Global Chlorinated Polyvinyl Chloride Market By Process(Aqueous Suspension Method, Solvent Method, Solid-Phase Method), By Application(Plumbing Systems, Fire Protection Systems, Chemical and Industrial Equipment, Power Cable Casing, Adhesives and Coatings, Others), By End-Use Industry(Construction, Chemical, Healthcare, Agriculture, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 119224

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

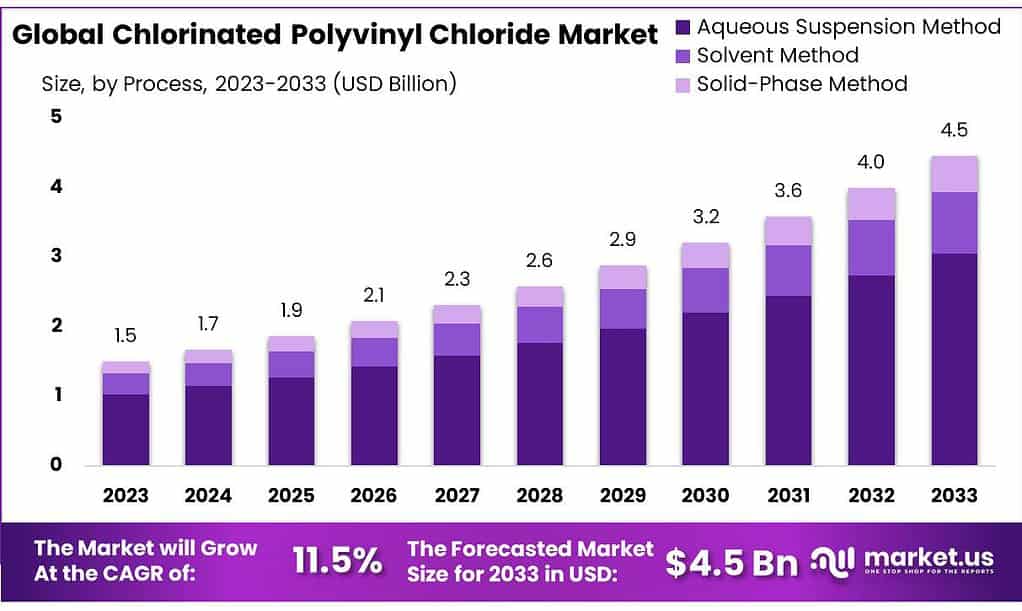

The global Chlorinated Polyvinyl Chloride Market size is expected to be worth around USD 4.5 billion by 2033, from USD 1.5 billion in 2023, growing at a CAGR of 11.5% during the forecast period from 2023 to 2033.

The Chlorinated Polyvinyl Chloride (CPVC) market involves the production and distribution of a specialized plastic polymer, which is extensively used across various industrial sectors. CPVC is derived from polyvinyl chloride (PVC), enhanced by the addition of chlorine to its structure, which improves its resistance to heat, chemicals, and corrosion. This makes CPVC particularly valuable in applications requiring high-temperature tolerance and chemical stability, such as hot water pipes, industrial liquid handling, and fire sprinkler systems.

The market for CPVC has been growing due to its advantages over traditional piping materials like copper and iron, including lower material costs, easier installation, and minimal maintenance requirements. Additionally, CPVC’s resistance to aggressive elements makes it ideal for use in harsh chemical environments, expanding its adoption in the chemical manufacturing and processing industries.

Another significant driver for the CPVC market is the ongoing construction boom in emerging economies, where rapid urbanization and infrastructure development are creating substantial demand for durable and reliable plumbing and fire suppression systems. The growth of the CPVC market is also supported by stringent building codes and regulations that emphasize fire safety and water conservation, further encouraging the use of CPVC in residential, commercial, and industrial construction.

Key Takeaways

- Market Growth: The CPVC market is to reach USD 4.5 billion by 2033, growing at 11.5% CAGR from 2023, driven by rising demand.

- Production Dominance: The aqueous Suspension Method holds a 68.4% market share in CPVC production, favored for cost-effectiveness.

