Global Business Process Outsourcing Market Size, Share, Global Market Forecast Report By Service Type (Customer Service, Finance & Accounting, Human Resources, Procurement & Supply Chain, and Other Service Types), By Enterprise Size (Small & Medium Enterprises and Large Enterprises), By End-Use Industry (IT & Telecommunications, BFSI, Manufacturing, Retail, Healthcare, and Other End-Use Industries), By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Oct. 2024

- Report ID: 57779

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Service Type Analysis

- Enterprise Size Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Geopolitical and Recession Impact Analysis

- Emerging Trends

- Top Use Cases for BPO

- Business Benefits of BPO

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

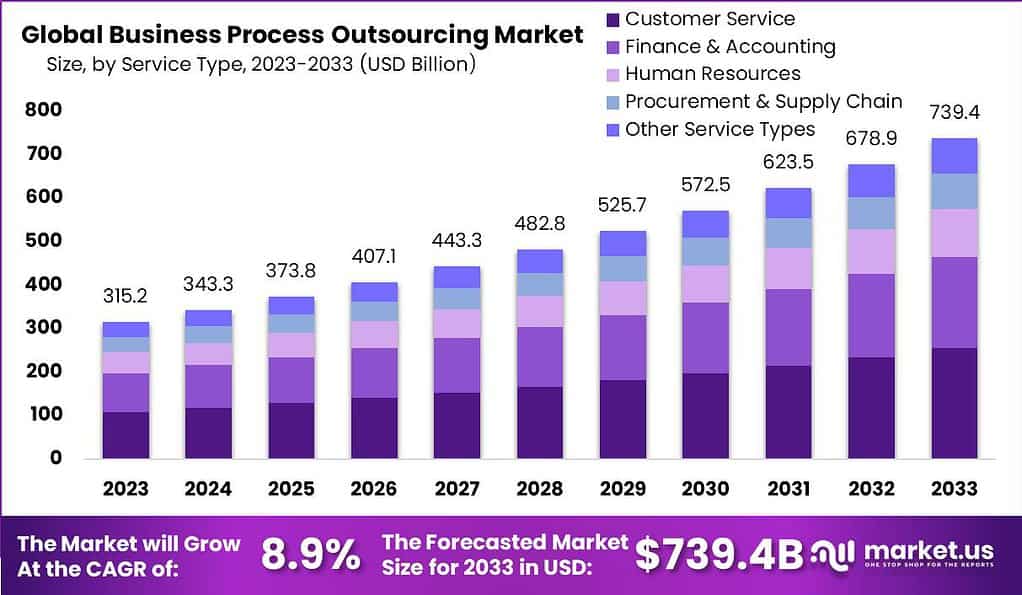

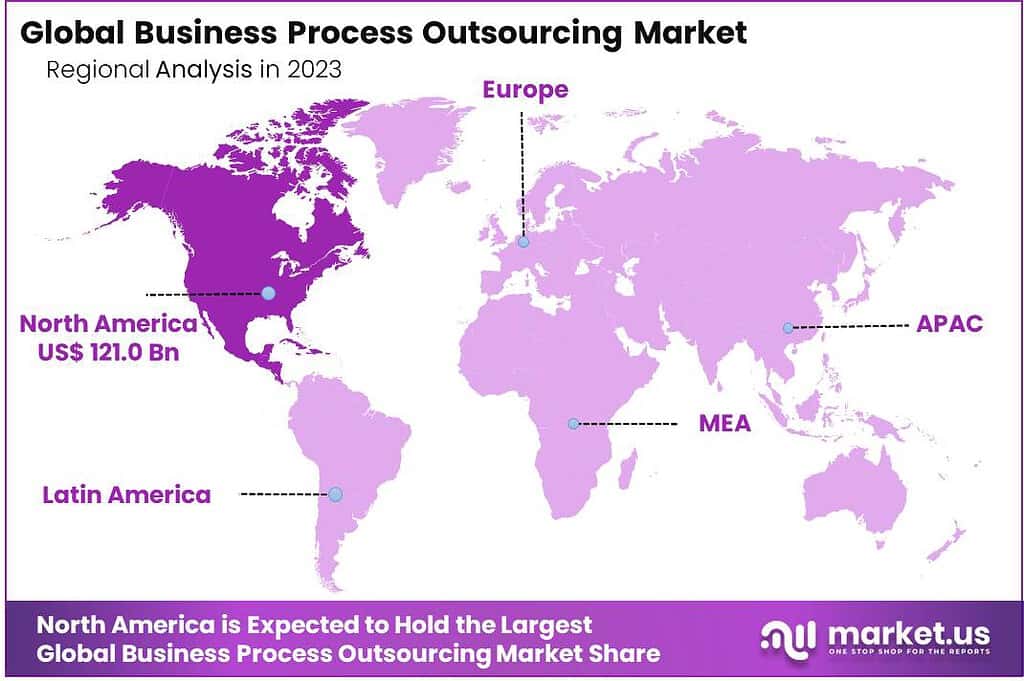

The Global Business Process Outsourcing Market size is expected to be worth around USD 739.4 Billion by 2033, from USD 315.2 Billion in 2023, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38.4% share, which translates to approximately USD 121 billion in revenue.

Business Process Outsourcing, or BPO, involves a company hiring another company to handle specific business tasks or services. These tasks often include customer service, accounting, data processing, or human resources. The main idea behind BPO is for companies to outsource non-core operations, allowing them to focus more on their primary business activities. This can lead to cost savings, improved efficiency, and access to advanced technologies without significant investment.

The Business Process Outsourcing (BPO) market is growing significantly as more companies choose to outsource various business-related processes to third-party service providers. This approach allows businesses to focus more on their core operations while outsourcing non-core activities such as customer service, HR, accounting, and IT services. By doing so, companies can reduce costs, increase efficiency, and improve service quality, making BPO a highly attractive option for many industries.

The demand for Business Process Outsourcing services is increasing because companies are looking for ways to cut costs while still maintaining high-quality operations. Outsourcing enables businesses to access skilled professionals and advanced technologies without the need for heavy investments in their own infrastructure. This is particularly appealing in competitive markets where efficiency and scalability are crucial for growth.

