Global Camping Floodlight Market Size, Share, Growth Analysis By Light Source (Halogen, Incandescent, LED), By Types (Under 100 Lumens, 100 to 199 Lumens, 200 to 500 Lumens, Above 500 Lumens), By Application (Camping, Hiking, Trekking, Mountaineering, Others), By Distribution Channel (E-Commerce, Hypermarkets, Supermarkets, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170939

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

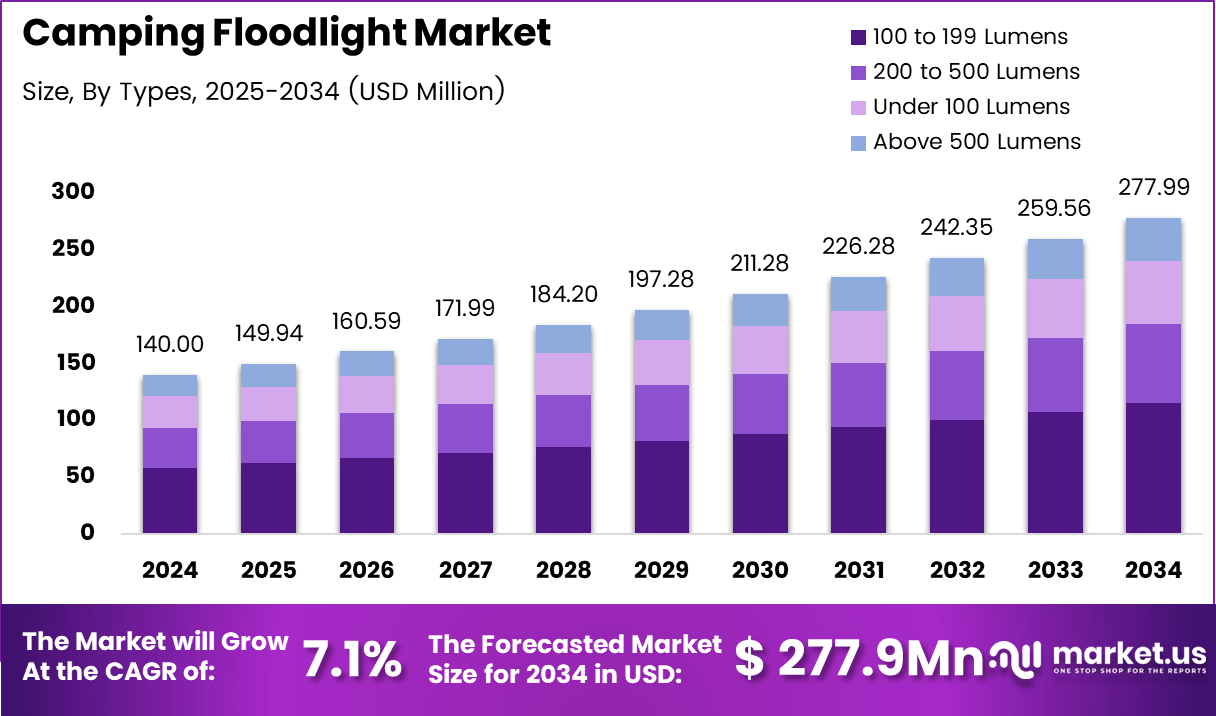

The Global Camping Floodlight Market size is expected to be worth around USD 277.9 million by 2034, from USD 140.0 Million in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

The camping floodlight refers to a portable, high intensity outdoor lighting solution designed for campsites, emergency use, and off grid activities. From a product standpoint, it focuses on wide area illumination, durability, and portability. Consequently, camping floodlights support safety, visibility, and convenience during low light outdoor conditions.

The camping floodlight market represents the commercial ecosystem around manufacturing, distribution, and adoption of these outdoor lighting products. Therefore, demand is closely linked to outdoor recreation trends, disaster preparedness, and rural electrification needs. As a result, the market aligns strongly with both consumer lifestyle shifts and functional utility requirements.

