Global Camshaft Lifters Market Market Size, Share, Growth Analysis By Type (Hydraulic Lifters, Mechanical (Solid) Lifters, Roller Lifters, Flat Tappet Lifters), By Engine (Petrol Engines, Diesel Engines), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Sales Channel (OEMs, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168294

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

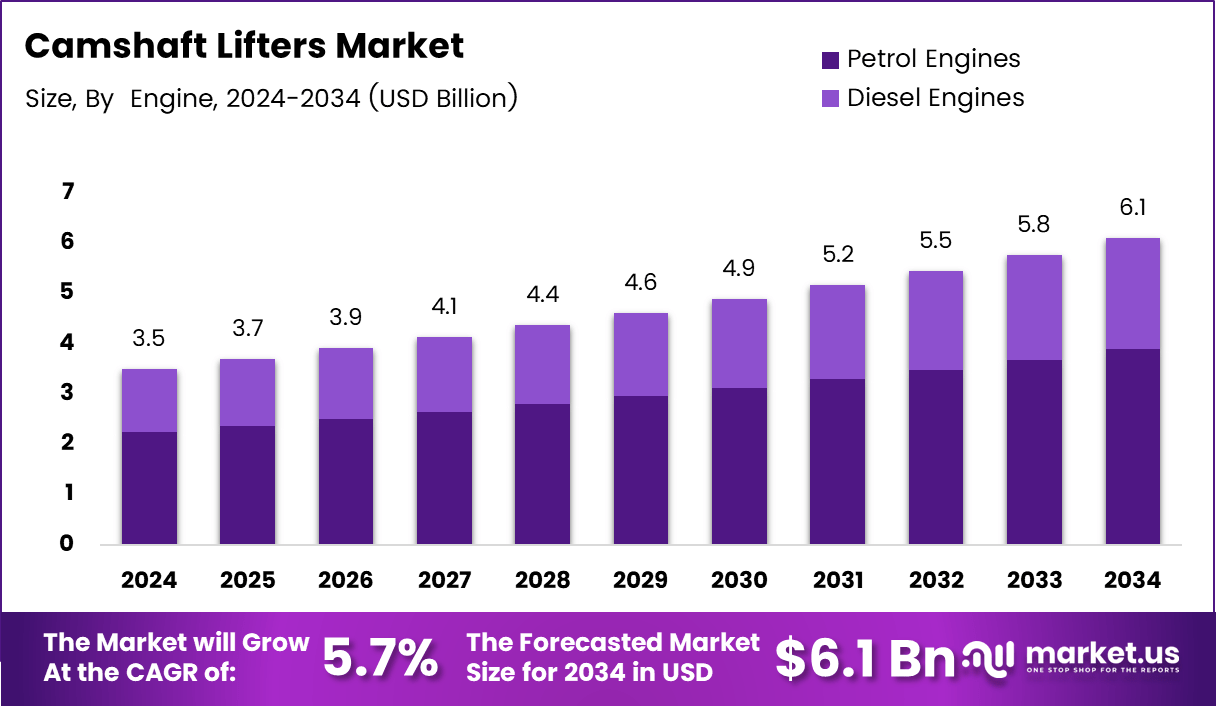

The Global Camshaft Lifters Market size is expected to be worth around USD 6.1 billion by 2034, from USD 3.5 billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The Camshaft Lifters Market represents a critical segment of the internal combustion engine ecosystem, supporting efficient valve timing and smooth engine performance across passenger and commercial vehicles. The market continues evolving as OEMs emphasize durability, low-friction materials, and precision engineering to meet rising global emission and fuel-efficiency standards.

Furthermore, the market grows steadily as automakers upgrade valvetrain architectures to enhance efficiency, reduce noise, and support higher-performance combustion cycles. Increasing demand for long-life engines and advanced hydraulic lifters encourages manufacturers to adopt improved metallurgy, heat treatment, and coating technologies. These advancements contribute to consistent adoption across mid-range and premium vehicle platforms.

