Global Business Continuity Management Solutions Market Size, Share, Industry Analysis Report By Component (Solutions, Services), By Organization Size (Small and Medium-sized Enterprises, Large Enterprises), By Industry (BFSI, Government, Healthcare, Transportation and Logistics, Energy and Utilities, Manufacturing and Retail, Telecom and IT, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160979

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Business Continuity Stats

- Role of Generative AI

- Analysts’ Viewpoint

- Investment opportunities

- U.S. Market Size

- Component Analysis

- Organization Size Analysis

- Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

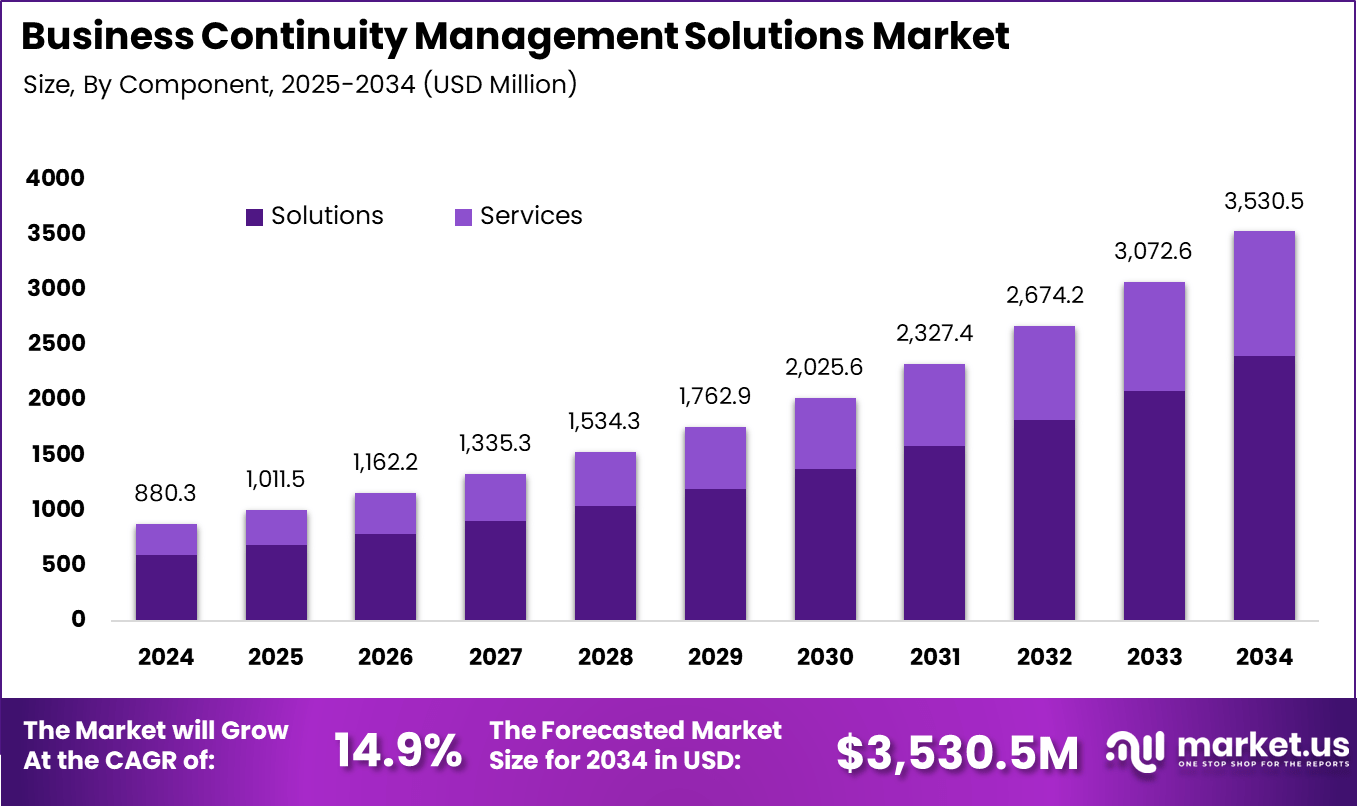

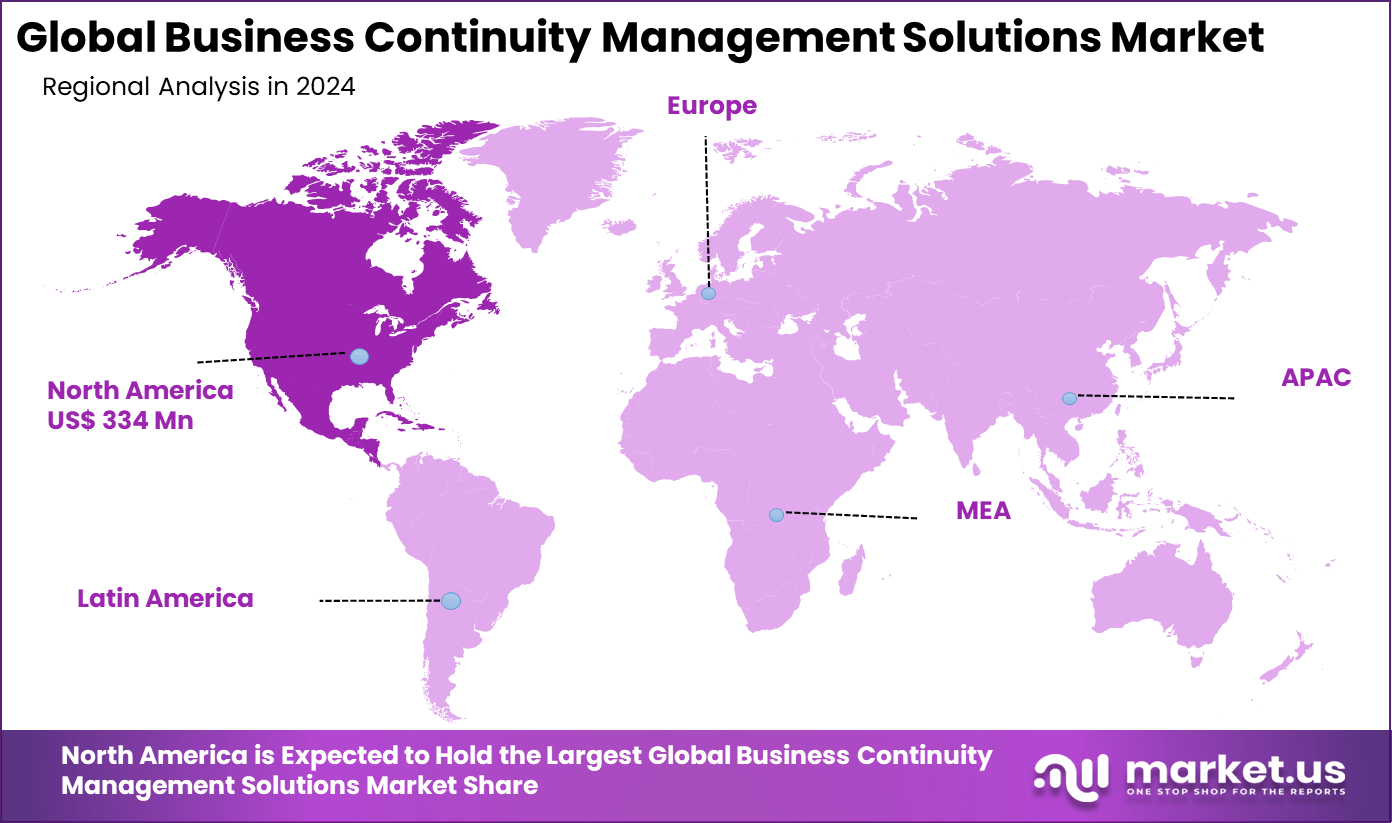

The Global Business Continuity Management Solutions Market size is expected to be worth around USD 3,530.5 million by 2034, from USD 880.3 million in 2024, growing at a CAGR of 14.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 334 million in revenue.

Business Continuity Management (BCM) Solutions market focuses on providing organizations with strategic frameworks and technologies to ensure ongoing operations during disruptions. These solutions enable companies to effectively manage risks from cyberattacks, natural disasters, or unforeseen events, minimizing operational downtime.

