Global Carbon Black Market By Type (Furnace Black, Channel Black, and Others), By Grade (Standard Grade, Specialty Grade), By Application(Tire Rubber, Non-Tire Rubber, Inks and Coatings, Plastics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 19905

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

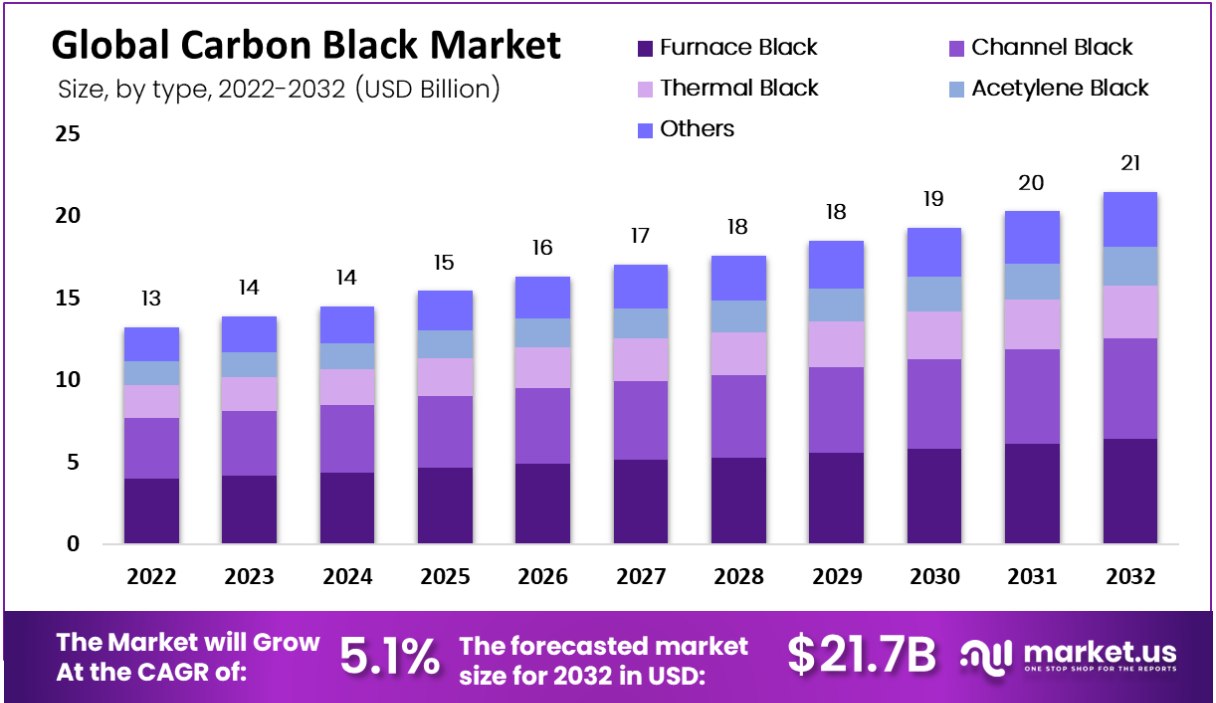

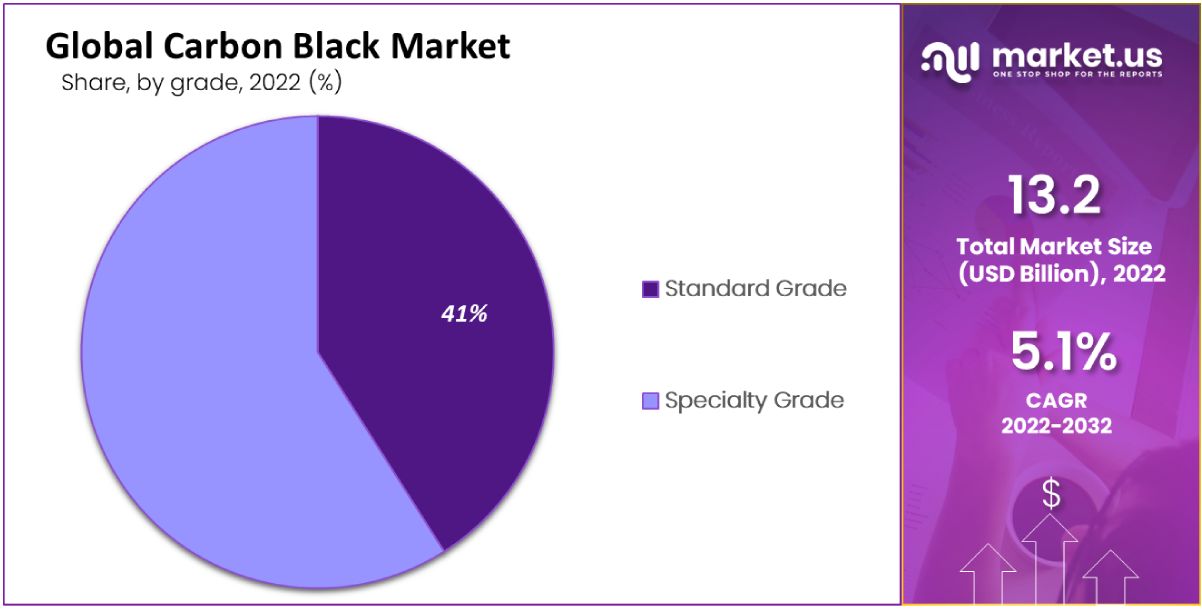

In 2022, the global Carbon Black Market Size was valued at USD 13.2 Bn. and is expected to grow around USD 21.7 Bn by 2032 between 2023 and 2032, this market is estimated to register the highest CAGR of 5.1%.

Carbon black is a type of para-crystalline carbon containing 95% pure carbon that improves the physical and mechanical properties of materials, making the final product more effective. Carbon black is mainly used in the manufacture of plastic products, printing inks, tires, mechanical rubber, and toners.

It finds its primary use in wire and cable insulation because it can absorb ultraviolet light and convert it to heat. In addition, it is used in the manufacture of a wide range of rubber products and pigments. Carbon black is an inexpensive rubber reinforcing agent used in tires.

Key Takeaways

- Market Developments: Currently, the global carbon black market is experiencing steady expansion; showing an estimated growth rate from 2023-2032, At a CAGR of 5.1%.

- Overview: Carbon black, an adaptable substance formed through incomplete combustion of hydrocarbons, finds widespread usage across industries due to its superior properties such as reinforcement, UV protection, and conductivity.

- Type Analysis: Furnace black represents the bulk of market contributions. Furnace black carbon finds widespread application for improving rubber’s blackening process while strengthening its properties.

- Grade Analysis: This grade serves an integral purpose as an industrial raw material in manufacturing processes for numerous industries such as polymers, printing, and coatings.

- Application Analysis: Carbon Black’s primary use (constituting 70% of total usage) is as a pigment and reinforcement agent in tire manufacturing, accounting for most of its total consumption.

- Drivers: Key factors driving carbon black market expansion include an expanding automotive sector, rising tire sales and consumption levels in emerging economies as well as its increasing usage to improve tire durability and other rubber-based products, thus further stimulating market expansion.

- Restrictions: Market challenges include stringent environmental regulations and health concerns related to carbon black exposure as well as fluctuations in raw material prices, along with competitive pressures and sustainability concerns posing major impediments to growth.

- Opportunities: One avenue of market expansion lies in developing sustainable production methods and innovative applications of carbon black within emerging industries; meeting customer demand for eco-conscious solutions while streamlining manufacturing processes can open doors of growth as a potential growth avenue.

- Trends: Current developments in the carbon black market include improvements in sustainable production methods, integration into an ever-evolving battery and electronics sector, research for novel applications within niche industries as well as circular economy practices like recycling of carbon black that demonstrate emerging trends.