Additionally, expanding construction, logistics, and agriculture activities drive demand for engines requiring stable lift performance under heavy operating loads. Aftermarket growth also accelerates as aging vehicles require replacement lifters, creating a stable revenue stream for component manufacturers. Consumers increasingly prefer reliable lifter solutions that extend engine life and reduce long-term maintenance expenses under varying usage conditions.

Moreover, government regulations promoting reduced emissions and better combustion efficiency push automakers to modernize valvetrain components. Programs that encourage improved engine designs indirectly boost demand for modern lifters. Hybrid engines that continue using internal combustion modules also maintain lifter relevance, ensuring stable long-term adoption despite the rise of luxury electric vehicles.

Consequently, new growth opportunities emerge from lightweight materials, advanced coatings, and precision-machined lifters that reduce friction and support higher RPM tolerance. The integration of smart diagnostics in future mechanical systems also opens space for predictive maintenance, enabling better performance monitoring across vehicle fleets. These innovations strengthen market readiness for upcoming emission and efficiency standards.

In addition, the market benefits from rising consumer interest in aftermarket performance upgrades. High-performance engines require specialized lift profiles, encouraging demand for advanced camshaft lifter designs. Improved oil formulations and extended-service technologies also enhance component longevity, adding long-term value for vehicle owners seeking reliable engine performance improvements.

Finally, industry data validates the durability advantages shaping this market. According to the Survey, a well-maintained camshaft and lifter system can last over 150,000 miles when serviced correctly, supporting growing consumer interest in long-life components. Additionally, high-performance aftermarket camshafts typically provide valve lifts of 0.450 to 0.650+ inches (11.4mm to 16.5mm), reinforcing demand for advanced lifters capable of supporting aggressive performance requirements across specialized applications.

Key Takeaways

- The Global Camshaft Lifters Market is projected to reach USD 6.1 billion by 2034 from USD 3.5 billion in 2024.

- The market expands at a stable CAGR of 5.7% during the forecast period from 2025 to 2034.

- Hydraulic Lifters dominate the By Type segment with a leading share of 48.3% in 2024.

- Petrol Engines lead the By Engine segment with a significant 63.9% share in 2024.

- Passenger Cars hold the largest share By Vehicle Type at a strong 69.5% in 2024.

