Global Circular Economy Trade Finance Market Size, Share, Industry Analysis Report By Solution Type (Supply Chain Finance, Receivables Finance, Payables Finance, Inventory Finance, Others), By Application (Manufacturing, Retail, Energy, Automotive, Consumer Goods, Others), By Enterprise Size (Large Enterprises, Small and Medium Enterprises), By Deployment Mode (On-Premises, Cloud-Based), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 164978

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Solution Type Analysis

- Application Analysis

- Enterprise Size Analysis

- Deployment Mode Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

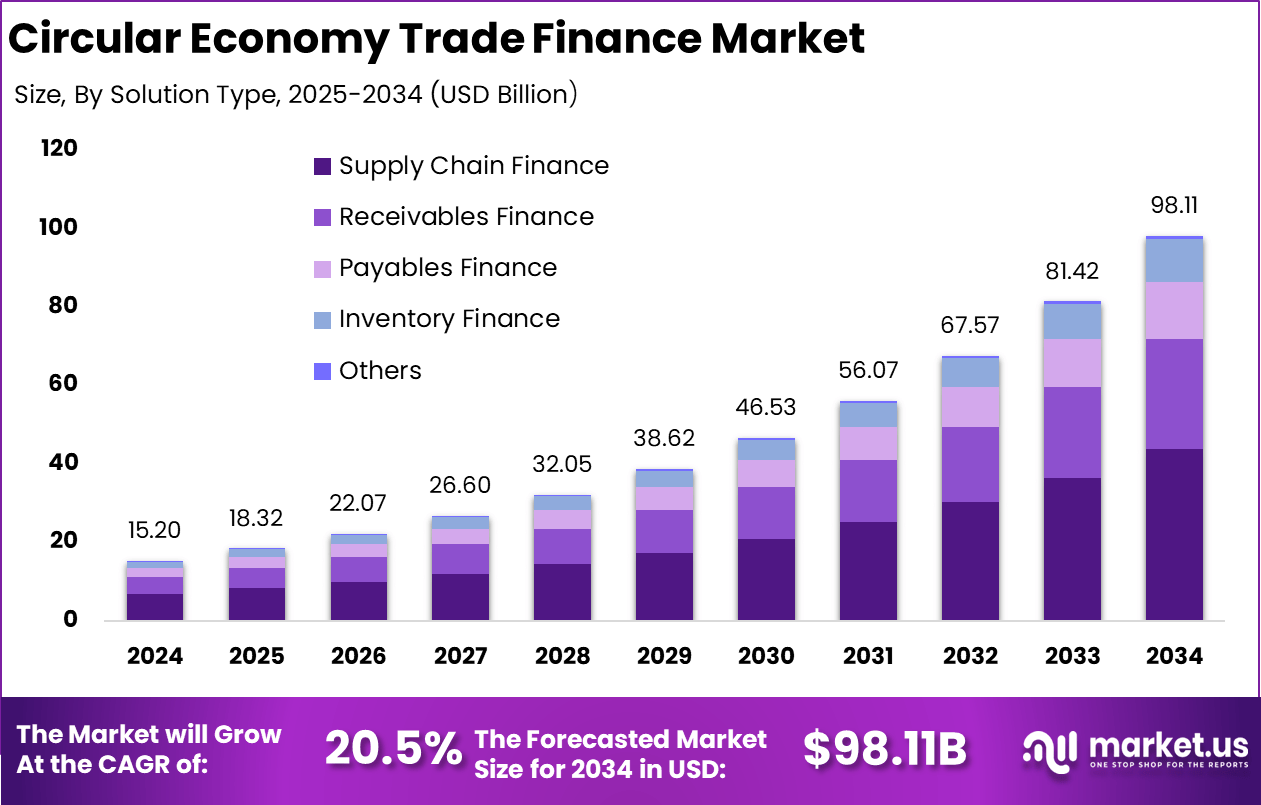

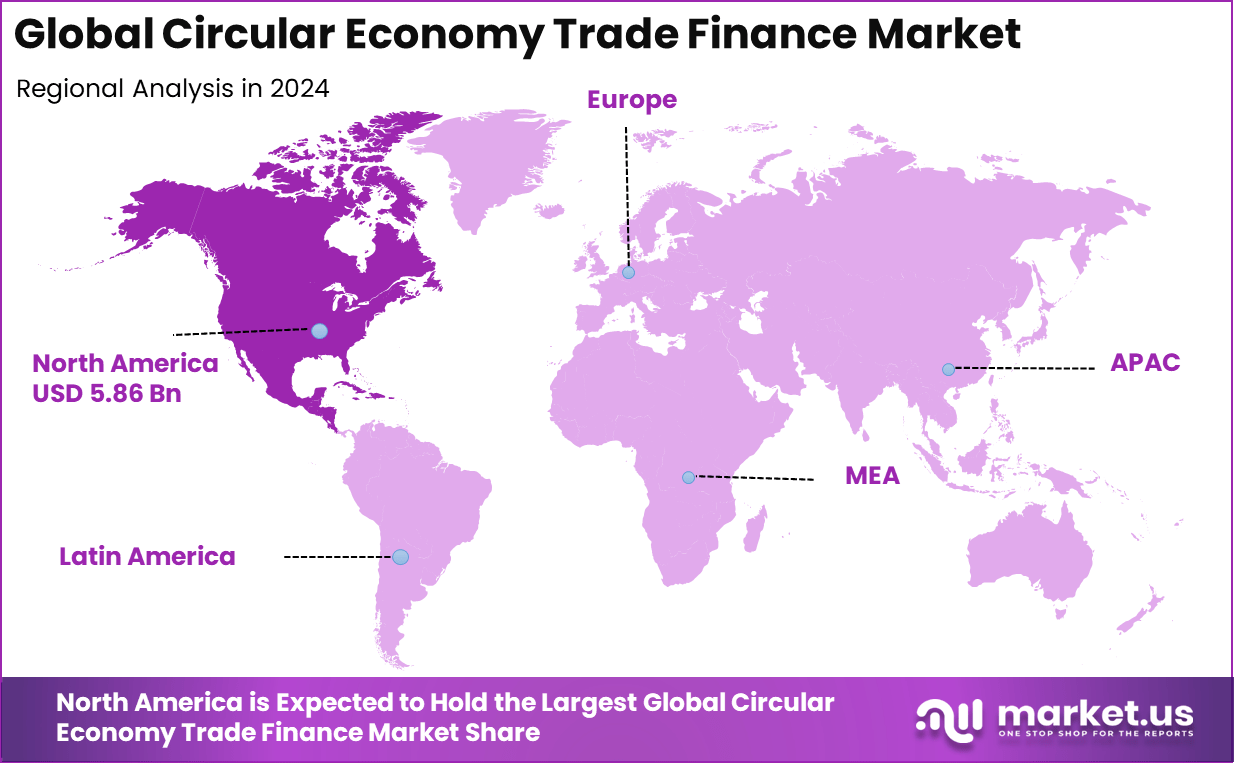

The Global Circular Economy Trade Finance Market size is expected to be worth around USD 98.11 billion by 2034, from USD 15.20 billion in 2024, growing at a CAGR of 20.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.6% share, holding USD 5.86 billion in revenue.

The Circular Economy Trade Finance Market represents financial services and mechanisms that support trade activities focused on circular economy principles. This includes funding projects that help extend product life cycles, promote recycling and remanufacturing, and encourage responsible resource management. The market supports sustainable supply chains by integrating environmental, social, and governance (ESG) considerations into trade finance products such as letters of credit, guarantees, leasing, and working capital solutions.

The main drivers behind this market’s growth include rising global commitments to sustainability and climate goals, increasing corporate emphasis on circular business models, and supportive government and international policies. Financial institutions are responding by developing tailored products that fund eco-friendly projects and resource-efficient supply chains. The rise of green bonds and sustainability-linked loans is also fueling investments in circular initiatives.

According to Market.us, The Global AI in Trade Finance Market is projected to reach USD 38.9 billion by 2033, increasing from USD 9.2 billion in 2023, with a robust CAGR of 15.5% during 2024-2033. This growth reflects the rising use of AI to automate document verification, risk assessment, and compliance processes, improving efficiency and reducing operational delays in global trade operations.

The market for Circular Economy Trade Finance is driven by a global shift toward sustainability and the growing adoption of circular business models. Companies and financial institutions are increasingly motivated to fund projects that focus on waste reduction, resource reuse, and eco-friendly production. This shift is supported by government policies and investor demand for green finance solutions, pushing banks to create tailored trade finance products that support sustainable supply chains.

