Car Safety Market By Type(Active Safety,Passive Safety), By Occupant(Adult safety, Pedestrian safety, Child safety, Safety assistance system), By Services(Hardware, Software), By System(Lane departure warning systems, Board safety systems), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 74348

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Car Safety Market size is expected to be worth around USD 363.4 Billion by 2033, From USD 145.3 Billion by 2023, growing at a CAGR of 9.60% during the forecast period from 2024 to 2033.

The Car Safety Market encompasses a comprehensive range of products, systems, and technologies designed to enhance vehicle safety and mitigate the risk of accidents. This market serves as a pivotal segment within the automotive industry, focusing on the development and integration of advanced safety features such as airbags, seatbelts, collision avoidance systems, and electronic stability control, among others.

Key stakeholders, including vehicle manufacturers, technology providers, and regulatory bodies, play a crucial role in driving innovations and adopting standards that ensure the safety of passengers and pedestrians. The demand in this market is propelled by increasing safety regulations, consumer awareness, and technological advancements, positioning it as a critical area for investment and development by automotive companies aiming to meet the evolving safety expectations of consumers globally.

The Car Safety Market continues to exhibit resilience and adaptability amidst dynamic shifts in global transportation landscapes. As analysts, we observe a trajectory marked by incremental improvements in safety standards, bolstered by technological advancements and stringent regulatory frameworks. In the first half of 2023, an estimated 19,515 lives were tragically lost in motor vehicle traffic crashes. However, this figure represents a noteworthy decrease of about 3.3% compared to the same period in 2022, reflecting the efficacy of ongoing safety initiatives.

Supporting this trend, the first three months of 2023 witnessed a similar decline, with an estimated 9,330 traffic crash fatalities—a decrease of about 3.3% compared to the corresponding period in 2022. Notably, in December 2023, the estimated number of deaths further declined to 3,740, showcasing a remarkable 6% reduction from 2022 and a 4% decrease from 2021.

These statistics underscore the pivotal role of innovative safety technologies and heightened awareness campaigns in mitigating road hazards. The concerted efforts of automotive manufacturers, regulatory bodies, and advocacy groups are instrumental in fostering a culture of safety consciousness and driving positive behavioral change among motorists.

Looking ahead, the Car Safety Market is poised for sustained growth, fueled by an unwavering commitment to enhancing vehicle safety standards and embracing emerging technologies such as autonomous driving systems, collision avoidance mechanisms, and advanced driver-assistance systems (ADAS). As analysts, we anticipate continued collaboration across industry stakeholders to harness innovation and pave the way for safer, more secure mobility solutions in the years to come.

Key Takeaways

- Market Growth: Global Car Safety Market size is expected to be worth around USD 363.4 Billion by 2033, From USD 145.3 Billion by 2023, growing at a CAGR of 9.60% during the forecast period from 2024 to 2033.

- Regional Dominance: Asia-Pacific dominates the Car Safety Market with an impressive 51.2% share.

- Segmentation Insights:

- By Type: Active safety systems dominate the market, holding a substantial 73.4% share of the industry.

- By Occupant: Adult safety features lead in occupant-specific offerings, capturing 68.9% of the market segment.

- By Services: Software services command the largest portion, with a significant 76.2% market share dominance.

- By System: Lane departure warning systems are the leading system type, securing 53.6% of the market share.

- Growth Opportunities: The global car safety market grows due to increasing accidents, driving demand for advanced features and propelled by technological advancements.

Driving Factors

Demand for Luxury Vehicles Fuels Car Safety Innovations

The demand for luxury vehicles significantly contributes to the growth of the car safety market. Luxury vehicle manufacturers are at the forefront of adopting advanced safety features and technologies to differentiate their offerings and meet the high expectations of their clientele. These vehicles often come equipped with the latest in safety innovations, such as autonomous braking systems, advanced driver-assistance systems (ADAS), and enhanced airbag systems, setting a benchmark for safety across the automotive industry.

This push for higher safety standards in luxury vehicles indirectly influences the broader market, encouraging mid-range and economy vehicle manufacturers to incorporate similar safety features to remain competitive. Consequently, the overall demand for car safety technologies increases, driving growth in the market.

