Global Cell Culture Media Bags Market By Product Type (Single Use Bags, Customizable Bags and Reusable Bags), By Material (Polyethylene, Ethylene Vinyl Acetate (EVA), Polypropylene and Others), By Application (Monoclonal Antibody Production, Vaccine Production, Stem Cell Research, Cell Therapy and Others), By Capacity (Medium Sized Bags, Small Sized Bags and Large Sized Bags), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutions and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175355

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

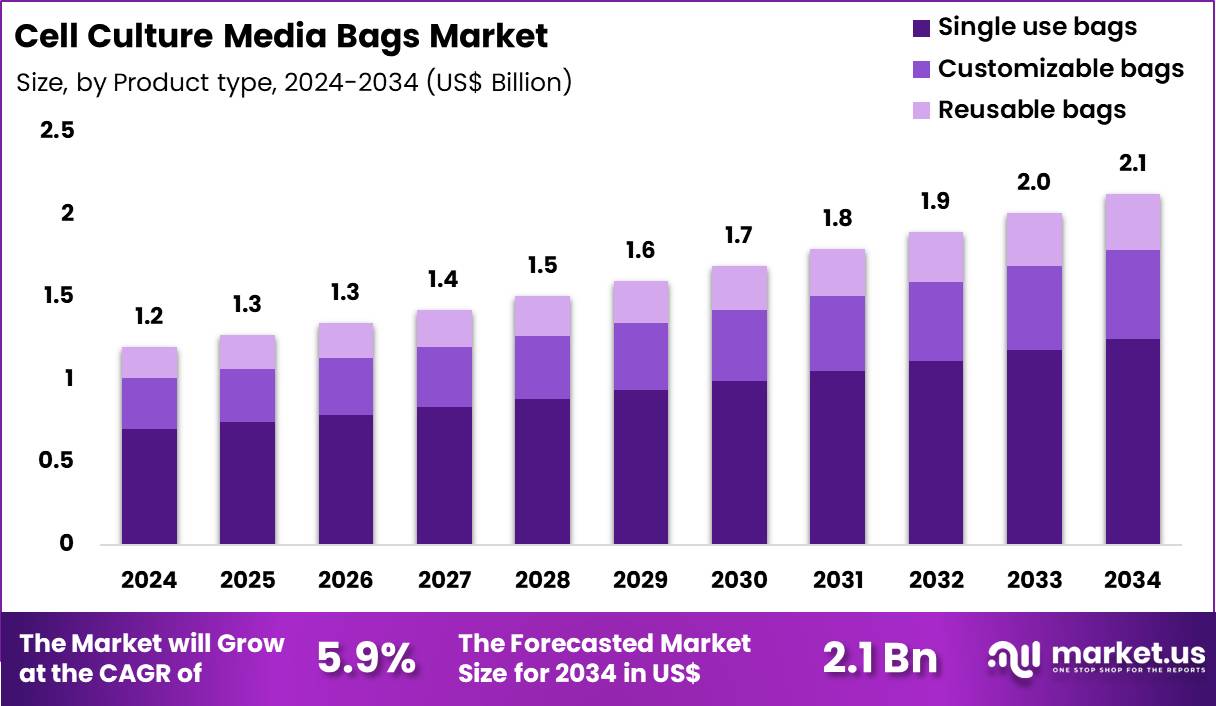

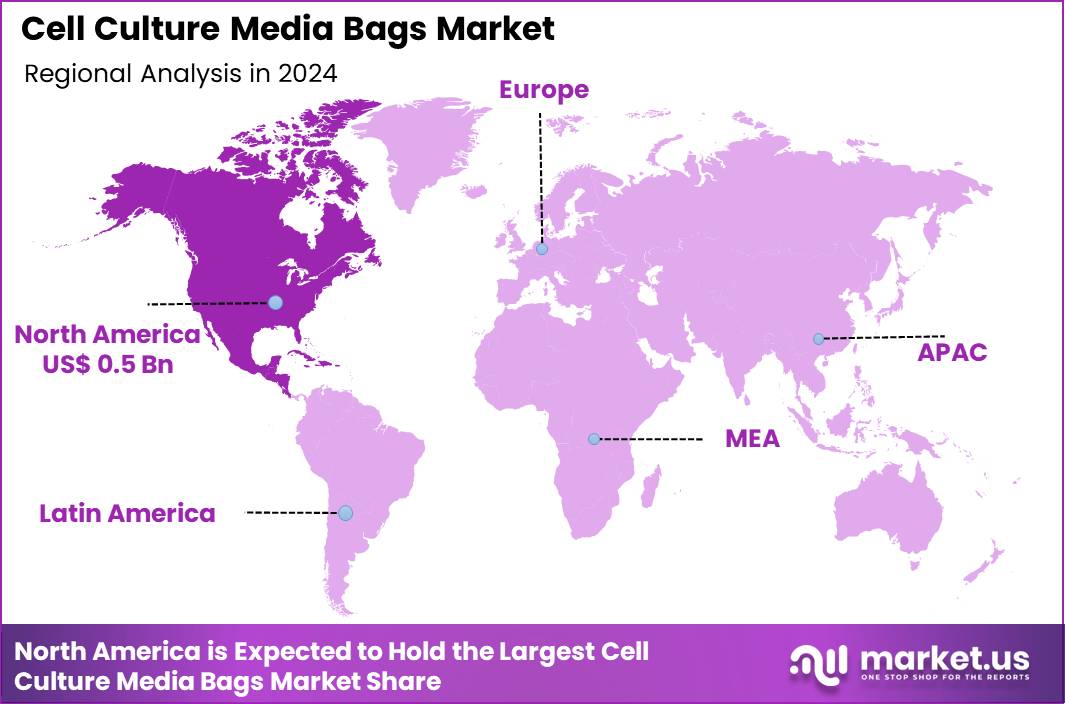

Global Cell Culture Media Bags Market size is expected to be worth around US$ 2.1 Billion by 2034 from US$ 1.2 Billion in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.9% share with a revenue of US$ 0.5 Billion.

Growing demand for scalable and contamination-free bioprocessing solutions accelerates the adoption of cell culture media bags that support efficient, closed-system cultivation of mammalian and microbial cells. Biopharmaceutical manufacturers increasingly utilize single-use 2D and 3D media bags for seed train expansion of CHO cells, maintaining sterility while preparing high-density inocula for large-scale bioreactor production of monoclonal antibodies.

These bags facilitate perfusion culture of stem cells, delivering continuous nutrient supply and waste removal to sustain long-term expansion in regenerative medicine applications. Contract development organizations employ rigid and flexible media bags for transient expression of recombinant proteins, enabling rapid production of research-grade material for preclinical studies.

