Global Carbomer Market By Source (Synthetic and Natural) By Type (Carbomer 940, Carbomer 980 and Carbomer 934) By Appearance (Liquid and White Powder) By Function (Thickening Agent, Emulsifier, Suspending Agent, Binding Agent and Dispersion Agent) By End use (Personal Care, Products, Pharmaceuticals, Homecare Products and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 17833

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

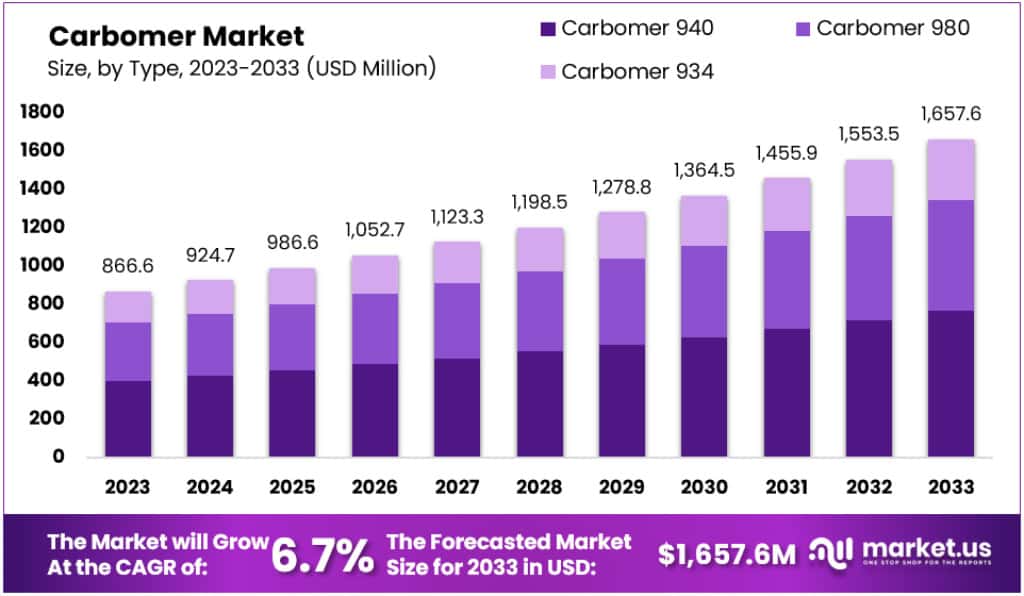

The Global Carbomer Market size is expected to be worth around USD 1657.6 Million by 2033, from USD 866.6 Million in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

Carbomer is a fluffy white powder used in lotions and cosmetic formulas as a thickener and stabilizer. Carbomer can be used to refer to different polymers that are made of acrylic acid. Dry Carbomer is a white powder used in cosmetics and personal care products. This prevents the emulsion from spreading and controls the consistency of the flow.

Carbomers can be classified according to their molecular weight and specific components. The increase in personal and cosmetic care product consumption is expected to drive the global Carbomer market to a significant growth rate over the forecast period. The Carbomer market is expected to grow due to increased demand for Carbomer within pharmaceutical products.

Key Takeaways

- The carbomer market is expected to reach around USD 1,657.6 million by 2033.

- In 2023, the market was valued at USD 866.6 million.

- This growth represents a CAGR of 6.7% from 2022 to 2032.

- Carbomer 940 held a dominant market position, capturing more than a significant 44% share in 2023.

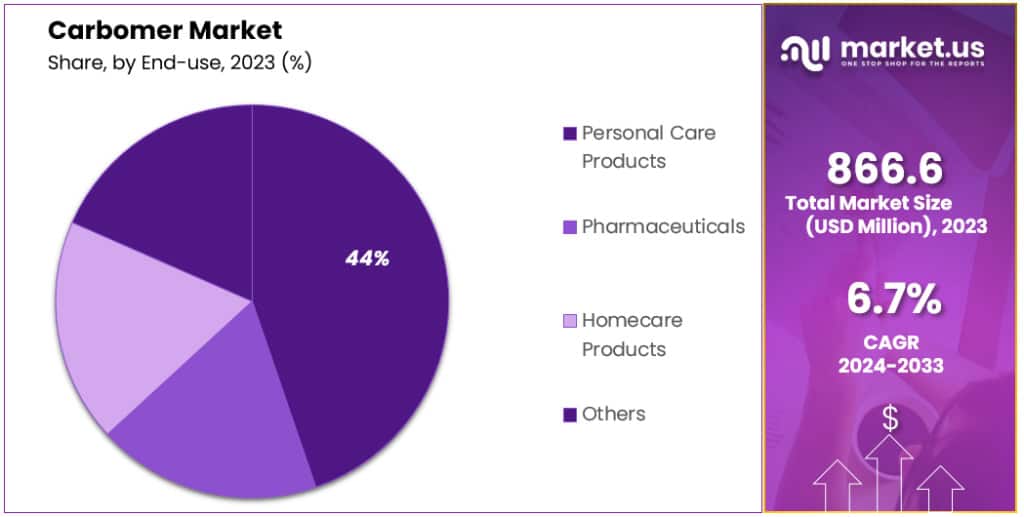

- Personal care products are the largest end-users, accounting for over 45% of the market in 2023.