The popularity of the Business Process Outsourcing market is on the rise. As globalization increases, businesses are more willing to outsource processes to countries where labor costs are lower, yet the quality of services is high. This global reach has made BPO popular among companies in both developed and emerging economies, expanding its appeal across various sectors including telecommunications, healthcare, banking, and retail.

The expansion of the Business Process Outsourcing market is supported by several factors, including technological advancements such as cloud computing and artificial intelligence. These technologies make it easier and more cost-effective to outsource complex processes and data-heavy tasks. Additionally, the growing focus on core business functions among large organizations drives the continual growth of BPO services.

As more companies realize the benefits of outsourcing, the market is set to expand further, offering more specialized services tailored to the diverse needs of businesses globally. The BPO market presents numerous opportunities, particularly in integrating new technologies like artificial intelligence (AI) and machine learning (ML) into traditional services. This integration allows BPO firms to offer more sophisticated, data-driven services to their clients, optimizing customer interactions and backend processing.

For instance, According to Nasscom, employees in the BPO sector face significant risks of job displacement due to advancements in generative AI. The chairman of Nasscom noted that while previous technological advancements primarily affected lower-end tasks, the current trend indicates a broader impact on white-collar jobs within the BPO industry

As per the report from Market.us, The global Business Process Outsourcing (BPO) market is poised for substantial growth, projected to reach a revenue of USD 343.3 billion in 2024. This growth trajectory is anticipated to continue with a Compound Annual Growth Rate (CAGR) of 8.9% over the forecast period from 2024 to 2030, ultimately achieving a market volume of USD 572.5 billion by 2030.

The BPO sector is experiencing rapid expansion, particularly in regions like the Philippines, where the industry’s growth rate is forecasted to be between 7% and 9% annually, outpacing the global average. according to select voicecom.

As highlighted by investopedia, Recent developments in U.S. tax policy, specifically President Biden’s proposal to increase the federal corporate income tax rate from 21% to 28%, are set to significantly impact the outsourcing industry. This adjustment would raise the combined state and federal corporate tax rate to 32%, making it nearly 50% higher than the Organisation for Economic Co-operation and Development (OECD) average.

