Cell Therapy Raw Materials Market By Product Type (Cell Culture Supplements, Antibodies, and Others), By End-user (Biopharmaceutical & Pharmaceutical Companies, CROs & CMOs, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151410

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

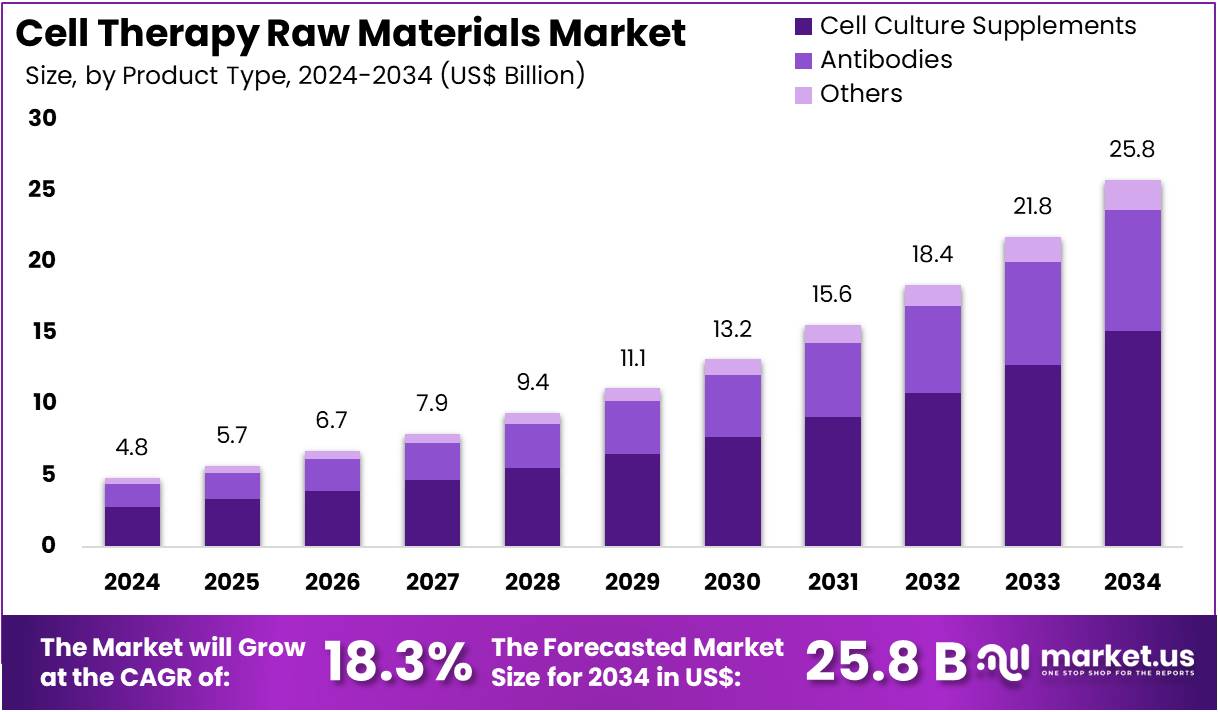

The Cell Therapy Raw Materials Market Size is expected to be worth around US$ 25.8 Billion by 2034 from US$ 4.8 Billion in 2024, growing at a CAGR of 18.3% during the forecast period 2025 to 2034.

Increasing demand for advanced cell therapies and the rising number of clinical trials focused on regenerative medicine are driving significant growth in the cell therapy raw materials market. These materials are essential for the development and production of cell therapies, including stem cell therapies, immune cell therapies, and gene therapies, which are gaining traction for their potential to treat a range of conditions, from cancer to autoimmune disorders.

The market sees demand for raw materials such as growth factors, culture media, sera, and scaffolding materials, all crucial for enhancing cell growth, differentiation, and functionality. Growing investments in research and development, along with advances in manufacturing technologies, are further accelerating market expansion. Recent trends indicate an increasing focus on improving the scalability and cost-effectiveness of cell therapy production, which presents significant opportunities for market players.

In June 2023, StemCyte formed a partnership with a prominent US immune cell therapy company to supply raw materials for allogeneic modified cell therapy. This collaboration ensures a steady supply of essential materials for developing innovative treatments, underlining the importance of reliable sourcing in advancing immune cell therapies. As the market continues to evolve, the demand for high-quality, specialized raw materials will remain central to the success of the cell therapy industry.