Vaccine developers apply these systems to culture viral vectors and recombinant antigens, ensuring consistent nutrient delivery during upstream processes for adenoviral and mRNA-based platforms. Cell therapy manufacturers rely on media bags for ex vivo expansion of T cells and NK cells, supporting autologous and allogeneic immunotherapy workflows with controlled gas exchange and volume scalability.

Manufacturers pursue opportunities to develop chemically defined, animal-component-free media bags that enhance reproducibility and regulatory compliance in advanced therapy medicinal products. Developers advance multilayer film technologies that improve gas permeability and barrier properties, expanding applications in hypoxia-sensitive stem cell cultures and microbial fermentation for biologics.

These innovations facilitate integration with automated filling systems, streamlining seed banking and media preparation for high-throughput biomanufacturing. Opportunities emerge in smart media bags equipped with integrated sensors for real-time pH, dissolved oxygen, and glucose monitoring, enabling process analytical technology in intensified perfusion cultures.

Companies invest in sustainable, recyclable bag materials that reduce plastic waste while maintaining biocompatibility for long-term cell expansion. Recent trends emphasize ready-to-use, pre-sterilized bags with customized media formulations, accelerating scale-up from development to commercial manufacturing across diverse therapeutic modalities.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2 Billion, with a CAGR of 5.9%, and is expected to reach US$ 2.1 Billion by the year 2034.

