Canine Total Knee Replacement Market By Product Type (Implant Systems, Instruments & Accessories), By Material Type (Metals and Metal Alloys, Polymers/Bone Cements), By End-User (Veterinary Hospitals & Clinics, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153583

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

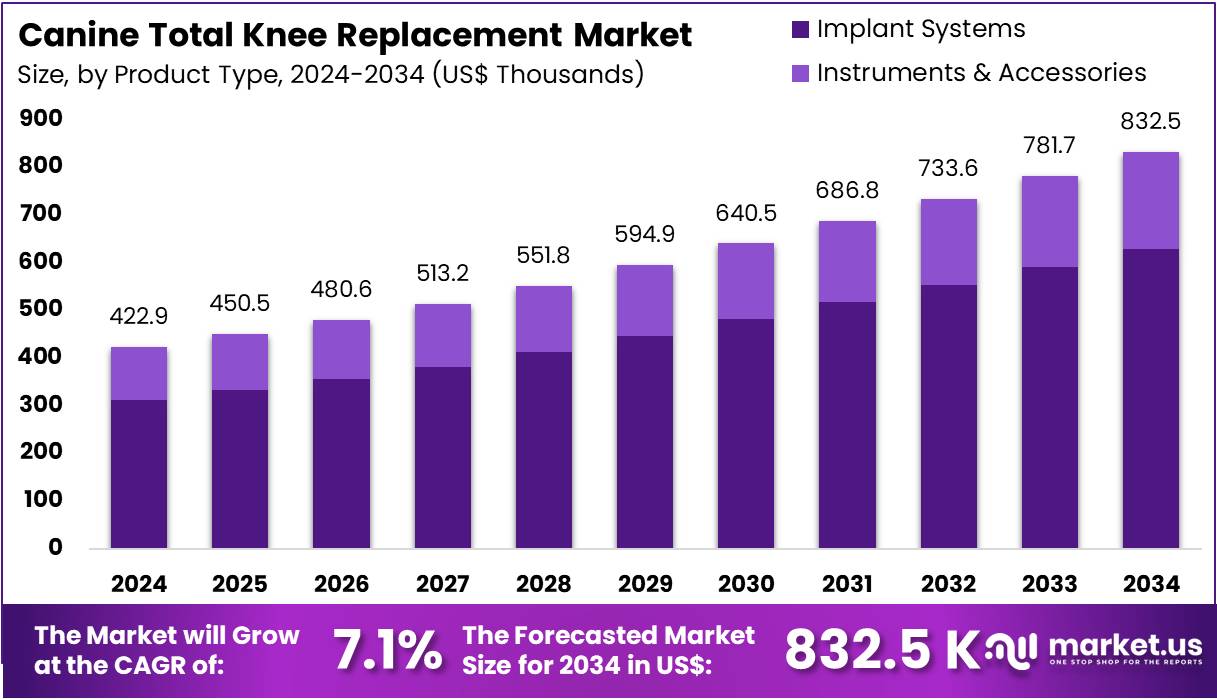

The Canine Total Knee Replacement Market Size is forecasted to be valued at US$ 832.5 K by 2034 from US$ 422.9 K in 2024, growing at a CAGR of 7.1% during the forecast period 2025 to 2034.

The Global Canine Total Knee Replacement (TKR) market is emerging as a specialized segment within veterinary orthopedics, driven by the growing prevalence of canine osteoarthritis and advancements in surgical solutions. Canine TKR is a surgical intervention used primarily for severe stifle joint degeneration, particularly in large or active breeds where traditional treatments like TPLO or TTA are ineffective. The market is supported by increasing pet ownership, rising willingness among owners to invest in advanced veterinary care, and improvements in implant materials and surgical tools.

