Cell and Gene Therapy Market By Therapy Type (Cell Therapy, Gene Therapy, Germ-line Gene Therapy (GGT), Somatic Cell Gene Therapy (SCGT)), By Indication (Oncology, Genetic Disorders, Neurological Disorders, Cardiovascular Disorders, Infectious Diseases, Dermatology, Orthopaedics, Others), By Delivery Method (In Vivo, Ex Vivo), By End-User (Hospitals, Academic & Research Institutes, Cancer Care Centers, Pharmaceutical & Biotechnology Companies, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 101909

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

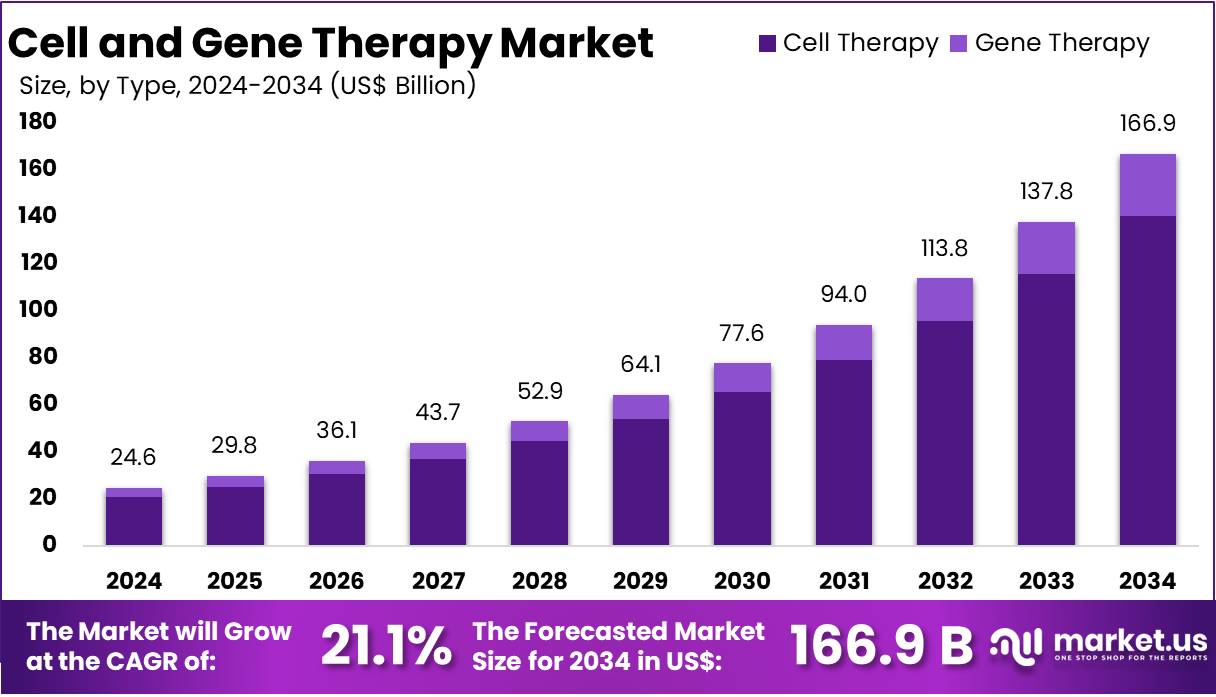

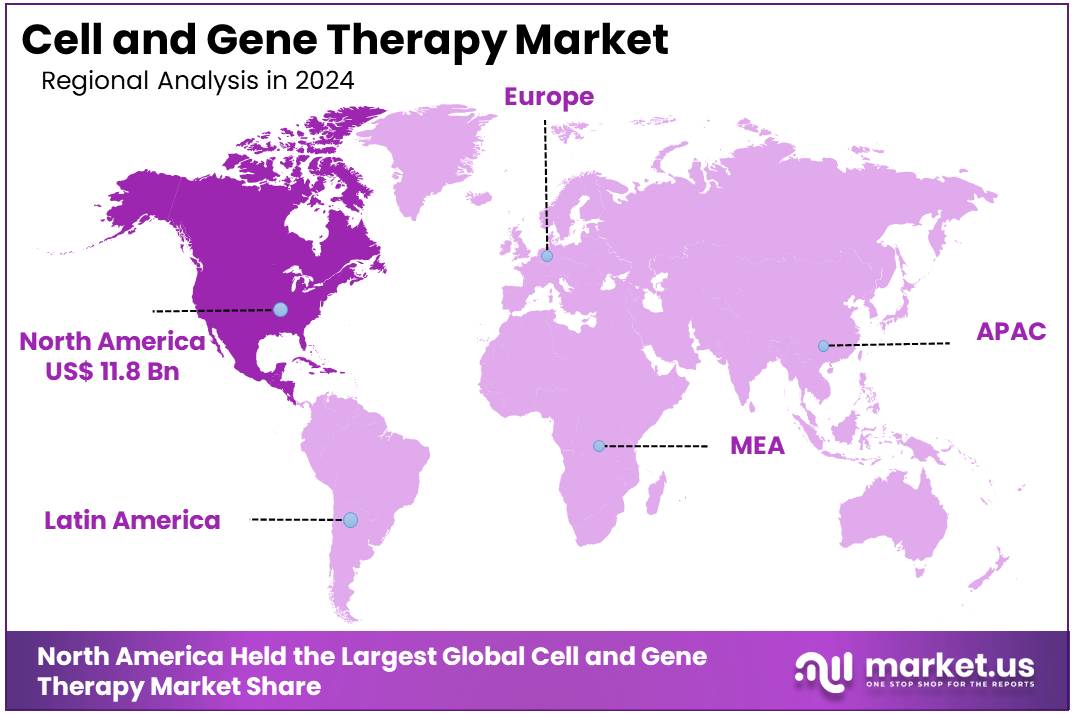

The Cell and Gene Therapy Market Size is forecasted to be valued at US$ 166.9 billion by 2034 from US$ 24.6 billion in 2024, growing at a CAGR of 21.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 47.8% share and holds US$ 11.8 Billion market value for the year.

Cell and gene therapy is transforming the medical landscape by offering promising treatments for a variety of genetic disorders and diseases that were previously deemed untreatable. Over the past decade, advancements in these therapies have led to the development of groundbreaking treatments that target the root causes of conditions like sickle cell anemia, hemophilia, and various types of cancer. One of the most notable successes in gene therapy has been the approval of CAR-T cell therapies for certain blood cancers. These therapies involve modifying a patient’s own immune cells to target and destroy cancer cells, offering a potential cure for patients who have not responded to traditional treatments.

Gene therapy itself, which involves introducing, altering, or removing genetic material within a patient’s cells, is also making waves in the treatment of genetic disorders. A key example is Luxturna, a gene therapy treatment for a rare form of inherited blindness caused by a mutation in the RPE65 gene. This was the first FDA-approved gene therapy for an inherited disease, marking a historic moment in the field. As we look to the future, other therapies targeting genetic disorders, such as Duchenne muscular dystrophy and cystic fibrosis, are undergoing clinical trials and have shown promising results.

