Global Carbon Dioxide Market By Source (Hydrogen, Ethyl Alcohol, Ethylene Oxide, Substitute Natural Gas, and Other Sources), By Application (Plastics, Inks, and Coatings), By Form(Liquid, Gas, Solid), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 33812

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

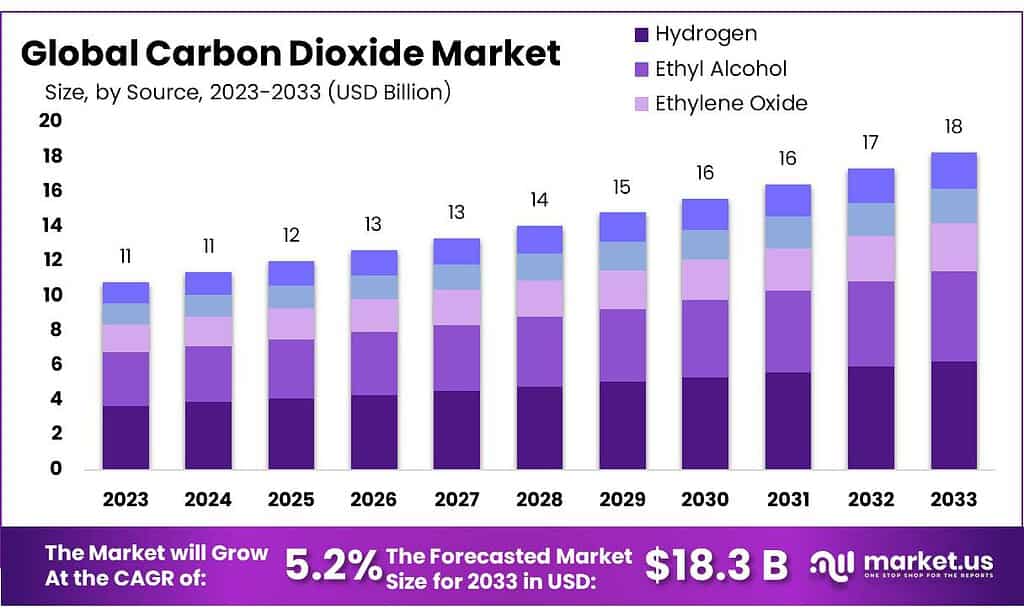

The global carbon dioxide market size is expected to be worth around USD 18.3 billion by 2033, from USD 10.8 billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2023 to 2033.

The market is expected to grow due to the increasing use of Carbon Dioxide (CO2) for enhanced oil recovery (EOR), and its growing usage in the food & beverage and medical industries.

The market’s growth is being driven by the increasing use of enhanced oil recovery technology and the depletion of oil reserves. The United States is the largest market for carbon dioxide worldwide. The U.S. market is growing due to ongoing industrialization and the thriving oil & gas sector.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth: Expected market size by 2033: USD 18.3 billion, from USD 10.8 billion in 2023, with a CAGR of 5.4%.

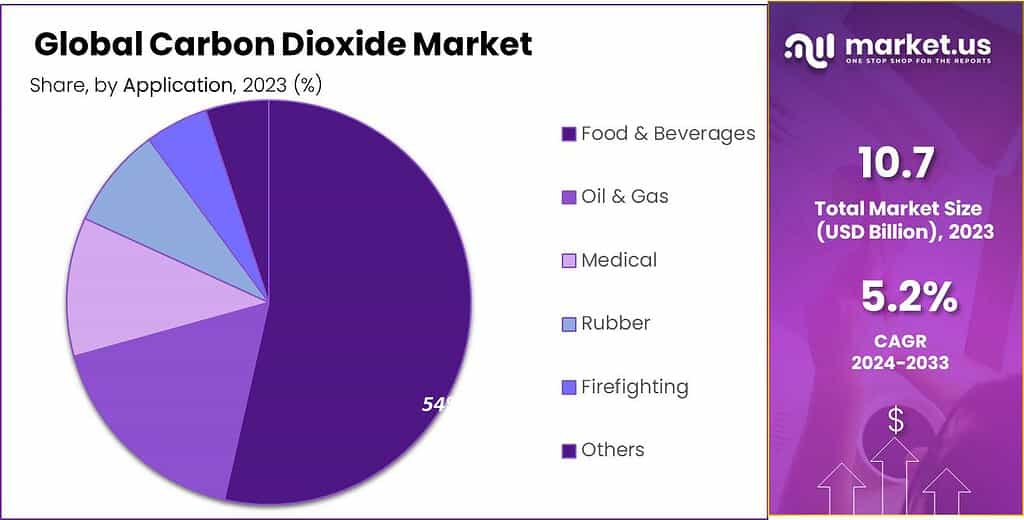

- Sources and Applications: Ethyl Alcohol led in 2023, accounting for 34.5% of the market. Dominant applications: Food & Beverage (53% share), medical, oil & gas, rubber, firefighting.

