Global Campervan Rental Market Size, Share, Growth Analysis By Vehicle (Economy Campervans, Luxury Campervans, Family Campervans), By End-user (Family Trip, Couple Travel, Group, Others), By Material (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148670

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

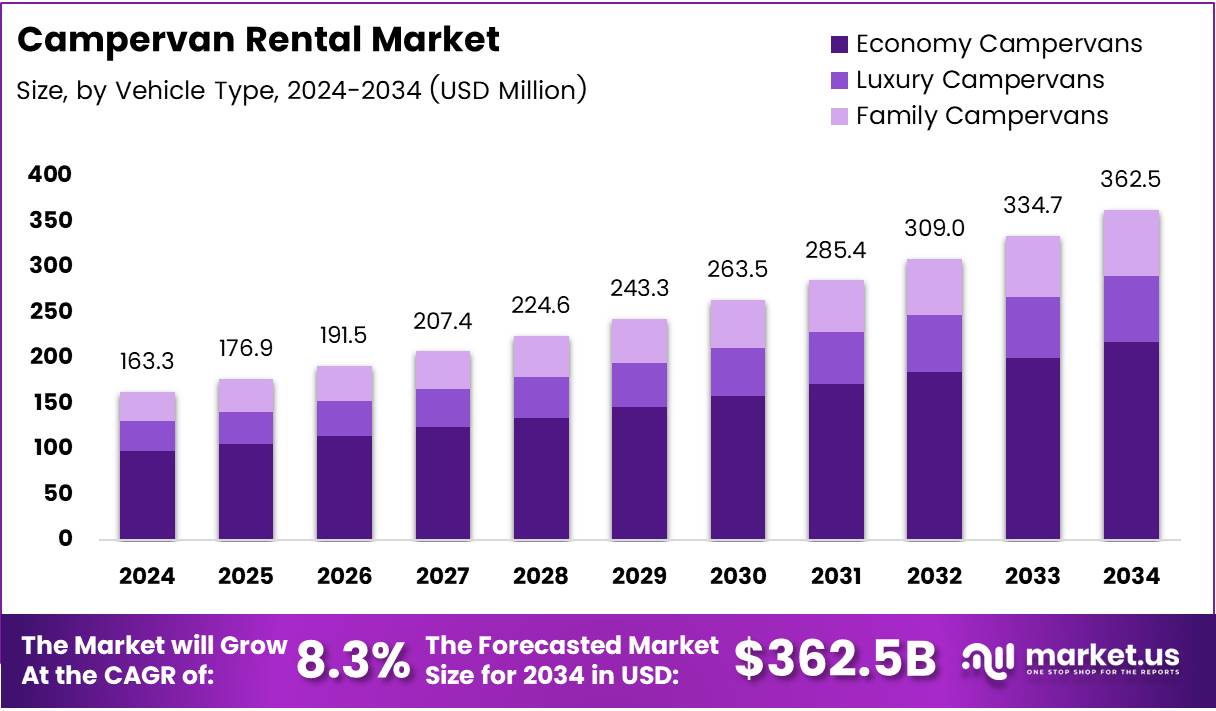

The Global Campervan Rental Market size is expected to be worth around USD 362.5 Million by 2034, from USD 163.3 Million in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034.

The Campervan Rental Market refers to the sector that offers vehicles equipped for travel and temporary living, rented out for short or extended periods. These services enable travelers to explore destinations with flexibility, combining transport and accommodation in one. Campervan hire services are increasingly popular for road trips, vacations, and weekend getaways due to their convenience and comfort.

The market is witnessing strong growth driven by rising demand for affordable campervan rental options. According to moderncampground, in the U.S., Class A motorhomes rent for an average of $313 per night, while Class B campervans and Class C motorhomes cost about $228 and $214 per night, respectively. These price points highlight the range of options available, appealing to different customer segments from budget-conscious to luxury travelers.

Used camper vans also show good resale value, indicating healthy market dynamics. According to escapecampervans, used camper vans generally sell for $60,000+ when in good condition and low mileage. This underscores the investment potential and sustained interest in campervan ownership following rental experiences.

Demographically, the market is energized by a younger audience. Traderinteractive notes that approximately 63% of RV renters are aged between 21 and 35 years, representing a shift toward younger travelers seeking adventure and flexible vacation options. This trend fuels growth opportunities for companies offering pet-friendly campervan rental and family campervan rental packages tailored to this demographic.

Moreover, the rental experience often serves as a gateway to ownership. About 75% of renters express a likelihood to purchase an RV within the next two years, according to traderinteractive. This suggests that campervan rental deals and campervan rental discounts are not only attracting travelers but also cultivating potential buyers, expanding the market footprint.