One of the major factors driving the growth of cell and gene therapy is the significant progress made in gene editing technologies, particularly CRISPR-Cas9. This technology allows for precise modifications to the DNA, offering the potential for permanent cures for a range of diseases. For instance, scientists are exploring the possibility of using CRISPR to treat sickle cell disease by correcting the genetic mutation that causes it. Early trials have shown that CRISPR could potentially offer a one-time cure for sickle cell disease, which currently requires lifelong treatment.

In 2024, seven Cell and Gene Therapy products were approved by the U.S. Food and Drug Administration (FDA) (Amtagvi, Aucatzyl, Beqvez, Kebilidi, Ryoncil, Symvess, Tecelra), many of which marked significant milestones in the US. Landmark trials using stem cells to treat Parkinson’s disease in both the US and Japan represent a turning point for cell therapy in neurodegeneration. Early-stage approaches targeting Alzheimer’s disease and amyotrophic lateral sclerosis are also showing promising results.

During COVID-19 lockdown in New York City, a small group of Parkinson’s disease patients participated in an experimental neurosurgical procedure at Memorial Sloan Kettering Cancer Center. This procedure involved implanting dopamine-producing neurons derived from human embryonic stem cells. In June 2025, the researchers published the results of their phase 1 study, which demonstrated that the transplanted cells survived, released dopamine, and were well-tolerated by the patients. Some participants even exhibited noticeable improvements, including a reduction in tremors.

However, gene therapy, which once held promise as a potential cure for rare diseases such as sickle cell anemia, is now losing the interest of early investors. Many are shifting their focus to higher-reward areas like obesity and cancer, as sales for some recent treatments have failed to meet expectations. For instance, in 2024, Pfizer discontinued its gene therapy indicated for hemophilia, which was priced at $3.5 million per patient. Bluebird Bio, a company once valued at nearly $10 billion, was sold to private equity firms for just $30 million. In 2024, gene therapy and gene-editing companies raised less than $1.4 billion across 39 venture rounds, marking a sharp decline from $3.5 billion raised in 60 deals in 2023, and a 57% decrease from the peak of $8.2 billion raised in 122 deals in 2021, according to DealForma’s data for Reuters.

Key Takeaways

- In 2024, the market for cell and gene therapy generated a revenue of US$ 24.6 billion, with a CAGR of 21.1%, and is expected to reach US$ 166.9 billion by the year 2034.

- Among the Therapy Type segment, Cell Therapy dominated the market with 84.1% share in 2024.