- Application Diversity: Plumbing Systems lead CPVC usage (45.6% market share), followed by Fire Protection Systems.

- Construction Dominance: The construction sector accounts for 56.4% of CPVC usage, driven by durability and ease of installation.

- North America commands the largest share of the global CPVC market, accounting for 36.8%.

By Process

In 2023, the Aqueous Suspension Method held a dominant market position in the Chlorinated Polyvinyl Chloride (CPVC) production process segment, capturing more than a 68.4% share. This method involves suspending PVC particles in water and then adding chlorine. The process is favored for its cost-effectiveness and scalability, making it suitable for large-scale production. It also allows for precise control over the degree of chlorination, which is crucial for achieving the desired material properties such as enhanced temperature and chemical resistance.

The Solvent Method, while less prevalent, is utilized for its ability to produce CPVC with very high molecular weight, which is beneficial for certain high-performance applications requiring exceptional strength and durability. In this process, PVC is dissolved in a solvent, and chlorine is introduced in the solution phase. Although this method offers advantages in product performance, it is generally more expensive and complex, limiting its use to specialized applications where higher material specifications are necessary.

Lastly, the Solid-Phase Method involves directly chlorinating solid PVC without the use of a solvent or water medium. This method is appreciated for producing CPVC with lower levels of byproducts and residuals, which can be advantageous in applications demanding high purity, such as in medical devices or food contact materials. However, the process control and uniformity of chlorination can be more challenging compared to the aqueous suspension method, making it less common in the industry.

By Application

In 2023, Plumbing Systems held a dominant market position in the Chlorinated Polyvinyl Chloride (CPVC) applications, capturing more than a 45.6% share. CPVC’s resistance to high temperatures and corrosion makes it ideal for hot and cold water lines, significantly contributing to its widespread use in residential, commercial, and industrial plumbing installations. Its lightweight and easy installation properties further enhance its appeal in the plumbing sector.

Fire Protection Systems also represent a significant application of CPVC, thanks to its flame-retardant properties and low smoke generation. CPVC is extensively used in sprinkler systems within buildings where safety regulations require durable and reliable fire suppression solutions. Its ability to withstand high temperatures makes CPVC a preferred choice for fire protection applications.

In the segment of Chemical & Industrial Equipment, CPVC is valued for its chemical stability and resistance to aggressive chemicals. This makes it suitable for use in chemical processing plants and industrial equipment where exposure to harsh substances is common. CPVC pipes and fittings are often employed in these environments to transport corrosive liquids safely.

Power Cable Casing is another important application for CPVC. The material’s excellent insulation properties, combined with its resistance to degradation under thermal stress, make it suitable for protecting electrical cables. This application is critical in both industrial settings and infrastructure projects, where ensuring the safety and reliability of power distribution is paramount.

Adhesives & Coatings utilize CPVC for its adhesive qualities and compatibility with a variety of surfaces. CPVC-based adhesives and coatings are used to create strong bonds and provide protective barriers for materials in the construction and automotive industries, enhancing durability and resistance to environmental factors.

By End-Use Industry

In 2023, Construction held a dominant market position in the Chlorinated Polyvinyl Chloride (CPVC) market, capturing more than a 56.4% share. This industry’s reliance on CPVC is primarily due to its durability, resistance to degradation, and ease of installation, making it a preferred material for plumbing, heating, and fire sprinkler systems in both residential and commercial buildings. The ongoing global construction boom, particularly in developing regions, further drives the demand for CPVC in this sector.

The Chemical industry also significantly utilizes CPVC, particularly for its chemical resistance properties. CPVC is extensively used in the construction of pipes and fittings, tanks, and valves that are required to handle corrosive substances. This makes it an essential material in chemical manufacturing plants and laboratories where exposure to harsh chemicals is frequent.

In Healthcare, CPVC finds applications in a range of medical products, including components for medical devices and packaging. Its biocompatibility and safe use in sensitive environments make it suitable for healthcare applications. Additionally, the inherent properties of CPVC that prevent bacterial growth are particularly advantageous in hospital settings.

