Global Chemical Distribution Market By Product (Specialty Chemicals and Commodity Chemicals), By End-Use (Automotive & Transport, Agriculture, Construction, Consumer Goods, Industrial Manufacturing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Dec 2023

- Report ID: 67398

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

The global chemical distribution market size is expected to be worth around USD 35.3 billion by 2033, from USD 10.3 billion in 2023, growing at a CAGR of 13.1% during the forecast period from 2023 to 2033.

Chemical distributors are likely to see increased demand for chemicals in the future, especially in the construction, pharmaceutical, and polymers industries. This is coupled with the high difficulty of reaching customers.

Key Takeaways

- The global chemical distribution market is set to reach USD 35.3 billion by 2033, growing from USD 10.3 billion in 2023 at a 13.1% CAGR.

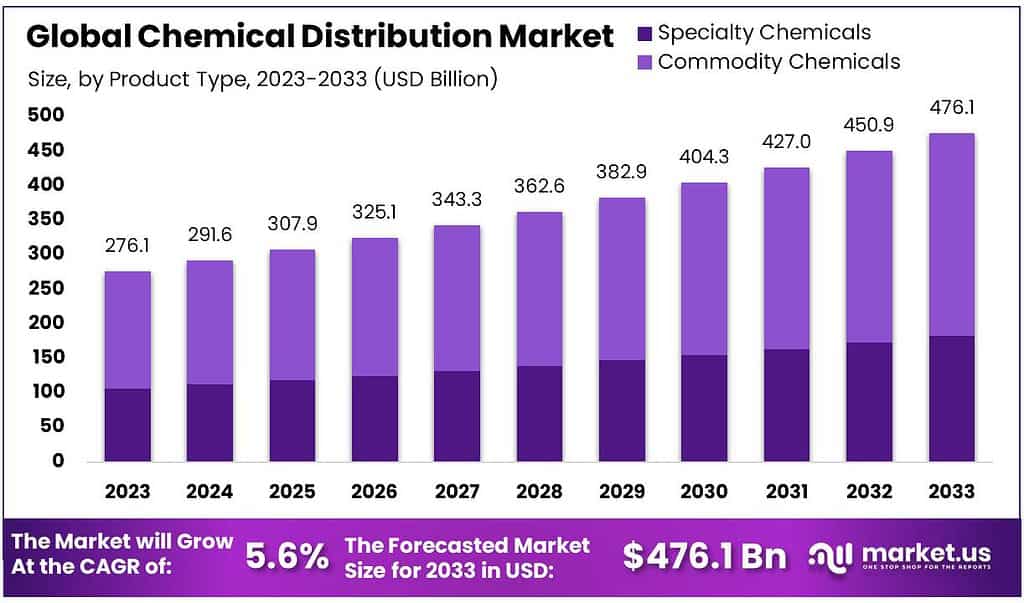

- Commodity chemicals hold the largest market share at 61.6%, widely used in industries such as automotive, electronics, and consumer goods.

