Global Celtic Salt Market Size, Share, And Business Benefits By Nature (Conventional, Organic), By Type (Coarse Celtic Salt, Fine Celtic Salt, Flavored Celtic Salt), By Application (Food and Beverage, Personal Care and Cosmetics, Healthcare and Wellness, Others), By Distribution Channel (Hypermarkets and Supermarkets, Speciality Store, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157139

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

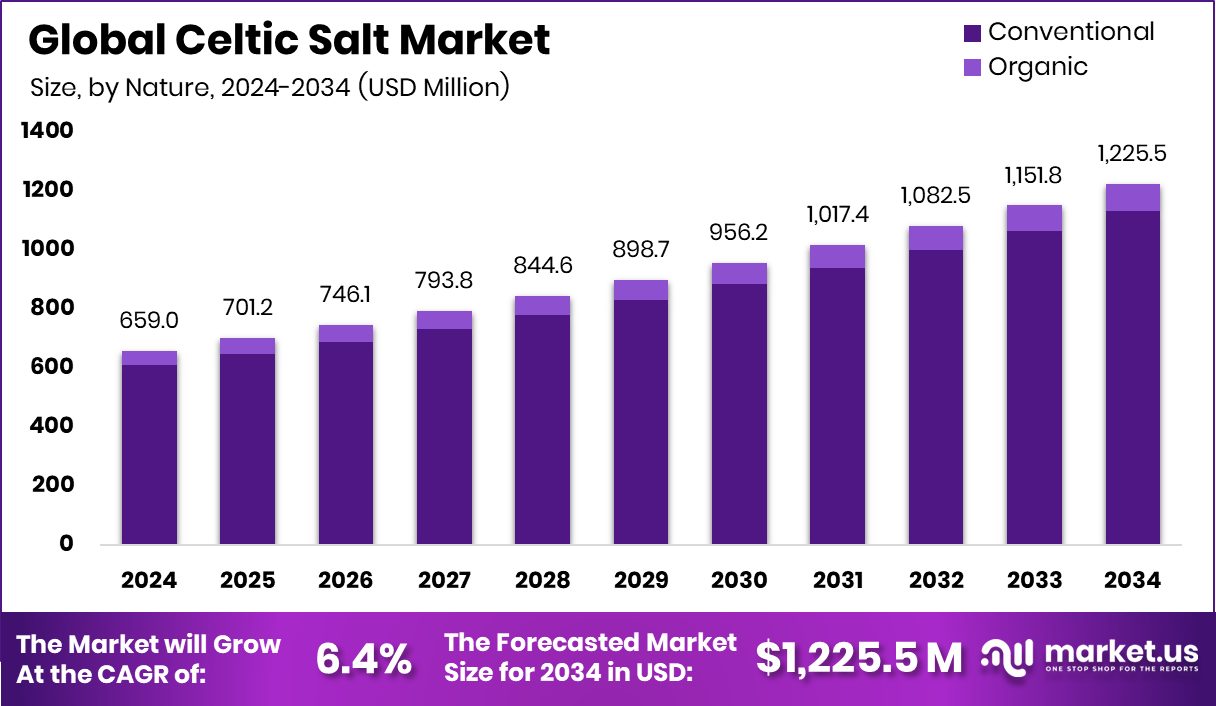

The Global Celtic Salt Market is expected to be worth around USD 1,225.5 million by 2034, up from USD 659.0 million in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034. With USD 249.1 Mn and 37.80% share, Europe dominates the Celtic Salt Market’s regional growth.

Celtic salt, often known as “Sel Gris” or grey sea salt, is a natural, unrefined salt harvested traditionally from the coastal regions of Brittany, France. Unlike processed table salt, Celtic salt retains trace minerals such as magnesium, calcium, and potassium, giving it a unique mineral-rich composition and a distinct light grey color. It is valued for its coarse texture, subtle flavor, and use in culinary, wellness, and even skincare applications, making it popular among health-conscious consumers seeking natural alternatives.

