Canada Golf Market Size, Share, Growth Analysis By Product (Golf Balls, Golf Shoes, Golf Bags and Accessories, Apparel, Footwear, Others), By Application (Amateur, Professional), By Distribution Channel (Sporting Goods Retailer, On-course Shops, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 68596

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

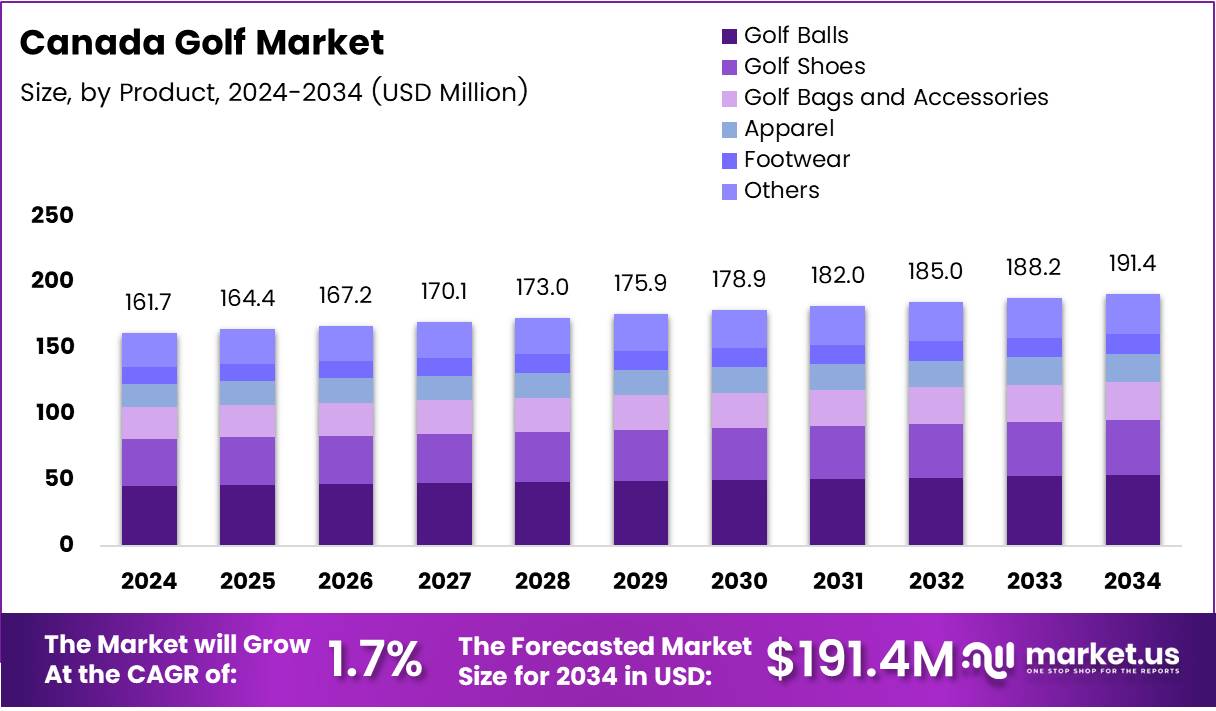

The Canada Golf Market size is expected to be worth around USD 191.4 Million by 2034, from USD 161.7 Million in 2024, growing at a CAGR of 1.7% during the forecast period from 2025 to 2034. This growth is primarily driven by the increasing popularity of golf as a recreational activity and rising demand for premium golf products.

Key Takeaways

- Canada Golf Market is projected to reach USD 191.4 Million by 2034, growing at a CAGR of 1.7% from 2025 to 2034.

- Golf Balls hold a dominant position in the By Product Analysis segment, with a share of 27.5% in 2024.

