Global Cell Separation Market Analysis By Product (Consumables,Instruments), By Cell Type (Human Cells, Animal Cells), By Technique (Centrifugation, Surface Marker, Filtration), By Application (Biomolecule Isolation, Cancer Research, Stem Cell Research, Tissue Regeneration, In Vitro Diagnostics, Therapeutics), By End-Use (Research Laboratories and Institutes, Hospitals and Diagnostic Laboratories, Cell Banks, Biotechnology and Biopharmaceutical Companies) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 125114

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

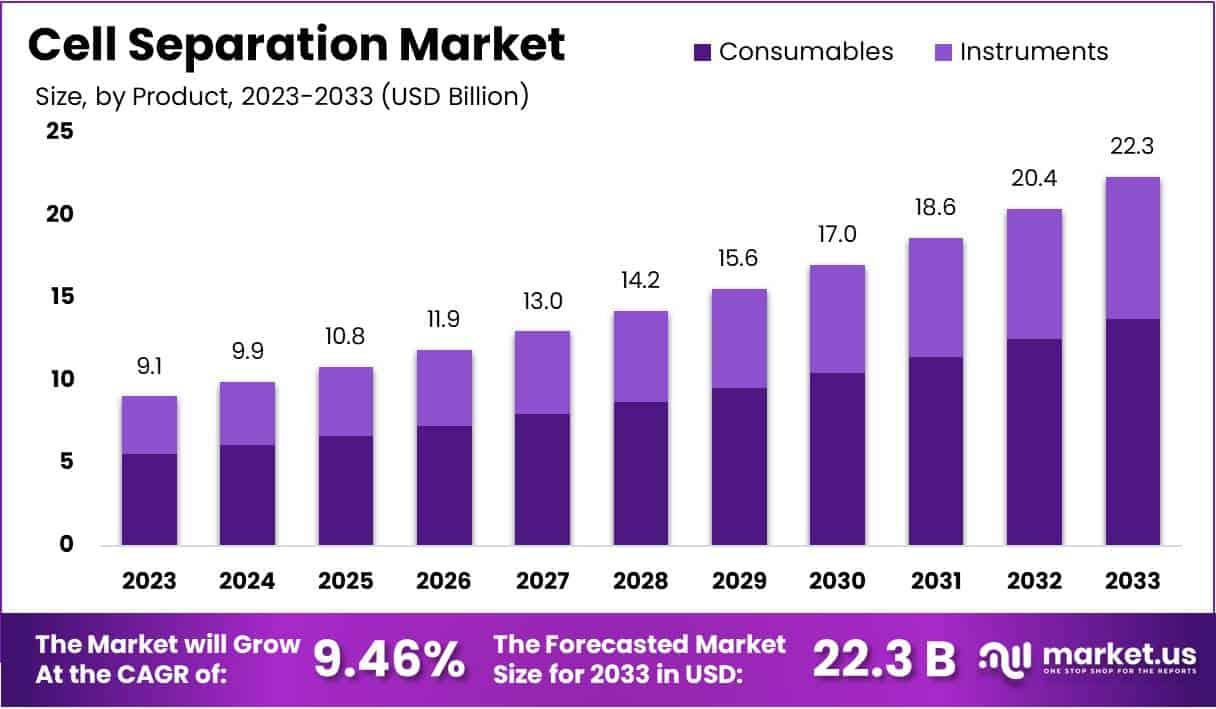

The Global Cell Separation Market size is expected to be worth around USD 22.3 Billion by 2033, from USD 9.1 Billion in 2023, growing at a CAGR of 9.46 % during the forecast period from 2024 to 2033.

The Cell Separation Market is experiencing significant growth, fueled by innovations and substantial investments in stem cell research. In 2024, the University of California, Irvine, was awarded a $4 million grant from the California Institute for Regenerative Medicine to enhance its stem cell research center. This development is part of a broader trend where investments in stem cell research are yielding considerable economic returns. A study from the USC Schaeffer Center indicated that such public investments have generated over 56,000 jobs and tripled the economic output from initial investments.

Technological advancements are also driving the market, especially with new tools like cost-reducing DNA sequencers that enhance biological research and diagnostics. The market is divided into consumables and instruments, with consumables leading due to their frequent repurchase cycle. The persistent R&D in the pharmaceutical sector supports a strong demand for consumables, projecting a sustained period of market growth and innovation.

In terms of regulation, the U.S. Bureau of Industry and Security (BIS) manages strict export controls aimed at protecting national security and economic interests. These regulations, part of the Export Administration Regulations (EAR), require detailed licensing for technologies with potential military applications. On the import side, technologies derived from biological sources are closely regulated by agencies like the FDA and the U.S. Department of Agriculture, ensuring compliance with stringent health standards.

