Global Catalyst Market By Raw Material (Chemical Compounds, Metals, Zeolites, and Others), By Product (Heterogeneous and Homogeneous), By Application (Petroleum Refining, Environmental, Polymers, and Petrochemicals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 52505

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

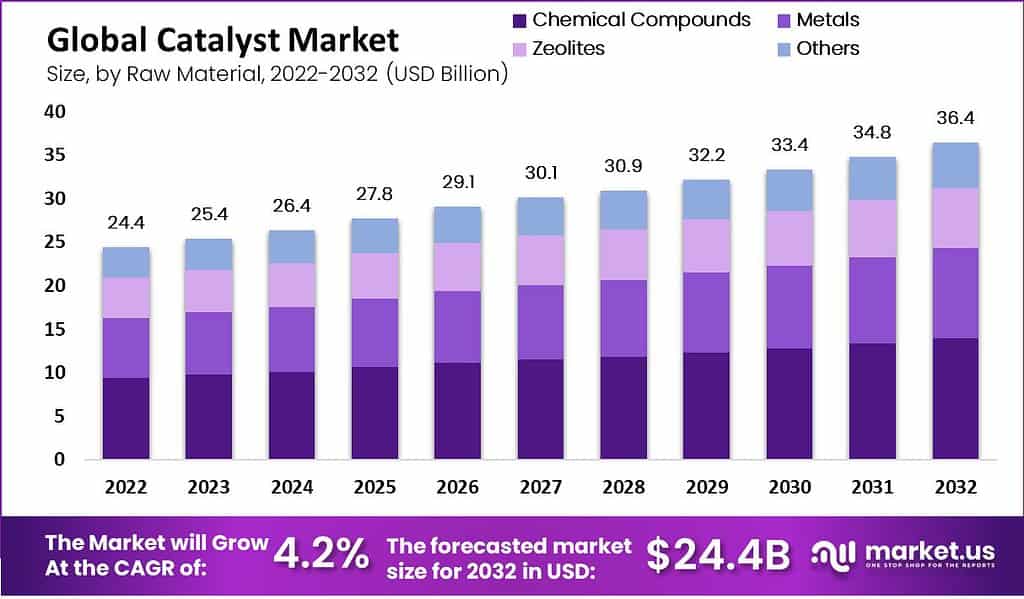

The global catalyst market size was valued at USD 24.4 Bn in 2022, and it is expected to grow to USD 36.4 Bn in the forecast period 2023-2032 with an anticipated CAGR of 4.2%.

Chemical substances known as catalysts are used to speed up chemical catalyst market reactions by altering the activation energy of the process. However, they are not consumed during the reaction, and after being cleaned up, catalysts can be used again. Different stimuli are widely available on the market, including zeolites, metals, substances, enzymes, and organometallic materials.

A class of porous, hydrated alum inosilicates known as zeolites can be produced chemically or naturally. Due to their distinctive crystal structure, which enables them to function as molecular sieves, they are most advantageous commercially. Industrial catalyst markets are typically made of metals because they can use the free electrons in the valence electrons of most metals to speed up reactions before they occur.

Key Takeaways

- Market Size: The global catalyst market size is projected to experience a steady growth trajectory, with a compound annual growth rate (CAGR) of approximately 4.2% from 2023 to 2032.

- Market Trend: The catalyst market is witnessing a significant shift towards environmentally friendly catalysts, particularly in response to the growing focus on sustainability and stringent environmental regulations.

- Raw Material Analysis: In 2022, chemical compounds held the largest market share, accounting for 38.3% of the raw material segment, establishing their dominance.

- Product Analysis: Regarding product classification, the market is divided into two main categories: heterogeneous and homogeneous. Heterogeneous catalysis stood out as the prevailing product segment, commanding the largest market share at 72.1% in the year 2022.