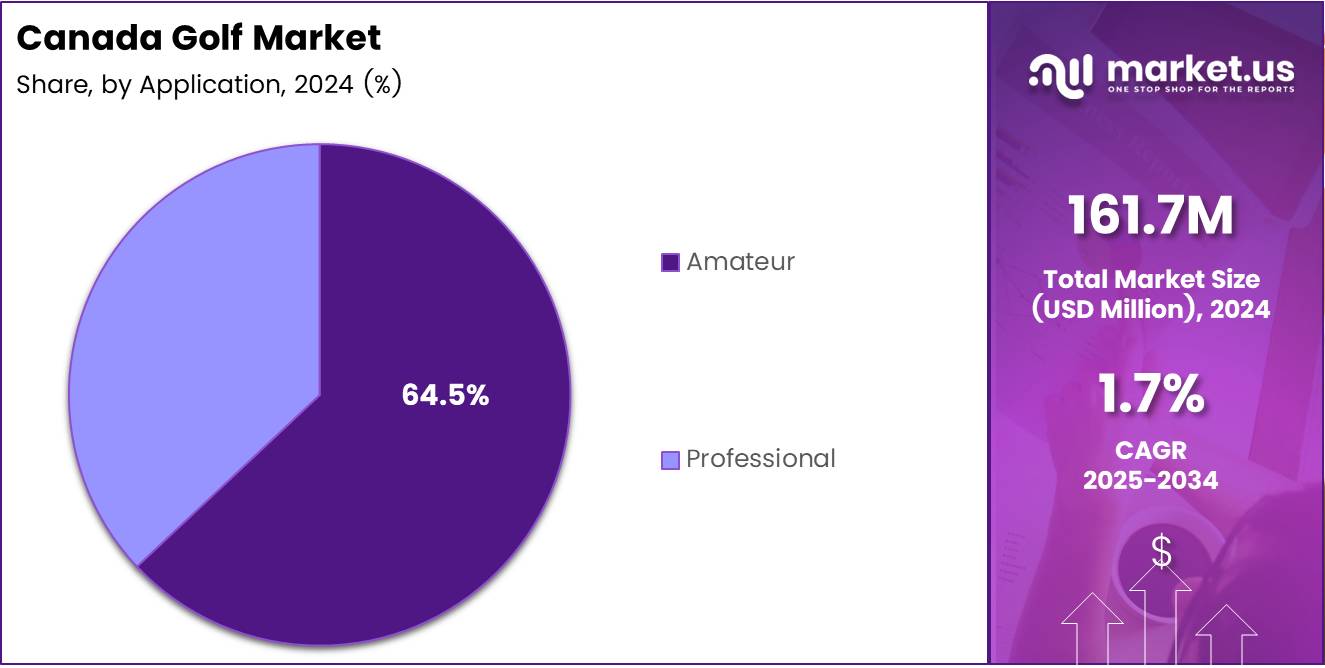

- The Amateur category leads in the By Application Analysis segment, accounting for 64.5% of the market in 2024.

- Sporting Goods Retailers dominate the By Distribution Channel segment, capturing 44.5% of the market share in 2024.

The Canada Golf Market has been experiencing significant growth in recent years, reflecting both the sport’s increasing popularity and the country’s strong golfing culture. According to Golf Canada, approximately 6 million Canadians participated in golf in 2023, marking an all-time high for the sport in the country. This surge in participation has positioned golf as Canada’s number one sport in terms of engagement, providing a solid foundation for continued market expansion.

The growth of the market is evident in the number of rounds played. In 2023 alone, Canadians played 74 million rounds of golf, a substantial 24% increase from the previous study in 2019. This upward trend in participation has been pivotal for the golf industry, as it directly impacts the demand for golfing equipment, memberships, and the maintenance of golf courses across the country. The increasing number of rounds played indicates a healthy and vibrant golf economy, supported by both seasoned golfers and newcomers to the sport.

Government support and investments have further fueled the growth of the Canadian golf market. Programs and initiatives aimed at encouraging youth participation, improving course facilities, and promoting tourism have played an essential role in expanding the sport’s reach.

Additionally, various levels of government have supported sustainability efforts within the industry, aiming to balance environmental concerns with the needs of golf course operators. These investments contribute to the overall economic impact of the golf industry in Canada.

Regulatory frameworks around golf courses and equipment continue to evolve, ensuring that the market operates within environmentally sustainable and socially responsible boundaries. Regulations surrounding water usage, turf management, and land preservation are important considerations for course operators, especially as climate change becomes a more pressing issue. These regulations, along with government incentives, help ensure the long-term viability of the golf market in Canada.

Looking ahead, the Canada Golf Market is well-positioned for further growth. With increasing participation rates, government investments, and evolving regulations, the market is poised to benefit from both local and international interest.

The sport’s accessibility, together with its broad appeal across various demographics, will likely continue driving the market forward, providing ample opportunities for both new and existing businesses within the sector. Overall, Canada’s golf market remains a dynamic and lucrative segment of the broader sports and leisure industry.

Product Analysis

In 2024, Golf Balls held a dominant market position in By Product Analysis segment of Canada Golf Market, with a 27.5% share.

In 2024, Golf Balls maintained a significant lead in the By Product Analysis segment of the Canada Golf Market. With a strong share of 27.5%, Golf Balls continue to be the preferred choice for golfers across the nation. Their essential role in the game, combined with constant innovations in material and design, reinforces their popularity.

