Global Chromium Market By Material (Ferrochromium, Chromium Chemicals, Chromium Metals and Others) By Application (Metallurgy, Chemicals, Refractory and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Jan 2024

- Report ID: 31574

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

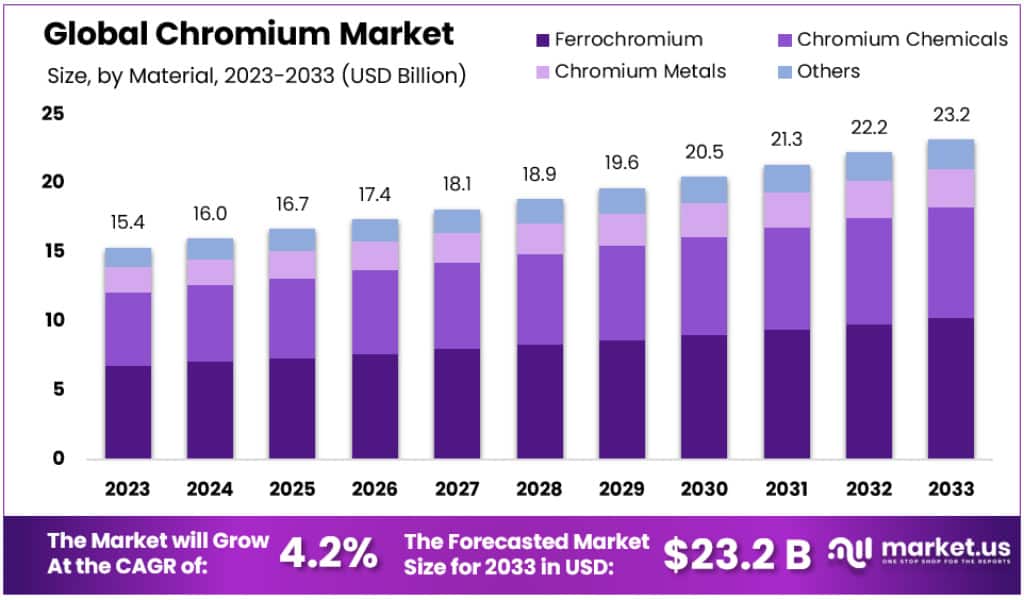

The Global Chromium Market size is expected to be worth around USD 23.2 Billion by 2033, from USD 15.5 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2023 to 2033.

It is expected that the key growth driver will be an increase in demand for Chromium from stainless steel industries for various end-use markets such as aerospace, defense, construction, electronics, and others. Over the forecast period, there will be most demand from the Asia Pacific.

China, the largest producer of specialty and stainless steel products, was the largest consumer of the product.

Key Takeaways

- The Global Chromium Market is projected to reach approximately USD 23.2 billion by 2033.

- In 2023, the market was valued at USD 15.5 billion.

- The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% between 2023 and 2033.

- Ferrochromium held a dominant market position in 2023, with over 44% market share.

- The chromium chemicals segment is expected to grow at a CAGR of approximately 6%.

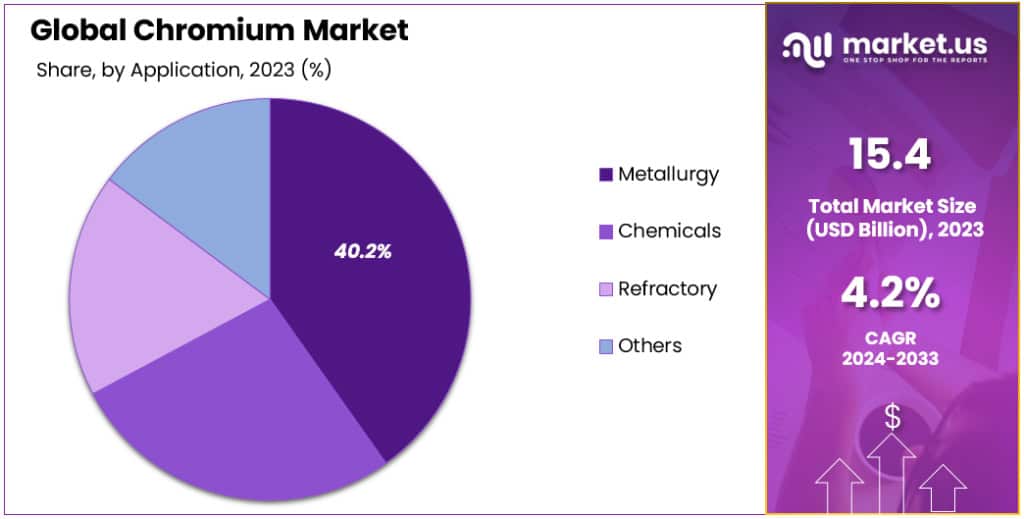

- Metallurgy accounted for more than 40.2% of the chromium market in 2023.