Rise in Demand for Passenger Vehicles Propels Safety Enhancements

The global increase in demand for passenger vehicles directly impacts the growth of the car safety market. As consumer awareness about vehicle safety escalates, coupled with stringent government regulations around the world mandating the inclusion of basic safety features in all vehicles, manufacturers are compelled to integrate advanced safety technologies into their designs. This trend is not limited to high-end vehicles but spans across all segments of the passenger vehicle market.

Technologies such as electronic stability control, tire pressure monitoring systems, and automatic emergency braking are becoming standard, contributing to the overall expansion of the car safety market. This surge in demand for passenger vehicles, equipped with advanced safety features, reflects a broader shift towards prioritizing passenger safety, significantly driving market growth.

Restraining Factors

High Cost of Safety Systems

The proliferation of advanced safety technologies in vehicles, while essential for reducing accidents and enhancing passenger protection, is significantly impacted by the high cost associated with these systems. Advanced Driver-Assistance Systems (ADAS), which include features such as automatic braking, adaptive cruise control, and lane-keeping assistance, require substantial investment in research and development, leading to higher retail prices for vehicles equipped with these technologies.

This financial barrier can limit market penetration, particularly in emerging economies and among price-sensitive consumers, thereby restraining the overall growth of the car safety market. However, as these technologies become more widespread and economies of scale are achieved, it is anticipated that the costs will gradually decrease, making safety systems more accessible and potentially stimulating market expansion.

Concerns about System Security

The integration of digital technologies into car safety systems introduces vulnerabilities to cyber threats, which could compromise the integrity and reliability of these systems. Concerns over hacking, data breaches, and the potential for remote manipulation of vehicle controls have emerged as significant challenges. These security concerns can deter consumers from adopting new safety technologies and slow down market growth.

To mitigate these risks, industry stakeholders are investing in robust cybersecurity measures, which, while increasing the cost, are essential for gaining consumer trust and ensuring the long-term growth of the car safety market. The ongoing efforts to enhance system security are expected to address these concerns, thereby supporting market growth by reassuring consumers about the safety and reliability of these advanced systems.

By Type Analysis

Active safety dominates with a 73.4% share of the market.

In 2023, the Car Safety Market was distinctly segmented into two primary categories: Active Safety and Passive Safety. Active Safety held a dominant market position in the “By Type” segment, capturing more than a 73.4% share. This segment’s substantial market share can be attributed to the increasing integration of advanced driver-assistance systems (ADAS) and other real-time monitoring technologies designed to prevent accidents and ensure the safety of the vehicle’s occupants.

The heightened emphasis on vehicular safety standards and regulations across global markets has further propelled the demand for Active Safety systems. These technologies, including automatic emergency braking, adaptive cruise control, lane departure warning systems, and blind spot detection, have become pivotal in reducing the incidence of road accidents. Conversely, Passive Safety, which encompasses features designed to minimize the impact and consequences of accidents such as airbags, seatbelts, and crumple zones, accounted for the remaining market share.

Despite its smaller percentage, the importance of Passive Safety remains critical, providing a secondary line of defense in the event of a collision. The ongoing advancements in materials and safety technology continue to enhance the efficacy of Passive Safety features, ensuring they remain a fundamental component of vehicle safety systems. The synergistic integration of Active and Passive Safety features is essential for achieving the highest standards of vehicular safety, addressing both prevention and protection to mitigate the risks and impacts of road accidents.