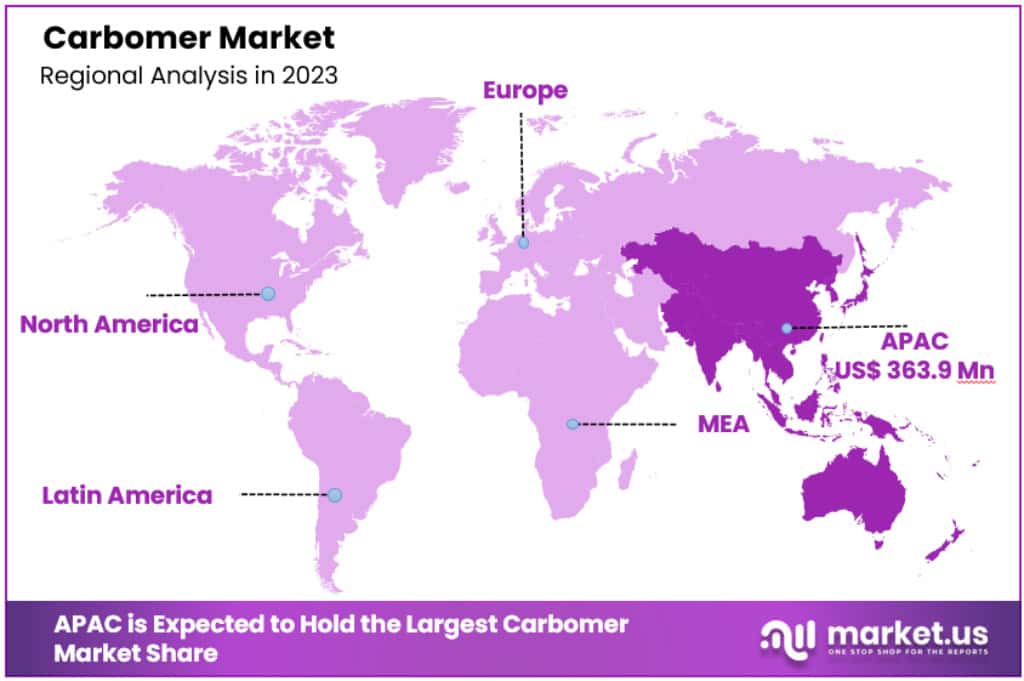

- In 2023, the Asia-Pacific region had the largest market share at 42%, valued at USD 363.9 million.

Type Analysis

In 2023, Carbomer 940 held a dominant market position, capturing more than a significant 44% share. This segment’s prominence can be attributed to its exceptional characteristics like high viscosity and efficient thickening ability, even in small quantities. Such properties amplify its suitability as a rheology modifier in the personal care industry, bolstering its demand. Its ability to offer larger suspending performance in minimal doses positions it as a highly efficient ingredient in various personal care products, contributing substantially to the segment’s market growth.

The Carbomer 980 segment is anticipated to exhibit robust growth throughout the forecast period. The versatility of Carbomer 980, with applications spanning across bath gels, hair styling gels, and various lotions, fuels its demand. The rising preference for thickening agents in an array of products reinforces the growth prospects for Carbomer 980. This polymer’s multifaceted utility in personal care products underlines its potential for rapid market expansion.

Carbomer 934 polymer is increasingly preferred for its creamy sensory qualities, making it a popular choice as a rheology modifier in lotions and cosmetic creams. This polymer is integral in enhancing the texture and consistency of a wide range of cosmetic products, from lotions to creams, by providing a rich, creamy feel. Its application in cosmetic formulations, including emulsions, heavy gels, and suspensions, further solidifies its market position.

The ‘Others’ segment, comprising various carbomer types like U-20, 981, U-21, 340, among others, is expected to dominate the market. These polymers, known for their distinct characteristics and wide-ranging applications in personal care, pharmaceuticals, and industrial cleaning systems, cater to a diverse set of needs in the market. The expansive utility of these carbomers in numerous applications underscores their significance in driving market growth.