Following Golf Balls, Golf Shoes represent another important category within the market. While not as dominant as Golf Balls, Golf Shoes continue to grow, owing to their critical function in enhancing performance and comfort. Golf Bags and Accessories also hold a notable position, contributing significantly to the overall market revenue, as golfers seek durable and functional gear.

Apparel, which includes items such as shirts, pants, and outerwear, complements the core products, offering not just utility but a fashionable touch. Footwear and other accessories round out the segment, providing additional options to golfers looking to personalize their game experience.

Application Analysis

In 2024, Amateur held a dominant market position in By Application Analysis segment of Canada Golf Market, with a 64.5% share.

In the By Application Analysis segment, the Amateur category leads the Canada Golf Market, holding a dominant share of 64.5% in 2024. This strong position highlights the widespread participation in recreational golf, where amateurs seek affordable, quality equipment to enhance their experience.

The Professional category, though smaller in comparison, maintains a steady presence within the market. Professionals demand top-tier equipment and performance, contributing to the premium product segment. Their influence, while substantial, is eclipsed by the sheer number of amateur golfers across the nation, driving the market’s growth.

Distribution Channel Analysis

In 2024, Sporting Goods Retailer held a dominant market position in By Distribution Channel Analysis segment of Canada Golf Market, with a 44.5% share.

In the By Distribution Channel Analysis segment of the Canada Golf Market, Sporting Goods Retailers took the lead in 2024, with a commanding share of 44.5%. These retail outlets continue to be the primary point of purchase for golfers, offering a wide range of products from golf balls to apparel, all in one location.

On-course shops also play a vital role, providing golfers with convenient access to essential products while on the golf course. However, they represent a smaller segment compared to retail stores.

The Online channel is growing rapidly as more consumers turn to e-commerce for purchasing golf equipment. While its share is still developing, the shift towards online shopping is evident in the expanding availability of products online.

Lastly, other distribution channels contribute to the overall market, catering to niche customer needs and providing alternative purchasing options for golf enthusiasts.

Key Market Segments

By Product

- Golf Balls

- Golf Shoes

- Golf Bags and Accessories

- Apparel

- Footwear

- Others

By Application

- Amateur

- Professional

By Distribution Channel

- Sporting Goods Retailer

- On-course Shops

- Online

- Others

Drivers

Increasing Popularity of Golf Among Millennials Drives Market Growth

The Canada golf market is benefiting from the increasing popularity of golf among millennials. Younger generations are showing more interest in golf, drawn by its social aspects and accessibility. Many millennials see golf as a way to connect with friends and network in a relaxed environment. As a result, golf courses and related businesses are seeing an uptick in demand from this demographic, helping to fuel the growth of the market.

Another key factor driving growth is the expansion of golf tourism in Canada. With scenic landscapes and world-class golf courses, Canada has become an attractive destination for golf enthusiasts. Tourists are traveling to Canada specifically for golf vacations, which boosts local economies and increases demand for golf-related services. This tourism trend is expected to continue growing as Canada is recognized for offering both challenging and beautiful courses.

Additionally, the rise in disposable income and leisure spending is contributing to the growth of the golf market. Canadians, especially in urban areas, now have more disposable income to spend on leisure activities such as golf. With more people willing to invest in recreational experiences, the golf market has seen a steady increase in participation and spending, further driving its expansion.

Restraints

Challenges Affecting the Growth of the Canada Golf Market

One of the major challenges facing the golf market in Canada is the high cost of golf course memberships and equipment. For many potential players, the expense of joining a golf course or purchasing quality golf equipment can be prohibitive. This high cost limits accessibility, making golf a more exclusive activity, which can restrict market growth.

Weather-related constraints also impact golf participation in Canada. The colder climate in many regions of Canada means that golf is often limited to the warmer months, leading to shorter playing seasons. This seasonal nature of the sport can affect overall participation rates and revenue for golf courses.

Additionally, competition from other leisure activities is another constraint. With a wide variety of entertainment options available, including outdoor sports, video games, and cultural experiences, golf must compete for the attention of potential participants. This growing competition can make it harder for golf to maintain its share of the leisure market, especially among younger consumers.

Growth Factors

Opportunities for Growth in the Canada Golf Market

There are several promising growth opportunities in the Canada golf market. The expansion of online golf retail and e-commerce platforms is one such opportunity. Consumers are increasingly shopping online for golf equipment, clothing, and accessories. This shift to e-commerce allows businesses to reach a wider audience and offer a more convenient shopping experience.