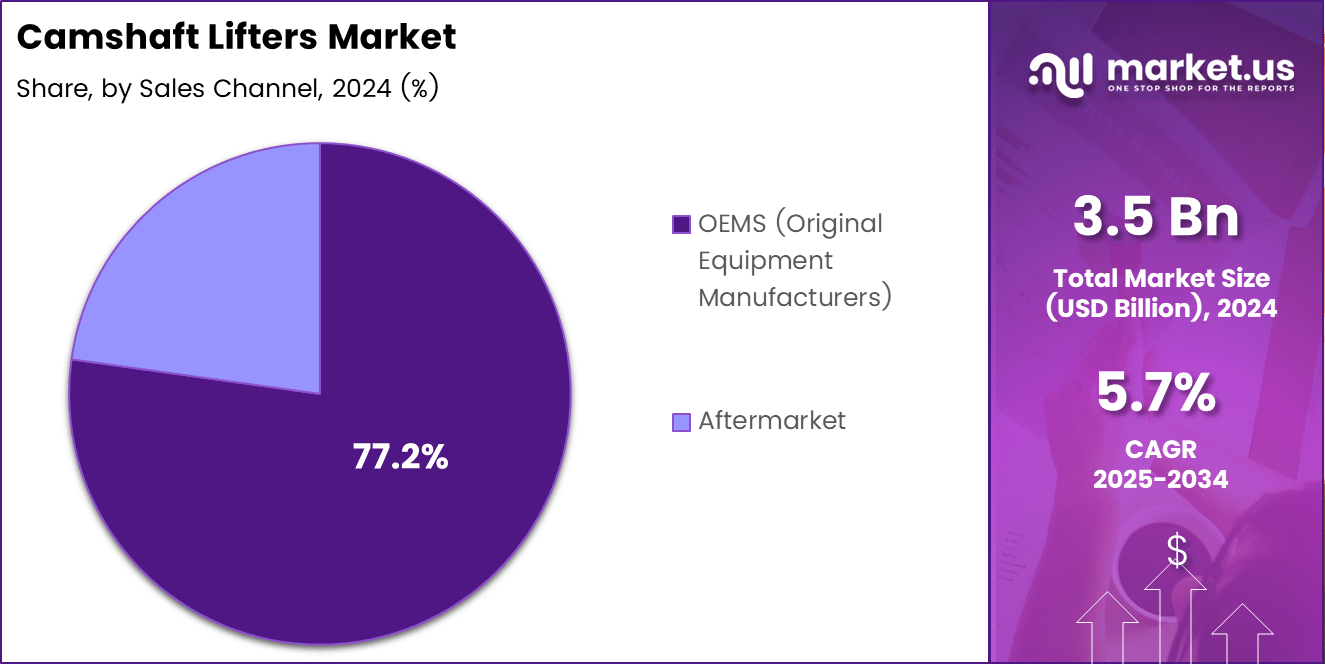

- OEMs dominate the By Sales Channel segment with a commanding 77.2% share in 2024.

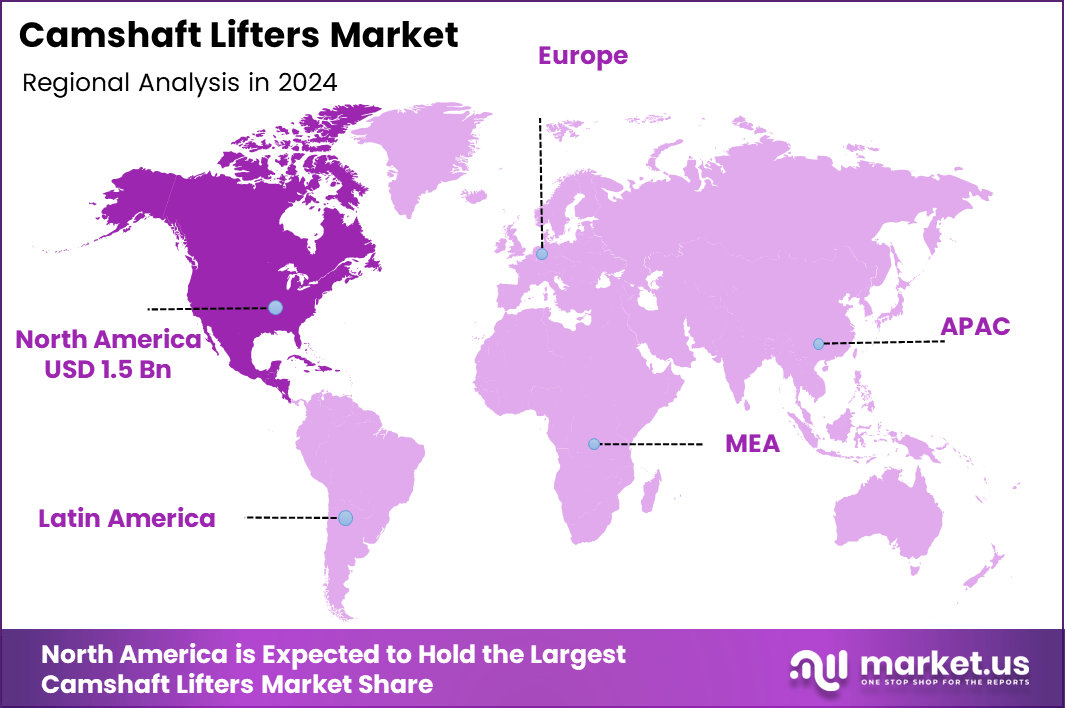

- North America leads the regional landscape with a market share of 44.9%, valued at USD 1.5 billion in 2024.

By Type Analysis

Hydraulic Lifters dominate with 48.3% due to smoother valve operation and reduced maintenance.

In 2024, Hydraulic Lifters held a dominant market position in the By Type Analysis segment of the Camshaft Lifters Market, with a 48.3% share. This segment grows as automakers adopt quieter valve-train systems. Additionally, rising consumer demand for low-maintenance engines strengthens the adoption of hydraulic variants across mass-market vehicles.