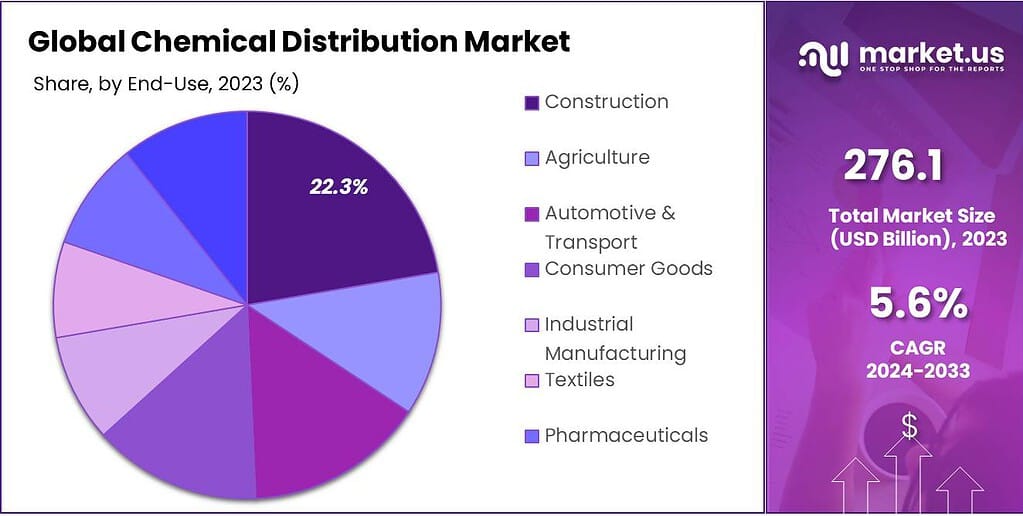

- The construction sector is a major market player, accounting for 22.3% of the chemical distribution market share in 2023.

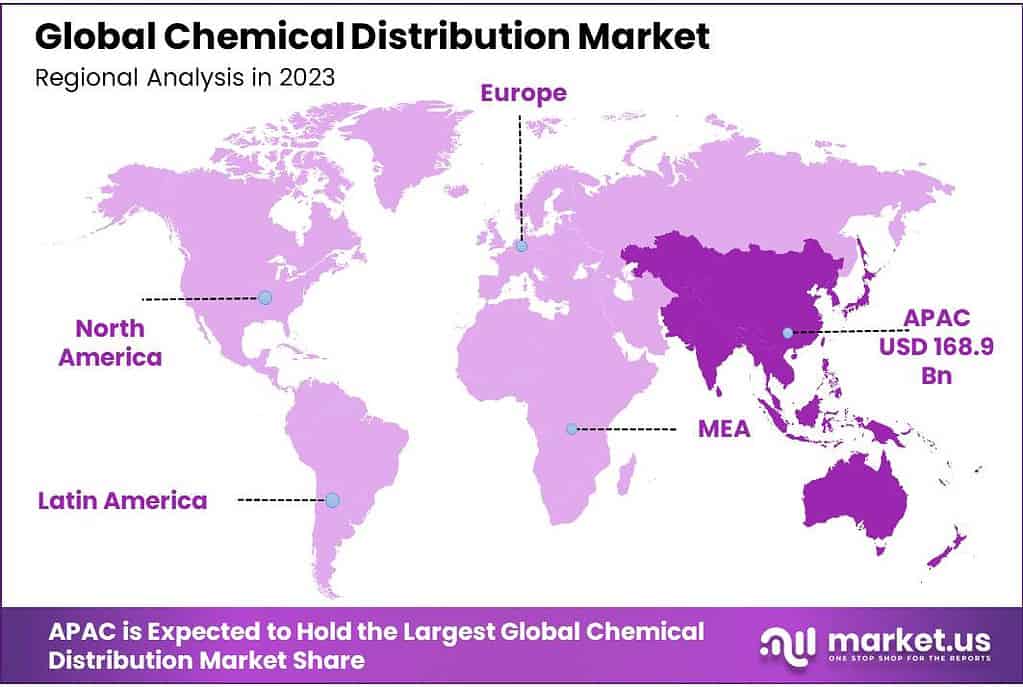

- The Asia Pacific region dominates the market, contributing 61.2% of the total revenue in 2023, bolstered by robust manufacturing growth and rising incomes.

Product Analysis

Commodity Chemicals’ Dominance: Commodity chemicals, making up 61.6% of the market, are the everyday chemicals we often encounter. Chemicals commonly found in products used across industries include synthetic rubber, petrochemicals (derived from petroleum), plastics & polymers, and materials used in explosives. These chemicals have many uses across manufacturing, construction, and other sectors of business.

The commodity chemicals industry includes plastics and rubber, synthetic rubber, and explosives. It also includes petrochemicals and other bulk polymers, fibers, basic organics, or aromatics. This segment, which has experienced a 14% increase in total return to shareholders (TRS) between 2000 and 2015, is collectively the best.