- By Indication, Infectious Diseases held significant revenue share of 27.2% in 2024.

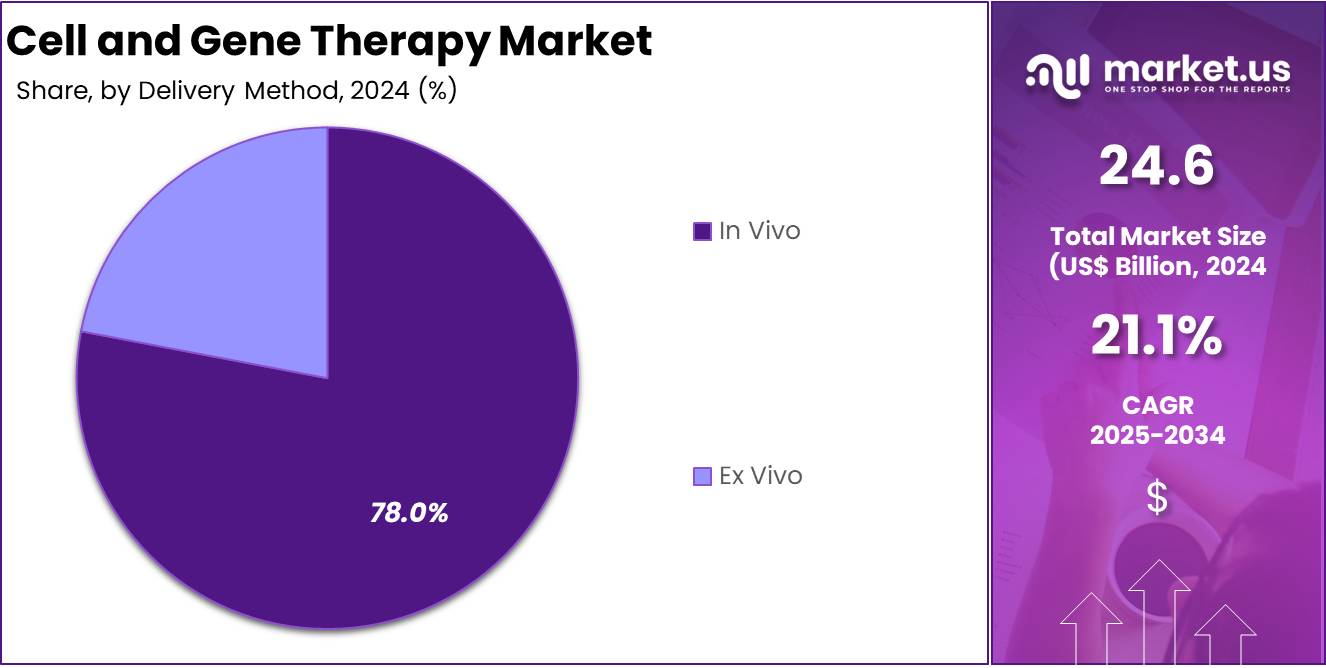

- Based on Delivery Method, In Vivo was the largest revenue generating segment holding 78.0% share in 2024.

- By End-User, Hospitals captured the maximum revenue share with 35.7% in 2024.

- North America held the largest share of 47.8% in 2024 in the global market.

Therapy Type Analysis

Cell therapy was the leading segment within the broader cell and gene therapy market capturing 84.1% share in 2024, due to its groundbreaking potential in treating a wide range of diseases, particularly those in oncology and hematology. The concept behind cell therapy involves using living cells to treat or cure a variety of conditions, often by replacing or repairing damaged tissue. This form of treatment is highly personalized, as it often uses the patient’s own cells, which reduces the risk of rejection and increases the likelihood of a successful outcome. It is a promising avenue for diseases that conventional treatments have struggled to address.

For example, Kymriah, the first CAR-T therapy approved by the FDA, has shown remarkable success in treating pediatric patients with acute lymphoblastic leukemia (ALL) who had failed to respond to other treatments. The success of CAR-T has marked a turning point in cancer treatment, offering hope to patients for whom traditional therapies, such as chemotherapy, had little to no effect.

Product launches and investments have also become pivotal in this field. In October 2023, India’s Central Drugs Standard Control Organization (CDSCO), the country’s equivalent to the US FDA, approved NexCAR19 as India’s first CAR-T cell therapy. Additionally, in January 2025, India launched its first global CAR T-cell therapy for adult B-cell Non-Hodgkin Lymphoma (B-NHL), a blood cancer affecting the lymphatic system, providing new hope for patients battling aggressive blood cancers.

In July 2025, Akadeum Life Sciences, a leader in buoyancy-based cell separation technology, successfully closed a financing round exceeding $20 million. This funding comes at a crucial time for Akadeum, following the launch of its GMP-compliant product suite, which is designed for use in clinical trials and represents a significant step forward in advancing next-generation cell therapies.