- Forms of CO2: Gases dominated the market due to flexibility across industries. Liquids followed, favored for storage and precise applications. Solids showed potential for niche applications.

- Drivers of Market Growth: Medical sector reliance on CO2 for surgeries and therapeutic purposes. Growing demand in food & beverage for carbonation and preservation.

- Market Restraints: Transportation concerns due to lack of standardized protocols. Regulatory pressures like the Kyoto Protocol limit CO2 utilization.

- Opportunities & Challenges: Eco-friendly initiatives drive innovation and market expansion. Technological advancements aid in efficient CO2 utilization. Challenges in transportation, regulatory restrictions, and initial costs hinder progress.

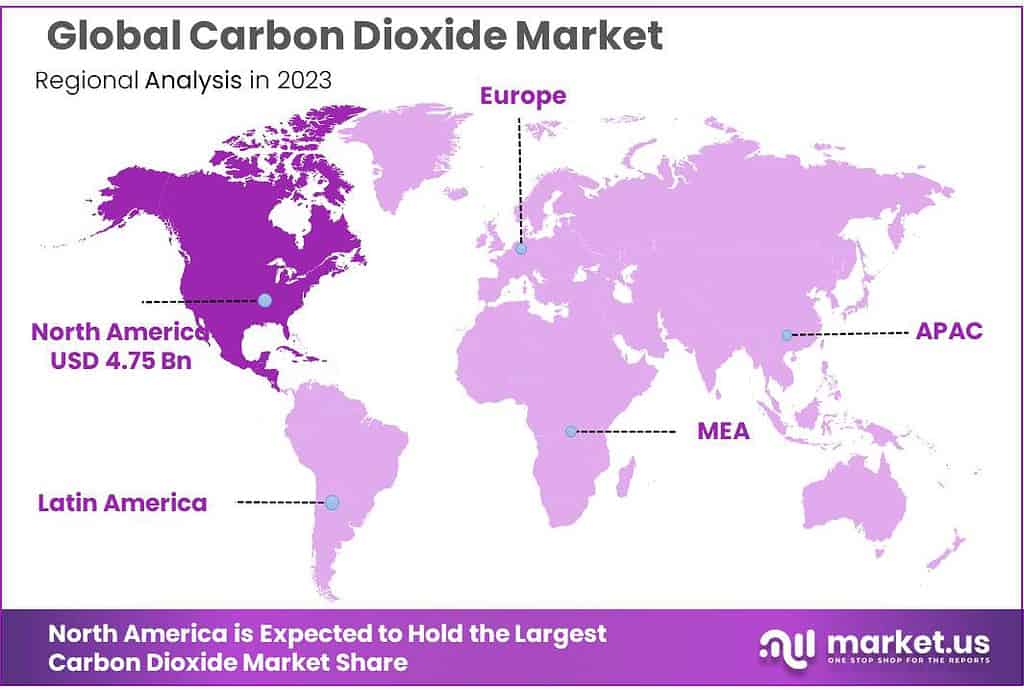

- Regional Analysis: North America dominates (43% market share), driven by industrial and healthcare sectors. Asia Pacific follows suit due to increased beverage and food production.

- Key Market Players: Major players include Matheson Tri-Gas, Inc., Linde plc, Air Liquide, among others. Strategies focus on sustainability, innovative technologies, and strategic partnerships.

Source Analysis

In 2023, Ethyl Alcohol led the carbon dioxide market, grabbing over 34.5% share. Its strong foothold was propelled by its widespread availability and efficient extraction methods.

This segment’s growth can be attributed largely to the availability of ethyl alcohol as a reliable and long-term source of high-commercially valuable carbon dioxide as a side-product.

In the future, carbon dioxide production from ethyl alcohol will be fueled by the increased global demand for food-grade carbon dioxide.

As a by-product of hydrogen production, carbon dioxide is often produced. Various processes are used for enhanced hydrogen production such as electrolytic processes, thermochemical processes, biological processes, and direct solar water-splitting processes.

By Form

In the carbon dioxide market of 2023, the landscape was shaped by different forms through which CO2 is harnessed and utilized. Gases emerged as the frontrunners, dominating the market with their flexibility across diverse industries.

Their ease of integration into various processes, from manufacturing to healthcare, propelled their widespread adoption, securing a significant portion of the market share. Liquids followed suit, boasting a substantial presence due to their convenient storage and transportation capabilities.