Government investment in tourism infrastructure and supportive regulations further enhance the market environment. Policies promoting domestic travel and outdoor recreation create favorable conditions for campervan rental booking online platforms to flourish. Additionally, insurance regulations tailored to campervan rental with insurance ensure safety and confidence for both providers and renters.

Key Takeaways

- The global vegan footwear market is projected to reach USD 74.4 billion by 2034, growing from USD 34.8 billion in 2024.

- The market is expected to grow at a CAGR of 7.9% from 2025 to 2034.

- In 2024, shoes dominated the product segment with a 39.2% market share.

- Polyurethane led the material segment in 2024 with a 36.2% share due to its durability and cost-effectiveness.

- The women’s segment held a dominant position in end-user analysis with a 42.3% share in 2024.

- North America leads the market with a 35.6% share, valued at around USD 12.5 billion.

By Vehicle Analysis

In 2024, Economy Campervans held a dominant market position in By Vehicle Analysis segment of Campervan Rental Market, with a strong share.

Economy Campervans continue to attract a broad customer base due to their affordability and practicality. Their value proposition resonates well with budget-conscious travelers who seek reliable yet cost-effective rental options. This has helped Economy Campervans secure a significant portion of the market share.

Luxury Campervans, while catering to a niche segment, maintain a stable position thanks to growing demand from travelers seeking premium comfort and high-end features. These vehicles appeal to customers who prioritize experience and amenities over cost.

Family Campervans have steadily gained traction by addressing the specific needs of larger groups or families requiring extra space and convenience. Their design and functionality make them a preferred choice for extended trips and multi-generational travel.

Overall, the vehicle segment is clearly segmented by price, features, and target customer groups, with Economy Campervans leading due to their balance of value and accessibility.

By End-user Analysis

In 2024, Family Trip held a dominant market position in By End-user Analysis segment of Campervan Rental Market, with a 36.9% share.

Family Trip remains the largest end-user segment with a 36.9% share, driven by increasing trends in family vacations and outdoor recreational activities. Families favor campervans as they provide flexibility and comfort, making long journeys more enjoyable for all ages.

Couple Travel represents a significant market segment, especially among younger and adventurous couples. This group values intimacy and convenience, opting for smaller, more agile campervans suitable for two.

Group travel is emerging steadily, particularly among friends or community groups who seek shared travel experiences. Campervans rented by groups tend to be larger and more equipped to handle multiple passengers comfortably.

The Others category captures niche segments including solo travelers and corporate rentals, which, while smaller, contribute to the overall market diversity and demand.

By Material Analysis

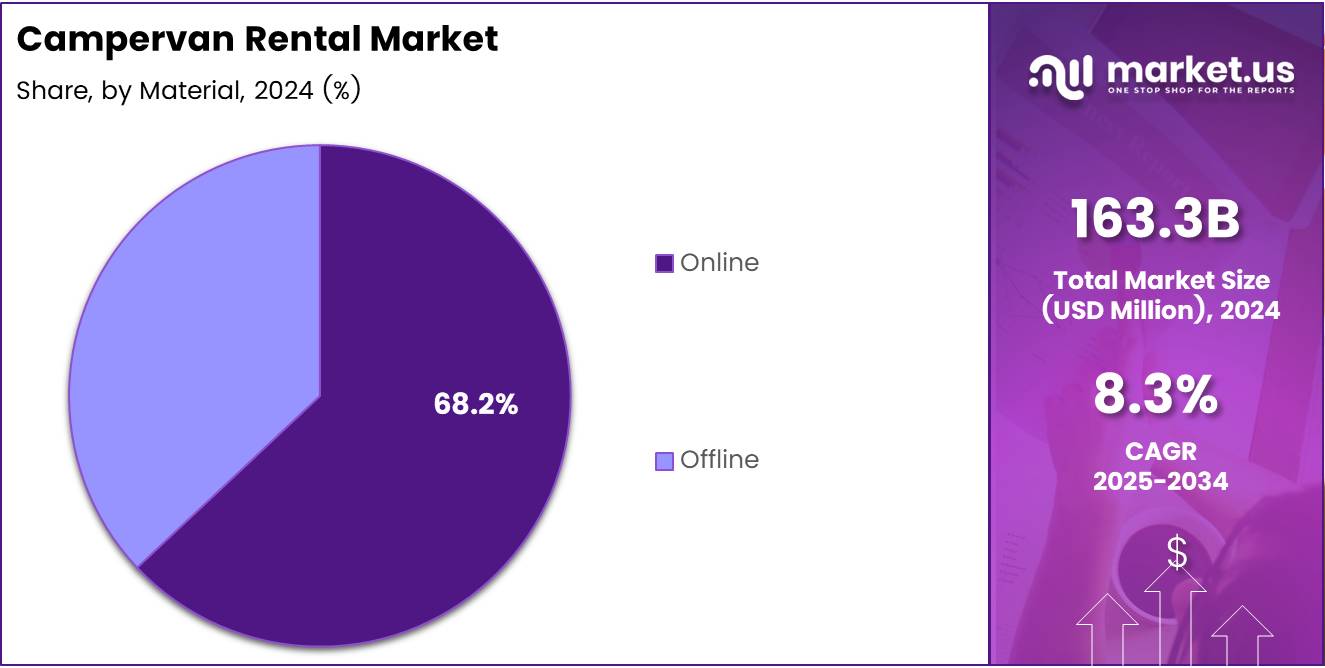

In 2024, Online held a dominant market position in By Material Analysis segment of Campervan Rental Market, with a 68.2% share.

