Global Chloromethane Market Report By Type (Methylene Chloride, Methyl Chloride, Carbon Tetrachloride, Chloroform), By Application (Refrigerant, Industrial Solvent, Silicone Polymers, Laboratory Chemicals, Chemical Intermediates, Methylating & Chlorinating Agent, Others), By End-Use (Pharmaceuticals, Agrochemicals, Textile, Automotive, Construction, Paints & Coatings, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122527

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

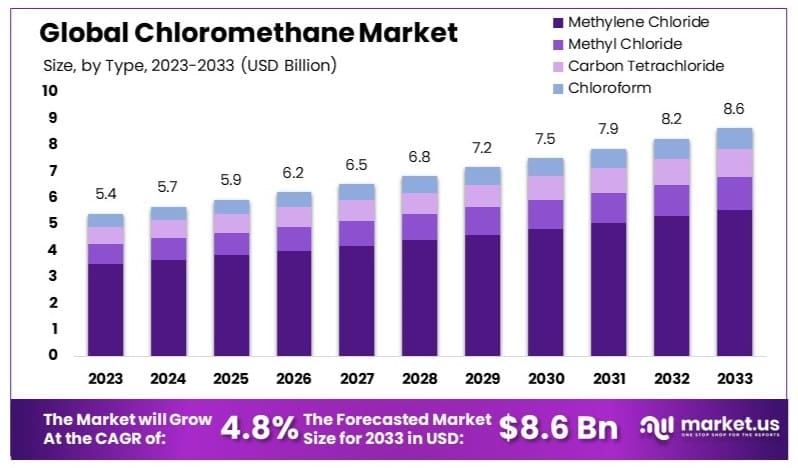

The Global Chloromethane Market size is expected to be worth around USD 8.6 Billion by 2033, from USD 5.4 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

The Chloromethane market centers on the production and supply of chloromethane, a versatile chemical used in manufacturing silicones, pharmaceuticals, and agrochemicals. It acts as a solvent and a raw material in various industrial processes.

The market is driven by the demand for silicones in construction and automotive industries and the growth of the pharmaceutical sector. Key players include chemical manufacturers and industrial suppliers. Trends indicate steady market growth, supported by advancements in chemical manufacturing and expanding end-use industries.

The chloromethane market is witnessing notable advancements in both application and technology, particularly highlighted by a recent study published in May 2022. This research conducted a quantum computational analysis of the bimolecular nucleophilic substitution (SN2) reaction between chloromethane and chloride ion.

The study assessed various quantum computing algorithms, focusing on their accuracy and the impacts of quantum noise. This exploration into quantum computational chemistry signifies a pivotal shift in how chemical reactions are modeled, promising enhancements in efficiency and precision in chloromethane applications.

Chloromethane, primarily used as a methylating agent in organic synthesis and as a refrigerant, stands at the forefront of significant industrial utility. The implications of this research extend beyond basic scientific interest, suggesting potential for increased optimization in synthesis processes that could lead to cost reductions and improved yield for industries relying on this chemical. Moreover, the integration of quantum computing in chemical reaction analysis can accelerate the development of more sustainable and efficient production methods, aligning with global sustainability goals.

As industries increasingly lean on innovative technologies to drive process improvements, the findings from this quantum computational study are likely to bolster the chloromethane market’s growth. Companies and investors might see this as an opportune moment to enhance R&D capabilities or invest in technologies fostering these advancements. Overall, the chloromethane market is set to expand its role in the chemical sector, fueled by both technological advancements and sustained industrial demand.

Key Takeaways

- Market Value: The Chloromethane Market was valued at USD 5.4 billion in 2023, and is expected to reach USD 8.6 billion by 2033, with a CAGR of 4.8%.

- Type Analysis: Methylene Chloride dominated with 64.3%; significant for its widespread industrial applications.

- Application Analysis: Silicone Polymers led with 18.6%; crucial for its use in manufacturing high-performance materials.

