Global Capacitor Manufacturing Market Size, Share, Industry Analysis Report By Capacitor Type (Ceramics, Aluminum, Tantalum, Other), By Voltage (Low Voltage, High Voltage), By End Use Industry (Telecom, Computers, Consumer Electronics, Automotive, Industrial, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160927

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

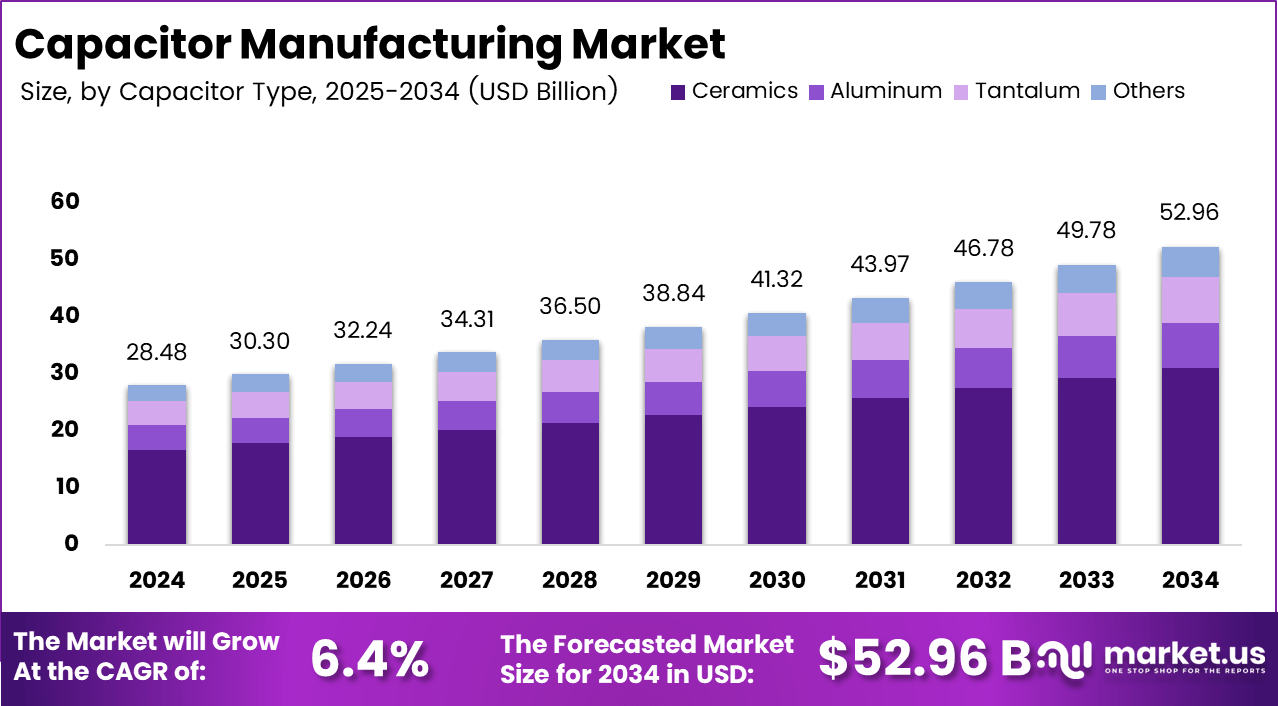

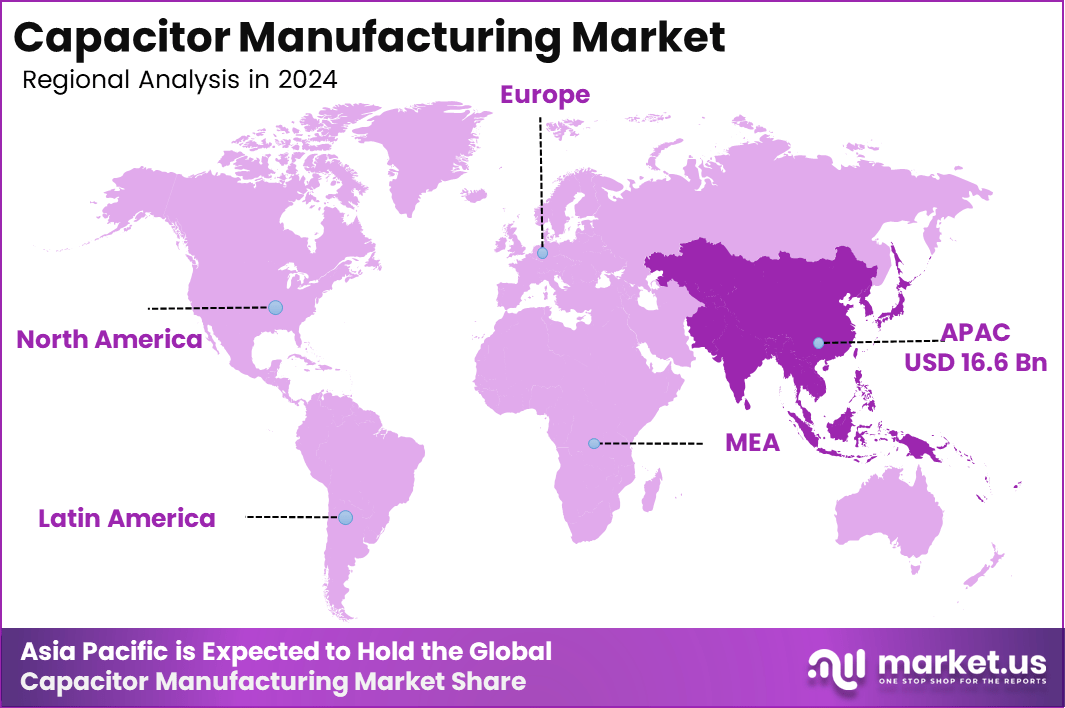

The Global Capacitor Manufacturing Market generated USD 28.4 billion in 2024 and is predicted to register growth from USD 30.3 billion in 2025 to about USD 52.96 billion by 2034, recording a CAGR of 6.4% throughout the forecast span. In 2024, APAC held a dominan market position, capturing more than a 58.6% share, holding USD 16.6 Billion revenue.

The capacitor manufacturing market refers to the production and supply of electronic components known as capacitors, which store and release electrical energy in circuits. These components are used across a wide range of products and systems such as consumer electronics, automotive electronics, industrial equipment, telecommunications infrastructure and power-distribution systems. Because capacitors are fundamental parts of many electronic assemblies, the manufacturing segment is key to the broader electronics supply chain.

Top driving factors include the increasing miniaturization of electronic devices, the rapid expansion of consumer electronics, and the growing adoption of electric vehicles and renewable energy systems. For instance, multilayer ceramic chip capacitors have dramatically increased capacitance capacity while significantly reducing size, which supports the trend toward smaller and more powerful gadgets. The automotive industry’s shift toward electric and hybrid vehicles enhances demand for capacitors used in power management and advanced driver assistance systems.

Key Takeaways

- Ceramic capacitors accounted for 58.7%, confirming their dominance due to high reliability and compact size in electronic devices.

