Global Ceramide Skincare Market Size, Share, Growth Analysis By Product Type (Ceramide Based Creams, Ceramide Based Lotions, Ceramide Based Serums, Ceramide Based Cleansers, Ceramide Based Masks, Others), By Process (Fermentation Ceramides, Plant Extract Ceramides), By Gender (Women, Men), By Skin Type (Dry Skin, Oily Skin, Combination Skin, Sensitive Skin), By Application (Cosmeceuticals, Pharmaceuticals, Food and Beverages, Dietary Supplements, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163663

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

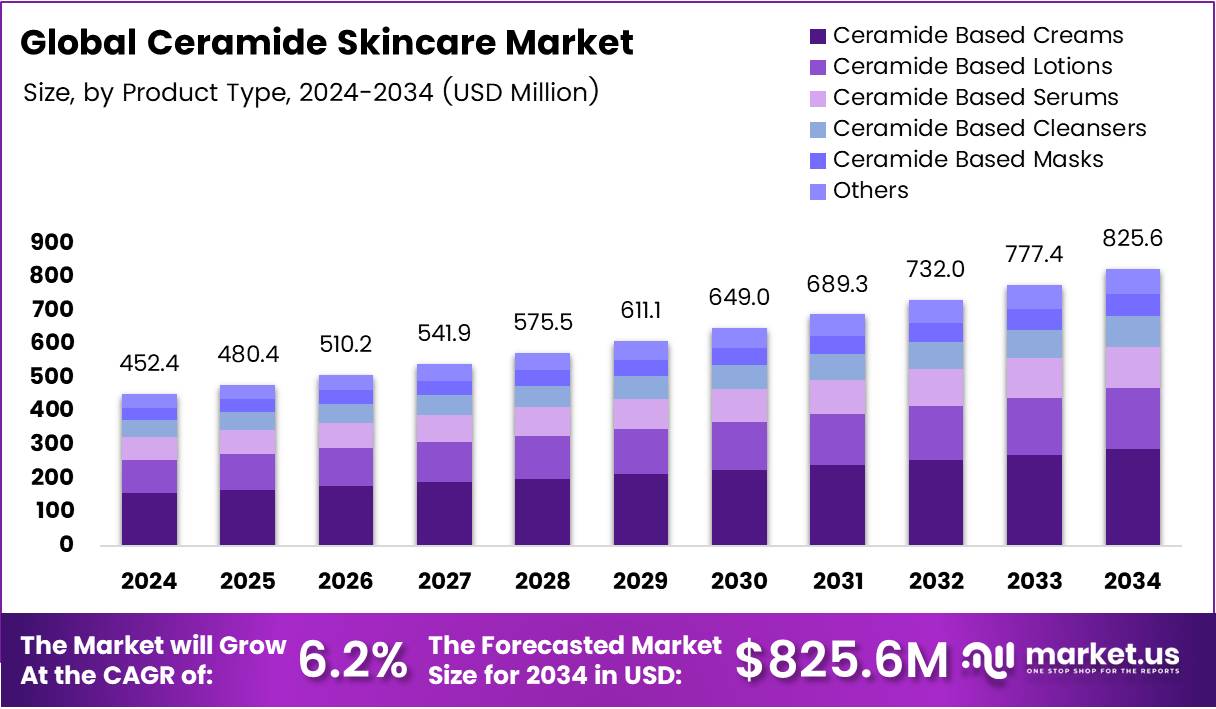

The Global Ceramide Skincare Market size is expected to be worth around USD 825.6 Million by 2034, from USD 452.4 Million in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The Ceramide Skincare Market represents a growing segment within the global beauty and personal care industry, driven by rising demand for skin barrier restoration products. Ceramides, as natural lipids, play a crucial role in maintaining moisture balance and protecting against environmental damage. Increasing consumer awareness of skincare science continues to boost product innovation and adoption.

Analysts observe that the market is expanding steadily due to the rising preference for dermatologist-recommended and science-based formulations. Consumers increasingly seek long-lasting hydration and anti-aging benefits, making ceramide-based skincare a key choice. The surge in e-commerce platforms further enhances product accessibility, allowing premium and mass brands to reach broader audiences globally.

Moreover, technological advancements in formulation science are enabling the development of ceramide-enriched serums, creams, and moisturizers with improved absorption and stability. These innovations cater to sensitive and dry skin segments, which collectively account for a significant portion of skincare consumption. This trend highlights how the Ceramide Skincare Market aligns with the clean beauty and functional skincare movements.