- End-Use Analysis: Pharmaceuticals dominated with 35.7%; essential for various medicinal chemical processes.

- Dominant Region: APAC held 44.5%; significant due to its large manufacturing base and industrial activities.

- Analyst Viewpoint: The chloromethane market is moderately competitive with growth potential in pharmaceuticals and polymers. Future trends suggest increased demand in Asia-Pacific.

- Growth Opportunities: Companies can focus on expanding production capacities and exploring new applications in pharmaceuticals and construction.

Driving Factors

Increasing Demand in Refrigeration and Air Conditioning Drives Market Growth

The growing demand for chloromethane, particularly methyl chloride (CH₃Cl), in refrigeration and air conditioning is significantly boosting the chloromethane market. This surge is driven by the expanding global cold chain, which necessitate reliable and efficient refrigeration systems. Additionally, rising middle-class populations in developing economies are increasing the demand for air conditioning, further propelling the need for chloromethane-based refrigerants.

This growth is largely due to the expansion of organized retail and the processed food sectors, which rely heavily on temperature-controlled environments. As industries such as pharmaceuticals, food and beverage, and logistics increasingly require sophisticated cooling solutions, the demand for chloromethane in refrigeration and air conditioning is set to rise. This factor interacts with urbanization and industrialization trends, creating a robust market environment for chloromethane products.

Growth in Pharmaceutical Manufacturing Drives Market Growth

The pharmaceutical industry’s robust expansion is driving the demand for chloromethane derivatives, especially dichloromethane (CH₂Cl₂), which are extensively used as solvents in drug manufacturing. The global pharmaceutical market is experiencing significant growth due to an aging population, increasing healthcare expenditures, and heightened drug research activities spurred by the COVID-19 pandemic.

For example, Pfizer reported a 42% operational growth in the first quarter of 2021, partly due to the production of its COVID-19 vaccine. This growth translates into higher demand for chloromethane-based solvents crucial for various pharmaceutical manufacturing processes. As the industry continues to innovate and expand, the need for reliable solvents like dichloromethane is expected to grow, further propelling the chloromethane market. This factor is synergistic with advancements in medical research and increasing global healthcare needs, fostering a sustained rise in market demand.

Expansion of Silicone Industry Drives Market Growth

The silicone industry, a major consumer of chloromethane, particularly methylchlorosilanes, is significantly contributing to the growth of the chloromethane market. Silicones are used in a wide range of applications, including construction, automotive, electronics, and personal care products. The global construction industry, for example, is projected to reach $17.5 trillion by 2030, up from $12.7 trillion in 2020. This substantial growth, driven by urbanization and infrastructure development, boosts the demand for silicone sealants and adhesives.

Consequently, the consumption of chloromethane, which is essential in the production of silicones, is also increasing. As the automotive and electronics industries continue to grow, the need for high-performance materials like silicones will rise, further driving the demand for chloromethane. This factor interacts with broader industrial growth trends and technological advancements, enhancing the overall market expansion for chloromethane products.

Restraining Factors

Environmental Regulations Restrain Market Growth

Stringent environmental regulations significantly limit the growth of the chloromethane market. Many chloromethane compounds, like chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs), are known to deplete the ozone layer. The Montreal Protocol, ratified by 198 countries, mandates the phase-out of these substances.

Developed countries have already phased out CFCs, and developing countries must completely phase out HCFCs by 2030. This global regulatory pressure forces industries to seek alternative substances, thereby reducing the reliance on chloromethane. The regulatory push towards more environmentally friendly options limits market expansion and creates a challenging landscape for manufacturers of chloromethane-based products.

Health and Safety Concerns Restrain Market Growth

Health risks associated with chloromethane exposure pose a significant restraint on market growth. Dichloromethane, a widely used chloromethane derivative, is classified as a probable human carcinogen by the International Agency for Research on Cancer (IARC). In 2019, the European Union’s REACH regulation identified methylene chloride, another name for dichloromethane, as a substance of very high concern (SVHC) due to its carcinogenic properties.