Globally, trade policies vary significantly, with countries like Malaysia imposing specific tariffs and quotas that affect market dynamics. Such variations highlight the importance of understanding regional regulatory landscapes to navigate the global market effectively.

Government initiatives continue to play a crucial role in supporting the cell separation industry. For instance, the NIH’s funding through the BRAIN Initiative and its open data initiatives provide vital resources for advancing research in cell separation technologies. Moreover, strategic partnerships and infrastructure expansions, particularly in China’s CGT sector, underscore a global commitment to enhancing scientific research and clinical capabilities in this field.

Key Takeaways

- Market Size and Growth: Expected to grow from USD 9.1 billion in 2023 to USD 22.3 billion by 2033, at a 9.46% CAGR.

- Consumables Dominance: In 2023, consumables held 61.4% of the market, driven by the high demand for reagents, kits, and disposables.

- Human Cells Focus: Human cells accounted for over 58% of the market in 2023, essential for research in cancer and regenerative medicine.

- Essential Techniques: Centrifugation and MACS are key for high-throughput and precise cell isolation, supporting advanced therapeutic and research applications.

- Primary End-Users: Biotech and pharmaceutical companies lead with 42.9% market share, fueled by robust R&D investments.

- Regional Dynamics: North America leads with a 39.9% market share; Asia-Pacific is set to grow fastest due to increasing healthcare investments.

- Technological Opportunities: Advancements in microfluidics and MACS promise to enhance cell separation efficiency and application breadth, stimulating further market growth.

Product Analysis

In 2023, the Consumables segment secured a commanding presence in the Cell Separation Market’s Product Segment, accounting for over 61.4% of the market share. This category includes essential items like reagents, kits, media, sera, beads, and disposables. The significance of this segment is highlighted by the high demand for these products and their frequent replenishment.

Key components such as reagents and kits are crucial for the precision and efficiency of cell separation technologies. Moreover, media and sera are vital for maintaining cell viability during separation, while beads and disposables are indispensable for ensuring contamination-free procedures.

The Instruments segment also plays a critical role in the Cell Separation Market, comprising devices like centrifuges, flow cytometers, filtration systems, and magnetic-activated cell separator systems. Centrifuges are widely valued for their ability to quickly and efficiently sediment cells based on density. Flow cytometers are particularly important in research and clinical environments due to their capability for high-throughput and detailed cell analysis.

Filtration systems, which sort cells by size and volume using various pore sizes, and magnetic-activated cell separator systems, which isolate specific cell populations using magnetic fields and beads, are essential for targeted cell separation. The robust demand for consumables underscores their foundational role in supporting the sector’s operational requirements.

Cell Type Analysis

In 2023, the Human Cells segment achieved a leading position within the Cell Type Segment of the Cell Separation Market, securing over a 58% share. This segment’s dominance stems largely from the widespread utilization of human cells in a variety of critical medical fields, such as cancer research, regenerative therapies, and immunological treatments. The escalating demand for human cells is propelled by continuous advancements in biomedical research coupled with the rising prevalence of chronic illnesses that necessitate innovative therapeutic strategies.

Meanwhile, the Animal Cells segment maintained a robust presence in the market. Though it commands a smaller share compared to human cells, this segment is bolstered by significant investment in veterinary research and pharmaceutical development processes. Animal cells are extensively used in toxicology tests and in developing models that simulate human diseases, which supports the segment’s consistent growth. Enhanced efficiency and purity in cell separation technologies are expected to further stimulate growth in both segments, backed by increased R&D investments in the healthcare sector.

Technique Analysis

The centrifugation technique is widely recognized for its essential role in cell separation, using differential sedimentation rates to sort cells by density. This method is particularly effective for processing large volumes swiftly and is commonly utilized in clinical and research settings, including cancer research and regenerative medicine. As the demand for rapid diagnostic procedures increases, the centrifugation market is expected to see significant growth.

Additionally, surface marker-based separation methods, such as magnetic-activated cell sorting (MACS) and fluorescence-activated cell sorting (FACS), are crucial for obtaining high-purity cell isolations. These techniques rely on antibodies attached to magnetic particles or fluorochromes to specifically target cells, making them indispensable in therapeutic applications and personalized medicine.

Filtration techniques, which use physical barriers to separate cells based on size and shape, offer a gentle and versatile alternative for cell separation. This method is especially beneficial for handling sensitive cells like stem cells, which might be damaged by more invasive techniques. Due to its simplicity and cost-effectiveness, filtration is widely accessible for use in both laboratory and field environments.