Technologies such as blockchain, Internet of Things (IoT), and artificial intelligence (AI) are widely adopted to enhance transparency, traceability, and efficiency in trade finance processes. Blockchain, for example, helps verify sustainable practices and reduces fraud risks, while IoT tracks product life cycles and material flows. AI supports impact measurement and credit evaluation aligned with ESG criteria. These technologies enable digital platforms that facilitate real-time monitoring and easier access to finance for circular projects.

For instance, in September 2025, HSBC launched a new Trade and Working Capital Solutions (TWCS) strategy in partnership with HSBC Global Trade Solutions. This innovative credit product allows investors access to a diversified pool of trade finance and working capital assets with a focus on circular economy projects. It offers portfolio diversification with real-economy assets, benefiting from HSBC’s vast global deal flow, reflecting the bank’s strong commitment to sustainable and circular finance solutions.

Key Takeaway

- The Supply Chain Finance segment led the market with a 44.7% share, driven by the increasing adoption of sustainable procurement and circular credit models to reduce waste and improve supply chain transparency.

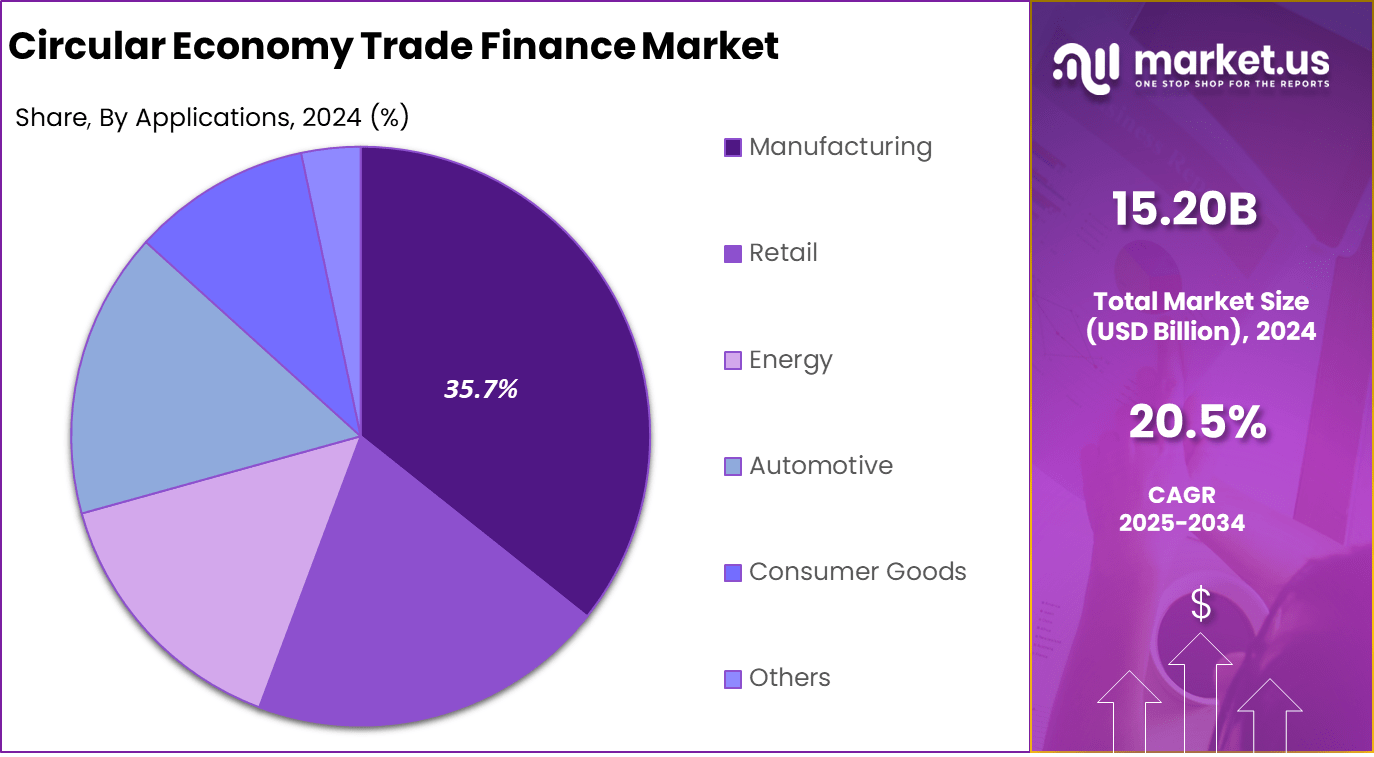

- The Manufacturing segment captured 35.7%, reflecting the growing emphasis on financing for recycled materials, green production processes, and sustainable resource utilization.