Such classifications can lead to severe restrictions or bans on its use. For instance, the EU banned dichloromethane in paint strippers for consumer use in 2012. These health and safety concerns drive regulatory actions that hinder the market’s growth and force industries to look for safer alternatives.

Type Analysis

Methylene Chloride dominates with 64.3% due to widespread industrial use and solvent properties.

The chloromethane market is segmented by type into methylene chloride, methyl chloride, carbon tetrachloride, and chloroform. Methylene chloride, holding a dominant position with 64.3%, is a crucial industrial solvent. It is widely used in the manufacture of paints, coatings, and adhesives, thanks to its excellent solvent properties and relatively low toxicity compared to other chlorinated solvents. The dominance of methylene chloride can be attributed to its versatility and effectiveness in applications such as paint stripping, pharmaceutical processing, and the production of foam polymers.

Methyl chloride is another significant sub-segment in this market. While not as dominant as methylene chloride, methyl chloride plays a critical role in the production of silicone polymers and as a refrigerant. Its demand is driven by the growing silicone industry and the need for efficient, lower-impact refrigerants in various cooling applications. Carbon tetrachloride and chloroform, though less prevalent, also contribute to the market. Carbon tetrachloride is primarily used in the production of refrigerants and as a feedstock in the synthesis of other chemicals, while chloroform is utilized in the pharmaceutical industry and as a solvent in laboratories.

The remaining sub-segments, while not as dominant as methylene chloride, each contribute uniquely to the market’s growth. Methyl chloride’s role in silicone polymer production is critical as the demand for silicone products in construction and automotive industries continues to rise. Carbon tetrachloride, despite its limited use due to environmental concerns, still finds application in niche markets. Chloroform, mainly used in pharmaceuticals and laboratories, maintains steady demand driven by ongoing research and development in these fields.

Application Analysis

Silicone Polymers dominate with 18.6% due to high demand in construction and automotive industries.

The application segmentation of the chloromethane market highlights several key areas: refrigerants, industrial solvents, silicone polymers, laboratory chemicals, chemical intermediates, methylating & chlorinating agents, and others. Silicone polymers stand out as the dominant sub-segment with 18.6% market share. This dominance is due to the extensive use of silicone in various industries, including construction, automotive, and electronics. The unique properties of silicone polymers, such as durability, flexibility, and resistance to extreme temperatures, drive their demand. In construction, silicone is used for sealants, adhesives, and coatings, while in the automotive sector, it is essential for gaskets, seals, and insulation.

The other applications, while not as dominant as silicone polymers, play significant roles in the market. Refrigerants, for example, are crucial in the HVAC industry, with chloromethanes being key components in various cooling systems. Industrial solvents are another important sub-segment, particularly in manufacturing and cleaning applications, where the solvent properties of chloromethanes are highly valued. Laboratory chemicals and chemical intermediates are essential in research and chemical synthesis, respectively, ensuring the ongoing development and production of new compounds. Methylating and chlorinating agents are used in chemical synthesis and processing, further underscoring the versatility of chloromethanes in industrial applications.

The growth in these other applications is driven by continuous advancements and demand in their respective fields. Refrigerants benefit from the increasing need for efficient cooling systems in residential and commercial spaces. Industrial solvents see steady demand due to their use in manufacturing and maintenance processes. Laboratory chemicals are critical for ongoing scientific research and innovation, while chemical intermediates are necessary for the production of a wide range of end products. Methylating and chlorinating agents are fundamental in chemical processing, ensuring the synthesis of various compounds needed across multiple industries.

End-Use Analysis

Pharmaceuticals dominate with 35.7% due to extensive use in drug formulation and production.

