Global CAR-T Cell Therapies Market By Drug Type (Axicabtagene Cilolecucel, Tisagenlecleucel, Brezucabtagene Autoleucel, Brexucabtagene Autoleucel, Lisocabtagene Maraleucel), By Modality (Research and Commercialized), By Target Antigen (CD19, CD22, BCMA, and Others), By Indication, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb 2023

- Report ID: 105628

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

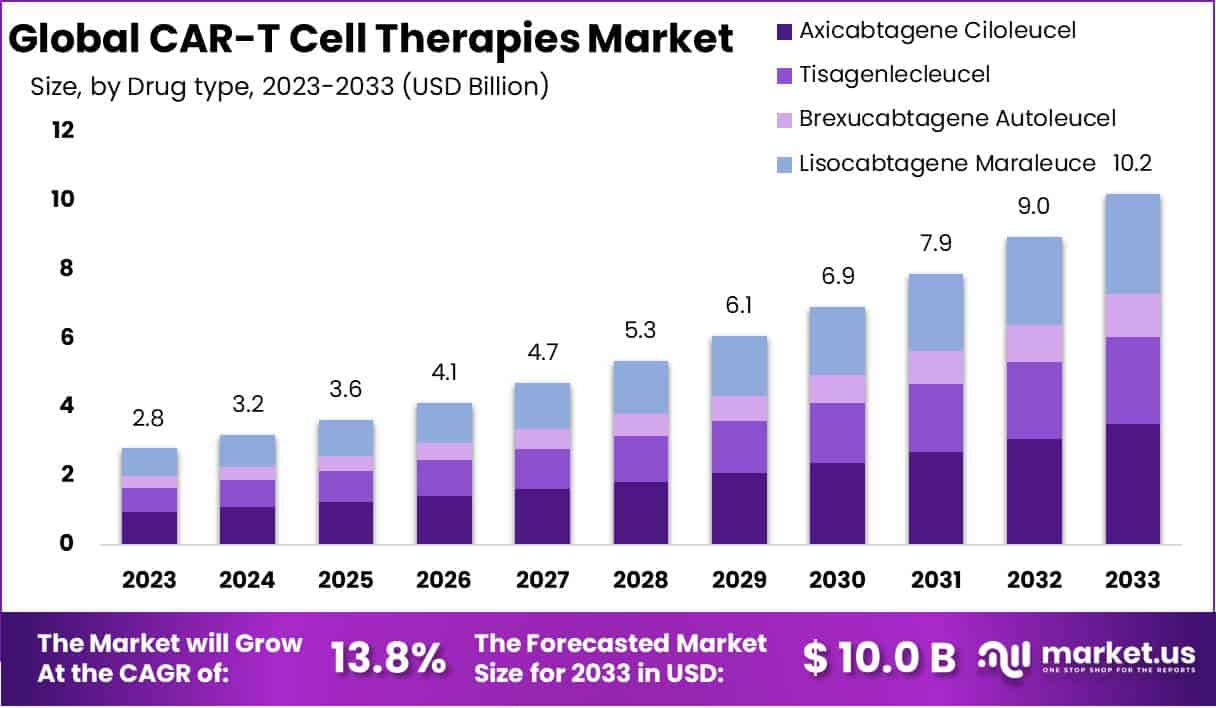

The Global CAR-T Cell Therapies Market size is expected to be worth around USD 10.2 Billion by 2033, from USD 2.8 Billion in 2023, growing at a CAGR of 13.8% during the forecast period from 2024 to 2033.

CAR-T Cell therapies are the type of cancer immunotherapy treatment that used immune cells called T cells, that are genetically changed in a lab to allow them to locate and destroy cancer cells more effectively. Chimeric antigen receptors are used to kill the cancer. CAR T-cell therapies are approved by the US Food and Drug Administration (FDA) to treat some types of lymphomas and leukemia’s, along with various myeloma. There are three main steps included in CAR T cell therapy which consist of engineering T cells, collecting T cells, and infusing the CAR T cells in the human body.

