Global Car Audio Market Size, Share, Growth Analysis By Component (Speaker (2-way, 3-way, 4-way), Amplifiers, DSP, Microphone, Tuners), By Sound Management (Voice recognition, Manual), By Vehicle (Passenger Vehicles (Hatchback, Sedan, SUV), Commercial Vehicles (Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV))), By Sales Channel (OEM (Speaker, Amplifier, DSP, Microphone, Tuners), Aftermarket (Speaker, Amplifier, DSP, Microphone, Tuners)), By Connectivity Technology (Wired, Wireless), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176986

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

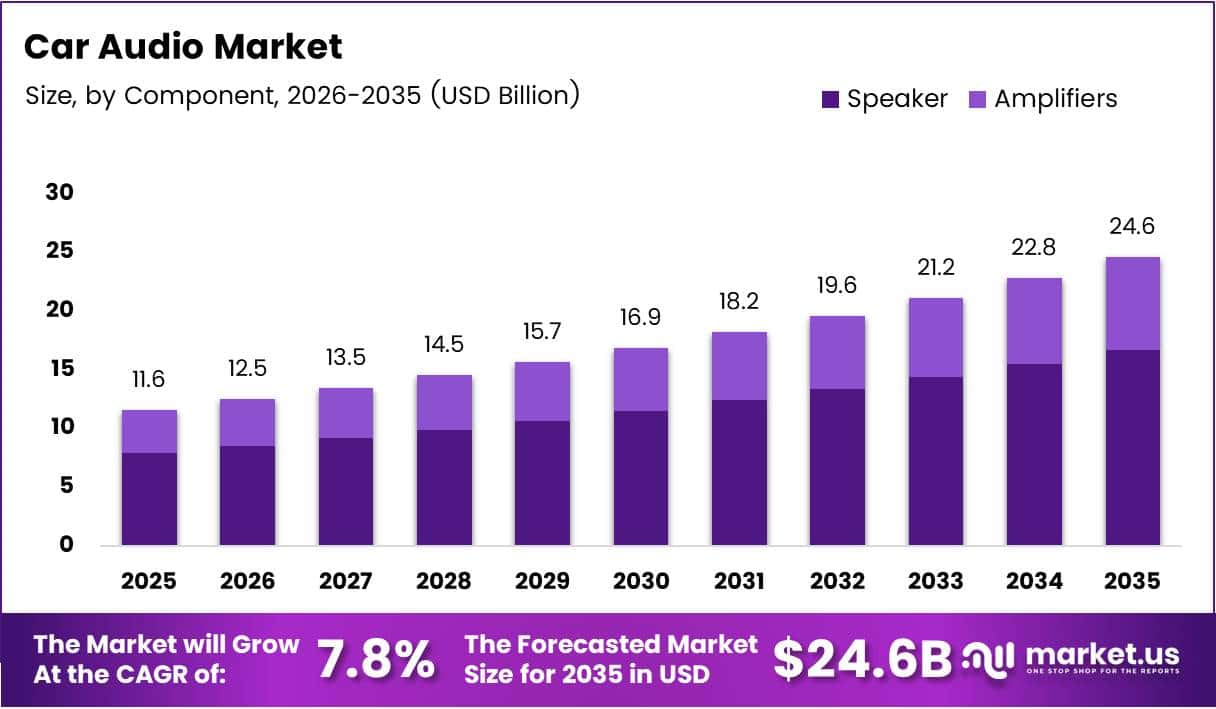

Global Car Audio Market size is expected to be worth around USD 24.6 Billion by 2035 from USD 11.6 Billion in 2025, growing at a CAGR of 7.8% during the forecast period 2026 to 2035.

Car audio systems represent sophisticated in-vehicle entertainment solutions combining speakers, amplifiers, processors, and connectivity technologies. These systems deliver personalized sound experiences while integrating seamlessly with modern vehicle infotainment architectures. Moreover, manufacturers continuously enhance acoustic performance through advanced digital signal processing and spatial audio capabilities.

Automotive audio technology has evolved significantly from basic radio receivers to complex multi-zone sound environments. Contemporary systems incorporate wireless connectivity standards, voice recognition, and smartphone ecosystem integration. Additionally, premium configurations feature immersive 3D spatial audio and adaptive noise-cancellation technologies that optimize cabin acoustics dynamically.