Global 2020 2021 2022 2023 2024 CAGR Revenue 378.38 381.99 388.72 400.99 422.86 7.1% Veterinary hospitals and specialty clinics are expanding their orthopedic capabilities, with companies like BioMedtrix, Fitzpatrick Referrals, and KYON AG offering innovative systems and instruments. The integration of digital planning, breed-specific implants, and cementless designs is reshaping procedural outcomes. With greater awareness and growing specialist adoption, the canine TKR market is set for steady growth, especially in developed regions such as North America and Europe, where pet healthcare expenditure is high.

The standard canine TKR procedure typically involves the surgical removal of the damaged femoral and tibial condyles and replacing them with metallic prostheses (often cobalt-chromium alloys) and a polyethylene insert acting as an artificial meniscus. Manufacturers like BioMedtrix offer the Canine Total Knee™ system, one of the most widely adopted modular prosthetic solutions, featuring cemented and press-fit options for secure fixation. The procedure is often preceded by advanced imaging (CT or MRI) for surgical planning and requires post-operative rehabilitation to ensure proper limb function.

As companion animal longevity increases due to better nutrition and veterinary care, so does the incidence of degenerative joint diseases like osteoarthritis. According to the American College of Veterinary Surgeons (ACVS), Osteoarthritis (OA) is the most common orthopedic condition observed in dogs, with estimated clinical prevalence of ~2.5% that increases to 20% when evaluated post-mortem. While TPLO and TTA are often used initially, dogs with progressive cartilage degradation or failed prior surgeries may require total knee replacement. The demand for TKR in veterinary medicine is thus driven by the need to restore mobility, alleviate chronic pain, and enhance the quality of life for aging or active canines.

Government initiatives and funding for veterinary care are playing a pivotal role in improving access to advanced treatments like TKR. In the United States, the USDA APHIS (Animal and Plant Health Inspection Service) offers various funding opportunities aimed at enhancing animal health. On a global scale, the World Organisation for Animal Health (WOAH) is instrumental in setting animal health standards, providing member countries with support through initiatives such as the PVS Pathway, which assists nations in assessing and improving their veterinary services.

The growing trend of treating pets as family members has further fueled demand for specialized and high-quality veterinary treatments. As pet owners increasingly invest in advanced surgeries like TKR, the market experiences heightened demand. In Asia, the surge in pet adoption over the past decade is evident, with 60% of the population owning pets, and 32% considering their cats and dogs to be their best friends.

Key Takeaways

- In 2024, the market for canine total knee replacement generated a revenue of US$ 422.9 K, with a CAGR of 7.1%, and is expected to reach US$ 832.5 K by the year 2034.

- By product type, implant systems segment dominated the market with 73.6% share in 2024.

- Based on the material type segment, metals and metal alloys was the largest segment, which accounted for 66.3% share in 2024.

