Global Ceramic Filter Market Size, Share, And Industry Analysis Report By Product (Ceramic Water Filter, Ceramic Air Filter), By Ceramic Type (Alumina, Zirconia, Silicon Carbide, Titania), By Distribution Channel (Direct, Indirect), By Application (Water Treatment, Air Filtration, Food and Beverage Filtration, Automotive Emission Control), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173041

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

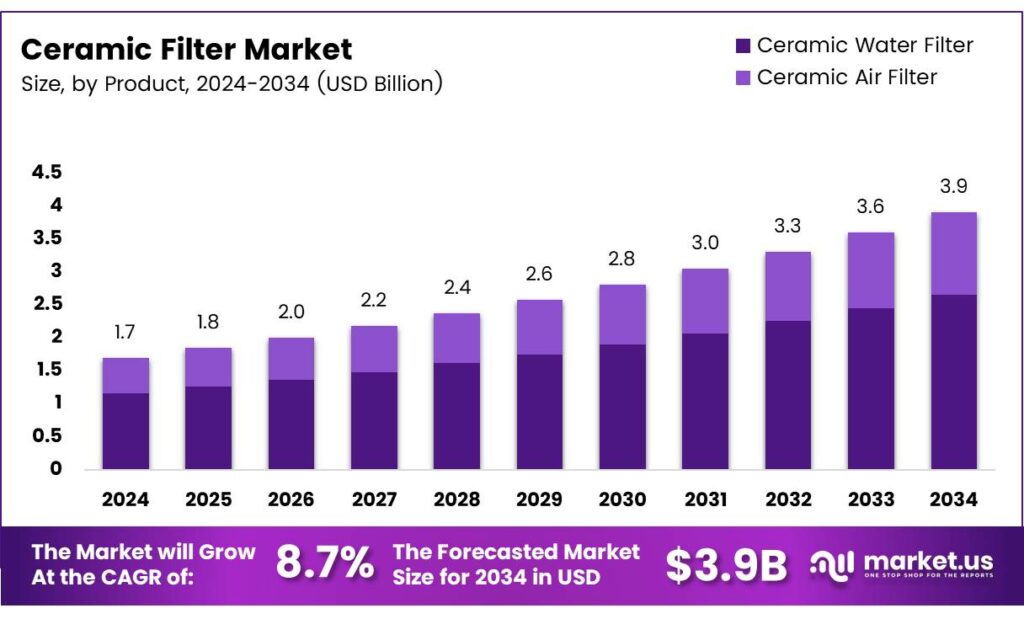

The Global Ceramic Filter Market size is expected to be worth around USD 3.9 billion by 2034, from USD 1.7 billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

The ceramic filter market refers to the commercial ecosystem surrounding porous ceramic-based filtration systems used for liquid and gas purification. These filters are valued for durability, thermal resistance, and precise particle separation. As industries prioritize reliability and compliance, ceramic filtration solutions increasingly support water treatment, industrial combustion, and environmental protection applications worldwide.

Ceramic filters demonstrate steady market growth driven by stricter environmental standards and rising clean water demand. Governments and municipalities increasingly adopt advanced filtration to improve public health outcomes. Consequently, the ceramic filter market demand expands across drinking water systems, rural sanitation programs, and decentralized purification infrastructure in developing and developed regions.

- Ceramic filter technology relies on highly compressed ceramic materials with diatomic properties, delivering structural stability under harsh conditions. Pore sizes of 0.2 microns block dirt and sand efficiently. Since most bacteria measure 0.5–1.0 microns, ceramic filters provide effective physical microbial barriers without chemical additives.

Beyond water purification, ceramic filters play a critical role in industrial emission control. Solid fuel combustion releases harmful particulate matter, affecting air quality. Ceramic filters reduce sub-micron particulate concentrations while operating reliably above 400°C, offering advantages over polymer-based filters that degrade under extreme thermal conditions.