Market growth is increasingly supported by the transition toward LED based portable lighting solutions. Moreover, consumers favor energy efficient products with longer operational lifespans and reduced maintenance. Accordingly, the camping floodlight market is expected to benefit from rising disposable income and expanding adventure tourism, particularly in emerging outdoor recreation economies.

Opportunities are further strengthened by government focus on energy efficiency and emergency preparedness. For instance, outdoor LED lighting aligns with efficiency standards promoted by energy departments and disaster management authorities. Consequently, procurement for relief camps, rural programs, and emergency kits creates a steady institutional demand alongside consumer sales.

Regulatory influence also shapes product design and safety compliance across regions. Therefore, manufacturers emphasize electrical safety standards, battery transportation regulations, and environmental compliance. In parallel, sustainability guidelines encourage rechargeable and low energy consumption lighting, positioning camping floodlights favorably within broader clean energy and outdoor equipment policies.

From a technology perspective, lighting performance and ergonomics continue to improve. According to the US Department of Energy, LED floodlights typically offer a lifespan ranging between 25,000 and 50,000 hours, supporting long term value perception. Additionally, color temperature selection improves user comfort and functional efficiency during outdoor use.

According to lighting engineering studies, warm white illumination around 5700 K reduces glare and insect attraction, while cooler tones enhance task visibility. Furthermore, compact high output designs delivering massive light volume within lightweight formats are increasingly preferred. As noted in manufacturer technical documentation, 10W mini floodlights weighing nearly 300 g balance portability and brightness.

In conclusion, the camping floodlight market demonstrates a balanced mix of recreational, safety, and utility driven demand. Therefore, strong product lifespans, evolving lighting performance, and supportive regulatory environments reinforce market momentum. As outdoor activities expand globally, camping floodlights remain positioned as essential equipment within the portable outdoor lighting segment.

Key Takeaways

- The global Camping Floodlight Market is projected to reach USD 277.9 million by 2034, expanding from USD 140.0 million in 2024 at a 7.1% CAGR.

- LED is the dominant light source segment with a 72.4% share, driven by energy efficiency and long operational lifespan.

- The 200 to 500 Lumens category leads the type segment with a 41.5% share, reflecting optimal brightness and portability.

- Camping applications account for the largest share at 56.2%, supported by rising recreational outdoor activities.