Opportunities also emerge through government-backed initiatives promoting safe cosmetic ingredients and transparency in product labeling. Regulatory frameworks in the U.S., EU, and Asia are emphasizing ingredient safety compliance and consumer protection, indirectly supporting ceramide formulation standardization. Such regulations encourage R&D investments in bio-based and sustainable ceramide extraction methods.

Additionally, many governments are supporting innovation in the cosmetic biotechnology sector through funding and partnerships. For instance, incentives for eco-friendly ingredient manufacturing are encouraging companies to invest in green chemistry. This shift is expected to strengthen the market’s sustainability outlook and enhance the trust of health-conscious consumers.

Key Takeaways

- The Global Ceramide Skincare Market is projected to reach USD 825.6 Million by 2034, growing from USD 452.4 Million in 2024 at a CAGR of 6.2%.

- Ceramide Based Creams dominate the market by product type with a 34.8% share in 2024, driven by superior moisturizing performance.

- Fermentation Ceramides lead the process segment with a 67.3% share, supported by sustainable and high-purity bio-fermentation methods.

- Women represent the largest gender segment, accounting for 69.2% of total market share due to higher skincare adoption.

- By skin type, Dry Skin holds the dominant 38.4% share, reflecting strong demand for hydration and barrier-repair solutions.

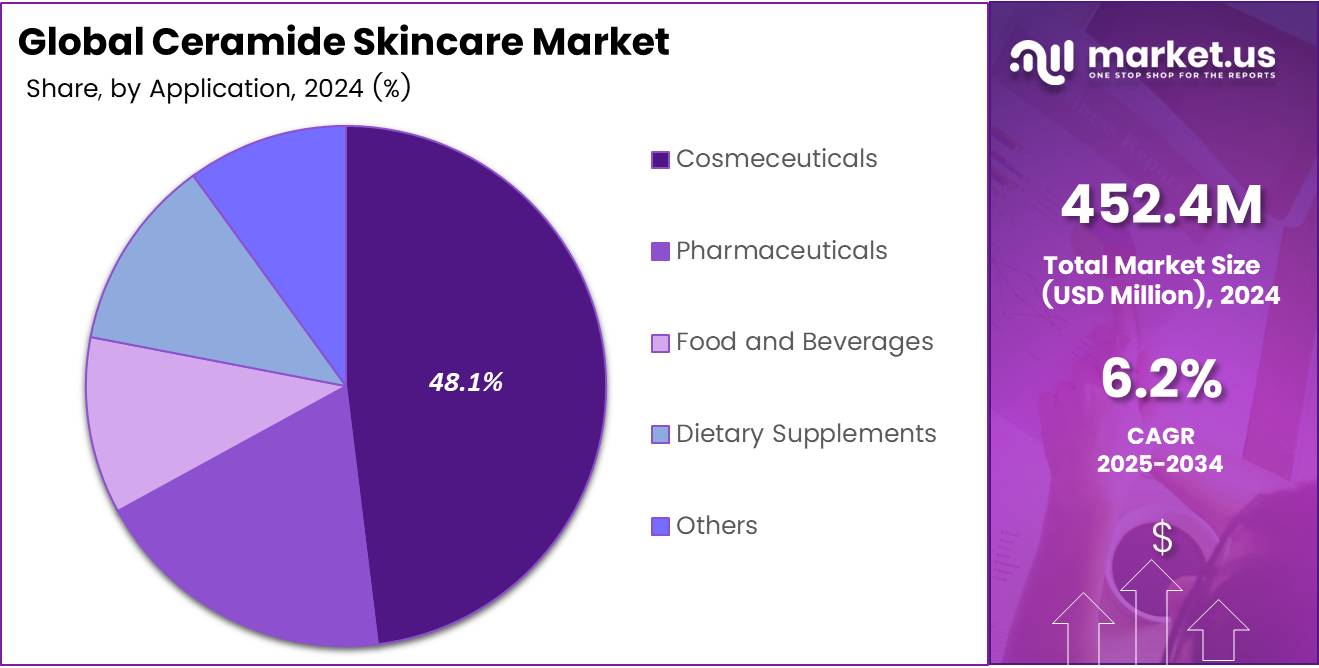

- Cosmeceuticals lead by application with a 48.1% market share, owing to the popularity of science-backed skincare formulations.