The market experiences robust expansion driven by rising consumer expectations for high-fidelity entertainment during commutes. Electric vehicle proliferation accelerates demand for specialized low-noise audio platforms optimized for quieter cabins. Furthermore, software-defined vehicle architectures enable over-the-air audio feature upgrades and personalization capabilities previously unavailable in traditional automotive systems.

Government regulations promoting vehicle safety technologies indirectly benefit audio markets through integrated voice command systems. Manufacturers collaborate with premium audio brands to differentiate vehicle offerings through co-branded factory-installed systems. Consequently, partnerships between automotive OEMs and established audio companies create competitive advantages in increasingly saturated automotive markets.

Investment in research focuses on AI-powered sound tuning and adaptive acoustic modeling technologies. Companies develop energy-efficient amplifier architectures specifically designed for electric vehicle power constraints. Therefore, innovation cycles accelerate as manufacturers balance premium audio quality with vehicle electrification requirements and sustainability mandates.

According to research published in arXiv, neural acoustic modeling in car cabins reduced magnitude reconstruction error by over 39%, demonstrating significant advancement in computational audio optimization. This breakthrough enables more precise sound calibration across diverse vehicle interior geometries and materials.

According to MDPI research, automotive neural network noise prediction achieved within 3% prediction error for vehicle acoustic modeling, substantially improving accuracy of cabin sound environment simulations. In November 2024, Bose acquired McIntosh Group, including high-end audio brands McIntosh and Sonus faber, expanding premium automotive audio capabilities through specialized luxury brand integration.

Key Takeaways

- Global Car Audio Market projected to reach USD 24.6 Billion by 2035 from USD 11.6 Billion in 2025 at 7.8% CAGR

- Speaker component segment dominates with 63.2% market share driven by multi-speaker premium configurations

- Manual sound management holds 67.9% share despite growing voice recognition adoption

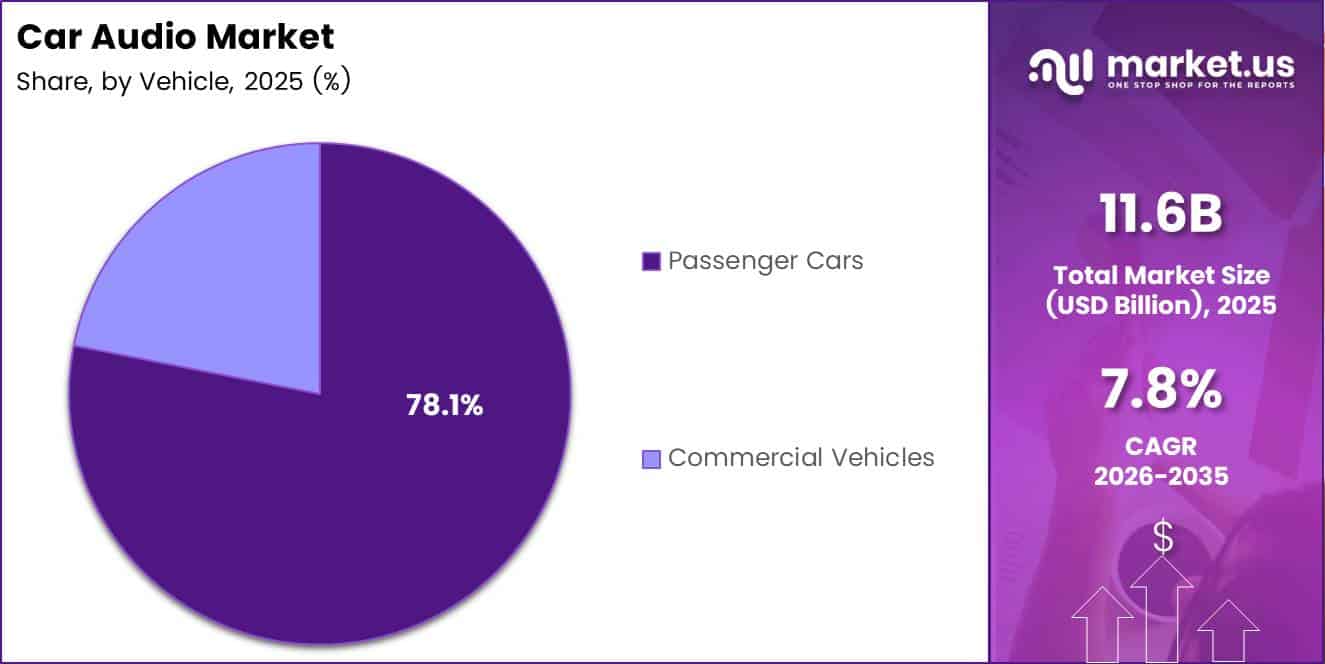

- Passenger vehicles account for 78.1% of market reflecting consumer entertainment priorities