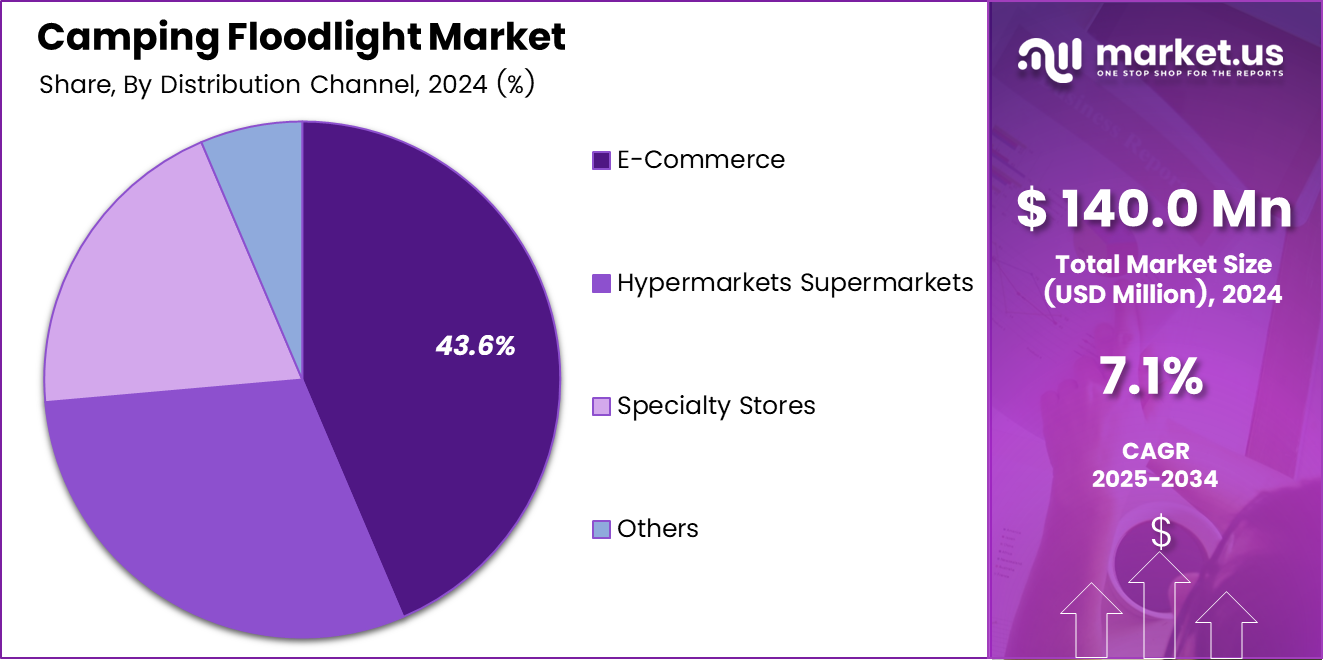

- E-Commerce is the leading distribution channel with a 43.6% share, due to convenience and wider product accessibility.

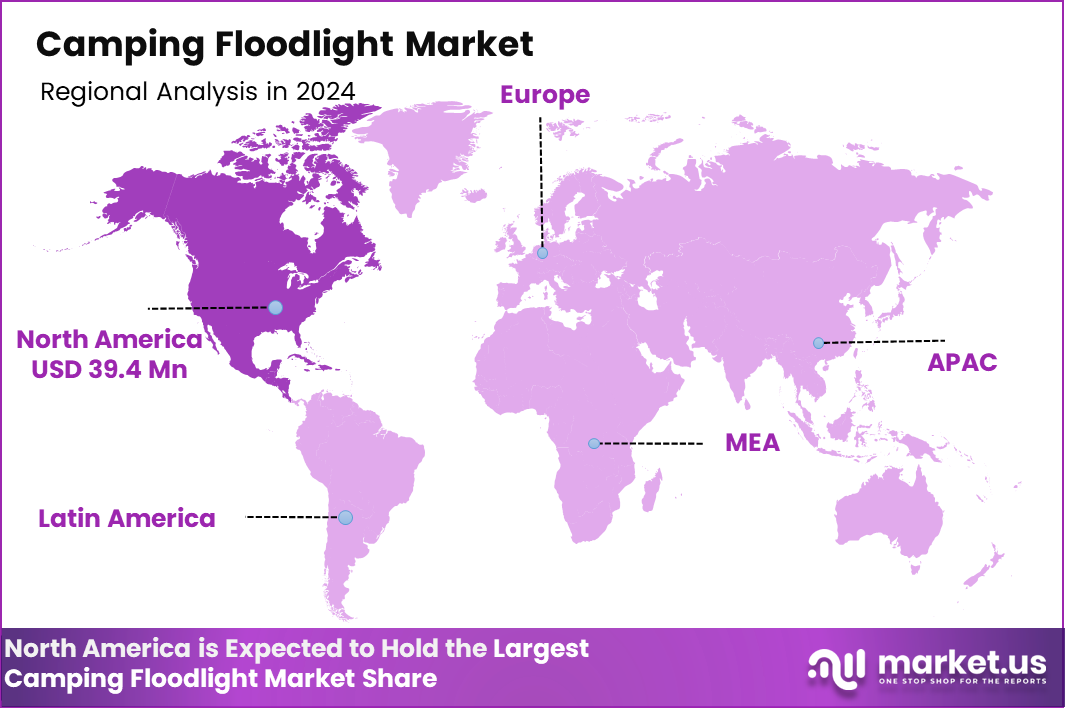

- North America dominates the regional landscape with a 39.4% share, valued at USD 55.1 million in 2024.

By Light Source Analysis

LED dominates with 72.4% due to its superior energy efficiency, long lifespan, and suitability for outdoor camping conditions.