Key Takeaways

- Market Growth: Expected to surge from USD 2.8 Billion in 2023 to USD 10.2 Billion by 2033, exhibiting a notable 13.8% CAGR during 2024-2033.

- Drug Type Dominance: Axicabtagene Ciloleucel Dominates with a 34.4% market share in 2023, propelled by FDA approval for large B-cell lymphoma treatment.

- Modality Dominance: The research segment holds a 71.5% market share in 2023, showcasing active research institution participation and numerous products in clinical development.

- Target Antigen Dominance: CD19/CD22 Antigens Lead with a 53.9% market share in 2023, showing efficacy in treating B-cell malignancies.

- Indication Dominance: Lymphoma claims a 57.1% market share in 2023, driven by FDA-approved CAR-T cell therapies for various lymphoma forms.

- End-User Segment: Hospitals dominate with a 62.8% market share in 2023, owing to advanced facilities, capabilities, and increased patient admissions.

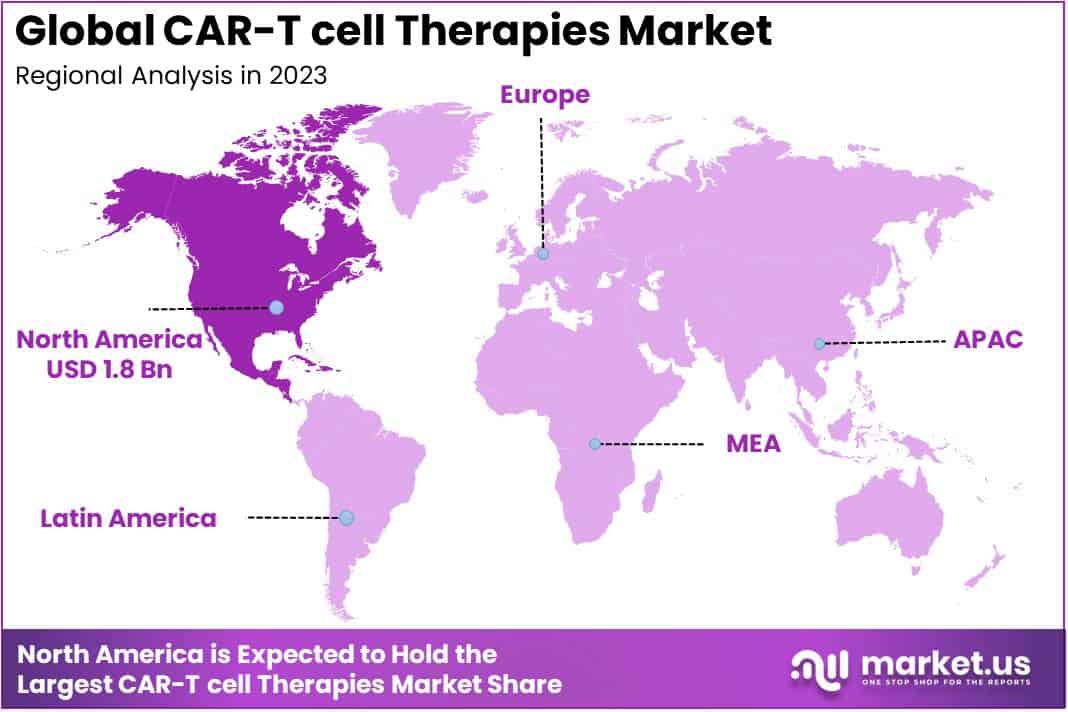

- North America Impact: North America contributes 61.49% to the market, holding a USD 1.8 Billion value in 2023, driven by chronic disease burden and robust R&D activities.

Driving Factors

Increase in Prevalence of Cancer is the Major Factor Driving the Market Growth

North America had the maximum cancer prevalence ratio in 2020, from twelve months. The 12-month prevalence rate for each cancer in North America was 588 per 100,000 population. The increasing number of adults and children developing cancer is projected to rise in demand for effective and consistent therapeutic treatment methods for the enhancement of the quality of patients’ lives.