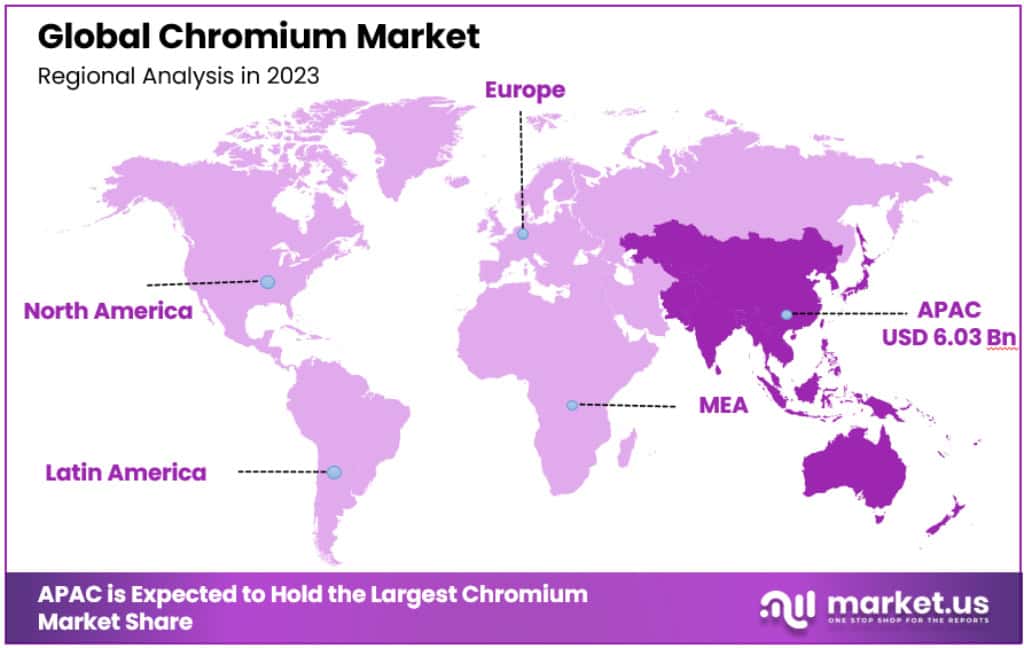

- Asia Pacific led the Chromium Market in 2023 with a commanding 38.5% share and a market value of USD 6.03 billion.

Material Analysis

In 2023, Ferrochromium held a dominant market position, capturing more than a significant 44% share. This segment, primarily composed of iron and chromium, is essential in the production of stainless steel. The alloy’s inherent qualities, like corrosion resistance and high-temperature strength, derive from the process of smelting chromite ore. In 2022, ferrochromium accounted for a substantial ~83% revenue share, reflecting its critical role in industries reliant on stainless steel. The segment’s demand is driven by industrial growth, increased construction activities, and a global rise in stainless steel production.

The chromium chemicals segment is on a growth trajectory, projected to expand at a CAGR of ~6%. Its pivotal role in stainless steel manufacturing, offering corrosion resistance and enhanced durability, fuels this segment. Chromium chemicals serve multiple industries, used in pigments, dyes, catalysts, and surface treatment processes. Their diverse applications underscore their importance in modern manufacturing and industrial processes.

Chromium’s utility extends beyond its traditional uses, contributing to metallurgical advancements and enhancing the properties of other metals. With a global production of approximately 40 million metric tons in 2022, led by South Africa, chromium’s influence on industries, including construction and machinery, is undeniable. Its application in the automotive industry, particularly in electroplating and conversion coatings, aligns with the rising automotive production and sales, further boosting the chromium market.

The trivalent chromium segment also maintained a significant share in 2023, propelled by its superior qualities over hexavalent chromium. It’s preferred for chrome plating due to its wide applicability, adherence to surfaces, lower temperature requirements, and resistance to harsh conditions. Trivalent chromium also offers environmental benefits and enhanced performance, contributing to its growing demand and the overall expansion of the chromium market.

Application Analysis

In 2023, Metallurgy held a dominant market position, capturing more than a significant 40.2% share. This segment, crucial for its mechanical strength, high oxidative resistance, hardness, and corrosion resistance, saw extensive use in the production of high-strength steel and superalloys. Chromium, primarily in the form of ferroalloys, metals, and stainless-steel scrap, is indispensable in metallurgical applications. With no viable substitute in stainless steel manufacturing, the sector continues to thrive on the unique properties chromium offers.