Key Takeaways

- In 2024, the market for cell therapy raw materials generated a revenue of US$ 4.8 billion, with a CAGR of 18.3%, and is expected to reach US$ 25.8 billion by the year 2034.

- The product type segment is divided into cell culture supplements, antibodies, and others, with cell culture supplements taking the lead in 2023 with a market share of 58.7%.

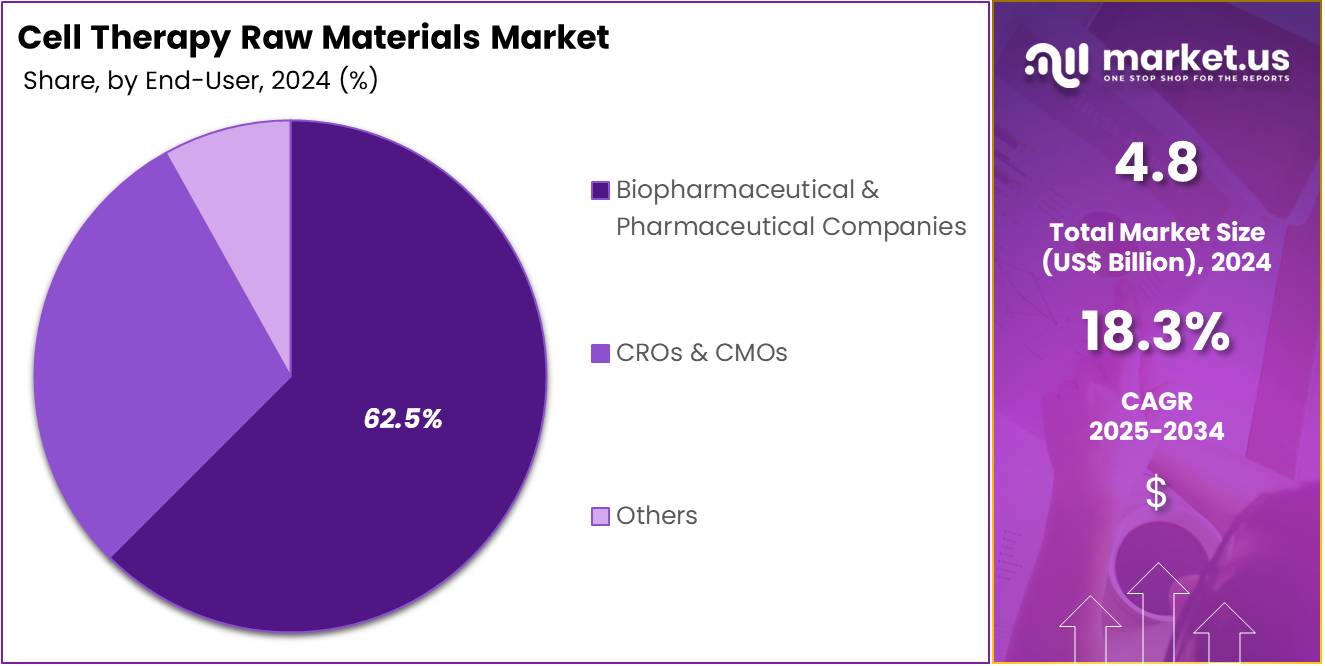

- Considering end-user, the market is divided into biopharmaceutical & pharmaceutical companies, CROs & CMOs, and others. Among these, biopharmaceutical & pharmaceutical companies held a significant share of 62.5%.