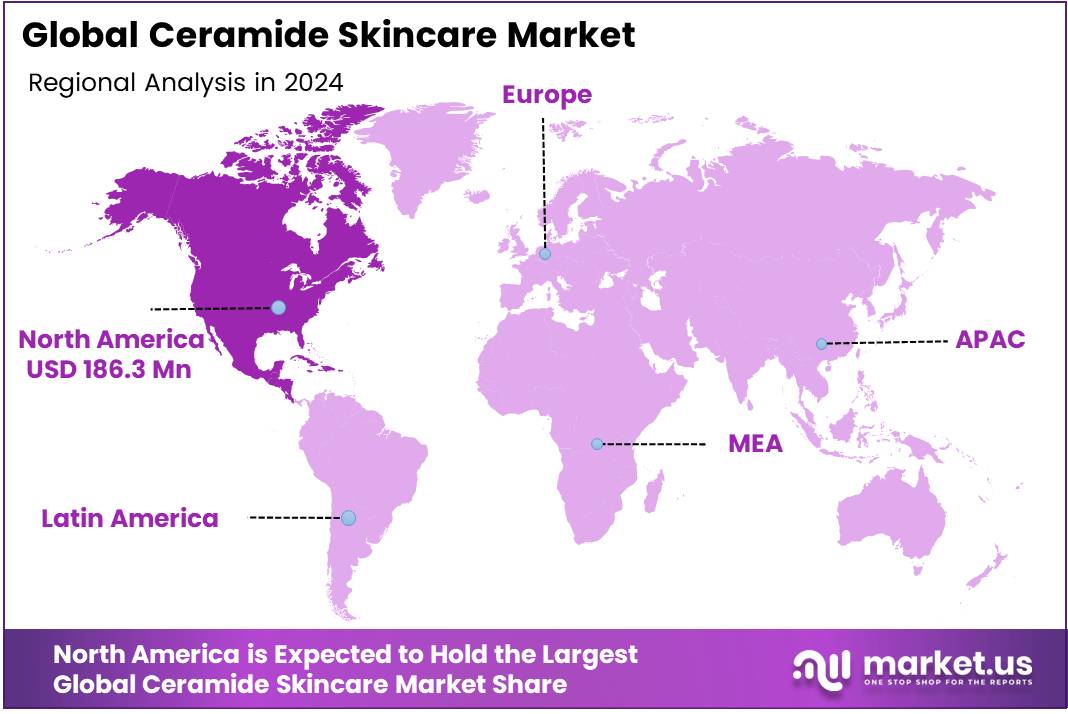

- North America dominates regionally with a 41.2% share valued at USD 186.3 Million, followed by strong growth in Europe and Asia Pacific.

By Product Type Analysis

Ceramide Based Creams dominate with 34.8% due to their superior moisturizing capability and wide consumer acceptance.

In 2024, Ceramide Based Creams held a dominant market position in the By Product Type segment of the Ceramide Skincare Market, with a 34.8% share. These creams are favored for their ability to restore the skin barrier and retain moisture effectively. Their deep hydration properties and dermatological endorsement make them a preferred choice among consumers.

Ceramide Based Lotions are gaining momentum as lightweight alternatives to creams. They appeal to users seeking quick absorption and non-greasy finishes, making them ideal for daily skincare routines. Increasing demand for multi-functional lotions is further boosting their growth.

Ceramide Based Serums are growing rapidly due to their high concentration of active ingredients. Consumers prefer serums for targeted skincare benefits like anti-aging, hydration, and skin repair. Their premium appeal also attracts a luxury skincare audience.

Ceramide Based Cleansers are increasingly popular for gentle skin cleansing without stripping natural oils. The rise of mild, pH-balanced formulations supports market expansion.

Ceramide Based Masks offer intense hydration treatments for dry and stressed skin. Growing usage in self-care routines and spa treatments enhances their demand.

Others include toners and exfoliants infused with ceramides, offering niche benefits for specific skin concerns.

By Process Analysis

Fermentation Ceramides dominate with 67.3% due to their purity, scalability, and eco-friendly production process.

In 2024, Fermentation Ceramides held a dominant market position in the By Process segment of the Ceramide Skincare Market, with a 67.3% share. These ceramides are produced through bio-fermentation, ensuring consistent quality and sustainable sourcing. Their high biocompatibility enhances formulation effectiveness, making them widely used in premium skincare products.