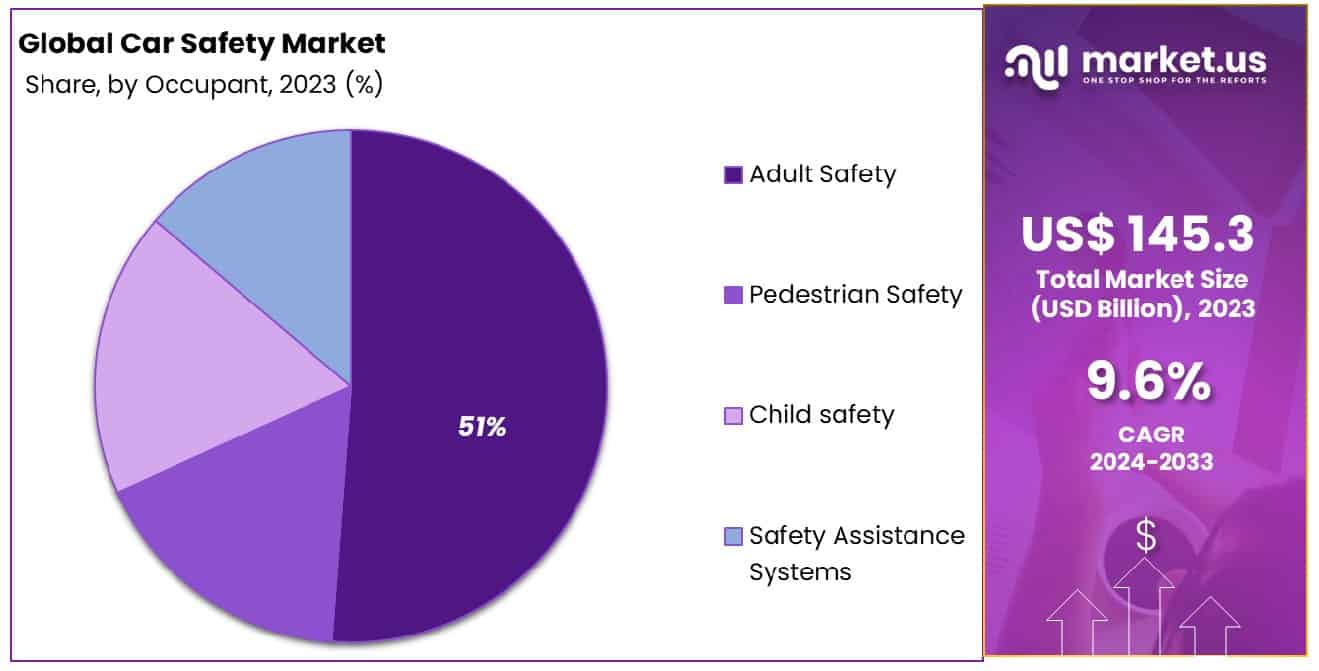

By Occupant Analysis

Adult safety holds a 68.9% market share.

In 2023, the Car Safety Market was segmented into distinct categories, focusing on the protection of different occupants and participants within the automotive ecosystem. These segments included Adult Safety, Pedestrian Safety, Child Safety, and Safety Assistance Systems. Adult Safety emerged as the preeminent segment, securing a dominant market position with a remarkable share of over 68.9%. This can be attributed to heightened regulatory mandates and increasing consumer awareness regarding adult occupant protection in vehicles.

The emphasis on adult safety underscores the industry’s prioritization of innovations and technological advancements aimed at minimizing injuries and fatalities among adult passengers and drivers in the event of a collision. Following Adult Safety, the segments of Pedestrian Safety, Child Safety, and Safety Assistance Systems also demonstrated significant contributions to the overall Car Safety Market.

These segments are driven by the growing demand for comprehensive safety features that extend protection beyond the vehicle’s occupants to include pedestrians and children, alongside the integration of advanced assistance systems designed to prevent accidents before they occur. The concerted efforts across these segments illustrate the automotive industry’s comprehensive approach to safety, balancing the needs of all road users with the integration of cutting-edge safety technologies.

By Services Analysis

Software services command a 76.2% market share.

In 2023, the Car Safety Market was segmented into two primary categories: Hardware and Software. Software emerged as the dominant segment, securing a substantial market share of over 76.2%. This commanding position can be attributed to the increasing reliance on advanced driver-assistance systems (ADAS) and autonomous driving technologies, which are predominantly software-driven. These systems require sophisticated software solutions for their operation, including algorithms for object detection, decision-making, and vehicle control, which have become critical for enhancing vehicle safety standards.

The hardware segment, while essential for the physical components of car safety systems such as sensors, cameras, and control units, has seen a relative decline in market share. This trend underscores the growing importance of software solutions in driving innovation and improving the efficacy of car safety systems. The shift towards software dominance is further supported by the automotive industry’s focus on connectivity and automation, which relies heavily on software capabilities to integrate with other systems and provide real-time data analysis for safer driving experiences.

The ascendancy of the software segment highlights a transformative phase in the Car Safety Market, where the value proposition is increasingly defined by software innovations, underlining their pivotal role in advancing car safety technologies.