- OEM sales channel leads with 69.8% share as factory-installed systems gain preference

- Wired connectivity technology maintains 59.5% dominance despite wireless growth

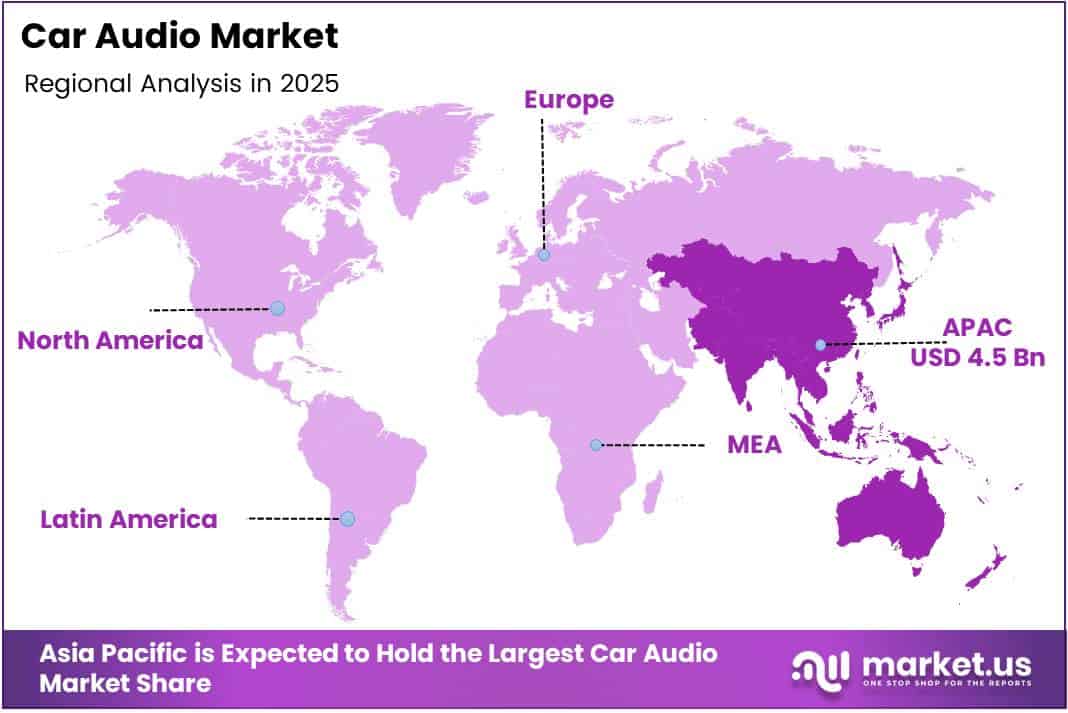

- Asia Pacific region commands 39.10% market share valued at USD 4.5 Billion

Component Analysis

Speaker dominates with 63.2% due to essential role in sound reproduction and multi-channel configurations.

In 2025, Speaker held a dominant market position in the By Component segment of Car Audio Market, with a 63.2% share. Speakers represent the fundamental sound output mechanism in vehicle audio systems, requiring multiple units for stereo imaging and surround sound experiences. Premium vehicles increasingly adopt multi-speaker configurations ranging from 6 to 20 units, driving substantial component volume. Consequently, speaker technology advancement focuses on compact high-efficiency drivers optimized for challenging automotive acoustic environments.

2-way speaker configurations balance cost-effectiveness with acceptable audio quality for mass-market vehicles. These systems separate frequency ranges between woofer and tweeter components, delivering clear vocal reproduction and adequate bass response. Moreover, manufacturers optimize crossover networks to minimize power consumption while maintaining sound fidelity across diverse musical genres and audio content types.

3-way speaker designs add dedicated midrange drivers for enhanced vocal clarity and instrument separation. These configurations appeal to audio enthusiasts seeking improved soundstage depth without premium system costs. Additionally, three-way designs reduce individual driver strain, extending component lifespan and reducing distortion during high-volume playback scenarios common in automotive environments.

4-way speaker systems represent premium offerings with dedicated super-tweeters for extended high-frequency response. These configurations deliver exceptional detail retrieval and spatial imaging preferred by discerning audiophiles. Furthermore, four-way designs enable more precise frequency distribution, reducing intermodulation distortion and improving overall system dynamics in acoustically challenging vehicle cabins.