The average total compensation for BPO professionals in the United States stands at approximately USD 205,756 per year, with base salaries averaging around USD 125,808 annually. This substantial remuneration reflects the critical role of BPO services in modern business operations, further underlining the sector’s importance.

According to Deloitte’s Global Outsourcing Survey, a significant 62% of executives report insufficient time or resources to tackle poor employee retention rates, which is prompting businesses to partner with BPO firms that offer access to a broader talent pool.

Furthermore, an overwhelming 96% of executives depend on outsourcing for enhancing their data and analytics capabilities. A 2023 survey by Clutch highlights that small business owners plan to invest in outsourcing, with 27% focusing on marketing services, 22% on IT services, and 21% on design services.

The United States is projected to lead in global BPO revenue with an estimated USD 146.4 billion in 2024. Annually, around 300,000 jobs are outsourced from the U.S., showcasing a strategic shift in employment to BPO sectors abroad, driven by economic efficiencies and a strategic approach to resource management in business processes.

Key Takeaway

- The Global Business Process Outsourcing (BPO) Market is projected to experience significant growth, escalating from a valuation of USD 315.2 Billion in 2023 to an estimated USD 739.4 Billion by 2033. This reflects a robust compound annual growth rate (CAGR) of 8.9% over the forecast period from 2024 to 2033.

- In the regional landscape, North America maintained its leading position in the BPO market in 2023, accounting for a substantial 38.4% share. This corresponds to revenue generation of approximately USD 121 Billion, underscoring the region’s pivotal role in the global BPO industry.

- From a service type perspective, the BPO market was predominantly led by a specific segment in 2023, which held a 34.5% share. This indicates a focused demand and utilization within this segment, highlighting its critical importance to the outsourcing strategies of businesses.

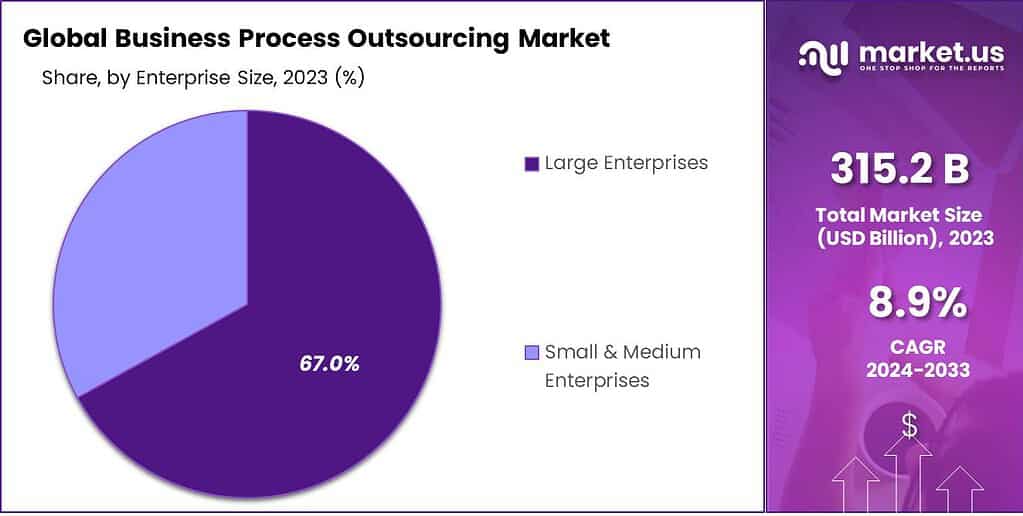

- In terms of enterprise size, large enterprises notably dominated the BPO market in 2023, capturing a significant 67.0% share. This dominance illustrates the reliance of larger organizations on outsourcing services to optimize operations and enhance efficiency.

- Furthermore, within the industry verticals, the IT & Telecommunications sector emerged as a major consumer in the BPO market in 2023, securing a leading 36.1% share. This reflects the sector’s extensive adoption of outsourcing services to manage its diverse and complex operational requirements effectively.

- 70% of companies engage in outsourcing primarily to achieve cost savings. This trend is underscored by significant financial efficiencies, with businesses that outsource Human Resources functions reporting an average cost reduction of 27.2%.