The ongoing development of filter materials and designs is anticipated to improve this method’s efficiency and adaptability, facilitating its adoption in a variety of biomedical applications. As the need for personalized medicine and biotechnological advancements grows, the market for cell separation technologies is expected to expand, driven by continual improvements in techniques and their integration into new applications.

Application Analysis

The cell separation market is experiencing significant growth across several application areas. In the realm of biomolecule isolation, demand is fueled by the need for pure samples essential in biochemical research. Similarly, cancer research relies on these technologies to differentiate between malignant and healthy cells, driving advancements in oncology. The importance of cell separation is also evident in stem cell research, where isolating various stem cells is vital for regenerative medicine. This segment grows as stem cell applications in chronic disease treatments increase.

Additionally, cell separation technologies are crucial in tissue regeneration, aiding in the creation of biomaterials that promote healing and organ regeneration. The market also benefits from its application in in vitro diagnostics, where cells extracted from bodily fluids are analyzed for precise diagnostics. In therapeutics, these technologies underpin the development of cell-based treatments for a range of conditions, supporting the push towards personalized medicine. Each application area contributes uniquely to the market’s expansion, driven by the continuous need for specialized and advanced healthcare solutions.

End-Use Analysis

In 2023, the Biotechnology and Biopharmaceutical Companies segment commanded a significant presence in the Cell Separation Market’s End-Use Segment, securing over 42.9% of the market share. This leadership is attributed to robust investment in research and development along with an escalating demand for cell-based therapies and regenerative medicine. Additionally, the surge in personalized medicine has amplified the reliance on cell separation technologies within these sectors.

Concurrently, Research Laboratories and Institutes represent a vital market portion, employing cell separation methods for foundational research and innovative treatment developments. Supported by substantial funding from both governmental and private entities, especially in developing regions, this segment thrives. Hospitals and Diagnostic Laboratories, as well as Cell Banks, also contribute notably to the market, driven by advancements in diagnostics and biobanking, respectively. Each segment demonstrates essential roles in enhancing healthcare and research through specialized applications of cell separation technology.

Key Market Segments

Product

- Consumables

- Reagents, Kits, Media, and Sera

- Beads

- Disposables

- Instruments

- Centrifuges

- Flow Cytometers

- Filtration Systems

- Magnetic-activated Cell Separator Systems

Cell Type

- Human Cells

- Animal Cells

Technique

- Centrifugation

- Surface Marker

- Filtration

Application

- Biomolecule Isolation

- Cancer Research

- Stem Cell Research

- Tissue Regeneration

- In Vitro Diagnostics

- Therapeutics

End-Use

- Research Laboratories and Institutes

- Hospitals and Diagnostic Laboratories

- Cell Banks

- Biotechnology and Biopharmaceutical Companies

Drivers

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases globally is a crucial driver for the cell separation market, especially as the demand for advanced diagnostic and therapeutic technologies grows. Chronic conditions such as cancer, diabetes, and cardiovascular diseases significantly strain healthcare systems and emphasize the need for efficient, targeted medical interventions. The World Health Organization reports that chronic diseases are the leading causes of mortality worldwide, highlighting the urgent need for effective medical solutions.

In the United States alone, chronic diseases such as heart disease, diabetes, and Alzheimer’s are responsible for a substantial number of deaths annually and have a profound economic impact, costing the healthcare system billions of dollars. This growing burden underscores the necessity for innovative technologies like cell separation, which are pivotal in developing personalized medicine and targeted therapies that can more effectively treat and manage these diseases.

By enabling the precise extraction and analysis of specific cell types, cell separation technologies enhance research capabilities and therapeutic applications, thereby directly influencing advancements in healthcare treatments and outcomes. This vital role supports the expansion of the cell separation market as it responds to the increasing demands of chronic disease management.

Restraints

High Cost of Cell-Based Research

In the Cell Separation Market, a significant restraint is the high cost associated with cell-based research, primarily driven by the expenses of cell sorting and separation technologies. Advanced cell separation methods, such as fluorescence-activated cell sorting (FACS) and magnetic-activated cell sorting (MACS), require costly equipment and consumables. For instance, a flow cytometer, essential for FACS, can cost anywhere from $35,000 for a used device to $500,000 for new, equipment. This financial burden can be prohibitive for smaller laboratories and institutions, particularly in developing regions where funding and infrastructure are limited.