Agriculture is another sector where CPVC is increasingly being used. It is employed in irrigation systems and equipment due to its resistance to pesticides and fertilizers as well as its overall robustness in outdoor conditions. The lightweight nature and longevity of CPVC pipes make them ideal for agricultural operations that require reliable and long-lasting materials.

Key Market Segments

By Process

- Aqueous Suspension Method

- Solvent Method

- Solid-Phase Method

By Application

- Plumbing Systems

- Fire Protection Systems

- Chemical & Industrial Equipment

- Power Cable Casing

- Adhesives & Coatings

- Others

By End-Use Industry

- Construction

- Chemical

- Healthcare

- Agriculture

- Others

Drivers

Sustainable Construction Practices Fueling Growth in Chlorinated Polyvinyl Chloride (CPVC) Market

In recent years, the global construction industry has undergone a significant transformation, driven by an increasing focus on sustainable practices and environmental responsibility. Amidst this paradigm shift, Chlorinated Polyvinyl Chloride (CPVC) has emerged as a key player, experiencing a surge in demand due to its versatility, durability, and eco-friendly properties. As sustainability becomes a paramount consideration in construction projects worldwide, CPVC’s intrinsic characteristics position it as a favorable alternative to traditional piping materials, thereby propelling the growth of the CPVC market.

Rising Environmental Concerns and Regulatory Standards

The escalating environmental concerns associated with conventional piping materials such as metal and PVC (Polyvinyl Chloride) have prompted governments and regulatory bodies worldwide to impose stringent regulations aimed at curbing their adverse environmental impact. PVC, in particular, has faced criticism due to its use of chlorine and the release of toxic by-products during manufacturing and disposal processes. Consequently, the construction industry is witnessing a gradual but definitive shift towards more environmentally sustainable alternatives, with CPVC emerging as a frontrunner.

CPVC offers several distinct advantages over its counterparts, primarily owing to its unique composition and manufacturing process. Unlike PVC, CPVC is chlorinated, resulting in enhanced chemical and heat resistance, making it suitable for a broader range of applications, including hot and cold water distribution systems. Moreover, CPVC exhibits superior corrosion resistance, longevity, and dimensional stability, ensuring minimal maintenance requirements and prolonged service life, factors crucial in sustainable construction practices.

Advantages of CPVC in Sustainable Construction

One of the primary drivers accelerating the adoption of CPVC in sustainable construction is its inherent eco-friendly attributes. CPVC production involves the chlorination of PVC, a process that enhances the material’s resistance to heat, chemicals, and fire while reducing its environmental footprint. Unlike PVC, which releases harmful toxins such as dioxins and phthalates during manufacturing and disposal, CPVC emits significantly lower levels of hazardous substances, thereby minimizing its ecological impact.

Furthermore, CPVC’s durability and longevity contribute to sustainable construction practices by reducing the need for frequent replacements and repairs, thereby conserving resources and minimizing waste generation. The material’s ability to withstand harsh environmental conditions, including extreme temperatures and corrosive substances, ensures reliable performance over extended periods, aligning with the principles of sustainability and resource conservation.

Restraints

Regulatory Restrictions and Environmental Concerns: Impeding Growth in the Chlorinated Polyvinyl Chloride (CPVC) Market

Despite the promising growth prospects and widespread adoption of Chlorinated Polyvinyl Chloride (CPVC) in various industries, the market faces significant restraints primarily stemming from regulatory restrictions and environmental concerns. As governments worldwide intensify efforts to mitigate the environmental impact of chemical substances and uphold stringent safety standards, CPVC manufacturers and stakeholders encounter numerous challenges that impede market expansion and innovation.

Stringent Regulatory Frameworks and Compliance Requirements

One of the major restraints inhibiting the growth of the CPVC market revolves around the complex regulatory landscape governing the production, distribution, and use of chlorinated compounds. Regulatory agencies, such as the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) in the European Union, impose stringent standards and compliance requirements to safeguard human health and the environment from the adverse effects of chemical substances.

CPVC manufacturers are subject to a myriad of regulatory obligations, including registration, evaluation, authorization, and restriction of chemicals (REACH) in the EU, and the Toxic Substances Control Act (TSCA) in the U.S. These regulations mandate comprehensive risk assessments, toxicity testing, and environmental impact assessments to ensure the safe production, handling, and disposal of CPVC and its constituent chemicals. Failure to comply with regulatory requirements can result in severe penalties, fines, and legal liabilities, posing significant financial and reputational risks to market players.