The market’s growth is driven by rising awareness of business threats and the increasing need for resilience across sectors such as finance, healthcare, and manufacturing. Organizations now pursue BCM not only for survival but also to protect reputation and customer trust, making it a critical element of modern risk management.

Top driving factors in the BCM solutions market include escalating cybersecurity threats, stringent regulatory compliance, and the rapid shift towards digital and cloud infrastructures. Cyber incidents and natural calamities cause heavy financial losses, pushing companies to adopt proactive BCM strategies. Additionally, regulations demanding robust continuity plans incentivize investments in BCM solutions to avoid legal penalties.

Based on data from InvenioIT, the cost of business continuity interruptions ranges from USD 137 to USD 16,000 per minute. More than two-thirds of industrial businesses face downtime at least once a month, and 9 out of 10 businesses experience one or more outages each quarter. In 2023, 54% of data centers reported losses exceeding USD 100,000 due to outages, while 1 in 5 businesses fail within their first year.

Key Takeaway

- By product type, 3D animation leads with 45.2%, driven by high demand in movies, gaming, advertising, and immersive media.

- By industry, media and entertainment dominates with 30.5%, reflecting the sector’s reliance on animation for content creation and visual storytelling.

- North America contributes 35.1%, supported by strong production studios, technological innovation, and streaming platforms.

- The US market reached USD 59.27 billion and is expanding at a steady CAGR of 9.2%, underscoring its global leadership in animation production and adoption.

Business Continuity Stats

According to SysGroup, 44% of businesses lack a disaster recovery plan. Software failures are responsible for 53% of unplanned downtime, followed by cybersecurity issues (52%), network outages (50%), human error (45%), hardware failures (38%), and theft (24%). In the UK, 33% of businesses have lost customers following a disaster, while 40% do not reopen after a disaster, and another 25% close within a year.

Only 33% of company folders are properly protected, with larger organizations facing higher risks of file compromise. UK businesses encounter approximately 65,000 hack attempts daily, of which 4,500 are successful. Companies without a disaster recovery plan have an estimated survival rate of less than 10%. IT downtime costs businesses an average of £3.6 million per year, translating to roughly £258,000 per hour.

One in five organizations has faced a serious outage over the past three years, according to the Uptime Institute. Data breaches remain widespread, with 83% of businesses experiencing multiple incidents. These statistics underline the critical importance of implementing robust disaster recovery and cybersecurity measures to maintain operational resilience and protect assets.

Role of Generative AI

Generative AI has emerged as a transformative force in business continuity management by enhancing readiness and responsiveness. It automates the creation of business continuity plans and impact analysis documents, significantly speeding up traditionally time-consuming processes. Around 70% of organizations integrating generative AI in BCM report improved planning efficiency and faster document drafting.

This technology supports scenario planning by generating multiple disruption response strategies instantly, helping businesses identify critical vulnerabilities and alternative actions without exhaustive manual effort. Moreover, generative AI assists in monitoring active risks by synthesizing vast amounts of data to provide early warnings, enabling organizations to act swiftly before minor issues escalate.

Besides efficiency, generative AI fuels better decision-making by offering fresh perspectives on recovery strategies and facilitating human-AI collaboration with governance protocols. Approximately 65% of BCM professionals agree that generative AI enables more comprehensive and adaptable continuity plans, ultimately enhancing organizational resilience.

Analysts’ Viewpoint

Demand analysis reveals a notable preference for cloud-based BCM solutions due to their scalability, cost efficiency, and ease of deployment. Organizations with distributed workforces and complex IT ecosystems benefit from these technologies that support remote access and real-time updates. Increasing use of artificial intelligence and automation enhances BCM platforms by improving risk assessment, predictive analysis, and faster recovery operations.

The increasing adoption of technologies such as cloud computing, AI, machine learning, and automation tools is redefining business continuity strategies. Cloud platforms offer flexibility in managing backups and recovery operations, significantly lowering infrastructure costs for large and small enterprises alike. AI-driven analytics predict potential threats and automate mitigation steps to reduce response times.

These technologies are adopted primarily because they enhance operational efficiency, reduce human error, and facilitate faster decision-making under pressure. The capability to monitor threats in real time and automate responses is becoming a key feature in competitive BCM solutions.