The end-use segmentation of the chloromethane market includes pharmaceuticals, agrochemicals, textiles, automotive, construction, paints & coatings, and others. Pharmaceuticals emerge as the dominant sub-segment with a 35.7% market share. This is due to the extensive use of chloromethanes in drug formulation and production. Methylene chloride, in particular, is widely used as a solvent in the pharmaceutical industry, playing a crucial role in the extraction and purification of active pharmaceutical ingredients (APIs). The growing demand for pharmaceuticals, driven by an aging population and the increasing prevalence of chronic diseases, further propels this sub-segment’s dominance.

Agrochemicals represent another important end-use segment. Chloromethanes are used in the production of pesticides and herbicides, which are essential for modern agriculture. The demand for agrochemicals is driven by the need to increase crop yields and protect against pests and diseases. The textile industry also utilizes chloromethanes, particularly in the production of synthetic fibers and as solvents in dyeing and finishing processes. In the automotive sector, chloromethanes are used in the manufacturing of various components, including rubber and plastics. The construction industry benefits from chloromethanes in the production of adhesives, sealants, and coatings. Paints and coatings also represent a significant end-use, with chloromethanes being used as solvents and in the formulation of various paint products.

Each of these other end-use segments contributes to the market’s overall growth. Agrochemicals continue to see demand due to the need for efficient and effective crop protection solutions. The textile industry benefits from the ongoing demand for synthetic fibers and high-quality finishing processes. The automotive sector’s growth drives the need for durable and reliable components made using chloromethanes. The construction industry’s expansion necessitates the use of adhesives, sealants, and coatings, while the paints and coatings segment relies on chloromethanes for the formulation of various products used in residential, commercial, and industrial applications. Together, these segments ensure the comprehensive growth and diversification of the chloromethane market.

Key Market Segments

By Type

- Methylene Chloride

- Methyl Chloride

- Carbon Tetrachloride

- Chloroform

By Application

- Refrigerant

- Industrial Solvent

- Silicone Polymers

- Laboratory Chemicals

- Chemical Intermediates

- Methylating & Chlorinating Agent

- Others

By End-Use

- Pharmaceuticals

- Agrochemicals

- Textile

- Automotive

- Construction

- Paints & Coatings

- Others

Growth Opportunities

Chloromethane in Renewable Energy Offers Growth Opportunity

Chloromethane has significant growth potential in the renewable energy sector, especially in solar panel manufacturing. Chloromethane derivatives, such as silane gas (produced from methyl chloride), are essential for depositing the silicon layer in photovoltaic cells. With the global push towards renewable energy to combat climate change, the solar energy market is booming.

For example, the International Energy Agency predicts that solar PV capacity will grow by over 60% from 2020 to 2030. This surge presents substantial opportunities for the chloromethane market, as the demand for efficient and high-quality solar panels continues to rise. This growth aligns with global sustainability goals and provides a strong market expansion avenue for chloromethane producers.

Bio-based Chloromethane Offers Growth Opportunity

The trend towards sustainability and bio-based products presents growth opportunities for the chloromethane market. Innovative companies are exploring the production of chloromethane from renewable sources. For instance, scientists at the University of Groningen in the Netherlands have developed a bacterial strain that can produce chloromethane from methanol, a common byproduct of biogas production.

This breakthrough opens up opportunities for chloromethane in the circular economy, appealing to environmentally conscious consumers and industries. The development of bio-based chloromethane aligns with the global shift towards green chemistry and sustainable manufacturing, offering a promising market expansion route.

Trending Factors

Chloromethane in Battery Technology Are Trending Factors

Chloromethane, particularly dichloromethane, is trending in the battery technology sector due to the electric vehicle (EV) revolution and growth in renewable energy storage. Dichloromethane is used in the production of lithium-ion battery components.

For instance, Tesla, a leader in this space, reported a 28% increase in battery production in Q1 2021 compared to Q1 2020. As more automakers shift towards EVs, the demand for efficient and high-capacity batteries will drive the need for chloromethane. This trend highlights the importance of chloromethane in advancing battery technology and supporting the global transition to electric mobility and renewable energy.