Indication Analysis

In cell and gene therapy market, the infectious diseases segment has rapidly become one of the largest areas of focus with 27.2% revenue share in 2024. This surge is driven by the urgent need for innovative treatments, particularly for viral infections like HIV, hepatitis, and other chronic diseases that continue to affect millions of people worldwide.

The global health crisis caused by the COVID-19 pandemic highlighted the vulnerabilities of health systems and underscored the necessity for new therapeutic approaches to address ongoing and emerging infectious threats. In addition, the growing concern over antibiotic resistance has further fueled the push for alternative treatments, including gene therapies that aim to target the root cause of infections rather than just managing symptoms.

Gene therapy in the context of infectious diseases often involves modifying a patient’s cells to either enhance the immune system’s ability to fight off pathogens or directly target and eliminate the infectious agent. One of the most promising applications of gene therapy is in the treatment of HIV. Traditional treatments, which manage the virus, do not eliminate it from the body due to the virus’s ability to integrate into the patient’s DNA.

However, researchers are now exploring gene-editing technologies like CRISPR to target and remove the HIV genome from infected cells, offering the potential for a permanent cure. This breakthrough could revolutionize the treatment of HIV, shifting from lifelong medication to a one-time, curative approach. In April 2024, researchers at Washington University School of Medicine in St. Louis were awarded a $6.2 million grant from the National Institutes of Health (NIH) to develop a gene therapy aimed at modifying the immune system’s B cells to generate broadly neutralizing antibodies against HIV. This approach, if successful, could potentially control or eradicate the infection without the need for continuous antiretroviral therapy.

Delivery Method Analysis

In vivo gene therapy dominated the market with 78.0% share in 2024, due to its ability to directly deliver genetic material into a patient’s body. Unlike ex vivo therapies, which involve removing cells from the body, modifying them, and reintroducing them, in vivo therapies simplify the process by bypassing the need for cell extraction. This method is particularly advantageous when treating diseases affecting tissues that are difficult to access surgically, such as those in the liver, eyes, and brain. By delivering the therapeutic genes directly to the target cells inside the body, in vivo therapy minimizes the risks and complexities associated with other forms of gene therapy.

A major driver of in vivo gene therapy’s success is the use of viral vectors, with adeno-associated virus (AAV) vectors being one of the most commonly used. AAVs are favored for their safety and efficiency in delivering genetic material to cells. In June 2025, the FDA approved an Investigational New Drug application for a gene therapy targeting Parkinson’s disease associated with GBA mutations (PD-GBA). Additionally, the first patient was dosed in a Phase I trial exploring an in vivo CAR-T candidate for autoimmune disorders. SpliceBio (Barcelona, Spain) also secured US$135 million in Series B funding to further develop its gene therapy candidate for retinal disease.

The success of in vivo gene therapies has opened the door to new research aimed at expanding their applications. As per a novel study, for in vivo gene therapy to succeed, a particle must be developed that efficiently targets HSCs without affecting other cells, delivering both a gene payload and gene editing tools. Researchers at Fred Hutch Cancer Center have developed an MVP for modifying blood stem cells in vivo in a mouse model by packaging these elements. The innovative aspect of their approach was the modification of the particle to specifically target CD90+ blood stem cells.

End-User Analysis

Hospital was the largest segment in the cell and gene therapy market contributing 35.7% share in 2024, primarily due to their essential role in delivering these advanced treatments directly to patients. The ability of hospitals to manage complex medical procedures and offer personalized therapies is a key factor in their prominence within the field. Cell and gene therapies, such as CAR-T cell treatments and gene editing procedures, require highly specialized medical teams, infrastructure, and facilities, which hospitals are well-equipped to provide.

In particular, the adoption of cell therapies for cancer treatment has been a significant driver of this trend. For instance, hospitals have become centers of excellence for administering CAR-T cell therapies, which involve modifying a patient’s own T cells to target and destroy cancer cells. A total of 191 patients undergoing CAR T cell therapy were identified from three claims databases: Optum® Clinformatics® Data Mart, IBM MarketScan® Commercial & Medicare Database, and IQVIA PharMetrics® Plus. The median age of these patients ranged from 56 to 67 years, with 63% to 75% being male. According to the study, the majority of patients (88% to 98%) received CAR T cell infusions in an inpatient setting.

The success of CAR-T therapies has been a game-changer in oncology. Hospitals like the John Theurer Cancer Center have become leaders in offering CAR-T treatments, particularly for patients with lymphoma and leukemia who have not responded to other forms of treatment. These hospitals are equipped with specialized facilities and trained staff capable of handling the unique demands of gene therapies.

