Global Bulldozer Market By Product Type (Crawler bulldozer, Wheeled bulldozer), By Bade Type (S-blade, U-blade, S-U-blade, Others), By Operating Weight (Less than 10,000 kg, 10,000-30,000 kg, More than 30,000 kg), By End Use (Construction, Forest, Agriculture, Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132382

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

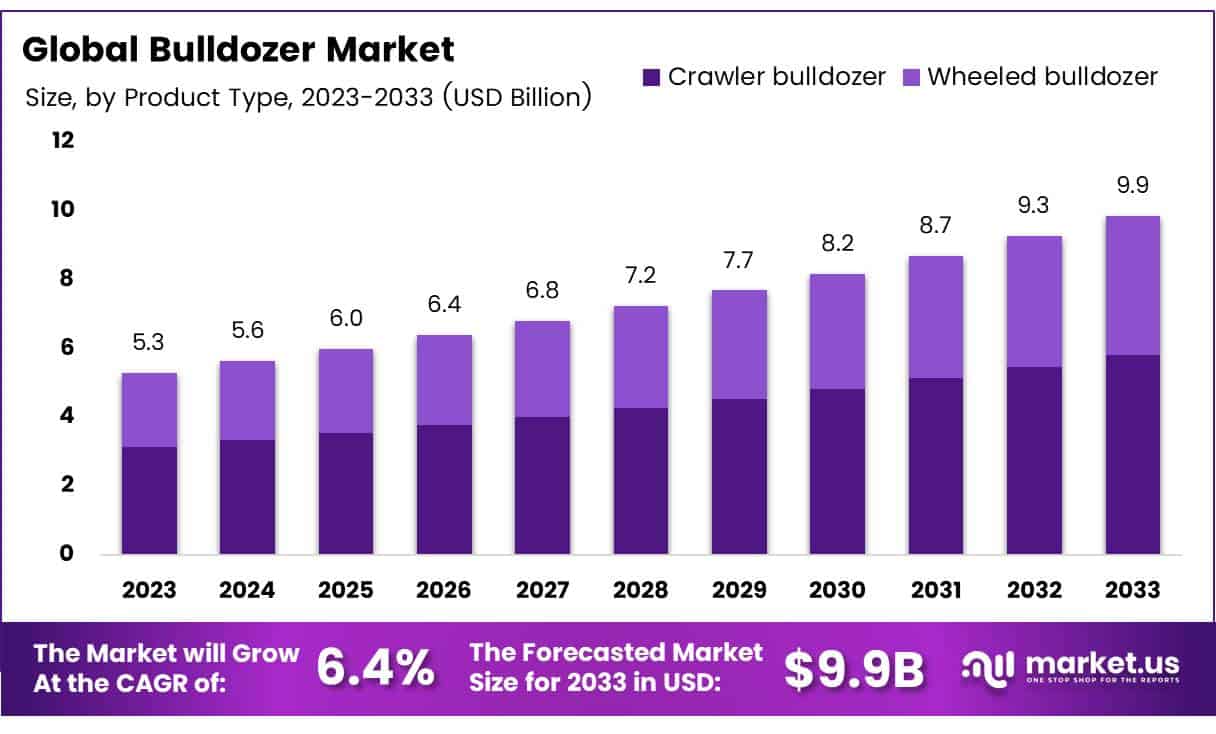

The Global Bulldozer Market size is expected to be worth around USD 5.3 Billion by 2033, from USD 5.3 Billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2024 to 2033.

A bulldozer is essential equipment widely used in construction, mining, and agriculture. Bulldozers are crucial for tasks such as earthmoving, road construction, and demolition. They can be equipped with various attachments to meet diverse operational needs, ranging from forestry to heavy lifting.

The bulldozer market encompasses the worldwide production, distribution, and sales of bulldozers, along with services like rentals and maintenance. This market serves a broad array of sectors, including construction and mining, which makes it sensitive to changes in economic conditions and public policy. For instance, increased construction activities and infrastructure projects typically boost the demand for bulldozers.