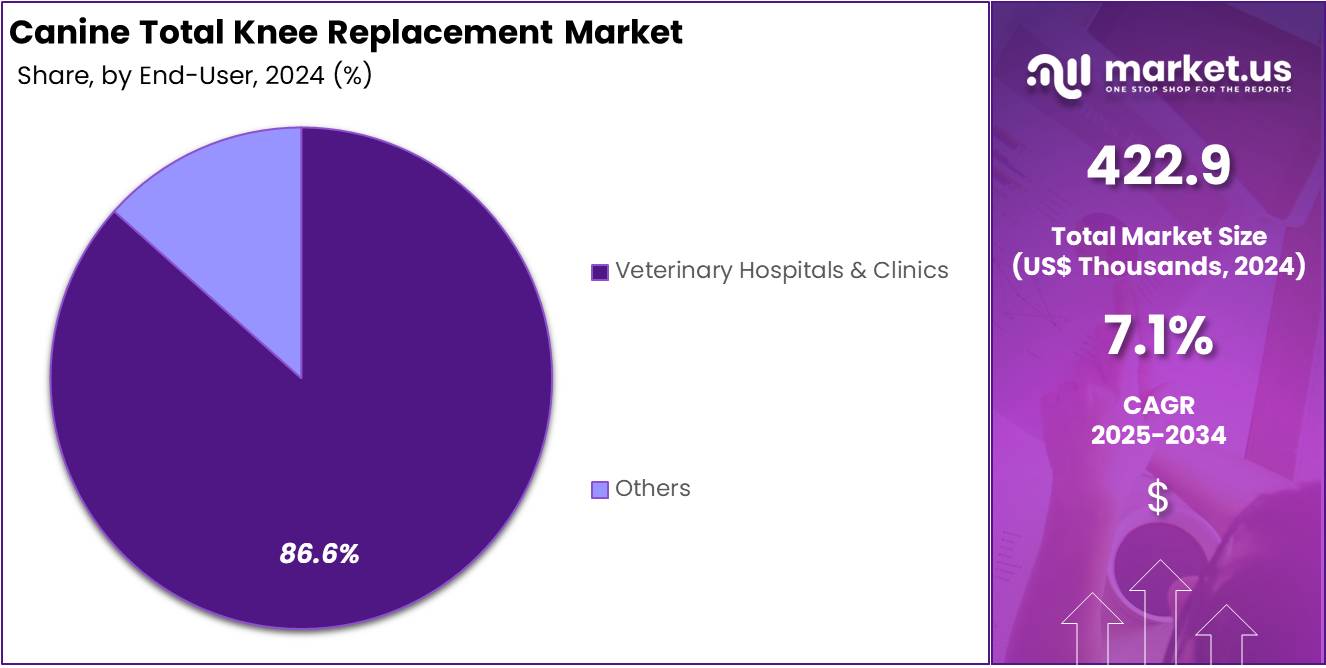

- By end-user, Veterinary Hospitals & Clinics was the largest revenue generating segment in 2024 holding 86.6% share.

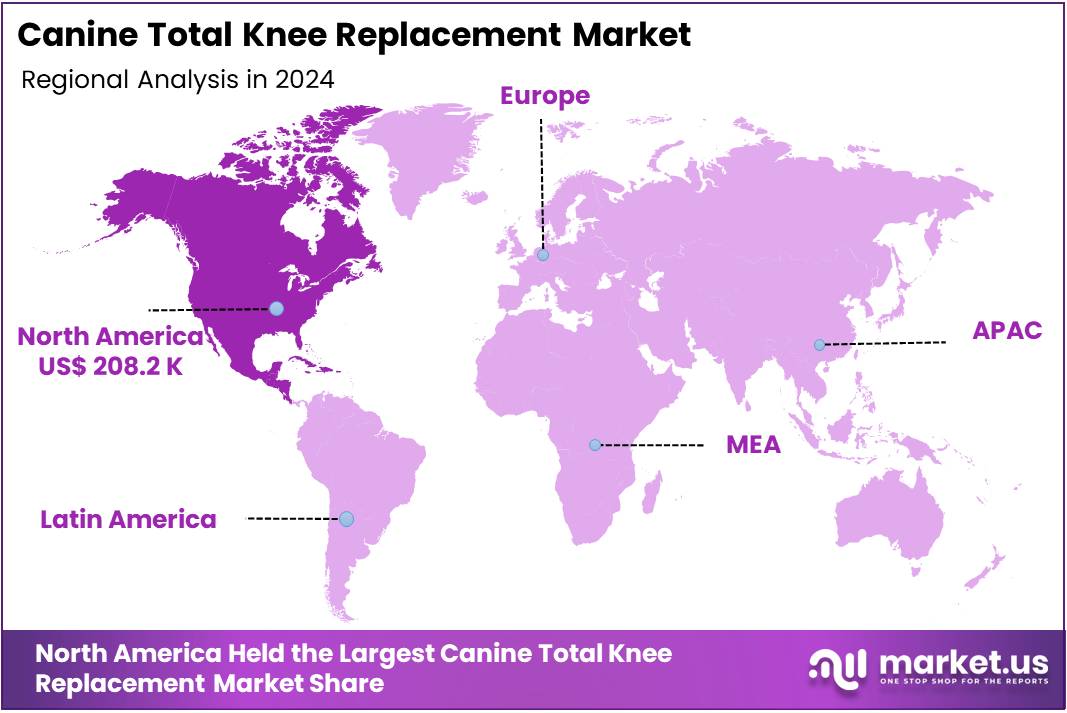

- North America held the largest share in the global canine TKR market with US accounting for 92.0% share in 2024.