- The product type segment is divided into single use bags, customizable bags and reusable bags, with single use bags taking the lead with a market share of 58.6%.

- Considering material, the market is divided into polyethylene, ethylene vinyl acetate (EVA), polypropylene and others. Among these, polyethylene held a significant share of 44.7%.

- Furthermore, concerning the application segment, the market is segregated into monoclonal antibody production, vaccine production, stem cell research, cell therapy and others. The monoclonal antibody production sector stands out as the dominant player, holding the largest revenue share of 36.9% in the market.

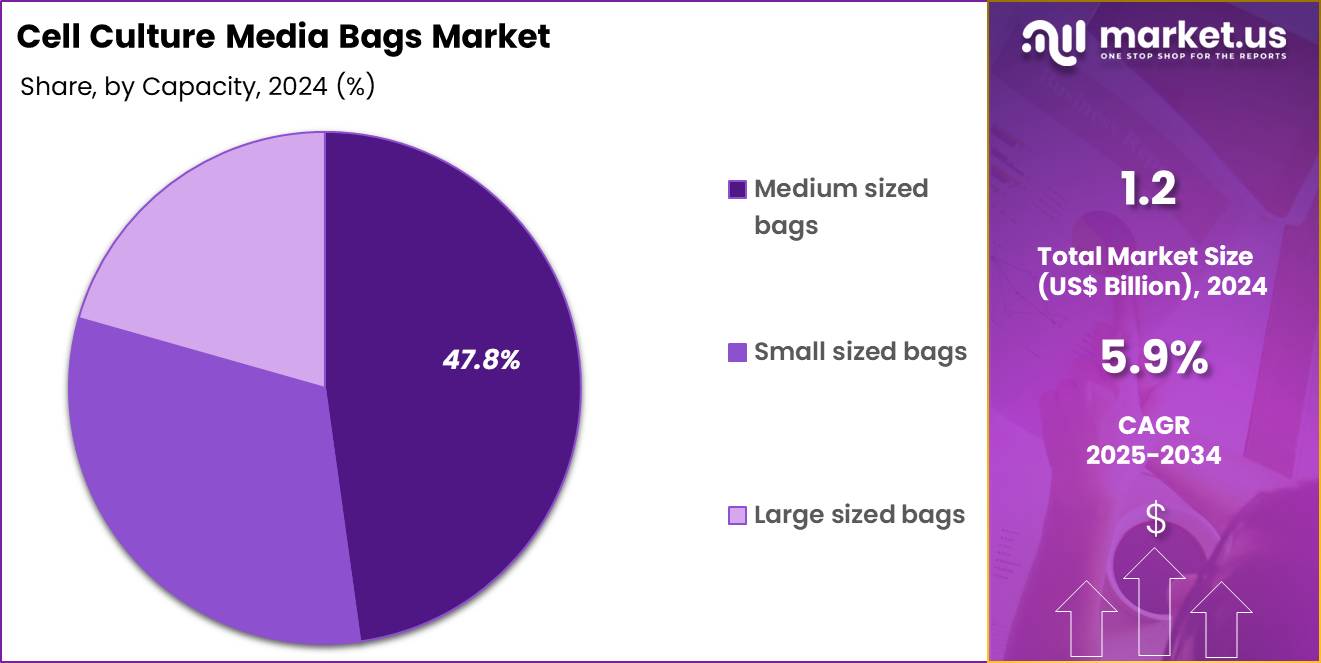

- The capacity segment is segregated into medium sized bags, small sized bags and large sized bags, with the medium sized bags segment leading the market, holding a revenue share of 47.8%.

- Considering end-user, the market is divided into pharmaceutical & biotechnology companies, academic & research institutions and others. Among these, pharmaceutical & biotechnology companies held a significant share of 52.3%.

- North America led the market by securing a market share of 38.9%.