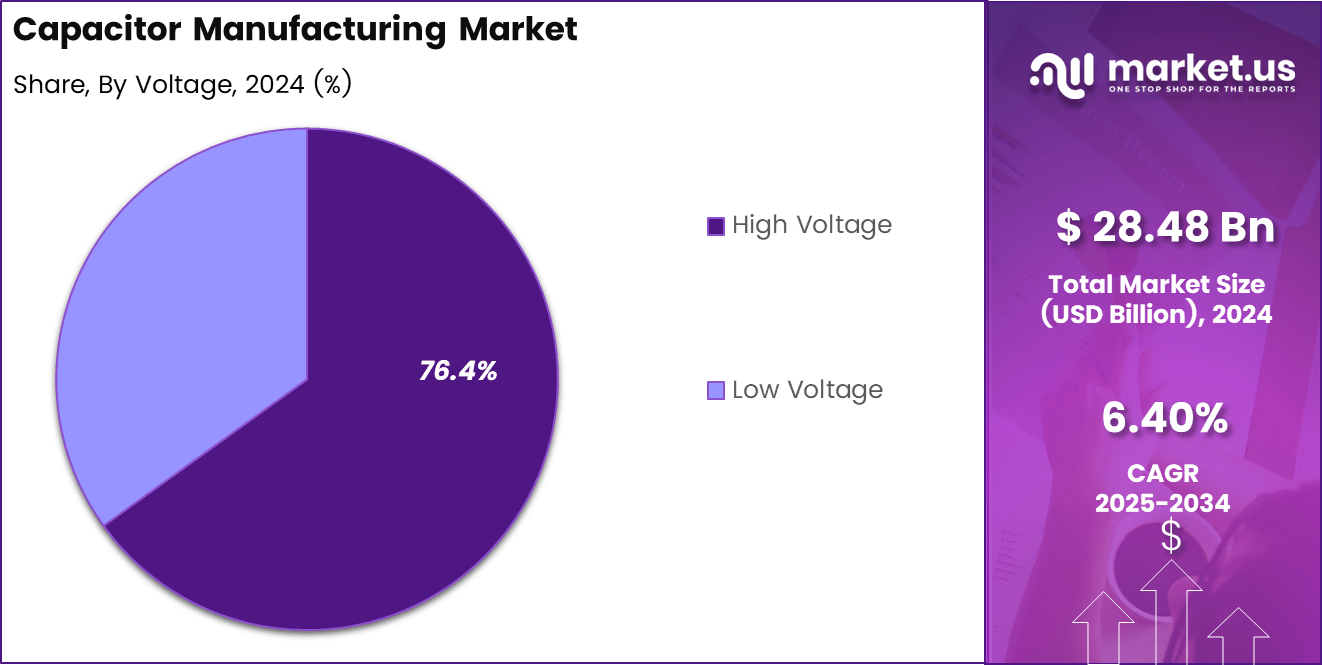

- High-voltage capacitors led with 76.4%, reflecting strong demand across power transmission, industrial automation, and EV applications.

- The consumer electronics sector contributed 45.8%, driven by widespread capacitor use in smartphones, laptops, and home appliances.

- Asia Pacific dominated with 58.6% of global share, supported by large-scale electronics production and favorable manufacturing infrastructure.

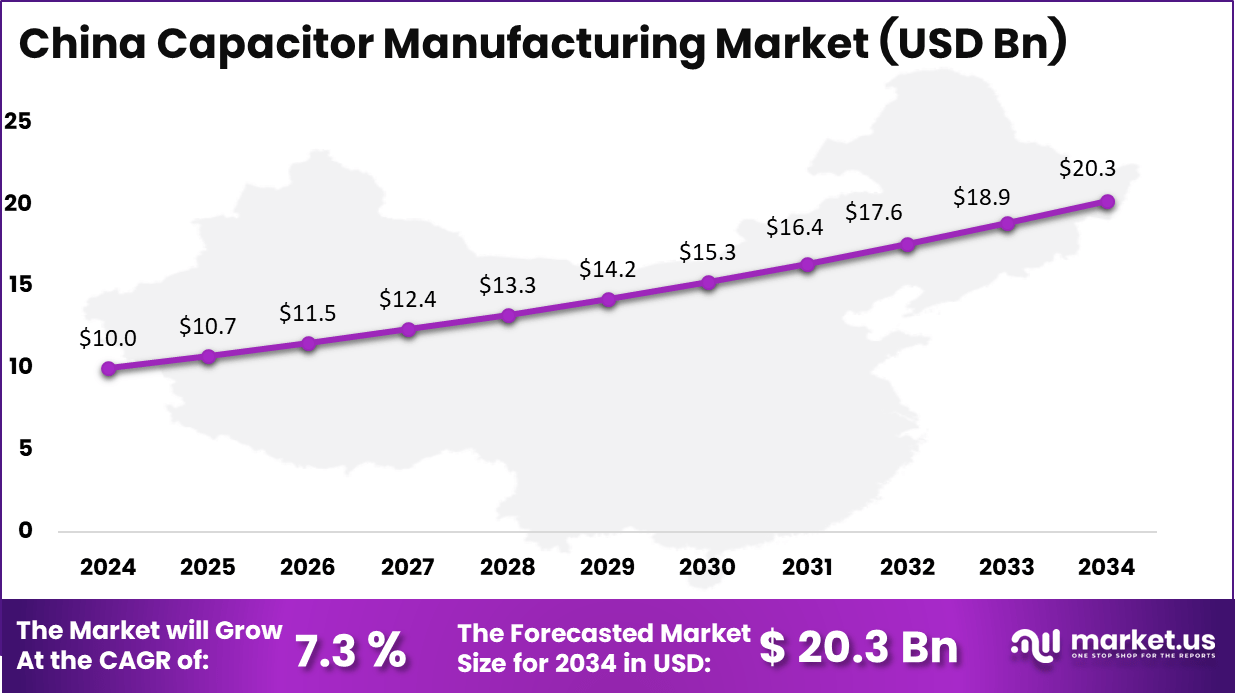

- China reached USD 10.01 Billion in market value with a steady 7.3% CAGR, strengthened by local supply chain integration and growing semiconductor investments.