- Approximately 65% of companies acknowledge that outsourcing facilitates a sharper focus on their primary business operations, enabling them to allocate resources and attention to areas that are critical for their strategic goals.

- Operational efficiency is another major driver for outsourcing, particularly among smaller enterprises. Notably, 37% of small businesses adopt outsourcing strategies to enhance their operational effectiveness, demonstrating the widespread acknowledgment of outsourcing as a means to streamline processes and improve service delivery.

Service Type Analysis

In 2023, the Service Type segment held a dominant market position within the Business Process Outsourcing (BPO) market, capturing more than a 34.5% share. This segment encompasses a variety of essential services including Customer Service, Finance & Accounting, Human Resources, Procurement & Supply Chain, among others, which are pivotal for the daily operations and strategic management of companies across various industries.

The prominence of this segment can be attributed to the increasing reliance on outsourced services that allow businesses to focus on their core competencies while reducing operational costs. The leading role of the Service Type segment is driven by several factors. Primarily, there is a growing trend among companies to enhance operational efficiency and improve customer satisfaction, which is effectively supported by outsourcing non-core activities.

Customer Service and Human Resources, for example, are crucial for maintaining brand reputation and employee satisfaction but can be resource-intensive to manage internally. By outsourcing these functions, companies not only optimize resource allocation but also benefit from the expertise of BPO providers specialized in these areas.

Additionally, the expansion of the Finance & Accounting services within BPO is another significant contributor to the growth of this segment. In an increasingly complex regulatory environment, businesses seek to outsource these functions to ensure compliance and accuracy in financial operations. Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning by BPO firms has enhanced the appeal of outsourcing by promising greater efficiency and data-driven decision-making capabilities.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position within the Business Process Outsourcing (BPO) market, capturing more than a 67.0% share. This substantial market share can primarily be attributed to the extensive outsourcing activities undertaken by large enterprises as they strive to optimize operational efficiencies and reduce costs. These corporations typically engage in BPO to leverage advanced technologies and skilled labor at lower costs than what is available in-house or domestically.

Large enterprises often have complex processes and massive volumes of transactions that necessitate robust systems and sophisticated management that BPO firms provide. By outsourcing non-core activities such as human resources, customer service, and finance and accounting, large organizations can focus more on their core competencies and strategic growth areas.

Moreover, BPO allows these enterprises to scale their operations rapidly without the corresponding scale in capital expenditures and headcount, which is particularly valuable in volatile economic conditions. Furthermore, large enterprises are better positioned to negotiate favorable terms with outsourcing providers, achieving cost-effectiveness and improved service levels.

The global presence of large enterprises also drives the need to offer round-the-clock services and support in multiple languages, which BPO vendors are well-equipped to handle. Additionally, the increasing reliance on digital transformations and the integration of artificial intelligence and machine learning in business processes are propelling the demand for sophisticated BPO services that large enterprises continuously seek.

The leading position of the Large Enterprises segment is reinforced by their ability to implement and benefit from transformative outsourcing strategies that are aligned with global business trends and technological advancements. This not only enhances their operational efficiencies but also provides them with a competitive edge in their respective industries

End-User Analysis

In 2023, the IT & Telecommunications segment held a dominant market position within the Business Process Outsourcing (BPO) market, capturing more than a 36.1% share. This leading position is primarily driven by the critical need within the sector for continuous innovation and the management of large-scale, complex networks and systems that are fundamental to modern communication services.

IT and telecommunications companies are increasingly relying on BPO providers to manage extensive customer service operations and technical support, enabling them to focus on core technological advancements and service enhancements. The rapid evolution of telecommunications technologies, including the rollout of 5G networks and the expansion of IoT (Internet of Things) connectivity, necessitates agile support systems that can adapt quickly to changing technologies and consumer demands.

BPO services enable IT and telecommunications companies to scale operations flexibly, managing large volumes of customer interactions efficiently, and ensuring high levels of customer satisfaction in a highly competitive market. Outsourcing also provides access to innovative solutions and expertise in emerging areas such as cloud computing and cybersecurity, which are pivotal in maintaining the integrity and competitiveness of IT infrastructures.