Plant Extract Ceramides are gaining attention as natural and vegan-friendly alternatives. Extracted from sources like rice and wheat, they cater to the rising consumer demand for clean beauty and eco-conscious formulations. Their growth is supported by innovation in botanical extraction technologies.

By Gender Analysis

Women dominate with 69.2% owing to higher skincare adoption and product awareness across all age groups.

In 2024, Women held a dominant market position in the By Gender segment of the Ceramide Skincare Market, with a 69.2% share. Women’s preference for targeted skincare solutions and anti-aging formulations drives significant consumption. The availability of diverse ceramide-based products tailored for women further boosts this dominance.

Men represent a growing demographic in skincare. Increasing awareness of grooming and skin health among men has led to rising demand for ceramide-infused products that combat dryness and environmental stress. Brands are launching male-specific lines to capture this expanding segment.

By Skin Type Analysis

Dry Skin dominates with 38.4% due to high demand for hydration and barrier-repair solutions.

In 2024, Dry Skin held a dominant market position in the By Skin Type segment of the Ceramide Skincare Market, with a 38.4% share. Ceramide-rich formulations are particularly effective for replenishing lipids and preventing moisture loss, making them essential for people with dry skin.

Oily Skin consumers are increasingly using ceramide-based products that balance sebum levels without clogging pores. Lightweight, non-comedogenic formulations are driving product adoption among this group.

Combination Skin requires balanced hydration, and ceramide products meet this need by repairing the skin barrier while maintaining equilibrium. The versatility of these products contributes to their steady demand.

Sensitive Skin users prefer ceramides for their soothing and anti-inflammatory properties. These formulations help reduce irritation and strengthen the skin’s defense against allergens and pollutants.

By Application Analysis

Cosmeceuticals dominate with 48.1% due to their dual benefits of skincare and therapeutic performance.

In 2024, Cosmeceuticals held a dominant market position in the By Application segment of the Ceramide Skincare Market, with a 48.1% share. The rising consumer preference for science-backed skincare solutions has accelerated this segment’s growth, especially in anti-aging and hydration-focused products.

Pharmaceuticals utilize ceramides in dermatological treatments for eczema and psoriasis. Their proven efficacy in repairing skin barriers enhances their medical relevance.

Food and Beverages are emerging as innovative applications, incorporating ceramides for beauty-from-within benefits. These functional products appeal to health-conscious consumers seeking holistic skincare.

Dietary Supplements are gaining popularity for supporting skin hydration and elasticity internally. Growing trends in nutricosmetics are propelling this segment.

Others include specialty applications such as baby skincare and clinical products, offering targeted benefits and niche market opportunities.

Key Market Segments

By Product Type

- Ceramide Based Creams

- Ceramide Based Lotions

- Ceramide Based Serums

- Ceramide Based Cleansers

- Ceramide Based Masks

- Others

By Process

- Fermentation Ceramides

- Plant Extract Ceramides

By Gender

- Women

- Men

By Skin Type

- Dry Skin

- Oily Skin

- Combination Skin

- Sensitive Skin

By Application

- Cosmeceuticals

- Pharmaceuticals

- Food and Beverages

- Dietary Supplements

- Others

Drivers

Rising Consumer Preference for Barrier-Repair and Moisture-Retention Skincare Solutions Drives Market Growth

The ceramide skincare market is witnessing strong growth as consumers increasingly seek products that restore and strengthen the skin barrier. Rising awareness about the importance of moisture retention and skin repair is fueling demand for ceramide-based creams, serums, and lotions. These products help prevent dryness and irritation, making them highly appealing to people with sensitive or damaged skin.

Dermatologists are also recommending ceramide-rich formulations for daily skincare, which has encouraged brands to launch clinically proven product lines. This growing trust in science-backed skincare is creating steady market momentum. Furthermore, the popularity of anti-aging solutions featuring ceramides is expanding the customer base, especially among middle-aged consumers looking to maintain skin elasticity.

E-commerce platforms and direct-to-consumer skincare brands have also played a crucial role in boosting market accessibility. With online reviews, influencer endorsements, and subscription models, consumers are more informed and confident in purchasing ceramide products. Overall, increasing consumer education and the push for effective moisture-locking skincare are key drivers shaping the ceramide skincare market’s growth trajectory.