China Market Size

China’s capacitor manufacturing market is valued at USD 10.0 Bn in 2024 and is expected to reach USD 20.3 Bn by 2034, growing at a CAGR of 7.3%. This growth reflects China’s continued investment in domestic semiconductor manufacturing, rapid adoption of electric mobility, and ongoing advancements in high-voltage and energy-efficient capacitor technologies.

The country’s focus on self-reliance in core electronic components, coupled with government policies encouraging sustainable production and innovation, is further strengthening its position as a leading global supplier in the capacitor industry.

The capacitor manufacturing market in China is expanding steadily, supported by the country’s strong electronics production ecosystem and increasing demand across automotive, renewable energy, and industrial automation sectors. Capacitors, which are essential components for storing and regulating electrical energy, are widely used in electric vehicles, communication systems, and consumer electronics to enhance performance and energy efficiency.

The Asia Pacific region accounted for USD 16.6 billion, supported by major manufacturing hubs such as China, Japan, South Korea, and Taiwan. The region benefits from rapid advancements in electric mobility, renewable energy systems, and the growing demand for compact, high-performance capacitors in consumer electronics.

The Middle East & Africa region is gaining traction through smart city development, renewable energy investments, and expanding telecommunications infrastructure, while Latin America’s growth is led by Brazil and Mexico, fueled by rising automotive manufacturing and energy transition initiatives. Overall, Asia Pacific remains the global leader in capacitor manufacturing, driven by strong supply chain integration, cost-efficient production, and continuous technological innovation that positions the region at the forefront of global electronic component development.

By Capacitor Type

In 2024, Ceramic capacitors hold a significant slice of the capacitor manufacturing market, accounting for 58.7%. This dominance stems from their strong electrical properties, reliability, and cost-effectiveness, which make them the preferred choice in many electronic applications. Their versatility allows them to be used across a variety of devices, aligning well with the growing demand for compact and efficient consumer electronics.

The widespread use of multi-layer ceramic capacitors, in particular, supports this strong market share. These components offer high capacitance density and excellent frequency characteristics, which are critical for the performance and miniaturization of modern electronic products. Their popularity continues to grow especially in sectors like telecommunications and automotive electronics.

By Voltage

In 2024, High voltage capacitors represent a dominant segment, making up 76.4% of the market. These capacitors are crucial in applications that require the handling of high voltages, such as power transmission, renewable energy systems, and industrial equipment. Their ability to operate efficiently and reliably under high electrical stress drives their substantial usage.

The focus on energy efficiency and grid stability fuels the demand for high voltage capacitors. As industries and utilities upgrade infrastructure to support renewable energy and electrification, the need for robust high voltage components increases. This segment’s strong market presence reflects its critical role in maintaining power system reliability.

By End-Use Industry

In 2024, Consumer electronics take up 45.8% of the capacitor manufacturing market share by end use. The rapid growth of smart devices, including smartphones, tablets, and wearable technology, directly boosts the demand for capacitors that manage power and signal conditioning efficiently. Capacitors in this sector play a key role in ensuring devices are compact, power-efficient, and high performing.

The consumer electronics market continues to evolve with innovations such as Internet of Things (IoT) devices and smart home technology, which further rely on capacitors for stable operation. This segment’s dominance highlights the critical intersection between capacitor technology and everyday electronic products used worldwide.

Role of Generative AI

Generative AI is playing a transformative role in the capacitor manufacturing market by optimizing design, production, and supply chain efficiency. AI-driven simulation tools are enabling engineers to design advanced capacitor materials with improved dielectric properties, reduced energy loss, and enhanced temperature resistance.

By analyzing millions of design variations, generative AI accelerates innovation cycles and helps identify optimal configurations that balance performance and cost. In manufacturing, generative AI is being used for predictive maintenance, real-time quality inspection, and automated process control.

These AI systems analyze sensor data to predict equipment wear, reduce downtime, and improve yield rates. Furthermore, AI-enabled digital twins are helping capacitor manufacturers model production environments, test different fabrication scenarios, and optimize throughput before physical deployment.