The Celtic salt market is gradually expanding as more people lean toward clean-label and minimally processed food ingredients. The demand is influenced by rising consumer awareness of the harmful effects of highly refined salt and the benefits of mineral-rich options. Beyond the food sector, its role in spa therapies, detox treatments, and natural remedies also adds to market growth.

One major growth factor is the global shift towards healthier lifestyles. Consumers are increasingly mindful of nutrient intake, and the presence of over 80 essential trace minerals in Celtic salt supports its rising adoption as a natural seasoning choice. According to an industry report, Veganz Group Secures €10M Funding to Boost 2D-Printed Oat Milk Production.

Demand is also strengthened by the growing culinary trend of gourmet and artisanal food experiences. Chefs and home cooks are turning to Celtic salt not just for taste but also for authenticity and a premium dining feel.

Key Takeaways

- The Global Celtic Salt Market is expected to be worth around USD 1,225.5 million by 2034, up from USD 659.0 million in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- In 2024, Conventional dominated the Celtic Salt Market, capturing 92.4% share with strong consumer preference.

- Coarse Celtic Salt led the market with 58.9% share, reflecting its popularity in culinary and wellness.

- The food and Beverage application held a 67.3% share, highlighting the growing demand for natural mineral-rich seasoning alternatives globally.

- Hypermarkets and Supermarkets accounted for a 38.5% share, making them the leading distribution channels for Celtic salt.

- Europe’s 37.80% share, valued at USD 249.1 Mn, highlights strong consumer demand for natural salts.

By Nature Analysis

In 2024, Conventional Celtic Salt dominated with a 92.4% strong market presence.

In 2024, Conventional held a dominant market position in the By Nature segment of the Celtic Salt Market, with a 92.4% share. This dominance reflects the strong consumer inclination toward products that are easily available, affordable, and widely accepted across both household and commercial applications.

Conventional Celtic salt continues to attract a broad base of buyers due to its natural mineral composition, authentic harvesting methods, and established trust built over decades of traditional use. Its availability in bulk and packaged forms also ensures accessibility across mainstream retail, making it the preferred choice in everyday cooking and food preparation.

The high share of 92.4% also highlights the balance between tradition and practicality. While consumers are more aware of health-focused alternatives, the conventional variant remains the most reliable and familiar option. Its consistent demand is supported by widespread distribution through supermarkets, specialty stores, and online platforms, ensuring strong market penetration.

Additionally, conventional Celtic salt retains its reputation as a natural product, which resonates with the growing clean-label movement. As a result, the segment is expected to maintain its leadership, driven by stable consumer demand, broad culinary usage, and trusted positioning in the natural salt category.

By Type Analysis

Coarse Celtic Salt held a leading 58.9% share, showing widespread consumer preference.

In 2024, Coarse Celtic Salt held a dominant market position in By Type segment of the Celtic Salt Market, with a 58.9% share. This strong share reflects the product’s popularity in culinary and household applications, where its distinct texture, mineral-rich composition, and natural flavor have made it a preferred choice among both professional chefs and everyday consumers.

Coarse Celtic salt is often used as a finishing salt, enhancing the taste and presentation of gourmet dishes, while also being recognized for its versatility in marinades, baking, and food preservation.

The prominence of this segment is also linked to its authenticity and traditional harvesting practices, which align well with the rising consumer preference for natural and less-processed food ingredients. Its coarse granules not only retain more minerals but also provide a unique mouthfeel, adding value to premium dining experiences.

The segment benefits from strong visibility in supermarkets, organic stores, and specialty food outlets, further driving its accessibility to a wide consumer base. With a commanding 58.9% share, Coarse Celtic Salt has established itself as the market leader in this category, supported by steady demand in both household kitchens and the expanding gourmet food service industry.

By Application Analysis

Food and Beverage applications captured a 67.3% share, driving demand for Celtic Salt.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Celtic Salt Market, with a 67.3% share. This leadership highlights the widespread use of Celtic salt as a natural seasoning and flavor enhancer in everyday meals, gourmet recipes, and packaged food products.

Its mineral-rich profile and distinct flavor make it a preferred choice for chefs, food manufacturers, and households seeking healthier alternatives to refined salt. The growing trend of clean-label and natural ingredients in the food sector has further boosted the adoption of Celtic salt, positioning it as a premium option in both traditional cooking and modern culinary innovation.