Current trends show that the bulldozer market is set to grow, driven by global urbanization and rising infrastructure investments. As cities expand and the need for new infrastructure escalates, the demand for bulldozers is expected to increase.

This growth is further supported by advancements in construction technology, such as the development of more fuel-efficient and environmentally friendly bulldozers. These innovations are part of a larger movement towards construction equipment that combines high productivity with reduced environmental impact.

Government investments in public infrastructure, like roads, housing, and public facilities, also significantly affect the bulldozer market. These projects require extensive earthmoving operations, which in turn increases the need for robust and efficient bulldozers.

Additionally, regulatory standards concerning emissions and safety are prompting manufacturers to develop machines that are both safer and cleaner, aligning with global environmental goals and safety protocols.

The demand for skilled heavy equipment operators, particularly bulldozer operators, underscores a critical market dynamic. According to the Bureau of Labor Statistics, the field of heavy equipment operation is projected to grow by 5% over the next decade, reflecting broader construction industry trends.

Annually, approximately 51,500 new roles are expected to open, highlighting the need for training and certification programs that can equip workers with the necessary skills to handle increasingly sophisticated machinery.

Recent statistics highlight the upward trajectory of the bulldozer market, particularly in specific sectors. For instance, UK retail sales of construction and earthmoving equipment, including bulldozers, saw a significant increase of 17% in the second quarter of 2024 compared to the first quarter, totaling over 7,500 units.

This surge is indicative of a rebounding construction sector and increased activities in earthmoving and site preparation. Furthermore, the role of federal agencies like the United States Forest Service, which manages an area as large as Texas, continues to bolster demand for bulldozers in land management and forestry applications, sustaining a steady market demand.

Key Takeaways

- The Global Bulldozer Market is projected to maintain its market size of USD 5.3 Billion from 2023 to 2033, with a steady growth rate of 6.4% CAGR.

- Crawler bulldozers dominated the Product Type segment in 2023, indicating their essential role across various industries.