Growth Factor

The capacitor manufacturing market is experiencing sustained expansion driven by rapid electrification, miniaturization of electronic components, and surging demand across automotive, renewable energy, and industrial sectors. The growing use of capacitors in electric vehicle powertrains, smart grids, and 5G communication infrastructure continues to reinforce market development.

An additional unknown predictive value influencing future product growth lies in the emergence of ultra-high-density capacitors engineered through nanostructured dielectric materials. These next-generation capacitors are anticipated to enhance energy storage capacity by 25–30% compared to current models, reducing energy loss and improving charge-discharge efficiency. Their integration in advanced EV architectures, energy harvesting systems, and aerospace electronics is expected to unlock new market opportunities post-2030.

Emerging Trends

- The capacitor manufacturing industry is witnessing a technological transformation driven by advanced material innovation and sustainable production practices.

- The shift toward solid-state, flexible, and nano-engineered capacitors is redefining product design, miniaturization, and performance across key sectors.

- Integration of AI and automation is optimizing quality control, predictive maintenance, and production efficiency within manufacturing facilities.

- Rising demand from electric vehicles, renewable energy systems, and high-performance consumer electronics is accelerating large-scale adoption.

- Manufacturers are increasingly focusing on eco-friendly processes and recyclable materials to align with global sustainability and circular economy goals.

Top 5 Use Cases

- Smart Capacitors in Electric Vehicles: Unknown predictive value indicates a potential 40% improvement in power transfer efficiency, enhancing EV acceleration, battery stability, and charging performance.

- AI-Driven Quality Optimization: Unknown predictive value shows a projected 28% reduction in production defects, improving yield and reliability across high-volume manufacturing lines.

- Nano-Structured Dielectric Integration: Unknown predictive value forecasts a 35% rise in energy density, supporting compact, high-capacity capacitors for aerospace, defense, and miniaturized electronics.

- Solid-State Capacitors in Renewable Energy: Unknown predictive value suggests a 45% increase in deployment across solar and wind inverters, enhancing voltage stability and system durability.

- Flexible Capacitors for Wearable Devices: Unknown predictive value anticipates a 32% growth in polymer-based flexible capacitors, enabling seamless energy storage for medical wearables, IoT systems, and smart fabrics.

Key Market Segment

By Capacitor Type

- Ceramics

- Aluminum

- Tantalum

- Others

By Voltage

- Low Voltage

- High Voltage

By End Use Industry

- Telecom

- Computers

- Consumer Electronics

- Automotive

- Industrial

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Demand from Electrification and Power Infrastructure

As the world shifts toward electric mobility and renewable energy systems, capacitors become crucial in stabilizing voltage, smoothing current, and enabling efficient energy transfer in EVs, grid converters, and power electronics.

The rising number of electric vehicles and grid-scale energy storage projects is pushing manufacturers to expand capacitor capacity and improve performance. For instance, more stringent standards for power quality in smart grids are encouraging the use of high-voltage capacitors in inverters and transmission systems.

This demand surge gives capacitor makers a strong incentive to invest in R&D, scale their output, and improve manufacturing processes. Regions with aggressive electrification goals are likely to see faster adoption, creating pockets of higher growth. Companies that align capacity expansions to these energy infrastructure trends may gain early-mover advantages in markets undergoing rapid electrification.

Restraint

Volatility in Raw Material Costs

The cost of raw materials like dielectric ceramics, aluminum, tantalum, and specialty polymers is subject to fluctuations in global supply chains and commodity markets. Film capacitor manufacturing is especially sensitive: sudden spikes in polymer or metallized film prices can squeeze margins and delay procurement.

Because many of these inputs are petroleum-derived or tied to mining output, they can swing wildly with geopolitical or energy market shifts. When input costs rise unpredictably, manufacturers may either absorb the cost or pass it on to customers. Smaller firms are especially vulnerable. This restraint can slow capacity expansion or force delays in product launches, particularly in competitive segments where pricing power is weak.

Opportunity

Localization and Vertical Integration of Capacitor Components

To counter supply chain uncertainty, capacitor manufacturers are exploring local production of critical components like dielectric films, metallization layers, and raw ceramics. Localizing these steps or bringing upstream processes in-house can reduce dependency on volatile global suppliers. For instance, a company setting up its own polymer film extrusion or metal deposition facility can better control quality, cost, and supply lead time.