One of the significant factor driving the market growth is that CAR- T cell therapies require short treatment to administered with a single infusion that may need at the most, two weeks’ impatient care. For example, the WHO published a fact sheet according to which, each year around 400,000 children are develop cancer February in 2022, and 2.26 Mn cases of breast cancer were found in 2021, worldwide.

Restraining Factors

High Cost of CAR-T Cell Therapy Hinder Market Growth

The high cost related with CAR-T cell therapy is the significant factor hampering the market growth. The cost of CAR-T cell therapies is influenced by various factors such as the complex manufacturing process, specialized requirements of healthcare and the personalized nature of the therapy.

Drug Type Analysis

Axicabtagene Ciloleucel Segment to Witness Significant Growth

The global CAR-T cell therapies market is classified into axicabtagene ciloleucel, tisagenlecleucel, brexucabtagene autoleucel, lisocabtagene maraleucel, and others. The axicabtagene ciloleucel segment accounted for the highest market revenue share of 34.4% in 2023, due to the rise in approval of axicabtagene cilolecucel medicine for the treatment of relapsed or refractory large B- cell lymphoma, replaced or refractory follicular lymphoma.

For instance, in April 2022 FDA approved axcibtagene ciololeucel for adults with large B-cell lymphoma that is refractory to first- line chemoimmunotherapy.

The brexucabtagene autoleucel segment is projected to witness the highest CAGR over the forecast period, due to increase in adoption of CAR-T cell therapies medicine in various countries for refractory B- cell precursor acute lymphoblastic leukemia.

Modality Analysis

Research Segment Dominated the Market and holds 71.5% Share in 2023

On the basis of modality, the global CAR-T cell therapies market is segmented into research and commercialized. Among these, the research segment hold the 71.5% market share in 2023, due to the highest number of CAR-T cell therapy products in the clinical development phase. Various research institutions including Mayo Clinic are actively participating in operating CAR -T cell therapies programs, is promoting the approach as a better way to control cancer.

The commercialized segment is estimated to witness maximum growth during the forecast period, due to the rising product approval from the regulatory bodies to fuel the commercial use of CAR-T cell therapies in hospital and clinical settings.

Target Antigen Analysis

CD19/CD22 Segment Accounted 53.9% Market Share in 2023

Based on target antigen, the global CAR-T cell therapies market is divided into CD19, CD22, BCMA, and others. The CD 19/CD22 target antigens segment accounted 53.9% market share in 2022. The CD19 has produced impressive results in treating patients with B-cell malignancies. The BCMA segment is expected to witness significant growth during the forecast period.

Indication Analysis

The Lymphoma Segment Dominates the Market Growth of the CAR-T Cell Therapies Market

Based on indication, the global CAR-T cell therapies market is segmented into lymphoma, acute lymphatic leukemia, autoimmune disorders, and others. The lymphoma segment dominated the maximum market revenue share of 57.1% in 2023, due to the higher number of approved CAR- T cell therapeutics for the treatment of different forms of lymphoma with a large number of target population. The FDA has approved various CAR-T cell therapies for lymphoma. CAR-T cell therapies that target CD19 have advanced the treatment of multiply replaced large B-cell lymphoma.

The acute lymphatic leukemia segment is anticipated to witness the fastest growth rate during the forecast period. These drugs are used for the treatment of acute lymphoblastic leukemia related to testing blood cancer.

End-User Analysis

The Hospitals Segment Holds the Highest Market Revenue Share During the Forecast Period

Based on end-users, the global CAR-T cell therapies market is classified into hospitals, cancer research institutes. Among these, the hospital’s segment dominated the highest market revenue share of 62.8% in 2023, owing to factors such as well-equipped operation theatres, advanced buying power, and an increase in patient admission.

The cancer research institutes segment is anticipated to grow at the highest CAGR, due to the accessibility of vast range of treatments of choice and rise in the number of cancer centers in some emerging countries.