Key Takeaways

- The Global Ceramic Filter Market is projected to grow from USD 1.7 billion in 2024 to USD 3.9 billion by 2034, at a CAGR of 8.7%.

- Ceramic Water Filters dominate the market by product, holding a leading share of 65.2% in 2024.

- Alumina is the leading ceramic type, accounting for a market share of 37.1% in 2024.

- Direct distribution channels lead with a market share of 53.7%, driven by strong manufacturer–customer engagement.

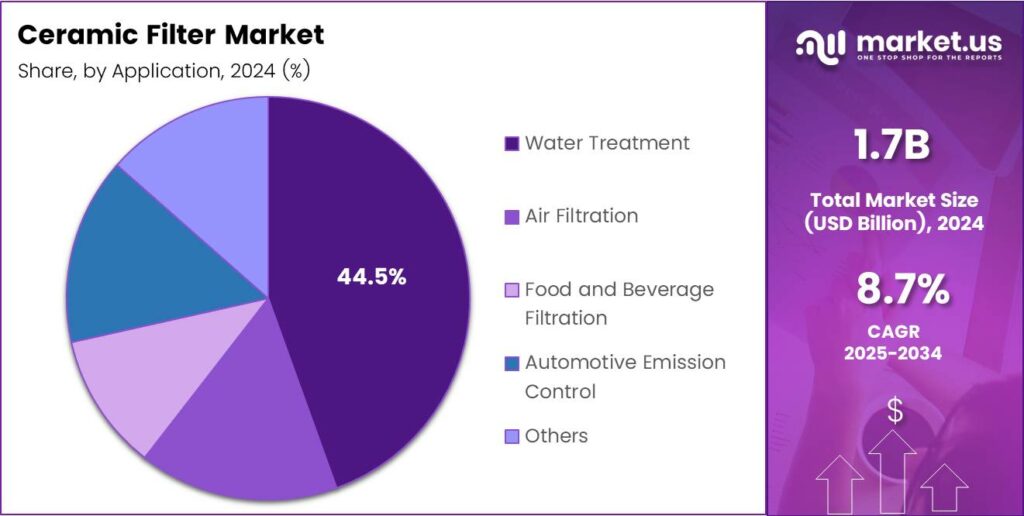

- Water Treatment is the largest application segment, representing 44.5% of total market demand in 2024.