Investment opportunities

Investment opportunities in this market are robust, particularly in advanced AI-powered BCM tools, cloud-based platforms, and hybrid solutions that cater to both on-premises and remote environments. Enterprises seek continuous innovation to address evolving threats, driving investment in R&D to expand BCM capabilities.

Emerging economies also present growth potential, as rising digital transformation efforts increase awareness of BCM importance. Additionally, partnerships between technology providers and risk intelligence firms open avenues for enhanced threat detection and resilience services. Investors focusing on sectors vulnerable to operational disruptions, such as healthcare and finance, may find elevated demand for BCM technologies and consulting services.

Business benefits from adopting BCM solutions include improved operational resilience, reduced downtime, and protection of revenue streams during crises. BCM helps maintain market credibility by assuring customers and stakeholders that the business can withstand interruptions. Organizations experience a reduction in financial losses related to disruptions and regulatory fines by proactively managing risks.

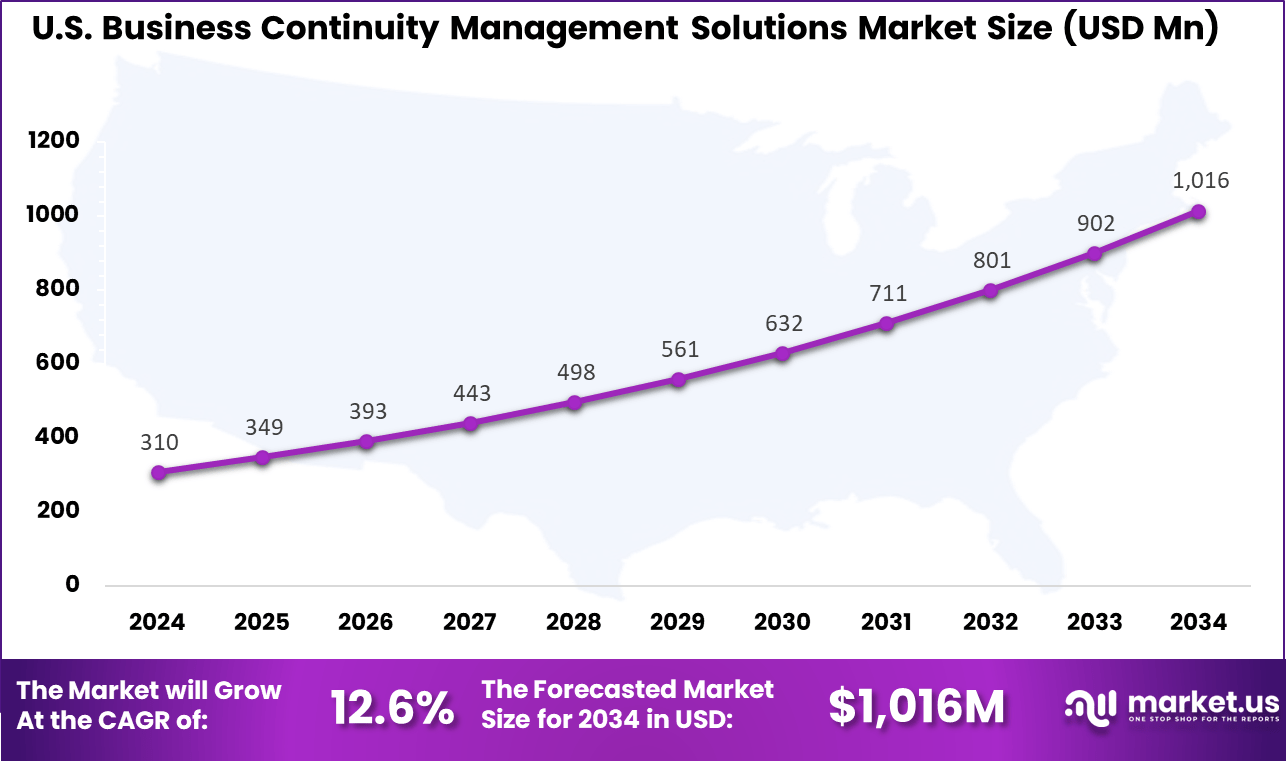

U.S. Market Size

The market for Business Continuity Management Solutions within the U.S. is growing tremendously and is currently valued at USD 310 million, the market has a projected CAGR of 12.6%. The market is growing tremendously due to heightened cybersecurity threats, increasing frequency of natural disasters, and stringent regulatory requirements across sectors such as finance, healthcare, and critical infrastructure.