Product Type Analysis

Single use bags contributed 58.6% of growth within product type and dominate the cell culture media bags market because bioprocessing teams prioritize speed, contamination control, and operational flexibility. Single use formats reduce cleaning validation workload, which shortens changeover time between batches and improves facility throughput.

Manufacturers also prefer disposable bags because they lower cross-batch carryover risk in multiproduct facilities. Growing adoption of single-use bioreactors and closed processing trains increases steady demand for compatible media bags. Procurement teams value predictable replacement cycles, which supports consistent recurring purchases across production sites.

Single use bags also support fast scale-up during clinical-to-commercial transitions because teams add capacity without major stainless-steel infrastructure. Supply chain planning improves because facilities standardize on validated bag platforms with defined connectors and ports.

Training becomes simpler when operators follow repeatable setup steps rather than complex CIP and SIP routines. Single use adoption aligns with CDMO models that run many campaigns, where turnaround time directly affects revenue. The segment is projected to remain dominant due to strong alignment with modern flexible manufacturing and strict contamination control expectations.

Material Analysis

Polyethylene accounted for 44.7% of growth within material and leads usage in cell culture media bags due to durability, compatibility, and scalable manufacturing economics. Process engineers prefer polyethylene because it offers strong mechanical strength for handling, transport, and mixing in production environments.

The material supports reliable sealing and weld performance, which matters for closed-system integrity and leak prevention. Polyethylene also suits multilayer film designs, enabling suppliers to tune barrier properties and flexibility for different media types. As demand rises for standardized single-use systems, polyethylene films provide consistent quality at high volumes.

Polyethylene also supports broad connector and tubing compatibility, which simplifies integration into fill-finish, media prep, and upstream workflows. Manufacturers favor materials that maintain structural integrity during cold storage and movement across cleanroom zones.

Cost efficiency plays a major role because high-volume biomanufacturing consumes large numbers of bags per year. Quality teams also prefer materials with well-documented performance and extractables profiles that align with supplier qualification processes. The segment is expected to retain leadership due to performance reliability, supply scalability, and widespread adoption across single-use bioprocess platforms.

Application Analysis

Monoclonal antibody production represented 36.9% of growth within application and drives demand for cell culture media bags because antibody manufacturing requires large, frequent media preparation and transfer cycles. Upstream production runs depend on consistent media supply for seed train expansion and production bioreactors.

High pipeline activity in oncology and immunology increases batch volumes and campaign frequency, raising media bag consumption. Facilities also run complex feeding strategies in intensified processes, which increases the number of media and supplement bags used per batch. Standardized bag-based media handling reduces contamination risk, which matters for high-value biologics.

Manufacturers also expand single-use upstream capacity to shorten build timelines, and this shift directly increases bag usage for storage, mixing, and transfer. CDMOs supporting multiple clients rely on media bags to execute fast changeovers while keeping closed processing.

Quality expectations remain strict for biologics, so teams prioritize validated bag systems that support sterility assurance and repeatable handling. Process optimization efforts increase sampling and media adjustments, which adds to bag utilization across production suites. The segment is anticipated to remain strong due to sustained biologics demand, high batch intensity, and ongoing scale-up of antibody manufacturing capacity.

Capacity Analysis

Medium sized bags contributed 47.8% of growth within capacity and lead the cell culture media bags market because they match the most common working volumes in upstream and media prep operations. Many facilities prepare media in intermediate batches to support seed trains, perfusion feeds, and daily replenishment schedules.

Medium sized formats offer a practical balance between handling ease and adequate volume, which improves operator workflow in cleanroom environments. These bags fit well on standard mixing stations, carts, and storage racks, supporting efficient movement between prep areas and production suites. Facilities also prefer medium sizes to reduce waste from unused media compared with oversized containers.

Medium sized bags support flexible production models, where teams run multiple smaller campaigns rather than single massive batches. This size range also reduces risk during handling because heavier bags increase strain and lifting hazards.