Chloromethane in Nanotech Are Trending Factors

Nanotechnology is an emerging trend with applications across various industries, and chloromethane compounds play a key role. Chloromethane is used as solvents and precursors in nanoparticle synthesis. For example, dichloromethane is used in producing carbon nanotubes, which have applications in electronics, energy, and healthcare.

The growing demand for advanced materials and miniaturized technologies fuels the use of chloromethane in nanotechnology. This trend underscores the expanding role of chloromethane in cutting-edge scientific research and industrial applications, offering new growth opportunities for the market.

Regional Analysis

APAC Dominates with 44.5% Market Share

The Asia-Pacific (APAC) region holds a dominant 44.5% market share in the chloromethane market, with a market value of $2.403 billion. This dominance is driven by the region’s rapid industrialization and urbanization. The growing demand for chloromethane in key industries such as pharmaceuticals, electronics, and chemicals is a major factor. Countries like China and India, with their expanding manufacturing sectors and rising middle-class populations, are significant contributors to this market growth.

APAC’s large population base and economic growth contribute to high demand for chloromethane. The region’s strong industrial base, particularly in chemical manufacturing and electronics, drives substantial consumption. Favorable government policies and investments in infrastructure and technology further bolster the market. Additionally, the presence of major chloromethane manufacturers in APAC enhances the region’s market position.

APAC’s market dominance is expected to continue, with sustained industrial growth and increasing investments in research and development. The region’s focus on technological advancements and environmental sustainability will likely drive further demand for chloromethane. With a robust supply chain and expanding applications in various sectors, APAC’s influence in the chloromethane market is set to grow.

North America Holds 25% Market Share

North America accounts for 25% of the chloromethane market. The region’s well-established pharmaceutical and chemical industries drive this demand. High investment in R&D and technological advancements contribute to market growth. The presence of major players and strict regulatory standards ensure consistent market performance. The market is poised for steady growth with increasing applications in pharmaceuticals and electronics.

Europe Captures 20% Market Share

Europe holds a 20% market share in the chloromethane market. The region’s strong industrial base, especially in pharmaceuticals and chemicals, drives this demand. Stringent environmental regulations and a focus on sustainable practices influence market dynamics. With continuous innovation and a strong focus on green chemistry, Europe is expected to maintain its market position.

Middle East & Africa Achieves 6% Market Share

The Middle East & Africa region captures 6% of the chloromethane market share. The region’s developing industrial sectors and growing demand for chemicals and pharmaceuticals drive this market. Economic diversification efforts and investments in infrastructure contribute to market growth. The market is expected to grow as industrialization and economic activities expand.

Latin America Secures 4.5% Market Share

Latin America holds a 4.5% market share in the chloromethane market. The region’s developing economy and increasing industrial activities contribute to this growth. Brazil and Mexico are key markets due to their expanding chemical and pharmaceutical industries. Market growth is expected as the region continues to develop its industrial base and infrastructure.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The chloromethane market is significantly influenced by several key players, each contributing to market dynamics through their strategic positioning and market influence. Leading the industry, Dow Chemical Company and INEOS Group Holdings S.A. leverage their extensive global presence and advanced manufacturing capabilities. These companies are pivotal in setting industry standards and driving innovation in chloromethane applications.

Akzo Nobel N.V. and Solvay S.A. are renowned for their focus on sustainability and technological advancements, enhancing their competitive edge in the market. Their commitment to eco-friendly solutions aligns with global environmental regulations, reinforcing their market position.

Shin-Etsu Chemical Co., Ltd. and Kem One emphasize high-quality production and strategic partnerships, ensuring consistent market supply and expanding their geographical reach. Gujarat Alkalies and Chemicals Limited and Tokuyama Corporation are key regional players, significantly impacting the market with their strong local manufacturing bases and robust distribution networks.