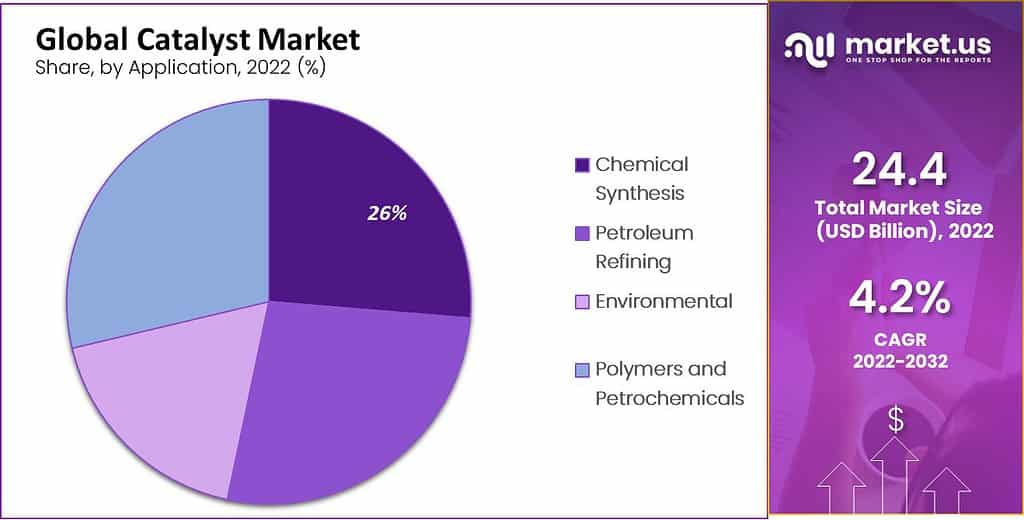

- Application Analysis: In terms of application, the market is categorized into petroleum refining, chemical synthesis, environmental applications, polymers, and petrochemicals. The most significant application segment in 2022 was chemical synthesis, holding a substantial market share of 26.3%.

- Drivers: Increasing environmental concerns and the need for sustainable processes, along with the expanding demand for chemicals and fuels, are the major drivers propelling the catalyst market.

- Restraints: High research and development costs, as well as the challenges associated with designing efficient catalysts for specific processes, pose significant restraints for market growth.

- Opportunities: Growing emphasis on renewable and clean energy technologies, alongside advancements in nanotechnology for catalyst development, presents lucrative opportunities for market growth.

- Challenges: Volatile costs of raw materials, geopolitical uncertainties impacting the supply chain, and competition from low-cost market players pose challenges to the catalyst market.

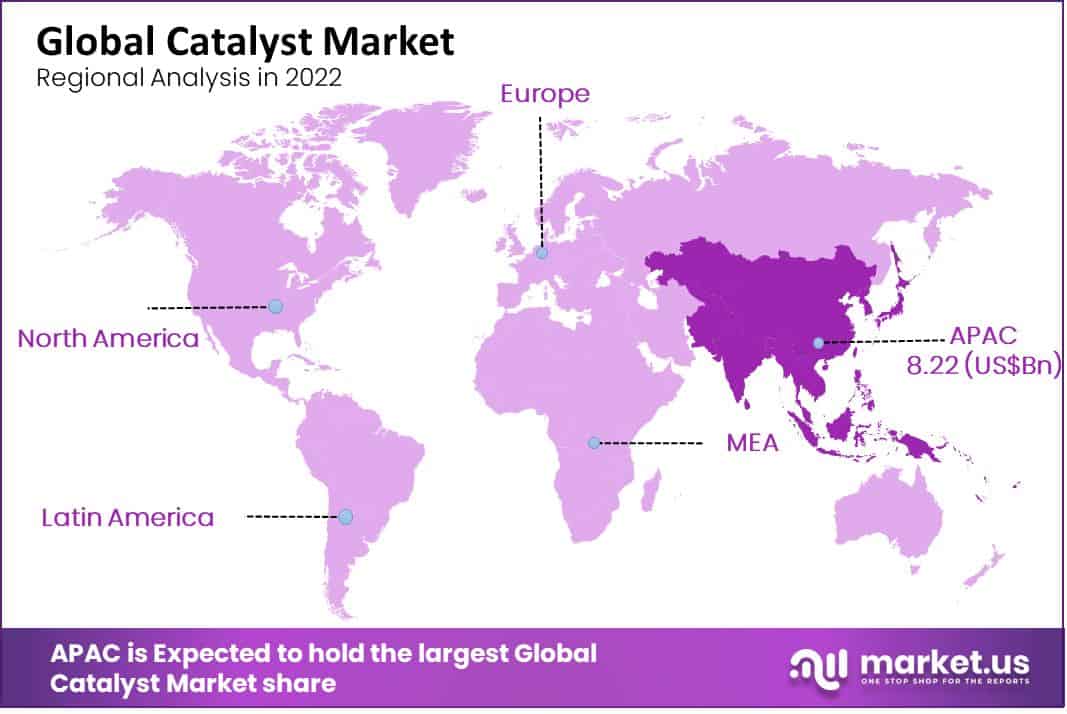

- Regional Analysis: In 2022, Asia Pacific emerged as the leader in market value share, constituting 33.7%. This was predominantly attributed to China’s strong presence and influence in the automotive, petrochemical, and polymer industries.