Moreover, the globalization of the telecommunications sector demands a versatile approach to customer service and back-office operations, often requiring multi-lingual support and round-the-clock service capabilities that BPO firms are equipped to provide. The integration of AI and automation into BPO practices further enhances the efficiency and scalability of services provided to the IT & Telecommunications industry, driving down costs and improving service delivery standards.

Key Market Segments

Based on the Service Type

- Finance & Accounting

- Human Resources

- Procurement & Supply Chain

- Customer Services

- Other Service Types

Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

Based on End-User

- BFSI

- Healthcare

- Manufacturing

- IT & Telecom

- Retail

- Other End-Users

Driver

Digital Transformation and Technology Integration

The global Business Process Outsourcing (BPO) market is experiencing significant growth, driven by the widespread adoption of digital transformation and advanced technologies like Artificial Intelligence (AI), Robotic Process Automation (RPA), and analytics. These technologies enhance the capabilities of BPO services by enabling more efficient process handling, improving turnaround times, and increasing service quality.

As businesses continue to focus on core competencies, the reliance on BPOs to manage non-core functions through these technological means is increasing, thereby expanding the market reach of BPOs. The strategic integration of these technologies helps companies maintain competitive edges by optimizing operational efficiencies and reducing costs

Restraint

Security Concerns

Security concerns pose significant challenges to the growth of the BPO market. With the increase in data breaches and cyber threats, companies are becoming more cautious about outsourcing their business processes. Vulnerabilities related to data security can lead to severe consequences, including financial losses and damage to reputation.

As BPO involves handling sensitive information, any potential security threat becomes a significant hindrance, making organizations hesitant to outsource their processes. Despite the introduction of advanced security solutions, the apprehension regarding data privacy and security remains a prominent barrier to market expansion

Opportunity

Expansion into Emerging Markets

Emerging markets offer a lucrative opportunity for the expansion of BPO services due to their cost-effective labor pools and improving technological infrastructures. Countries like India, China, and the Philippines have become global hubs for BPO services, providing significant cost advantages and a skilled workforce proficient in English.

The economic growth in these regions further fuels the demand for BPO services across various sectors, including telecommunications, healthcare, and finance. The strategic expansion into these markets can provide BPO companies with access to new customer segments and contribute to revenue growth

Challenge

Managing Service Quality Across Diverse Processes

A significant challenge in the BPO industry is maintaining consistent service quality across various and complex business processes. Each client may require customized solutions that can handle their specific operational needs, which can vary greatly from one industry to another.

The need to manage these diverse requirements, often across different geographical and regulatory environments, puts pressure on BPO providers to maintain high standards of service delivery. Moreover, the integration of new technologies, while beneficial, also requires ongoing training and adaptation, adding complexity to service management

Geopolitical and Recession Impact Analysis

Geopolitical Impact Analysis

The Global Business Process Outsourcing Market is significantly influenced by geopolitical factors, which can lead to shifts in market dynamics and operational strategies. Political instability, trade disputes, and changes in regulatory landscapes in outsourcing destinations can disrupt service delivery and affect the cost structures of BPO services. For instance, geopolitical tensions can result in the imposition of tariffs, affecting the cost competitiveness of outsourcing services from certain regions.

Companies may need to reevaluate their outsourcing strategies and consider diversifying their geographic presence to mitigate risks associated with geopolitical uncertainties. This environment necessitates flexibility and adaptability among BPO providers, for navigating through potential disruptions and maintain service continuity for their clients.

Recession Impact Analysis

Economic downturns and recessions present both challenges and opportunities for the market. During recessions, businesses focus on cost optimization and operational efficiency to navigate through financial constraints, leading to an increased demand for BPO services as a means to reduce expenses.

However, the demand for these services may decrease, with companies prioritizing essential over discretionary services. On the opportunity side, recessions can accelerate outsourcing trends, as companies look to transform their business models and reduce fixed costs.

BPO providers offering innovative, cost-effective solutions and demonstrating the ability to add strategic value can thrive during economic downturns. However, the overall impact of a recession on the market depends on the depth and duration of the economic downturn, as well as the adaptability of BPO providers to meet changing client needs.