Restraints

Limited Consumer Awareness in Emerging and Price-Sensitive Markets Restrains Market Expansion

Despite strong growth potential, the ceramide skincare market faces challenges in reaching emerging and low-income regions. Many consumers in these markets have limited awareness about ceramides and their skin health benefits, leading to lower adoption rates compared to developed economies. Additionally, higher product prices often make ceramide-based formulations less accessible to cost-sensitive consumers.

Another major restraint is the complexity of product formulation. Ceramides are delicate ingredients that can lose stability and effectiveness during manufacturing or storage. This makes it difficult for brands to maintain consistent quality, especially in hot or humid climates. These challenges increase production costs and limit innovation among smaller players.

The market also faces stiff competition from alternative skincare ingredients such as hyaluronic acid and peptides. These substitutes offer similar hydration and anti-aging benefits at a lower cost, attracting a wider audience. As a result, ceramide-based products must focus on differentiation and education to maintain market relevance and compete effectively in the skincare industry.

Growth Factors

Development of Vegan and Plant-Derived Ceramide Alternatives Creates New Growth Opportunities

The growing trend toward clean and sustainable beauty is opening new avenues for the ceramide skincare market. Companies are increasingly developing vegan and plant-based ceramide alternatives to meet consumer demand for ethical and eco-friendly skincare. This shift not only broadens the market reach but also aligns with global sustainability goals.

Ceramides are also being incorporated into multifunctional skincare and cosmetic products, such as tinted moisturizers, sunscreens, and anti-aging foundations. These hybrid solutions appeal to busy consumers seeking simplicity and efficiency in their skincare routines. This integration strategy enhances brand value and encourages product diversification.

Moreover, brands are exploring male grooming and teen skincare segments, recognizing their growing interest in barrier-repair solutions. Partnerships with dermatology clinics and pharmaceutical companies further enhance credibility and product visibility. Such collaborations allow brands to develop clinically tested, dermatologist-backed formulations, strengthening consumer trust and driving market expansion in the coming years.

Emerging Trends

Surge in K-Beauty and J-Beauty Formulations Featuring Advanced Ceramide Complexes Shapes Market Trends

Asian beauty trends, particularly K-beauty and J-beauty, are significantly influencing the global ceramide skincare market. These formulations emphasize skin barrier repair, hydration, and gentle ingredients, inspiring global brands to adopt similar approaches. The use of advanced ceramide complexes in these products enhances skin resilience and moisture retention, appealing to a wide audience.

Consumers are also becoming more interested in microbiome-friendly and barrier-fortifying skincare routines. This trend supports the use of ceramides, which naturally strengthen the skin’s protective layer. As awareness of skin microbiome health rises, brands offering ceramide-infused products are seeing higher engagement and loyalty.

Sustainability is another key trend, with brands focusing on eco-certified ingredient sourcing and recyclable packaging. Additionally, the influence of social media, dermatologists, and beauty influencers is shaping consumer education. Online skincare communities and expert-led content continue to drive awareness about the benefits of ceramides, making them a core component of modern skincare routines.

Regional Analysis

North America Dominates the Ceramide Skincare Market with a Market Share of 41.2%, Valued at USD 186.3 Million

North America leads the global ceramide skincare market, accounting for a significant 41.2% market share and a valuation of USD 186.3 million. The region’s dominance is driven by growing consumer awareness regarding skin barrier protection and the rising adoption of advanced dermatological formulations. Increased spending on premium skincare products, coupled with the strong presence of established beauty retailers and e-commerce platforms, further fuels market expansion across the United States and Canada.

Europe Ceramide Skincare Market Trends

Europe holds a substantial position in the ceramide skincare market, supported by increasing demand for science-backed skincare solutions and clean-label beauty products. The region benefits from a mature cosmetic industry and a rising trend toward anti-aging and moisturizing formulations. Countries such as Germany, France, and the UK contribute significantly, with consumers showing strong preference for sustainable and dermatologist-tested skincare options.

Asia Pacific Ceramide Skincare Market Trends

The Asia Pacific market is experiencing rapid growth due to a surge in beauty-conscious consumers and an expanding middle-class population. Growing awareness of skin health, along with the influence of K-beauty and J-beauty trends, is propelling the use of ceramide-based skincare formulations. Emerging economies like China, Japan, and South Korea are key contributors, with increased demand for innovative, multifunctional skincare solutions.