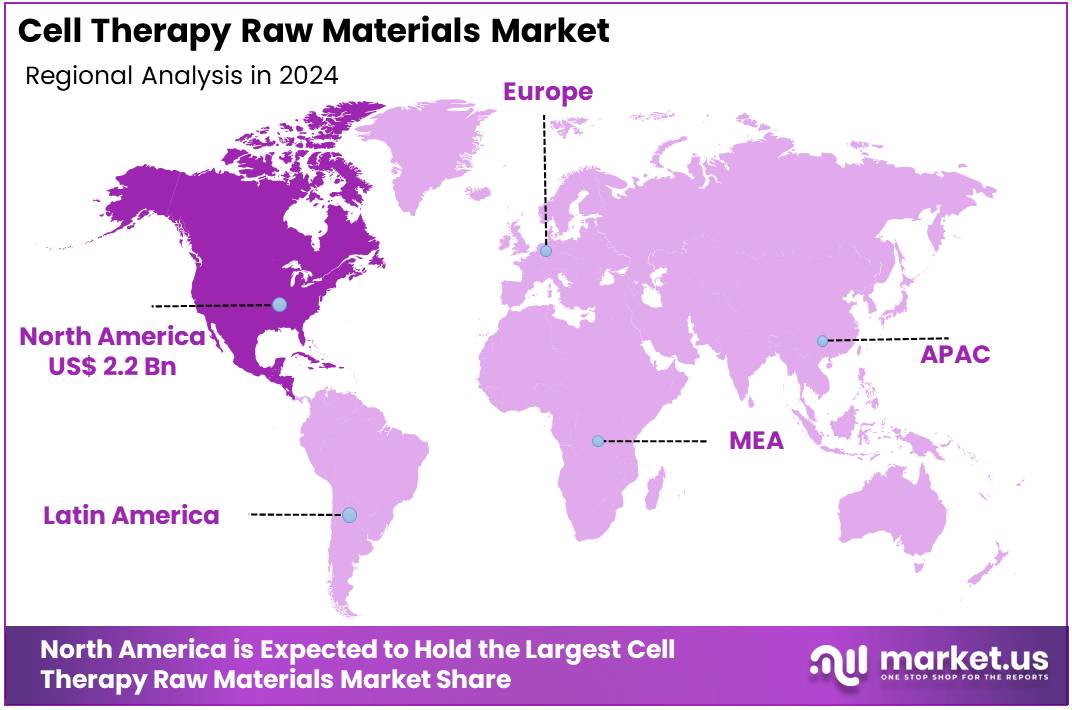

- North America led the market by securing a market share of 46.3% in 2023.

Product Type Analysis

Cell culture supplements are expected to dominate the cell therapy raw materials market, accounting for 58.7% of the share. These supplements, which include nutrients, growth factors, and other substances necessary for cell culture, are essential in maintaining and promoting cell growth, which is critical in the production of cell therapies.

The growth of this segment is anticipated to be driven by the increasing demand for cell-based therapies and biologics, particularly in oncology and regenerative medicine. The rising focus on personalized medicine, which relies heavily on the use of patient-specific cells for therapy, is likely to spur further demand for high-quality cell culture supplements. Additionally, the growing number of clinical trials and the expansion of cell-based therapies into new therapeutic areas will continue to increase the need for specialized supplements, fueling the market growth.

End-User Analysis

Biopharmaceutical and pharmaceutical companies are projected to be the largest end-users in the cell therapy raw materials market, comprising 62.5% of the market share. The growing adoption of cell therapies for the treatment of various chronic diseases and conditions is expected to drive the demand for raw materials, particularly from these companies. Biopharmaceutical and pharmaceutical companies are heavily investing in the development of cell therapies, with applications spanning oncology, gene therapy, and immunotherapy.

The increasing number of collaborations between pharmaceutical companies and biotech firms for cell-based treatments is anticipated to further propel the growth of this segment. As regulatory frameworks evolve to accommodate advanced therapeutic products, biopharmaceutical companies are expected to continue to be key players in the expansion of the cell therapy market, driving the demand for essential raw materials like cell culture supplements and antibodies.

Key Market Segments

By Product Type

- Cell Culture Supplements

- Antibodies

- Others

By End-user

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Others

Drivers

Rapid Expansion of the Cell and Gene Therapy Pipeline is Driving the Market

The rapid expansion of the cell and gene therapy pipeline, with an increasing number of therapies advancing through clinical development and gaining regulatory approvals, is a primary driver for the cell therapy raw materials market. As more cell and gene therapies move closer to commercialization, the demand for high-quality, consistent, and regulatory-compliant raw materials, such as growth factors, cell culture media, and cryopreservation solutions, escalates dramatically.

The US Food and Drug Administration (FDA) reported in April 2024 that the number of cell and gene therapy Investigational New Drug (IND) applications continued to increase, projecting over 200 INDs submitted in 2024. Furthermore, the FDA approved 7 new cell and gene therapy products in 2023. This robust pipeline directly translates into higher demand for specialized raw materials essential for cell expansion, differentiation, and preservation.

Restraints

High Cost and Stringent Quality Requirements are Restraining the Market

The cell therapy raw materials market faces significant restraint due to the exceptionally high cost associated with manufacturing and sourcing these specialized materials, coupled with extremely stringent quality and regulatory requirements. Raw materials for cell therapies must often be of animal-origin-free, cGMP-grade, and free from adventitious agents, which adds considerable expense and complexity to their production.