Emerging Trends

The Business Process Outsourcing (BPO) industry is experiencing significant trends and transformations, which are shaping its future in dynamic ways. Here are some of the key trends currently influencing the BPO landscape:

- Artificial Intelligence and Machine Learning: The integration of AI and machine learning is revolutionizing BPO services by automating routine tasks and enhancing data processing capabilities. This trend not only improves operational efficiency but also enhances the customer experience by providing quick and accurate services.

- Data Privacy and Security: As BPOs handle increasing amounts of sensitive data, robust security measures are becoming crucial. The industry is seeing more stringent data protection protocols including encryption and multi-factor authentication to safeguard client information against cyber threats.

- Remote Work: The shift towards remote work continues to prevail across the BPO industry, allowing access to a global talent pool and resulting in cost savings and operational efficiencies. This model is expected to persist, blending traditional and remote work environments.

- Enhanced Customer Experience: BPOs are focusing on virtual customer experience improvements through technologies like self-service portals, which help businesses differentiate themselves in a competitive market.

- Blockchain Technology: Adoption of blockchain is growing within the BPO sector, providing enhanced transparency, security, and efficiency, especially in processes like supply chain management and financial transactions.

- Sustainability and Social Responsibility: There is an increasing emphasis on eco-friendly practices within the BPO industry. Companies are partnering with service providers that adopt green policies, reflecting a broader corporate responsibility towards environmental sustainability.

Top Use Cases for BPO

- Information Technology: The demand for outsourcing IT services remains robust as companies seek expertise in managing IT infrastructure and software development. This segment includes everything from basic IT support to advanced software engineering and mobile app development.

- Customer Service: BPOs are extensively used for customer service functions, handling everything from call center operations to customer relationship management, helping companies maintain and improve customer interactions and satisfaction levels.

- Finance and Accounting: Outsourcing financial services, such as payroll, bookkeeping, and financial planning, allows businesses to benefit from specialized financial expertise and improved compliance and accuracy.

- Human Resources: HR outsourcing includes recruitment, payroll processing, employee training, and benefits management, which helps businesses reduce costs and manage employee relations more efficiently.

- Healthcare Services: With the growing complexity of healthcare administration, BPOs are increasingly used for medical billing, claims processing, and healthcare management, ensuring compliance and improving patient care efficiency.

Business Benefits of BPO

- Cost Reduction: One of the primary benefits of BPO is the significant reduction in costs. By outsourcing non-core functions, companies can save on labor costs and overheads, which is particularly beneficial during economic downturns or periods of financial restraint.

- Access to Expertise: Outsourcing allows companies to access specialized skills and knowledge that may not be available in-house, particularly in technical or niche areas. This can lead to improved quality of service and innovation.

- Focus on Core Business: By delegating routine and administrative tasks to external providers, businesses can focus more on their core activities, leading to better resource allocation and potentially higher profitability.

- Scalability and Flexibility: BPO provides companies with the flexibility to scale operations up or down based on business requirements, which is crucial for handling market fluctuations and growth phases without the need for significant capital investment.

- Risk Mitigation: Outsourcing can help mitigate business risks by distributing certain responsibilities to vendors who may be better equipped to manage potential risks, particularly in areas like compliance and data security.

- Enhanced Efficiency: Through outsourcing, companies can streamline processes and improve service delivery timings, which enhances overall operational efficiency.

- Global Reach: BPO enables businesses to operate on a global scale without needing to establish a physical presence in multiple countries. This is facilitated by leveraging the global footprint of BPO providers.

Regional Analysis

In 2023, North America held a dominant market position in the Business Process Outsourcing (BPO) sector, capturing more than a 38.4% share, with revenues reaching USD 121 billion. This substantial market presence can be attributed to several pivotal factors. Primarily, the region benefits from a mature IT infrastructure, which supports the vast array of BPO services such as customer service, human resources, and finance and accounting outsourcing.

Moreover, the presence of a large number of Fortune 500 companies in North America, which continuously seek to optimize their operations and reduce costs, significantly contributes to the demand for BPO services. Furthermore, North America’s leadership in the BPO market is bolstered by its strong emphasis on service quality and technological adoption.