Mechanical (Solid) Lifters continue gaining relevance as performance-focused engines demand higher RPM stability. This segment benefits from motorsport activities and enthusiast-grade modifications. Although it remains smaller, it attracts buyers who prioritize precision tuning. Increasing aftermarket upgrades sustain its long-term demand within traditional internal combustion platforms.

Roller Lifters expand steadily as OEMs integrate friction-reducing technologies. Reduced wear, enhanced fuel efficiency, and improved contact profiles drive adoption. Manufacturers emphasize lighter materials and advanced coatings to increase durability. Emerging hybrid powertrains requiring optimized valve timing further strengthen interest in roller-based lifter solutions.

Flat Tappet Lifters sustain market presence in budget-oriented engines and legacy vehicle platforms. Their cost-effectiveness supports continued demand, especially in older engine rebuilds. Although newer technologies overshadow them, restoration enthusiasts and cost-sensitive markets maintain consistent consumption levels across global automotive repair ecosystems.

By Engine Analysis

Petrol Engines dominate with 63.9% due to widespread passenger car adoption.

In 2024, Petrol Engines held a dominant market position in the By Engine Analysis segment of the Camshaft Lifters Market, with a 63.9% share. Growing gasoline vehicle sales, smoother combustion profiles, and reduced engine vibration contribute to sustained adoption. OEM investment in lightweight petrol engines further reinforces market leadership globally.

Diesel Engines maintain a sizable demand due to heavy-duty applications and long-life engine characteristics. Commercial fleets rely on diesel powertrains for higher torque output, supporting lifter usage in long-haul vehicles. Despite regulatory pressure, diesel engines retain relevance in industrial, agricultural, and off-road sectors where durability is prioritized.

By Vehicle Type Analysis

Passenger Cars dominate with 69.5% due to large-scale vehicle production and consumer preference.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of the Camshaft Lifters Market, with a 69.5% share. Higher global car ownership, urban mobility expansion, and rapid engine technology upgrades fuel consistent demand for lifters. Automakers utilize advanced valve systems to improve fuel efficiency.

Light Commercial Vehicles witness stable adoption as small logistics fleets expand. Delivery services and last-mile transportation rely on durable valve-train components. Growing e-commerce ecosystems boost light-duty engines, strengthening the need for dependable lifter systems capable of supporting frequent operational cycles and sustained load capacity.

Heavy Commercial Vehicles continue to require robust mechanical systems to withstand intensive workloads. Their engines demand reliable lifters to manage higher compression ratios and long engine hours. Infrastructure development programs and freight movement growth support ongoing consumption across trucks, buses, and heavy-duty industrial vehicles.

By Sales Channel Analysis

OEMS dominate with 77.2% due to strong integration into new vehicle manufacturing.

In 2024, OEMS held a dominant market position in the By Sales Channel Analysis segment of the Camshaft Lifters Market, with a 77.2% share. Automakers increasingly integrate factory-fitted lifters to enhance reliability. Consistent vehicle production volumes enable large-scale demand, supported by stringent regulatory standards for engine performance.

Aftermarket demand grows as aging vehicles require component replacement. Frequent engine rebuilds, performance upgrades, and maintenance cycles sustain its relevance. Independent repair shops and specialty performance stores contribute to steady sales, ensuring continuous opportunities for aftermarket suppliers worldwide.

Key Market Segments

By Type

- Hydraulic Lifters

- Mechanical (Solid) Lifters

- Roller Lifters

- Flat Tappet Lifters

By Engine

- Petrol Engines

- Diesel Engines

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Sales Channel

- OEMs (Original Equipment Manufacturers)

- Aftermarket

Drivers

Growing Demand for Fuel-Efficient Engines Drives Market Growth

Automakers increasingly focus on fuel-efficient engines, and this trend strengthens the use of optimized valve timing mechanisms. Better valve control helps engines burn fuel cleanly and improve performance. As emission rules tighten globally, manufacturers rely on camshaft lifters to support smoother and more precise combustion.