Amplifiers provide essential power amplification converting low-level signals into speaker-driving current. Modern automotive amplifiers integrate digital signal processing for equalization, crossover management, and acoustic correction. Therefore, Class-D amplifier architectures dominate due to superior efficiency reducing thermal management requirements in space-constrained vehicle installations.

DSP (Digital Signal Processors) enable advanced sound customization through parametric equalization and time alignment. These components correct acoustic anomalies caused by asymmetric speaker placement and cabin geometry. Additionally, DSP technology facilitates multi-zone audio control allowing independent sound environments for different passenger seating positions.

Microphone components support voice recognition, hands-free communication, and active noise cancellation systems. Array configurations using multiple microphones improve voice pickup clarity while rejecting ambient road and wind noise. Consequently, microphone integration becomes increasingly sophisticated as voice control interfaces replace traditional physical button controls in modern vehicle infotainment systems.

Tuners maintain relevance for AM/FM radio reception despite streaming audio service proliferation. Digital tuner architectures deliver improved sensitivity and selectivity compared to legacy analog designs. Moreover, tuners provide emergency broadcast reception and local content access in areas with limited cellular network coverage.

Sound Management Analysis

Manual dominates with 67.9% due to user preference for direct tactile control and lower system complexity.

In 2025, Manual held a dominant market position in the By Sound Management segment of Car Audio Market, with a 67.9% share. Manual control interfaces including physical buttons, knobs, and touchscreen sliders remain preferred by consumers valuing immediate tactile feedback. These systems avoid voice recognition latency and misinterpretation issues common in noisy driving environments. Furthermore, manual controls operate independently of microphone functionality and speech processing algorithms, ensuring reliable operation across all conditions.

Voice recognition technology gains traction as automotive infotainment systems integrate sophisticated natural language processing. Modern voice control enables hands-free audio source selection, volume adjustment, and sound profile changes without visual distraction. Additionally, voice commands support safer driving by reducing manual interface interaction while maintaining full audio system functionality and personalization capabilities.

Vehicle Analysis

Passenger Vehicles dominates with 78.1% due to higher entertainment prioritization and discretionary audio spending.

In 2025, Passenger Vehicles held a dominant market position in the By Vehicle segment of Car Audio Market, with a 78.1% share. Personal vehicle owners invest significantly in audio quality enhancements for daily commutes and recreational travel. Consumer preference for premium entertainment experiences drives aftermarket upgrades and factory-installed high-end systems. Moreover, passenger vehicle buyers demonstrate willingness to pay premium prices for branded audio systems from recognized manufacturers like Harman Kardon and Bose.

Hatchback vehicles represent entry-level and compact car segments where audio systems balance cost constraints with acceptable performance. Manufacturers optimize speaker placement within limited cabin space while maintaining stereo imaging quality. Additionally, hatchback audio configurations typically feature 4–6 speaker setups providing adequate sound coverage for smaller interior volumes without excessive component costs.

Sedan configurations offer larger cabin volumes requiring more powerful amplification and additional speakers for consistent coverage. Mid-size and luxury sedans frequently include premium audio packages as optional equipment or standard features in higher trim levels. Furthermore, sedan acoustics benefit from enclosed trunk separation reducing rear speaker interference and improving overall sound clarity.

SUV vehicles present unique audio challenges due to large cabin volumes and third-row seating configurations. Premium SUV audio systems deploy 10–20 speakers with dedicated amplifiers ensuring even sound distribution throughout expansive interiors. Consequently, SUV audio installations command higher prices reflecting increased component counts and sophisticated tuning requirements for complex acoustic environments.

Commercial Vehicles prioritize functionality and durability over premium audio quality given utilitarian usage patterns. Fleet operators focus on communication clarity and basic entertainment functionality rather than high-fidelity reproduction. Therefore, commercial vehicle audio specifications emphasize reliability, simple operation, and resistance to harsh operating conditions including vibration and temperature extremes.

Light Commercial Vehicles (LCV) serving delivery and small business applications feature basic audio systems with standard connectivity options. These configurations support hands-free calling, navigation guidance, and background entertainment for drivers spending extended periods in vehicles. Additionally, LCV audio systems integrate with telematics platforms providing fleet management and driver communication capabilities beyond traditional entertainment functions.