The Online channel leads the market due to its convenience, broad accessibility, and the ability to compare numerous options quickly with a 68.2% share. Customers prefer online platforms for transparent pricing, availability checks, and customer reviews, which enhance confidence in rental decisions.

Offline rentals continue to serve a loyal customer base that values personal interaction and in-person vehicle inspections before renting. However, this channel holds a smaller market share compared to the rapid growth of digital bookings.

The rise of mobile apps and integrated booking systems has further propelled the online segment, allowing renters to make quick and secure transactions anytime and anywhere.

As digital transformation progresses, online rental platforms are expected to consolidate their dominance by offering personalized experiences and seamless booking processes.

Key Market Segments

By Vehicle

- Economy Campervans

- Luxury Campervans

- Family Campervans

By End-user

- Family Trip

- Couple Travel

- Group

- Others

By Material

- Online

- Offline

Drivers

Surge in Eco-Tourism and Sustainable Travel Preferences Drives Campervan Rental Market Growth

The growing awareness of eco-tourism and the desire for sustainable travel have become key drivers in the campervan rental market. Travelers increasingly seek environmentally friendly vacation options, and campervans offer a way to explore nature responsibly without relying on hotels or flights. This shift supports market expansion by aligning with modern consumer values.

Additionally, the rise of digital nomads and remote work culture has encouraged more people to adopt a mobile lifestyle. Campervans provide the flexibility needed to work from anywhere while traveling, blending leisure and productivity. This lifestyle trend significantly boosts demand for campervan rentals.

Infrastructure supporting campervan travel is also expanding. More dedicated parking spots, campgrounds, and service areas designed for campervans make traveling easier and safer. This improved accessibility attracts both first-time and experienced renters, facilitating market growth.

Lastly, domestic and regional road trips are gaining popularity as travelers prefer closer, personalized, and safer trips post-pandemic. Campervans perfectly fit this trend, offering comfort and convenience for road explorers. Together, these factors are steadily driving the campervan rental market forward.

Restraints

High Initial Rental and Maintenance Costs Restrain Campervan Rental Market Growth

One major restraint in the campervan rental market is the high initial cost of renting and maintaining these vehicles. Campervans require significant upkeep to ensure safety and comfort, which increases rental prices and can discourage budget-conscious travelers.

Access to repair and service facilities in remote travel areas remains limited. Breakdowns or technical issues far from urban centers pose challenges, reducing consumer confidence in campervan rentals for long trips or remote locations.

The market also faces seasonal demand fluctuations. Campervan rentals peak during holiday seasons and warmer months but experience lower usage in off-season periods. This seasonal dependency affects consistent revenue generation for rental companies.

Strict government regulations around wild camping and parking further restrict campervan use. Many regions enforce laws that limit overnight stays or specific parking zones, complicating travel planning and limiting the freedom that campervan renters seek. These challenges act as barriers to market growth.

Growth Factors

Integration of Smart Technology and IoT in Campervans Opens New Growth Opportunities

The campervan rental market is poised for growth through the integration of smart technologies and the Internet of Things (IoT). Features such as automated climate control, remote diagnostics, and smart security enhance user experience and vehicle safety, attracting tech-savvy customers.

Expanding into untapped emerging markets and rural destinations presents significant opportunities. As awareness of campervan travel spreads, new regions can offer unique experiences, encouraging travelers to explore beyond traditional hotspots.

Customization services tailored to niche travel groups are also growing. Rentals can be adapted for families, adventure seekers, or luxury travelers, allowing providers to meet diverse customer needs and increase market appeal.

Strategic partnerships with travel agencies and tourism boards further support growth by promoting campervan travel packages. These collaborations help integrate campervans into broader tourism ecosystems, expanding reach and customer base.

Emerging Trends

Rise of Campervan Sharing Platforms and Peer-to-Peer Rentals Drives Market Trends

Campervan sharing platforms and peer-to-peer rental models are transforming the market landscape. These platforms lower barriers to entry for both owners and renters, increasing vehicle availability and variety, which attracts more users.

There is a growing demand for off-grid and solar-powered campervan models. Environmentally conscious travelers prefer sustainable energy solutions, and such innovations reduce dependence on traditional power sources, enhancing travel flexibility.