Operators achieve faster mixing and temperature equilibration at medium volumes, supporting quicker readiness for use. Inventory management becomes simpler when facilities standardize around a common mid-range capacity for most workflows. The segment is projected to remain dominant due to strong fit with typical batch sizes, easier handling, and compatibility with common mixing and storage infrastructure.

End-User Analysis

Pharmaceutical and biotechnology companies accounted for 52.3% of growth within end-users and represent the largest buying group because they run the highest volume of commercial and clinical biomanufacturing. These companies operate large upstream facilities that consume media bags daily across seed trains, production bioreactors, and buffer preparation.

Capital investment in single-use processing continues to rise, increasing recurring demand for compatible bag systems. In-house process development teams also purchase bags for scale-down models and pilot runs, expanding consumption beyond commercial production. Large biologics portfolios increase the number of parallel programs, which raises total bag usage across sites.

Biotech firms also accelerate production timelines, and single-use bags support fast setup without extensive infrastructure changes. Supplier qualification programs encourage long-term contracts, which stabilizes purchasing volumes for bag manufacturers.

Pharma companies emphasize regulatory compliance and traceability, driving preference for validated bag platforms and consistent supply. Global expansion of biologics manufacturing footprints increases demand across regions and facilities. The segment is expected to remain dominant due to production scale, continuous manufacturing campaigns, and sustained investment in biologics and advanced therapies.

Key Market Segments

By Product Type

- Single use Bags

- Customizable Bags

- Reusable Bags

By Material

- Polyethylene

- Ethylene Vinyl Acetate (EVA)

- Polypropylene

- Others

By Application

- Monoclonal Antibody Production

- Vaccine Production

- Stem Cell Research

- Cell Therapy

- Others

By Capacity

- Medium sized Bags

- Small sized Bags

- Large sized Bags

By End-user

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Others

Drivers

Increasing demand for biopharmaceuticals is driving the market.

The surging requirement for biologics and vaccines has substantially elevated the utilization of cell culture media bags in manufacturing processes worldwide. Enhanced focus on monoclonal antibodies and cell therapies necessitates scalable storage solutions for media preparation and handling.

According to the International Trade Administration, in 2022, over $25 billion in biopharmaceutical exports originated from majority foreign-owned firms operating in the United States. This export volume illustrates the expanding global trade and production capacity reliant on efficient bioprocessing equipment. Cell culture media bags offer sterility and flexibility essential for upstream biomanufacturing stages.

The correlation between biopharma pipelines and single-use technologies further propels adoption in contract development organizations. National policies promoting biologic drug development contribute to sustained infrastructure investments. Leading suppliers are optimizing bag designs to align with this heightened production demand. This driver enhances operational efficiencies in pharmaceutical facilities across regions. Ultimately, the biopharma surge underpins robust expansion in specialized containment solutions.

Restraints

Supply chain vulnerabilities in premium polymers is restraining the market.

The dependence on specialized materials for cell culture media bags exposes manufacturers to disruptions in raw material availability and pricing fluctuations. Geopolitical tensions and logistic challenges amplify risks in sourcing fluoropolymers and other high-grade components. Regulatory demands for material traceability add complexity to supply networks, increasing operational overheads.

Facilities in cost-sensitive regions face delays due to inconsistent polymer deliveries, impacting production timelines. Alternative sourcing strategies are limited by quality assurance requirements for biocompatible films. This restraint curtails scalability for smaller bioprocessing entities amid volatile global trade. Industry collaborations aim to diversify supplier bases but encounter certification hurdles.

Consequently, vulnerabilities hinder timely market responses to demand spikes. Efforts to localize production partially address these issues in select economies. Overall, supply chain fragility remains a critical barrier to seamless growth.

Opportunities

Rising investments in Asia-Pacific biomanufacturing is creating growth opportunities.

The acceleration of biopharma infrastructure in Asia-Pacific countries provides avenues for deploying cell culture media bags in new facilities and expansions. Governmental funding for biotechnology hubs supports the integration of single-use systems in regional production sites. The area’s increasing role in global vaccine and biologic supply chains amplifies demand for reliable media storage.