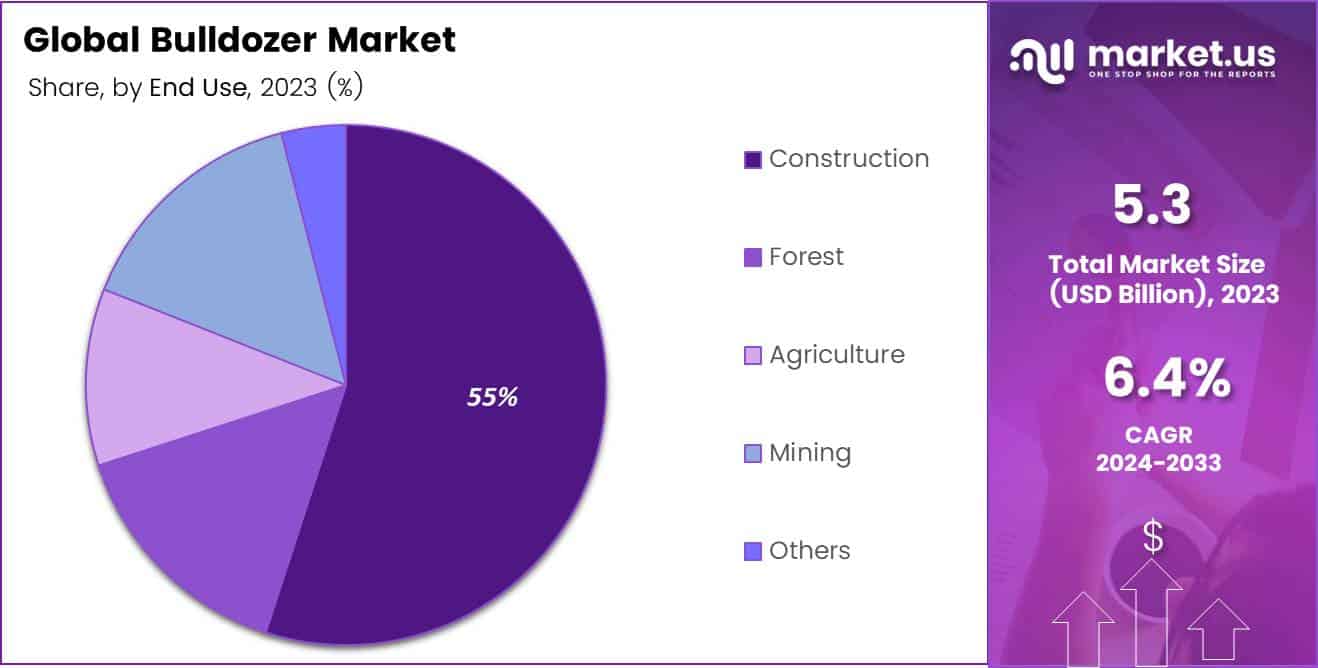

- Construction was the leading end-use segment in 2023, holding a 55% share, driven by global urbanization and increased infrastructure spending.

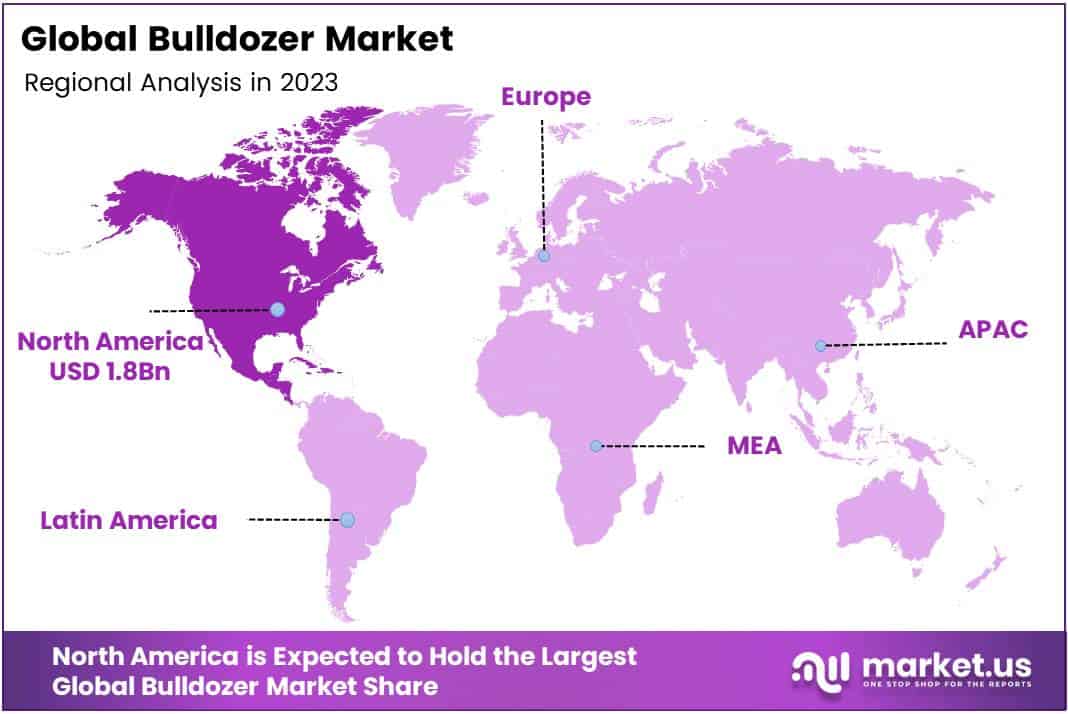

- North America held the largest regional market share at 36%, or approximately USD 1.9 billion, fueled by significant infrastructure and mining projects in the U.S. and Canada.