In 2024, LED held a dominant market position in the By Light Source Analysis segment of Camping Floodlight Market, with a 72.4% share. This dominance is driven by low power consumption, extended operating hours, and consistent brightness. As a result, campers increasingly prefer LED floodlights for reliability and reduced battery replacement frequency.

In contrast, halogen floodlights continue to serve niche camping needs where warm light output is preferred. However, higher heat generation and lower energy efficiency limit their adoption. Nevertheless, they remain relevant for short-duration outdoor activities and budget-focused consumers.

Similarly, incandescent floodlights maintain limited demand in traditional camping setups. Their lower upfront cost supports minimal usage, yet shorter lifespan and higher energy draw restrict broader market penetration, especially as portable power efficiency becomes a key purchasing criterion.

By Types Analysis

200 to 500 Lumens dominates with 41.5% as it balances brightness, portability, and energy efficiency for most camping scenarios.

In 2024, 200 to 500 Lumens held a dominant market position in the By Types Analysis segment of Camping Floodlight Market, with a 41.5% share. This range provides adequate illumination for campsites while preserving battery life, making it ideal for extended outdoor stays.

Under 100 Lumens floodlights primarily address ambient and backup lighting needs. Their compact size and low power usage support lightweight camping, although limited brightness restricts use in larger or group campsite environments.

The 100 to 199 Lumens category serves moderate lighting requirements such as tent interiors and cooking areas. This segment benefits from affordability and versatility, supporting consistent demand among casual campers.

Above 500 Lumens floodlights cater to high-intensity lighting needs, including group camps and emergency scenarios. However, higher power consumption and bulk reduce adoption for routine camping activities.

By Application Analysis

Camping dominates with 56.2% due to widespread recreational participation and consistent demand for portable lighting solutions.

In 2024, Camping held a dominant market position in the By Application Analysis segment of Camping Floodlight Market, with a 56.2% share. This growth is supported by increased outdoor recreation and demand for dependable campsite illumination.

Hiking applications focus on lightweight and portable floodlights for rest stops and temporary shelter lighting. Demand remains steady, supported by minimalistic and energy-efficient product designs.

Trekking applications require durable lighting capable of withstanding extended outdoor exposure. Consequently, this segment emphasizes robustness and weather resistance rather than high brightness.

Mountaineering relies on high-reliability floodlights for extreme environments. Although volumes remain lower, performance consistency supports niche adoption.

Other applications include backyard camping and emergency outdoor use, contributing incremental demand through versatility-driven purchasing decisions.

By Distribution Channel Analysis

E-Commerce dominates with 43.6% due to wide product availability, price transparency, and convenience.

In 2024, E-Commerce held a dominant market position in the By Distribution Channel Analysis segment of Camping Floodlight Market, with a 43.6% share. Online platforms enable easy comparison, driving informed purchasing and broader reach.

Hypermarkets and supermarkets support impulse purchases and seasonal demand. Their physical presence enhances visibility, particularly during peak camping periods.

Specialty stores cater to experienced campers seeking expert guidance and premium products. Although smaller in share, this channel supports value-driven sales.

Other distribution channels, including local retailers and outdoor events, contribute supplementary demand through targeted and regional sales strategies.

Key Market Segments

By Light Source

- Halogen

- Incandescent

- LED

By Types

- Under 100 Lumens

- 100 to 199 Lumens

- 200 to 500 Lumens

- Above 500 Lumens

By Application

- Camping

- Hiking

- Trekking

- Mountaineering

- Others

By Distribution Channel

- E-Commerce

- Hypermarkets

- Supermarkets

- Specialty Stores

- Others

Drivers

Rising Participation in Camping and Outdoor Recreation Drives Market Growth

The growing interest in camping, trekking, and outdoor recreation across urban and semi urban populations is a key driver for the camping floodlight market. More people are spending leisure time outdoors as a way to relax, stay fit, and connect with nature. This trend is increasing the need for reliable lighting solutions during night time activities. Camping floodlights help users move safely, Camping tents Set up, and manage cooking or group activities after sunset.