- Key Players Analysis: Major players in the catalyst market include Albemarle Corporation, Apache Corporation, BASF SE, Clariant AG, Clariant International Ltd., Cue Energy Resources Ltd, Chevron Phillips Chemical Company LP, Exxon Mobil Corporation, Nippon Chemical Industrial CO., Haldor Topsoe A/S, Johnson Matthey, INTERACT, Solvay S.A, Tokyo Chemical, Solvionic SA, Sinopec, Axens S.A, Engelhard, Honeywell International Inc., Other Key Players.

Driving Factors

Increase in utilization and rising demand for catalysts.

There is a growing demand for catalysts in many ease of application, including chemical synthesis, petroleum refinery, polymers, petrochemicals, and environmental, and drives the need for process optimization, yield improvement, and cost savings. Furthermore, ecological catalysts can help manufacturers comply with all mandates regarding NOx and SOx, as well as carbon dioxide emissions.

There has been a shift in energy key trends to alternative renewable fuels such as biodiesel, shale gas, and diesel fuel, prompting the demand for catalysts. Manufacturers looking to improve their feedstock or refine by producing value-added chemical petrochemicals, such as polyolefin or methane, have sparked the need for this product in petrochemicals, the chemical sectors, and chemical applications.

Increase in research and development facilities.

The focus of catalyst research in recent years has been on heterogeneous metal catalysts, which can overcome the drawbacks of their homogeneous counterparts and increase product yields while reducing side reactions. These are the main market growth catalyst factors.

An important step toward less expensive catalysts for energy production has been made with the successful and long-lasting hydrogen production from water using graphene doped with nitrogen and enhanced with cobalt atoms. These elements work together to increase the demand for catalysts, which boosts the expansion of the global catalyst market.

Restraining Factors

High production cost and scarcity of raw materials.

Despite the enormous opportunities that the global catalyst market offers its participants, a few factors, such as the complexity of the manufacturing process for catalysts and the scarcity of raw materials, are preventing the market’s expansion.

Technological developments in key fields like chemical synthesis also lower the need for stimuli, negatively affecting market demand. High costs of production and concern regarding sintering, a leading cause of the deterioration of catalytic performance of industrial catalysts market Share operating at elevated temperatures, are some of the major restraints for the growth of the global catalyst market.

Raw Material Analysis

Significant use of catalysts in chemicals.

By raw materials, the market is divided into chemical compounds, metals, zeolites, and others. With the market’s largest share of 38.3%, chemical compounds emerged as the most dominant raw material segment in 2022. The most common chemical compounds in catalyst raw materials are sulfuric and calcium carbonate.

Metals also play an important role in the synthesis of metal catalysts. Titanium dioxide, aluminum oxide, and alumina can be used for the synthesis of catalysts. Synthesized metal catalysts are recognized as the most important factor in accelerating lipid oxidation in dairy products.

Zeolites are an additional type of material used in catalysts. Due to their porosity, they are mainly used in catalyzing, adsorbent, and other applications. The porous structure of zeolites allows for a wide range of ions to be accommodated. These can be found naturally or manufactured through crystallization reactions.

Product Analysis

Use of catalysts in biodiesel production.

Based on product, the market is segmented into heterogeneous and homogeneous. Heterogeneous catalysis emerged as a dominant product segment, with the largest market share of 72.1% in 2022. Heterogeneous catalysts can be made from homogeneous materials using solid supports. Sulfated zirconia is a common example of a heterogeneous catalyst.

This segment will be driven by the benefits of heterogeneous catalytic applications, such as their ease of use, cost-effectiveness, separation of products, and application. It is also expected that heterogeneous catalysts will be more accepted than their homogenous counterparts in biodiesel production over the forecast period.