Similarly, in countries like India, the Tata Memorial Centre has introduced CAR-T trials, with a focus on making these therapies available to a larger population through subsidized costs. In addition, in January 2025, Children’s Hospital Los Angeles (CHLA), a national leader in advanced pediatric care and innovative cell and gene therapy research, announced the addition of its 10th cell and gene therapy treatment. This milestone establishes CHLA as the pediatric provider with the most FDA-approved, cutting-edge cell and gene therapy treatments on the West Coast.

Key Market Segments

By Therapy Type

- Cell Therapy

- Stem Cells

- Embryonic (pluripotent) stem cells

- Tissue-specific (multipotent or unipotent) stem cells

- Induced pluripotent stem cells (iPS)

- Dendritic Cells

- NK Cells

- T Cells

- CAR T-cell therapy

- Tumor-Infiltrating Lymphocyte (TIL) Therapy

- Others

- Stem Cells

- Gene Therapy

- Germ-line Gene Therapy (GGT)

- Somatic Cell Gene Therapy (SCGT)

By Indication

- Oncology

- Hematological Cancers

- Solid Tumors

- Rare Cancers

- Genetic Disorders

- Neurological Disorders

- Cardiovascular Disorders

- Infectious Diseases

- Dermatology

- Orthopaedics

- Others

By Delivery Method

- In Vivo

- Ex Vivo

By End-User

- Hospitals

- Academic & Research Institutes

- Cancer Care Centers

- Pharmaceutical & Biotechnology Companies

- Others

Drivers

Advancements in Gene Editing Technologies

Advancements in gene editing technologies have significantly propelled the field of cell and gene therapy, offering unprecedented precision and versatility in treating a wide array of genetic disorders. Central to this progress is the development of CRISPR-Cas9, a groundbreaking tool that enables scientists to make targeted modifications to DNA with remarkable accuracy. This technology has not only enhanced the understanding of gene function but also paved the way for therapeutic applications that were once considered unattainable.

For instance, the development of gene therapies for blood disorders is an important milestone achieved in the field of CRISPR technology. In December 2023, FDA approved Casgevy, the first CRISPR-Cas9-based gene therapy for sickle cell disease and transfusion-dependent beta-thalassemia. This therapy involves editing a patient’s hematopoietic stem cells to increase the production of fetal hemoglobin, thereby alleviating the symptoms associated with these conditions. The approval of Casgevy marks a significant milestone in the application of gene editing for therapeutic purposes, demonstrating its potential to cure genetic diseases rather than merely managing their symptoms.

Beyond blood disorders, CRISPR technology has shown promise in treating a variety of other genetic conditions. For instance, researchers have utilized CRISPR-based gene editing to enhance the immune response in cancer therapy. By modifying T cells to express receptors that specifically target tumor cells, scientists have developed personalized cancer therapies that are more effective and have fewer side effects than traditional treatments. These advancements have opened new avenues for treating cancers that were previously difficult to manage.

In August 2024, scientists from the CSIR-Institute of Genomics and Integrative Biology in New Delhi developed an advanced genome-editing system capable of modifying DNA with greater precision and efficiency than current CRISPR-based technologies. Additionally, in July 2025, a research team from the University of Maryland School of Medicine (UMSOM) won a $250,000 prize from the National Institutes of Health (NIH) to enhance technologies for delivering genome editing tools to specific cells in the body. Furthermore, in December 2024, Qi Biodesign, a company specializing in genome-editing technologies, announced the successful completion of a $75 million funding round, covering seed funding as well as Series Pre-A and Series A stages.

The continuous evolution of gene editing technologies, including the development of next-generation tools like base editors and prime editors, promises even greater precision and fewer off-target effects. These advancements are expected to expand the therapeutic applications of gene editing, offering hope for individuals with a broader range of genetic disorders.

Restraints

High Cost of Therapies

The high cost of cell and gene therapies remains a significant barrier to their widespread adoption and equitable access, despite their transformative potential in treating previously untreatable diseases. The financial burden of these therapies often leads to difficult decisions for patients, healthcare providers, and policymakers. For instance, the gene therapy Zolgensma, used to treat spinal muscular atrophy, is priced at $2.1 million for a single treatment. The cost includes a list price of $750,000 for the first year, followed by $350,000 annually, totaling around $4 million over a decade.

Similarly, Hemgenix, a treatment for hemophilia B, is priced at $3.5 million per dose, making it the most expensive drug at the time of its FDA approval in November 2022, according to CSL Behring. These exorbitant costs are primarily attributed to the complex and individualized manufacturing processes, the need for specialized medical infrastructure, and the relatively small patient populations served.

The economic implications extend beyond the initial treatment costs. Patients often face additional expenses related to pre-treatment assessments, post-treatment monitoring, and potential long-term care. For example, the production of viral vectors, essential components in many gene therapies, can exceed $500,000 per batch. Furthermore, the high upfront costs of these therapies can strain healthcare systems, particularly in low- and middle-income countries where resources are limited. In regions like sub-Saharan Africa and parts of Asia, the financial and infrastructural challenges make the implementation of gene therapies currently unfeasible.

