Celiac Disease Diagnostics Market By Product Type (Serology Rapid Testing Kits (tTG-IgA, EMA, Anti-gliadin), Genetic Rapid Testing Kits), By Technique (ELISA, Immunochromatography), By Sample Type (Blood Serum, Other Body Fluids), By End User (Hospitals, Diagnostic Laboratories, Specialty Clinics, and Home Care Setting), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166372

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

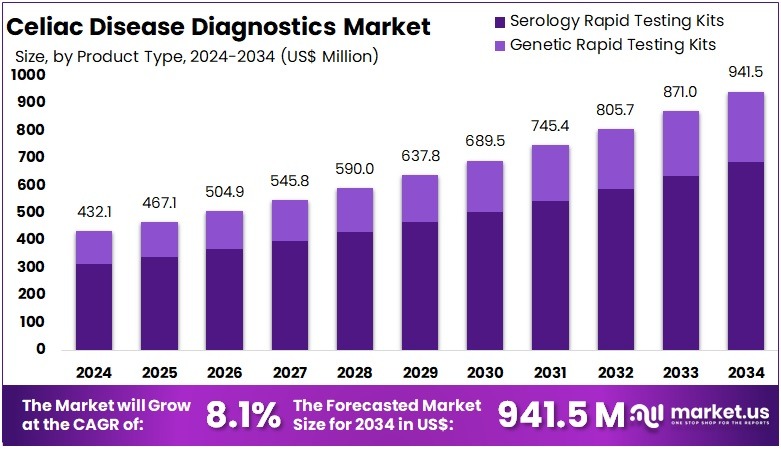

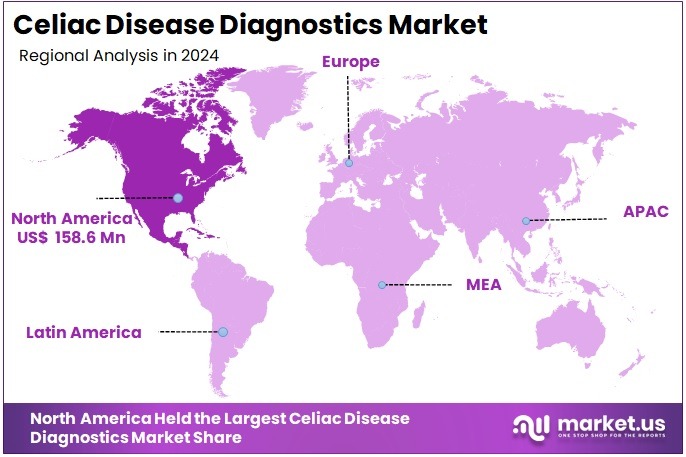

The Celiac Disease Diagnostics Market Size is expected to be worth around US$ 941.5 million by 2034 from US$ 432.1 million in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 36.7% share and holds US$ 158.6 Million market value for the year.

Celiac disease is a long-term digestive and immune disorder in which gluten intake triggers an abnormal immune response that injures the small intestine. This reaction leads to significant inflammation and progressive damage to the intestinal lining, resulting in poor nutrient absorption and malabsorption-related complications.

Despite being considered a relatively uncommon condition; untreated cases may progress to severe health issues. The market for celiac disease diagnostics is expanding due to rising disease prevalence, growing public awareness, continuous advancements in diagnostic technologies, higher healthcare spending, and an increasing emphasis on precise and early detection.

The Celiac disease diagnostics market is experiencing steady expansion as global awareness, screening rates, and access to testing continue to increase. Celiac disease affects an estimated 1% of the global population, but a significant portion remains undiagnosed due to asymptomatic or atypical presentations. As initiatives promoting early detection gain traction across North America, Europe and parts of Asia, demand for accurate and accessible diagnostics is rising.

Serology tests, particularly tissue transglutaminase IgA (tTG-IgA) and deamidated gliadin peptide (DGP) assays, remain the frontline tools due to their sensitivity, affordability, and ease of use. At the same time, genetic assays such as HLA-DQ2/DQ8 typing are increasingly used to rule out disease risk among high-risk individuals, expanding the scope of testing beyond symptomatic patients.

The market also benefits from advancements in point-of-care technology and the emergence of home-based testing kits, which make initial screening more convenient and widen reach to underserved regions. Hospitals and diagnostic laboratories continue to dominate end-use segments, but at-home testing represents one of the fastest-growing categories, particularly in technologically advanced markets. Digital health integration—where test results link to mobile apps or teleconsultation platforms—is further reshaping patient engagement.