The homogeneous catalysts are products like boric acid, hydrochloric acid, phosphoric acid, and p-toluene sulfonic acids. These catalysts perform better than their heterogeneous counterparts in industrial and raw materials reactions. These procedures can create large quantities of toxic waste and pose environmental dangers. These environmentally friendly catalysts are needed. The availability of biodegradable, homogenous catalysts such as Methane Sulfonic Acids (MSA) has been a great help in meeting these demands.

Application Analysis

Catalysts have significant applications in petroleum refining industries.

By application, the market is divided into petroleum refining, chemical synthesis, environmental, polymers, and petrochemicals. With a 26.3% market share in 2022, chemical synthesis was the most important application segment. Chemical synthesis covers raw material and chemical chemistry. Processes like Contact, Haber, or converting ammonia to nitric acid require the use and maintenance of catalysts.

The global catalyst industry is expected to grow over the forecast period, increasing catalyst market share and demand. The popularity of stimuli in chemical synthesizing is due to their superior properties. They have exceptional functional group tolerance and are inexpensive. All of the above key factors contribute to increasing the use of catalysts in chemical syntheses and driving segment growth.

In addition to chemical synthesis, triggers can also be used in cracking feedstock in petroleum refining to increase the yield of high-quality products. Using catalysts promotes the optimization of hydrocracking processes and offers cost-savings and energy demands saving benefits. It has contributed to the growth rate of the petroleum refining market.

Catalyst plays an important role in producing clean fuels, converting raw materials into essential energies, and controlling NOx production. The reduction of greenhouse gases is the most important benefit of catalysts to the environment.

Key Market Segments

Based on Raw Material

- Chemical Compounds

- Metals

- Zeolites

- Others

Based On Product

- Heterogeneous

- Homogeneous

Based On Application

- Petroleum Refining

- Chemical Synthesis

- Environmental

- Polymers and Petrochemicals

Growth Opportunity

Investment to enhance catalyst qualities and lower fuel costs to create growth opportunities.

The rising use of catalysts in different areas like substance union, oil refining, polymers and petrochemicals, and biological applications for process streamlining, yield improvement, cost-cutting, and energy-saving is the central driving the development of the business.

Besides, natural impetuses help makers gather the severity of the severe NOx, Sox, and carbon dioxide emanation guidelines. Hence, the impetus request has additionally ascended because of changing energy patterns relating to sustainable powers, for example, biodiesel and shale gas fuel.

Over the forecast period, the interest for the item in petrochemical and substance applications is supposed to be supported by makers looking to enhance their feedstock or refining by handling esteem-added petrochemicals and synthetics like methanol and polyolefin.

Latest Trends

The growing expansion of the petroleum industry is resulting in the rising establishment of petrol refining capacities.

The developing extension of the petrol business is bringing about the rising foundation of petroleum refining limits and the requirement for different synthetic items and eco-accommodating fills. Thus, it is decidedly impacting the market. Furthermore, the heightening interest in petrol-based things from power age plants is growing the uses of modern impetuses in petrol refining and petrochemical plants for a helpful, faster, more secure, and more effective creative process.

Aside from this, the rising utilization of exhaust systems in car fabricating outflow control frameworks offers rewarding learning experiences to industry financial backers. It can likewise be credited to expanding natural worries and the execution of strict unofficial laws for controlling discharge levels. Moreover, the improvement of Nano-impetuses that help with upgrading synergist strategies in the drug and food and drink (F&B) businesses are making a positive market viewpoint.

Also, essential coordinated efforts among driving industry players to extend their worldwide market reach, alongside expanding interests in innovative work (Research and Development) exercises to upgrade impetuses productivity while limiting functional expenses, are affecting the market growth.

Regional Analysis

Asia Pacific region is dominating the market due to the availability of chemical production companies.

Asia Pacific accounted for the largest value share, 33.7%, in 2022, due to China’s dominance in the automotive, petrochemicals, and polymer industries. China had a substantial percentage of chemical and plastics production companies.

It has become a leading manufacturing destination for chemical products and petrochemicals due to rising domestic demand and low manufacturing costs compared to the US and European Union countries. The increasing FDI investments in the Asia Pacific and the lucrative growth strategies and opportunities projected by developing nations like India and Vietnam will further boost market growth.