Product Type Analysis

The Implant Systems segment held 73.6% share in 2024, which encompass prosthetic components specifically designed to replace the diseased or damaged structures of the canine stifle (knee) joint. These systems are critical for restoring mobility, alleviating chronic pain, and improving the quality of life in dogs suffering from end-stage osteoarthritis or traumatic joint degeneration.

Implant systems typically include femoral, tibial, and patellar components made of biocompatible materials such as titanium, cobalt-chromium alloys, and UHMWPE (ultra-high molecular weight polyethylene). The shift toward cementless and biologically integrative implant systems is driving innovation, allowing for long-term stability through osseointegration rather than bone cement.

The segment is experiencing growth due to increasing veterinary specialist adoption, rising pet owner willingness to invest in advanced care, and expanding use of human orthopedic design concepts in veterinary applications. For example, BioMedtrix offers a Canine Total Knee system that replicates natural joint movement and uses cementless fixation. KYON AG also provides modular TKR systems that allow for precise sizing and alignment, improving surgical outcomes.

Canine Total Knee Replacement Market, Product Type Analysis, 2020-2024 (US$ Thousands)

Product Type 2020 2021 2022 2023 2024 Implant Systems 276.37 279.28 284.42 294.44 311.16 Instruments & Accessories 102.01 102.71 104.30 106.54 111.70 Material Type Analysis

The metals and metal alloys segment represents the dominant material type used in the manufacturing of canine total knee replacement (TKR) implant systems. These materials form the structural components of the prosthetic joint primarily the femoral and tibial implants and are selected for their mechanical strength, wear resistance, and biocompatibility. This segment held 66.3% market share in 2024 of the material type market, driven by the need for durable, long-lasting implants in dogs with severe osteoarthritis. As minimally invasive surgeries and cementless techniques grow in popularity, demand for advanced metal-based implants with porous coatings and customized geometries is expected to rise steadily.

Metals and metal alloys are engineered for long-term stability, ensuring the implants can sustain tensile and compressive forces from daily canine activity. For example, in clinical trials, cementless titanium knee implants in large breeds have shown over 6 years of successful function with minimal bone resorption or loosening. For example, titanium and Titanium Alloys (Ti-6Al-4V) are known for their lightweight, corrosion resistance, and osseointegration properties. Ideal for cementless TKR systems like those from BioMedtrix and Innoplant Medizintechnik GmbH, where biological fixation is key.

Canine Total Knee Replacement Market, Material Type Analysis, 2020-2024 (US$ Thousands)

Material Type 2020 2021 2022 2023 2024 Metals and Metal Alloys 244.17 246.66 252.34 263.37 280.37 Polymers/Bone Cements 134.21 135.33 136.38 137.61 142.49 End-User Analysis

The Veterinary Hospitals & Clinics segment is the largest end-user category in the global canine TKR Market accounting for 86.6% market share in 2024. These facilities are the primary centers for performing TKR surgeries, post-operative care, and long-term patient follow-ups, thereby playing a pivotal role in driving market demand and adoption.

Veterinary hospitals and specialty clinics possess the necessary surgical infrastructure, such as sterile operating rooms, advanced imaging (CT/MRI), and anesthesia equipment, critical for successful TKR procedures. Many employ board-certified veterinary orthopedic surgeons, making them the go-to institutions for complex procedures like total knee replacement.