Key Market Segments

By Drug Type

- Axicabtagene Ciloleucel

- Tisagenlecleucel

- Brexucabtagene Autoleucel

- Lisocabtagene Maraleucel

- Other Drug Types

By Modality

- Research

- Commercialized

By Target Antigen

- CD19

- CD22

- BCMA

- Other Target Antigens

By Indication

- Lymphoma

- Acute Lymphocytic Leukemia

- Autoimmune Disorders

- Other Indications

By End-User

- Hospitals

- Cancer Treatment Centers

Growth Opportunity

Increase in Awareness About Novel Medicine

Increasing awareness and rise in adoption of novel medicine of CAR-T cell therapies and favorable drugs present in pipelines are estimated to provide significant opportunities for the market. The rapidly enhancing clinical trial activities and current commercialization of CAR-T cell therapy, which is anticipated to offer major opportunities for market growth. Additionally increasing R&D investments from major companies offers significant opportunities for market growth.

Latest Trends

Increasing Number of Product Approvals is one of the Global Trends in the Market

One of the rising trends in the market is the increasing number of product approvals. The development and use of CAR-T cell therapies have revolutionized cancer treatment. Additionally, researchers are focusing on enhancing safety and efficacy of CAR-T cell therapies. This includes developing strategies to lower side effects.

For instance, In July 2022, Novartis AG announced KYMRIAH® (tisagenlecleucel) a CD19-directed genetically altered related T cell immunotherapy indicated for the treatment of patients up till 25 years with B-cell precursor acute lymphoblastic leukemia that is refractory or in second or later relapse. Moreover, according to the Food and Drug Administration, two chimeric antigen receptor-T (CAR-T) cell therapies were approved for advanced lymphoma and acute lymphoblastic leukemia.

Regional Analysis

North America Dominates the Global CAR-T Cell Therapy Market During the Forecast Period

North America accounted for a significant CAR-T cell therapy market revenue share of 61.49% and holds USD 1.8 Billion market value for the year. Due to rising burden of chronic diseases such as autoimmune disorders and cancer, growth in R&D activities, and strong key players. The accessibility of approved therapeutics with higher acceptance of CAR t cell therapies. For Example, according to the American Cancer Society estimated that the numbers of novel cancer cases and deaths are 1,958,310 and 609,820 cancer death in the North American region. Additionally, various strategic are contributed by the key players.

The Asia-Pacific market is anticipated to hold the maximum revenue share during the forecast period, due to the increase in consciousness regarding CAR T-cell therapy and rising number of target population.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The key players are focusing on R&D activities to develop novel CAR T-cell therapies products for the treatment of several types of cancer. The increasing number of market players in CAR-T cell therapies market is estimated to rise in the competitive struggle in the market.

Some of the prominent key players in the CAR T-cell therapies market include Pfizer Inc., Amgen Inc., Gilead Sciences, Inc., Merck & Co., Inc., Bluebird Bio, Inc., Bristol-Myers Squibb Company, Juno Therapeutics, Inc., and other key players.

Market Key Players

- Juno Therapeutics, Inc.

- Bristol-Myers Squibb Company

- Bluebird Bio, Inc.

- Gilead Sciences, Inc.

- Merck & Co., Inc.

- Pfizer, Inc.

- Sorrento Therapeutics, Inc.

- Merck KGaA

- Amgen Inc.

- Eureka Therapeutics Inc.

- Calyxt Inc.

- Autolus Therapeutics

- CARsgen Therapeutics Co.Ltd.

- Poseida Therapeutics, Inc.

- Fortress Biotech, Inc.

- Other Key Players

Recent Development

- In October 2023, Gilead Sciences, Inc. completed a significant acquisition by purchasing Kite Pharma for $5.4 billion. This move granted Gilead access to Yescarta, the leading CAR-T therapy designed for treating large B-cell lymphoma.

- In September 2023, A major collaboration took place between Pfizer Inc. and Allogene Therapeutics. The two companies joined forces in a $3 billion agreement aimed at developing allogeneic CAR-T cell therapies. This collaboration is expected to provide “off-the-shelf” treatments for various medical conditions.