Their versatility made them a preferred choice in industries requiring a more controlled and precise application of carbon dioxide. Solids, while less prevalent in the market, showcased promise in specialized applications.

As technology continued to evolve, the potential for solid forms of CO2 increased, hinting at a gradual but promising growth trajectory within niche sectors seeking innovative solutions.

Application Analysis

In 2023, the Food & Beverage sector led the carbon dioxide market, claiming over 53% of the share due to its extensive use in carbonation for soft drinks and preservation in food packaging.

Modified Atmospheric Package (MAP) is a common way to increase the shelf life of food products. It is also used in cryogenic freezing systems which have greater temperature flexibility than traditional mechanical refrigeration systems.

These factors will also contribute significantly to carbon dioxide consumption in food and beverage applications in the near future. There are many uses for carbon dioxide in the food and beverage industry. It is also used in chilling and freezing applications.

Carbon dioxide can also be used to regulate the temperature of food products in storage and transportation to preserve their quality and extend their shelf life.

Worldwide, carbon dioxide is becoming more important in medical applications. It is also used to develop new medicines that reduce the need for invasive surgery. Carbon dioxide gas is used primarily as an insufflation ingredient for many surgical procedures including endoscopy and laparoscopy.

It induces warmth and acts as a vasodilator by stimulating the skin’s heat receptors. Endoscopic procedures can be performed on patients easily by insufflation of carbon dioxide.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Source

- Hydrogen

- Ethyl Alcohol

- Ethylene Oxide

- Substitute Natural Gas

- Other Sources

By Form

- Liquid

- Gas

- Solid

By Application

- Food & Beverages

- Oil & Gas

- Medical

- Rubber

- Firefighting

- Other Applications

Drivers

The carbon dioxide market is experiencing a significant surge, primarily propelled by its expanding applications in the medical and food & beverage sectors. In medicine, CO2 serves diverse purposes, functioning as an insufflation gas vital for stabilizing body cavities during minimally invasive surgeries and playing a role in procedures like cryotherapy and respiratory stimulation.

Its usage extends to tissue freezing and tooth sensitivity assessment, reflecting its versatility within this rapidly growing industry. Similarly, in the food & beverage domain, carbon dioxide finds widespread use. It’s instrumental in the carbonation of beverages and the freezing of meat & poultry, catering to consumer preferences for fizzy drinks and the need to preserve perishable food items.

This gas, available in food-grade and industrial-grade forms, serves various needs within this industry. The escalating demand from packaged food & beverage producers is anticipated to be a key driver, fueling the market’s growth as these sectors continue to expand and innovate.

Restraints

The progression of the carbon dioxide market faces significant hurdles, primarily centered around transportation concerns associated with this gas. While pipelines serve as a common means of transporting CO2, the absence of standardized protocols for ensuring pipeline quality stands as a major obstacle hindering market growth.

This lack of authentication standards raises uncertainties about the reliability and safety of transportation channels. Moreover, the transportation of CO2 involves substantial maintenance costs and poses inherent risks of leakage into the atmosphere, presenting environmental concerns and further impeding market expansion.

The regulatory landscape, exemplified by agreements like the Kyoto Protocol, compounds these challenges. Such protocols, geared towards curbing greenhouse gas emissions, inevitably put constraints on the market’s potential growth, adding regulatory pressures and limiting the utilization of carbon dioxide in various industries.

These combined factors significantly impede the market’s progression despite its potential in multiple sectors

Opportunity

The carbon dioxide market has big chance to grow because lots of industries need it. Things like food, healthcare, and making stuff use carbon dioxide in different ways. This means the market has a lot of room to get bigger.

People care more than ever before about being eco-friendly. In an effort to reduce greenhouse gases and cut back emissions, there has been an upsurge in innovations for CO2. Companies working on such ideas could make significant profits.

Better technology helps a lot too. New ways to catch and use carbon dioxide are making things more efficient and opening up new ways to use it.

Companies that make gases and chemicals are teaming up to fight emissions. They’re making plans to capture CO2 or invest in clean energy. This teamwork is boosting the market for CO2-related stuff.

Rules and support from governments also help. They encourage using CO2 in smarter ways, which boosts the market.

Challenges

Moving CO2 Is Difficult: Pipelines can make moving CO2 difficult. There are no set rules regulating their quality or safety; thus leaving people wondering whether they are safe. Fixing and maintaining these pipelines costs a great deal of money while CO2 leakage damages both the environment and market growth.

Rules and Limits: Various agreements such as the Kyoto Protocol encourage countries to reduce CO2 emissions for environmental benefits; while this might help businesses use less of it for work purposes. Unfortunately, this might impose new restrictions that restrict how much of it they can use during production processes.