Key Takeaways

- In 2024, the market generated a revenue of US$ 432.1 million, with a CAGR of 8.1%, and is expected to reach US$ 941.5 million by the year 2034.

- The Product Type segment is divided into Serology Rapid Testing Kits, and Genetic Rapid Testing Kits, with Serology Rapid Testing Kits taking the lead in 2024 with a market share of 72.9%.

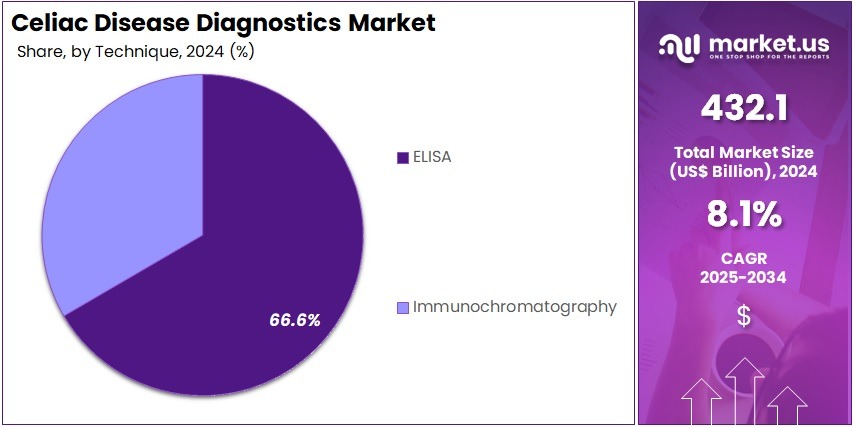

- The Technique segment is divided into ELISA and Immunochromatography, with ELISA taking the lead in 2024 with a market share of 66.6%.

- The Sample Type segment is divided into Blood Serum and Other Body Fluids, with Blood Serum taking the lead in 2024 with a market share of 78.9%

- Considering End User segment, the market is bifurcated into Hospitals, Diagnostic Laboratories, Specialty Clinics, and Home Care Setting, with Hospitals dominating the market with 41.2% market share in 2024.

- North America led the market by securing a market share of 36.7% in 2024.

Product Type Analysis

Serology rapid testing kits dominated the Celiac disease diagnostics market and accounted for 72.9% market share because they remain the first-line and most widely adopted method for detecting celiac-specific antibodies.

Tests such as tTG-IgA, DGP-IgA/IgG, and EMA are globally recommended as the primary diagnostic tools due to their high sensitivity, cost-effectiveness, and ease of use. Since these tests require only a small blood sample and provide quick results, they are routinely used in hospitals, diagnostic laboratories, and even home-testing formats.

Serology kits also support large-scale population screening, which makes them the preferred modality in regions where early diagnosis programs are actively promoted. Their ability to indicate immune response to gluten exposure makes them essential both for diagnosis and for monitoring treatment adherence.

Furthermore, rising awareness of celiac disease, improved screening guidelines, and expanding adoption in primary care settings significantly boost the share of serology kits. Overall, their clinical reliability, affordability, and accessibility position serology rapid testing kits as the dominant product category in this market.

Technique Analysis

ELISA dominated the technique segment because it is the most accurate, sensitive, and widely validated method for detecting celiac-specific antibodies such as tTG-IgA and DGP with the segment covering of about 66.6% market share in 2024.

Hospitals and diagnostic laboratories use ELISA as the standard testing platform due to its high throughput, reproducibility, and suitability for large-scale screening. Its reliability in both initial diagnosis and follow-up monitoring makes it the preferred choice over rapid lateral-flow methods. As a result, ELISA accounts for the majority of diagnostic volume worldwide.

Sample Type Analysis

Blood serum is the dominant sample type with 78.9% market share in 2024 because nearly all frontline celiac tests especially serology assays—require serum to measure antibody levels accurately. Serum provides stable and clinically reliable markers, making it the foundation for ELISA, confirmatory immunoassays, and monitoring protocols.

Since celiac diagnosis relies heavily on immune-response markers, serum-based testing remains essential in hospitals, labs, and screening programs, giving this segment the largest share. A new blood-based assay has the potential to significantly improve the diagnosis of coeliac disease (CeD), especially for individuals who have already adopted a gluten-free diet (GFD). It provides a minimally invasive, accurate, and clinically practical option compared with existing diagnostic approaches.