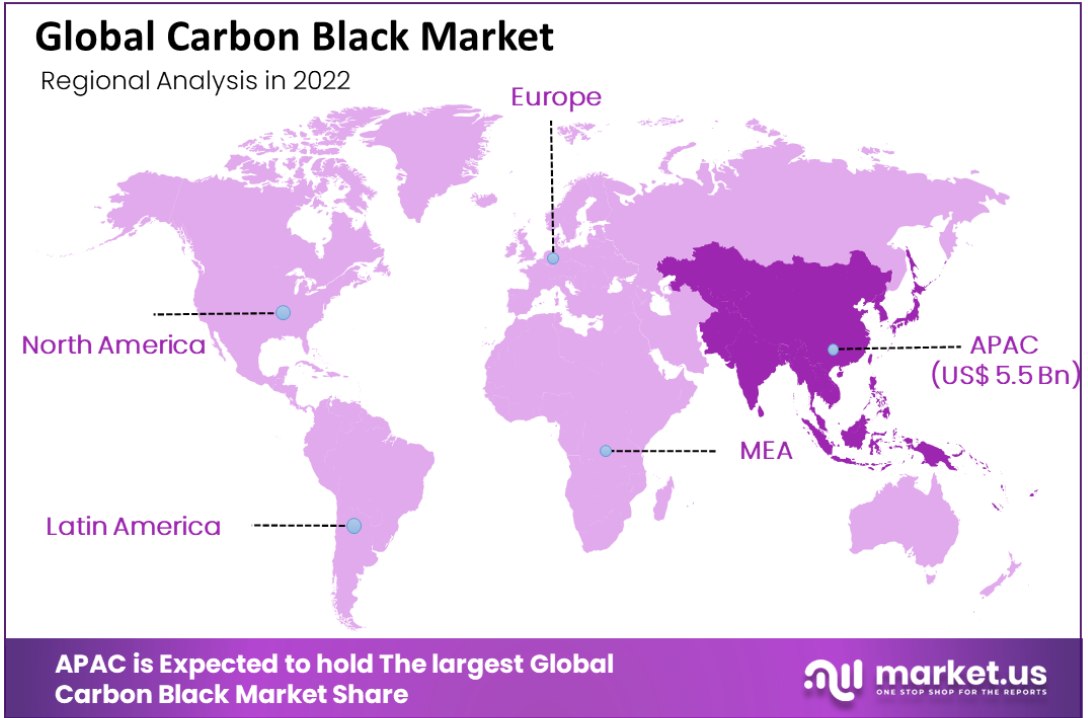

- Asia-Pacific: With a 33.88% market share and expected compound annual compound growth rates of 8.1% over its projected period, Asia Pacific stands out as a promising carbon black market share market.

- Key Players in Carbon Black Market: Carbon black markets comprise both established companies and startups specializing in the production and applications of carbon black. Key players often invest in research and development initiatives, sustainability efforts, strategic collaborations, and competitive alliances to meet evolving market requirements while remaining profitable and maintaining their edge; maintaining credibility by showing its benefits is of particular significance in this ever-evolving environment.

Drivers

Rapid Growth in the Rubber Industry to Propel Market Growth

The global carbon black industry report is driven by the significant use of carbon black in the tire industry, and growing use in industries such as construction, manufacturing, and printing. Important markets for tires outside of China are Europe, America, India, and Japan. Steady growth in car ownership is also supporting the industry as it contributes to increased demand for tires.

Carbon black demand is expected to grow in the automotive industry, mainly in emerging countries such as China and India. India is, Asia’s leading carbon black industry after China, and it is projected to become the third-largest automotive industry by 2022. Rising demand for replacement tires in countries such as the United States and China also supports the driving carbon black market.

Increasing Use of Specialty Carbon Black Market in Emerging Countries Driving Market Growth

Increasing end-uses for specialty carbon black products are driving the growth of the carbon black industry, especially in developed countries like the United States. Carbon black products are used in segments such as sealants, adhesives, and coatings and are expected to drive market growth.

As a result of infrastructure developments around the world is also anticipated to drive demand for carbon black across the world. Increasing penetration of carbon black products in emerging markets such as China, Southeast Asia, the Middle East, and South America will continue to drive the growth of the global carbon black industry.

Use of Carbon Black in Construction and Manufacturing Industries Driving the Market

Carbon black is used in the deep black paint and coatings industry to act as a protective coating for a variety of products. Apart from that, the demand for carbon black in the construction industry is increasing because the mixture of carbon black and cement improves surface hardness, uniformity, compressive strength, and tensile strength. Thus large use of carbon black in manufacturing industries is expected to drive the carbon black market.

Restraints

Fluctuations in Raw Material Prices and Increasing Governmental Regulations

Fluctuating raw material prices, increasing use of alternative silica, and environmental concerns related to carbon black production are expected to restrain the growth of the market in the coming years. Carbon black production releases hazardous gases including sulfur dioxide, nitrogen oxides, carbon dioxide, carbon monoxide, and other particles that can harm the expanding growth of the carbon black market. Also increasing governmental regulation restrains the market growth.