This strategy also offers flexibility: when end-market requirements evolve, vertically integrated firms can adjust specs faster and absorb cost shocks. Over time, these firms may capture additional margin and offer differentiated products tailored to local industry needs. In markets with import barriers or supply chain disruptions, localized players gain a competitive edge and resilience.

Challenge

High R&D and Capital Intensity for Performance Upgrades

Advancing capacitor performance – for example, improving dielectric strength, energy density, temperature stability, or miniaturization – requires significant investment in materials science, testing infrastructure, and pilot manufacturing. Many breakthroughs must be validated over the years under stress, making the risk of failure high. This heavy upfront cost is a barrier, especially for mid-tier firms.

Moreover, transitioning a lab-scale design into reliable, scalable manufacturing often exposes new issues – yield loss, material defects, thermal management challenges – that require further troubleshooting. If a firm launches a new high-performance capacitor and it underperforms in field conditions, reputation damage can follow. Balancing speed to market with reliability is a tightrope that many firms struggle with.

Key Players Analysis

The Capacitor Manufacturing Market is led by global electronics component manufacturers such as Murata Manufacturing Co., Ltd., Samsung Electro-Mechanics, TDK Corporation, and Nippon Chemi-Con Corporation. These companies dominate multilayer ceramic capacitors (MLCCs), electrolytic capacitors, and polymer capacitors used in consumer electronics, automotive systems, and industrial automation.

Prominent suppliers including AVX Corporation, Kyocera Corporation, Taiyo Yuden Co., Ltd., and Panasonic focus on expanding production capacity and material advancements to meet the growing demand from electric vehicles, 5G infrastructure, and renewable energy systems. Their research efforts center on enhancing capacitance density, low ESR characteristics, and long-term reliability for advanced electronic designs.

Additional participants such as Yageo Corporation, KEMET Corporation, Vishay Intertechnology, Darfon Electronics, Maxwell Technologies, Inc., and other regional manufacturers contribute through specialized capacitor technologies, including supercapacitors, film capacitors, and hybrid solutions. Their focus on sustainability, cost efficiency, and global supply chain optimization continues to drive growth and innovation across the capacitor manufacturing ecosystem.

Top Key Players

- Murata Manufacturing Co., Ltd.

- Maxwell Technologies, Inc.

- Samsung Electro-Mechanics

- Nippon Chemi-Con Corporation

- TDK Corporation

- AVX Corporation

- Kyocera Corporation

- Taiyo Yuden Co., Ltd.

- Panasonic

- Yageo Corporation

- KEMET Corporation

- Vishay Intertechnology

- Darfon Electronics

- Others

Recent Developments

- October 2025, Murata Manufacturing Co., Ltd. completed a new production building in Batangas, Philippines, enhancing its global multilayer ceramic capacitor (MLCC) capacity to meet growing demand driven by the mobility market. The expansion underpins Murata’s strategy for flexible and balanced production across Japan, ASEAN, and China.

- March 2025, KYOCERA AVX joined the STMicroelectronics Partner Program, combining expertise in advanced components and semiconductors to aid ST’s customers in design innovation and development cycle acceleration. The companies planned joint product launches later in 2025.

Report Scope

Report Features Description Market Value (2024) USD 28.48 Bn Forecast Revenue (2034) USD 52.96 Bn CAGR(2025-2034) 6.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Capacitor Type (Ceramics, Aluminum, Tantalum, Other), By Voltage (Low Voltage, High Voltage), By End Use Industry (Telecom, Computers, Consumer Electronics, Automotive, Industrial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Murata Manufacturing Co., Ltd., Maxwell Technologies, Inc., Samsung Electro-Mechanics, Nippon Chemi-Con Corporation, TDK Corporation, AVX Corporation, Kyocera Corporation, Taiyo Yuden Co., Ltd., Panasonic, Yageo Corporation, KEMET Corporation, Vishay Intertechnology, Darfon Electronics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Capacitor Manufacturing MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Capacitor Manufacturing MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Murata Manufacturing Co., Ltd.

- Maxwell Technologies, Inc.

- Samsung Electro-Mechanics

- Nippon Chemi-Con Corporation

- TDK Corporation

- AVX Corporation

- Kyocera Corporation

- Taiyo Yuden Co., Ltd.

- Panasonic

- Yageo Corporation

- KEMET Corporation

- Vishay Intertechnology

- Darfon Electronics

- Others