Heavy Commercial Vehicles (HCV) including trucks and buses install robust audio systems designed for continuous operation over long-haul routes. Driver fatigue reduction drives demand for quality audio entertainment during extended driving shifts. Moreover, HCV systems incorporate multiple input sources including satellite radio, USB media, and smartphone connectivity supporting diverse driver preferences across international operations.

Sales Channel Analysis

OEM dominates with 69.8% due to integrated factory installation quality and warranty coverage benefits.

In 2025, OEM held a dominant market position in the By Sales Channel segment of Car Audio Market, with a 69.8% share. Factory-installed audio systems benefit from precise acoustic tuning during vehicle development and seamless integration with infotainment architectures. Consumers increasingly prefer OEM systems avoiding aftermarket installation complexity and potential vehicle warranty implications. Furthermore, automotive manufacturers leverage audio system branding as differentiation strategy, partnering with premium audio companies to enhance perceived vehicle value.

Speaker components in OEM channels undergo rigorous vehicle-specific acoustic optimization and durability testing. Factory speaker installations utilize custom mounting locations and enclosures designed during vehicle engineering phases. Additionally, OEM speakers receive weatherproofing and vibration resistance treatments ensuring longevity under automotive operating conditions.

Amplifier integration through OEM channels enables sophisticated vehicle electrical system coordination and thermal management. Factory amplifiers mount in optimized locations with proper cooling and power delivery from vehicle electrical architecture. Moreover, OEM amplifier tuning accounts for specific vehicle acoustics, speaker characteristics, and cabin geometry creating cohesive system performance.

DSP processors in factory systems receive comprehensive vehicle-specific acoustic calibration data during manufacturing. OEM DSP configurations correct for asymmetric speaker placement and cabin resonances unique to each vehicle model. Therefore, factory DSP tuning delivers superior acoustic performance compared to generic aftermarket solutions lacking vehicle-specific optimization data.

Microphone arrays in OEM installations integrate with vehicle infotainment, voice recognition, and active noise cancellation systems. Factory microphone placement optimization improves voice pickup quality while minimizing wind and road noise interference. Consequently, OEM microphone systems deliver superior hands-free communication and voice command recognition compared to aftermarket alternatives.

Tuners supplied through OEM channels provide seamless integration with vehicle antenna systems and infotainment displays. Factory tuner installations receive proper RF shielding and grounding minimizing interference from vehicle electrical systems. Additionally, OEM tuners support manufacturer-specific features including HD Radio, traffic information, and emergency alert systems.

Aftermarket channels serve vehicle owners seeking audio upgrades beyond factory-installed configurations. This segment appeals to audio enthusiasts demanding higher performance than OEM offerings and owners of older vehicles lacking modern connectivity. Moreover, aftermarket installations enable extensive customization including subwoofer additions, amplifier upgrades, and complete system replacements tailored to individual preferences.

Aftermarket Speaker upgrades represent the most common modification as direct replacements for factory units. Enthusiasts select speakers based on power handling, frequency response, and sensitivity specifications exceeding OEM component capabilities. Additionally, aftermarket speaker installations often include sound deadening materials reducing road noise and improving overall acoustic quality.

Aftermarket Amplifier additions provide power output unavailable from factory head units enabling high-performance speaker and subwoofer operation. External amplifiers deliver cleaner power with lower distortion improving dynamic range and overall sound quality. Furthermore, aftermarket amplifiers offer tuning flexibility through adjustable crossovers, gain controls, and equalization unavailable in integrated factory systems.

Aftermarket DSP processors enable advanced sound tuning and acoustic correction in vehicles with basic factory systems. Standalone DSP units provide parametric equalization, time alignment, and crossover management transforming mediocre factory audio into high-performance systems. Consequently, DSP upgrades represent cost-effective improvements delivering substantial acoustic benefits without complete system replacement.

Aftermarket Microphone upgrades improve hands-free calling quality and voice recognition accuracy in older vehicles. External microphone installations with noise-canceling technology enhance communication clarity in high-noise driving environments. Additionally, aftermarket microphones integrate with smartphone assistants enabling voice control capabilities absent from legacy factory systems.

Aftermarket Tuners add modern connectivity features to older vehicles including Bluetooth streaming, USB media playback, and smartphone integration. Replacement head units with integrated tuners provide updated user interfaces and compatibility with current mobile device ecosystems. Moreover, aftermarket tuners enable technology updates extending vehicle infotainment relevance without complete vehicle replacement.