End-use Analysis

In 2023, the Personal Care Products segment held a dominant market position, capturing more than a significant 45.5% share. This dominance is primarily due to the rising consumer preference for personal care and cosmetic products. Carbomers play a crucial role in this sector as gelling agents or emulsifiers, essential for the manufacturing of a wide range of products including facial cleansers, soaps, body washes, shampoos, hair conditioners, styling products, sun care items, and lotions.

The increasing consumer spending on cosmetics is propelling innovation in product lines, thereby fostering the growth of this segment. The deep dependence of carbomer manufacturers on the burgeoning personal care industry, coupled with strategic collaborations and partnerships, underscores the segment’s significant market influence.

The pharmaceuticals industry represents a significant and growing segment in the carbomer market. Here, carbomers are utilized as rheology modifiers, suspension stabilizers, tablet binders, mucoadhesive aids, and bioavailability enhancers. The escalating research and development activities within the pharmaceutical industry, aimed at introducing advanced products, are surging the demand for pharmaceutical excipients, including carbomers. This trend is indicative of the segment’s potential for substantial growth during the forecast period.

The ‘Others’ segment, encompassing applications in paints, coatings, dyestuffs, surfactants, and cleaners, is poised for steady growth. In these industries, carbomers function as stabilizers, rheology modifiers, and thickening agents. The increasing demand for paints, coatings, and surface cleaners further strengthens the growth prospects of this segment. This diverse range of applications outside the core personal care and pharmaceutical sectors highlights the versatile nature of carbomers and their integral role across various industries.

Key Market Segments

By Source

- Synthetic

- Natural

By Type

- Carbomer 940

- Carbomer 980

- Carbomer 934

By Appearance

- Liquid

- White Powder

By Function

- Thickening Agent

- Emulsifier

- Suspending Agent

- Binding Agent

- Dispersion Agent

By End-use

- Personal Care Products

- Pharmaceuticals

- Homecare Products

- Others

Drivers

Increasing Demand from the Pharmaceutical Industry:

- Growth Impact: The pharmaceutical industry’s demand for carbomers is significantly driving market growth. Factors such as healthcare infrastructure development and rising health consciousness have flourished the pharmaceutical industry worldwide.

- Application: Carbomers offer bioavailability, high adhesion, permanent suspension, and sustained-release properties, making them ideal for drug delivery systems and various medical applications.

- Market Example: For instance, Lubrizol offers specialized carbomer products for oral treatment and drug formulations.

Surging Personal Care Industry:

- Consumer Trends: The personal care industry’s growth, driven by improving quality of life and consumer trends towards luxury and personal care brands, is enhancing carbomer adoption.

- Product Features: Carbomers enhance the consistency and flow of cosmetics, providing smooth, silky textures to lotions, creams, and gels.

- Market Expansion: Rising consumer expenditure on personal products and skincare innovations are likely to provide numerous opportunities for key players.

Restraints

Government Regulation on Benzene Polymerized Carbomer:

- Health Concerns: Due to the carcinogenic nature of benzene, regulations are imposed to reduce its use in carbomer production, especially in the pharmaceutical industry.

- Market Impact: This has led to recalls of products like hand sanitizers and aerosol medications, compelling manufacturers to seek alternative methods, thereby increasing production costs.

Opportunities

Expanding Applications in Various Industries:

- Adhesives Industry: The growth of industrial adhesives and packaging adhesives markets presents opportunities for carbomer usage.

- Detergent and Paints & Coatings Market: The use of carbomers in detergents and as thickeners in paints and coatings is creating additional market opportunities.

Post-COVID-19 Market Recovery:

- Healthcare Products Demand: The surge in healthcare products and hand sanitizers during the pandemic is expected to continue driving demand in the post-COVID era.

Challenges

Limited Quantity Requirement in Production Processes:

- Efficiency Factor: The need for small amounts of carbomer in various industry production processes may restrict steep demand growth, despite expansion in end-goods industries.

Trends

Rapid Growth in the Personal Care Industry:

- Market Influence: The increasing disposable incomes, the impact of beauty products on human behavior, and attraction towards the latest trends are key trends driving carbomer market growth in the personal care sector.

Rise in Demand for Pharmaceutical Products:

- Healthcare Sector Growth: Increased health awareness and innovations in the healthcare sector are fueling the demand for pharmaceutical products, subsequently driving the carbomer market.

Growing Influence in Various End-Use Industries:

- Diverse Applications: The utility of carbomers in construction, adhesives, and coatings highlights its growing influence across different sectors.