Many BPO providers in the region are embracing digital transformation strategies, incorporating artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) to offer more efficient and effective solutions. These technologies not only enhance the accuracy of outsourced tasks but also allow for handling of complex processes, thereby attracting businesses aiming for innovation in their operations.

The region’s stringent regulatory environment concerning data protection and privacy standards such as GDPR and CCPA reassures companies about the security and compliance of outsourcing providers. This legal framework builds trust and makes North American BPO services particularly appealing to sectors such as banking, healthcare, and telecommunications, which handle sensitive information.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Business Process Outsourcing (BPO) market features a range of key players, each contributing to the industry’s dynamic landscape through strategic innovations and expansions. Accenture plc, IBM Corporation, and Amdocs Ltd. are prominent names that lead the market, distinguished by their extensive service offerings and global presence.

Accenture plc has strengthened its market position through targeted acquisitions, such as their recent acquisition of a cloud consulting company. This move is designed to enhance their cloud services portfolio, directly responding to the increasing demand for cloud-based BPO services. The company is also noted for its strong focus on artificial intelligence and digital transformation solutions, helping clients improve efficiency and competitiveness.

IBM Corporation remains a formidable player in the BPO sector, continually innovating in areas like cognitive computing and blockchain. Recently, IBM launched a new AI-powered service platform tailored to transform customer service processes. This platform integrates advanced analytics and AI to streamline operations and enhance decision-making, reflecting IBM’s commitment to incorporating cutting-edge technology in its services.

Amdocs Ltd. focuses on maintaining its leadership in the telecommunications BPO services by consistently rolling out new products and services. For instance, Amdocs recently introduced a next-generation billing and service platform that allows telecom companies to manage customer data more efficiently, thus enhancing customer satisfaction and service delivery. Their approach to innovation is closely aligned with the evolving needs of the digital and telecom sectors, ensuring their strong market position.

Top Key Players in the Market

- Accenture plc

- IBM Corporation

- Amdocs Ltd.

- Capgemini SE

- Cognizant

- Tata Consultancy Services Limited

- Wipro Limited

- HCL Technologies Limited

- Genpact

- NCR Voyix Corporation

- Concentrix

- TTEC Holdings, Inc.

- Other Key Players

Recent Developments

Report Scope

Report Features Description Market Value (2023) USD 315.2 Bn Forecast Revenue (2033) USD 739.4 Bn CAGR (2024-2033) 8.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Customer Service, Finance & Accounting, Human Resources, Procurement & Supply Chain, and Other Service Types), By Enterprise Size (Small & Medium Enterprises and Large Enterprises), By End-Use Industry (IT & Telecommunications, BFSI, Manufacturing, Retail, Healthcare, and Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture plc, IBM Corporation, Amdocs Ltd., Capgemini SE, Cognizant, Tata Consultancy Services Limited, Wipro Limited, HCL Technologies Limited, Genpact, NCR Voyix Corporation, Concentrix, TTEC Holdings, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Business Process Outsourcing (BPO)?BPO is the practice of contracting specific business processes or functions to a third-party service provider. These processes can include customer support, finance and accounting, human resources, and more.

How big is business process outsourcing market?In 2023, the global business process outsourcing market was valued at USD 266.8 billion and is expected to grow USD 544.8 billion in 2032. Between 2023 and 2032 this market is estimated to register a CAGR of 8.5%.

Who are the key players in the mobile artificial intelligence market?Accenture PLC, Amdocs Ltd, Capgemini SE, CBRE Group, Inc., HCL Technologies Limited, Infosys BPM Limited, NCR Corporation, SODEXO S.A., TTEC Holdings, Inc., Wipro Limited, Other Key Players

What are the common challenges associated with BPO?Challenges in BPO can include issues with data security and confidentiality, communication barriers, cultural differences, loss of control over certain processes, and potential risks to quality and service levels.

Business Process Outsourcing MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample

Business Process Outsourcing MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture plc

- IBM Corporation

- Amdocs Ltd.

- Capgemini SE

- Cognizant

- Tata Consultancy Services Limited

- Wipro Limited

- HCL Technologies Limited

- Genpact

- NCR Voyix Corporation

- Concentrix

- TTEC Holdings, Inc.

- Other Key Players