- Government investments in infrastructure are key drivers for the bulldozer market, boosting the demand for this heavy machinery essential for earthmoving and leveling.

- The integration of automation and robotics is revolutionizing the bulldozer market, increasing the efficiency, productivity, and safety of these machines.

Product Type Analysis

Crawler Bulldozers Lead with Dominance in Bulldozer Market

In 2023, the crawler bulldozer held a dominant market position in the By Product Type Analysis segment of the Bulldozer Market, showcasing its widespread adoption in various industries.

Crawler bulldozers, renowned for their substantial traction and ground-holding capability, have been the preferred choice in challenging environments such as mining and heavy construction sites. This preference is attributed to their ability to operate efficiently on uneven and rough terrain, where wheeled bulldozers may not perform optimally.

Wheeled bulldozers, although they exhibit greater mobility and speed, are generally suited to smoother surfaces and find their applications in less demanding conditions. As a result, their market penetration is less pronounced compared to their tracked counterparts.

The market’s inclination towards crawler bulldozers is further supported by their enhanced durability and lower maintenance costs over time, which aligns with the financial and operational priorities of major industries.

The ongoing preference for crawler bulldozers is expected to continue as technological advancements in this product category focus on improving efficiency and reducing environmental impact, aligning with global sustainability goals and regulatory standards. This trend is anticipated to fortify the crawler bulldozer’s leading position in the market, driving growth and innovation in the broader bulldozer industry.

End Use Analysis

Construction Dominates Bulldozer Market with 55% Share

In 2023, Construction held a dominant market position in the By End Use Analysis segment of the Bulldozer Market, capturing a 55% share. This significant market presence underscores the pivotal role bulldozers play in construction activities, from site preparation to demolition.

The robust performance of this sector is largely driven by global urbanization trends and substantial investments in infrastructure development.

Following Construction, the Mining sector emerged as another key user, albeit with a smaller market share, reflecting the critical requirement for heavy-duty equipment in extraction and earth-moving operations.

The Forest and Agriculture sectors also utilize bulldozers, but to a lesser extent, primarily for land clearing and agroforestry management practices, contributing to their smaller shares in the market landscape.

The Others category, encompassing miscellaneous applications like road building and landfill operations, collectively holds a modest portion of the market. This diversity in application underscores the versatility of bulldozers and their adaptability to various operational demands across different industries. The combined utility across these sectors reinforces the bulldozer’s essential role in heavy machinery and construction equipment markets globally.

Key Market Segments

By Product Type

- Crawler bulldozer

- Wheeled bulldozer

By Bade Type

- S-blade

- U-blade

- S-U-blade

- Others

By Operating Weight

- Less than 10,000 kg

- 10,000-30,000 kg

- More than 30,000 kg

By End Use

- Construction

- Forest

- Agriculture

- Mining

- Others

Drivers

Infrastructure Development Spurs Bulldozer Demand

The bulldozer market is experiencing significant growth primarily due to increased government investment in infrastructure projects. As countries focus on enhancing their infrastructure, including roads, bridges, and public buildings, the demand for heavy machinery like bulldozers is on the rise.

This machinery is crucial for various construction and development activities, offering the necessary power for earthmoving, grading, and ground leveling.

Additionally, the expansion of mining activities contributes to this demand. Mining companies rely on bulldozers for excavation and site preparation as they expand operations to meet the global demand for minerals. Moreover, the construction equipment rental market is expanding.

More businesses are opting to rent bulldozers instead of purchasing them outright, which reduces initial capital expenditure and allows flexible access to the latest equipment.

This trend is particularly advantageous for small to medium-sized enterprises (SMEs) and short-term projects that require specific types of bulldozers. Collectively, these factors are driving robust growth in the bulldozer market, making it an essential asset in both construction and mining sectors.