The shift toward hybrid work models and digital transformation has shown the need for resilient operations. U.S. organizations are increasingly investing in cloud-based and AI-driven BCM tools to ensure continuity, safeguard data, and meet evolving compliance standards in a complex and volatile risk environment.

For instance, in October 2025, Dominion DMS partnered with the Kentucky Automobile Dealers Association (KADA) to deliver a tailored Business Continuity Solution for auto dealers across the U.S. This collaboration highlights the U.S.’s continued dominance in the Business Continuity Management (BCM) Solutions market, driven by sector-specific innovations and strong industry partnerships.

In 2024, North America held a dominant market position in the Global Business Continuity Management Solutions Market, capturing more than a 38% share, holding USD 334 million in revenue. This dominance is due to its advanced IT infrastructure, high awareness of risk management, and strict regulatory compliance mandates across key industries such as finance, healthcare, and critical infrastructure.

The region’s proactive stance on cybersecurity, coupled with significant investments in digital transformation and cloud technologies, further fueled adoption. Additionally, the presence of major BCM solution providers and a skilled workforce supported the region’s leadership in driving innovation and resilience strategies.

For instance, in November 2024, Assurance Software announced its merger with ClearView Continuity, significantly strengthening its presence in the North American Business Continuity Management (BCM) solutions market. The combined entity brings together two industry leaders, enhancing capabilities in business continuity planning, risk management, and resilience strategy delivery.

Component Analysis

In 2024, The solutions segment dominates the business continuity management market with a strong 68% share. This dominance is due to organizations increasingly adopting comprehensive BCM software solutions that offer end-to-end capabilities such as risk assessment, disaster recovery, and crisis communication.

These solutions help businesses maintain operations during disruptions and quickly restore services, which is critical for minimizing financial and reputational damage. The growing importance of automated and cloud-based BCM solutions also fuels this segment’s growth.

Companies are shifting towards scalable platforms that can be easily updated and managed remotely, ensuring business resilience even during emergencies. This trend aligns with the expanding complexity of IT environments and the need for integrated continuity strategies across multiple departments and locations.

For Instance, in September 2025, Swimlane introduced what it described as the most cost-effective Business Continuity Management (BCM) solution available, aimed at addressing the affordability and complexity barriers often faced by mid-market and resource-constrained organizations.

Organization Size Analysis

In 2024, Large enterprises hold a commanding 61% share in the BCM solutions market. Their larger budgets and extensive IT ecosystems make them more capable of investing in and benefiting from robust continuity planning and management systems. Large organizations often face greater disruption risks and regulatory scrutiny, which drives their demand for advanced BCM tools designed to handle complex and critical operations.

Additionally, the increasing digital transformation efforts in large companies further encourage the adoption of BCM solutions to safeguard data integrity and uptime. With expanded global operations, these enterprises require BCM systems that support compliance, risk mitigation, and rapid recovery across diverse markets and infrastructures.

For instance, in July 2024, Everbridge announced the acquisition of Infinite Blue, a recognized leader in enterprise business continuity solutions. This strategic move expands Everbridge’s capabilities in end-to-end operational resilience by integrating Infinite Blue’s flagship platform, “BC in the Cloud,” into its own critical event management ecosystem.