Middle East and Africa Ceramide Skincare Market Trends

The Middle East and Africa region is witnessing steady development in the ceramide skincare market, supported by increasing urbanization and rising consumer interest in high-quality skincare. Demand is primarily concentrated in affluent urban centers, where consumers are drawn to premium and imported beauty products. Additionally, heightened awareness of skin hydration and protection from harsh climatic conditions is promoting ceramide-based product adoption.

Latin America Ceramide Skincare Market Trends

Latin America’s ceramide skincare market is gradually expanding, driven by growing consumer focus on self-care and personal grooming. The region’s younger population and rising disposable incomes are fueling demand for effective skincare formulations that enhance skin health and appearance. Brazil and Mexico are emerging as key markets, supported by the increasing availability of international and local skincare brands promoting ceramide-enriched products.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Ceramide Skincare Company Insights

Elizabeth Arden is expected to retain strong brand-driven visibility in ceramide-based anti-aging ranges in 2024, leveraging premium positioning and science-backed messaging to capture urban, aging, and affluent female consumers. Its multi-step skincare formats will likely support higher average selling prices and cross-selling within department store and online channels.

CeraVe will continue expanding mass and dermocosmetic penetration through fragrance-free, barrier-restoring ceramide formulations endorsed by dermatologists. Its accessibility, simple SKU architecture, and dermatologist-led education are enabling rapid adoption among sensitive-skin and teen segments, especially in e-commerce and pharmacy-led markets.

Procter & Gamble is poised to scale ceramide actives within broader skincare portfolios by combining barrier claims with hydration and anti-pollution narratives. With strong distribution, marketing assets, and data-led consumer insights, P&G can localize ceramide messaging for APAC and North America, targeting working women seeking clinically credible yet daily-use products.

L’Oréal is likely to drive the fastest innovation tempo in 2024, integrating ceramides with niacinamide, peptides, and retinoid-adjacent actives to address aging, dryness, and skin-barrier disruption caused by urban lifestyles. Its multi-brand architecture across luxury, dermocosmetic, and mass channels provides flexibility to price and position ceramide lines differently, supporting premiumization and market education on barrier health.

Estée Lauder Companies, Shiseido, Johnson & Johnson, Amorepacific, and Mizon will remain relevant through region-focused launches and K-beauty textures, but their collective growth will depend on how effectively they pair ceramides with sensorial formats and clinical storytelling to differentiate from me-too barrier products in 2024.

Top Key Players in the Market

- Elizabeth Arden

- CeraVe

- Procter & Gamble

- L’Oréal

- Estée Lauder Companies

- Shiseido

- Johnson & Johnson

- Amorepacific

- Mizon

Recent Developments

- In August 2025, Alkem launched a ceramide-boosting moisturizing lotion aimed at enhancing skin barrier repair and hydration. The product leverages advanced dermatological formulations to support moisture retention and restore the natural lipid layer.

- In September 2025, COSRX introduced a new barrier-protecting Ceramide Face Mist and Body Cream for the fall season. These products were designed to strengthen skin resilience and deliver lightweight, long-lasting moisture.

- In April 2024, Syensqo acquired the Korean ceramides specialist JinYoung Bio to expand its skincare ingredients portfolio. The acquisition bolsters Syensqo’s innovation pipeline in bio-based ceramide technologies and active skincare solutions.

Report Scope

Report Features Description Market Value (2024) USD 452.4 Million Forecast Revenue (2034) USD 825.6 Million CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ceramide Based Creams, Ceramide Based Lotions, Ceramide Based Serums, Ceramide Based Cleansers, Ceramide Based Masks, Others), By Process (Fermentation Ceramides, Plant Extract Ceramides), By Gender (Women, Men), By Skin Type (Dry Skin, Oily Skin, Combination Skin, Sensitive Skin), By Application (Cosmeceuticals, Pharmaceuticals, Food and Beverages, Dietary Supplements, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Elizabeth Arden, CeraVe, Procter & Gamble, L’Oréal, Estée Lauder Companies, Shiseido, Johnson & Johnson, Amorepacific, Mizon Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Elizabeth Arden

- CeraVe

- Procter & Gamble

- L'Oréal

- Estée Lauder Companies

- Shiseido

- Johnson & Johnson

- Amorepacific

- Mizon