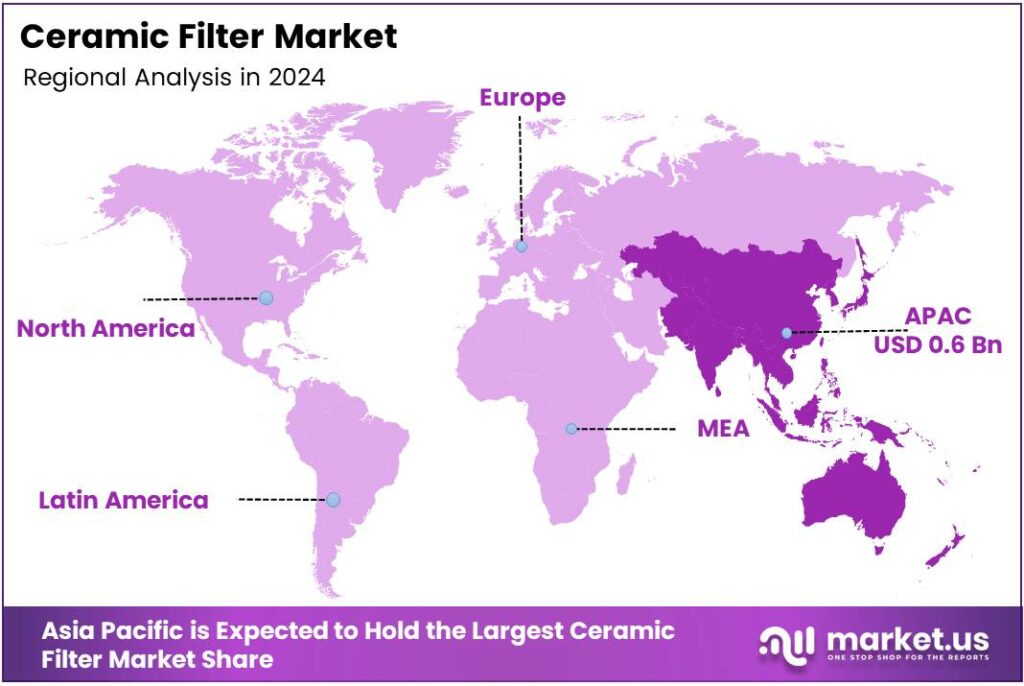

- Asia Pacific is the dominant regional market, capturing 38.6% share and valued at USD 0.6 billion in 2024.

By Product Analysis

Ceramic Water Filter dominates with 65.2% due to its wide use in household and community drinking water systems.

In 2024, Ceramic Water Filter held a dominant market position in the By Product Analysis segment of the Ceramic Filter Market, with a 65.2% share. This leadership is supported by growing awareness of safe drinking water and the need for affordable filtration solutions. Moreover, ceramic water filters are trusted for removing bacteria and suspended particles without electricity.

Ceramic Air Filter represents the remaining market share and continues to gain attention in industrial and indoor air quality applications. These filters are valued for their ability to withstand high temperatures and harsh operating conditions. As a result, they are increasingly adopted in manufacturing facilities, commercial buildings, and controlled ventilation systems.

By Ceramic Type Analysis

Alumina dominates with 37.1% due to its durability, thermal stability, and cost efficiency.

In 2024, Alumina held a dominant market position in the By Ceramic Type Analysis segment of the Ceramic Filter Market, with a 37.1% share. This dominance is driven by alumina’s strong mechanical strength and resistance to chemical corrosion. Consequently, it is widely used across water treatment and industrial filtration processes.

Zirconia ceramic filters are known for their fine pore structure and high filtration accuracy. These properties make them suitable for specialized applications where precision and reliability are critical. Therefore, zirconia is preferred in advanced filtration environments despite its higher production complexity.

Silicon carbide ceramic filters offer excellent thermal shock resistance and high permeability. These characteristics support their use in high-temperature gas and molten metal filtration. As industries seek longer filter life, silicon carbide continues to gain steady adoption.

By Distribution Channel Analysis

Direct distribution dominates with 53.7% due to strong manufacturer–customer relationships.

In 2024, Direct held a dominant market position in the By Distribution Channel Analysis segment of the Ceramic Filter Market, with a 53.7% share. This channel benefits from direct technical support, better pricing control, and customized solutions. As a result, large buyers prefer direct procurement from manufacturers.

Indirect distribution continues to serve smaller buyers and remote markets through distributors and retailers. This channel improves product accessibility and supports after-sales service across wider regions. Therefore, indirect sales remain important for market expansion and regional reach.

By Application Analysis

Water Treatment dominates with 44.5% due to rising demand for clean and safe water solutions.

In 2024, Water Treatment held a dominant market position in the By Application Analysis segment of the Ceramic Filter Market, with a 44.5% share. This dominance is linked to increasing use of ceramic filters in household, municipal, and emergency water purification systems. These filters offer reliable microbial removal using simple designs.

Air Filtration applications are expanding steadily, especially in industrial exhaust systems and indoor air quality management. Ceramic filters perform well under high heat and dust loads, making them suitable for demanding environments.

Food and Beverage Filtration relies on ceramic filters for hygiene and product consistency. Their inert nature supports safe filtration during beverage processing and food manufacturing. Consequently, adoption remains stable across processing facilities. Automotive Emission Control uses ceramic filters to capture particulate matter from exhaust systems.