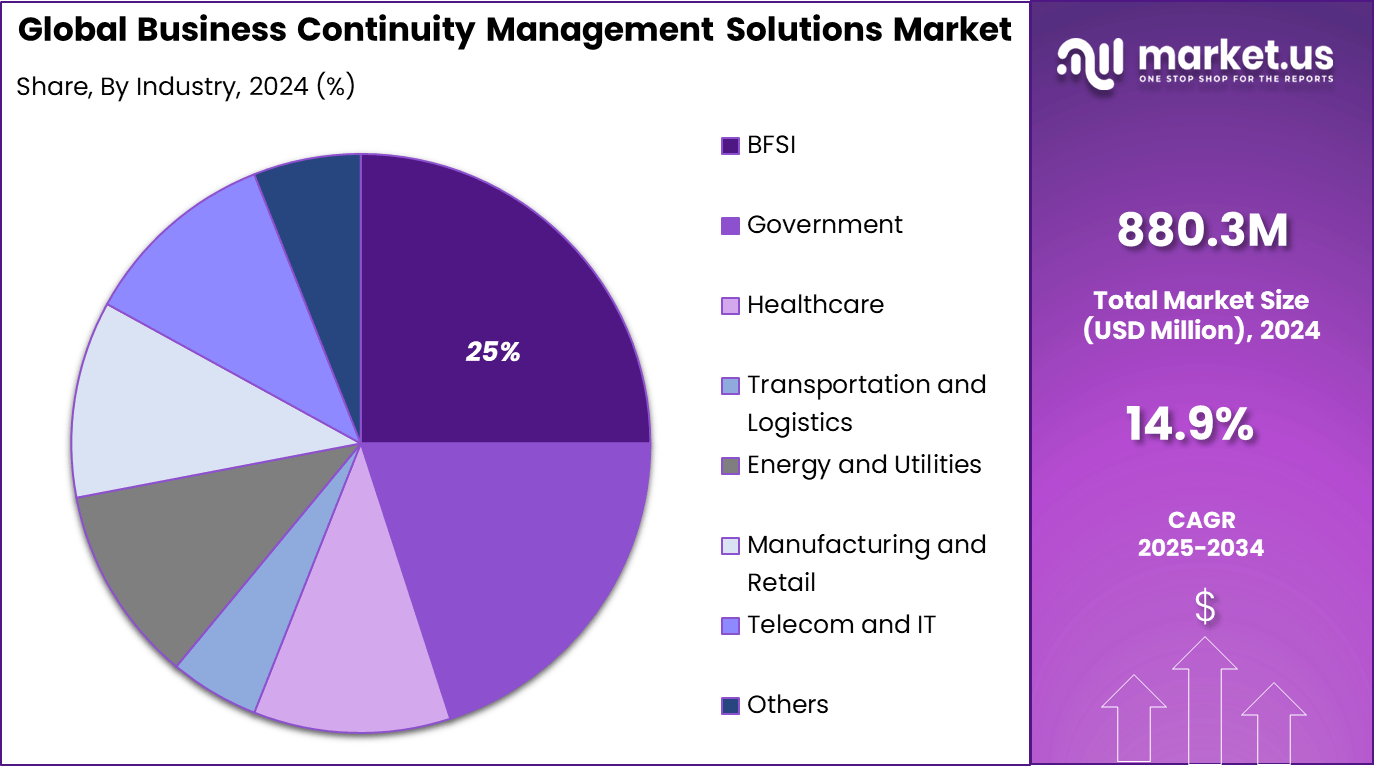

Industry Analysis

In 2024, the BFSI (Banking, Financial Services, and Insurance) sector accounts for 25% of the BCM market share. This industry is highly regulated and requires stringent continuity plans to protect sensitive financial data and maintain uninterrupted service to customers. Operational disruptions in BFSI can have severe consequences, including financial loss and legal penalties, which places business continuity at the forefront of industry priorities.

Rising cyber threats and increasing reliance on digital banking platforms emphasize the need for advanced BCM solutions within BFSI. These solutions are critical for efficient disaster recovery, regulatory compliance, and risk management, ensuring the sector remains resilient amid evolving challenges.

For instance, In May 2025, Commercial Bank Qatar announced that it had achieved ISO 22301 certification for its Business Continuity Management System (BCMS). This globally recognized standard confirms the bank’s strong approach to maintaining operations during disruptions. Obtaining ISO 22301 highlights the bank’s commitment to operational resilience, regulatory compliance, and uninterrupted customer service.

Emerging Trends

One key trend in BCM solutions is the rise of AI-powered automation across multiple processes, including backup, disaster recovery, and incident response. Over 60% of BCM providers are now incorporating machine learning and AI to streamline recovery operations and reduce manual interventions.