Strategic alliances with local entities enable compliance and customized solutions for diverse markets. Capacity enhancements in high-population nations address unmet needs in chronic disease treatments. Sartorius reported sales revenue of 3,380.7 million euros in 2024, with Bioprocess Solutions at 2,690.2 million euros, reflecting strong regional contributions.

Training initiatives for technical staff promote standardized adoption of advanced bags. This opportunity facilitates entry into price-competitive yet expanding sectors. Key corporations are establishing Asian operations to capitalize on lower costs and proximity. Targeted expansions can secure substantial footholds in dynamic healthcare landscapes.

Impact of Macroeconomic / Geopolitical Factors

Global economic advancements channel increased capital into bioprocessing infrastructure, strengthening the cell culture media bags market as biopharmaceutical manufacturers expand single-use systems to support scalable production of biologics and cell therapies. Executives leverage steady demand from vaccine and monoclonal antibody pipelines, which sustains procurement of flexible, sterile containment solutions in high-growth regions.

Nevertheless, persistent worldwide inflation raises expenses for polymer films and manufacturing processes, obliging suppliers to address profitability constraints in competitive environments. Geopolitical frictions in plastic resin and component sourcing regions disrupt consistent material availability, requiring distributors to manage extended lead times and supply variability.

Industry participants counter these challenges by broadening vendor networks to more reliable sources, which enhances procurement stability and supports collaborative quality improvements. Current US tariffs on imported bioprocessing plastics and related consumables from major exporters like China, often imposing additional duties ranging from 10% to 25% under trade measures, elevate landed costs for overseas-dependent products entering the American market.

Domestic producers capitalize on this landscape by intensifying local fabrication efforts, which promotes technological localization and aligns with strategic supply security objectives. Continuous innovations in durable, low-extractable films and integrated bag designs reliably propel the sector forward, ensuring robust scalability and enhanced efficiency for biomanufacturing operations worldwide.

Latest Trends

Development of multi-layer film constructions is a recent trend in the market.

In 2024, advancements in multi-layer films for cell culture media bags improved barrier properties against oxygen and moisture permeation. These constructions incorporate specialized polymers to enhance durability during storage and transport of sensitive media. Enhanced film integrity reduces risks of contamination in sterile bioprocessing environments.

Manufacturers focused on biocompatibility testing to ensure compatibility with various cell lines and formulations. Clinical applications in vaccine production benefited from extended shelf-life capabilities of these bags. Regulatory evaluations in 2024 confirmed compliance for global distribution of upgraded products.

Industry emphasis on sustainability integrated recyclable elements into film designs. Collaborations refined extrusion techniques for consistent layer adhesion. The trend addresses efficiency demands in large-scale monoclonal antibody manufacturing. These innovations position multi-layer bags as preferred for complex biologic workflows.

Regional Analysis

North America is leading the Cell Culture Media Bags Market

North America maintains a 38.9% share of the global cell culture media bags market, showcasing substantial advancement in 2024 attributed to intensified bioprocessing demands in vaccine and monoclonal antibody production amid ongoing global health priorities. Enhanced adoption of single-use technologies has streamlined operations, reducing contamination risks and operational costs for large-scale mammalian cell cultures in U.S. facilities.

Prominent suppliers have introduced gamma-irradiated, multi-layer film bags with improved barrier properties to handle chemically defined media formulations effectively. Rising investments in regenerative medicine have propelled utilization in stem cell expansion protocols, supporting autologous therapies. Health agencies have emphasized compliance with USP standards, fostering innovation in customizable bag configurations for upstream processes.

Strategic expansions by contract manufacturers have bolstered supply chain resilience, accommodating surge capacities in pandemic preparedness. Integration with automated bioreactors has optimized media storage and transfer, enhancing yield efficiencies. In 2024, the FDA approved seven cell and gene therapy products, necessitating reliable media containment solutions for clinical-grade manufacturing.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Biotechnology corporations and academic bodies propel forward momentum in single-use bioprocessing containers across the Asia Pacific region during the forecast period, leveraging demographic shifts and policy incentives to address unmet needs in biologics production. China spearheads localization efforts by funding scalable facilities for serum-free media handling in oncology drug development.