The 67.3% share also reflects strong integration of Celtic salt into bakery products, sauces, dressings, snacks, and ready-to-eat meals, where taste and authenticity are vital to consumer acceptance. With rising consumer awareness of mineral-rich diets and natural food sources, demand for Celtic salt in the food and beverage industry continues to grow steadily.

Its availability through mainstream retail and specialty outlets strengthens market reach, while increasing use in gourmet restaurants enhances its image as a high-quality ingredient. This ensures that the Food and Beverage segment remains the largest and most influential driver within the Celtic Salt Market.

By Distribution Channel Analysis

Hypermarkets and Supermarkets secured a 38.5% share, serving as primary distribution channels.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Celtic Salt Market, with a 38.5% share. This dominance is largely attributed to the extensive reach, variety of offerings, and convenience these retail formats provide to consumers.

Hypermarkets and supermarkets serve as the most accessible channels for everyday grocery shopping, allowing customers to compare product ranges, packaging sizes, and price points in one place. The wide shelf presence of Celtic salt in these outlets has helped build strong consumer trust and repeat purchases, ensuring consistent demand within this segment.

The 38.5% share also reflects the role of promotional strategies and attractive in-store displays that highlight Celtic salt as a premium yet essential kitchen ingredient. Bulk buying options, discounts, and loyalty programs in these large-format stores further enhance affordability and encourage higher volumes of sales.

Additionally, supermarkets and hypermarkets act as a bridge between traditional grocery demand and evolving consumer interest in natural and minimally processed products, giving Celtic salt greater visibility. With their established distribution networks and ability to cater to both urban and suburban markets, hypermarkets and supermarkets remain the strongest drivers of product accessibility and market growth in this segment.

Key Market Segments

By Nature

- Conventional

- Organic

By Type

- Coarse Celtic Salt

- Fine Celtic Salt

- Flavored Celtic Salt

By Application

- Food and Beverage

- Personal Care and Cosmetics

- Healthcare and Wellness

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Speciality Store

- Online

- Others

Driving Factors

Rising Health Awareness Boosts Natural Salt Choices

One of the top driving factors for the Celtic Salt Market is the growing awareness about health and nutrition among consumers. People today are more mindful of the negative effects of refined and processed foods, especially regular table salt that lacks minerals. Celtic salt, being unrefined and rich in natural minerals like magnesium, calcium, and potassium, is seen as a healthier choice.

This has made it popular not only in home kitchens but also in restaurants and specialty food outlets. As consumers seek clean-label and natural products, Celtic salt fits well with this lifestyle shift. This increasing demand for healthier salt alternatives continues to drive steady growth for the market worldwide.

Restraining Factors

Higher Prices Limit Wider Consumer Market Reach

A key restraining factor for the Celtic Salt Market is its relatively higher price compared to regular table salt. Since Celtic salt is harvested using traditional methods and retains its natural minerals, the production process is more labor-intensive, making it costlier.

For many price-sensitive consumers, especially in developing regions, this becomes a challenge when choosing between affordable refined salt and premium Celtic salt. While health-conscious buyers are willing to pay more, the mass market often prioritizes cost over nutritional benefits.

This price gap limits the widespread adoption of Celtic salt and slows down its growth potential, particularly in areas where affordability is a major factor in food purchasing decisions.

Growth Opportunity

Expanding Wellness Products Create New Market Pathways

A major growth opportunity for the Celtic Salt Market lies in its increasing use beyond food and beverages, particularly in wellness and personal care products. Celtic salt is rich in minerals and is widely used in bath salts, body scrubs, and spa therapies for its detoxifying and skin-soothing benefits.

With global demand for natural and chemical-free beauty solutions rising, this opens up new avenues for manufacturers to diversify their product offerings. Wellness-conscious consumers are actively seeking authentic, natural ingredients, and Celtic salt fits this demand perfectly.

By expanding into health, beauty, and spa industries, the market can tap into a broader audience, enhancing revenue streams while strengthening its presence in lifestyle-driven sectors.