To address these challenges, various strategies are being explored. Some healthcare systems have implemented value-based pricing models, where payment is tied to the therapy’s effectiveness and long-term benefits. Additionally, outcome-based agreements allow for partial reimbursement if the therapy does not achieve the desired results. These approaches aim to balance the high costs with the potential long-term savings from reduced chronic care needs. However, such models require robust data collection and monitoring systems to assess outcomes accurately.

Opportunities

Growing Focus on Rare Diseases

The growing focus on rare diseases presents a significant opportunity in the field of cell and gene therapy, driven by advancements in gene editing technologies and a deeper understanding of genetic disorders. Approximately 80% of the 7,000 known rare diseases are monogenic, caused by mutations in a single gene, making them particularly amenable to gene therapy approaches.

For instance, the development of gene therapies for spinal muscular atrophy (SMA) is one of the important landmarks achieved. Zolgensma, a one-time gene therapy, has demonstrated the potential to halt disease progression in infants diagnosed with SMA, a condition that leads to muscle weakness and respiratory failure. Similarly, Luxturna has restored vision in patients with inherited retinal dystrophies, underscoring the transformative impact of gene therapy on rare diseases.

Recent advancements in gene editing technologies have significantly broadened the treatment options for rare diseases. In a groundbreaking medical development, a child with a rare genetic disorder was treated successfully using a personalized CRISPR gene editing therapy by a team at Children’s Hospital of Philadelphia (CHOP) and Penn Medicine. The infant, KJ, was born with severe carbamoyl phosphate synthetase 1 (CPS1) deficiency, a rare metabolic disorder. After spending the first several months of his life in the hospital on a restrictive diet, KJ received his first dose of the customized therapy in February 2025, at six to seven months of age. The treatment was administered safely, and KJ is now progressing well and thriving.

Additionally, in November 2024, the FDA approved Kebilidi (eladocagene exuparvovec-tneq), an adeno-associated virus vector-based gene therapy designed to treat both adult and pediatric patients with aromatic L-amino acid decarboxylase (AADC) deficiency. Kebilidi is the first FDA-approved gene therapy for AADC deficiency, a rare genetic disorder that impairs the production of certain neurotransmitters essential for communication within the body’s nervous system.

The increasing number of FDA-approved gene therapies for rare diseases reflects the growing recognition of their clinical value. By the end of 2023, ten gene therapies had been approved, with an additional 30 to 50 expected by 2030. This surge in approvals is accompanied by a concerted effort to improve access to these therapies, including the development of value-based pricing models and expanded insurance coverage.

Impact of Macroeconomic / Geopolitical Factors

In the US, the high cost of gene therapies, such as Zolgensma and Casgevy, has sparked concerns among insurers and policymakers regarding long-term affordability and reimbursement strategies. As a result, alternative payment models, including installment payments and outcome-based rebates, are being explored to alleviate financial pressures on healthcare systems. Additionally, industry experts have expressed concerns about the increasing competitive threat from China, highlighting the significant innovation occurring offshore, outside the jurisdiction of the FDA. They argue that the U.S. process is slow, costly, and inflexible.

In contrast, the U.S. government has invested in biotech infrastructure and research initiatives to strengthen domestic innovation and reduce reliance on foreign manufacturing. However, recent legislative actions, such as the Biosecure Act introduced in U.S. Congress in January, aim to prohibit U.S. companies receiving federal grant money from collaborating with WuXi AppTec and related entities. The draft legislation also names three other Chinese companies, including the gene sequencing firm BGI Genomics. These measures are prompting companies to reconsider their international partnerships and manufacturing strategies.

Despite billions of dollars being committed to reshoring pharma manufacturing in response to tariff threats from President Donald Trump, the industry does not appear ready to completely abandon foreign operations. In particular, biotechs focused on rare diseases and complex modalities like cell and gene therapies have urged the Trump administration to provide exemptions to pending pharma tariffs. According to BioMarin, with 95% of the more than 10,000 known rare diseases still lacking an FDA-approved therapy, maintaining incentives for innovation in rare diseases is essential for public health. The Alliance for Regenerative Medicine (ARM) has also warned that tariffs could delay or hinder access to cell and gene therapies for U.S. patients.

Latest Trends

Growing Number of Product Approvals

The increasing number of product approvals in cell and gene therapy reflects significant advancements in biotechnology and regulatory processes, heralding a new era of personalized medicine. In 2024, the FDA approved seven novel cell and gene therapy products, marking a notable expansion in the availability of treatments for various genetic and rare diseases. These approvals include innovative therapies such as Amtagvi, Aucatzyl, Beqvez, Kebilidi, Ryoncil, Symvess, and Tecelra, each representing a significant step forward in the treatment of conditions previously lacking effective options.

