like Good Clinical Practice (GCP).

The focus is shifting from simple cold storage to smart, data-driven biobanking that leverages digitized metadata for translational research. For instance, a search of industry announcements confirms that leading service providers are continuously expanding their digital and automated footprint to meet rising demand.

In a representative case, a major research logistics organization announced an expansion in June 2024, highlighting the addition of new capacity including walk-in cold rooms and standard & ultra-low freezers, alongside a focus on providing diverse temperature storage options and advanced warehousing solutions. This expansion, coupled with the increasing integration of data management and indexing services into archiving solutions, points toward a clear market move where physical storage is inextricably linked with sophisticated digital inventory and data governance to improve efficiency and reliability in clinical trials.

Regional Analysis

North America is leading the Clinical Trial Biorepository & Archiving Solution Market

In 2024, North America dominated with a 48.2% share of the global clinical trial biorepository & archiving solution market, propelled by stringent regulatory requirements for sample integrity and data traceability in expanding multi-site oncology and rare disease studies. Sponsors increasingly relied on automated inventory systems to manage cryogenic storage and chain-of-custody protocols, minimizing degradation risks for plasma and tissue specimens essential to biomarker validation.

The FDA’s emphasis on good clinical practice guidelines encouraged adoption of compliant digital archiving platforms, facilitating audit-ready retrieval for post-approval surveillance. University-affiliated biobanks expanded capacity through public-private partnerships, supporting longitudinal cohort analyses that inform adaptive trial designs. Heightened focus on pharmacogenomics drove demand for scalable repositories capable of handling high-volume genomic sequencing outputs, accelerating variant discovery for targeted therapies.

Fiscal incentives under the 21st Century Cures Act spurred investments in interoperable solutions, enabling seamless integration with electronic data capture tools across decentralized networks. Industry consortia advanced cryogenic robotics for high-throughput processing, reducing labor costs while upholding biosafety standards in urban lab hubs. These innovations highlighted the region’s commitment to robust infrastructure for translational research. The World Health Organization reported 186,497 registered clinical trials in the United States as of June 2024, underscoring the scale driving biorepository expansions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific clinical trial biorepository & archiving solution sector to accelerate during the forecast period, as national regulators harmonize standards to accommodate surging Phase III enrollments in infectious disease and metabolic disorder investigations. Authorities in South Korea and Australia invest in national biobank networks, equipping investigators with secure vaults for serum and DNA preservation to expedite endpoint adjudication.

Biotech firms ally with regional labs to deploy blockchain-ledger systems, anticipating streamlined compliance for cross-national sample transfers in collaborative vaccine platforms. Research consortia in Thailand and the Philippines pioneer modular archiving software, positioning community sites to archive electronic case report forms without connectivity disruptions.

Governments anticipate subsidizing ultra-low temperature freezers for peripheral facilities, bridging logistical gaps in island nations for equitable specimen access. Local innovators integrate AI for predictive degradation modeling, enhancing reliability for protein-based assays in tropical environments. These advancements solidify the region’s role in cost-efficient, resilient trial support ecosystems. The World Health Organization documented 23,250 registered clinical trials in the Western Pacific region in 2023, signaling robust momentum for archiving infrastructure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major firms in the clinical trial sample storage sector cultivate expansion by engineering automated systems that safeguard biospecimens under varied conditions, from ambient to ultra-low temperatures, to support precision drug development. They negotiate co-development agreements with biotech innovators to synchronize archiving protocols with emerging trial protocols, thereby expediting sample retrieval and analysis timelines.

Organizations channel investments into blockchain-enabled tracking modules, fortifying chain-of-custody integrity and audit readiness for multinational studies. Executives spearhead facility upgrades with modular designs, enabling scalable capacity to accommodate decentralized trial surges. They intensify efforts in Asia-Pacific and Africa, forging localized compliance frameworks to harness untapped research pipelines. Moreover, they introduce outcome-linked contracts that tie fees to trial milestones, incentivizing seamless integrations and bolstering sponsor commitments.

Thermo Fisher Scientific Inc., founded in 2006 through a merger of Thermo Electron and Fisher Scientific and based in Waltham, Massachusetts, stands as a preeminent provider of integrated life sciences tools, including biorepository infrastructure for global clinical research. The entity engineers cryogenic freezers, liquid handling robotics, and cloud archiving suites to preserve sample viability across trial lifecycles. Thermo Fisher dedicates resources to interoperability enhancements, linking storage solutions with electronic data capture systems for streamlined compliance.

CEO Marc N. Casper oversees a vast network spanning 50 countries, championing sustainability in cold-chain logistics. The company allies with research consortia to refine protocols for rare disease cohorts, amplifying data utility. Thermo Fisher cements its stature by prioritizing resilient, tech-forward architectures that underpin accelerated therapeutic discoveries.

Top Key Players in the Clinical Trial Biorepository & Archiving Solution Market

- Q2 Solutions

- Precision Medicine Group, LLC.

- Patheon (Thermo Fisher Scientific, Inc.)

- Medpace

- Labcorp Drug Development

- LabConnect

- Charles River Laboratories

- Cell&Co BioServices (Cryoport)

- Brooks Life Sciences (Azenta, Inc.)

- American Type Culture Collection (ATCC)

Recent Developments

- In June 2024: Cryoport expanded its Pont-du-Chateau facility in France, significantly increasing its storage capacity to better meet the rising demand for biostorage solutions in the clinical trial sector. This facility expansion supports the increasing global need for secure and scalable biosample storage, reinforcing Cryoport’s capabilities to manage and distribute critical clinical trial materials worldwide, ensuring seamless access to vital samples throughout the research and development process.

- In April 2024: LabConnect acquired A4P Consulting Ltd, a firm specializing in biomarker strategy and biosample management for clinical trials. This acquisition strengthens LabConnect’s offerings in clinical trial biorepository and archiving services, enabling the company to provide integrated project management and logistics solutions. By adding these capabilities, LabConnect enhances its position in the market, providing end-to-end solutions that streamline the handling and storage of biosamples, further supporting the expanding needs of clinical trial operations.

Report Scope

Report Features Description Market Value (2024) US$ 4.4 billion Forecast Revenue (2034) US$ 9.7 billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Clinical products (Stem cells, Organs, Human tissue, and Other clinical products), and Preclinical products), By Services (Biorepository services (Warehousing and storage, Transportation, Sample processing, and Other services), and Archiving solution services (Database indexing & management, and Scanning and destruction)), By Phase (Preclinical, Phase IV, Phase III, Phase II, and Phase I), By End-user (Pharmaceutical companies, Contract research organizations, Biotechnology companies, and Academic and research institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Q2 Solutions, Precision Medicine Group, LLC., Patheon (Thermo Fisher Scientific, Inc.), Medpace, Labcorp Drug Development, LabConnect, Charles River Laboratories, Cell&Co BioServices (Cryoport), Brooks Life Sciences (Azenta, Inc.), American Type Culture Collection (ATCC). Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Trial Biorepository & Archiving Solution MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Trial Biorepository & Archiving Solution MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Q2 Solutions

- Precision Medicine Group, LLC.

- Patheon (Thermo Fisher Scientific, Inc.)

- Medpace

- Labcorp Drug Development

- LabConnect

- Charles River Laboratories

- Cell&Co BioServices (Cryoport)

- Brooks Life Sciences (Azenta, Inc.)

- American Type Culture Collection (ATCC)