- Large Enterprises dominated with a 72.6% share, as major corporations integrate circular financing mechanisms into their sustainability and ESG frameworks.

- The On-Premises deployment segment accounted for 60.2%, underlining the preference for secure, internally managed financial data systems among large financial institutions.

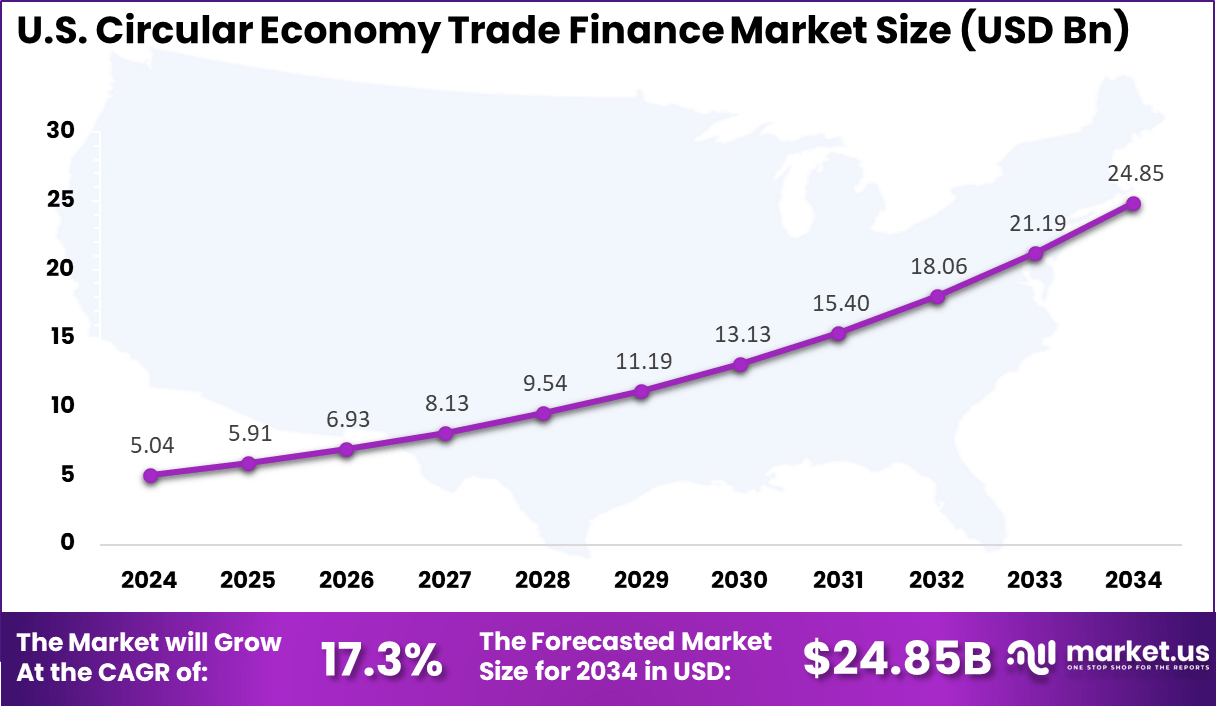

- The U.S. market reached USD 5.04 Billion in 2024, recording a robust 17.3% CAGR, supported by the country’s transition toward responsible trade finance and sustainable capital structures.

- North America held a commanding 38.6% share of the global market, reflecting strong regulatory support, green financing initiatives, and growing collaboration between banks and corporate clients to enable circular economy practices.

Role of Generative AI

Generative AI is playing a key role in advancing circular economy trade finance by improving decision-making, pricing, and demand forecasting. Companies use AI algorithms to dynamically set competitive prices for resale goods and optimize secondary markets. Around 85% of circular economy firms have begun adopting AI tools to enhance resource management, reduce waste, and evaluate sustainability impacts more quickly and accurately.

This use of generative AI aids traders and financiers by creating clearer, data-driven insights that speed up transactions and reduce risks in circular trade finance. Generative AI also supports digital twins and simulations that model economic and environmental scenarios, helping organizations understand trade-offs and hidden limits in circular projects.