AI-driven route planning and travel assistance tools are becoming popular. These technologies help renters optimize their trips by suggesting efficient routes, points of interest, and campsite availability, improving overall travel experience.

Finally, minimalist and modular interior designs are trending. These designs maximize space, improve comfort, and offer customizable living areas, aligning with consumer preferences for simplicity and functionality in mobile living.

Regional Analysis

North America Dominates the Campervan Rental Market with a Market Share of 43.8%, Valued at US$70.2 Million

North America holds a commanding lead in the campervan rental market, accounting for a significant 43.8% share. The region benefits from a well-established road trip culture, strong tourism infrastructure, and a growing interest in outdoor recreational activities, which collectively drive demand for campervan rentals. Increasing investments in campervan-friendly facilities further support market expansion in this region.

Regional Mentions:

The Europe market also shows robust growth, fueled by diverse tourist destinations and government initiatives promoting eco-tourism and sustainable travel. Well-developed road networks and rising popularity of domestic and cross-border travel contribute to increasing campervan rentals across major European countries.

In the Asia Pacific region, the campervan rental market is emerging rapidly, supported by rising disposable incomes, growing interest in adventure tourism, and expanding infrastructure. Urbanization coupled with evolving travel preferences is expected to propel further demand for campervan rentals in this region.

The Middle East & Africa region is gradually witnessing growth driven by increasing tourism activities and investments in hospitality infrastructure. However, market development is relatively slower due to limited campervan rental penetration and infrastructure challenges.

In Latin America, rising tourism and improving road infrastructure are creating favorable conditions for campervan rental market growth. The region is poised for steady expansion as interest in domestic travel and exploration of remote destinations rises among consumers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global Campervan Rental Market is shaped significantly by several leading companies, each bringing unique strengths and strategies to the industry. Cruise America remains a prominent player with a well-established fleet and widespread rental network across North America, catering to both domestic travelers and international tourists. Their extensive service coverage and customer-centric approach continue to strengthen their market position.

Auto Europe distinguishes itself by offering a broad range of campervan options across multiple regions, supported by a robust online booking platform that simplifies the rental process. Their strategic partnerships with local providers enhance accessibility and competitive pricing, attracting a diverse customer base seeking flexible travel solutions.

GoCamp leverages technology to offer tailored campervan rental experiences, focusing on personalization and ease of use through its digital platform. This innovation appeals especially to younger, tech-savvy consumers looking for customized travel adventures, positioning GoCamp as a growing competitor in the market.

Britz excels in the Asia-Pacific region with a strong presence and comprehensive vehicle options suited for various travel needs. Their emphasis on quality maintenance and customer service ensures high satisfaction rates, supporting their expansion in key markets.

Together, these companies contribute to the dynamic growth of the Campervan Rental Market by addressing evolving consumer preferences, expanding geographic footprints, and enhancing digital engagement. Their strategies underscore the importance of adaptability and customer focus in maintaining competitiveness within this fast-growing segment.

Top Key Players in the Market

- Cruise America

- Auto Europe

- GoCamp

- Britz

- INDIE CAMPERS

- Apollo RV Holidays

- Outdoorsy, Inc.

- Spaceships Rentals

- JUCY GROUP Limited.

- Escape Camper Vans

Recent Developments

- In July 2024, a leading Portuguese campervan rental company successfully raised €35 million in funding, aiming to expand its fleet and enhance service offerings across Europe. This substantial capital injection is expected to accelerate the company’s growth and market presence.

- In April 2024, Blacksford RV Rentals was acquired by Cortina Partners, leading to rapid and substantial growth for the company. The acquisition has enabled Blacksford to scale operations and increase its market share in the RV rental sector.

- In February 2024, the motorhome rental platform Campiri announced a merger with FreewayCamper, combining resources to offer an enhanced rental experience. This strategic merger aims to create a more competitive and expansive rental platform.

- In October 2024, FreewayCamper secured an investment of €4 million, intended to support its technological advancements and fleet expansion. This funding round marks a crucial step in FreewayCamper’s growth trajectory within the campervan rental industry.

Report Scope

Report Features Description Market Value (2024) USD 163.3 Million Forecast Revenue (2034) USD 362.5 Million CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Economy Campervans, Luxury Campervans, Family Campervans), By End-user (Family Trip, Couple Travel, Group, Others), By Material (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cruise America, Auto Europe, GoCamp, Britz, INDIE CAMPERS, Apollo RV Holidays, Outdoorsy, Inc., Spaceships Rentals, JUCY GROUP Limited., Escape Camper Vans Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cruise America

- Auto Europe

- GoCamp

- Britz

- INDIE CAMPERS

- Apollo RV Holidays

- Outdoorsy, Inc.

- Spaceships Rentals

- JUCY GROUP Limited.

- Escape Camper Vans