These facilities also offer rehabilitation services including hydrotherapy, laser therapy, and physiotherapy, that are crucial for optimal recovery and functional restoration in dogs after TKR surgery. In 2024, more than 75% of all canine orthopedic surgeries including total knee replacements are conducted in referral hospitals and specialty clinics, especially in North America and Europe.

Canine Total Knee Replacement Market, End-User Analysis, 2020-2024 (US$ Thousands)

End-User 2020 2021 2022 2023 2024 Veterinary Hospitals & Clinics 326.28 329.50 335.49 346.59 366.18 Others 52.11 52.49 53.23 54.39 56.68 Key Market Segments

By Product Type

- Implant Systems

- Instruments & Accessories

By Material Type

- Metals and Metal Alloys

- Polymers/Bone Cements

By End-User

- Veterinary Hospitals & Clinics

- Others

Drivers

Rising Prevalence of Canine Osteoarthritis and Joint Degeneration

One of the primary driving forces behind the growth of the Global Canine Total Knee Replacement (TKR) Market is the rising prevalence of osteoarthritis (OA) and degenerative joint diseases in dogs, particularly among large breeds and aging pets. Osteoarthritis affects approximately 20% to 25% of the canine population, according to the American College of Veterinary Surgeons (ACVS), and is especially prevalent in older, overweight, or highly active dogs.

It leads to the progressive degeneration of joint cartilage, chronic pain, and reduced mobility conditions that significantly diminish a dog’s quality of life. In many cases, the stifle joint (knee) is one of the most commonly affected joints due to high biomechanical stress and its vulnerability to cranial cruciate ligament (CrCL) rupture, a leading cause of lameness in dogs.

When conservative treatments such as weight management, physical therapy, NSAIDs, or even osteotomy procedures like TPLO (Tibial Plateau Leveling Osteotomy) or TTA (Tibial Tuberosity Advancement) fail to alleviate the symptoms, Total Knee Replacement becomes a medically necessary solution. For example, BioMedtrix’s Canine Total Knee™ system is widely used in advanced cases of joint degeneration where the entire joint must be replaced to restore function and relieve pain.

Veterinary referral centers in the U.S., such as the University of Florida’s College of Veterinary Medicine and Cornell University Hospital for Animals, have documented successful TKR procedures in dogs suffering from end-stage OA. The Association for Pet Obesity Prevention (APOP) reports that over 55% of dogs in the U.S. are overweight or obese, amplifying the stress on weight-bearing joints and accelerating degenerative processes.

Restraints

High Procedure and Implant Cost

The high cost of canine TKR procedures and implants limits accessibility for many pet owners and slowing broader adoption despite technological advancements and growing demand. It is among the most advanced and resource-intensive orthopedic surgeries available for dogs. The total cost typically includes preoperative diagnostics (such as advanced imaging), the surgical procedure itself, the implant, anesthesia, hospitalization, postoperative care, and rehabilitation.

In high-income markets like the U.S. and Western Europe, the total cost of a canine TKR can range from $6,000 to over $12,000 per procedure, depending on the complexity, location, and the veterinary facility’s expertise. This is significantly higher than more common procedures like TPLO (Tibial Plateau Leveling Osteotomy), which typically cost between $3,000 and $5,000.

Implants used in canine TKR are often custom-designed or modular systems produced using high-quality materials like cobalt-chromium alloys and ultra-high-molecular-weight polyethylene (UHMWPE), which are durable but expensive. These implants are typically imported or manufactured by specialized orthopedic companies, further adding to the cost due to limited veterinary-scale production and supply chain complexities. While demand for advanced orthopedic care is rising, high costs act as a barrier for the majority of pet owners.

According to a 2024 USA Today survey, 66% of dog owners reported cutting back on personal spending to afford pet care, and some resorted to loans or financial assistance for major veterinary expenses. Even in affluent regions, only a minority of owners can afford TKR without insurance or external support. Pet insurance uptake is increasing, but coverage limits and exclusions often mean owners still face substantial out-of-pocket costs.