The chemicals segment is set to witness substantial growth, projected to register a CAGR of 4.6%. Sodium dichromate stands out as a key product containing chromium in this industry, widely used for surface treatments and as a precursor for other chromium chemicals. The array of chromium-based chemicals, including chrome oxide, chromic acid, and potassium dichromate, highlights the segment’s versatility and its crucial role in various industrial processes.

The refractory segment, while not detailed in the provided information, typically involves the use of chromium and its compounds in high-temperature materials and linings for furnaces, kilns, and incinerators. The unique high-temperature stability and corrosion resistance of chromium make it a preferred material in this segment. The growth in industries requiring high-temperature processing, like steel, cement, and glass, indirectly drives the demand for chromium in refractory applications.

Маrkеt Ѕеgmеntѕ

By Material

- Ferrochromium

- Chromium Chemicals

- Chromium Metals

- Others

By Application

- Metallurgy

- Chemicals

- Refractory

- Others

Drivers

Increasing Demand from the Electronics Industry

The anticorrosive properties of chromium make it a preferred material for electroplating in the electronics industry. The production and shipment of electronic equipment reached US$ 52.6 billion in Q4 of 2020, as per the Statistical Handbook of Japan 2021, and Lenovo Group reported a revenue of US$ 60,742 million in the fiscal year 2020/21, up by 20%. With the United States investing approximately US$ 142.2 billion in computer production and China’s National IC Fund investing US$ 39 billion to boost semiconductor production, the demand for chromium is expected to rise significantly.

Surge in Automobile Production

The automotive industry’s growth is a significant driver for the chromium market. With the new registration of motor vehicles reaching up to 16,763 units in Europe and 37,467 units in Asia during Q4 of 2020, and the European Union witnessing a 25.2% increase in new passenger cars from January to June 2021, the demand for chromium for electroplating and conversion coatings is expected to soar.

Restraints

Health Hazards of Hexavalent Chromium

Prolonged exposure to hexavalent chromium can cause severe health issues such as occupational asthma, eye damage, respiratory cancer, and skin ulcers. According to a study by the California Office of Environmental Health Hazard Assessment (OEHHA), extended exposure to 0.045 nanograms per cubic meter of hexavalent chromium could increase cancer risk among workers. These health risks are significant restraints for market growth.

Opportunities

Metallurgical Applications Growth

Chromium’s role in improving the hardenability, impact strengths, and corrosion resistance of metals is crucial for the heavy machinery and construction sectors. With around 41 million metric tons produced globally in 2022 and a 3.5% increase in global crude steel production in January 2023, chromium’s demand in metallurgical processes is expected to witness substantial growth.

Increase in Decorative and Functional Plating in the Automotive Sector

The trend of decorative plating in the automotive sector is increasing the demand for chromium. Chrome plating is used for various vehicle components due to its resistance to corrosion and ability to strengthen the material. The high lubricity of chrome also extends the life of machinery by reducing friction, further driving the market.

Challenges

Environmental and Health Concerns

The environmental and health hazards associated with chromium, especially hexavalent chromium, continue to be a significant challenge. These concerns may restrict the use of chromium in various industries, impacting the market growth negatively.

Trends

Rise in Stainless Steel Demand

The demand for stainless steel, containing at least 10.5% chromium, is rising due to its exceptional corrosion resistance and mechanical qualities. Industries like automobile, construction, and food & beverages are driving this demand, further fueling the chromium market.

Functional Chromium Alloy Demand

The demand for functional chromium alloy in applications like piston rings and rods in large two-stroke engines is growing. These components are crucial for transmitting power in engines, indicating a positive trend for chromium usage in the automotive sector.

Regional Analysis

In 2023, Asia Pacific is leading the Chromium Market, holding a commanding 38.5% share, with a market value of USD 6.03 billion. This region dominated the market primarily due to the booming stainless steel production driven by massive demand from automotive, aerospace, defense, electronics, and building & construction industries. Rapid industrialization in countries like China and India is pushing the growth further. For instance, India’s stainless steel production soared from 3.3 million tons in 2016 to 3.6 million tons by the end of 2017.

Asia-Pacific remains the global powerhouse, driven by robust manufacturing sectors and increasing metallurgical demand. It’s the leading region for chromium used in stainless steel production, a vital material in global manufacturing. According to the World Steel Association, the Asia-Pacific region churned out approximately 107 million tons of crude steel in January 2023, totaling over 1,350 million tons in 2022. China’s production increased by 2.3% in January 2023 compared to the previous year, reaching 79.5 million tons. Additionally, the region’s automotive industry, particularly in China and India, is experiencing rapid growth, further boosting the chromium market. For instance, China’s automobile production increased by 3.4% in 2022, with an estimated production of 27 million vehicles.