Another notable trend is the increased adoption of cloud-based continuity platforms, offering scalability and multi-cloud environment support that simplify business continuity across hybrid infrastructures. This approach reduces single points of failure and enhances resilience against IT disruptions.

Additionally, the market is witnessing more integrated solutions that combine security, compliance, and recovery management into unified platforms. This integration aids organizations in managing their entire continuity strategy from a single dashboard, improving visibility and coordination.

Growing demands for compliance with stringent data privacy rules are shaping these platform features, ensuring BCM solutions provide audit trails and policy enforcement. More than 55% of businesses adopting integrated BCM solutions report improved compliance and faster recovery times.

Growth Factors

The growth of BCM solutions is driven by rising concerns over cyber threats, which target critical business functions and data. Reports show that 78% of enterprise disruptions are cyber-related, pushing demand for advanced BCM capabilities that can anticipate and mitigate such attacks.

Additionally, the increase in natural disasters and global disruptions is encouraging organizations to invest in robust continuity strategies to safeguard operations and reputation. Awareness about these risks has increased by over 40% in the past three years among business decision-makers.

Another major growth factor is digital transformation, which has made businesses more dependent on complex IT infrastructure. This dependence increases the stakes for maintaining service availability, driving enterprises to implement automated, AI-enhanced continuity tools to minimize downtime. Almost 68% of organizations cite digital shift as a key reason for upgrading their BCM systems.

Key Market Segments

By Component

- Solutions

- Crisis Management

- Risk Management

- Audit Management

- Government, Risk, and Compliance (GRC)

- Others

- Services

- Professional

- Managed

By Organization Size

- Small and Medium-sized Enterprises

- Large Enterprises

By Industry

- BFSI

- Government

- Healthcare

- Transportation and Logistics

- Energy and Utilities

- Manufacturing and Retail

- Telecom and IT

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Frequency of Disruptions

The growing frequency and harshness of disruptions such as cyberattacks, natural disasters, and pandemics have made business continuity an urgent priority for organizations worldwide. Businesses recognize the need to maintain operations despite unexpected events, driving demand for robust BCM solutions.

The rise of digital transformation has also increased reliance on IT infrastructure, making continuity and recovery planning essential to avoid costly downtime. With these rising risks, companies are investing more in BCM strategies and technologies that can provide rapid response, risk mitigation, and recovery capabilities.

For instance, in September 2025, Premier Continuum unveiled a new AI-powered solution within its flagship Business Continuity Management software, ParaSolution. This enhancement leverages artificial intelligence to automate and optimize key continuity planning tasks such as business impact analysis, risk assessment, and plan maintenance.

Restraint

High Implementation Costs

One of the key restraints in broader adoption of BCM solutions is the high cost associated with implementing and maintaining comprehensive systems. Many organizations, particularly small and medium enterprises, find the initial investment substantial, which can deter them from deploying fully integrated continuity management frameworks.

The cost hurdle includes both software acquisition and the need for ongoing staffing and training. Moreover, integrating BCM solutions with existing IT infrastructure often requires complex customization, adding to deployment expenses. As a result, despite the evident value, budget constraints remain a significant barrier for many businesses looking to adopt advanced BCM systems for safeguarding operations.

Opportunities

Cloud-Based and AI-Driven Solutions

The evolution towards cloud-based BCM solutions presents a significant opportunity for the market. Cloud platforms offer scalability, flexibility, and cost-effectiveness, allowing organizations to implement continuity solutions without heavy upfront infrastructure investment. This shift also supports remote work models and hybrid IT environments, which are becoming standard in today’s businesses.

Additionally, integrating artificial intelligence and machine learning into BCM processes enhances risk assessment, automation, and incident response. These technologies reduce human error, speed up recovery times, and optimize resource allocation, making BCM more efficient and accessible. Providers embracing this technology trend can capture a growing segment of the market seeking advanced and adaptive continuity solutions.

For instance, in September 2025, Everbridge announced the integration of BC in the Cloud (BCIC) into its High Velocity Critical Event Management (CEM) platform at DRJ Fall 2025. This cloud-based Business Continuity Management (BCM) solution enhances real-time visibility and automation during disruptions by unifying business continuity planning with critical event response in a centralized, cloud-native environment.