Key Market Segments

By Product

- Ceramic Water Filter

- Ceramic Air Filter

By Ceramic Type

- Alumina

- Zirconia

- Silicon Carbide

- Titania

- Others

By Distribution Channel

- Direct

- Indirect

By Application

- Water Treatment

- Air Filtration

- Food and Beverage Filtration

- Automotive Emission Control

- Others

Emerging Trends

Adoption of Advanced Materials Shapes Ceramic Filter Market Trends

One major trend in the ceramic filter market is the use of advanced ceramic materials such as alumina and silicon carbide. These materials improve strength, porosity control, and resistance to extreme temperatures, making filters suitable for both water and air applications.

- The integration of ceramic filters into multi-stage filtration systems. Manufacturers are combining ceramic elements with activated carbon or membrane layers to address a wider range of contaminants, including odor and organic impurities. The World Health Organization, unsafe drinking water still affects over 2 billion people globally, which is pushing innovation in point-of-use filtration technologies, including ceramic filters with sub-micron pores.

Design innovation is also gaining attention. Compact, user-friendly filter designs are being developed for urban households with limited space. At the same time, large-capacity ceramic filters are trending in community and institutional settings. Digital awareness campaigns and e-commerce platforms are shaping buying behavior.

Drivers

Rising Demand for Safe Drinking Water Drives Ceramic Filter Market Growth

The ceramic filter market is mainly driven by the growing need for safe and clean drinking water across urban and rural areas. Many regions still face issues with water contamination, including bacteria, sediments, and suspended particles. Ceramic filters offer a simple and reliable solution because they can physically block harmful microorganisms without using electricity or chemicals.

- Ceramic filters are often included in community water programs due to their long life, low maintenance needs, and affordability for households with limited income. The U.S. Environmental Protection Agency highlights that ceramic filtration with pore sizes around 0.2 microns can physically block bacteria and protozoa without chemicals or electricity.

Environmental concerns also support market growth. Ceramic filters are reusable and generate less waste compared to disposable plastic-based filters. This aligns well with sustainability goals and encourages adoption among environmentally conscious consumers.

Restraints

High Initial Cost and Maintenance Challenges Limit Market Expansion

One of the main restraints in the ceramic filter market is the relatively high initial cost compared to basic filtration options. Although ceramic filters last longer, the upfront price can discourage price-sensitive consumers, especially in developing regions.

- Maintenance is another concern. Ceramic filters require regular cleaning to prevent clogging of pores. If not cleaned properly, flow rates can drop significantly, affecting user satisfaction. Ceramic filtration can reduce waterborne disease incidence by up to 40% when used consistently.

Limited filtration scope also acts as a restraint. Ceramic filters are effective against bacteria and sediments but are less efficient at removing dissolved chemicals, salts, or heavy metals without additional treatment stages. This limits their use in areas where chemical contamination is a major issue.

Growth Factors

Government Water Programs Create New Growth Opportunities

Strong growth opportunities are emerging from government-led water safety and sanitation programs. Many countries are investing in decentralized water purification systems for rural and semi-urban communities. Ceramic filters are well-suited for these programs due to their durability and low operating cost.

Technological improvements also open new opportunities. Advances in ceramic materials and pore-size control are improving filtration efficiency and flow rates. These innovations help ceramic filters compete more effectively with advanced membrane-based systems.

Rising demand from industrial and commercial sectors adds further potential. Food processing units, breweries, and pharmaceutical manufacturers increasingly prefer ceramic filtration for its thermal stability and hygiene benefits. This expands the market beyond household use.

Regional Analysis

Asia Pacific Dominates the Ceramic Filter Market with a Market Share of 38.6%, Valued at USD 0.6 billion

Asia Pacific holds the leading position in the Ceramic Filter Market, supported by rapid urbanization, rising industrial water treatment needs, and expanding access to safe drinking water. In 2024, the region accounted for a dominant 38.6% share, with market value reaching USD 0.6 billion. Strong government focus on clean water infrastructure, coupled with growth in manufacturing, food processing, and air filtration applications, continues to support demand.