By System Analysis

Lane departure warning systems lead with a 53.6% share.

In 2023, Lane Departure Warning Systems (LDWS) and On-Board Safety Systems were pivotal components in the “By System” segment of the Car Safety Market. LDWS, in particular, held a dominant market position, capturing more than a 53.6% share. This significant market share underscores the heightened emphasis on advanced safety technologies within the automotive sector. The substantial preference for LDWS can be attributed to its critical role in enhancing driver safety by minimizing accidents caused by unintentional lane departures.

The integration of LDWS into a wide array of vehicles reflects the automotive industry’s commitment to leveraging technology to improve road safety. These systems, through auditory, visual, and haptic alerts, significantly reduce the risk of collisions by notifying drivers of unintentional lane changes, thus encouraging corrective action. The ascendancy of LDWS in the Car Safety Market is further bolstered by regulatory mandates and growing consumer demand for vehicles equipped with advanced safety features.

On-board safety Systems, complementing LDWS, incorporate a suite of technologies aimed at protecting passengers and enhancing vehicle operation. Despite LDWS’s more pronounced market share, these systems collectively contribute to the overarching objective of mitigating road traffic accidents and enhancing the safety credentials of modern vehicles. Together, LDWS and On-Board Safety Systems exemplify the automotive industry’s shift towards more autonomous and safety-focused vehicle technologies, marking a significant stride in the evolution of car safety standards.

Key Market Segments

By Type

- Active Safety

- Passive Safety

By Occupant

- Adult safety

- Pedestrian safety

- Child safety

- Safety assistance system

By Services

- Hardware

- Software

By System

- Lane departure warning systems

- Board safety systems

Growth Opportunities

Increasing Accidents

The global car safety market is poised for significant growth, primarily driven by the escalating number of road accidents worldwide. This uptrend in accidents underscores the urgent need for enhanced safety features in connected vehicles, propelling automakers and technology providers to prioritize innovations in safety systems. As vehicular safety becomes a paramount concern among consumers, regulatory bodies across various regions are mandating stricter safety standards, thereby catalyzing the market’s expansion.

The demand for advanced safety features, such as automatic emergency braking, adaptive cruise control, and blind-spot detection, is anticipated to surge. This demand serves as a critical catalyst for growth in the car safety market, providing substantial opportunities for industry stakeholders to innovate and expand their market presence.

Technological Advancements

Technological advancements represent a cornerstone for the evolution of the car safety market in 2023. The integration of artificial intelligence (AI) and machine learning (ML) into safety systems is set to redefine vehicular safety, offering predictive capabilities and enhancing real-time decision-making processes. Furthermore, the proliferation of connected cars and the Internet of Things (IoT) technologies are facilitating the development of more sophisticated safety features, capable of communicating with external infrastructure and other vehicles to preemptively identify and mitigate potential hazards.

The advent of autonomous vehicles also underscores the critical role of advanced safety technologies in ensuring passenger safety, thereby fueling market growth. Industry players who leverage these technological innovations to enhance car safety features are likely to gain a competitive edge, capturing greater market share in this rapidly evolving landscape.

Latest Trends

Increased Adoption of Electric Vehicles (EVs) Worldwide

The global car safety market is witnessing a transformative shift with the increased adoption of electric vehicles (EVs). This trend is driven by a heightened awareness of environmental issues, supportive government policies, and advancements in EV technology. The integration of advanced safety features in EVs, such as enhanced battery protection systems, advanced driver-assistance systems (ADAS), and improved structural integrity, is becoming a standard.

The growth of the EV market can be attributed to consumer demand for sustainable and energy-efficient transportation solutions. Consequently, manufacturers are focusing on incorporating innovative safety technologies to mitigate the unique risks associated with electric mobility, thereby augmenting the overall safety of these vehicles.

Shift Towards Micro-Mobility Among Consumers

The shift towards micro-mobility is another significant trend shaping the global car safety market. This movement is primarily motivated by the increasing urbanization and the need for flexible, cost-effective transportation solutions in congested city environments. Micro-mobility devices, including electric scooters and bikes, are being equipped with advanced safety features to protect users in urban settings. These include lighting systems for enhanced visibility, electronic braking systems, and connectivity features for real-time tracking and diagnostics.