Connectivity Technology Analysis

Wired dominates with 59.5% due to superior signal quality and universal compatibility advantages.

In 2025, Wired held a dominant market position in the By Connectivity Technology segment of Car Audio Market, with a 59.5% share. Wired connections including USB, auxiliary input, and proprietary interfaces deliver uncompressed audio signals with minimal latency. These physical connections avoid wireless protocol compatibility issues and provide reliable operation without pairing complexities. Furthermore, wired connections enable simultaneous device charging while streaming audio, addressing range anxiety for mobile device users during extended trips.

Wireless connectivity through Bluetooth, Wi-Fi, and emerging ultra-wideband technologies gains adoption as smartphone integration becomes standard. Modern wireless protocols deliver improved audio quality approaching wired connection performance while eliminating cable clutter. Additionally, wireless systems support multiple device pairing enabling seamless switching between passenger smartphones and automatic connection when entering vehicles.

Drivers

Rising Integration of AI-Powered Personalized Sound Tuning and Smart Noise-Cancellation Audio Architectures

Artificial intelligence technologies transform automotive audio through adaptive sound customization learning individual listener preferences. Machine learning algorithms analyze listening patterns, music genres, and environmental conditions to optimize equalization automatically. Moreover, AI-powered systems adjust audio settings based on vehicle speed, road surface, and cabin noise levels without manual intervention.

According to Harman research, energy-efficient EV audio and electronics system architectures can use about half the parts versus traditional systems, demonstrating AI optimization benefits. Smart noise-cancellation employs predictive algorithms generating anti-phase signals that eliminate unwanted ambient sounds before reaching passengers. Additionally, AI-enhanced audio processing reduces component counts through intelligent signal routing and multi-function processor consolidation.

In January 2024, Harman (Samsung subsidiary) expanded its Ready Vision and Ready Care automotive technology portfolio to enhance in-car audio and digital cockpit experiences. Neural processing enables real-time acoustic environment analysis adjusting speaker output for optimal sound distribution across seating positions. Therefore, AI integration represents fundamental shift from static audio configurations toward dynamic systems responding intelligently to changing conditions.

By Component

- Speaker

- 2-way

- 3-way

- 4-way

- Amplifiers

- DSP

- Microphone

- Tuners

By Sound Management

- Voice recognition

- Manual

By Vehicle

- Passenger Vehicles

- Hatchback

- Sedan

- SUV

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

By Sales Channel

- OEM

- Speaker

- Amplifier

- DSP

- Microphone

- Tuners

- Aftermarket

- Speaker

- Amplifier

- DSP

- Microphone

- Tuners

By Connectivity Technology

- Wired

- Wireless

Restraints

High Cost Burden of Multi-Speaker Premium Audio Configurations Limiting Mass-Market Vehicle Penetration

Premium audio systems with 10–20 speakers, dedicated amplifiers, and advanced DSP processing command significant price premiums. These high-end configurations add $2,000–$5,000 to vehicle costs, restricting adoption primarily to luxury segments and upper trim levels. Consequently, budget-conscious consumers purchasing entry-level and mid-range vehicles forgo premium audio options due to cost constraints.

Manufacturing complexity increases proportionally with speaker counts requiring extensive wiring, mounting hardware, and acoustic optimization. Component multiplication drives material costs, assembly time, and quality control requirements impacting overall vehicle production economics. Additionally, premium audio systems demand sophisticated integration with vehicle electrical architectures and infotainment platforms increasing engineering development expenses.

Mass-market manufacturers balance audio quality aspirations against price sensitivity in competitive vehicle segments. Cost-effective audio solutions sacrifice component counts and acoustic performance maintaining affordable pricing while meeting minimum consumer expectations. Therefore, market penetration of advanced audio technologies remains limited by economic realities of volume vehicle production and consumer willingness to pay.

Growth Factors

Expansion of Over-The-Air (OTA) Upgradable Audio Software and Feature Monetization Models in Connected Vehicles

Software-defined audio architectures enable post-purchase feature additions and performance enhancements through wireless updates. Manufacturers deploy subscription-based audio enhancements including spatial audio modes, personalized sound profiles, and premium equalization presets. Moreover, OTA capabilities allow continuous improvement of audio algorithms incorporating user feedback and acoustic optimization discoveries.