Traditional CeD diagnostic methods often lose reliability once a patient starts a GFD, as gluten-specific T-cell populations decline and intestinal biopsy results become less conclusive. Although tetramer assays can accurately identify gluten-reactive CD4+ T cells, their technical complexity restricts widespread clinical adoption. To address this challenge, researchers evaluated a novel whole-blood IL-2 release assay (WBAIL-2), exploring its potential as a simpler and more accessible diagnostic tool.

End User Analysis

Hospitals dominated the end-user segment with covering about 41.2% market share because they are the primary settings where patients undergo initial screening, detailed evaluation, and follow-up testing for celiac disease.

Most ELISA-based diagnostics and confirmatory tests are conducted within hospital laboratories equipped with automated platforms and gastroenterology specialists. Hospitals also serve as the first referral point for symptomatic patients, enabling high patient throughput and consistent testing demand. This central clinical role makes hospitals the largest and most influential user group in the market.

Key Market Segments

By Product Type

- Serology Rapid Testing Kits

- tTG-IgA

- EMA

- Anti-gliadin

- Genetic Rapid Testing Kits s

By Technique

- ELISA

- Immunochromatography

By Sample Type

- Blood Serum

- Other Body Fluids

By End User

- Hospitals

- Diagnostic Laboratories

- Specialty Clinics

- Home Care Setting

Drivers

Increasing prevalence and diagnosis rates of celiac disease

The growing recognition and diagnosis of celiac disease is a key driver for the diagnostics market. For example, the general population prevalence is estimated at around 0.5-1% in many regions, and first-degree relatives of patients have roughly a 1 in 10 risk. As awareness among healthcare providers and patients increases, more people with symptoms (gastrointestinal and extra-intestinal) are being screened. The availability of non-invasive serology tests such as tTG-IgA and DGP antibodies, in combination with improved lab infrastructure, has enabled more testing.

As a result, more diagnoses become possible and the demand for diagnostics increases. This driver is particularly meaningful because untreated celiac disease can lead to long-term complications (osteoporosis, infertility, lymphoma) and so there is both clinical impetus and patient demand for earlier detection. The expansion of gluten-related food awareness, gluten-free diet trends, and patient advocacy groups also contribute to this awareness. Thus, as more cases are detected and healthcare systems promote screening, the diagnostics market is expected to grow in response.

Restraints

High cost of advanced testing and variability in awareness in certain regions

One major restraint on the celiac disease diagnostics market is the cost and accessibility of advanced diagnostic tests, and the fact that awareness remains low in many developing regions. For example, while serological testing is relatively cheap, more advanced genetic or multiplex assays and point-of-care kits carry higher costs, and reimbursement may be limited in some geographies.

Moreover, some studies show that in less developed regions, healthcare providers may have limited awareness of celiac disease, leading to under-diagnosis—and that means the potential market remains constrained in those markets. Additionally, missed or delayed diagnosis can incur high healthcare costs: a study in Europe found that medical costs before proper diagnosis were significantly higher than after diagnosis for celiac patients.

These factors — cost pressures, low awareness, variable reimbursement — restrict the full expansion of diagnostics in lower-income markets and limit adoption of premium technologies.

Opportunities

Adoption of at-home testing kits and point-of-care diagnostics

A significant opportunity lies in the shift toward decentralised diagnostics: home-based test kits and point-of-care (POC) solutions for celiac disease are gaining traction. Reports note that home-test kits (blood or swab-based) are being launched to enable consumers to screen for celiac disease themselves and then send samples to labs or interpret results via digital health platforms.

Also, POC testing in primary care can enable faster results, earlier referral, and convenience, which helps to extend screening beyond specialist gastroenterology settings. For diagnostic companies, this opens new patient segments and channels (consumer/self-care segment, retail diagnostics), especially in developed markets.

And in emerging markets with increasing healthcare access, simplified and lower-cost POC/home kits could drive uptake and volume growth. As testing moves closer to the patient’s home or primary care setting, this offers a chance to grow market size, improve early detection, and build new business models.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a meaningful influence on the Celiac disease diagnostics market, shaping access to testing, supply-chain stability, pricing, and adoption rates across regions. Economic slowdowns often impact healthcare spending patterns, with governments and private hospitals prioritising essential or acute-care diagnostics over specialised autoimmune tests. This shift may temporarily reduce testing volumes in lower-income markets where out-of-pocket spending dominates.