India advances through dedicated programs that subsidize infrastructure for GMP-compliant storage systems in vaccine hubs. Japan innovates with high-barrier materials to extend shelf life for advanced therapy medicinal products. Pharmaceutical leaders form joint ventures to standardize port designs and connectivity for seamless integration in perfusion cultures.

Research consortia validate eco-friendly alternatives to reduce plastic waste in high-volume operations. Regulatory harmonization facilitates cross-border trade of pre-sterilized assemblies. In 2024, India’s Union Cabinet allocated Rs. 9197 crore to the Bio-RIDE scheme, encompassing biomanufacturing components to bolster entrepreneurship and R&D in biotechnology.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Cell Culture Media Bags market drive growth by supplying robust, sterile, single-use storage and transfer solutions that protect media integrity for biologics and cell therapy production. Companies expand adoption by engineering bags with low-extractable materials, strong weld strength, and reliable port configurations that support closed, contamination-resistant workflows.

Commercial strategies emphasize long-term supply agreements with biopharma manufacturers and CDMOs to ensure consistency of consumables across validated processes. Innovation priorities include larger-volume formats, enhanced mixing compatibility, and improved gas barrier performance that supports sensitive culture requirements.

Market expansion targets regions scaling upstream bioprocessing capacity and accelerating clinical-to-commercial transitions. Sartorius operates as a leading participant with a comprehensive single-use bioprocess portfolio, global manufacturing footprint, and deep application expertise that supports dependable media handling in modern biomanufacturing.

Top Key Players

- Sartorius AG

- Thermo Fisher Scientific

- Merck KGaA

- Cytiva

- Corning Incorporated

- Danaher Corporation

- Saint Gobain

- Lonza

- Meissner Filtration Products, Inc.

- Pall Corporation

Recent Developments

- In August 2025, Thermo Fisher Scientific introduced a new range of cell culture media bags built for high throughput bioprocessing workflows. This launch supports the market by improving scalability and consistency for manufacturers running larger batch volumes and faster turnaround schedules, strengthening demand from biopharma customers that require reliable single use fluid handling solutions.

- In September 2025, Merck KGaA announced a sustainability focused program that includes the use of biodegradable materials in cell culture media bag products. This initiative supports market growth by aligning media bag development with tightening environmental expectations from regulators and procurement teams, increasing adoption among biomanufacturers seeking lower waste footprints without compromising process safety.

- In July 2025, Sartorius AG formed a co development partnership with a biotechnology company to advance next generation cell culture media solutions. This collaboration supports the market by accelerating innovation timelines and expanding specialized offerings for complex biologics production, reinforcing demand for high performance media bags and related single use systems across upstream manufacturing.

Report Scope

Report Features Description Market Value (2024) US$ 1.2 Billion Forecast Revenue (2034) US$ 2.1 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single Use Bags, Customizable Bags and Reusable Bags), By Material (Polyethylene, Ethylene Vinyl Acetate (EVA), Polypropylene and Others), By Application (Monoclonal Antibody Production, Vaccine Production, Stem Cell Research, Cell Therapy and Others), By Capacity (Medium Sized Bags, Small Sized Bags and Large Sized Bags), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutions and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sartorius AG, Thermo Fisher Scientific, Merck KGaA, Cytiva, Corning Incorporated, Danaher Corporation, Saint Gobain, Lonza, Meissner Filtration Products, Inc., Pall Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell Culture Media Bags MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Cell Culture Media Bags MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Sartorius AG

- Thermo Fisher Scientific

- Merck KGaA

- Cytiva

- Corning Incorporated

- Danaher Corporation

- Saint Gobain

- Lonza

- Meissner Filtration Products, Inc.

- Pall Corporation