These high costs are attributed to the need for high-quality instruments, reagents, and compliance with stringent regulatory standards to ensure precise and reliable results. The extensive financial investment not only covers the initial purchase of equipment but also ongoing operational costs such as maintenance and the procurement of specific consumables necessary for each separation.

Furthermore, the intricacies of cell-based research and the low success rates in cell therapy trials amplify the financial risks involved, making it challenging for smaller entities and emerging markets to adopt these advanced technologies. This financial barrier significantly impacts the accessibility of cutting-edge research tools in less affluent regions, limiting the scope of research and development activities in these areas.

Opportunities

Technological Advancements in Cell Separation

In the Cell Separation Market, significant opportunities are presented by technological advancements, particularly in microfluidics and magnetic-activated cell sorting (MACS). These technologies are revolutionizing the precision and efficiency of cell separation processes. For instance, microfluidics has enabled the development of lab-on-a-chip devices that can manipulate tiny volumes of fluids with high precision, allowing for faster and more accurate cell sorting. This has particular relevance in clinical and research settings where the isolation of specific cell types is crucial.

Magnetic-activated cell sorting has also seen considerable enhancements. Recent advancements have improved the specificity and yield of cell separation processes. By utilizing micro-scale magnetophoresis, this technology offers greater control over the cell separation environment, resulting in high-throughput capabilities and reduced operational costs. These systems are capable of isolating cell types with high purity, exceeding 99% in some cases, and are increasingly used in both research and clinical applications.

Such technological innovations are crucial for the expansion of applications in areas like cancer research, stem cell biology, and immunology, where the precise separation of cells is vital for downstream applications. As these technologies continue to evolve, they are expected to drive significant growth in the cell separation market by enhancing the capabilities and applications of cell sorting systems.

Trends

Growing Applications in Stem Cell Research

The cell separation market is experiencing significant growth due to the expanding applications of stem cells in regenerative medicine and therapeutic fields. The International Society for Stem Cell Research (ISSCR) states that stem cell research is increasingly focused on developing therapies for conditions such as Parkinson’s disease, diabetes, and heart disease. As a result, there is a rising demand for advanced cell separation technologies that can efficiently isolate specific cell types.

In the United States alone, the use of stem cells in clinical trials has increased by 25% over the past five years, highlighting the growing reliance on these technologies. Companies like Thermo Fisher Scientific and Becton Dickinson are investing in developing innovative solutions to meet this demand, ensuring precise cell separation and enabling breakthroughs in medical research and treatment.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 39.9% share and holds USD 3.6 billion market value for the year. The robust growth in this region can be attributed to advanced healthcare infrastructure, substantial investments in biotechnology and pharmaceutical research, and the strong presence of key industry players. Additionally, increasing government and private funding for cell-based research and the rising prevalence of chronic diseases have significantly driven the demand for cell separation technologies.

Europe follows North America in market share, influenced heavily by its growing biotechnology sector and supportive government policies regarding healthcare research. The region’s focus on innovation and development in cancer research and regenerative medicine further boosts the adoption of cell separation techniques.

Asia-Pacific is projected to experience the fastest growth during the forecast period. This surge is due to rising healthcare expenditure, increasing awareness of advanced therapeutic modalities, and the expansion of healthcare facilities in emerging economies such as China and India. The region benefits from improving regulatory frameworks, which facilitate the faster approval of biotechnological procedures, thereby enhancing market growth.

Latin America and the Middle East & Africa regions, while holding smaller shares in the global market, are anticipated to witness gradual growth. This growth is spurred by the increasing investment in healthcare infrastructure, rising number of partnerships between local and international biotech companies, and the growing prevalence of diseases that require cellular analysis for diagnostics and treatment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Cell Separation Market is influenced by several leading companies, each contributing innovative technologies and solutions. Thermo Fisher Scientific Inc. is recognized for its extensive portfolio of cell separation tools and reagents. The company consistently introduces advanced solutions tailored to various research and clinical needs through strong research and development capabilities.

Thermo Fisher’s global presence and dedication to quality make it a preferred provider for laboratories and healthcare facilities. Similarly, BD (Becton, Dickinson and Company) plays a crucial role in the market with its innovative cell separation technologies. BD’s expertise in flow cytometry enables precise and efficient separation of cell populations, reinforcing its market position. The company focuses on innovation and customer satisfaction, supported by a vast distribution network.

Danaher Corporation, through its subsidiary Beckman Coulter, offers centrifugation and flow cytometry products that are integral to cell separation processes. Danaher’s strategic acquisitions and commitment to developing user-friendly technologies enhance its market competitiveness. Other key players, such as Terumo Corporation and STEMCELL Technologies Inc., bring precision and innovation to the market, with specialized products for research and clinical applications.