Environmental Concerns and Public Perception

Another critical restraint confronting the CPVC market relates to growing environmental concerns and public perception regarding the use of chlorinated compounds in industrial applications. Chlorination, the process integral to CPVC production, involves the addition of chlorine gas to PVC resin to enhance its thermal and chemical resistance properties. While chlorination is essential for imparting desirable characteristics to CPVC, it also raises environmental alarms due to the potential release of chlorine by-products and harmful emissions during manufacturing and disposal processes.

Environmental advocacy groups and concerned stakeholders raise objections to CPVC production, citing potential risks associated with chlorine exposure, dioxin formation, and ecological disruption. Public perception plays a pivotal role in shaping consumer preferences and influencing purchasing decisions, thereby exerting indirect pressure on CPVC manufacturers to adopt more sustainable and eco-friendly alternatives. Moreover, heightened awareness of environmental issues, coupled with media scrutiny and social activism, amplifies pressure on regulatory authorities to enact stricter regulations and oversight measures, further complicating market dynamics for CPVC stakeholders.

Market Uncertainty and Technological Challenges

In addition to regulatory constraints and environmental considerations, the CPVC market grapples with inherent uncertainties and technological challenges that hinder innovation and market expansion. Rapid advancements in materials science, polymer chemistry, and manufacturing technologies necessitate continuous research and development efforts to improve CPVC’s performance, sustainability, and cost-effectiveness. However, the inherent complexity of CPVC chemistry and processing techniques poses challenges in achieving desired outcomes and overcoming technical barriers.

Furthermore, market volatility, fluctuating raw material prices, and geopolitical factors add another layer of uncertainty to the CPVC industry, influencing investment decisions, supply chain dynamics, and pricing strategies. Economic downturns, trade disputes, and geopolitical tensions can disrupt market stability, dampen consumer confidence, and impede growth opportunities for CPVC manufacturers and suppliers.

Opportunity

Emerging Opportunities in the Infrastructure Sector: Driving Growth in the Chlorinated Polyvinyl Chloride (CPVC) Market

Expanding Infrastructure Investments: Catalyst for CPVC Market Growth

The global infrastructure sector stands on the cusp of unprecedented growth and transformation, fueled by burgeoning urbanization, population growth, and increasing demand for sustainable infrastructure solutions. Within this dynamic landscape, Chlorinated Polyvinyl Chloride (CPVC) emerges as a pivotal enabler, poised to capitalize on emerging opportunities and drive innovation in piping systems for various infrastructure projects worldwide.

Urbanization and Population Growth

Rapid urbanization and population growth in emerging economies are reshaping the infrastructure landscape, creating a pressing need for robust, reliable, and sustainable piping solutions to support urban development and expansion. As urban centers burgeon with residential, commercial, and industrial developments, the demand for efficient water supply, sanitation, and HVAC (Heating, Ventilation, and Air Conditioning) systems escalates, presenting a significant opportunity for CPVC manufacturers and suppliers.

CPVC’s inherent characteristics, including corrosion resistance, durability, and ease of installation, position it as a preferred choice for plumbing and piping applications in urban infrastructure projects. The material’s ability to withstand harsh environmental conditions, extreme temperatures, and corrosive substances ensures long-term performance and reliability, essential considerations in urban environments characterized by high population densities and intensive usage.

Infrastructure Renewal and Retrofitting

In addition to new construction projects, the ongoing trend towards infrastructure renewal, modernization, and retrofitting presents lucrative opportunities for CPVC market players. Aging infrastructure assets, particularly in developed economies, necessitate upgrades and replacements to enhance performance, efficiency, and resilience against emerging challenges such as climate change and water scarcity.

CPVC offers a compelling solution for infrastructure renewal initiatives, offering cost-effective, sustainable alternatives to traditional piping materials such as metal and concrete. Its lightweight nature, flexibility, and ease of installation facilitate seamless retrofitting of existing structures without significant disruption to operations or infrastructure networks. Moreover, CPVC’s compatibility with modern plumbing technologies, including prefabricated piping systems and modular construction methods, streamlines installation processes and accelerates project timelines, driving cost savings and operational efficiencies.