The rising production of high-performance and turbocharged passenger vehicles also accelerates demand. These vehicles require durable and responsive valvetrain systems to handle higher pressure and temperature levels. Turbocharged engines depend heavily on accurate valve timing, making lifters essential for stable acceleration and long-term engine reliability.

Commercial vehicle fleet expansion adds further momentum. Logistics growth, construction activity, and industrial operations require strong engines that operate for long hours. Fleet operators prioritize vehicles with robust valvetrain components that reduce downtime. This stability strengthens the market for high-quality camshaft lifters designed for heavy usage.

Restraints

High Repair and Replacement Costs Restrict Market Expansion

The market faces challenges due to the high repair and replacement costs linked to hydraulic lifter failures. When lifters malfunction, vehicles may experience noise, power loss, or engine damage. Repairing these issues requires skilled labor and expensive parts, making customers hesitant to choose advanced lifter systems.

Fluctuating raw material prices also affect production economics. Steel, alloys, and precision-machined components regularly experience price shifts. Manufacturers struggle to maintain stable pricing, especially when global supply chains face disruptions. This volatility often reduces profit margins and impacts pricing decisions across both OEM and aftermarket channels.

Growth Factors

Development of Lightweight Low-Friction Lifters Creates New Opportunities

The development of lightweight and low-friction lifters opens major opportunities for improved engine efficiency. Reducing internal engine resistance helps manufacturers achieve better fuel performance. Automakers explore advanced materials and coatings that enhance smooth movement while extending the overall life of the component.

Aging vehicle fleets in developing markets also strengthen aftermarket demand. Many cars and commercial vehicles in these regions require ongoing maintenance and periodic engine rebuilds. This creates steady opportunities for suppliers offering cost-effective and durable replacement lifters suited for older engines.

The integration of smart sensors in lifters is emerging as a strong growth area. Real-time monitoring of engine performance helps detect valve timing issues early. This technology supports predictive maintenance and aligns with the automotive industry’s shift toward connected and intelligent powertrain systems.

Emerging Trends

Rising Preference for Roller Lifters Shapes Market Trends

Roller lifters gain popularity because they reduce friction and improve engine output. Their rolling contact design minimizes surface wear, resulting in smoother operation. Performance-focused engines increasingly rely on roller systems to achieve higher efficiency and deliver stronger torque and acceleration response.

The adoption of CNC precision manufacturing strengthens lifter durability. CNC machining ensures tighter tolerances, improved surface finishes, and consistent quality across large-scale production. This trend helps manufacturers meet the reliability expectations of both passenger and commercial vehicle segments.

Advanced coatings such as DLC are becoming more common. These coatings offer better wear resistance and enable longer lifter life, especially in high-temperature environments. The push for components that withstand more aggressive engine loads drives adoption across OEM and aftermarket channels.

The shift toward modular valvetrain assemblies also influences market direction. Modular systems allow faster customization and easier maintenance. Automakers benefit from flexible designs that reduce assembly time and support various engine configurations, creating continued momentum for innovative camshaft lifter solutions.

Regional Analysis

North America Camshaft Lifters Market Dominates with a Share of 44.9%, Valued at USD 1.5 Billion

North America held the leading position in the camshaft lifters market with a substantial 44.9% share, accounting for nearly USD 1.5 Billion in 2024. The region benefits from strong vehicle production, advanced engine design adoption, and a mature aftermarket ecosystem. Continuous investments in fuel-efficient and high-performance engines strengthen demand, while stringent emission norms encourage automakers to integrate optimized valvetrain systems.

Europe Camshaft Lifters Market Trends

Europe follows as a significant market driven by the region’s strong automotive manufacturing base and rapid integration of hybrid and turbocharged technologies. Regulatory pressure to reduce CO₂ emissions accelerates the adoption of precise valve timing components. Growth also stems from Germany, France, and Italy, where engineering advancements and aftermarket modernization support consistent demand for camshaft lifters.

Asia Pacific Camshaft Lifters Market Trends

Asia Pacific represents one of the fastest-developing markets due to expanding passenger vehicle production and increasing adoption of compact, fuel-efficient engines. Countries such as China, Japan, and South Korea continue to advance engine technology, boosting the requirement for optimized valvetrain performance. Rising disposable incomes and a growing aftermarket further accelerate market uptake.