Market Key Players

- Thermo Fisher Scientific Inc.

- BD

- Danaher

- Terumo Corp.

- STEMCELL Technologies Inc.

- Bio-Rad Laboratories Inc.

- Merck KGaA

- Agilent Technologies Inc.

- Corning Inc.

- Akadeum Life Sciences

Recent Developments

- March 2024: Terumo Blood and Cell Technologies partnered with the CiRA Foundation to develop automated manufacturing of induced pluripotent stem (iPS) cells. This collaboration aims to integrate Terumo’s Quantum Flex technology with CiRA’s expertise to advance cell manufacturing processes, which are crucial for regenerative medicine and cell therapies.

- October 2023: Danaher completed the separation of its Environmental & Applied Solutions segment, creating an independent company named Veralto Corporation. This strategic move is part of Danaher’s focus on core growth areas, allowing Veralto to independently manage its operations and focus on water quality and product identification businesses.

- March 2023: Merck KGaA announced the expansion of its Life Science business with a new production facility in Molsheim, France. This facility, part of a €130 million investment, focuses on producing Mobius® single-use assemblies, which are vital for cell separation and biopharmaceutical manufacturing. This expansion aims to meet the increasing demand for advanced manufacturing capabilities in Europe and globally.

- September 2022: Danaher announced the merger of its bioprocessing businesses, Cytiva and Pall Life Sciences, into a single entity known as “The Biotechnology Group.” This merger created a comprehensive product portfolio, making it the largest in the bioprocessing sector. The combined entity is expected to generate $7.5 billion in revenue from bioprocessing, emphasizing its leading position in upstream and downstream applications.

Report Scope

Report Features Description Market Value (2023) USD 9.1 Billion Forecast Revenue (2033) USD 22.3 Billion CAGR (2024-2033) 9.46% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product [Consumables (Reagents, Kits, Media, and Sera, Beads, Disposables), Instruments (Centrifuges, Flow Cytometers, Filtration Systems, Magnetic-activated Cell Separator Systems)], By Cell Type (Human Cells, Animal Cells), By Technique (Centrifugation, Surface Marker, Filtration), By Application (Biomolecule Isolation, Cancer Research, Stem Cell Research, Tissue Regeneration, In Vitro Diagnostics, Therapeutics), By End-Use (Research Laboratories and Institutes, Hospitals and Diagnostic Laboratories, Cell Banks, Biotechnology and Biopharmaceutical Companies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., BD, Danaher, Terumo Corp., STEMCELL Technologies Inc., Bio-Rad Laboratories Inc., Merck KGaA, Agilent Technologies Inc., Corning Inc., Akadeum Life Sciences Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Cell Separation market in 2023?The Cell Separation market size is USD 9.1 billion in 2023.

What is the projected CAGR at which the Cell Separation market is expected to grow at?The Cell Separation market is expected to grow at a CAGR of 9.46% (2024-2033).

List the segments encompassed in this report on the Cell Separation market?Market.US has segmented the Cell Separation market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Consumables (Reagents, Kits, Media, and Sera, Beads, Disposables), Instruments (Centrifuges, Flow Cytometers, Filtration Systems, Magnetic-activated Cell Separator Systems). By Cell Type the market has been segmented into Human Cells, Animal Cells. By Technique the market has been segmented into Centrifugation, Surface Marker, Filtration. By Application the market has been segmented into Biomolecule Isolation, Cancer Research, Stem Cell Research, Tissue Regeneration, In Vitro Diagnostics, Therapeutics. By End-Use the market has been segmented into Research Laboratories and Institutes, Hospitals and Diagnostic Laboratories, Cell Banks, Biotechnology and Biopharmaceutical Companies.

List the key industry players of the Cell Separation market?Thermo Fisher Scientific Inc., BD, Danaher, Terumo Corp., STEMCELL Technologies Inc., Bio-Rad Laboratories Inc., Merck KGaA, Agilent Technologies Inc., Corning Inc., Akadeum Life Sciences, and Other Kay Players

Which region is more appealing for vendors employed in the Cell Separation market?North America is expected to account for the highest revenue share of 39% and boasting an impressive market value of USD 3.6 billion. Therefore, the Cell Separation industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Cell Separation?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Cell Separation Market.

-

-

- Thermo Fisher Scientific Inc.

- BD

- Danaher

- Terumo Corp.

- STEMCELL Technologies Inc.

- Bio-Rad Laboratories Inc.

- Merck KGaA

- Agilent Technologies Inc.

- Corning Inc.

- Akadeum Life Sciences