This technology boosts efficiency in financing by improving transparency in project evaluation and accelerating reporting processes. Approximately 70% of circular trade finance institutions report that AI adoption has shortened decision timelines from weeks to days, greatly enhancing funding speed and accuracy.

Investment and Business Benefits

Investment opportunities in Circular Economy Trade Finance are expanding as more financial institutions develop bespoke products for circular projects. There is particular interest in funding sectors like sustainable supply chains, remanufacturing, and waste management. Public-private partnerships and the rise of ESG-focused investment funds provide additional channels for capital flow.

Moreover, emerging markets in Asia, Africa, and Latin America present significant prospects due to growing urbanization and resource scarcity. Business benefits of adopting Circular Economy Trade Finance are diverse. Companies experience cost savings by reducing raw material use and extending product lifecycles through refurbishment and recycling. These practices lower production costs and reduce exposure to volatile commodity prices.

Circular finance also opens new revenue streams via service-based models such as leasing and product-as-a-service options, which attract environmentally conscious consumers and deepen customer relationships. Importantly, circular finance contributes to reducing environmental impact and enhancing corporate reputation.

U.S. Market Size

The market for Circular Economy Trade Finance within the U.S. is growing tremendously and is currently valued at USD 5.04 billion, the market has a projected CAGR of 17.3%. This growth is driven by increasing commitments by businesses and governments to sustainability and climate targets, which encourage the adoption of circular business models.

Financial institutions are developing specialized financing solutions that support resource-efficient supply chains and environmentally friendly projects in various industries, including manufacturing. Furthermore, regulatory support and rising corporate ESG commitments are creating demand for innovative financial products such as green bonds and sustainability-linked loans.

Advances in digital technologies like blockchain and IoT also support transparent and efficient funding processes. This combination of market, policy, and technology factors is fueling the U.S. market’s expansion and positioning it as a leader in circular economy trade finance.

For instance, in August 2025, HSBC’s Global Trade Solutions unit reported a revenue increase to US$1.37 billion in H1 2025, driven by guarantees supporting infrastructure and production expansion. Despite tariff uncertainties, HSBC maintained resilience and sought to expand its U.S. market share in circular economy trade finance.

In 2024, North America held a dominant market position in the Global Circular Economy Trade Finance Market, capturing more than a 38.6% share, holding USD 5.86 billion in revenue. This leadership stems from the region’s advanced financial infrastructure and strong corporate focus on sustainability goals. Companies and financial institutions in North America actively support circular economy initiatives by offering tailored trade finance products that promote resource efficiency and waste reduction.

Additionally, regulatory frameworks and rising environmental, social, and governance commitments have driven demand for sustainable financing solutions. The integration of digital technologies like blockchain improves transparency and traceability, further strengthening North America’s market hold. These factors combine to create a robust environment for circular economy trade finance growth across the region.

For instance, in July 2025, Citigroup secured recognition for North America’s largest ESG social finance bond at $3 billion, supporting sustainable finance goals aligned with circular economy principles and social inclusion across markets, including the U.S. and Canada.

Solution Type Analysis

In 2024, The Supply Chain Finance segment held a dominant market position, capturing a 44.7% share of the Global Circular Economy Trade Finance Market. It provides crucial financial support that helps businesses manage cash flow and optimize working capital while embracing circular practices.

Companies involved in circular supply chains benefit from these tailored financing options that enable smoother financial transactions throughout the product lifecycle. By fostering collaboration among manufacturers, suppliers, and distributors, supply chain finance bridges traditional financial flows with sustainability goals.

This solution type is favored because it directly supports resource-efficient operations. It breaks down financial barriers that might otherwise slow down initiatives focused on reuse, refurbishment, and recycling. Supply chain finance is a key enabler that accelerates the adoption of circular economy principles across diverse industries.

For Instance, In October 2025, BNP Paribas strengthened its commitment to the circular economy by financing projects focused on waste reduction and resource efficiency. The bank prioritized circular procurement and product life extension in its sustainability strategy and acted as a global coordinator in a major bond issuance to cut packaging and food waste, reinforcing its leadership in sustainable supply chain finance.