Inflationary pressures also raise the cost of diagnostic reagents, antibodies, assay components, and single-use consumables, affecting both manufacturers and laboratories. As production costs rise, smaller diagnostic centres may delay technology upgrades or restrict testing menus, indirectly slowing market expansion.

Geopolitical tensions, trade disruptions, and sanctions have created volatility in the global supply chain for raw materials used in serology and ELISA kit manufacturing. Many diagnostic consumables rely on cross-border sourcing of enzymes, coated plates, and high-purity reagents. Disruptions in shipping routes or restrictions on biotechnology exports can delay kit availability, particularly in Asia, Middle East, and parts of Africa. Countries experiencing political instability or conflict often see reduced healthcare infrastructure development, limiting access to early diagnosis and screening.

At the same time, increased global migration due to geopolitical shifts influences disease awareness and screening demand. Populations relocating from high-prevalence regions to new healthcare systems often require targeted screening programs, creating pockets of increased diagnostic activity. Additionally, post-pandemic investment in healthcare strengthening—supported by international agencies—has expanded laboratory automation and immunoassay capacity in many developing markets.

Latest Trends

Greater incorporation of genetic testing and multiplex serology for personalised diagnosis

A notable trend in this market is the increasing use of genetic testing (e.g., HLA-DQ2/DQ8) and multiplex serology (several antibodies simultaneously) to improve risk stratification and diagnostic accuracy. For instance, some reports highlight the use of next-generation sequencing-based risk scores in celiac disease, as well as advanced serology panels that detect tTG-IgA, DGP-IgA/IgG and other markers in one assay.

Also, new research is integrating AI and image-analysis (for biopsy slides) to support diagnosis. This trend reflects a move toward more personalised diagnostics rather than one-size-fits-all, greater automation and higher throughput testing, and integrated diagnostics across autoimmune-disease screening. For companies in the diagnostics market, investing in multiplex, rapid, and genetic/omics-based assays is becoming a differentiator. Over time this trend is projected to shift the standard of care, offering more nuanced risk profiling and perhaps even screening in asymptomatic high-risk populations.

Regional Analysis

North America is leading the Celiac Disease Diagnostics Market

North America is the largest region in the Celiac disease diagnostics market holding around 36.7% market share in 2024 because of its high disease awareness, well-established diagnostic infrastructure, and strong adoption of serology and genetic testing. The United States leads the region as celiac disease affects an estimated 1 in 133 people, and screening guidelines encourage early testing among high-risk groups such as individuals with type 1 diabetes, thyroid disorders, and family history.

Hospitals and diagnostic laboratories widely use ELISA platforms, while home-based test kits are increasingly available through retail and digital health channels. Insurance coverage for serology and biopsy further supports routine diagnosis.

In Canada and the US, advocacy organizations and gluten-free food policies strengthen education efforts, pushing more symptomatic and asymptomatic individuals to undergo screening. For example, large reference labs such as Quest Diagnostics and LabCorp routinely process high testing volumes, reinforcing the region’s dominant share. These factors collectively secure North America’s position as the largest regional market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region in the Celiac disease diagnostics market due to rising healthcare awareness, expanding diagnostic capabilities, and increasing recognition of gluten-related disorders. Historically underdiagnosed, countries such as India, China, Japan, and South Korea are witnessing rapid improvements in medical infrastructure and nutrition-related disease surveillance.

Growing adoption of Western diets, higher wheat consumption, and improved primary care access have brought more cases into clinical focus. For instance, India’s gastroenterology associations have reported rising celiac detection rates, particularly in northern states with high wheat intake. As ELISA platforms become more affordable and specialty diagnostic laboratories expand in China and Southeast Asia, testing volumes continue to accelerate.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Thermo Fisher Scientific Inc., PRIMA Lab SA, Glutenostics, Inc., NanoRepro AG, Targeted Genomics, Bio-Rad Laboratories Inc., Biohit Oyj, Labsystems Diagnostics Oy, RxHome Test, AESKU.GROUP GmbH, LaCAR MDx Technologies, Inova Diagnostics, EmpowerDx (part of Eurofins Scientific), Everlywell, Inc., and Other key players.