Another important driver is the rising preference for portable high lumen lighting. Campers increasingly look for bright and wide area illumination that improves visibility and reduces safety risks. Floodlights provide stronger lighting compared to headlamps or lanterns, making them suitable for shared spaces at campsites. This makes them popular among families and group campers.

The shift toward rechargeable LED floodlights also supports market growth. LEDs consume less power, last longer, and reduce the need for frequent battery replacement. As users become more aware of energy efficiency, LED floodlights are becoming the preferred option. In addition, the expansion of adventure tourism and organized outdoor events is increasing demand for dependable lighting that can perform consistently in remote locations.

Restraints

Limited Battery Endurance in High Brightness Modes Restrains Market Expansion

One of the major restraints in the camping floodlight market is limited battery endurance, especially when floodlights are used at high brightness levels. While strong illumination is useful, it often drains the battery quickly. This creates challenges for campers who stay overnight or travel for multiple days without access to charging facilities. Frequent recharging reduces convenience and limits continuous usage.

Another restraint is performance degradation in harsh outdoor conditions. Camping floodlights are often exposed to cold temperatures, moisture, dust, and uneven terrain. In extreme cold, battery efficiency can drop, reducing light output and operating time. Similarly, prolonged exposure to rain or humidity can affect internal components if the product is not properly sealed.

Rugged outdoor use also increases the risk of physical damage from drops or impact. If floodlights fail during use, it can affect safety and user experience. These reliability concerns make some consumers cautious when investing in high powered floodlights. As a result, durability and battery limitations continue to restrain wider adoption in demanding outdoor environments

Growth Factors

Integration of Solar Charging Creates New Growth Opportunities

The integration of solar charging features presents a strong growth opportunity for the camping floodlight market. Solar enabled floodlights allow users to recharge devices during the day and use them at night, making them ideal for off grid environments. This feature supports sustainable energy use and reduces dependence on external power sources.

There is also rising demand for lightweight and compact floodlights designed for backpackers and solo campers. These users prioritize portability and ease of carrying. Compact designs with adequate brightness can attract this growing customer segment, especially among younger outdoor enthusiasts.

Camping floodlights are also gaining interest in emergency preparedness and disaster response. They are increasingly used for roadside assistance, power outages, and relief operations. This expands demand beyond recreational use. Additionally, the growth of e commerce platforms is helping manufacturers reach customers in remote and emerging markets, improving product visibility and access worldwide.

Emerging Trends

Rapid Shift Toward USB C Fast Charging Shapes Market Trends

One of the key trending factors in the camping floodlight market is the shift toward USB C fast charging. This charging standard allows quicker power replenishment and compatibility with multiple devices. Multi output connectivity also enables floodlights to act as power sources for phones and small gadgets, adding extra value for users.

Another trend is the growing popularity of adjustable beam angles and multi mode lighting. Users prefer floodlights that can switch between wide area lighting and focused beams depending on activity. Multiple lighting modes help conserve battery while offering flexibility for different outdoor needs.

The adoption of durable waterproof and shock resistant designs is also increasing. Campers now expect floodlights to perform reliably in rain, mud, and rough handling. Products built for harsh environments improve trust and long term use. These design focused trends are shaping product innovation and influencing purchasing decisions in the market.

Regional Analysis

North America Dominates the Camping Floodlight Market with a Market Share of 39.4%, Valued at USD 55.1 Million

North America leads the camping floodlight market due to high participation in camping, RV travel, and outdoor recreation activities across the US and Canada. In 2024, the region accounted for a dominant share of 39.4%, with the market valued at USD 55.1 Million, supported by strong consumer spending on premium outdoor gear. Widespread adoption of rechargeable LED floodlights, along with growing safety awareness during outdoor stays, continues to strengthen regional demand.

Europe Camping Floodlight Market Trends

Europe represents a mature and steadily growing market, driven by organized camping culture, trekking activities, and eco tourism across countries such as Germany, France, and the Nordic region. Increasing preference for energy efficient and weather resistant lighting solutions supports market expansion. Regulatory emphasis on low energy consumption products further encourages the use of LED based camping floodlights across the region.