Application Analysis

In 2024, the Manufacturing segment held a dominant market position, capturing a 35.7% share of the Global Circular Economy Trade Finance Market. This dominance is driven by manufacturing’s critical role in resource use, waste generation, and product lifecycle management. Circular economy trade finance in manufacturing supports projects focused on eco-design, refurbishing, and recycling materials to minimize resource consumption and waste.

With many manufacturers shifting from linear to circular models, financing solutions are vital to fund activities like redesigning production lines, using recycled inputs, and extending product durability. This segment’s growth highlights the industry’s commitment to sustainable manufacturing and the increasing demand for circular finance products tailored to industrial needs.

For instance, in March 2025, Banco Santander launched a global challenge to encourage startups and scaleups with innovative solutions for natural resource optimization and waste reduction in manufacturing and related fields. This initiative reflects the increasing focus on circular manufacturing, supported by financial institutions excited to fund projects that reduce resource use and enhance recycling within the industry.

Enterprise Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 72.6% share of the Global Circular Economy Trade Finance Market. These companies have the scale, resources, and strategic focus to lead circular economy transitions. Their extensive supply chains and complex operations require substantial financial support to implement circular practices such as sustainable sourcing, waste reduction programs, and product life extension.

The preference for large enterprises in this segment arises from their ability to manage larger transactions and meet stringent environmental, social, and governance (ESG) standards. Financial institutions view large enterprises as lower-risk clients for circular trade finance, enabling advanced deals that fund green innovation across multiple markets and geographies.

For Instance, in July 2025, Barclays reported that sustainable finance lending, mainly directed at large corporations, generated significant returns, with plans to expand offerings to include sectors like commercial real estate and mining. Their approach underscores the importance of supporting large enterprises with robust trade finance products that enable circular economy practices.

Deployment Mode Analysis

In 2024, The On-Premises segment held a dominant market position, capturing a 60.2% share of the Global Circular Economy Trade Finance Market. This reflects the demand for controlled, secure, and customized financial platforms within organizations actively managing circular finance operations. On-premises solutions allow firms to keep sensitive financial data in-house while ensuring integration with their existing systems for supply chain and sustainability management.

While cloud-based services grow in popularity, the on-premises model remains preferred in sectors with tight regulatory requirements or where direct oversight of trade finance workflows is critical for circular economy compliance. This segment indicates that many enterprises value data sovereignty and operational control in implementing circular finance solutions.

For Instance, in February 2025, Standard Chartered became the first international bank fully aligned with the International Chamber of Commerce’s Sustainable Trade Finance Principles, emphasizing transparency and rigorous risk management. Their trade finance products for circular economy activities are deployed by using on-premises solutions to ensure sensitive data control and compliance, especially in regulated markets.

Emerging trends

Emerging trends in circular economy trade finance include the rise of sustainability-linked lending and green bonds tied to circular projects. These innovative financial instruments now account for roughly 40% of new financing deals in the sector, reflecting strong interest in linking financial rewards to eco-friendly outcomes.

There is also a growing focus on digital platforms using blockchain and IoT to track resources through supply chains, increasing transparency and accountability. Over 60% of recent circular trade finance deals incorporate blockchain for real-time tracking and impact measurement. Another important trend is the increasing role of public-private partnerships (PPPs) to fund infrastructure supporting circularity, especially in emerging markets.

These collaborations often help overcome funding gaps and improve capital flows toward recycling, waste management, and resource recovery. Market participants are adopting more customized financial products designed around material reuse and sustainable supply chains, which are showing a steady rise in issuance, growing by 22% in just two years.

Growth Factors

Growth in circular economy trade finance is mainly fueled by rising corporate ESG commitments and regulatory support. More than 75% of financial institutions now consider sustainability criteria essential for loan approvals linked to circular projects.

These regulatory frameworks provide incentives for banks and investors, encouraging them to develop tailored financing models that promote resource efficiency. Additionally, increasing awareness among companies of supply chain risks tied to material scarcity is driving demand for circular financing as a risk management tool.

Technological advances also underpin market growth, as digital financing platforms improve the speed and reliability of funding circular initiatives. The integration of AI, blockchain, and IoT allows for a more accurate assessment of project impact and viability. Over 50% of banks active in this space report that technology investments have led to a 30% drop in administrative costs, enabling them to offer more competitive and flexible financial products.