The National Institute of Standards and Technology (NIST) has highlighted the need for improved standards and quality control for gene therapy manufacturing, indicating the complexity of ensuring raw material purity. A December 2023 report from the US Government Accountability Office (GAO) on “Biomedical Manufacturing: FDA Actions to Support Manufacturing of Cell and Gene Therapies” noted that manufacturing challenges, including ensuring the quality and consistency of raw materials, contribute to the high cost and complexity of bringing these therapies to market. These factors can create barriers for smaller developers and increase the overall cost of cell therapy production.

Opportunities

Emergence of Novel Materials and Advanced Manufacturing Technologies Creates Growth Opportunities

The ongoing emergence of novel raw materials and advancements in manufacturing technologies present significant growth opportunities in the cell therapy raw materials market. Innovations include the development of chemically defined and serum-free media, recombinant growth factors, and specialized cryopreservation solutions that enhance cell viability, purity, and scalability of cell therapy production.

Furthermore, advancements in automation and closed-system manufacturing are reducing manual intervention and minimizing contamination risks. For example, a 2024 publication in Nature Biomedical Engineering discussed advancements in bioreactor technology for cell and gene therapy manufacturing, enabling larger-scale production with improved control. These innovations aim to address critical bottlenecks in cell therapy manufacturing, improving consistency, reducing costs, and enabling the large-scale commercialization of these advanced therapies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the cell therapy raw materials market, primarily through their impact on global research and development (R&D) investment, venture capital funding for biotech startups, and overall healthcare expenditure. Periods of robust economic growth often correlate with increased funding for life sciences R&D, which directly supports the development and scaling of cell and gene therapies, thereby boosting demand for specialized raw materials.

Conversely, economic downturns or periods of high inflation can lead to tighter investment capital, potentially slowing the pipeline of new cell therapies and, consequently, demand for their raw materials. The World Bank projected global economic growth to be 2.6% in 2024, down from 3.0% in 2022, which can influence investment landscapes. Geopolitical factors, such as trade policies, international intellectual property protections, and the stability of global supply chains for highly specialized biological components, are also crucial.

Disruptions caused by geopolitical tensions, as seen in 2024 with various trade and logistics issues, can increase the cost and delay the delivery of critical raw materials, impacting production timelines and costs for cell therapy manufacturers. However, the transformative potential of cell therapies to cure previously untreatable diseases ensures continued strategic investment and development, providing a strong foundation for the market even amidst economic and geopolitical volatility.

Current US tariff policies can directly impact the cell therapy raw materials market by altering the cost of imported specialized media, recombinant proteins, cryopreservatives, and advanced single-use manufacturing components. Given the highly specialized nature of these materials and their often global sourcing, tariffs imposed on key imports can significantly increase the operational costs for US-based cell therapy manufacturers.

A May 2025 analysis by the Peterson Institute for International Economics indicated that new US tariffs could raise costs for manufacturers who rely heavily on imported intermediate inputs. For instance, the US International Trade Commission’s (USITC) data from 2024 shows significant imports of certain biological products and laboratory reagents, which could be subject to tariffs. This could translate to higher prices for finished cell therapies, potentially affecting patient access or the financial viability of clinical trials.

Conversely, these tariff policies can act as a powerful incentive for manufacturers to invest in expanding or establishing domestic production capabilities for critical cell therapy raw materials within the US. This strategic push aims to create a more localized and secure supply chain, reducing reliance on potentially volatile international sources and enhancing national resilience in this critical biomedical sector, despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Increased Focus on Supply Chain Resiliency and Diversification is a Recent Trend

A prominent recent trend in the cell therapy raw materials market is the increased focus on enhancing supply chain resiliency and diversification. The COVID-19 pandemic highlighted vulnerabilities in global supply chains, leading cell therapy developers to prioritize securing multiple qualified suppliers for critical raw materials and reducing reliance on single-source providers. This involves increased vetting of suppliers, establishing redundancy in sourcing, and potentially investing in regional manufacturing hubs.

The US Government Accountability Office (GAO) in a December 2023 report on “Biomedical Manufacturing: FDA Actions to Support Manufacturing of Cell and Gene Therapies” emphasized that companies in the cell and gene therapy sector have sought to enhance supply chain robustness due to past disruptions. This strategic shift aims to mitigate risks from geopolitical events, natural disasters, or pandemics, ensuring a consistent and reliable supply of essential materials for uninterrupted cell therapy production.