Challenges

Rapidly Evolving Threat Landscape

A major challenge for BCM solutions providers and users is keeping pace with the rapidly evolving threat landscape. Cyber threats grow in sophistication and frequency, while natural disasters and geopolitical tensions add layers of complexity to risk scenarios. BCM strategies must continuously adapt to new risks, which demands ongoing investment and innovation.

This dynamic environment also requires constant updates to compliance requirements and regulatory standards, making it difficult for organizations to maintain up-to-date continuity plans. Staying ahead of emerging threats while ensuring operational resilience requires both technological agility and skilled professionals, creating a continuous challenge for the market.

For instance, in March 2025, Rubrik partnered with Deloitte to enhance data security and resilience through integrated solutions addressing the evolving threat landscape. This collaboration focuses on delivering advanced cyber recovery and Business Continuity Management (BCM) solutions, particularly targeting ransomware threats and data breaches.

Key Players Analysis

The Business Continuity Management (BCM) Solutions Market is led by specialized risk and compliance solution providers such as Fusion Risk Management Inc., Logic Manager Inc., MetricStream Inc., NAVEX Global Inc., and Quantivate LLC. These companies offer integrated platforms for risk assessment, disaster recovery planning, and operational resilience.

Technology and infrastructure providers including IBM Corporation, Microsoft Corporation, Oracle Corporation, Dell Technologies Inc., VMware Inc., and SAP SE contribute through cloud-based continuity platforms, automated recovery systems, and enterprise-wide monitoring tools. Their offerings enable seamless integration with IT environments, data protection, and real-time analytics to minimize downtime.

Additional players such as Carbonite Inc., CLDigital, Datto Holdings Corporation, Fair Isaac Corporation, SolarWinds Corp., Sungard Availability Services LP, SAI360 Inc., Wolters Kluwer NV, X2nSat Inc., and a range of other key participants provide specialized backup, replication, and risk management services. Collectively, these companies strengthen market adoption by addressing diverse business continuity requirements across industries worldwide.

Top Key Players in the Market

- Fusion Risk Management Inc.

- Logic Manager Inc.

- MetricStream Inc.

- NAVEX Global Inc.

- Quantivate LLC

- Virtual Corporation, etc.

- Carbonite Inc.

- CLDigital

- Datto Holdings Corporation

- Dell Technologies Inc.

- Fair Isaac Corporation

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAI360 Inc.

- SAP SE

- SolarWinds Corp.

- Sungard Availability Services LP

- VMware Inc.

- Wolters Kluwer NV

- X2nSat Inc.

- Other Key Players

Recent Developments

- In February 2025, Fusion Risk Management launched “BC Plan inFusion”, a next-generation capability powered by generative AI. This innovation enables organizations to seamlessly convert existing business continuity plans, spreadsheets, and documents into structured, actionable data within the Fusion platform.

- In April 2025, e& UAE (formerly Etisalat) unveiled its suite of Business Continuity Solutions at the World Congress on Emergency Management & Safety (WCEMS) 2025. These solutions are designed to help organizations across the UAE and broader Middle East region enhance operational resilience, ensure uninterrupted services, and respond effectively to emergencies.

Report Scope

Report Features Description Market Value (2024) USD 880.3 Mn Forecast Revenue (2034) USD 3,530.5 Mn CAGR(2025-2034) 14.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Organization Size (Small and Medium-sized Enterprises, Large Enterprises), By Industry (BFSI, Government, Healthcare, Transportation and Logistics, Energy and Utilities, Manufacturing and Retail, Telecom and IT, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fusion Risk Management Inc., Logic Manager Inc., MetricStream Inc., NAVEX Global Inc., Quantivate LLC, Virtual Corporation, etc., Carbonite Inc., CLDigital, Datto Holdings Corporation, Dell Technologies Inc., Fair Isaac Corporation, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAI360 Inc., SAP SE, SolarWinds Corp., Sungard Availability Services LP, VMware Inc., Wolters Kluwer NV, X2nSat Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Business Continuity Management Solutions MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Business Continuity Management Solutions MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-