During the same period, specialty compounds only increased by about 12%. Despite a drop in sales caused by the crash in crude oil prices, the commodity chemicals segment was able to maintain selling prices in certain markets.

The dominance of commodity compounds in the global supply chain was due to their huge consumption in major end-use industries like automotive, electronics, and consumer goods. This segment has experienced a 4.8% CAGR from 2023-2032 due to its large consumption in various industries.

The specialty product category refers to high-performance and customized chemical products that are tailored to specific consumer needs.

Coatings Adhesives Sealants, Coatings, Elastomers(CASE), construction materials, cosmetic additives, polymers, and lubricant additives are some specialty compounds. These compounds are widely used in end-use industries like automotive, construction, electronics, and pharmaceuticals.

Because of the availability of cheap petrochemicals, large manufacturers are moving to the Middle East/Africa (MEA) as their manufacturing base. Due to the high labor costs and economic growth, other industries are expanding production in Asia.

Trade liberalization, the elimination of economic barriers, advanced processing technology, and rapid growth in industrialized Asian countries have all contributed to the rise in the standard of living in many of these developing countries. This has also influenced specialty chemical consumption and distribution.

Specialty chemicals will be the fastest-growing segment. The future will see a rise in demand for applications-specific chemicals in various industries, as well as technological advances in terms of production.

End Use Analysis

Construction’s Dominance: In 2023, the Construction sector emerged as a significant player in the chemical distribution market, capturing a substantial share of over 22.3%. This sector heavily relies on an array of chemicals for various purposes within the construction industry.

Chemicals are pivotal in creating durable and innovative building materials, such as adhesives, sealants, coatings, and specialized compounds used in infrastructure development, contributing significantly to this sector’s dominance in the market.

In the United States, and in China, there has been an increase in pollution. This has prompted innovation in building materials. One of these businesses, Boral Roofing, has created a smog-repellent substance that eliminates nitrogen oxides (NOx). The air quality is raised by using this tile.

Additionally, increased construction investment in developing nations throughout Asia and the Pacific will fuel the demand for specialized chemicals. With a 34.9% share of total revenue in 2023, the downstream market has been the dominant market for commodity chemicals.

The downstream sector covers petroleum crude oil refining, process, and purification of natural gas. This sector also includes the marketing, distributing, and selling many petroleum-derived products.

Key Market Segments

Product

- Specialty Chemicals

- Agrochemicals

- CASE

- Specialty Polymers & Resins

- Electronic

- Others

- Commodity Chemicals

- Synthetic Rubber

- Plastic & polymers

- Petrochemicals

- Explosives

- Others

End-Use

- Automotive & Transport

- Agriculture

- Construction

- Consumer Goods

- Industrial Manufacturing

- Textiles

- Pharmaceuticals

- Others

Drivers

The market landscape has been evolving, driven by several key factors that continue to shape and redefine various sectors. One prominent catalyst is the amplified demand stemming from diverse end-use sectors, where consumer preferences and industry requirements have surged, prompting a parallel increase in product and service demand.

Simultaneously, the utilization of both bulk and specialty chemicals has seen a notable upsurge. These chemicals, playing pivotal roles across numerous industries, have witnessed growing adoption rates. This surge can be attributed to their indispensable applications in a wide array of manufacturing processes, thereby further propelling their market demand.

Agriculture and construction sectors, cornerstones of global infrastructure and sustenance, have seen a rising adoption of cutting-edge solutions and chemical applications. These sectors are embracing advanced technologies and innovative chemical solutions to enhance productivity, efficiency, and sustainability practices, thereby fueling the market growth in these domains.

Moreover, the integration of cutting-edge technologies has become a hallmark of market evolution. This integration encompasses various aspects, including process optimization, automation, and the development of more eco-friendly products. This concerted effort toward technological integration has not only streamlined operations but has also paved the way for novel applications and improved product offerings.