Thermo Fisher Scientific is expected to strengthen Celiac disease diagnostics through its advanced immunoassay analyzers, HLA genotyping solutions, and ELISA platforms that enhance early and accurate detection. The company supports clinical laboratories with automated systems that improve test sensitivity, workflow efficiency, and adoption of high-precision serology and genetic testing.

PRIMA Lab SA is projected to advance Celiac disease diagnostics with its easy-to-use rapid self-testing kits that support early screening outside clinical settings. The company focuses on accessible, affordable point-of-care solutions that allow individuals to monitor gluten sensitivity, increasing awareness, timely diagnosis, and wider adoption of home-based diagnostic kits. Glutenostics develops specialized Celiac diagnostic and monitoring tools, including G12 antibody-based tests that detect gluten immunogenic peptides.

The company emphasizes patient-centric solutions for individuals on gluten-free diets, offering tools that help verify gluten exposure, support long-term disease management, and improve overall diagnostic accuracy in everyday monitoring.

Top Key Players in the Celiac Disease Diagnostics Market

- Thermo Fisher Scientific Inc.

- PRIMA Lab SA

- Glutenostics, Inc.

- NanoRepro AG

- Targeted Genomics

- Bio-Rad Laboratories Inc.

- Biohit Oyj

- Labsystems Diagnostics Oy

- RxHome Test

- GROUP GmbH

- LaCAR MDx Technologies

- Inova Diagnostics

- EmpowerDx (part of Eurofins Scientific)

- Everlywell, Inc.

- Other key players

Recent Developments

- In February 2025: AliveDx announced submission of a 510(k) pre-market notification to the U.S. Food and Drug Administration (FDA) for its MosaiQ AiPlex® Celiac Disease (CD) multiplex microarray. The assay, already IVDR-CE marked (August 2024), enables a “syndromic approach” to celiac diagnostics combining IgA and IgG isotypes and testing five auto-antibody markers in a single step using only 20 µL of patient sample. The company states this should accelerate diagnosis and simplify lab workflows

- In May 2025: Targeted Genomics announced a commercial collaboration with OraSure Technologies, Inc. (makers of the ORAcollect®·Dx saliva collection device) to expand at-home genetic testing for celiac risk via their GlutenID® test. This test analyzes 15 possible HLA gene combinations (DQ2, DQ8, DQ2.2, DQ7) from a saliva sample. Individuals testing negative are reported to have <1 % lifetime risk of developing celiac disease.

- In October, 2025: Targeted Genomics launched CeliacDx™, a direct-to-consumer testing service that bundles the GlutenID genetic test, a subsequent antibody panel for those at elevated risk, and expert pathology consult results that can be shared with healthcare providers.

- In May 2025: Hepion Pharmaceuticals entered into a binding letter of intent (LOI) with New Day Diagnostics LLC to in-license CE-marked diagnostic tests including a celiac disease screening assay (CeliaCare CE-IVD), a respiratory multiplex panel (COVID-19/Influenza A/B/RSV), and an H. pylori test.

Report Scope

Report Features Description Market Value (2024) US$ 432.1 million Forecast Revenue (2034) US$ 941.5 million CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Serology Rapid Testing Kits (tTG-IgA, EMA, Anti-gliadin), Genetic Rapid Testing Kits), By Technique (ELISA, Immunochromatography), By Sample Type (Blood Serum, Other Body Fluids), By End User (Hospitals, Diagnostic Laboratories, Specialty Clinics, and Home Care Setting) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., PRIMA Lab SA, Glutenostics, Inc., NanoRepro AG, Targeted Genomics, Bio-Rad Laboratories Inc., Biohit Oyj, Labsystems Diagnostics Oy, RxHome Test, AESKU.GROUP GmbH, LaCAR MDx Technologies, Inova Diagnostics, EmpowerDx (part of Eurofins Scientific), Everlywell, Inc., and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Celiac Disease Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Celiac Disease Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- PRIMA Lab SA

- Glutenostics, Inc.

- NanoRepro AG

- Targeted Genomics

- Bio-Rad Laboratories Inc.

- Biohit Oyj

- Labsystems Diagnostics Oy

- RxHome Test

- GROUP GmbH

- LaCAR MDx Technologies

- Inova Diagnostics

- EmpowerDx (part of Eurofins Scientific)

- Everlywell, Inc.

- Other key players