According to Harman Sustainability initiatives, manufacturing operations target 100% renewable electricity usage by 2025, demonstrating corporate commitment supporting sustainable growth. Connected vehicle platforms facilitate A/B testing of audio features with real-world user populations before full deployment. Additionally, software monetization creates recurring revenue streams beyond initial hardware sales transforming automotive audio into ongoing service relationship.

In January 2025, Sony Honda Mobility confirmed development progress on immersive 360 Reality Audio integration for next-gen software-defined vehicles. In February 2025, Continental expanded high-performance cockpit domain controllers enabling advanced audio signal processing within centralized vehicle compute architecture. Feature unlocking through digital purchases allows consumers to upgrade audio capabilities without physical component replacement, expanding addressable market to existing vehicle populations.

According to research, some audio products are manufactured using up to 90% post-consumer recycled plastic, supporting circular economy principles while reducing material costs. Aftermarket demand for customizable high-performance audio upgrades in aging vehicle fleets creates substantial growth opportunity. Vehicle owners seek modern connectivity and improved sound quality extending useful life of older vehicles through audio system replacement.

Emerging Trends

Surge in AI-Supported Infotainment, Voice Assistant, and Adaptive Sound Environment Technologies

Intelligent voice assistants integrated with automotive audio systems enable natural language control of entertainment, navigation, and vehicle functions. Advanced natural language processing understands context, handles multi-step commands, and personalizes responses based on driver preferences and historical interactions. Moreover, voice assistants reduce driver distraction by eliminating visual interface dependency during critical driving tasks.

Adaptive sound environments automatically adjust audio characteristics based on cabin occupancy, door positions, and window status. Smart systems detect passenger count and seating positions optimizing speaker balance and fade for occupied areas only. Additionally, adaptive technologies modify audio output compensating for wind noise, road surface changes, and vehicle speed variations maintaining consistent listening experience.

In May 2025, Dirac partnered with multiple OEMs to deploy next-generation digital room correction and spatial audio optimization software for vehicles. Smartphone ecosystem standardization through Apple CarPlay and Android Auto achieves near-universal vehicle compatibility. Native streaming applications including Spotify, Apple Music, and Amazon Music integrate seamlessly with vehicle infotainment eliminating external device dependency.

According to arXiv research, neural acoustic modeling reduced phase reconstruction error by over 51%, enabling unprecedented acoustic precision. Spatial audio technologies including Dolby Atmos create three-dimensional sound fields with height channels and object-based mixing. Multi-zone cabin sound experiences allow simultaneous different audio content for front and rear passengers without headphones.

Regional Analysis

Asia Pacific Dominates the Car Audio Market with a Market Share of 39.10%, Valued at USD 4.5 Billion

Asia Pacific commands the largest global market share driven by massive vehicle production volumes in China, Japan, and South Korea. Regional automotive manufacturing centers integrate advanced audio systems across diverse vehicle segments from economy to luxury. Moreover, Asia Pacific holds a 39.10% market position valued at USD 4.5 Billion, reflecting strong consumer demand for in-vehicle entertainment technologies and rising disposable incomes across emerging economies.

North America Car Audio Market Trends

North America demonstrates strong preference for premium factory-installed audio systems with established brand partnerships. Regional consumers prioritize smartphone integration, voice control, and wireless connectivity in vehicle purchasing decisions. Additionally, extensive commute times and long-distance travel patterns drive demand for high-quality entertainment systems across passenger vehicle segments.

Europe Car Audio Market Trends

Europe emphasizes premium audio quality with strong market presence of luxury vehicle manufacturers offering branded sound systems. Stringent vehicle noise regulations indirectly benefit audio markets through improved cabin quietness enabling better acoustic performance. Furthermore, European consumers demonstrate willingness to specify optional premium audio packages during vehicle configuration reflecting sophisticated audiophile preferences.

Latin America Car Audio Market Trends

Latin America focuses on aftermarket audio upgrades due to price-sensitive new vehicle markets with basic factory systems. Regional consumers personalize vehicles through custom audio installations reflecting cultural emphasis on music and entertainment. Moreover, growing middle-class populations increase discretionary spending on vehicle enhancement including audio system improvements and connectivity upgrades.