Latest Trends

Growing Popularity of Gourmet and Artisanal Cooking

One of the latest trends shaping the Celtic Salt Market is its rising use in gourmet and artisanal cooking. Consumers today are not only eating for nutrition but also seeking premium dining experiences at home and in restaurants. Celtic salt, with its coarse texture, natural flavor, and mineral-rich profile, is becoming a preferred choice for chefs and food enthusiasts who value authenticity.

It is often used as a finishing salt to enhance taste and presentation in dishes, from baked goods to fine meats and seafood. This trend is also supported by social media and food culture, where showcasing unique, natural ingredients has become popular. As a result, Celtic salt is gaining stronger recognition as a premium culinary staple.

Regional Analysis

In 2024, Europe led the Celtic Salt Market with a 37.80% share, reaching USD 249.1 Mn.

In 2024, Europe held a dominant position in the global Celtic Salt Market, capturing 37.80% share valued at USD 249.1 million. This leadership is driven by the region’s strong consumer preference for natural, unrefined, and mineral-rich food products, supported by a growing shift toward healthier dietary habits.

European consumers are increasingly seeking clean-label and organic alternatives, making Celtic salt a popular choice in both household cooking and gourmet dining. The region’s well-established food and beverage industry further strengthens demand, with chefs, restaurants, and artisanal food producers incorporating Celtic salt into premium recipes and packaged goods.

Additionally, rising awareness of mineral intake and the health benefits of unprocessed salts has significantly contributed to its market acceptance. Wide availability across supermarkets, hypermarkets, and specialty stores has also supported accessibility, ensuring consistent sales growth.

Europe’s position as the leading region highlights its role in shaping global market dynamics, as consumer awareness and demand for natural wellness-focused products continue to expand. With its established culinary culture and rising emphasis on sustainable food sourcing, Europe is expected to maintain its dominance, setting trends that influence the growth trajectory of the Celtic Salt Market worldwide.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Eden Foods has built its reputation by offering natural and organic food products, and its inclusion of Celtic salt within its product range complements its commitment to clean, wholesome eating. By integrating mineral-rich salt into its lineup, the company appeals to health-conscious consumers looking for trusted sources of natural ingredients.

Le Marinier, rooted in the traditional harvesting regions of France, strengthens the cultural and geographic authenticity of the Celtic salt category. Its role ensures continuity of the artisanal salt-making heritage, making it highly valued in both gourmet and everyday use. This brand reflects the deep heritage tied to Brittany’s salt traditions, which enhances consumer trust in authenticity.

Selina naturally plays an influential role by bringing Celtic salt to wider international markets. Known for advocating natural wellness products, the company highlights the nutritional benefits of mineral-rich salt, thus connecting well with the clean-label and health-focused consumer segments.

Top Key Players in the Market

- Eden Foods

- Le Marinier

- Selina Naturally

- Le Guérandais

- SaltWorks

- 82 Minerals

- Cupplement BV

- The Spice Lab

- Himalayan Chef

- Maldon Salt

Recent Developments

- In 2024, Selina Naturally expanded its Celtic Sea Salt® portfolio by launching the Celtic River Salts® line, which includes Fine, Flake, Smoked, and Pink Potassium Cave Salt. These salts are sustainably sourced from a natural brine spring in Spain.

Report Scope

Report Features Description Market Value (2024) USD 659.0 Million Forecast Revenue (2034) USD 1,225.5 Million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Conventional, Organic), By Type (Coarse Celtic Salt, Fine Celtic Salt, Flavored Celtic Salt), By Application (Food and Beverage, Personal Care and Cosmetics, Healthcare and Wellness, Others), By Distribution Channel (Hypermarkets and Supermarkets, Speciality Store, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Eden Foods, Le Marinier, Selina Naturally, Le Guérandais, SaltWorks, 82 Minerals, Cupplement BV, The Spice Lab, Himalayan Chef, Maldon Salt Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Eden Foods

- Le Marinier

- Selina Naturally

- Le Guérandais

- SaltWorks

- 82 Minerals

- Cupplement BV

- The Spice Lab

- Himalayan Chef

- Maldon Salt