Another key opportunity is the integration of technology into golf training and equipment. Innovations like smart golf clubs, GPS-enabled golf watches, and virtual training apps are changing the way people play and practice golf. These technological advancements are appealing to both beginners and experienced players, creating new market opportunities.

The growing participation of women in golf presents another opportunity for market growth. More women are taking up the sport, with many courses offering tailored programs to make golf more inclusive. This trend is helping to diversify the market and expand its reach.

Lastly, investments in eco-friendly and sustainable golf course practices offer opportunities to appeal to environmentally-conscious consumers. Golf courses that prioritize sustainability can attract a broader customer base, particularly those who are looking to enjoy the sport while being mindful of their environmental impact.

Emerging Trends

Emerging Trends in the Canada Golf Market

There are several emerging trends in the Canada golf market. The adoption of virtual golf and golf simulation technology is one of the most notable trends. With advancements in virtual reality and golf simulators, players can now practice their swing or compete virtually, even during off-seasons. This has made golf more accessible and appealing to a broader audience, especially in regions with long winters.

Another growing trend is the increased focus on golf fitness and health. Golfers are becoming more health-conscious, integrating fitness routines into their training to improve performance. This trend is fueling the demand for specialized golf fitness programs, apparel, and equipment.

The rise of golf-related entertainment and experiences is also contributing to market growth. Golf-focused entertainment venues, like indoor golf lounges and mini-golf attractions, are gaining popularity, especially among younger audiences. These new experiences make golf more fun and social, helping to attract a wider range of participants and boosting interest in the sport.

Key Canada Golf Company Insights

In 2024, several key players are shaping the trajectory of the global Canada Golf Market with their innovations and strategic initiatives.

Lululemon Athletica Inc. continues to diversify its portfolio by blending athleisure with high-performance golf apparel. Their focus on premium, breathable fabrics and stylish designs positions them as a key player in the golf apparel segment, appealing to a younger, more fashion-conscious demographic.

Levelwear Inc. has solidified its position in the Canadian golf market through its versatile and performance-driven golf apparel. Known for its modern designs and premium fabrics, the company caters to both amateurs and seasoned players, allowing them to perform at their best while maintaining a sense of style.

Callaway Golf Co. remains a global leader in golf equipment and accessories, with its innovative approach to golf club technology. Their emphasis on creating clubs that maximize distance and accuracy keeps them at the forefront of the golf industry, particularly in Canada, where golf enthusiasts value high-performance gear.

NIKE Inc. continues to maintain a strong presence in the golf market through its range of golf equipment, footwear, and apparel. Leveraging its iconic brand, Nike introduces cutting-edge designs and technologies that appeal to golfers looking for both style and functionality, maintaining its competitive edge in the Canadian golf industry.

Top Key Players in the Market

- Lululemon Athletica Inc.

- Levelwear Inc.

- Callaway Golf Co.

- NIKE Inc.

- Acushnet Holdings Corp.

- Amer Sports Oyj

- Adidas AG

- Under Armour Inc.

- PUMA SE

- ECCO Sko A/S

- Skechers USA Inc.

Recent Developments

- In September 2024, the Golf Ontario Scholarship Program will support aspiring young golfers in Canada, offering financial assistance to those pursuing academic and athletic excellence in the sport.

- In April 2023, Golf Canada launched the National Golf League to support the growth of youth golf, aligning with the First Tee – Canada initiative to inspire and empower young golfers across the nation.

- In March 2025, EMERGE signed a definitive agreement to acquire Tee 2 Green, a profitable golf apparel and equipment business, expanding its footprint in the golf industry and enhancing its product offerings.

Report Scope

Report Features Description Market Value (2024) USD 161.7 Million Forecast Revenue (2034) USD 191.4 Million CAGR (2025-2034) 1.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Golf Balls, Golf Shoes, Golf Bags and Accessories, Apparel, Footwear, Others), By Application (Amateur, Professional), By Distribution Channel (Sporting Goods Retailer, On-course Shops, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Lululemon Athletica Inc., Levelwear Inc., Callaway Golf Co., NIKE Inc., Acushnet Holdings Corp., Amer Sports Oyj, Adidas AG, Under Armour Inc., PUMA SE, ECCO Sko A/S, Skechers USA Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lululemon Athletica Inc.

- Levelwear Inc.

- Callaway Golf Co.

- NIKE Inc.

- Acushnet Holdings Corp.

- Amer Sports Oyj

- Adidas AG

- Under Armour Inc.

- PUMA SE

- ECCO Sko A/S

- Skechers USA Inc.