Middle East & Africa Car Audio Market Trends

Middle East and Africa markets segment between luxury vehicle preferences in Gulf regions and practical transportation in developing economies. Premium vehicle segments adopt high-end factory audio systems while mass-market vehicles rely on basic functionality. Additionally, extreme climate conditions require audio components with enhanced temperature tolerance and reliability under harsh environmental operating conditions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Alpine Electronics Inc. delivers specialized automotive audio solutions emphasizing sound quality and integration capabilities across diverse vehicle platforms. The company develops head units, speakers, and amplifiers optimized for aftermarket installations with extensive vehicle compatibility. Alpine maintains strong presence in performance audio segments targeting enthusiasts seeking superior sound reproduction. Moreover, the company invests in wireless connectivity and smartphone integration technologies meeting evolving consumer connectivity expectations.

Harman International operates as Samsung subsidiary providing comprehensive automotive audio systems and connected car technologies. The company partners with premium automotive brands deploying co-branded audio systems including JBL, Harman Kardon, and Mark Levinson configurations. Harman develops advanced DSP algorithms, amplifier architectures, and speaker technologies for factory-installed premium audio experiences. Additionally, the company expands into software-defined audio platforms enabling OTA feature upgrades and subscription-based audio enhancements.

Sony Corporation leverages consumer electronics expertise delivering high-fidelity automotive audio components and complete system solutions. The company integrates proprietary audio technologies including digital amplification, noise cancellation, and spatial audio processing into vehicle applications. Sony collaborates with automotive manufacturers on next-generation entertainment systems incorporating immersive audio formats. Furthermore, the company explores automotive opportunities through Sony Honda Mobility joint venture developing software-defined vehicle audio architectures.

Bose Corporation specializes in premium automotive audio systems featuring proprietary acoustic technologies and signal processing innovations. The company maintains exclusive partnerships with luxury automotive brands providing factory-installed high-end audio configurations. Bose develops active noise cancellation, adaptive equalization, and multi-channel surround sound technologies specifically optimized for challenging vehicle acoustic environments. The November 2024 acquisition of McIntosh Group expands capabilities in ultra-premium automotive audio segments through specialized luxury brand integration.

Key players

- Alpine Electronics Inc.

- Harman International

- Sony Corporation

- Bose Corporation

- Pioneer Corporation

- Blaupunkt GmbH

- Panasonic Corporation

- JVC Kenwood Corporation

- Clarion Co., Ltd.

Recent Developments

- March 2024 – Panasonic Automotive launched an upgraded SkipGen IV automotive infotainment processor platform to support advanced in-vehicle audio and multimedia performance with enhanced processing capabilities enabling 4K video and multi-zone audio distribution across vehicle cabin environments.

- June 2024 – JVCKENWOOD introduced next-generation in-car receivers supporting high-resolution audio playback and enhanced connectivity featuring wireless smartphone integration, HD Radio reception, and compatibility with lossless audio formats delivering studio-quality sound reproduction in automotive environments.

- September 2024 – LG acquired automotive software company Cybellum assets to strengthen vehicle software and connected car platform capabilities including infotainment ecosystems, demonstrating strategic commitment to integrated digital cockpit and audio system development for next-generation vehicles.

- October 2024 – Qualcomm expanded Snapdragon Digital Chassis collaborations to support premium in-vehicle audio processing and immersive sound systems, enabling advanced computational audio algorithms, spatial audio rendering, and AI-powered acoustic optimization across multiple automotive manufacturer partnerships.

- November 2024 – Mahindra introduced new EV models featuring premium multi-speaker Harman Kardon audio systems integrated with connected infotainment architecture, offering 12-speaker configurations with dedicated amplification and digital signal processing optimized for electric vehicle cabin acoustics.

Report Scope

Report Features Description Market Value (2025) USD 11.6 Billion Forecast Revenue (2035) USD 24.6 Billion CAGR (2026-2035) 7.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Speaker (2-way, 3-way, 4-way), Amplifiers, DSP, Microphone, Tuners), By Sound Management (Voice recognition, Manual), By Vehicle (Passenger Vehicles (Hatchback, Sedan, SUV), Commercial Vehicles (Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV))), By Sales Channel (OEM (Speaker, Amplifier, DSP, Microphone, Tuners), Aftermarket (Speaker, Amplifier, DSP, Microphone, Tuners)), By Connectivity Technology (Wired, Wireless) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alpine Electronics Inc., Harman International, Sony Corporation, Bose Corporation, Pioneer Corporation, Blaupunkt GmbH, Panasonic Corporation, JVC Kenwood Corporation, Clarion Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alpine Electronics Inc.

- Harman International

- Sony Corporation

- Bose Corporation

- Pioneer Corporation

- Blaupunkt GmbH

- Panasonic Corporation

- JVC Kenwood Corporation

- Clarion Co., Ltd.