Asia Pacific Camping Floodlight Market Trends

Asia Pacific is witnessing accelerating growth due to rising interest in outdoor leisure activities, adventure tourism, and weekend camping among urban populations. Expanding middle class income levels and improving access to outdoor equipment retail channels are supporting adoption. Countries such as China, Japan, Australia, and South Korea are contributing significantly to regional demand growth.

Middle East and Africa Camping Floodlight Market Trends

The Middle East and Africa market is developing gradually, supported by desert camping, safari tourism, and outdoor recreational events. Demand is primarily driven by the need for high lumen, durable lighting solutions capable of operating in extreme temperatures. Growth is also supported by increasing tourism investments and recreational infrastructure development in select countries.

Latin America Camping Floodlight Market Trends

Latin America shows moderate growth, supported by rising participation in outdoor festivals, camping, and nature based tourism. Increasing availability of affordable rechargeable floodlights and expanding e commerce penetration are improving market accessibility. Countries with strong tourism activity and natural reserves continue to drive regional demand.

U.S. Camping Floodlight Market Trends

The U.S. remains a key contributor within North America, supported by a strong camping culture, national park visitation, and widespread RV usage. High consumer awareness regarding portable safety lighting and preference for durable, long lifespan LED floodlights sustain steady market demand. Seasonal camping trends and organized outdoor events further reinforce market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Camping Floodlight Company Insights

In 2024, Princeton Tec continues to hold a strong position in the global camping floodlight market due to its long standing focus on rugged outdoor lighting solutions. The company’s emphasis on durability, compact design, and reliable illumination aligns well with the needs of campers, rescue teams, and military users. This positioning supports consistent demand across professional and recreational segments.

Petzl remains a strategically important player, leveraging its deep expertise in outdoor and climbing equipment to strengthen its camping floodlight portfolio. The brand’s focus on ergonomic design, balanced light output, and user safety resonates strongly with adventure tourists and organized outdoor activity providers. As outdoor recreation grows, Petzl’s integrated approach supports steady market relevance.

In 2024, Nitecore is viewed as a technology driven player within the camping floodlight market, particularly known for high performance LED lighting and power management capabilities. Its strength lies in delivering compact floodlights with high lumen output and advanced battery efficiency. This approach attracts tech savvy consumers seeking multifunctional and reliable outdoor lighting solutions.

Energizer brings a mass market advantage to the camping floodlight landscape through strong brand recognition and broad distribution reach. The company’s focus on dependable, easy to use lighting products supports adoption among casual campers and emergency preparedness consumers. This accessibility driven strategy reinforces its role in expanding overall market penetration.

Top Key Players in the Market

- Princeton Tec

- Petzl

- Nitecore

- Energizer

- Black Diamond

- GRDE

- Coast

- Thorfire

- Vintrack

- Yalumi Corporation

Recent Developments

- In Jan 17, 2025, LEDVANCE announced the acquisition of loblicht, a German lighting expert known for high quality design focused lighting products. This acquisition strengthens LEDVANCE’s lighting project expertise and expands its premium brand portfolio across architectural and professional lighting segments.

- In Dec 9, 2024, Mateminco launched the X1 Pro LED & LEP flashlight, combining Laser Excited Phosphor spotlighting with LED floodlight technology. The product introduction highlights Mateminco’s focus on advanced illumination performance for outdoor, tactical, and professional use cases.

Report Scope

Report Features Description Market Value (2024) USD 140.0 Million Forecast Revenue (2034) USD 277.9 million CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Light Source (Halogen, Incandescent, LED), By Types (Under 100 Lumens, 100 to 199 Lumens, 200 to 500 Lumens, Above 500 Lumens), By Application (Camping, Hiking, Trekking, Mountaineering, Others), By Distribution Channel (E-Commerce, Hypermarkets, Supermarkets, Specialty Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Princeton Tec, Petzl, Nitecore, Energizer, Black Diamond, GRDE, Coast, Thorfire, Vintrack, Yalumi Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Princeton Tec

- Petzl

- Nitecore

- Energizer

- Black Diamond

- GRDE

- Coast

- Thorfire

- Vintrack

- Yalumi Corporation