North America is second in market size due to evolving low-sulfur and automotive mandates that require environmental catalysts. The rising demand for catalysts to transform heavy crude oil into lighter fractions like gasoline, diesel, and kerosene is expected to increase. The development of Mexico’s oil, gas, and chemical industries also influences market growth in North America.

With the 6.5% market share in Africa and the Middle East, there are lucrative opportunities for petroleum refining catalysts in this region due to their dominance in Oman and Kuwait, as well as Saudi Arabia, Oman, and Qatar. The expected rise in domestic demand for polymers in the Middle East from the construction, pharmaceutical, and packaging industries will drive chemical manufacturers to produce more petrochemicals and polymers.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Key Players Analysis

Expansion in production capacities of major companies strengthens the market.

Key companies generally focus on acquisitions, alliances investments, and building fully optimized supply chains. In-house R&D is a key focus area for product development. The market is moderately fragmented due to the presence of several domestic and global market players.

The rising investments by market players will open new opportunities in the global catalyst market. Production expansion with increasing automotive mandates and maintaining long-term chain supply with refineries and petrochemical plants have helped manufacturers to stay ahead in global catalyst market revenue.

Market Key Players

- Albemarle Corporation

- Apache Corporation

- BASF SE

- Clariant AG

- Clariant International Ltd.

- Cue Energy Resources Ltd

- Chevron Phillips Chemical Company LP

- Exxon Mobil Corporation

- Nippon Chemical Industrial CO.

- Haldor Topsoe A/S

- Johnson Matthey

- INTERACT

- Solvay S.A

- Tokyo Chemical

- Solvionic SA

- Sinopec

- Axens S.A

- Engelhard

- Honeywell International Inc.

- Other Key Players

Recent Developments

- In September 2020, Clariant announced the construction of a new catalyst production site in China.

- In May 2021, BASF SE announced its plan to expand projects at Platinum Group Metals(PGM)

Report Scope

Report Features Description Report Features Description Market Value (2022) US$ 24.4 Bn Forecast Revenue (2032) US$ 36.4 Bn CAGR (2023-2032) 4.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Raw Material- Chemical Compounds, Metals, Zeolites, and Others; By Product- Homogenous and Heterogeneous; By Application- Petroleum Refineries, Chemical Synthesis, Environmental, Polymers, and Petrochemicals. Regional Analysis North America – The US, Canada, & Mexico; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape CIECH SA, Ciner Group Resources Corporation, Genesis Energy L.P., GHCL Limited, Lianyungang Soda Ash Co. Ltd, NIRMA LIMITED, Sisecam Group, Solvay S.A, Shandong Haihua Group Co. Ltd, Tata Chemicals Limited, FMC Corporation, Novacap Group, DCW Limited, OCI COMPANY Ltd., Tronox limited, SEQENS Group and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

Frequently Asked Questions (FAQ)

What is the projected CAGR at which the Catalyst Market is expected to grow at?The Catalyst Market is expected to grow at a CAGR of 4.2% (2023-2032).

What is the size of Catalyst Market in 2022?The Catalyst Market size is USD 24.4 Bn in 2022.

Which region is more appealing for vendors employed in the Catalyst Market?Asia Pacific accounted for the largest value share, 33.7%, in 2022.

Name the key business areas for the Catalyst Market.The US, Canada, China, India, Brazil, South Africa, Malaysia, Australia & New Zealand, Argentina etc., are leading key areas of operation for the Catalyst Market.

List the segments encompassed in this report on the Catalyst Market?Market.US has segmented the Catalyst Market by geography (North America, Europe, APAC, South America, And Middle East and South Africa). The market has been segmented Based on Raw Material Chemical Compounds, Metals, Zeolites, and Others. Based On Product Heterogeneous, and Homogeneous. Based On Application Petroleum Refining, Chemical Synthesis, Environmental, Polymers and Petrochemicals.

-

-

- Albemarle Corporation

- Apache Corporation

- BASF SE

- Clariant AG

- Clariant International Ltd.

- Cue Energy Resources Ltd

- Chevron Phillips Chemical Company LP

- Exxon Mobil Corporation

- Nippon Chemical Industrial CO.

- Haldor Topsoe A/S

- Johnson Matthey

- INTERACT

- Solvay S.A

- Tokyo Chemical

- Solvionic SA

- Sinopec

- Axens S.A

- Engelhard

- Honeywell International Inc.

- Other Key Players