Restraints

High Costs Limit Bulldozer Adoption

In the bulldozer market, one of the primary restraints is the high initial investment required. Bulldozers represent a significant capital expenditure, which can be prohibitive for small and medium-sized enterprises (SMEs). This financial barrier often prevents these businesses from expanding their equipment inventory, directly affecting market growth.

Furthermore, the effectiveness of bulldozers heavily relies on the availability of skilled operators. The market faces challenges from a notable shortage of such labor, which can hamper operational efficiency and reduce overall demand for bulldozers. These issues collectively contribute to slower market expansion, as potential buyers are either financially discouraged or concerned about the return on investment due to labor constraints.

This situation underscores the need for strategies to lower entry costs and improve training programs to enhance operator availability, ensuring steady demand in the bulldozer sector.

Growth Factors

Bulldozer Market Emerging Markets Offer Expansive Opportunities

As global economies expand, especially in the Asia-Pacific and Latin America regions, the bulldozer market sees significant growth opportunities. Manufacturers are poised to capitalize on this by entering and establishing strong footholds in these emerging markets.

Furthermore, there is a rising trend towards adopting electric and hybrid bulldozers, driven by increasing environmental awareness. These innovative models promise reduced emissions and lower operating costs, making them attractive to both new and existing customers.

Additionally, manufacturers can leverage the potential of aftermarket services, which include maintenance and repair. By offering comprehensive support, companies not only enhance customer loyalty but also open up lucrative, ongoing revenue streams. This holistic approach to expansion and sustainability positions the bulldozer market for robust growth in the coming years.

Emerging Trends

Bulldozers Get Smarter with Automation

The bulldozer market is witnessing significant growth driven by the integration of automation and robotics. This trend is transforming traditional construction equipment into high-tech machinery capable of autonomous operations, which enhances productivity and safety on construction sites.

Additionally, the adoption of telematics in bulldozers is becoming more prevalent; this technology enables real-time monitoring of machine performance and health, facilitating better maintenance scheduling and operational efficiency.

Moreover, the shift towards digital platforms for the marketing and sales of bulldozers is reshaping the industry landscape, making it easier for buyers to make informed decisions and for sellers to reach a broader audience. These technological advancements are setting new standards in the construction industry, promising improved efficiency and reduced operational costs.

Regional Analysis

North America Dominant with 36% Market Share, Valued at USD 1.9 Billion

The global Bulldozer Market presents distinct regional dynamics, with North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America all contributing to the overall market landscape.

North America emerges as the dominating region, holding a substantial 36% market share, which translates to a market value of approximately USD 1.9 billion. This robust position is primarily driven by extensive infrastructure projects and mining activities, especially in the United States and Canada, where there is a high demand for advanced and heavy-duty bulldozers.

Regional Mentions

In Europe, the market is characterized by moderate growth, supported by increasing construction activities in Eastern Europe and the renovation of aging infrastructure in Western Europe. The adoption of eco-friendly and fuel-efficient bulldozers is propelling the market forward in this region, reflecting Europe’s stringent environmental regulations.

Asia Pacific is witnessing rapid growth in the Bulldozer Market, fueled by significant investments in infrastructure and mining sectors, particularly in China, India, and Southeast Asia. The region’s market is also benefiting from the increasing adoption of technologically enhanced equipment for construction and agricultural activities, making it a critical area for market expansion.

The Middle East & Africa region shows promising growth potential, with infrastructure developments and oil exploration projects driving the demand for bulldozers. Countries such as Saudi Arabia and the UAE are investing heavily in construction projects, which is anticipated to boost the market in this region.

Latin America, though smaller in comparison, is experiencing growth due to developments in agricultural and mining sectors. Countries like Brazil and Argentina are slowly increasing their equipment fleets to meet the demands of large-scale agricultural projects and mining operations.