Innovation and Technology:

- Market Development: Continuous innovation and new technologies in manufacturing across industries like cosmetics, personal care, and pharmaceuticals are supporting market demand.

Regional Analysis

Regionally, the most significant carbomer market share was 42%, accounted for by the Asia-Pacific in 2023, with values of USD 363.9 Million. In this region, China is the dominant market in the region due to its higher consumption across all industries. The increase is attributed to the growing population, favorable government regulations, and rising consumer healthcare spending.

The United States is the largest Carbomer consumer in the world. Carbomer Market growth has been fueled by the rapid expansion of the healthcare industry and increased R&D. Increased online sales of cosmetic products will increase product adoption in the region.

Over the years, the region has seen healthy competition from large-scale European cosmetics manufacturers like Estee Lauder, Unilever, and L’Oréal. Latin American customers are increasingly aware of the many benefits of pharmaceuticals and cosmetics.

Domestic and foreign investors have a clear path to investing in the domestic cosmetics sector due to their growing desire for healthy living. Carbomer Market growth is driven by the ever-increasing demand for halal products in Africa and the Middle East. Certain product grades can be accepted as halal-certified cosmetic components.

Key Regions

North America

- The US

- Canada

- Mexico

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Lubrizol, a world-leading specialty chemical company, is present in over 100 countries. It is a leading specialty chemical company that serves many industries, including beauty and personal, pharmaceuticals and energy solutions, homecare and lubricants, and water treatment. It manufactures various products for personal, topical, and pharmaceutical care applications.

Market Key Players

- Anhui Newman Fine Chemicals Co. Ltd.

- Evonik Industries AG

- The Lubrizol Corporation

- Maruti Chemicals

- Ashland

- Sumitomo seika chemicals co. Ltd.

- Amnem

- SINOWAY INDUSTRIAL CO. LTD

- Yucheng Jinhe Industrial Co. Ltd

- QINGDAO YINUOXIN NEW MATERIAL CO. LTD

- Other Key Players

Recent Developments

- October 2023: Lubrizol Corporation, a major carbomer producer, announced the expansion of its Carbopol® Aqua SF polymer production capacity in North America. This expansion aims to meet the growing demand for high-performance carbomers in personal care and pharmaceutical applications.

- December 2023: The Korean Ministry of Food and Drug Safety approved BASF’s Luviskol® K30 for use in oral dispersible tablets (ODTs). This approval opens up new opportunities for carbomers in the pharmaceutical market.

Acquisitions

- Solvay acquired Chemilux, a leading specialty chemicals company known for its carboxymethylcellulose (CMC) products. This acquisition strengthens Solvay’s position in the thickener and rheology control market.

New Trends & Company News

- Sustainable Carbomers: There is a growing trend towards the development and use of sustainable carbomers. Companies like Arkema are investing in bio-based carbomers derived from renewable resources like corn sugar.

- Carbomers in Drug Delivery: Carbomers are increasingly being used in drug delivery systems due to their ability to control the release and absorption of drugs. Companies like BASF and Lubrizol are developing new carbomers specifically for pharmaceutical applications.

- Emerging Markets: The demand for carbomers is growing rapidly in emerging markets like China and India. This is due to the increasing disposable income and growing awareness of personal care and hygiene products. Companies are expanding their production and distribution networks in these regions to cater to the growing demand.

Report Scope

Report Features Description Market Value (2023) USD 866.6 Million Forecast Revenue (2033) USD 1657.6 Million CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Synthetic and Natural) By Type (Carbomer 940, Carbomer 980 and Carbomer 934) By Appearance (Liquid and White Powder) By Function (Thickening Agent, Emulsifier, Suspending Agent, Binding Agent and Dispersion Agent) By End use (Personal Care, Products, Pharmaceuticals, Homecare Products and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Anhui Newman Fine Chemicals Co. Ltd., Evonik Industries AG, The Lubrizol Corporation, Maruti Chemicals, Ashland, Sumitomo Seika Chemicals Co. Ltd., Amnem, SINOWAY INDUSTRIAL CO. LTD, Yucheng Jinhe Industrial Co. Ltd, QINGDAO YINUOXIN NEW MATERIAL CO. LTD and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anhui Newman Fine Chemicals Co. Ltd.

- Evonik Industries AG

- The Lubrizol Corporation

- Maruti Chemicals

- Ashland

- Sumitomo seika chemicals co. Ltd.

- Amnem

- SINOWAY INDUSTRIAL CO. LTD

- Yucheng Jinhe Industrial Co. Ltd

- QINGDAO YINUOXIN NEW MATERIAL CO. LTD

- Other Key Players