Opportunities

Development of Custom and Breed-Specific Implant

As canine anatomy varies widely across breeds in size, bone structure, and joint biomechanics, the demand for personalized orthopedic solutions is rising. Unlike human implants, where standard sizing can accommodate broad populations, veterinary implants often require tailored designs to ensure optimal fit, function, and surgical outcomes.

The need for breed-specific implants stems from the vast variation in dog breeds, ranging from toy breeds like Chihuahuas weighing under 5 kg to giant breeds like Great Danes exceeding 60 kg. A “one-size-fits-all” implant risks poor alignment, instability, or excessive wear, potentially compromising long-term outcomes. For instance, a Labrador Retriever’s stifle anatomy differs significantly from that of a French Bulldog, necessitating different implant shapes, angles, and fixation techniques.

The use of 3D imaging (CT/MRI) and additive manufacturing has revolutionized the feasibility of creating customized implants. Companies like KYON AG, BioMedtrix, and Fitzpatrick Referrals have already developed modular systems that can be tailored to different dog sizes, and the next step involves full customization. For example, preoperative 3D scans can now be used to create patient-specific cutting guides and implants, improving accuracy, reducing surgical time, and enhancing recovery.

Impact of Macroeconomic / Geopolitical Factors

Economic conditions, particularly in developed nations, directly impact pet owners’ willingness and ability to invest in advanced veterinary procedures. For instance, during economic downturns or periods of inflation, discretionary spending declines, leading to reduced expenditures on non-essential pet healthcare services, including TKR surgeries.

Economic growth leads to higher disposable income, which in turn increases consumer spending on pets. Rising healthcare expenditure worldwide, especially in emerging economies, drives demand for advanced orthopedic surgeries for pets. Over 66% of households in the US own a pet, with total spending on pets exceeding US$136 billion annually.

Geopolitical instability and changes in international trade policies, such as tariffs or trade restrictions, can disrupt the global supply chain for materials used in TKR surgeries (e.g., metals for implants, surgical tools). Changes in tariffs can lead to increased costs for manufacturers, potentially increasing the prices of TKR devices and related services.

Latest Trends

Shift Toward Cementless and Biologic-Friendly Implant Designs

A significant trend in the canine Total Knee Replacement (TKR) market is the shift toward cementless and biologic-friendly implant designs, driven by the desire for longer-lasting implants, reduced complications, and improved osseointegration. Traditional cemented implants, while effective, carry risks such as cement breakdown, inflammation, and loosening over time, particularly in active or large-breed dogs. Cementless designs address these issues by enabling bone in-growth into specially treated surfaces of the implant (e.g., porous titanium or hydroxyapatite coatings), offering a more natural and biologically stable fixation.

Veterinary orthopedic companies like BioMedtrix and KYON AG are pioneering cementless systems in TKR, building on their success in total hip replacement (THR). A long-term canine study demonstrated excellent osseointegration and implant stability up to 6 years post-surgery, with no complications at necropsy, validating the durability of cementless technology. Additionally, biologic-friendly materials reduce inflammatory responses and promote better compatibility with joint tissues. This is particularly beneficial in younger dogs or those with autoimmune conditions, where traditional materials might trigger adverse reactions.

Regional Analysis

North America is leading the Canine Total Knee Replacement Market

The US is the largest market for Canine Total Knee Replacement (TKR) holding 92.0% share in 2024, driven by a combination of advanced veterinary infrastructure, strong consumer spending on pet health, widespread pet insurance adoption, and the early availability of canine orthopedic implant systems.

According to the American Pet Products Association (APPA), the U.S. pet industry reached $152 billion in expenditures in 2024, with $39.8 billion spent on veterinary care and products alone, projected to rise to $41.4 billion in 2025. These figures reflect countries’ strong demand for advanced veterinary procedures, including total knee replacements.