The emphasis on safety in micro-mobility solutions is critical to addressing consumer concerns regarding the risk of accidents, thereby encouraging adoption. This trend underscores the industry’s pivot towards developing comprehensive safety features that cater to the evolving preferences of consumers, highlighting the market’s adaptability and focus on innovation.

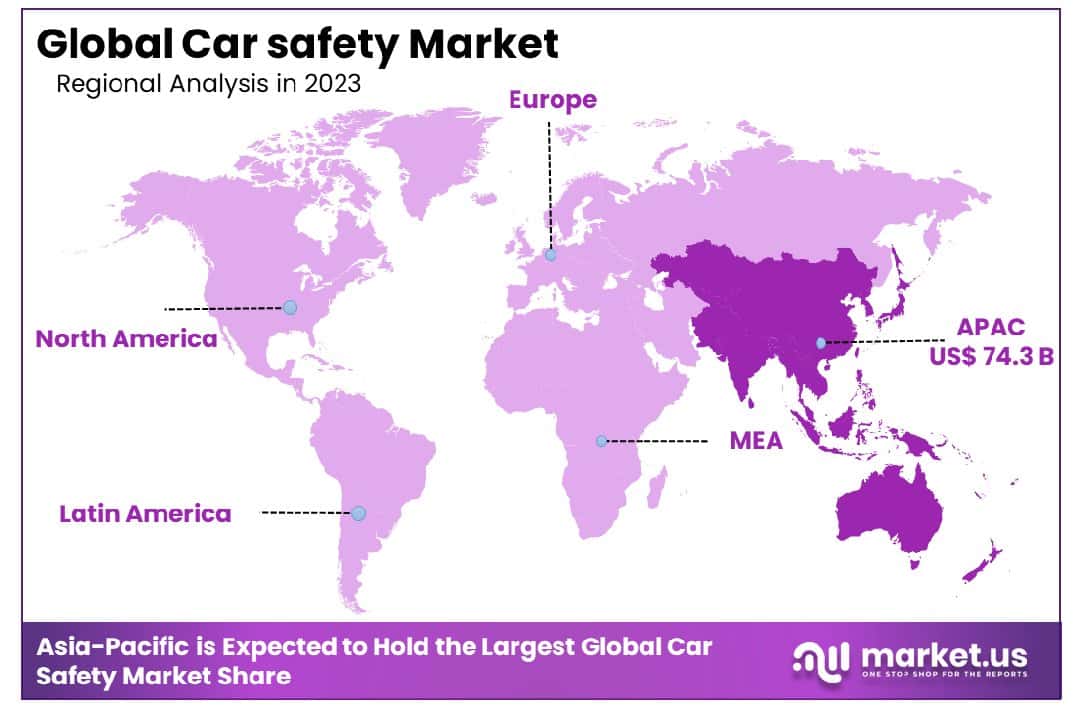

Regional Analysis

Asia-Pacific dominates the car safety market with an impressive 51.2% market share, reflecting its significant influence.

The global market for car safety has witnessed significant evolution, driven by technological advancements, stringent regulatory standards, and increasing consumer awareness regarding vehicle safety features. Among the regions, Asia-Pacific emerges as the dominating region, accounting for 51.2% of the market share, underpinned by rapid industrialization, the presence of major automotive manufacturers, and burgeoning demand in countries like China, Japan, and South Korea. This region’s growth can be attributed to its aggressive implementation of safety regulations, coupled with a surge in vehicle production and sales.

North America also holds a substantial portion of the car safety market, fueled by advanced technological integration and strict safety norms set by organizations such as the National Highway Traffic Safety Administration (NHTSA). The adoption of advanced driver-assistance systems (ADAS) and the push for electric vehicles (EVs) have further propelled the market in this region.

Europe follows closely, characterized by its robust automotive industry, stringent safety standards, and high consumer demand for vehicles equipped with advanced safety features. The European Union’s regulations mandating the inclusion of safety systems in new vehicles have significantly contributed to the region’s market growth.