The chemical industry’s expansion in the Asia-Pacific region, where chromium is used as a catalyst in various processes, is also expected to boost the market. For example, the Japan Iron and Steel Federation predicts a significant rise in crude steel output, forecasting Japan’s production to hit 96.3 million tonnes in 2021, a 14.9% increase from 2020. Moreover, India’s crude steel production is expected to reach 118.1 million tonnes in 2021, up 17.8% from 2020.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Global market competition is fierce, and there are many key players. Kermas Group Ltd. and Glencore PLC are the major players.

Product demand, technological innovation, regulatory compliance, and distribution networks all play a role in the degree of competition. The market is concentrated in North America, while there is fierce competition between players in the Asia Pacific. The following are some of the most prominent players in global Chromium Markets:

Маrkеt Кеу Рlауеrѕ

- Glencore

- Kermas

- Zimasco

- ЕNRС

- Samancor Chrome

- Assmang Proprietary Limited

- ОМС (Odisha Mining Corporation Ltd.)

- Hernic Ferrochrome (Pty) Ltd.

- African Chrome Fields

- Tata

- CVK Group

- Al Tamman Indsil FerroChrome L.L.C

- Gulf Mining Group LLC

- MVC Holdings LLC

- Tenaris

- Other Key Players

Recent Developments

- June 2023: The Indian government enforced export restrictions on chromium ores and concentrates to regulate their export, primarily to industries like stainless steel production. Exporters now need a license from the Directorate General of Foreign Trade (DGFT) for chromium shipments. India had exported chromium ores and concentrates worth USD 10.96 million in 2022-23, mostly to China.

- June 2023: Researchers developed a novel method called ion enrichment chip–laser-induced breakdown spectroscopy (IEC-LIBS) for the rapid detection of various chromium oxidation states in soil and water. Published in the Journal of Analytical Atomic Spectrometry, this method is simple, environmentally friendly, and efficient for field applications, aiding in meeting environmental quality standards.

- May 2023: African Chrome Fields announced the imminent opening of its new aluminothermic smelting factory in Zimbabwe. The USD 40 million investment facility uses innovative technology to convert chrome ore to ferrochrome without external power, benefiting both South African and international customers.

- November 2022: Yildirim Group completed the acquisition of Elementis plc’s chromium business for USD 170 million. This purchase included two production facilities in Corpus Christi (TX) and Castle Hayne (NC), along with three facilities in Amarillo (TX), Dakota (NE), and Milwaukee (WI).

- June 2022: Tenaris declared a USD 29 million investment in its Dalmine steel shop to enhance the production of high chromium content specialty steels, like chromium 13. The upgrade, set for completion in early 2023, will enhance three production stages.

- January 2022: Yildirim Group acquired Albchrome Holding, an Albanian company specializing in chrome and ferrochromium. This move aims to support the company’s growth and solidify its global market position.

Report Scope

Report Features Description Market Value (2023) USD 15.5 Billion Forecast Revenue (2033) SD 23.2 Billion CAGR (2023-2032) 4.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Ferrochromium, Chromium Chemicals, Chromium Metals and Others) By Application (Metallurgy, Chemicals, Refractory and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Glencore, Kermas, Zimasco, ЕNRС, Samancor Chrome, Assmang Proprietary Limited, ОМС (Odisha Mining Corporation Ltd.), Hernic Ferrochrome (Pty) Ltd., African Chrome Fields, Tata, CVK Group, Al Tamman Indsil FerroChrome L.L.C, Gulf Mining Group LLC, MVC Holdings LLC, Tenaris, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Chromium Market size in 2023?The Chromium Market size is USD 15.5 Billion in 2023.

What is the CAGR for the Chromium Market?The Chromium Market is expected to grow at a CAGR of 4.2% during 2024-2033.

Who are the key players in the Chromium Market?Glencore, Kermas, Zimasco, ЕNRС, Samancor Chrome, Assmang Proprietary Limited, ОМС (Odisha Mining Corporation Ltd.), Hernic Ferrochrome (Pty) Ltd., African Chrome Fields, Tata, CVK Group, Al Tamman Indsil FerroChrome L.L.C, Gulf Mining Group LLC, MVC Holdings LLC, Tenaris and Other Key Players are the key vendors in the Cyclohexane market

-

-

- Glencore

- Kermas

- Zimasco

- ЕNRС

- Samancor Chrome

- Assmang Proprietary Limited

- ОМС (Odisha Mining Corporation Ltd.)

- Hernic Ferrochrome (Pty) Ltd.

- African Chrome Fields

- Tata

- CVK Group

- Al Tamman Indsil FerroChrome L.L.C

- Gulf Mining Group LLC

- MVC Holdings LLC

- Tenaris

- Other Key Players