Among these, Amtagvi (lifileucel) stands out as the first FDA-approved treatment utilizing tumor-infiltrating lymphocytes (TILs) for solid tumors, specifically melanoma. This approval marks a milestone in cancer therapy, expanding the application of cell-based treatments beyond hematologic malignancies. Another significant development is the approval of Beqvez (fidanacogene elaparvovec-dzkt), a gene therapy for adults with moderate to severe hemophilia B. This therapy employs an adeno-associated virus (AAV) vector to deliver a functional copy of the factor IX gene, addressing the underlying cause of the bleeding disorder and offering patients a potential long-term solution.

The trend of increasing approvals is not limited to 2024. In 2023, the FDA approved several groundbreaking therapies, including Casgevy and Lyfgenia for sickle cell disease, Beremagene geperpavec for dystrophic epidermolysis bullosa, and Valoctocogene roxaparvovec for severe hemophilia A. These approvals underscore the growing recognition of cell and gene therapies as viable treatment options for a range of genetic disorders.

The surge in approvals is also reflected in the expanding pipeline of gene therapies. As of early 2024, there were approximately 36 FDA-approved gene therapies, with an additional 500 in development. Industry experts anticipate that 10–20 new gene therapies will receive approval annually by 2025, indicating a robust and accelerating trajectory for the field.

Some of the recent cell and gene therapy product approvals

Product Approval Year Disease(s) Location(s) Approved Originator Company Encelto 2025 Macular telangiectasia type 2 (MacTel) US Neurotech Aucatzyl 2024 Acute lymphocytic leukemia US Autolus Tecelra 2024 Synovial sarcoma US Adaptimmune Nexiguran Ziclumeran (nex-z) 2025 Transthyretin Amyloid Cardiomyopathy (ATTR-CM, Wild Type Or Hereditary) US, Europe Intellia Therapeutics, Inc. NEU-001 2025 Hirschsprung disease (HD) US Neurenati Therapeutics Inc. Regional Analysis

North America is leading the Cell and Gene Therapy Market

North America was the largest region in the cell and gene therapy market, holding 47.8% share in 2024. Robust healthcare infrastructure, cutting-edge research facilities, and a supportive regulatory environment drive this. The US is a global leader in the development and adoption of these therapies. The FDA has played a significant role in accelerating the approval of new therapies, with breakthrough designs and expedited review processes for high-impact treatments.

According to the American Society of Gene & Cell Therapy (ASGCT), approximately 15 million Americans, half of whom are children, are affected by rare genetic disorders. However, since early 2023, over 100 clinical-stage gene therapy programs have been discontinued. Moreover, the U.S. is home to many biotech and pharmaceutical companies actively advancing gene therapies, providing a solid foundation for ongoing innovation. This concentration of expertise, coupled with extensive funding from private investors, has fostered an environment where new gene therapies can be developed, tested, and brought to market faster than in many other regions.

In addition to clinical advancements, North America’s healthcare infrastructure allows for the complex logistics involved in delivering these therapies, including the need for specialized medical personnel, equipment, and facilities. According to Pharmacy Times data, the cell and gene therapy landscape is evolving rapidly, with more than 22 FDA-approved therapies expected to be available in the US market by 2025. Projections indicate that by 2030, over 200 therapies will be approved, and 100,000 patients will have been treated in the US.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is rapidly emerging as the fastest-growing region for cell and gene therapy, spurred by improving healthcare infrastructure, increased government support, and a rapidly expanding biotechnology sector. Countries such as China, Japan, and South Korea are at the forefront of this growth, with governments investing heavily in biotech innovation and creating favorable conditions for research and development. China, for example, has seen a significant rise in gene therapy clinical trials and approvals, with a number of local companies developing therapies targeting rare genetic disorders and cancer.

As of July 2025, researchers in China have developed a more affordable and accessible method for delivering highly specialized, personalized cell therapies to treat blood cancers and other serious diseases. This new approach is easier to program than traditional methods and comes at a significantly lower cost.

CAR-T cell therapy, which has shown promise in treating conditions such as asthma and autoimmune diseases, remains challenging to produce and deliver to patients, with high associated costs. To address these challenges, a group of Chinese medical experts has proposed a solution using gene therapy tools. They reported successfully producing anticancer cells directly inside the human body and, for the first time, using them to treat four patients with multiple myeloma, the second most common blood cancer.

On the other hand, in Japan, efforts are underway to integrate gene therapy into the national healthcare system, with regulatory bodies expediting the approval of innovative therapies. In May 2025, Sarepta Therapeutics, Inc. announced that Japan’s Ministry of Health, Labour, and Welfare (MHLW) approved ELEVIDYS (delandistrogene moxeparvovec), a gene therapy for Duchenne muscular dystrophy (DMD), through the country’s conditional and time-limited approval pathway. Meanwhile, South Korea is positioning itself as a biotech hub with substantial investments in gene therapy manufacturing and development.