The Middle East & Africa and Latin America regions, although smaller in market size compared to the aforementioned regions, are experiencing gradual growth. This expansion is driven by increasing vehicle sales, rising awareness about vehicle safety, and slowly tightening safety regulations. These regions present untapped potential with opportunities for significant growth as they continue to develop their automotive and regulatory frameworks.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Car Safety Market witnessed a significant impact from key players such as Schaeffler AG, Valeo SA, Ryobi, Mitsubishi Electric Corp, Toyota Boshoku Corp, Tata Motors, Autoliv Inc, Hyundai Mobis, Infineon, Denso Corporation, and ZF Friedrichshafen AG. These companies played pivotal roles in shaping the landscape of automotive safety through their innovative products and technologies.

Schaeffler AG, renowned for its expertise in automotive components, continued to enhance safety systems with advanced solutions, contributing to the overall improvement of vehicle safety standards. Similarly, Valeo SA, a frontrunner in automotive technology, introduced cutting-edge safety features aimed at mitigating road accidents and enhancing occupant protection.

Ryobi, Mitsubishi Electric Corp, and Toyota Boshoku Corp also made significant strides in the car safety sector by integrating state-of-the-art sensor technologies and intelligent systems into their products. These advancements not only enhanced collision avoidance capabilities but also improved overall vehicle stability and control.

Tata Motors, Autoliv Inc., and Hyundai Mobis remained at the forefront of safety innovation, investing heavily in research and development to address emerging safety challenges. Their emphasis on active and passive safety systems contributed to the reduction of fatalities and injuries on roads worldwide.

Furthermore, companies like Infineon, Denso Corporation, and ZF Friedrichshafen AG played crucial roles in providing essential components and technologies that form the backbone of modern car safety systems. Their expertise in sensors, control units, and safety electronics ensured the reliability and effectiveness of safety features across various vehicle models.

Market Key Players

- Schaeffler AG

- Valeo SA

- Ryobi

- Mitsubishi Electric Corp

- Toyota Boshoku Corp

- Tata Motors

- Autoliv Inc

- Hyundai Mobis

- Infineon

- Denso Corporation

- ZF Friedrichshafen AG

Recent Development

- In September 2023, Mercedes’ Driver Pilot ADAS achieved level 3 autonomy, enhancing safety. IoT integration by various companies revolutionizes connectivity and data management, while e-fuels promise carbon neutrality, led by industry-wide efforts.

- In May 2023, Autoliv showcased an integrated cockpit, zero-gravity seat, and Star steering wheel at the Shanghai Automobile Industry Exhibition 2023, aiming to enhance safety and comfort in vehicles. Over 35,000 visitors witnessed Autoliv’s innovations.

Report Scope

Report Features Description Market Value (2023) USD 145.3 Billion Forecast Revenue (2033) USD 363.4 Billion CAGR (2024-2033) 9.60% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Active Safety,Passive Safety), By Occupant(Adult safety, Pedestrian safety, Child safety, Safety assistance system), By Services(Hardware, Software), By System(Lane departure warning systems, Board safety systems) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Schaeffler AG, Valeo SA, Ryobi, Mitsubishi Electric Corp, Toyota Boshoku Corp, Tata Motors, Autoliv Inc, Hyundai Mobis, Infineon, Denso Corporation, ZF Friedrichshafen AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Car Safety Market in 2023?The Car Safety Market size is USD 145.3 Billion in 2023.

What is the projected CAGR at which the Car Safety Market is expected to grow at?The Car Safety Market is expected to grow at a CAGR of 9.60% (2024-2033).

List the segments encompassed in this report on the Car Safety Market?Market.US has segmented the Car Safety Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Active Safety,Passive Safety), By Occupant(Adult safety, Pedestrian safety, Child safety, Safety assistance system), By Services(Hardware, Software), By System(Lane departure warning systems, Board safety systems)

List the key industry players of the Car Safety Market?Schaeffler AG, Valeo SA, Ryobi, Mitsubishi Electric Corp, Toyota Boshoku Corp, Tata Motors, Autoliv Inc, Hyundai Mobis, Infineon, Denso Corporation, ZF Friedrichshafen AG

Name the key areas of business for Car Safety Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Car Safety Market.

-

-

- Schaeffler AG

- Valeo SA

- Ryobi

- Mitsubishi Electric Corp

- Toyota Boshoku Corp

- Tata Motors

- Autoliv Inc

- Hyundai Mobis

- Infineon

- Denso Corporation

- ZF Friedrichshafen AG