- In August 2023, Merck & Co., Inc. marked its entry into the CAR-T market with the launch of Abcema (idecabtagene vicleucel), a CAR-T therapy specifically designed for multiple myeloma.

- In July 2023, Bluebird Bio, Inc. shared positive results from the Phase 2 clinical trial of bb2122, its CAR-T therapy for pediatric acute lymphoblastic leukemia (ALL). The trial showcased high remission rates and durable responses, indicating promising outcomes for the treatment.

Report Scope

Report Features Description Market Value (2023) US$ 2.2 Bn Forecast Revenue (2033) US$ 7.9 Bn CAGR (2024-2033) 13.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type- Axicabtagene Ciloleucel, Tisagenlecleucel, Brexucabtagene Autoleucel, Lisocabtagene maraleucel, and Other Drug Types; By Modality- Research and Commercialized; By Target Antigen- CD19, CD22, BCMA, and Other Target Antigens; By Indication- Lymphoma, Acute Lymphocytic Leukemia, Autoimmune Disorders, and Other Indications; By End-User- Hospitals and Cancer Treatment Centers Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Juno Therapeutics, Inc., Bristol-Myers Squibb Company, Bluebird Bio, Inc., Gilead Sciences, Inc., Merck & Co., Inc. Pfizer, Inc. Sorrento Therapeutics, Inc., Merck KGaA,Amgen Inc. Eureka Therapeutics Inc., Calyxt Inc., Autolus Therapeutics,CARsgen Therapeutics Co.Ltd.,Poseida Therapeutics, Inc. , Fortress Biotech, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the CAR-T Cell Therapies market in 2023?The CAR-T Cell Therapies market size is USD 2.8 billion in 2023.

What is the projected CAGR at which the CAR-T Cell Therapies market is expected to grow at?The CAR-T Cell Therapies market is expected to grow at a CAGR of 13.8% (2024-2033).

List the segments encompassed in this report on the CAR-T Cell Therapies market?Market.US has segmented the CAR-T Cell Therapies market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). CAR-T Cell Therapies Market By Drug Type the market has been segmented into Axicabtagene Cilolecucel, Tisagenlecleucel, Brezucabtagene Autoleucel, Brexucabtagene Autoleucel, Lisocabtagene Maraleucel. By Modality the market has been segmented into Research and Commercialized. By Target Antigen the market has been segmented into CD19, CD22, BCMA, and Others.

List the key industry players of the CAR-T Cell Therapies market?Juno Therapeutics Inc., Bristol-Myers Squibb Company, Bluebird Bio Inc., Gilead Sciences Inc., Merck & Co. Inc., Pfizer Inc., Sorrento Therapeutics Inc., Merck KGaA, Amgen Inc., Eureka Therapeutics Inc., Calyxt Inc., Autolus Therapeutics, CARsgen Therapeutics Co.Ltd., Poseida Therapeutics Inc., Fortress Biotech Inc.

Which region is more appealing for vendors employed in the CAR-T Cell Therapies market?North America is expected to account for the highest revenue share of 61.49% and boasting an impressive market value of USD 1.8 billion. Therefore, the CAR-T Cell Therapies industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for CAR-T Cell Therapies?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the CAR-T Cell Therapies Market.

CAR-T Cell Therapies MarketPublished date: Feb 2023add_shopping_cartBuy Now get_appDownload Sample

CAR-T Cell Therapies MarketPublished date: Feb 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Juno Therapeutics, Inc.

- Bristol-Myers Squibb Company

- Bluebird Bio, Inc.

- Gilead Sciences, Inc.

- Merck & Co., Inc.

- Pfizer, Inc.

- Sorrento Therapeutics, Inc.

- Merck KGaA

- Amgen Inc.

- Eureka Therapeutics Inc.

- Calyxt Inc.

- Autolus Therapeutics

- CARsgen Therapeutics Co.Ltd.

- Poseida Therapeutics, Inc.

- Fortress Biotech, Inc.

- Other Key Players