Major pharmaceutical companies, as well as local startups, are driving progress in areas like cell-based therapies and gene editing technologies, leveraging the country’s well-developed research infrastructure. The rapid pace of innovation, combined with increasing regional collaboration and knowledge sharing, suggests that Asia Pacific will continue to see significant growth in the cell and gene therapy market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global competitive landscape of the cell and gene therapy market is shaped by a combination of established pharmaceutical giants, specialized biotech firms, and emerging companies that are pioneering novel treatments. Leading players in the market include well-known companies like Novartis, Gilead Sciences, and Roche, which have invested heavily in gene therapy research and development, positioning themselves as key contributors to this transformative field.

Novartis, for example, made headlines with the approval of Zolgensma, which is one of the most expensive treatments in the world. The company has leveraged its deep expertise in gene therapy to expand its portfolio, focusing on rare diseases and genetic disorders that require personalized treatments.

Top Key Players in the Cell and Gene Therapy Market

- Novartis

- Gilead Sciences (Kite Pharma)

- Bluebird Bio

- Sarepta Therapeutics

- Bristol-Myers Squibb (Juno Therapeutics)

- Regeneron Pharmaceuticals

- Amgen

- Pfizer

- Roche (Genentech)

- AbbVie (Allergan)

- Cellectis

- Intellia Therapeutics

- CRISPR Therapeutics

- Beam Therapeutics

- Orchard Therapeutics

- Autolus Therapeutics

Recent Developments

- In June 2025: Sarepta and its global partner Roche suspended the commercial and clinical use of Duchenne muscular dystrophy (DMD) gene therapy Elevidys (delandistrogene moxeparvovec) in non-ambulatory patients after reassessing its safety profile following two patient fatalities.

- In June 2025: bluebird bio announced the completion of its sale to investment funds managed by global firms Carlyle and SK Capital Partners, LP. Following the completion of the transaction, bluebird’s common stock ceased trading and will no longer be listed publicly. Carlyle and SK Capital have made substantial investments to support and expand bluebird’s commercial efforts in delivering gene therapies for patients with sickle cell disease, β-thalassemia, and cerebral adrenoleukodystrophy.

- In November 2024: Roche finalized a definitive agreement for acquiring Poseida Therapeutics, Inc., a public clinical-stage biopharma company headquartered in San Diego, California, renowned for pioneering donor-derived CAR-T cell therapies. The later company’s research and development portfolio encompasses both pre-clinical and clinical stage off-the-shelf (allogeneic) CAR-T therapies targeting multiple therapeutic areas, including hematological malignancies, solid tumors, autoimmune diseases, along with advanced manufacturing capabilities and technology platforms.

- In November 2024: Novartis acquired Kate Therapeutics for up to $1.1 billion in a deal that strengthens its presence in both neuroscience drug development and gene therapy.

Report Scope

Report Features Description Market Value (2024) US$ 24.6 billion Forecast Revenue (2034) US$ 166.9 billion CAGR (2025-2034) 21.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy Type (Cell Therapy-Stem Cells-Embryonic (pluripotent) stem cells, Tissue-specific (multipotent or unipotent) stem cells, Induced pluripotent stem cells (iPS); Dendritic Cells; NK Cells; T Cells-CAR T-cell therapy, Tumor-Infiltrating Lymphocyte (TIL) Therapy; Others; Gene Therapy-Germ-line Gene Therapy (GGT); Somatic Cell Gene Therapy (SCGT)), By Indication (Oncology- Hematological Cancers, Solid Tumors, Rare Cancers; Genetic Disorders; Neurological Disorders; Cardiovascular Disorders; Infectious Diseases; Dermatology; Orthopaedics; Others), By Delivery Method (In Vivo, Ex Vivo), By End-User (Hospitals, Academic & Research Institutes, Cancer Care Centers, Pharmaceutical & Biotechnology Companies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novartis, Gilead Sciences (Kite Pharma), Bluebird Bio, Sarepta Therapeutics, Bristol-Myers Squibb (Juno Therapeutics), Regeneron Pharmaceuticals, Amgen, Pfizer, Roche (Genentech), AbbVie (Allergan), Cellectis, Intellia Therapeutics, CRISPR Therapeutics, Beam Therapeutics, Orchard Therapeutics, Autolus Therapeutics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell and Gene Therapy MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Cell and Gene Therapy MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GalaxoSmithKline plc

- Novartis AG

- Amgen Inc.

- Bristol-Myers Squibb Company

- Spark Therapeutics

- Pfizer Inc.

- Biogen Inc.

- Thermo Fisher Scientific Inc.

- Other Key Players