Regional Analysis

North America is leading the Cell Therapy Raw Materials Market

North America dominated the market with the highest revenue share of 46.3% owing to the rapid expansion of the cell and gene therapy pipeline and increasing regulatory approvals. The US FDA’s Center for Biologics Evaluation and Research (CBER) reported a rise in cell and gene therapy Investigational New Drug (IND) applications, reaching 378 in fiscal year 2023, up from 309 in fiscal year 2022. This growth in clinical development directly boosts the demand for essential raw materials such as cell culture media, reagents, and cryopreservation solutions.

Key industry players, including Thermo Fisher Scientific and Danaher, whose life sciences segments supply these materials, saw substantial revenue increases. Thermo Fisher’s Life Sciences Solutions Group generated US$ 13.43 billion in 2023, while Danaher’s Biotechnology segment recorded US$ 7.2 billion in the same year. These trends highlight how advancements in cell therapy research are driving the demand for raw materials.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increased cell therapy research, government support, and healthcare investments in countries like China and Japan. The number of cell and gene therapy clinical trials in the region has risen, signaling a strong pipeline that requires a steady supply of specialized raw materials.

Regulatory bodies such as China’s National Medical Products Administration (NMPA) are facilitating the approval of cell therapy products, further supporting market growth. Companies like Thermo Fisher Scientific are expanding their operations in the region, contributing to their global revenue. With strategic investments in biomanufacturing and increasing research activity, the demand for raw materials is projected to grow significantly in Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cell therapy raw materials market employ several strategies to drive growth, including expanding their product portfolios through the development of novel raw materials tailored for specific cell therapies. They focus on enhancing the scalability and reproducibility of manufacturing processes by offering standardized, quality-controlled materials that meet current Good Manufacturing Practice (cGMP) standards. Companies also invest in research and development to improve the performance and safety profiles of their offerings, ensuring they align with the evolving needs of cell therapy applications.

Strategic partnerships with biotechnology firms and academic institutions help accelerate innovation and facilitate the integration of new materials into clinical practices. Additionally, these players aim to strengthen their global presence by establishing manufacturing facilities and distribution networks in key markets, ensuring timely and efficient delivery of materials to support the growing demand for cell-based therapies.

Lonza Group AG, a Swiss multinational company, is a prominent player in the cell therapy raw materials market. Established in 1897 and headquartered in Basel, Switzerland, Lonza provides comprehensive services to the pharmaceutical, biotechnology, and nutrition sectors. The company offers a broad range of products and services, including cell culture media, reagents, and cGMP-compliant manufacturing solutions, supporting the development and production of cell and gene therapies. With a global presence and a commitment to innovation, Lonza plays a crucial role in advancing the field of cell therapy by supplying high-quality raw materials essential for the successful manufacture of therapeutic products.

Top Key Players in the Cell Therapy Raw Materials Market

- Thermo Fisher Scientific

- Sartorius Stedim Biotech

- PromoCell GmbH

- Merck KGaA

- Danaher

- Charles River Laboratories

- BioCentriq

- Actylis

Recent Developments

- In December 2024: BioCentriq secured a long-term lease for a new 60,000 sq. ft. facility in Princeton, NJ, with a US$12 million investment to expand its cell therapy development and production. This facility will boost the supply of critical raw materials, including cell culture media and cytokines, to meet growing therapy demands.

- In October 2024: Thermo Fisher Scientific launched a bioprocess design center in Genome Valley, Hyderabad, to address the rising biopharma demand in the Asia-Pacific region. The center will offer specialized services for cell culture media and single-use technologies to support the cell therapy market.

Report Scope

Report Features Description Market Value (2024) US$ 4.8 billion Forecast Revenue (2034) US$ 25.8 billion CAGR (2025-2034) 18.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cell Culture Supplements, Antibodies, and Others), By End-user (Biopharmaceutical & Pharmaceutical Companies, CROs & CMOs, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Sartorius Stedim Biotech, PromoCell GmbH, Merck KGaA, Danaher, Charles River Laboratories, BioCentriq , Actylis. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell Therapy Raw Materials MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Cell Therapy Raw Materials MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Sartorius Stedim Biotech

- PromoCell GmbH

- Merck KGaA

- Danaher

- Charles River Laboratories

- BioCentriq

- Actylis