Overall, the Bulldozer Market is experiencing significant regional variations in growth dynamics, with North America leading in market share due to its high-value projects and technological adoption.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global bulldozer market in 2023 is significantly shaped by the strategic maneuvers and innovations of leading players. Among them, Caterpillar continues to lead with robust product offerings and technological enhancements, focusing on fuel efficiency and sustainability.

Komatsu closely follows, emphasizing automation and precision in earthmoving operations through their GPS-enabled units, which have increased productivity and reduced operational costs.

Volvo Construction Equipment and Hyundai Heavy Industries are noted for their advances in integrating hybrid technologies that meet stringent emission standards while maintaining performance. JCB and John Deere focus on expanding their compact bulldozer range, which is popular in urban construction projects due to size and agility advantages.

Hitachi Construction Machinery and Sumitomo Heavy Industries are enhancing their market presence through innovations in electric bulldozers, aligning with global trends towards electrification. These electric models are designed to offer lower lifetime operating costs and reduced environmental impact.

XCMG, Zoomlion, Sany, and Shantui Construction Machinery are expanding aggressively in emerging markets. Their strategies include competitive pricing and localized manufacturing to reduce costs.

Particularly, Sany and Shantui have increased their market share by focusing on reliability and cost-effectiveness, appealing to budget-conscious consumers in Asia and Africa.

Doosan differentiates itself with advanced telematics systems, providing operators with real-time data to optimize machine performance and maintenance schedules. This approach not only enhances efficiency but also increases the operational lifespan of their machinery.

Overall, the competition in the bulldozer market is fierce, with companies continuously innovating and adapting to meet the evolving demands of construction industries worldwide.

Top Key Players in the Market

- Hyundai Heavy Industries

- Volvo Construction Equipment

- Case Construction Equipment

- JCB

- Zoomlion

- Komatsu

- XCMG

- Hitachi Construction Machinery

- Sumitomo Heavy Industries

- Sany

- Shantui Construction Machinery

- Caterpillar

- John Deere

- Doosan

Recent Developments

- In July 2024, AMM made a significant investment in Liebherr’s range of crawler dozers. This strategic move aims to enhance their construction equipment portfolio, underscoring their commitment to expanding their heavy machinery assets.

- In September 2023, Develon announced the availability of its DD130 dozer in North America. The introduction of this dozer is part of Develon’s efforts to increase its market presence and offer robust construction solutions in the region.

- In October 2023, LiuGong, a China-based Original Equipment Manufacturer (OEM), completed the sale of its crawler dozer factory in Stalowa Wola, Poland, to Huta Stalowa Wola (HSW). This transaction marks the return of the factory to HSW, from whom LiuGong had previously acquired the Dressta dozer business and manufacturing plant.

- In September 2024, Hitachi Construction Machinery Co Ltd (HCM) acquired approximately 12% of the equity in Envirosuite Ltd for A$10 million, becoming its largest single entity shareholder. This investment strengthens HCM’s environmental management portfolio, aligning with its sustainability and technological advancement goals.

Report Scope

Report Features Description Market Value (2023) USD 5.3 Billion Forecast Revenue (2033) USD 5.3 Billion CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Crawler bulldozer, Wheeled bulldozer), By Bade Type (S-blade, U-blade, S-U-blade, Others), By Operating Weight (Less than 10,000 kg, 10,000-30,000 kg, More than 30,000 kg), By End Use (Construction, Forest, Agriculture, Mining, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hyundai Heavy Industries, Volvo Construction Equipment, Case Construction Equipment, JCB, Zoomlion, Komatsu, XCMG, Hitachi Construction Machinery, Sumitomo Heavy Industries, Sany, Shantui Construction Machinery, Caterpillar, John Deere, Doosan Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hyundai Heavy Industries

- Volvo Construction Equipment

- Case Construction Equipment

- JCB

- Zoomlion

- Komatsu

- XCMG

- Hitachi Construction Machinery

- Sumitomo Heavy Industries

- Sany

- Shantui Construction Machinery

- Caterpillar

- John Deere

- Doosan