Type Analysis

The furnace Segment is the Dominant

Based on type, the market for carbon black is segmented into channel black, acetylene black, thermal black, furnace black, and others. The furnace black segment is the largest contributor to the market. Furnace black carbon is used to increase the blackening process for rubber and reinforcement of rubber is expected to drive market growth.

Also, furnace black carbon is used to produce color pigment in cosmetics and its increasing usage is expected to further drive the growth of the market. The thermal black section is also expected to drive the market in the forecast period. Thermal black is UV absorbent so it has a large requirement in the plastic industries. Thermal black is also used in rubber-based adhesives.

Acetylene black has high purity and extreme conductivity aiding its usage in the production of silicon products, dry cells, and electric power cables. Channel black is obtained as soot by impingement of small natural gas flames on metal surfaces. Acetylene black is produced from the acetylene gas using the thermal decomposition method

Grade Analysis

The specialty Grade Segment is the Dominant

By grade, carbon black is classified into standard grade and specialty grade. The specialty grade segment is dominant as Specialty grade carbon black is an important industrial raw material, which is incorporated into the production processes of various industries, including the polymers, printing, and coating industries.

Specialty carbon blacks are distinguished by their strengthening, electrical conductivity, dispensability, and UV resistance. Rising demand from other end-use industries such as consumer goods, construction, and automotive is expected to boost the demand for specialty grades.

A growing manufacturing sector is expected to drive the consumption of specialty grades during the forecast period. N772 is standard-grade carbon black with a low surface area and low structure. At a comparable load, it offers minimal latency, and high resiliency compared to N774, and N660. This grade is suitable for heavy-duty general-purpose industrial rubber products.

Application Analysis

Application in Tire Rubber is Dominant

Based on the application of carbon black market is classified into tire, non-tire rubber, inks, coatings, plastics, and others. The tire segment was the highest contributor to the market in 2022. The best-known use of carbon black (70%) is as a pigment and reinforcement in tires.

Carbon black helps to draw heat away from the tread and belt of tires while helping to reduce heat damage and increase tire life. As the demand for vehicles increases, the automotive market is expected to grow significantly. This factor is expected to drive demand for carbon black, especially in tires and seat belts.

The non-tire segment is expected to grab the market as a strengthening agent and shock absorbent in the production of various industrial rubber products. Carbon black is used in Industrial rubber products like rubber roofing, gaskets, cables, and rubber mats.

The demand for carbon black from the inks and coatings industries, paints, and plastic manufacturing industries is due to consumers’ preference for black-colored products. High consumption in manufacturing industries is anticipated to drive the carbon black market.

Market Key Segments

Based on Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

Based on Grade

- Standard Grade

- Specialty Grade

Based on Application

- Tire Rubber

- Non-Tire Rubber

- Inks and Coatings

- Plastics

- Others

Opportunity

Increasing Use in Automotive Industries and Increasing Research and Development Facilities

The carbon black industry is also boosted due to growing automotive industries, and construction industries in several emerging economies such as Brazil, India, South Africa, and China. The rapidly increasing geriatric population, rising per capita incomes, and high car-owning volumes are driving the need for enhancing the carbon-black industries in these nations.

Therefore, the governments in these economies are increasing their investments aimed at improving facilities & infrastructure. Owing to the high number of applications of carbon black products in plastic industries, pain industries, and automotive industries the rising investment in this industry is slated to offer growth opportunities in the market.

Trends

Competitive Landscapes of Manufacturers in Carbon Black Industries

Manufacturers are now more inclined toward raw material procurement at competitive pricing. Raw material procurement involves engaging in long-term supply contracts with raw material suppliers. Some independent manufacturers hire third-party suppliers to sell their products.

Carbon black manufacturers are increasingly focused on product innovation and differentiation as they are steadily moving toward consolidation through mergers & acquisitions, joint ventures, and collaborative partnerships. Such trends are currently being witnessed in this market, thereby bolstering the demand for carbon black products in the process.