North America represents a mature and technology-driven market for ceramic filters, driven by strict environmental regulations and high awareness of water and air quality standards. Demand is supported by industrial emission control, municipal water treatment upgrades, and household filtration adoption. Advanced material research and replacement demand also contribute to stable market growth across the region.

Europe shows steady growth due to strong regulatory frameworks focused on sustainability, clean water reuse, and industrial emission reduction. Ceramic filters are increasingly used in wastewater treatment, food and beverage processing, and automotive emission systems. The region benefits from innovation in advanced ceramics and rising investments in the circular economy and environmental protection initiatives.

The Middle East and Africa market is gradually expanding, supported by water scarcity concerns and growing investments in desalination and water purification projects. Ceramic filters are gaining attention for their durability and suitability for harsh operating conditions. Infrastructure development and improving access to clean drinking water are key factors influencing regional demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Haldor Topsoe A/S stands out in 2024 for its deep process-engineering strength and advanced materials know-how, which support high-performance ceramic filtration in demanding industrial environments. Its credibility in harsh operating conditions makes it well-positioned for projects where uptime, consistency, and lifecycle performance matter more than upfront cost.

Doulton Ceramics carries strong market relevance through its long heritage in ceramic filtration and practical understanding of household and small-scale water purification needs. In 2024, its value proposition remains tied to trust, product reliability, and broad adoption, where simple, non-electric filtration is preferred in day-to-day use.

Glosfume Ltd. is viewed as a focused industrial player linked to filtration solutions that support emission control and particulate capture in challenging process settings. In 2024, its outlook benefits from tighter environmental expectations, as customers increasingly prioritize compliant performance, predictable maintenance cycles, and fit-for-purpose system design.

Aquacera is recognized in 2024 for ceramic water filtration solutions that align with decentralized water treatment and point-of-use needs, including situations with limited infrastructure. Its positioning is strengthened by growing demand for affordable, durable filtration options, especially where water quality variability and supply interruptions make resilient treatment solutions more important.

Top Key Players in the Market

- Haldor Topsoe A/S

- Doulton Ceramics

- Glosfume Ltd.

- Aquacera

- KLT Filtration

- Ceramic Filters Company, Inc.

- Anguil Environmental Systems Inc.

- Tri-Mer Corporation

- Pall Corporation

- Veolia

Recent Developments

- In 2025, Topsoe partnered with Skovgaard Energy and Vestas to develop the world’s first dynamic green ammonia plant in Denmark, focusing on renewable energy integration for low-carbon processes. Topsoe has been active in areas related to emissions control and clean air technologies, which align with catalytic filtration applications like their TopFrax ceramic filters for dust and gas treatment.

- In 2025, Doulton introduced new water filter bundles, curating collections to help users select appropriate ceramic filtration systems for home use. Doulton Ceramics specializes in ceramic water filtration systems. An article outlined 5 practical tips to reduce PFAS and forever chemicals, promoting their ceramic filters in addressing these contaminants in drinking water.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 3.9 Billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Ceramic Water Filter, Ceramic Air Filter), By Ceramic Type (Alumina, Zirconia, Silicon Carbide, Titania, Others), By Distribution Channel (Direct, Indirect), By Application (Water Treatment, Air Filtration, Food and Beverage Filtration, Automotive Emission Control, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Haldor Topsoe A/S, Doulton Ceramics, Glosfume Ltd., Aquacera, KLT Filtration, Ceramic Filters Company, Inc., Anguil Environmental Systems Inc., Tri-Mer Corporation, Pall Corporation, Veolia Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Haldor Topsoe A/S

- Doulton Ceramics

- Glosfume Ltd.

- Aquacera

- KLT Filtration

- Ceramic Filters Company, Inc.

- Anguil Environmental Systems Inc.

- Tri-Mer Corporation

- Pall Corporation

- Veolia