The interplay of these drivers has led to a dynamic market environment, characterized by innovation, diversification, and a constant quest for enhanced efficiency and sustainability across industries. As these trends persist and evolve, they are expected to continue reshaping market dynamics, fostering new opportunities, and steering the trajectory of the chemical and allied sectors into a promising future.

Restraints

At times, market conditions create bottlenecks. One major challenge involves how businesses affect the environment and operate safely – there are rules they need to follow to safeguard nature while also keeping everyone safe – but following them and making changes that make operations more eco-friendly can cost businesses money.

Problems often arise with material costs fluctuating significantly, making it hard for companies to plan and consistently make profits. Sometimes this happens as a result of happenings in other countries or changes to the global economy.

Companies are actively trying to find ways to overcome this challenge by discovering more eco-friendly methods of manufacturing products. They’re searching for safer and more sustainable materials that they can use; some even manage price fluctuations by switching up where they get their materials from.

Although environmental problems do exist, businesses that find ways to work around them and implement changes that aid the environment tend to do better overall. They adapt while simultaneously being more responsible.

Opportunities

In the bustling market, several exciting opportunities are emerging that can steer industries towards growth and success. One such opportunity lies in the increased emphasis on producing superior-quality products. Consumers today are more discriminating, seeking products that not only meet their needs but also uphold high standards of quality. This demand creates opportunities for companies that focus on product quality to differentiate themselves and gain competitive advantages and develop customer relationships.

Additionally, the landscape presents opportunities through increasing consolidation and merger and acquisition (M&A) activities. Companies often merge or acquire other businesses to broaden their market presence, diversify offerings or gain access to new technologies or markets. Consolidation can create synergies, economies of scale and increased market reach – providing companies with an opportunity to strengthen their position within their industries.

For companies considering mergers or acquisitions, this environment offers opportunities to strategically align with complementary businesses, pool resources, and capitalize on each other’s strengths to drive innovation and market penetration. Moreover, it allows for the exploration of new market segments and the potential to broaden product portfolios, catering to evolving consumer demands and preferences.

Harnessing these opportunities requires a keen understanding of market trends, consumer behaviors, and strategic foresight. Companies that prioritize delivering high-quality products and services stand to capture a loyal customer base. Simultaneously, those exploring consolidation and M&A activities strategically position themselves for growth, innovation, and a competitive advantage in a rapidly evolving market landscape. Identifying and leveraging these opportunities can pave the way for sustainable success and market leadership.

Challenges

Rules and Laws: Companies that distribute chemicals must abide by strict laws about how they handle and transport these materials, but these laws can vary widely across locations making it hard to stay abreast of them and follow them properly.

Selling Chemicals Can Be Complicated: Selling chemicals involves multiple steps and multiple middlemen, so keeping track of each step and making sure the chemicals remain in good condition while moving through each one can be challenging.

Price Variability: Due to fluctuating material costs in producing chemicals, companies often struggle with determining their prices and potential profits when pricing their products and calculating how much profit they’ll make from selling them.

Reacclimating to New Technology: Although new technology can make things simpler, its introduction can bring with it many changes that must be addressed to make the transition easy and seamless. Figuring out how best to utilize and integrate this new tech with our old methods may take some getting used to.

Helping the Environment: With increased public concern regarding how chemicals impact our Earth, companies must find ways to offer environmentally-friendly alternatives that don’t cost more to produce. However, sometimes this means investing more money upfront.

Plenty of Competition: Multiple companies offering similar services make it hard for smaller ones to compete effectively and grow as it becomes difficult to decide how much to charge their clients for products or services. This can make pricing decisions more complex.

Making Customers Happy: Customers want things fast and exactly how they want them. Companies must find ways to meet this need without losing money in the process.

Regional Analysis

The Asia Pacific emerged as the largest regional market and accounted for 61.2% overall revenue share for 2023. The forecast period will see an increase in manufacturing activities and a significant rise in per capita disposable income. China, India Malaysia, Vietnam, and Thailand are experiencing the growth of various industries, including automotive, construction, electrical, and electronics.