Middle East & Africa Camshaft Lifters Market Trends

The Middle East & Africa market grows gradually, supported by rising vehicle parc, improving service networks, and increasing demand for durable engine components in hot-climate regions. The expansion of commercial fleets, particularly in the Gulf countries, supports aftermarket replacement demand. Continued infrastructure development contributes to higher utilization of commercial vehicles.

Latin America Camshaft Lifters Market Trends

Latin America shows steady progress with increasing vehicle production in Brazil and Mexico and growing interest in fuel-efficient engine technologies. The aftermarket remains a crucial revenue source due to aging vehicle fleets and higher maintenance requirements. Government efforts to revive automotive manufacturing further support market development.

U.S. Camshaft Lifters Market Trends

The U.S. remains a key contributor within North America, driven by high adoption of performance engines, strong OEM presence, and a well-established aftermarket. Continued consumer preference for SUVs, trucks, and high-horsepower vehicles sustains demand for reliable lifters. Regulatory emphasis on efficiency and emissions control encourages the integration of advanced valvetrain technologies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Camshaft Lifters Market Company Insights

The global Camshaft Lifters Market in 2024 reflects a steady technological transition toward lightweight materials, improved friction reduction, and high-precision valve actuation systems. Increasing demand for fuel-efficient engines, turbocharged powertrains, and stricter emission norms shapes the competitive strategies of leading manufacturers. Four key companies continue to influence material selection, lifter geometry, machining tolerances, and OEM-level integration trends.

Aisin Seiki remains a pivotal contributor through its extensive expertise in precision engine components engineered for thermal stability and reduced wear. Its strong automotive OEM partnerships, especially in Asia, enable consistent adoption of advanced hydraulic and roller lifters in compact, hybrid, and high-efficiency engines.

BorgWarner strengthens market innovation with advanced valvetrain systems optimized for variable valve timing and elevated engine performance. The company’s continued investments in high-efficiency turbocharging platforms naturally support demand for lifters that can withstand higher loads, rapid cycling, and thermal fluctuations.

Comp Cams plays an influential role in the performance aftermarket, where it supplies high-lift and race-grade lifters engineered for aggressive cam profiles. Its focus on motorsport-tested designs enhances segment adoption among engine builders seeking precise tappet motion, durability at high RPMs, and tailored performance tuning.

Eaton continues to expand its footprint with reliable hydraulic lifters designed for quieter operation, improved lubrication, and longer service intervals. Its engineering capabilities in fuel-efficient engine systems support OEM transitions toward lower emissions and optimized valve actuation, strengthening its competitive presence across North America and Europe

Top Key Players in the Market

- Aisin Seiki

- BorgWarner

- Comp Cams

- Eaton

- Elgin Industries

- Hyundai Kefico

- Rane Engine Valve

- Schrick GmbH

- Shivam Autotech

- Tenneco

Recent Developments

- In September 2025, Tenneco launched an advanced lifter solution with specialized noise-reduction technology to improve engine refinement.The product is designed for next-generation engines, including hybrid powertrains, where noise becomes more noticeable during electric-to-gas transitions.

- In February 2024, Schaeffler AG invested over $230 million in a new greenfield manufacturing facility in Ohio, U.S..The investment aims to strengthen production capacity for advanced engine components, including valve lifters and e-mobility solutions.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Billion Forecast Revenue (2034) USD 6.1 billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hydraulic Lifters, Mechanical (Solid) Lifters, Roller Lifters, Flat Tappet Lifters), By Engine (Petrol Engines, Diesel Engines), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Sales Channel (OEMs, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aisin Seiki, BorgWarner, Comp Cams, Eaton, Elgin Industries, Hyundai Kefico, Rane Engine Valve, Schrick GmbH, Shivam Autotech, Tenneco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aisin Seiki

- BorgWarner

- Comp Cams

- Eaton

- Elgin Industries

- Hyundai Kefico

- Rane Engine Valve

- Schrick GmbH

- Shivam Autotech

- Tenneco