Water Infrastructure Development

Water infrastructure development emerges as a key focal point for CPVC market expansion, driven by escalating water demand, aging infrastructure assets, and growing emphasis on water conservation and efficiency. CPVC’s suitability for potable water distribution, wastewater management, and irrigation systems positions it as an ideal solution for addressing critical water infrastructure challenges and meeting regulatory requirements.

CPVC’s inert properties, chemical resistance, and hygienic characteristics ensure the safe transport and delivery of potable water without leaching harmful contaminants or compromising water quality. Furthermore, CPVC’s resistance to corrosion and biofilm formation minimizes maintenance requirements and extends the service life of water distribution networks, reducing operational costs and enhancing system reliability.

Trends

Innovation and Sustainability: Key Trends Shaping the Chlorinated Polyvinyl Chloride (CPVC) Market

Advancements in Material Science Driving CPVC Market Trends

The Chlorinated Polyvinyl Chloride (CPVC) market is witnessing a paradigm shift driven by evolving industry trends and technological advancements that emphasize innovation and sustainability. As stakeholders across various sectors strive to meet stringent regulatory standards, address environmental concerns, and enhance operational efficiency, CPVC emerges as a versatile solution, poised to capitalize on emerging trends and shape the future of the piping industry.

Green Chemistry and Sustainable Manufacturing

One of the prominent trends reshaping the CPVC market is the growing emphasis on green chemistry principles and sustainable manufacturing practices. With increasing awareness of environmental issues and regulatory pressure to reduce carbon footprint, CPVC manufacturers are exploring innovative approaches to minimize environmental impact throughout the product lifecycle, from raw material sourcing to end-of-life disposal.

Green chemistry initiatives focus on optimizing chemical processes to minimize waste generation, energy consumption, and hazardous emissions, thereby promoting eco-friendly production methods and reducing environmental footprint. CPVC manufacturers are investing in research and development to develop bio-based feedstocks, renewable energy sources, and eco-friendly additives that enhance product sustainability and align with circular economy principles.

Enhanced Performance and Functional Integration

Another notable trend in the CPVC market is the ongoing pursuit of enhanced performance and functional integration to meet evolving end-user requirements and industry standards. As applications diversify and performance expectations rise, CPVC manufacturers are investing in product innovation and technology upgrades to deliver high-performance solutions tailored to specific end-use applications.

Advancements in CPVC formulations, compounding techniques, and processing technologies enable the development of specialty grades with enhanced properties such as fire resistance, UV stability, and antimicrobial efficacy. These specialized CPVC formulations cater to niche markets and demanding applications such as fire sprinkler systems, chemical processing, and healthcare facilities, where stringent performance requirements and regulatory compliance are paramount.

Digitalization and Industry 4.0 Integration

In line with broader industry trends towards digitalization and Industry 4.0 integration, the CPVC market is witnessing the adoption of digital technologies and data-driven solutions to optimize manufacturing processes, improve product quality, and enhance supply chain efficiency. CPVC manufacturers are leveraging advanced analytics, artificial intelligence, and Internet of Things (IoT) technologies to monitor production parameters, predict equipment failures, and optimize resource utilization in real-time.

Digitalization initiatives enable CPVC manufacturers to achieve greater operational agility, responsiveness, and flexibility in meeting fluctuating market demands while ensuring consistent product quality and regulatory compliance. Additionally, digital tools such as simulation software and virtual prototyping facilitate product design optimization, accelerating time-to-market for new CPVC formulations and customized solutions tailored to specific customer requirements.

Regional Analysis

North America is poised to take the lead in the Chlorinated Polyvinyl Chloride (CPVC) market. As of 2023, North America commands the largest share of the global CPVC market, accounting for 36.8%. The United States stands out as a key driver of CPVC adoption, fueled by a growing demand for safer and more reliable piping solutions. This surge is prompted by concerns surrounding outdated plumbing practices and the rising incidence of pipe-related issues.