The region’s chemical production is expected to increase at an incredible rate as major players shift to high-opportunity markets. With a higher CAGR (5.9%) in specialty chemicals between 2023 and 2032, commodity compounds will continue to be the dominant segment of Asia Pacific.

North America’s chemical industry is one the most consolidated, with Univar and Brenntag holding a 30-40% market share. The market will see increased capital investment from international chemical producers due to labor market upgrading, easy access to credit, and abundant feedstock. The trend to use third-party distributors has changed as a platform for expansion into untapped regions.

Major chemical companies in North America have been increasing their production capabilities in recent years. In North America, however, the petrochemical market has seen a slowdown in recent years due to low crude oil prices and a weaker GDP in Latin America. The United States Gulf Coast is home to several planned projects, notably South Louisiana Methanol and Nat gasoline, which are scheduled to produce 1.75 million MT and 1.8 million MT per year, respectively, of petrochemicals.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Global distributor companies like Millipore Sigma, Brenntag, and Univar Solutions have acquired small distributors to help them achieve economies of scale. This has allowed them to concentrate on special sales channels, rationalizing their distributor base and strengthening their supply chain networks.

To diversify their product lines and increase market share globally, companies use major strategies such as acquisitions, mergers, and capacity expansion. Major companies are increasing the number of specialty products in their product portfolios to consolidate growth.

Key Market Players

- Brenntag AG

- Helm AG

- Univar Inc.

- Omya AG

- Jebsen& Jessen Offshore Pte. Ltd.

- TER Group

- Barentz B.V.

- Azelis Holding S.A.

- Solvadis

- Ashland, Inc.

- Nexeo Solution Holding LLC

- ICC Chemicals, Inc.

Recent Development

In February 2023, Univar Solutions Inc. announced its acquisition of ChemSol Group in Costa Rica, El Salvador, Panama, Guatemala, and Honduras to strengthen its footprint in Central America and boost its ingredients and specialties portfolio.

In March 2023, Brenntag acquired Aik Moh Group to enhance its production and distribution of industrial chemicals, and offer value-added services including logistics, repacking, warehousing, and mixing and blending, with a focus on South-East Asia.

In May 2023, Azelis joined Sirius International to further its goal of becoming a global leader in providing sustainable chemical raw materials.

Report Scope

Report Features Description Market Value (2023) USD 10.3 Billion Forecast Revenue (2033) USD 35.3 Billion CAGR (2023-2032) 13.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Specialty Chemicals and Commodity Chemicals), By End-Use (Automotive & Transport, Agriculture, Construction, Consumer Goods, Industrial Manufacturing) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Brenntag AG, Helm AG, Univar Inc., Omya AG, Jebsen& Jessen Offshore Pte. Ltd., TER Group, Barentz B.V., Azelis Holding S.A., Solvadis, Ashland, Inc., Nexeo Solution Holding LLC, ICC Chemicals, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is chemical distribution?Chemical distribution involves the wholesale and logistical distribution of chemicals from manufacturers to end-users across various industries. It serves as a link between chemical producers and consumers, offering a range of products, storage, and delivery services.

What services do chemical distributors offer?Chemical distributors typically provide services such as inventory management, blending, packaging, technical support, regulatory compliance assistance, transportation, and warehousing to meet the specific needs of their clients.

What are the future prospects for the chemical distribution market?The chemical distribution market is expected to continue growing, driven by increasing demand across various industries. Trends include a focus on sustainability, innovation in supply chain management, and further integration of digital technologies to enhance efficiency.

Chemical Distribution MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Chemical Distribution MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Brenntag AG

- Helm AG

- Univar Inc.

- Omya AG

- Jebsen& Jessen Offshore Pte. Ltd.

- TER Group

- Barentz B.V.

- Azelis Holding S.A.

- Solvadis

- Ashland, Inc.

- Nexeo Solution Holding LLC

- ICC Chemicals, Inc.