Technology Must Improve: To capture, store, and use CO2 more effectively requires better technology. Progress here is vital if we’re to grow as an industry; otherwise it could become impossible to use CO2 effectively.

People May Misunderstand It: Not everyone understands how CO2 helps create products without damaging the environment, so some need more education on its benefits in terms of making items in an eco-friendly manner.

Costly at First: Adopting new methods of CO2 capture can be expensive at first. Some businesses may be unwilling to spend large sums before seeing whether its worth it, which may impede progress toward using CO2 more efficiently.

Regional Analysis

North America was the dominant market for carbon dioxide in the world in 2023, accounting for more than 43% of the total market revenue. North America’s industrial sector is expected to grow the market.

The thriving healthcare industry in North America will encourage the use of carbon dioxide for surgeries to stabilize body cavities and increase the surgical surface area. Over the forecast period, carbon dioxide demand is expected to rise due to its increasing use in various applications.

The Asia Pacific was the second-largest revenue contributor in 2021. The Asia Pacific is the largest consumer of carbon dioxide worldwide. Asia Pacific’s largest application sector is food & beverages.

The region’s increased production is due to the increasing use of carbon dioxide in beverages and food products. To avoid industrial hazards, the rapid industrialization of Asia Pacific has encouraged the use of firefighting equipment. To extinguish flames, equipment such as fire extinguishers uses carbon dioxide.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- Korea

- India

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

MEA

- GCC

- South Africa

- Israel

- Rest of MEA

After considering long-term opportunities as well as the current regulatory environment, top market players like Matheson Tri-Gas, Inc., and Linde plc have adopted strategies to grow and sustain their market share.

Additionally, companies are now focusing more on providing long-term value for shareholders. Key players are focusing on building strong and low-risk strategies to ensure significant profit margins and a solid foundation for shareholders.

Due to the increased demand from end-users for industrial gases, these companies are now more focused on producing industrial gas strategically with advanced sourcing-automation manufacturing processes.

Кеу Маrkеt Рlауеrѕ

- Acail Gás

- Air Liquide

- Air Products and Chemicals, Inc.

- Greco Gas Inc.

- Linde AG

- Messer Group

- Sicgil India Limited

- SOL Group

- Strandmøllen A/S

- Other Key Players

Recent Development

In June 2023, SOL Group, a gas production company, gained the ISCC PLUS certification and continues to conduct sustainability activities for obtaining a carbon dioxide recovery facility in Wanze, Belgium. This will help the company to secure the biodiversity and environment by promoting the reuse of wastes, thus resulting in energy transition and climate neutrality

In May 2023, Messer Group, a provider of industrial gas, initiated an investment for recycling carbon dioxide with the implementation of the gas scrubbing technology from BASF, a leading chemical producer. This technology will help in recovering carbon dioxide from the flue gas, and utilize it for enhancing supply reliability

In April 2023, Linde AG , a global multinational chemical company, stated an agreement with Heidelberg Materials, a global building materials company, to jointly develop and operate a large scale carbon capture project. The purpose of the project is to reduce carbon dioxide emissions by capturing, liquifying, and purifying 70,000 tons of carbon dioxide each year

In March 2023, Air Liquide has planned to invest 60 million euros to rebuild and lower the carbon dioxide footprint of two specific oxygen production facilities in Tianjin, China. The project will ensure low supply of carbon dioxide energy to the facilities, hence leading to a reduction in carbon emissions

Report Scope

Report Features Description Market Value (2023) USD 10.8 Billion Forecast Revenue (2033) USD 18.3 Billion CAGR (2023-2032) 5.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Hydrogen, Ethyl Alcohol, Ethylene Oxide, Substitute Natural Gas, and Other Sources), By Application (Plastics, Inks, and Coatings), By Form(Liquid, Gas, Solid) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Acail Gás, Air Liquide, Air Products and Chemicals, Inc., Greco Gas Inc., Linde AG, Messer Group, Sicgil India Limited, SOL Group, Strandmøllen A/S, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is carbon dioxide (CO2)?Carbon dioxide is a colorless and odorless gas composed of carbon and oxygen. It is naturally present in the Earth's atmosphere and is produced during processes like respiration and combustion.

What are the main sources of carbon dioxide?Sources include natural processes such as volcanic eruptions, respiration in living organisms, and human activities like burning fossil fuels, industrial processes, and deforestation.

What’s the future outlook for the carbon dioxide market?The market is expected to grow due to the increasing demand for carbonation in beverages, continued industrial applications, and the development of new technologies for carbon capture and utilization.

-

-

- Acail Gás

- Air Liquide

- Air Products and Chemicals, Inc.

- Greco Gas Inc.

- Linde AG

- Messer Group

- Sicgil India Limited

- SOL Group

- Strandmøllen A/S

- Other Key Players