Key Market Segments

By Solution Type

- Supply Chain Finance

- Receivables Finance

- Payables Finance

- Inventory Finance

- Others

By Application

- Manufacturing

- Retail

- Energy

- Automotive

- Consumer Goods

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

By Deployment Mode

- On-Premises

- Cloud-Based

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Global Commitment to Sustainability

The expanding global push towards sustainability strongly fuels the Circular Economy Trade Finance Market. Governments, corporations, and financial institutions are increasingly adopting circular business models aimed at reducing waste, reusing materials, and improving resource efficiency. This commitment has led to the creation of innovative financial products like green bonds and sustainability-linked loans that directly support projects aligning with circular economy principles.

Such growing demand for eco-friendly trade finance solutions motivates banks and investors to develop tailored offerings to meet the needs of the circular economy transition. Additionally, the rise of supportive policies from governments and international agencies provides a favorable regulatory environment for circular investments.

Digital advancements in transparency and tracking technologies also streamline funding processes, enhancing trust among stakeholders. These factors combine to direct more capital toward projects that align with circular economy goals, giving a clear boost to the growth of trade finance focused on sustainability.

For instance, in June 2023, BNP Paribas reinforced its support for the circular economy by financing projects that reduce waste and promote the reuse of resources. The bank backed initiatives like Carrefour’s bond issue targeting packaging reduction and food waste minimization, plus innovative recycling projects in industrial sectors. BNP Paribas has developed internal circular economy definitions to guide consistent financing across its operations, showing its leadership in sustainable trade finance.

Restraint

Complexity in Standardization and Impact Measurement

A major barrier to market growth is the lack of standardized frameworks for circular economy finance and the difficulty in reliably measuring project impact. The circular economy involves diverse industries, processes, and metrics, which complicates risk assessment and credit evaluation for financiers. Small and medium enterprises (SMEs), which are often critical to circular projects, face challenges in demonstrating sustainability credentials due to limited knowledge and resources.

This uncertainty restricts the broader adoption of circular trade finance products. Moreover, regulatory compliance across different regions is complex because circular economy definitions and standards vary globally. This creates hurdles for cross-border financing and scaling of circular initiatives. Without clear international standards, financial institutions struggle with assessing the long-term viability and environmental impact of circular projects, limiting their willingness to provide financing.

For instance, in July 2025, HSBC reported on its trade finance business facing challenges due to geopolitical issues like US tariffs impacting global trade flows. Despite growth in trade fee income, uncertainties linked to worsening trade relations created complexity in financing decisions. These fluctuating market conditions restrict the broader adoption of circular finance products, as risk assessment becomes harder with unstable trade disruptions.

Opportunities

Digital Tools for Circular Performance Tracking

The increasing integration of digital finance platforms presents a significant opportunity for the Circular Economy Trade Finance Market. Technologies such as blockchain, IoT and data analytics enable transparent tracking of product life cycles and resource usage. These tools enhance the ability of financial institutions to quantify circular performance and verify sustainability claims, which, in turn, facilitates more accurate risk assessment and impact measurement.

This digital transformation allows for the creation of innovative financial products like sustainability-linked credits and green letters of credit. Such instruments can incentivize businesses to adopt circular practices more widely. By fostering collaboration between manufacturers, recyclers, and financiers on transparent platforms, the market can accelerate the adoption of circular economy principles and expand the range of fundable projects, opening new growth avenues.

For instance, in November 2025, Santander actively expanded trade finance offerings by partnering with private credit funds. This collaboration increased liquidity and optimized working capital solutions for corporates, enabling more flexible funding for sustainable and circular economy projects. Santander’s innovation in private credit integration opened new pathways for finance tailored to circular business models.

Challenges

Limited Awareness and Expertise

The lack of widespread understanding and expertise in circular economy concepts among businesses, investors, and financiers poses a substantial challenge to market expansion. Many organizations remain unfamiliar with how to identify, quantify, and finance circular projects effectively. This knowledge gap prevents the scaling of circular trade finance solutions beyond early adopters and slows market development.

Complicated project requirements and uncertain financial returns can deter investment, especially when combined with long gestation periods typical of circular initiatives. Furthermore, infrastructural gaps in many regions, particularly in developing markets, delay implementation and reduce confidence in circular projects. Overcoming these knowledge and infrastructure challenges is essential for unlocking the full potential of circular economy trade finance.