Companies like SRF Limited and Occidental Chemical Corporation drive market growth through diversified product portfolios and strategic expansions. Juhua Group Corporation and Ercros S.A. focus on leveraging regional market dynamics to strengthen their market influence.

Alfa Aesar and Sinopec Group bring unique strengths in research and development, fostering innovation and enhancing product offerings in the chloromethane market. Collectively, these companies shape the competitive landscape, drive market trends, and contribute to the market’s overall growth and sustainability.

Market Key Players

- Dow Chemical Company

- INEOS Group Holdings S.A.

- Akzo Nobel N.V.

- Solvay S.A.

- Kem One

- Shin-Etsu Chemical Co., Ltd.

- Gujarat Alkalies and Chemicals Limited

- Tokuyama Corporation

- SRF Limited

- Occidental Chemical Corporation

- Juhua Group Corporation

- Ercros S.A.

- KEM ONE

- Alfa Aesar

- Sinopec Group

Recent Developments

- December 2023: Asahi Kasei Launches Chlor-Alkali Electrolysis Cells Rental Service Asahi Kasei launched a demonstration trial of a rental service for chlor-alkali electrolysis cells in Europe with Nobian and LOGISTEED Europe. The service aims to contribute to the circular economy and reduce customer burden.

- May 2022: Quantum Computational Analysis of SN2 Reaction A study published in Scientific Reports performed a quantum computational analysis of the bimolecular nucleophilic substitution (SN2) reaction between chloromethane and chloride ion, evaluating the accuracy and quantum noise effects of different quantum computing algorithms.

- August 2020: SRF to Invest in New Chloromethane Plant Indian chemical company SRF announced plans to invest ₹315 crore to set up a new chloromethane plant in India, expanding its production capacity to meet growing demand.

Report Scope

Report Features Description Market Value (2023) USD 5.4 Billion Forecast Revenue (2033) USD 8.6 Billion CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Methylene Chloride, Methyl Chloride, Carbon Tetrachloride, Chloroform), By Application (Refrigerant, Industrial Solvent, Silicone Polymers, Laboratory Chemicals, Chemical Intermediates, Methylating & Chlorinating Agent, Others), By End-Use (Pharmaceuticals, Agrochemicals, Textile, Automotive, Construction, Paints & Coatings, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dow Chemical Company, INEOS Group Holdings S.A., Akzo Nobel N.V., Solvay S.A., Kem One, Shin-Etsu Chemical Co., Ltd., Gujarat Alkalies and Chemicals Limited , Tokuyama Corporation, SRF Limited, Occidental Chemical Corporation, Juhua Group Corporation, Ercros S.A., KEM ONE, Alfa Aesar, Sinopec Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Global Chloromethane Market by 2033?The Global Chloromethane Market is expected to reach USD 8.6 billion by 2033. The market is anticipated to grow at a CAGR of 4.8% during this period.

Which region holds the largest market share in the Chloromethane Market?The Asia-Pacific (APAC) region holds the largest market share, accounting for 44.5%.

Who are the key players in the chloromethane market?Key players include Dow Chemical Company, INEOS Group Holdings S.A., Akzo Nobel N.V., Solvay S.A., and Shin-Etsu Chemical Co., Ltd.

What advancements are trending in the chloromethane market?Advancements in battery technology and nanotechnology, with applications in electric vehicles and nanoparticle synthesis, are trending factors.

-

-

- Dow Chemical Company

- INEOS Group Holdings S.A.

- Akzo Nobel N.V.

- Solvay S.A.

- Kem One

- Shin-Etsu Chemical Co., Ltd.

- Gujarat Alkalies and Chemicals Limited

- Tokuyama Corporation

- SRF Limited

- Occidental Chemical Corporation

- Juhua Group Corporation

- Ercros S.A.

- KEM ONE

- Alfa Aesar

- Sinopec Group