US also exhibits one of the highest levels of pet insurance adoption globally, which plays a crucial role in making costly surgical interventions like TKR more accessible. In 2024, nearly 6.25 million pets were insured in the U.S., according to the North American Pet Health Insurance Association (NAPHIA), with orthopedic surgeries among the top reimbursed procedures.

The Asia Pacific region is expected to experience significant CAGR during the forecast period

Australia represents a growing market with a high rate of pet ownership nearly 69% of Australian households own pets, and around 48% of those own at least one dog, the country provides a strong foundation for demand in advanced veterinary orthopedic procedures. This rising pet ownership, coupled with growing awareness of animal welfare and the humanization of pets, has increased the demand for complex interventions like TKR in canine patients. While Australia has a relatively smaller population compared to North America and Europe, its spending on veterinary care per pet is among the highest in the world.

According to Animal Medicines Australia (AMA), pet owners spent over AUD 3 billion (~US$ 2 billion) on veterinary services in 2023, with a growing portion directed toward surgical and orthopedic procedures. The rise in pet insurance enrollment especially in metropolitan areas has also made advanced procedures like TKR more financially viable for pet owners.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Rest of Europe

- Asia Pacific

- China

- Australia

- Rest of APAC

- Rest of the World

Key Players Analysis

The global Canine Total Knee Replacement (TKR) market in 2024 is shaped by a mix of specialized implant manufacturers, veterinary orthopedic centers, and medical device suppliers. Key players include BioMedtrix, LLC, a U.S.-based pioneer known for offering one of the first full canine TKR systems; Fitzpatrick Referrals, a UK-based advanced veterinary center recognized for its custom-made total knee replacements; and Narang Medical, an India-based company offering a range of orthopedic instruments and accessories at competitive prices, with a strong global distribution network.

Top Key Players in the Canine Total Knee Replacement Market

- BioMedtrix, LLC

- Innoplant Medizintechnik GmbH

- KYON AG

- OrthoMed UK Ltd

- Narang Medical

- Fitzpatrick Referrals

Recent Developments

- Texas A&M University performed its first canine TKR in 2022 and now offers knee, ankle, and elbow replacements. Their use of 3D-printed bone models for surgical planning improves precision in implant placement.

- An unexpected collaboration between forensic anthropologists and veterinarians in June 2025 may offer a solution to reducing ligament injuries during total knee replacement (TKR) surgeries in dogs. Dr. Joe Hefner, a forensic anthropologist, and Savannah Holcombe, a doctoral student at Michigan State University (MSU), teamed up with researchers from MSU’s College of Veterinary Medicine and Cambridge Veterinary School. Together, they aim to enhance the accuracy of identifying collateral ligament attachment points in dogs. Their work seeks to improve surgical planning by providing orthopedic veterinarians with more precise imaging and anatomical references. According to Hefner, many TKR surgeries in dogs face challenges due to the limited visibility of the lateral and medial collateral ligaments in pre-surgical scans, often resulting in less successful outcomes.

- “If the medial or lateral ligament is injured during surgery, it can significantly impact the dog’s mobility,” Hefner explained. “The leg will never fully recover its original mechanical strength.”

Report Scope

Report Features Description Market Value (2024) US$ 422.9 K Forecast Revenue (2034) US$ 832.5 K CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Implant Systems, Instruments & Accessories), By Material Type (Metals and Metal Alloys, Polymers/Bone Cements), By End-User (Veterinary Hospitals & Clinics, Others) Regional Analysis North America-US, Canada; Europe-Germany, France, The UK, Rest of Europe; Asia Pacific-China, Australia, Rest of APAC; Rest of the World Competitive Landscape BioMedtrix, LLC, Innoplant Medizintechnik GmbH, KYON AG, OrthoMed UK Ltd, Narang Medical, Fitzpatrick Referrals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Canine Total Knee Replacement MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Canine Total Knee Replacement MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BioMedtrix, LLC

- Innoplant Medizintechnik GmbH

- KYON AG

- OrthoMed UK Ltd

- Narang Medical

- Fitzpatrick Referrals