For instance, in January 2025, Rabobank partnered with the Ellen MacArthur Foundation to boost circular economy finance, especially targeting SMEs. While environmentally conscious small businesses benefit from impact loans with favorable terms, Rabobank acknowledged the challenge of limited awareness and expertise among many SMEs on circular finance. This gap hinders the scaling of projects needing tailored funding and guidance.

Key Players Analysis

The Circular Economy Trade Finance Market is driven by global banking and financial institutions such as HSBC Holdings plc, BNP Paribas, Deutsche Bank, and Santander Bank. These firms offer specialized financing structures and underwriting tailored to circular economy projects – such as recycling supply chains, reusable packaging systems, and remanufacturing business models. Their expertise in structured finance and sustainability-linked lending supports companies that are transitioning to circular business models.

Major multinational banks including ING Group, Barclays, Citigroup, JPMorgan Chase & Co., and Standard Chartered are expanding trade finance solutions that incorporate ESG metrics, traceability of materials, and circular supply chain networks. These institutions provide working capital facilities, letters of credit, and supplier financing designed to incentivize resource efficiency and closed-loop operations. Their platforms facilitate risk assessment and liquidity for circular economy transaction flows that cross borders.

Additional participants such as Rabobank, UniCredit, ABN AMRO, Credit Agricole, Sumitomo Mitsui Banking Corporation, Mizuho Financial Group, UBS Group AG, Wells Fargo, Bank of America, Goldman Sachs, and other market players contribute with trade finance advisory, commodity traceability systems, and digital platforms supporting circular procurement. Their involvement accelerates the adoption of trade finance instruments aligned with circular economy principles, enabling businesses to scale circular initiatives while reducing environmental impact.

Top Key Players in the Market

- BNP Paribas

- HSBC Holdings plc

- ING Group

- Santander Bank

- Standard Chartered

- Rabobank

- Barclays

- Deutsche Bank

- Citigroup

- JPMorgan Chase & Co.

- UniCredit

- ABN AMRO

- Credit Agricole

- Sumitomo Mitsui Banking Corporation

- Mizuho Financial Group

- UBS Group AG

- Wells Fargo

- Bank of America

- Goldman Sachs

- Other Major Players

Recent Developments

- In April 2025, BNP Paribas strengthened its commitment to the circular economy by coordinating Carrefour’s €1.5 billion bond issue aimed at reducing food waste and packaging by 2025. The bank also supported innovative recycling projects such as La Fonte Ardennaise, which recycles foundry sand and reduces CO2 emissions by 20,000 tonnes annually. BNP Paribas continues to finance sustainable business models as part of its carbon-neutral economy goal by 2050.

- In February 2025, Standard Chartered became the first international bank to fully adopt the International Chamber of Commerce’s Principles for Sustainable Trade Finance. This move underscores the bank’s leadership in offering transparent and rigorous sustainable trade finance solutions aligned with environmental and social risk standards. The bank’s frameworks support client sustainability goals with innovative financing products.

Report Scope

Report Features Description Market Value (2024) USD 15.2 Bn Forecast Revenue (2034) USD 98.1 Bn CAGR (2025-2034) 20.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution Type (Supply Chain Finance, Receivables Finance, Payables Finance, Inventory Finance, Others), By Application (Manufacturing, Retail, Energy, Automotive, Consumer Goods, Others), By Enterprise Size (Large Enterprises, Small and Medium Enterprises), By Deployment Mode (On-Premises, Cloud-Based) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BNP Paribas, HSBC Holdings plc, ING Group, Santander Bank, Standard Chartered, Rabobank, Barclays, Deutsche Bank, Citigroup, JPMorgan Chase & Co., UniCredit, Société Générale, ABN AMRO, Credit Agricole, Sumitomo Mitsui Banking Corporation, Mizuho Financial Group, UBS Group AG, Wells Fargo, Bank of America, Goldman Sachs, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Circular Economy Trade Finance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Circular Economy Trade Finance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BNP Paribas

- HSBC Holdings plc

- ING Group

- Santander Bank

- Standard Chartered

- Rabobank

- Barclays

- Deutsche Bank

- Citigroup

- JPMorgan Chase & Co.

- UniCredit

- Société Générale

- ABN AMRO

- Credit Agricole

- Sumitomo Mitsui Banking Corporation

- Mizuho Financial Group

- UBS Group AG

- Wells Fargo

- Bank of America

- Goldman Sachs

- Other Major Players