There is mounting recognition across North American industries and communities regarding the significance of sustainable piping solutions. This awareness is spurring investments in advanced alternatives like CPVC. Stakeholders in this market grasp the advantages offered by CPVC, including enhanced durability, cost-effectiveness, and reduced environmental impact, which encourages greater willingness to invest in these alternatives.

North America benefits from a robust infrastructure in the piping industry, bolstered by a network of professionals and technology providers. This conducive environment fosters the development and integration of CPVC solutions, with industry leaders advocating for their widespread adoption. Moreover, many prominent CPVC technology companies are headquartered in North America, driving continuous research, innovation, and the availability of a diverse range of high-quality CPVC products in the market.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Analysis of key players in the Chlorinated Polyvinyl Chloride (CPVC) market reveals several prominent companies driving industry growth and innovation. These key players are instrumental in shaping market dynamics, influencing product development, and expanding market reach. Some of the leading players in the CPVC market include

Market Key Players

- The Lubrizol Corporation

- Sekisui Chemical Co., Ltd.

- Meghmani Finechem Limited

- Shandong Novista Chemical Co., Ltd.

- Shandong Pujie Rubber & Plastic Co., Ltd.

- Kaneka Corporation

- Shandong Yada New Material Co., Ltd.

- KEM ONE

- Shandong Xuye New Materials Co., Ltd.

- DCW Limited

- Sundow Polymers Co., Ltd.

- Mitsui & Co., Ltd.

Recent Developments

December 2023, Lubrizol’s CPVC business witnessed steady growth, driven by increasing adoption in construction, plumbing, and industrial sectors, positioning the company as a frontrunner in the CPVC market.

September 2023 Sekisui Chemical Co., Ltd, the company launched a CPVC compound with improved chemical resistance, addressing the needs of industries requiring robust corrosion-resistant materials.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Bn Forecast Revenue (2033) USD 4.5 Bn CAGR (2024-2033) 11.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Process(Aqueous Suspension Method, Solvent Method, Solid-Phase Method), By Application(Plumbing Systems, Fire Protection Systems, Chemical and Industrial Equipment, Power Cable Casing, Adhesives and Coatings, Others), By End-Use Industry(Construction, Chemical, Healthcare, Agriculture, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape The Lubrizol Corporation, Sekisui Chemical Co., Ltd., Meghmani Finechem Limited, Shandong Novista Chemical Co., Ltd., Shandong Pujie Rubber & Plastic Co., Ltd., Kaneka Corporation, Shandong Yada New Material Co., Ltd., KEM ONE, Shandong Xuye New Materials Co., Ltd., DCW Limited, Sundow Polymers Co., Ltd., Mitsui & Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Chlorinated Polyvinyl Chloride Market?Chlorinated Polyvinyl Chloride Market size is expected to be worth around USD 4.5 billion by 2033, from USD 1.5 billion in 2023

What CAGR is projected for the Chlorinated Polyvinyl Chloride Market?The Chlorinated Polyvinyl Chloride Market is expected to grow at 11.5% CAGR (2024-2033).

Name the major industry players in the Chlorinated Polyvinyl Chloride Market?The Lubrizol Corporation, Sekisui Chemical Co., Ltd., Meghmani Finechem Limited, Shandong Novista Chemical Co., Ltd., Shandong Pujie Rubber & Plastic Co., Ltd., Kaneka Corporation, Shandong Yada New Material Co., Ltd., KEM ONE, Shandong Xuye New Materials Co., Ltd., DCW Limited, Sundow Polymers Co., Ltd., Mitsui & Co., Ltd.

Chlorinated Polyvinyl Chloride MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Chlorinated Polyvinyl Chloride MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

The Lubrizol Corporation Sekisui Chemical Co., Ltd. Meghmani Finechem Limited Shandong Novista Chemical Co., Ltd. Shandong Pujie Rubber & Plastic Co., Ltd. Kaneka Corporation Shandong Yada New Material Co., Ltd. KEM ONE Shandong Xuye New Materials Co., Ltd. DCW Limited Sundow Polymers Co., Ltd. Mitsui & Co., Ltd.