Regional Analysis

Asia Pacific Region Holds Largest Market Size in Carbon Black Market

Asia Pacific is estimated to be the most lucrative market in the global carbon black market share, with the largest market share of 33.8%, and is expected to register a CAGR of 8.1% during the forecast period. Growth in this region can be attributed to increased plastic consumption in key end-use industries, such as construction, automotive, conductive polymers, and packaging.

The increase in polymer production in China, India, and Southeast Asian countries such as Korea, Thailand, Malaysia, and Vietnam is expected to remain the main driving force behind the growth of these markets. area during the forecast period.

Economic growth in North America expanding the automotive industries, polymer industries, and manufacturing industries are likely to gain high carbon black product demand in this region. Europe region will show significant growth in the carbon black market during the forecast period due to strong demand in textile industries.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Several carbon black market companies are concentrating on expanding their existing operations and R&D facilities.

Furthermore, businesses in the carbon black market are developing new products and portfolio expansion strategies through investments mergers, and acquisitions. In addition, several key players are now focusing on different marketing strategies such as improving product quality, which is boosting the target products’ growth.

Market Key Players

- Birla Carbon

- Cabot Corporation

- Continental Carbon Company

- Orion Engineered Carbons S.A.

- PCBL Limited

- Mitsubishi Chemical Corporation

- Jiangxi Black Cat Carbon Black Co. Ltd.

- Tokai Carbon Co. Ltd.

- Longxing Chemical Stock Co. Ltd

- Omsk Carbon Group

- Atlas Organics Private Limited

- Continental Carbon Company

- Himadri Speciality Chemical Ltd

- Philips Carbon Black Limited

- Orion Engineered Carbons GmbH

- Other Key Players

Recent Developments

- In June 2022, ADNOC Distribution signed a new carbon black supply to increase their market in carbon black

- In March 2022, Cabot Corporation acquired Tokai Carbon Group and took over its carbon black manufacturing facilities in China.

- In February 2022, Orion Engineered Carbons opened a new production of carbon black in Italy.

Report Scope

Report Features Description Market Value (2022) US$ 13.2 Bn Forecast Revenue (2032) US$ 21.7 Bn CAGR (2023-2032) 5.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others; By Grade- Standard Grade, Specialty Grade; By Application- Tire Rubber, Non-Tire Rubber, Inks and Coatings, Plastics, and Others Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Birla Carbon, Cabot Corporation, Continental Carbon Company, Orion Engineered Carbons S.A., PCBL Limited, Mitsubishi Chemical Corporation, Jiangxi Black Cat Carbon Black Co. Ltd., Tokai Carbon Co. Ltd., Longxing Chemical Stock Co. Ltd, Omsk Carbon Group, Atlas Organics Private Limited, Continental Carbon Company, Himadri Speciality Chemical Ltd, Philips Carbon Black Limited, Orion Engineered Carbons GmbH, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the carbon black market size in 2022?The carbon black market size is USD 13.2 billion for 2022.

What is the CAGR for the carbon black market?The carbon black market expected to grow at a CAGR of 5.1% during 2023-2032.

What are the segments covered in the carbon black market report?Market.US has segmented the Global carbon black market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). Based on Type, market is segmented into Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others. Based on Grade, market is segmented into, Standard Grade, Specialty Grade. Based on Application market is segmented into Tire Rubber, Non-Tire Rubber, Inks and Coatings, Plastics, Others.

Who are the key players in the carbon black market?Birla Carbon, Cabot Corporation, Continental Carbon Company, Orion Engineered Carbons S.A., PCBL Limited, Mitsubishi Chemical Corporation, Jiangxi Black Cat Carbon Black Co. Ltd., Tokai Carbon Co. Ltd., Longxing Chemical Stock Co. Ltd Other Key Players Other key players are the key vendors in the carbon black market.

-

-

- Birla Carbon

- Cabot Corporation

- Continental Carbon Company

- Orion Engineered Carbons S.A.

- PCBL Limited

- Mitsubishi Chemical Corporation

- Jiangxi Black Cat Carbon Black Co. Ltd.

- Tokai Carbon Co. Ltd.

- Longxing Chemical Stock Co. Ltd

- Omsk Carbon Group

- Atlas Organics Private Limited

- Continental Carbon Company

- Himadri Speciality Chemical Ltd

- Philips Carbon Black Limited

- Orion Engineered Carbons GmbH

- Other Key Players